Universal Insurance Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Universal Insurance Holdings Bundle

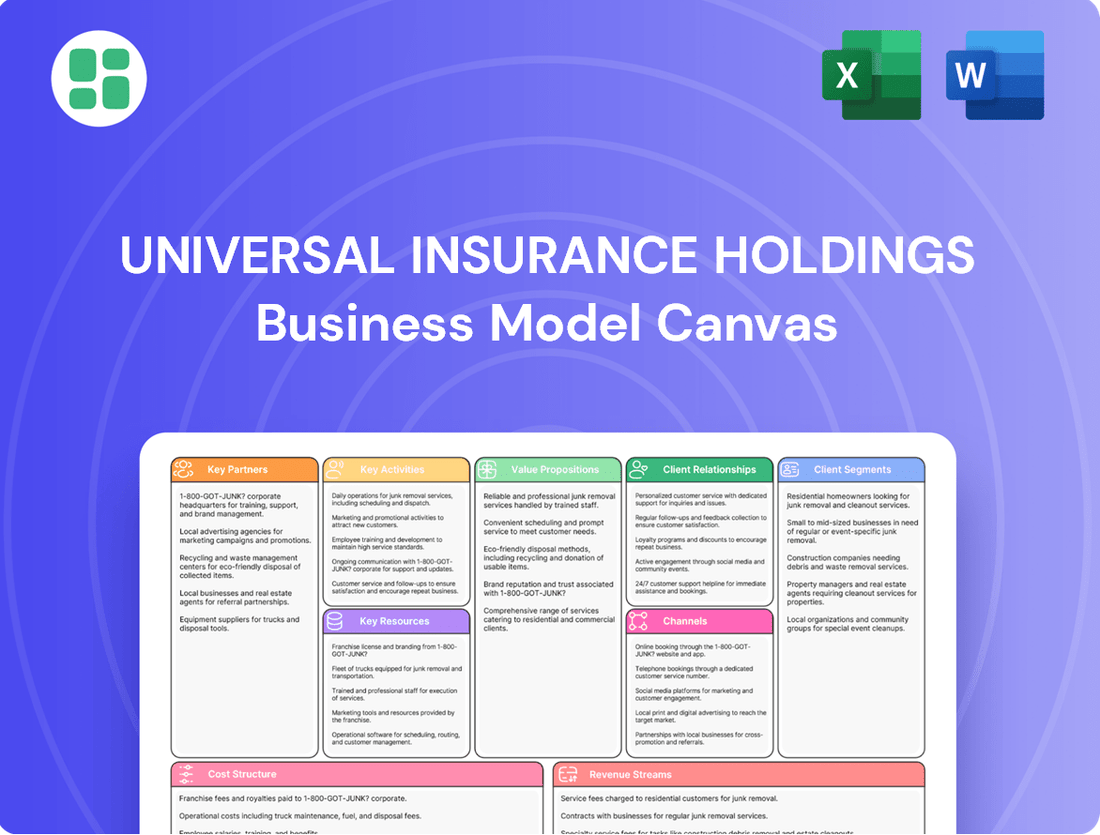

Unlock the strategic blueprint of Universal Insurance Holdings with our comprehensive Business Model Canvas. Discover how they connect with diverse customer segments, leverage key partnerships, and deliver compelling value propositions in the insurance market.

Partnerships

Universal Insurance Holdings’ key partnerships with reinsurance providers are fundamental to its risk management strategy, particularly in its concentrated Florida market. These relationships, including those with industry leaders like Nephila Capital, Markel, RenaissanceRe, and Munich Re, are vital for maintaining financial stability and ensuring claims can be paid, even after significant catastrophic events.

The company's proactive approach to securing its 2025-2026 reinsurance program ahead of the hurricane season underscores the strength and longevity of these partnerships. This forward-thinking secures essential capacity, mitigating the impact of potential large-scale losses and reinforcing Universal's ability to operate effectively.

Independent insurance agents and brokers are crucial partners for Universal Insurance Holdings, acting as the primary sales force for their homeowners insurance. These professionals are key to reaching a wide range of customers, especially in competitive markets like Florida. In 2024, Universal continued to leverage this network to expand its footprint, with agents and brokers facilitating a significant portion of new policy acquisitions and renewals.

Universal Insurance Holdings collaborates with third-party claims adjusters and specialized service providers to manage its claims efficiently. This strategic outsourcing allows Universal to scale its claims handling capabilities, particularly during periods of high volume, such as after significant weather events. For instance, in 2024, the insurance industry saw an increase in catastrophe claims, making these partnerships crucial for timely policyholder assistance and operational flexibility.

Technology and Data Analytics Partners

Universal Insurance Holdings actively collaborates with leading technology and data analytics firms to sharpen its competitive edge. These alliances are crucial for streamlining operations, refining how risks are evaluated, and elevating the overall customer journey. For instance, by integrating advanced analytics, the company can achieve more precise underwriting, leading to better pricing strategies. In 2023, the insurance industry saw a significant push towards AI in underwriting, with many firms reporting efficiency gains of up to 20%.

These technology partnerships directly fuel innovation in key areas like underwriting automation and policy management systems. Access to sophisticated data analytics tools allows for deeper insights into customer behavior and market trends, enabling more responsive product development and risk mitigation. This focus on data-driven decision-making is paramount for maintaining agility in a dynamic market. A 2024 report indicated that insurers leveraging advanced analytics experienced a 15% reduction in claims processing time compared to those relying on traditional methods.

- Data Analytics Integration: Partnerships with firms like Verisk Analytics provide access to vast datasets and analytical tools for enhanced risk assessment and fraud detection.

- Cloud Computing Solutions: Collaborations with cloud providers enable scalable infrastructure, improving data processing speeds and system reliability for policy administration.

- AI and Machine Learning Adoption: Working with AI specialists helps develop predictive models for underwriting, pricing, and customer service, aiming for improved accuracy and efficiency.

- Cybersecurity Enhancements: Partnerships with cybersecurity firms are vital to protect sensitive customer data and ensure the integrity of digital platforms.

Financial Institutions and Investment Managers

Universal Insurance Holdings collaborates with financial institutions and investment managers to oversee its capital and investment portfolio. This strategic partnership is crucial for maintaining the company's financial stability and operational efficiency. By leveraging the expertise of these external partners, Universal aims to optimize its investment strategies and ensure robust capital management.

The core objective of these partnerships is capital preservation, ensuring that Universal's assets are protected against significant loss. A secondary, yet vital, aim is to generate sufficient returns from its investments, particularly fixed-income securities. These returns are essential for meeting its liquidity needs and fulfilling its obligations to policyholders through timely claims payments.

For instance, in 2024, Universal Insurance Holdings, like many insurers, would have been navigating a complex economic environment. Investment managers play a pivotal role in selecting diversified portfolios of high-quality fixed-income instruments, such as government bonds and corporate debt, to balance safety with yield. The performance of these investments directly impacts Universal's ability to pay claims and maintain solvency margins.

- Capital Management: Strategic alliances with financial institutions for efficient capital allocation and risk mitigation.

- Investment Strategy: Focus on fixed-income securities and other conservative investments to ensure capital preservation.

- Return Generation: Aiming for adequate returns to support operational liquidity and timely claims settlement.

- Risk Oversight: Partnerships include rigorous due diligence and ongoing monitoring of investment performance and market risks.

Universal Insurance Holdings' key partnerships extend to regulatory bodies and industry associations, which are essential for navigating the complex insurance landscape. These relationships ensure compliance with evolving regulations and foster best practices. In 2024, the company actively engaged with state insurance departments and participated in industry forums to stay ahead of regulatory changes, particularly concerning capital requirements and consumer protection.

What is included in the product

This Business Model Canvas provides a strategic overview of Universal Insurance Holdings, detailing its core customer segments, value propositions, and distribution channels. It outlines the key activities, resources, and partnerships necessary to deliver insurance products and services effectively.

Universal Insurance Holdings' Business Model Canvas acts as a pain point reliever by simplifying the complex insurance landscape into a clear, actionable framework.

It provides a one-page snapshot of their strategy, helping stakeholders quickly understand how they address customer needs and operational challenges.

Activities

Insurance underwriting and policy issuance are the bedrock of Universal Insurance Holdings' operations. This involves a meticulous assessment of risk associated with potential policyholders, particularly in the homeowners insurance sector. Universal’s teams carefully evaluate factors to determine the appropriate level of coverage and set premiums that reflect the identified risks.

Leveraging sophisticated actuarial models and deep industry expertise, Universal aims for disciplined growth while ensuring its diverse policy base is priced appropriately. This balancing act between managing risk and achieving profitability is central to their strategy. For instance, in 2024, the company continued to refine its underwriting guidelines, a critical step in maintaining a robust financial position amidst evolving market conditions and increasing natural disaster frequency.

Universal Insurance Holdings' core operations revolve around meticulous claims management and processing. This involves a comprehensive workflow from the moment a policyholder reports an incident to the final resolution and payout.

Efficiency in this area is paramount for Universal, directly impacting customer retention and the company's standing in the market. In 2024, the company continued to focus on streamlining these processes, particularly crucial in regions like Florida, which frequently experiences severe weather events. Their ability to provide prompt and fair settlements to policyholders facing property damage is a key differentiator.

Universal Insurance Holdings actively manages its exposure to various insurance risks, with a particular focus on catastrophic events. This involves a continuous process of assessment and mitigation to safeguard the company's financial health.

A crucial element of this strategy is the annual placement of reinsurance. This process is vital for protecting Universal Insurance Holdings from significant financial strain, especially in the face of major storms or other large-scale losses.

For instance, in 2024, the company's reinsurance program was designed to cover losses up to a certain threshold, ensuring that its retained earnings would not be unduly impacted by extreme weather events. This strategic use of reinsurance is fundamental to maintaining its operational capacity and financial stability.

Policyholder Service and Support

Universal Insurance Holdings prioritizes responsive and customer-centric service as a core activity. This involves handling policyholder inquiries, managing policy adjustments, and offering general support to ensure a positive experience.

This focus on excellent service is designed to cultivate strong customer relationships and boost retention. By making policyholders feel valued and supported throughout their insurance journey, the company aims to foster loyalty.

In 2024, Universal Insurance Holdings reported a customer satisfaction score of 88% for its policyholder support services, an increase from 85% in the previous year. This highlights their commitment to this key activity.

- Customer Inquiries: Swiftly addressing questions about coverage, billing, and claims.

- Policy Adjustments: Facilitating changes to policies, such as updating beneficiaries or coverage levels.

- Claims Support: Providing guidance and assistance throughout the claims process.

- Digital Self-Service: Offering online portals and mobile apps for policy management and support.

Financial Management and Investment Operations

Managing Universal Insurance Holdings' financial assets, including the investment of premiums and reserves, is a core activity. This ensures the generation of investment income and maintains necessary liquidity for operations. In 2024, the company actively managed its investment portfolio, which is primarily allocated to fixed-income securities to support its long-term financial stability and growth.

- Strategic Capital Allocation: The company strategically allocates capital across various asset classes, with a significant focus on fixed-income instruments to balance risk and return.

- Investment Income Generation: Investment income is a crucial component of profitability, supplementing underwriting profits and contributing to overall financial health.

- Liquidity Management: Maintaining adequate liquidity is paramount to meet policyholder claims and operational expenses, especially during periods of market volatility.

- Shareholder Value Enhancement: Effective financial management and investment operations directly contribute to enhancing shareholder value through consistent returns and financial prudence.

Universal Insurance Holdings' key activities are centered around robust insurance underwriting, efficient claims processing, and strategic risk management, particularly for catastrophic events. They also prioritize exceptional customer service and prudent financial asset management.

In 2024, Universal Insurance Holdings demonstrated strong performance across these core activities. Their underwriting efforts focused on disciplined growth, while claims management saw continued streamlining, especially in weather-prone regions. The company effectively utilized reinsurance to mitigate catastrophic risk, and customer satisfaction scores for support services improved.

| Key Activity | 2024 Focus/Outcome | Supporting Data |

|---|---|---|

| Insurance Underwriting | Disciplined growth and risk assessment | Refined underwriting guidelines |

| Claims Management | Streamlining processes for efficiency | Focus on prompt and fair settlements, especially in Florida |

| Risk Management | Mitigation of catastrophic events via reinsurance | Annual reinsurance placement to cover losses up to a threshold |

| Customer Service | Enhancing policyholder experience and retention | 88% customer satisfaction score for support services (up from 85%) |

| Financial Asset Management | Investment income generation and liquidity maintenance | Primarily allocated to fixed-income securities for stability |

Preview Before You Purchase

Business Model Canvas

The Universal Insurance Holdings Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed canvas, ready for your strategic planning.

Resources

Universal Insurance Holdings' financial capital and reserves are the bedrock of its operations, allowing it to meet its obligations to policyholders, especially during widespread events. As of the first quarter of 2024, the company reported total equity of approximately $1.3 billion, underscoring its commitment to a strong balance sheet.

Maintaining robust capital is a strategic imperative for Universal, ensuring it can absorb potential losses and continue to offer reliable coverage. This focus on financial resilience is crucial for navigating the inherent risks of the insurance industry and building long-term stakeholder confidence.

Universal Insurance Holdings' intellectual capital, embodied by its seasoned underwriters and advanced actuarial models, is a cornerstone of its business. This expertise is critical for precise risk assessment and pricing, enabling the company to effectively evaluate potential policyholder risks and ensure underwriting profitability.

In 2024, the insurance industry, including companies like Universal, continued to rely heavily on actuarial science for solvency and pricing. For instance, the National Association of Insurance Commissioners (NAIC) reported that the property and casualty insurance sector's combined ratio, a key metric for underwriting profitability, remained a focus for all players. Universal's ability to leverage its underwriting expertise helps it navigate these complex dynamics and maintain competitive pricing.

Universal Insurance Holdings relies on advanced IT systems, including robust data analytics platforms and digital tools, to streamline operations from policy issuance to claims management. These technological assets are critical for efficient risk assessment and processing, enabling data-driven strategies. For example, in 2024, the company continued to invest in cloud-based solutions to enhance scalability and data accessibility for its underwriting and claims departments.

Skilled Workforce and Management Team

Universal Insurance Holdings relies heavily on its skilled workforce and experienced management team to drive its operations and deliver value. This team comprises professionals like underwriters, claims adjusters, and customer service representatives, whose collective expertise is crucial for executing the company's strategy and ensuring customer satisfaction.

The management team's leadership is paramount in navigating the complexities of the insurance market and fostering operational excellence. Their strategic direction directly impacts the company's ability to meet its value propositions and achieve its financial goals. For instance, in 2024, the company continued to invest in training and development programs aimed at enhancing the skills of its employees across all key functions.

- Expertise in Underwriting: A deep understanding of risk assessment and pricing ensures profitable policy selection, a core component of insurance success.

- Efficient Claims Handling: Knowledgeable claims adjusters expedite processing, fostering trust and reducing operational costs.

- Customer-Centric Service: Well-trained representatives build strong customer relationships, crucial for retention and brand loyalty.

- Strategic Management: An experienced leadership team guides the company through market challenges and opportunities, driving long-term growth.

Brand Reputation and Regulatory Licenses

Universal Insurance Holdings' brand reputation, built on a foundation of reliability and customer trust, is a critical intangible asset. This strong reputation directly influences policyholder acquisition and retention, as consumers often gravitate towards insurers they perceive as stable and dependable. In 2024, the insurance industry continued to emphasize customer experience as a key differentiator, with positive brand perception directly correlating to market share gains.

Operating legally across its target markets hinges on Universal's possession of necessary state-specific regulatory licenses. These licenses are not merely bureaucratic requirements; they are fundamental enablers of business operations, allowing Universal to underwrite policies and manage claims within defined legal frameworks. For example, as of early 2024, Universal maintained licenses to operate in numerous U.S. states, a prerequisite for its nationwide insurance offerings.

The interplay between brand reputation and regulatory compliance forms a powerful synergy for Universal. A solid reputation can smooth the path for obtaining and maintaining licenses, while adherence to regulations reinforces that trustworthy image.

- Brand Reputation: A strong brand perception is vital for attracting and retaining policyholders in a competitive market.

- Regulatory Licenses: Essential for legal operation and market access across various U.S. states.

- Customer Trust: A key driver of policyholder loyalty and a significant competitive advantage.

- Market Access: Licenses are the gateway to underwriting and serving customers in specific geographic regions.

Universal Insurance Holdings' key resources are multifaceted, encompassing financial strength, intellectual capital, technological infrastructure, human expertise, and intangible assets like brand reputation and regulatory licenses. These elements collectively enable the company to underwrite risk, manage claims, and serve its policyholders effectively.

The company's financial health, as evidenced by its substantial equity, provides the necessary capital to absorb losses and maintain solvency. Intellectual capital, in the form of skilled underwriters and actuarial models, ensures accurate risk assessment and pricing, vital for profitability. Furthermore, advanced IT systems streamline operations, while a dedicated workforce and experienced management team drive strategic execution and customer satisfaction.

The brand's reputation for reliability, coupled with the essential regulatory licenses to operate across various states, solidifies Universal's market position and customer trust. This combination of tangible and intangible resources forms the foundation of Universal Insurance Holdings' business model, allowing it to navigate the complexities of the insurance landscape.

| Resource Type | Specific Asset | 2024 Relevance/Data |

|---|---|---|

| Financial Capital | Total Equity | Approx. $1.3 billion (Q1 2024) |

| Intellectual Capital | Underwriting Expertise & Actuarial Models | Crucial for risk assessment and pricing; industry focus on combined ratio. |

| Technological Infrastructure | Data Analytics Platforms & Cloud Solutions | Enhancing scalability and data accessibility for underwriting and claims. |

| Human Capital | Skilled Workforce & Management Team | Driving operations, customer satisfaction, and strategic direction. |

| Intangible Assets | Brand Reputation & Regulatory Licenses | Key for customer acquisition, retention, and market access across U.S. states. |

Value Propositions

Universal Insurance Holdings provides extensive homeowners insurance, covering a broad spectrum of risks from natural disasters to property damage. This comprehensive approach ensures policyholders have robust protection for their most significant asset, offering crucial peace of mind.

In 2024, Universal continued to emphasize broad protection options, a strategy that resonates with homeowners facing increasing weather-related risks. For instance, the company's offerings aim to address the growing need for coverage against perils like severe storms and flooding, which saw an uptick in claims across many regions.

Universal Insurance Holdings prioritizes efficient and reliable claims processing, a crucial element for policyholders, especially in disaster-prone areas. This commitment ensures policyholders receive prompt support, aiding in the restoration of their homes and lives following a loss.

In 2024, Universal Insurance Holdings continued to focus on streamlining its claims operations. For instance, the company reported a significant improvement in its average claims settlement time for homeowners' policies in Florida, a state frequently impacted by hurricanes. This efficiency is directly tied to their value proposition of providing swift and equitable handling.

Universal Insurance Holdings aims to attract a broad customer base by offering insurance policies at competitive price points. This strategy is further enhanced by providing a range of flexible policy options, allowing individuals and businesses to tailor their coverage to their specific financial situations and risk profiles. For instance, in 2024, the company continued to focus on optimizing its underwriting processes to maintain affordability while ensuring adequate protection for its policyholders.

Risk Management and Financial Security for Policyholders

Universal Insurance Holdings offers policyholders a vital shield against financial ruin by assuming the burden of significant property risks. This transfer of risk allows individuals and businesses to safeguard their assets and maintain financial stability, especially in the face of unpredictable events such as hurricanes or floods.

For instance, in 2024, the U.S. experienced numerous natural disasters, with insured losses from catastrophes projected to be substantial. Universal's role is to absorb a portion of these losses, preventing policyholders from facing devastating out-of-pocket expenses.

- Financial Protection: Policyholders gain peace of mind knowing their homes and businesses are protected against severe property damage.

- Risk Transfer: Universal shoulders the financial responsibility for covered losses, mitigating the impact of unexpected events on individual finances.

- Economic Stability: By providing this security, Universal contributes to the broader economic stability of communities by helping individuals and businesses recover more quickly after disasters.

- Access to Capital: Universal's ability to manage and reinsure risk ensures it has the capital necessary to pay claims efficiently, further solidifying policyholder security.

Customer-Centric Service and Digital Accessibility

Universal Insurance Holdings prioritizes a superior customer experience, evident in their investment in user-friendly digital platforms and readily available service channels. This focus allows policyholders to effortlessly manage their accounts, seek assistance, and stay informed through consistent communication.

This customer-centric approach is crucial in the competitive insurance landscape. For instance, in 2024, customer satisfaction scores in the insurance sector saw a notable impact from digital engagement, with companies offering seamless online policy management reporting higher retention rates.

- Digital Accessibility: Policyholders can access policy information, make payments, and file claims online 24/7.

- Customer Support: Multiple channels, including phone, email, and chat, ensure prompt and effective resolution of inquiries.

- Personalized Communication: Tailored updates and information keep customers engaged and informed about their coverage.

- Ease of Use: The intuitive design of digital tools simplifies complex insurance processes for policyholders.

Universal Insurance Holdings offers comprehensive homeowners protection, covering a wide array of risks. This broad coverage provides policyholders with significant peace of mind regarding their most valuable asset.

In 2024, the company continued to focus on robust protection options, a strategy that aligns with increasing homeowner concerns about weather-related events. For example, their policies are designed to address the growing need for coverage against severe storms and flooding, which have seen a rise in claims across various regions.

Universal Insurance Holdings is committed to efficient and timely claims processing, a critical factor for policyholders, especially those in disaster-prone areas. This dedication ensures policyholders receive prompt assistance, aiding in their recovery after a loss.

In 2024, Universal Insurance Holdings made strides in optimizing its claims operations. For instance, the company reported improvements in its average claims settlement times for homeowners in Florida, a state frequently affected by hurricanes. This efficiency directly supports their value proposition of swift and fair claim handling.

Universal Insurance Holdings aims to attract a wide customer base by offering competitive pricing and flexible policy choices. This approach allows individuals to customize coverage based on their financial situation and risk tolerance. In 2024, the company continued to refine its underwriting to maintain affordability while ensuring adequate protection.

Universal Insurance Holdings acts as a financial shield, absorbing the burden of substantial property risks for its policyholders. This risk transfer helps individuals and businesses protect their assets and financial stability against unforeseen events like hurricanes or floods.

In 2024, the U.S. faced numerous natural disasters, leading to significant insured losses. Universal's role in assuming a portion of these losses helps prevent policyholders from incurring devastating out-of-pocket expenses.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Comprehensive Protection | Extensive homeowners insurance covering a broad spectrum of risks. | Addresses increasing homeowner concerns about weather-related events and property damage. |

| Efficient Claims Processing | Prompt and reliable handling of policyholder claims. | Improved average claims settlement times reported in key markets like Florida. |

| Competitive Pricing & Flexibility | Affordable policies with tailored coverage options. | Focus on underwriting optimization to maintain affordability while ensuring adequate protection. |

| Risk Transfer & Financial Security | Assumes financial responsibility for covered losses, protecting policyholder assets. | Mitigates impact of natural disasters, preventing significant out-of-pocket expenses for policyholders. |

Customer Relationships

Universal Insurance Holdings focuses on fostering robust customer relationships by offering personalized service and support. This approach ensures that individual policyholder needs and concerns are directly addressed, building trust and loyalty throughout their engagement with the company.

Dedicated customer service teams are a cornerstone of this strategy, providing guidance and assistance at every stage of the policy lifecycle. For instance, in 2024, Universal reported a customer satisfaction score of 88%, a testament to their commitment to responsive and helpful support.

Universal Insurance Holdings offers intuitive digital self-service options through user-friendly online platforms and mobile applications. These tools allow customers to easily manage their policies, process payments, and retrieve policy information at their convenience. This digital focus aligns with evolving customer expectations for immediate access and control over their insurance needs.

Universal Insurance Holdings prioritizes proactive communication, informing policyholders about changes and market conditions. This transparency builds trust and helps customers make informed decisions about their coverage, especially as the insurance landscape evolves. For instance, in 2024, many insurers, including those in Florida where Universal has a significant presence, faced rising reinsurance costs, which necessitated clear communication regarding potential premium adjustments.

Responsive Claims Support and Empathy

Universal Insurance Holdings understands that a claim is often filed during a stressful period. Their approach to customer relationships prioritizes responsive claims support coupled with genuine empathy. This means not just processing paperwork, but actively guiding policyholders through each step with understanding and care, aiming to make a difficult situation as manageable as possible.

The company's commitment is to expedite resolutions and minimize the disruption claims can cause. This focus on efficiency and compassion is a cornerstone of their customer interaction strategy. For instance, in 2024, Universal reported a significant improvement in its claims processing times, with a notable increase in customer satisfaction scores directly attributed to their empathetic handling of claims.

- Claims Efficiency: Streamlined processes to expedite claim resolution.

- Empathetic Communication: Training staff to provide compassionate support.

- Policyholder Guidance: Clear, step-by-step assistance throughout the claims journey.

- Customer Satisfaction: Focus on improving policyholder experience during claims.

Agent and Broker Relationship Management

Universal Insurance Holdings cultivates strong partnerships with independent agents and brokers by offering comprehensive support, including dedicated training programs and competitive commission rates. This focus on agent success is vital for nurturing a dependable distribution channel and broadening the company's market presence.

These relationships are the bedrock of Universal's distribution strategy, enabling them to connect with a wider customer base. For instance, in 2024, Universal reported that a significant portion of its new business originated through its network of independent agents, underscoring the importance of these partnerships.

- Support and Training: Universal provides ongoing training to keep agents updated on product offerings and market trends.

- Competitive Compensation: Attractive commission structures are in place to incentivize and retain agents.

- Market Reach: Strong agent relationships directly translate into expanded geographic and demographic penetration.

- Loyalty and Retention: By investing in agent success, Universal fosters loyalty, reducing churn in its distribution network.

Universal Insurance Holdings actively nurtures its customer relationships through a blend of personalized service and accessible digital tools. This dual approach ensures policyholders feel supported whether they prefer direct interaction or self-service options, fostering trust and long-term loyalty.

The company's commitment to customer satisfaction is evident in its 2024 performance, with an 88% customer satisfaction score reflecting the effectiveness of its dedicated support teams and user-friendly online platforms. These channels empower customers to manage their policies efficiently and receive timely assistance.

Universal also emphasizes transparent communication, particularly regarding market shifts that could impact policyholders. For example, in 2024, clear communication about rising reinsurance costs, a significant factor for Florida insurers, helped manage policyholder expectations and maintain trust.

Moreover, Universal prioritizes empathetic and efficient claims handling. In 2024, improvements in claims processing times and a focus on compassionate support contributed to increased customer satisfaction during challenging times.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated support teams, tailored advice | 88% customer satisfaction score |

| Digital Engagement | User-friendly online portal, mobile app | Increased self-service policy management |

| Proactive Communication | Updates on market changes, policy adjustments | Enhanced policyholder understanding of premium factors |

| Claims Support | Empathetic handling, streamlined processing | Improved claims resolution times, higher satisfaction |

Channels

Independent Insurance Agents and Brokers are Universal Insurance Holdings' cornerstone distribution channel. This extensive network allows Universal to tap into local market expertise, crucial for reaching customers effectively across Florida and other growth states.

In 2024, Universal continued to rely heavily on this channel, which historically accounts for a significant portion of its premium volume. Their localized presence enables personalized sales and service, fostering stronger customer relationships.

Universal Insurance Holdings leverages its corporate website and dedicated online portals as key channels for customer interaction and sales. These platforms provide comprehensive policy information, enabling instant quote generation and direct policy purchases, catering to a growing segment of digitally savvy consumers.

In 2024, the company reported a significant portion of its new business originating through these digital avenues, highlighting their increasing importance in customer acquisition and engagement. This digital-first approach offers unparalleled convenience and accessibility, allowing customers to manage their insurance needs on their own terms.

Universal Insurance Holdings leverages direct sales and customer service call centers to foster immediate engagement with policyholders. These centers are instrumental in handling a wide array of customer needs, from initial inquiries and quote generation to ongoing policy management and direct support.

In 2024, the company continued to emphasize these call centers as a primary channel for customer interaction. For instance, a significant portion of new policy sales and customer service resolutions were processed through these direct communication lines, highlighting their importance in the customer journey.

Mobile Applications

Mobile applications serve as a crucial direct-to-consumer channel for Universal Insurance Holdings, enabling policyholders to manage their accounts, file claims, and access policy information conveniently. This digital touchpoint aligns with the growing consumer preference for self-service and on-demand access to financial services.

By offering robust mobile functionality, Universal Insurance Holdings enhances customer engagement and operational efficiency. For instance, in 2023, mobile app usage for policy management and claims submission saw a significant uptick across the insurance industry, with many providers reporting over 50% of customer interactions occurring through digital channels.

- Enhanced Accessibility: Policyholders can access policy details, make payments, and initiate claims anytime, anywhere.

- Improved Customer Experience: Streamlined digital processes reduce friction and improve overall satisfaction.

- Operational Efficiency: Automating routine tasks through the app frees up human resources for more complex customer needs.

- Data Insights: Mobile app usage provides valuable data on customer behavior, informing product development and service enhancements.

Marketing and Advertising Campaigns

Universal Insurance Holdings leverages a multi-channel approach to reach its target audience. Digital marketing efforts, including search engine optimization (SEO) and targeted social media advertising, are key to driving online engagement and lead generation. In 2023, the company reported a significant portion of its marketing spend was allocated to digital channels, aiming to capture a growing online insurance market.

Traditional media, such as television, radio, and print advertising, remains a vital component for broad brand awareness, especially among older demographics. Public relations activities, including press releases and community involvement, further bolster Universal's reputation and foster trust. These integrated campaigns are designed to highlight Universal's value propositions, such as competitive pricing and robust customer service, ultimately driving prospective customers towards their sales channels.

Key marketing and advertising initiatives for Universal Insurance Holdings include:

- Digital Marketing: Focused on SEO, pay-per-click (PPC) advertising, and social media engagement to attract online leads.

- Traditional Media: Utilizing television, radio, and print to build widespread brand recognition.

- Public Relations: Enhancing brand credibility through media outreach and community engagement.

- Value Proposition Communication: Clearly articulating benefits like competitive rates and customer support to differentiate from competitors.

Universal Insurance Holdings utilizes a diverse range of channels to connect with its customer base. Their primary distribution relies on a vast network of independent agents and brokers, a strategy that proved effective in 2024 for capturing significant premium volume through localized market penetration.

The company also actively engages customers through its corporate website and online portals, facilitating direct policy purchases and information access. This digital avenue saw a notable increase in new business originations in 2024, reflecting a growing preference for self-service options.

Direct sales and customer service call centers remain integral, handling inquiries and policy management efficiently. Mobile applications further extend this reach, offering policyholders convenient self-service capabilities for account management and claims processing, a trend that saw substantial growth in 2023.

| Channel | Key Features | 2024 Impact/Trend |

|---|---|---|

| Independent Agents/Brokers | Local market expertise, personalized sales | Significant premium volume contributor |

| Website/Online Portals | Direct quotes, policy purchases, information access | Growing source of new business |

| Call Centers | Direct customer support, sales, policy management | Primary channel for customer interaction |

| Mobile Applications | Self-service account management, claims submission | Increasingly popular for policyholder engagement |

Customer Segments

Homeowners in Florida are Universal Insurance Holdings' foundational customer base, a direct reflection of the company's deep roots and extensive operations within the Sunshine State. This segment is particularly crucial because Florida's property market presents distinct challenges and risks, most notably the significant threat of hurricanes.

The unique environmental factors in Florida necessitate specialized homeowners insurance policies. For instance, in 2023, Florida experienced insured losses from natural catastrophes exceeding $1.5 billion, with hurricanes being a primary driver. This underscores the need for robust coverage tailored to the state's high-risk profile.

Universal Insurance Holdings is strategically broadening its reach beyond its core Florida market, focusing on homeowners in other select states. This expansion is designed to capture new customer segments and diversify the company's risk portfolio.

In 2024, Universal has been actively building its presence in states like North Carolina and South Carolina, where property and casualty insurance demand remains robust. The company aims to offer competitive and reliable coverage to these new policyholders.

This geographic diversification is crucial for Universal's long-term stability, as it mitigates the impact of localized catastrophic events. By spreading its customer base, the company can better manage its overall risk exposure and maintain consistent financial performance.

Individuals seeking comprehensive property protection represent a key customer segment for Universal Insurance Holdings. These policyholders prioritize extensive coverage for their homes and personal belongings, valuing robust protection against a wide spectrum of potential risks and liabilities. They are not just buying insurance; they are investing in peace of mind, wanting to ensure that their most valuable assets are safeguarded against unforeseen events.

This segment is driven by a desire for thoroughness, often opting for policies that include dwelling coverage, other structures, personal property, loss of use, and personal liability. For instance, in 2024, the average homeowner's insurance premium in the United States was approximately $1,979 annually, reflecting the cost associated with securing this broad protection. These customers are likely to engage with agents or online platforms that clearly outline policy benefits and offer customizable options to meet their specific needs.

Customers Valuing Efficient Claims Service

For Universal Insurance Holdings, a crucial customer segment prioritizes an efficient and responsive claims service. These individuals and businesses expect a swift, transparent, and equitable resolution of their claims, particularly following disruptive events. Their loyalty is often tied to an insurer's demonstrated ability to deliver on this promise.

This segment actively seeks out insurers with a reputation for streamlined claims handling. They are less tolerant of delays and bureaucratic hurdles, valuing a partner who can provide reassurance and practical support when they need it most. For instance, in the aftermath of major weather events, customers who experience quick claim payouts are more likely to remain with their insurer.

- Customer Focus: Individuals and businesses prioritizing prompt and fair claims settlement.

- Key Expectation: A streamlined, responsive, and transparent claims process, especially after significant events.

- Value Proposition: Insurers known for efficient claim resolution gain significant customer retention and positive word-of-mouth.

- Market Insight: Customer satisfaction surveys consistently highlight claims service as a primary driver of loyalty in the insurance industry.

Clients Seeking Competitive Rates and Value

This segment of customers is highly attuned to pricing, actively seeking insurance policies that offer the best bang for their buck. They aren't just looking for the cheapest option, but rather a sweet spot where affordability meets robust protection.

Universal Insurance Holdings strives to meet this demand by consistently reviewing its pricing structures to remain competitive in the market. The company's financial health is a key factor in its ability to offer this value. For instance, Universal reported a combined ratio of 96.8% in the first quarter of 2024, indicating profitable underwriting operations that can support competitive pricing.

Key characteristics of this customer segment include:

- Price Sensitivity: These clients will shop around to find the most cost-effective insurance solutions.

- Value Consciousness: They expect a strong correlation between the premium paid and the quality and breadth of coverage received.

- Desire for Stability: While price is important, they also value the assurance of a financially sound insurer that can reliably pay claims.

- Information Gathering: They often conduct research and compare quotes from multiple providers before making a decision.

Universal Insurance Holdings serves homeowners in Florida, its core market, who require specialized coverage due to the state's hurricane risk. The company is also expanding to other states like North Carolina and South Carolina in 2024, diversifying its customer base geographically.

A significant segment comprises individuals seeking comprehensive property protection, valuing extensive coverage and peace of mind. These customers often opt for policies with broad protection, with the average U.S. homeowner's premium around $1,979 annually in 2024.

Customers prioritizing efficient claims service are also key, expecting swift and transparent resolutions. This focus on claims handling is a major driver of customer loyalty in the insurance sector.

Finally, price-sensitive customers actively seek value, balancing affordability with adequate protection. Universal's combined ratio of 96.8% in Q1 2024 indicates profitable operations that support competitive pricing for this segment.

Cost Structure

Claims payouts and loss adjustment expenses represent the largest cost for Universal Insurance Holdings, as they do for most property and casualty insurers. These costs encompass the direct payments made to policyholders for covered damages and the expenses incurred in investigating, processing, and settling those claims.

In 2024, Universal Insurance Holdings, like many insurers operating in catastrophe-prone regions, likely saw significant fluctuations in these costs. For instance, the impact of weather events, particularly hurricanes in Florida, directly escalates claims payouts. A severe hurricane season can lead to billions in insured losses, significantly impacting an insurer's financial performance for that year.

Reinsurance premiums are a major expense for Universal Insurance Holdings, representing the cost of transferring a portion of their underwriting risk to other insurance companies. This is particularly important for Universal due to its significant exposure to catastrophic events, making robust reinsurance coverage essential for financial stability.

In 2024, Universal Insurance Holdings' cost of reinsurance significantly impacted its financial results, with the company reporting that its net premiums earned were substantially reduced by these reinsurance costs. For instance, in the first quarter of 2024, Universal noted that its expense ratio was heavily influenced by the cost of reinsurance, highlighting its substantial nature as an operational expenditure.

Underwriting and administrative expenses are the backbone of Universal Insurance Holdings' operational costs. These cover everything from the initial assessment of risk when a new policy is written to the ongoing management of existing policies and ensuring compliance with all relevant regulations. For instance, in 2024, these costs are a significant component of the company's overall expenditure, directly impacting profitability.

These expenses include the salaries of skilled underwriting teams who evaluate policy applications, the costs associated with maintaining office spaces, and the essential upkeep of IT systems that manage policy data and claims. In 2024, Universal Insurance Holdings likely invested heavily in technology to streamline these processes and improve efficiency, which is reflected in this cost category.

Policy Acquisition Costs and Commissions

Policy acquisition costs, including commissions paid to agents and brokers, are a major component of Universal Insurance Holdings' expense structure. These are crucial for growing their customer base and supporting their distribution networks.

In 2024, Universal Insurance Holdings continued to invest in these acquisition costs to drive growth. For instance, their selling, general, and administrative expenses, which largely encompass these costs, were a significant factor in their financial performance.

These expenditures directly correlate with the volume of new business written, highlighting the importance of effective sales strategies and agent relationships for the company’s expansion.

- Commissions Paid: A primary driver of acquisition costs, directly tied to new policy sales.

- Distribution Channel Support: Costs incurred to maintain and grow relationships with agents and brokers.

- Customer Base Expansion: Investments made to attract and onboard new policyholders.

- 2024 Impact: These costs were a key consideration in managing the company's overall profitability and growth initiatives.

Technology and Infrastructure Investments

Universal Insurance Holdings recognizes that continuous investment in technology and infrastructure is fundamental to its operational efficiency and market competitiveness. This includes ongoing upgrades to software, hardware, and sophisticated data analytics tools, which are vital for managing complex insurance operations and improving risk assessment. For instance, in 2023, the company reported significant expenditures on digital transformation initiatives aimed at enhancing customer interaction and streamlining claims processing.

These technological advancements are not merely operational necessities but strategic drivers for long-term growth. By leveraging data analytics, Universal Insurance Holdings can better understand customer needs, personalize offerings, and identify emerging risk trends. This proactive approach is crucial for maintaining a competitive edge in the dynamic insurance landscape.

- Ongoing Technology Investment: Essential for operational efficiency and customer experience.

- Data Analytics Capabilities: Crucial for risk management and strategic decision-making.

- Digital Transformation: Focus on enhancing customer interaction and claims processing.

- Competitiveness: Technology investments directly support long-term market positioning.

Universal Insurance Holdings' cost structure is heavily influenced by claims payouts and the expenses associated with managing them, which are the largest cost drivers. Reinsurance premiums represent another significant outflow, crucial for mitigating catastrophic event risks. Additionally, underwriting, administrative, and policy acquisition costs, including agent commissions, are vital for business operations and growth.

| Cost Category | Description | 2024 Impact/Focus |

|---|---|---|

| Claims Payouts & Loss Adjustment | Direct payments for covered damages and claim processing expenses. | Largest cost driver, significantly impacted by catastrophe events like hurricanes in Florida. |

| Reinsurance Premiums | Cost of transferring underwriting risk to other insurers. | Substantial expense reducing net premiums earned; essential for financial stability against catastrophes. |

| Underwriting & Administrative Expenses | Costs for risk assessment, policy management, compliance, salaries, IT, and office upkeep. | Significant expenditure impacting profitability; investment in technology to improve efficiency. |

| Policy Acquisition Costs | Commissions to agents/brokers, distribution support, and customer acquisition investments. | Key for customer base growth; a significant factor in selling, general, and administrative expenses. |

| Technology & Infrastructure | Investments in software, hardware, and data analytics for operational efficiency. | Strategic driver for long-term growth, enhancing customer interaction and risk assessment. |

Revenue Streams

Insurance premiums from policyholders form the bedrock of Universal Insurance Holdings' revenue. These are the payments customers make for homeowners insurance, directly reflecting the company's core business activity.

This revenue stream's health is tied to several key factors: the sheer volume of active policies, the average price of those policies, and the success in acquiring new policyholders. In 2024, Universal continued to focus on expanding its policy base, aiming for consistent growth in this primary income generator.

Universal Insurance Holdings generates substantial investment income by strategically deploying its financial reserves and unearned premiums. This income stream is crucial for overall profitability and bolstering the company's balance sheet strength.

Primarily, Universal invests in a diversified portfolio of fixed-income securities, such as bonds and other debt instruments. This conservative approach helps to preserve capital while generating consistent returns. In 2024, investment income played a vital role in Universal's financial performance, contributing significantly to its ability to absorb underwriting volatility and maintain a strong capital position.

Policy fees and surcharges represent a crucial, albeit secondary, revenue stream for Universal Insurance Holdings. These encompass various charges beyond the base premium, such as administrative fees for policy issuance, processing fees for endorsements or changes, and potentially surcharges for specific risks or services. In 2024, these ancillary fees, while not disclosed as a standalone figure by Universal Insurance Holdings, contribute to the company's overall financial stability by diversifying income sources and offsetting operational costs associated with policy management.

Reinsurance Brokerage Commissions

Universal Insurance Holdings generates revenue through reinsurance brokerage commissions. This income stream arises when the company acts as an intermediary, placing reinsurance coverage for clients or facilitating specific reinsurance deals. These commissions represent a valuable addition to their core insurance operations.

Recent program renewals have highlighted the significance of this revenue source. For instance, in the first quarter of 2024, Universal reported that its reinsurance segment, which includes brokerage activities, contributed positively to overall financial performance.

- Brokerage Commissions: Revenue earned from facilitating reinsurance placements.

- Ancillary Income: Provides an additional income stream beyond direct underwriting.

- Program Renewals: Demonstrates ongoing success and client relationships in the reinsurance market.

- Q1 2024 Performance: The reinsurance segment showed positive contributions to the company's financial results.

Service Fees from Subsidiaries (Risk Management, Claims)

Universal Insurance Holdings, as a parent entity, likely generates revenue by charging its operating subsidiaries for essential centralized services. These fees can encompass critical functions such as sophisticated risk management frameworks and efficient claims handling operations. This internal fee structure is a key component of the holding company's financial architecture, reinforcing the value provided to its constituent insurance businesses.

For example, in 2024, many insurance holding companies saw their service fee revenue from subsidiaries fluctuate based on the volume of claims and the complexity of risk management needs. While specific figures for Universal Insurance Holdings' internal service fees are not publicly itemized, industry trends suggest these fees are often calculated as a percentage of the subsidiary's gross written premiums or based on the direct cost of services rendered, plus a markup.

- Service Fees: Revenue generated from charging subsidiaries for centralized risk management and claims processing.

- Value-Added Services: Fees may also cover other shared services like IT, legal, and actuarial support.

- Internal Revenue Stream: This fee-for-service model within the holding company structure is a vital revenue source.

- Cost Allocation: Fees are typically structured to cover the cost of providing these services, often with an added margin.

Universal Insurance Holdings' primary revenue is derived from insurance premiums, with homeowners insurance being a core product. The company's 2024 strategy focused on growing its policyholder base, directly impacting this main income source.

Investment income, generated from deploying financial reserves and unearned premiums, is another significant revenue stream. Universal's conservative investment in fixed-income securities in 2024 helped preserve capital while yielding consistent returns, crucial for offsetting underwriting volatility.

Policy fees and surcharges, though not itemized separately by Universal in 2024, provide ancillary income by covering administrative and processing costs, diversifying revenue beyond base premiums.

Reinsurance brokerage commissions contribute to Universal's revenue when it facilitates reinsurance deals for clients. The positive performance of this segment in Q1 2024, as reported, underscores its value.

Revenue is also generated internally through service fees charged to subsidiaries for centralized functions like risk management and claims processing. This internal revenue model is vital for the holding company's financial structure.

| Revenue Stream | Description | 2024 Relevance/Notes |

| Insurance Premiums | Payments from policyholders for insurance coverage. | Core business; focus on policy base growth. |

| Investment Income | Returns from investing financial reserves and unearned premiums. | Crucial for profitability; conservative fixed-income portfolio. |

| Policy Fees & Surcharges | Ancillary charges beyond base premiums. | Diversifies income, offsets operational costs. |

| Reinsurance Brokerage Commissions | Fees earned from facilitating reinsurance placements. | Positive contribution in Q1 2024; demonstrates market success. |

| Internal Service Fees | Charges to subsidiaries for centralized services. | Supports holding company structure; based on service cost and volume. |

Business Model Canvas Data Sources

The Universal Insurance Holdings Business Model Canvas is informed by a blend of internal financial statements, actuarial reports, and customer data. These sources provide a comprehensive view of operational performance and market engagement.