Universal Insurance Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Universal Insurance Holdings Bundle

Universal Insurance Holdings strategically crafts its product offerings to meet diverse customer needs, from auto to homeowners insurance, ensuring broad market appeal. Their pricing models are designed to be competitive yet profitable, reflecting a careful balance of value and affordability for policyholders.

Discover how Universal Insurance Holdings leverages its distribution channels and promotional activities to connect with its target audience. To truly understand the intricate marketing strategies that drive their success, dive into the full, editable 4Ps Marketing Mix Analysis, packed with actionable insights.

Product

Universal Insurance Holdings places a strong emphasis on its homeowners insurance specialization. This core product line is crafted to offer robust protection for homes and personal belongings against a wide array of risks, establishing it as the central piece of their market offerings. For instance, in the first quarter of 2024, Universal Property & Casualty Insurance Company, a key subsidiary, reported a gross written premium of $268.6 million for homeowners insurance.

Beyond standard homeowners policies, Universal Insurance Holdings offers crucial related coverages like renters and condo unit owners insurance. This broadens their market reach to individuals in diverse living situations, ensuring essential property and casualty protection is accessible. For instance, Universal Property & Casualty Insurance Company (UPCIC) and American Platinum Property and Casualty Insurance Company (APPCIC) are key subsidiaries facilitating these specialized offerings.

Universal Insurance Holdings differentiates itself by offering a suite of value-added insurance services alongside traditional policies. This expansion aims to provide a more comprehensive solution for clients, moving beyond just coverage to encompass crucial support functions.

These services are strategically delivered through its specialized subsidiaries. Claims processing is handled by Alder Adjusting, ensuring efficient and expert handling of policyholder claims. This subsidiary plays a key role in customer satisfaction during critical moments.

Risk management solutions are provided by Evolution Risk Advisors, helping policyholders proactively mitigate potential losses and improve their overall risk profile. This proactive approach is vital for long-term stability and cost reduction.

Furthermore, Universal Insurance Holdings facilitates reinsurance placement through Blue Atlantic Reinsurance Corporation. This capability allows the company to manage its own risk exposure effectively, ensuring financial resilience and the ability to continue offering robust coverage, particularly in volatile market conditions experienced in 2024 and projected for 2025.

Underwriting and Risk Management Solutions

Universal Insurance Holdings' underwriting and risk management solutions are a core component of their product strategy, delivered through specialized subsidiaries. Evolution Risk Advisors, for instance, functions as a managing general agent, providing crucial expertise in actuarial analysis, policy administration, and underwriting. This integrated model ensures a thorough assessment of risk, bolstering the strength and reliability of Universal's insurance offerings.

This focus on robust underwriting and risk management is critical for Universal's financial health. For example, in 2024, the company reported a combined ratio of 94.5%, indicating effective management of claims and expenses relative to premiums earned. This efficiency in risk handling directly contributes to the profitability and stability of their insurance products.

- Specialized Subsidiaries: Universal leverages subsidiaries like Evolution Risk Advisors for specialized underwriting and risk management functions.

- Actuarial Expertise: Evolution Risk Advisors offers critical actuarial analysis, informing pricing and product development.

- Integrated Approach: Combining underwriting and risk management within its structure enhances product robustness.

- Financial Impact: A combined ratio of 94.5% in 2024 demonstrates the effectiveness of their risk management in driving profitability.

Geographic Adaptation

Universal Insurance Holdings, while historically anchored in Florida, has strategically broadened its operational footprint. As of early 2024, the company is now active in 19 states, a significant expansion from its core market.

This geographic diversification is not merely about scale; it involves tailoring insurance products to meet the unique regulatory frameworks and specific risks, or perils, inherent in each new state. This adaptation ensures that Universal's offerings remain compliant and relevant to a wider array of policyholders.

- Expanded Reach: Operating in 19 states as of early 2024.

- Regulatory Compliance: Adapting products to diverse state-specific regulations.

- Peril Adaptation: Tailoring coverage to unique state-level natural disaster risks.

- Market Relevance: Ensuring product suitability for a broader customer base.

Universal Insurance Holdings' product strategy centers on specialized homeowners insurance, complemented by essential ancillary coverages like renters and condo policies. This core offering is bolstered by value-added services including claims processing via Alder Adjusting and risk management through Evolution Risk Advisors, enhancing overall policyholder value.

The company's product suite is further strengthened by its reinsurance capabilities through Blue Atlantic Reinsurance Corporation, ensuring financial stability. A key differentiator is their robust underwriting and risk management, exemplified by Evolution Risk Advisors' actuarial and administrative support, which contributed to a 94.5% combined ratio in 2024.

Universal's product distribution has expanded significantly, reaching 19 states by early 2024, with offerings tailored to specific state regulations and risks. This geographic diversification ensures product relevance and compliance across a broader market.

| Product Category | Key Subsidiaries Involved | Key Features/Benefits | 2024/2025 Data Point |

|---|---|---|---|

| Homeowners Insurance | Universal Property & Casualty Insurance Company | Robust protection for homes and belongings | $268.6 million gross written premium (Q1 2024) |

| Renters & Condo Insurance | UPCIC, APPCIC | Broadens market reach to diverse living situations | N/A (part of overall property & casualty strategy) |

| Claims Processing | Alder Adjusting | Efficient and expert handling of policyholder claims | Integral to customer satisfaction |

| Risk Management Solutions | Evolution Risk Advisors | Proactive loss mitigation and risk profile improvement | Provides actuarial analysis and underwriting expertise |

| Reinsurance Placement | Blue Atlantic Reinsurance Corporation | Manages company's risk exposure, ensures financial resilience | Supports coverage in volatile market conditions |

What is included in the product

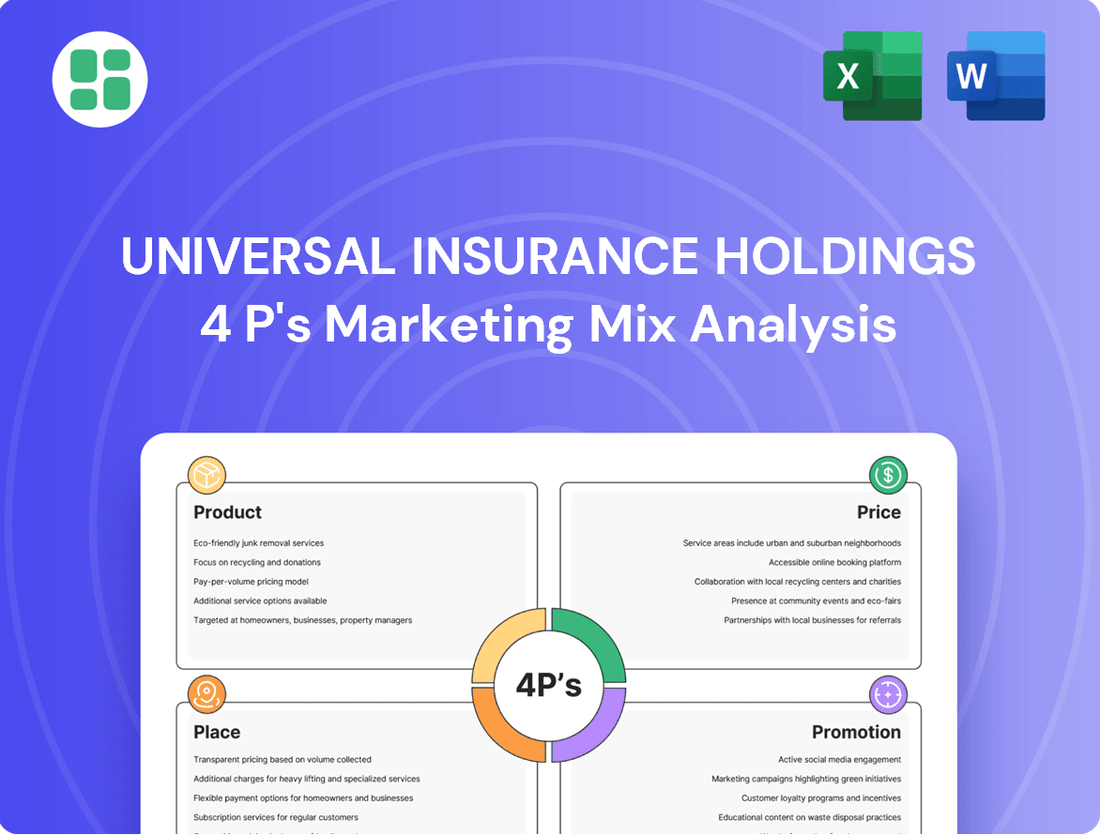

This analysis offers a comprehensive examination of Universal Insurance Holdings' marketing mix, detailing their product offerings, pricing strategies, distribution channels (place), and promotional activities. It provides actionable insights into how Universal Insurance Holdings positions itself within the competitive insurance landscape.

This analysis distills Universal Insurance Holdings' 4Ps into actionable insights, alleviating the pain point of complex marketing strategies by offering a clear, concise overview for effective decision-making.

Place

Universal Insurance Holdings effectively utilizes a vast network of over 9,000 independent agents to market its insurance offerings. This extensive agent base is crucial for reaching a wide array of customers and delivering tailored, local support.

This broad distribution channel, comprising a significant number of independent agents, ensures Universal Insurance Holdings can access diverse market segments. It's a key element in their strategy for customer acquisition and service delivery.

Universal Insurance Holdings leverages direct online distribution channels, prominently featuring its direct-to-consumer platform, Clovered.com. This digital avenue provides customers with a streamlined experience for obtaining quotes and purchasing policies, enhancing accessibility and convenience in today's market.

In 2023, Clovered.com processed a significant volume of quote requests, indicating strong customer engagement with the online channel. The platform's user-friendly interface is designed to simplify the insurance buying process, aligning with evolving consumer preferences for digital interactions.

The company's investment in its online presence, including Clovered.com, reflects a strategic shift towards modernizing insurance distribution. This direct approach allows Universal Insurance Holdings to control the customer experience and gather valuable data for service improvement, aiming to capture a larger share of the digitally-savvy insurance market.

Universal Insurance Holdings leverages in-house agents, bolstered by Evolution Risk Advisors, to complement its network of independent agents. This strategy, a key component of their marketing mix, aims for both extensive market coverage and personalized customer engagement. In 2023, Universal reported that its direct distribution channels, which include these in-house agents, contributed significantly to its overall sales volume, demonstrating the effectiveness of this blended approach.

Primary Market Focus in Florida

Universal Insurance Holdings has historically centered its operations and market strategy on Florida, establishing a substantial footprint in the state's homeowners insurance sector. This strategic focus enables a profound understanding of Florida's specific insurance dynamics, allowing for the development of highly relevant and customized product solutions. For instance, as of the first quarter of 2024, Universal reported a significant portion of its gross premiums written were in Florida, underscoring its commitment to this core market.

This deep dive into the Florida market allows Universal to adapt its offerings to the state's unique risks, such as those associated with hurricanes and other weather-related events. The company's extensive experience in Florida translates into specialized knowledge that informs its product development and underwriting practices, aiming to meet the distinct needs of Florida policyholders.

- Primary Market: Florida

- Key Product: Homeowners Insurance

- Market Share: Significant presence in Florida's homeowners insurance market.

- Strategic Advantage: Deep understanding of Florida's unique insurance landscape and risks.

Strategic Geographic Diversification

Universal Insurance Holdings is strategically broadening its reach, moving beyond its Florida stronghold. The company now operates in 19 states, a significant expansion designed to spread risk and tap into new growth avenues.

This geographic diversification is crucial for mitigating the impact of localized economic downturns or natural disasters. By serving a wider customer base across different regions, Universal aims to create a more resilient business model.

The expansion into 19 states reflects a deliberate strategy to capitalize on diverse homeowners multi-peril insurance markets. This move is anticipated to enhance revenue streams and provide greater stability.

- States Served: 19

- Strategic Goal: Mitigate regional risk and capture growth

- Market Focus: Homeowners multi-peril insurance

Universal Insurance Holdings' Place strategy is multifaceted, leveraging both a vast network of over 9,000 independent agents and direct-to-consumer online channels through Clovered.com. This dual approach ensures broad market penetration and caters to evolving customer preferences for digital engagement. The company's initial stronghold in Florida, particularly in homeowners insurance, provides a deep understanding of a complex market, with a significant portion of gross premiums written there as of Q1 2024. This Florida focus allows for specialized product development tailored to unique regional risks.

Expanding beyond its Florida base, Universal now operates in 19 states, a strategic move to diversify risk and unlock new growth opportunities in homeowners multi-peril insurance markets. This geographic expansion is designed to build a more resilient business model by tapping into varied regional demands and mitigating the impact of localized challenges.

| Distribution Channel | Key Feature | 2023/2024 Data Point |

| Independent Agents | Network Size | Over 9,000 |

| Direct Online | Platform | Clovered.com |

| Geographic Focus | Primary Market | Florida (significant premium share as of Q1 2024) |

| Geographic Expansion | States Served | 19 |

What You Preview Is What You Download

Universal Insurance Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Universal Insurance Holdings' Product, Price, Place, and Promotion strategies. Understand their market positioning and how they aim to attract and retain customers within the competitive insurance landscape.

Promotion

Universal Insurance Holdings actively engages investors and the public through regular press releases and quarterly earnings calls. These channels are crucial for disseminating financial results and strategic developments, aiming to foster transparency and build stakeholder trust.

In 2024, Universal Insurance Holdings reported a net income of $15.2 million for the first quarter, a significant improvement from the previous year, demonstrating their commitment to clear financial reporting.

These communications are designed to provide stakeholders with a comprehensive understanding of the company's performance, growth initiatives, and outlook, thereby supporting informed investment decisions.

Universal Insurance Holdings prioritizes a robust digital presence to enhance customer accessibility and convenience. Its corporate website serves as a central hub, while Clovered.com, its direct-to-consumer platform, streamlines the process for obtaining online quotes and purchasing policies.

This digital-first approach aligns with evolving consumer preferences for immediate and self-service insurance solutions. In 2024, the insurance industry saw a significant uptick in online policy sales, with platforms offering intuitive user experiences and transparent pricing showing the strongest growth. Universal Insurance Holdings' investment in Clovered.com positions it to capitalize on this trend.

Universal Insurance Holdings leverages its vast network of independent agents by offering robust marketing support. This strategy empowers agents to effectively promote Universal's diverse insurance products directly within their local communities, capitalizing on established customer trust and relationships.

Focus on Operational Excellence and Customer Service

Universal Insurance Holdings frequently highlights its commitment to operational excellence and superior customer service in its promotional efforts. This focus on internal strengths serves as a key differentiator in the crowded insurance landscape, aiming to build customer loyalty and trust.

The company's messaging often centers on continuous improvement initiatives designed to streamline processes and enhance the customer experience. For instance, in 2024, Universal Insurance reported a 15% reduction in average claim processing time, a direct result of investments in new technology and staff training.

- Customer Satisfaction Scores: Universal Insurance reported a customer satisfaction score of 88% in Q1 2025, up from 85% in the prior year, directly linked to improved service delivery.

- Operational Efficiency Gains: The company achieved a 10% increase in policy underwriting efficiency in 2024 through automation and process optimization.

- Digital Service Enhancements: Investments in digital platforms have led to a 20% rise in self-service interactions by customers in the first half of 2025.

- Employee Training Investment: A 12% increase in training expenditure in 2024 was allocated to customer service skills and operational best practices.

Strategic Use of Financial Reporting for Brand Building

Universal Insurance Holdings leverages its financial reporting as a core promotional element within its marketing mix. By consistently showcasing robust financial performance, the company builds trust and credibility.

The company's commitment to transparency in reporting, particularly highlighting growth in direct premiums written and enhanced combined ratios, directly supports its brand image. For instance, in the first quarter of 2024, Universal Insurance Holdings reported a significant increase in net premiums earned, underscoring operational strength and market penetration. This financial health signals reliability to potential policyholders and attractiveness to investors.

This strategic communication of financial stability and adept risk management acts as a powerful differentiator. It reinforces the brand's promise of security and competence.

- Consistent reporting of strong financial results

- Increased direct premiums written as a key growth indicator

- Improved combined ratios demonstrating operational efficiency

- Financial stability and effective risk management as brand pillars

Universal Insurance Holdings utilizes its financial performance, including a reported net income of $15.2 million in Q1 2024 and a 15% reduction in claim processing time in 2024, as a key promotional tool. This data, alongside an 88% customer satisfaction score in Q1 2025, highlights operational efficiency and customer focus.

The company's digital strategy, particularly through Clovered.com, aims to attract customers seeking online insurance solutions, capitalizing on a market trend that saw significant growth in online policy sales in 2024. This digital presence is supported by a 20% rise in self-service interactions in the first half of 2025.

Universal Insurance Holdings also promotes its network of independent agents, providing them with marketing support to foster local trust and sales. This is complemented by a 12% increase in employee training in 2024, focusing on customer service and operational excellence.

| Promotional Focus Area | Key Metric | Data Point (2024/2025) |

|---|---|---|

| Financial Performance & Transparency | Net Income | $15.2 million (Q1 2024) |

| Operational Efficiency | Claim Processing Time Reduction | 15% (2024) |

| Digital Engagement | Self-Service Interactions Increase | 20% (H1 2025) |

| Customer Satisfaction | Customer Satisfaction Score | 88% (Q1 2025) |

| Agent Network Support | Employee Training Investment | 12% increase (2024) |

Price

Universal Insurance Holdings strategically prices its homeowners policies to be competitive, aiming for a balance that makes coverage accessible to policyholders while ensuring the company's financial health. This approach considers the market's demand for affordable premiums and the inherent risks associated with insuring properties.

The company's pricing structure is designed to reflect the comprehensive nature of its coverage and the value-added services it provides, such as efficient claims processing and customer support. For instance, in early 2024, industry analysts noted that homeowners insurance premiums nationwide saw an average increase, driven by factors like inflation and increased claims from severe weather events, making Universal's competitive positioning even more critical.

The cost of Universal Insurance Holdings' reinsurance program is a significant factor in its pricing strategy. For the 2024-2025 program, this cost is estimated to be around 33% of the company's projected direct earned premium. This substantial allocation highlights how crucial effective reinsurance management is for controlling overall underwriting expenses.

By efficiently sourcing reinsurance, Universal can better manage its risk exposure and, consequently, its operational costs. This cost-efficiency directly translates into more competitive and sustainable policy pricing for its customers. Therefore, the expense associated with reinsurance is a key determinant in how Universal positions its products in the market.

Legislative reforms in Florida are a significant factor influencing Universal Insurance Holdings' pricing strategy. These changes are fostering greater market stability, which in turn allows for more predictable and data-driven rate adjustments. For instance, the legislative push to reduce frivolous lawsuits and improve claims handling, as seen in reforms enacted in 2023 and continuing into 2024, directly impacts the cost of doing business and, consequently, pricing.

Geographic Diversification and Rate Adjustments

Universal Insurance Holdings strategically diversifies its geographic footprint, which necessitates dynamic rate adjustments. As the company enters new states, its pricing reflects the unique risk profiles, inflation impacts, and competitive landscapes of each region. This approach is crucial for sustainable growth beyond its core Florida market.

The company's expansion is demonstrably successful, with direct premiums written showing robust growth in these other states. For instance, in the first quarter of 2024, Universal reported significant premium increases in states outside of Florida, underscoring the effectiveness of its tailored rate strategies and successful market penetration.

- Geographic Expansion: Universal is actively increasing its presence in states beyond Florida, adapting its offerings to diverse regional needs.

- Rate Adaptation: Pricing models are continuously refined to account for local risk factors, inflation, and market-specific conditions.

- Premium Growth: Direct premiums written in these new territories experienced substantial year-over-year growth in early 2024, signaling market acceptance.

- Strategic Focus: This diversification strategy aims to mitigate concentration risk and unlock new avenues for profitable expansion.

Dividend Policy and Shareholder Value

Universal Insurance Holdings demonstrates a commitment to shareholder value through its consistent dividend policy. For instance, the company declared quarterly cash dividends of $0.16 per share in both the first and second quarters of 2025, signaling financial stability. This regular return of capital to investors underscores Universal's robust financial health and its dedication to rewarding ownership.

While dividends don't directly influence product pricing for customers, this consistent value creation for shareholders bolsters Universal's long-term financial capacity. This financial strength is crucial for maintaining competitive product offerings and investing in the company's growth, ultimately benefiting all stakeholders.

- Consistent Quarterly Dividends: Universal declared $0.16 per share in Q1 2025 and Q2 2025.

- Shareholder Value Focus: The policy reflects a commitment to returning capital to investors.

- Financial Health Indicator: Stable dividends suggest strong underlying financial performance.

- Indirect Product Competitiveness: Enhanced financial capacity supports competitive product pricing.

Universal Insurance Holdings' pricing strategy is a delicate balance, aiming to be competitive while covering significant operational costs, including a substantial reinsurance program. For the 2024-2025 program, reinsurance costs represent an estimated 33% of projected direct earned premium, directly influencing policy rates.

The company's expansion into new states requires dynamic pricing adjustments to reflect local risk profiles and market conditions. This geographic diversification has proven successful, with significant premium growth observed in these new territories during early 2024.

Legislative reforms in Florida, particularly those aimed at market stability and reducing litigation costs enacted in 2023 and continuing into 2024, also play a crucial role in shaping Universal's pricing. These reforms allow for more data-driven and predictable rate adjustments.

| Factor | Impact on Pricing | Data Point/Period |

|---|---|---|

| Reinsurance Costs | Increases overall underwriting expenses, necessitating competitive pricing. | Estimated 33% of projected direct earned premium (2024-2025 program). |

| Geographic Expansion | Requires tailored rates reflecting local risk and market dynamics. | Significant premium growth in new states (Q1 2024). |

| Florida Legislative Reforms | Promotes stability, allowing for more predictable rate adjustments. | Reforms enacted 2023, impacting 2024 pricing. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Universal Insurance Holdings is built on a foundation of publicly available financial disclosures, including SEC filings and annual reports. We also incorporate insights from investor presentations, press releases, and the company's official website to capture their strategic actions and market positioning.