UnitedHealth Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UnitedHealth Group Bundle

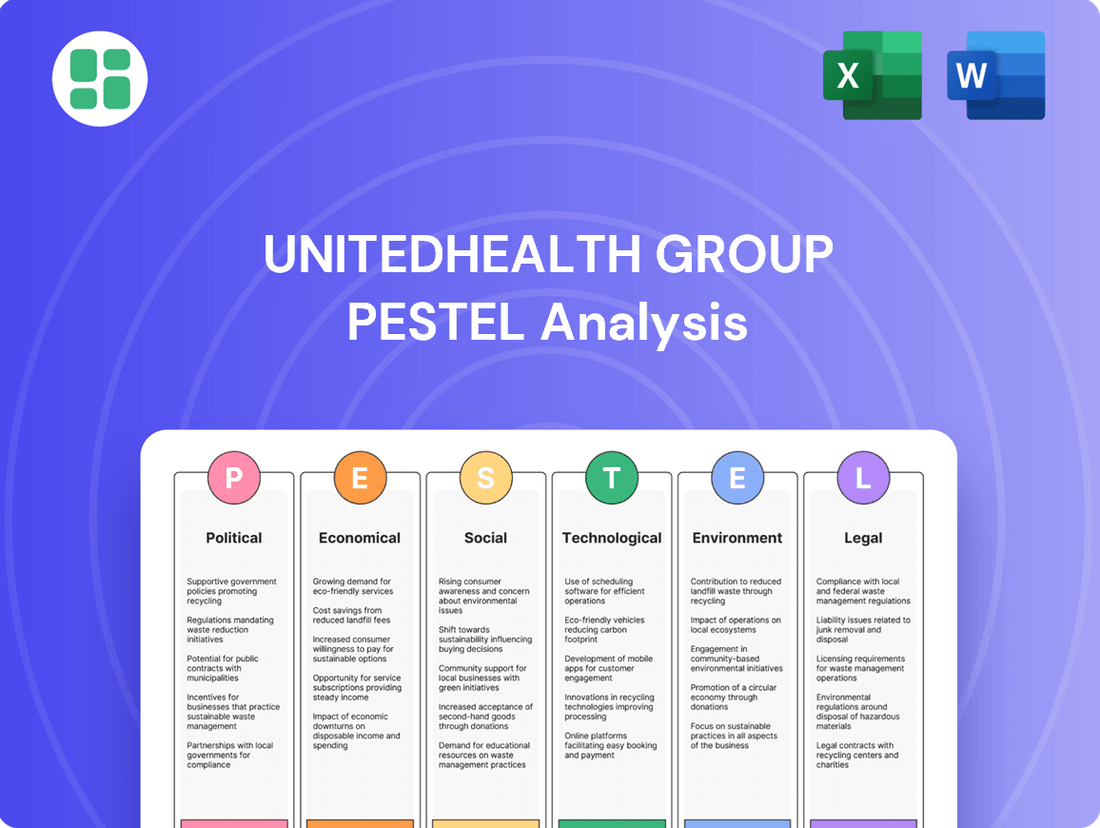

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping UnitedHealth Group's trajectory. This comprehensive PESTLE analysis offers actionable insights into the external forces driving innovation and risk within the healthcare giant. Equip yourself with the knowledge to anticipate market shifts and refine your strategic approach.

Political factors

UnitedHealth Group's performance is deeply intertwined with government healthcare policies, especially concerning Medicare Advantage and Medicaid. For instance, the Centers for Medicare & Medicaid Services (CMS) announced a proposed 0.2% rate increase for Medicare Advantage plans in 2024, a figure that directly impacts UnitedHealth's substantial Medicare Advantage segment.

Ongoing legislative efforts, such as the Inflation Reduction Act's provisions affecting prescription drug pricing for Medicare Part D, also present significant considerations. These policy adjustments can alter reimbursement levels and benefit designs, directly influencing the financial viability of UnitedHealthcare's various insurance products.

UnitedHealth Group (UNH) is under persistent regulatory scrutiny, particularly concerning antitrust issues and its Medicare Advantage operations. The Department of Justice, for instance, has been investigating the company's billing practices, with a particular focus on how artificial intelligence might be used in diagnostics and its potential impact on Medicare billing. This ongoing examination, which has been a significant factor throughout 2024 and is expected to continue into 2025, could result in substantial legal challenges and financial penalties, potentially affecting UNH's public image and its ability to operate freely.

UnitedHealth Group (UHG) actively lobbies policymakers to shape healthcare regulations, particularly focusing on policies that support its value-based care initiatives and ensure predictable revenue streams from programs like Medicare Advantage. For instance, in 2023, UHG's political action committee contributed over $4.4 million to federal candidates and party committees, demonstrating a significant investment in influencing the political environment. Their policy recommendations, such as those detailed in the 'A Path Forward' report, aim to create a stable payment structure and encourage a transition to payment models that reward quality outcomes over volume.

Healthcare Spending Priorities

Government decisions on healthcare spending priorities significantly shape UnitedHealth Group's operational landscape. For instance, shifts in Medicare and Medicaid funding directly influence the revenue streams of its UnitedHealthcare segment. In 2024, the Centers for Medicare & Medicaid Services (CMS) finalized a 3.3% increase in Medicare Advantage payments for 2025, a figure that was lower than some initial projections, impacting the profitability of plans serving seniors.

UnitedHealth Group's strategic alignment with national health initiatives is crucial for securing government contracts and fostering growth. The company actively participates in programs aimed at improving public health outcomes, such as initiatives focused on chronic disease management and value-based care. These efforts are vital for maintaining and expanding its market share in government-sponsored health plans.

The political climate and legislative actions regarding healthcare reform present both opportunities and challenges. For example, legislative debates around prescription drug pricing or the expansion of public health insurance programs can create uncertainty or open new avenues for service expansion. UnitedHealth Group must remain agile, adapting its business model to policy changes and prioritizing areas where government funding aligns with its core competencies.

Key areas of government focus that impact UnitedHealth Group include:

- Funding for Medicare and Medicaid: Fluctuations in these programs directly affect revenue and operational strategies.

- Public Health Initiatives: Investments in areas like mental health, preventative care, and substance abuse treatment create new service opportunities.

- Healthcare Affordability and Access: Policies aimed at reducing costs or expanding coverage can influence market demand and competitive dynamics.

- Regulatory Environment: Changes in healthcare regulations, such as those related to data privacy or network adequacy, require ongoing compliance and strategic adjustments.

International Healthcare Policy Trends

UnitedHealth Group's Optum, while U.S.-centric, increasingly navigates international markets, making global healthcare policy a critical factor. Changes in data privacy regulations, such as GDPR in Europe, directly impact how Optum handles patient information across its international operations. For instance, the continued expansion of digital health services necessitates adherence to varying national healthcare system structures and compliance requirements, influencing Optum's service delivery models and strategic growth. In 2024, the World Health Organization continued to emphasize global health equity, a trend that could shape regulatory approaches to healthcare access and service provision in countries where Optum aims to expand.

International policy shifts directly affect Optum's global strategy and compliance efforts.

- Global Data Privacy Laws: Evolving regulations like GDPR and similar frameworks in Asia and Latin America require robust data protection measures for Optum's international patient data, impacting operational costs and data sharing capabilities.

- Healthcare System Structures: Variations in national healthcare funding models and provider regulations in countries where Optum offers services, such as its expanding presence in Latin America, necessitate tailored operational approaches.

- Digital Health Regulations: As telehealth and remote patient monitoring gain traction globally, differing regulatory landscapes for these services in markets like the UK and Australia present both opportunities and compliance challenges for Optum.

Government funding levels for Medicare and Medicaid are paramount, directly influencing UnitedHealth Group's revenue. For example, the finalized 3.3% increase in Medicare Advantage payments for 2025, announced by CMS, impacts profitability for plans serving seniors. Furthermore, ongoing regulatory scrutiny, including Department of Justice investigations into billing practices in 2024 and expected into 2025, poses significant legal and financial risks.

UnitedHealth Group actively engages in lobbying, contributing millions to influence policy, aiming for stable payment structures and support for value-based care initiatives. The company's strategic alignment with public health programs, such as chronic disease management, is vital for securing government contracts and expanding its market share in government-sponsored health plans.

The political landscape surrounding healthcare reform creates both opportunities and challenges, requiring agility in adapting to policy changes, especially concerning prescription drug pricing and public health insurance expansion.

International policy shifts, particularly concerning data privacy laws like GDPR and varying healthcare system structures in markets where Optum expands, necessitate tailored operational approaches and robust compliance measures.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting UnitedHealth Group, detailing how political, economic, social, technological, environmental, and legal factors create both challenges and avenues for growth.

It offers actionable insights for strategic decision-making, equipping stakeholders to navigate the complex landscape and capitalize on emerging opportunities within the healthcare industry.

A concise, PESTLE-driven overview of UnitedHealth Group's external landscape, simplifying complex market forces into actionable insights for strategic decision-making.

This PESTLE analysis acts as a pain point reliever by offering a clear, structured understanding of the external factors impacting UnitedHealth Group, enabling proactive risk mitigation and opportunity identification.

Economic factors

Rising healthcare expenditures present a persistent economic challenge, directly impacting UnitedHealth Group's operational landscape. For instance, in the US, national health spending reached an estimated $4.5 trillion in 2023, a figure projected to continue its upward trajectory, increasing pressure on affordability for both individuals and employers.

UnitedHealth Group's core strategy is intrinsically linked to navigating these cost pressures by improving the efficiency and accessibility of care. The company's business model is designed to manage these escalating medical costs while ensuring the delivery of comprehensive health services, a crucial element given the anticipated ongoing rise in healthcare expenses.

Inflationary pressures are a significant headwind for UnitedHealth Group, directly impacting its operational expenses. Costs for labor, medical supplies, and technology have seen notable increases. For instance, in the first quarter of 2024, UnitedHealth Group reported a medical care ratio of 83.1%, up from 81.5% in the prior year's quarter, signaling a rise in healthcare service utilization and associated costs.

Managing these escalating costs is paramount for UnitedHealth Group's financial health. The company's ability to control its medical care ratio, which represents the percentage of premium revenue spent on medical claims, directly influences its profitability. Successfully navigating these inflationary trends is crucial for meeting its financial guidance and maintaining shareholder value.

UnitedHealth Group's performance is significantly tied to the overall economic climate. During periods of robust economic growth, businesses tend to expand, leading to higher employment and, consequently, increased employer-sponsored health plan enrollment. For instance, in 2023, the US economy experienced continued growth, which generally supports higher commercial membership for UnitedHealthcare.

Conversely, economic downturns or recessions can negatively impact enrollment. As businesses face financial strain, they may reduce workforce size or shift to less comprehensive, more cost-effective health plans. This can also drive individuals towards government-subsidized programs like Medicare and Medicaid. UnitedHealth Group's diverse portfolio, including its substantial Medicare and Medicaid businesses, provides a degree of resilience during such economic contractions.

Interest Rates and Capital Costs

Fluctuations in interest rates directly impact UnitedHealth Group's financial health. For instance, changes in the Federal Reserve's benchmark rate influence the cost of borrowing for the company, affecting its ability to finance acquisitions or fund ongoing operations. Higher rates can make debt more expensive, potentially slowing down strategic growth initiatives or reducing the capital available for share buybacks or dividends.

The company's investment portfolio, which includes significant cash reserves, is also sensitive to interest rate movements. As of the first quarter of 2024, UnitedHealth Group held approximately $25.2 billion in cash and cash equivalents. Changes in prevailing interest rates, such as the Federal Funds Rate which averaged around 5.33% in Q1 2024, directly affect the income generated from these holdings.

Furthermore, UnitedHealth Group's capital structure, which involves a mix of debt and equity, is inherently tied to prevailing interest rate environments. A rising rate scenario could increase the cost of servicing its existing debt and make new debt financing less attractive, potentially influencing its long-term capital allocation strategies and overall cost of capital.

- Impact on Borrowing Costs: UnitedHealth Group's cost of capital for new debt issuance is directly influenced by benchmark interest rates.

- Investment Income Sensitivity: The substantial cash reserves held by the company, totaling billions, generate income that fluctuates with prevailing interest rates.

- Acquisition Financing: Higher interest rates can increase the cost of financing significant acquisitions, a key growth strategy for UnitedHealth Group.

- Shareholder Returns: Increased borrowing costs or reduced investment income due to interest rate shifts could impact the company's capacity to return capital to shareholders.

Labor Market Trends and Workforce Shortages

The healthcare sector, including services provided by Optum Health, is grappling with persistent labor shortages, especially for skilled nurses and allied health professionals. This scarcity directly contributes to increased wage demands and operational costs, impacting UnitedHealth Group's bottom line.

To counter these workforce challenges, UnitedHealth Group is focusing on technological advancements and operational efficiencies. These investments aim to alleviate the strain of rising labor expenses and maintain sufficient staffing levels across its care delivery network.

- Nursing Shortage: As of early 2024, the U.S. faced a projected deficit of over 1 million registered nurses by 2030, a trend that continues to exert upward pressure on wages.

- Wage Inflation: Healthcare worker wages saw a notable increase in 2023, with some reports indicating year-over-year growth exceeding 5% for certain roles, directly affecting labor costs for companies like UnitedHealth Group.

- Technology Investment: UnitedHealth Group has been actively investing in telehealth platforms and AI-driven administrative tools to improve efficiency and potentially reduce reliance on certain labor-intensive roles.

- Staffing Ratios: Maintaining adequate nurse-to-patient ratios remains a critical concern, with regulatory bodies and professional organizations advocating for improved staffing levels, which can necessitate higher employment numbers.

Economic factors significantly shape UnitedHealth Group's operating environment, from rising healthcare expenditures to the broader economic climate. Inflationary pressures directly impact operational costs, as seen in the first quarter of 2024 where the medical care ratio increased to 83.1%. Economic growth generally boosts employer-sponsored health plan enrollment, benefiting commercial membership, while downturns can shift individuals to government programs, highlighting the importance of UnitedHealth Group's diverse business segments.

Interest rate fluctuations also play a crucial role, influencing borrowing costs and investment income. With approximately $25.2 billion in cash and cash equivalents as of Q1 2024, changes in rates, like the Federal Funds Rate averaging 5.33% in Q1 2024, directly affect investment earnings. Additionally, labor shortages, particularly for nurses, contribute to wage inflation, with healthcare worker wages seeing increases exceeding 5% in 2023 for certain roles, prompting investments in technology and efficiency.

| Economic Factor | Impact on UnitedHealth Group | Supporting Data (2023-2024) |

| Rising Healthcare Expenditures | Increased operational costs, pressure on affordability | US national health spending reached an estimated $4.5 trillion in 2023. |

| Inflationary Pressures | Higher labor, medical supply, and technology costs | Medical care ratio rose to 83.1% in Q1 2024 from 81.5% in Q1 2023. |

| Economic Growth/Downturns | Influences employer-sponsored health plan enrollment | US economy experienced continued growth in 2023, supporting commercial membership. |

| Interest Rate Fluctuations | Affects borrowing costs and investment income | Federal Funds Rate averaged 5.33% in Q1 2024; company held $25.2 billion in cash/equivalents in Q1 2024. |

| Labor Shortages | Increased wage demands and operational costs | Healthcare worker wages increased over 5% in 2023 for some roles; projected nursing deficit of over 1 million by 2030. |

Same Document Delivered

UnitedHealth Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of UnitedHealth Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping its strategic landscape.

Sociological factors

The demographic shift towards an older population, coupled with the increasing prevalence of chronic diseases, is a significant driver for UnitedHealth Group. This trend directly boosts demand for healthcare services, especially for offerings like Medicare Advantage plans. For instance, in 2024, Medicare Advantage enrollment was projected to reach over 32 million beneficiaries, a substantial market UnitedHealth Group actively serves.

UnitedHealth Group's strategic focus on seniors and individuals with complex health needs, including the expansion of its Dual Special Needs Plans (DSNP), aligns perfectly with this societal change. These plans cater to individuals eligible for both Medicare and Medicaid, a group disproportionately affected by chronic conditions. This demographic trend is a cornerstone of UnitedHealth Group's growth trajectory, as it captures a larger share of this expanding healthcare segment.

Consumers increasingly favor digital health solutions offering personalization and convenience, with telehealth and mobile health apps leading the way. This trend is evident in the projected growth of the global digital health market, expected to reach over $660 billion by 2025, up from approximately $211 billion in 2021.

UnitedHealth Group is actively adapting by bolstering its digital infrastructure. This includes enabling features for appointment scheduling, prescription refills, and virtual care access through its platforms. For instance, their Optum division is heavily invested in expanding virtual care capabilities, aiming to serve millions more members through digital channels.

Meeting these evolving patient expectations necessitates ongoing technological investment. UnitedHealth Group's commitment to innovation in digital health is demonstrated by their substantial R&D spending, which supports the development of user-friendly interfaces and advanced virtual care technologies to boost patient engagement and satisfaction.

UnitedHealth Group is increasingly focused on health equity, recognizing that factors outside of traditional healthcare, like housing and food security, significantly impact health outcomes. This aligns with a growing societal emphasis on social determinants of health, influencing how UNH designs its community health programs and services. For instance, in 2023, UNH committed $100 million to address social determinants of health, aiming to improve access to care for underserved populations.

The company's strategy actively seeks to bridge health disparities and enhance care accessibility for vulnerable groups. This involves expanding services, particularly for individuals with complex health needs and those residing in underserved geographic areas, directly supporting broader societal objectives for fair and equitable health results.

Public Perception of Managed Care

Public perception of managed care and health insurers significantly shapes UnitedHealth Group's (UHG) brand reputation and member trust. Concerns surrounding practices like prior authorization and claim denials often fuel negative sentiment, impacting how individuals view the healthcare system and their insurers.

UHG has faced scrutiny over its use of artificial intelligence (AI) in claims processing. For instance, reports in early 2024 highlighted concerns about Optum, UHG's health services arm, using AI to identify potentially unnecessary patient care, which critics argue could lead to claim denials and erode patient trust. This necessitates a strong commitment to transparency and responsible AI deployment to rebuild and maintain public confidence.

- Brand Reputation Impact: Negative public perception stemming from claim disputes or perceived AI bias can damage UHG's brand, potentially leading to member attrition.

- Trust Deficit: Issues like prior authorization delays and claim denials contribute to a broader trust deficit in managed care, affecting patient-provider relationships and insurer loyalty.

- AI Transparency Demands: The increasing use of AI in healthcare necessitates clear communication and ethical guidelines to ensure public acceptance and mitigate fears of unfair decision-making.

- Regulatory Scrutiny: Public outcry and media attention on these issues can attract increased regulatory oversight, potentially leading to new compliance burdens for UHG.

Lifestyle Changes and Preventative Care Trends

Societal shifts are increasingly prioritizing preventative care and proactive health management. This trend is evident in the growing adoption of wellness programs and a focus on managing chronic conditions before they escalate, directly influencing healthcare demand and service delivery models. UnitedHealth Group is actively aligning with this by championing value-based care, which rewards providers for keeping people healthy and reducing overall healthcare expenditures.

UnitedHealth Group's strategy heavily involves promoting wellness initiatives and utilizing advanced data analytics to pinpoint individuals at higher risk. This proactive approach aims to improve health outcomes and curb long-term costs. For instance, in 2024, UnitedHealth Group reported that its Optum health services segment, which includes many of these preventative and data-driven initiatives, saw revenue growth, underscoring the market's receptiveness to these strategies.

- Growing Demand for Wellness: Consumers are actively seeking services that promote well-being and disease prevention.

- Value-Based Care Adoption: Healthcare providers are increasingly adopting models that incentivize preventative services, with UnitedHealth Group being a key facilitator.

- Data-Driven Interventions: Leveraging data to identify at-risk populations allows for targeted preventative care, a core component of UnitedHealth Group's strategy.

- Chronic Condition Management: A significant portion of healthcare spending is on chronic diseases; proactive management is a key focus for cost reduction and improved quality of life.

Societal expectations are shifting towards greater health equity, with a growing emphasis on addressing social determinants of health like housing and food security. UnitedHealth Group is responding by investing in programs that tackle these issues, aiming to improve outcomes for underserved communities. For example, in 2023, UNH committed $100 million to address social determinants of health, demonstrating a commitment to broader societal goals.

The increasing preference for digital health solutions, including telehealth and mobile apps, is a significant trend. UnitedHealth Group is enhancing its digital infrastructure to meet this demand, with its Optum division actively expanding virtual care capabilities. This focus on digital convenience is crucial for engaging consumers, as the global digital health market is projected to exceed $660 billion by 2025.

Public perception of healthcare insurers, influenced by issues such as claim denials and the use of AI in processing, directly impacts UnitedHealth Group's brand reputation and member trust. Concerns about AI in claims processing, highlighted in early 2024 regarding Optum, underscore the need for transparency and ethical AI deployment to maintain public confidence.

There's a clear societal push towards preventative care and proactive health management. UnitedHealth Group is aligning with this by promoting wellness initiatives and adopting value-based care models. This strategy is reflected in the growth of its Optum segment, which focuses on data-driven interventions and chronic condition management, indicating market receptiveness to these preventative approaches.

Technological factors

The surge in telehealth and virtual care is a major technological shift, with UnitedHealth Group actively incorporating these services. For instance, in 2024, Optum, a UnitedHealth Group subsidiary, reported significant growth in its virtual care offerings, facilitating millions of virtual visits for members across its health plans.

This expansion directly addresses the demand for more accessible and convenient healthcare solutions. By integrating virtual medical and mental health appointments, UnitedHealth Group is not only meeting member needs but also leveraging technology to improve overall health system efficiency and outcomes.

UnitedHealth Group is heavily invested in artificial intelligence and advanced data analytics, especially through its Optum division. This technological focus underpins their strategy to enhance healthcare delivery and operational efficiency.

The company is actively using AI for a range of applications, from generating predictive insights and automating administrative tasks to providing clinical decision support and streamlining pharmacy operations. This commitment is evident in their development of over 1,000 AI applications aimed at improving both the quality of care and overall efficiency within the healthcare system.

By leveraging vast datasets, UnitedHealth Group aims to identify trends, personalize patient care pathways, and reduce costs. For instance, in 2023, Optum reported significant advancements in AI-driven tools designed to predict patient readmissions and optimize treatment plans, contributing to better health outcomes and more efficient resource allocation.

UnitedHealth Group's increasing reliance on digital health platforms places cybersecurity threats and data privacy at the forefront of its operational concerns. The company's 2024 cyberattack on its Change Healthcare subsidiary, which disrupted healthcare payments and patient care nationwide, underscored the immense vulnerability and critical need for enhanced security protocols. This incident alone cost the company an estimated $872 million in the first quarter of 2024, demonstrating the significant financial and operational impact of such breaches. Protecting sensitive patient data is not just a technical challenge but a fundamental requirement for maintaining customer trust and adhering to stringent regulatory frameworks like HIPAA.

Wearable Technology and Remote Patient Monitoring

The increasing adoption of wearable technology and remote patient monitoring (RPM) devices presents significant opportunities for UnitedHealth Group. These devices enable continuous health data collection, allowing for more proactive health management and personalized interventions. For instance, by 2025, it's projected that over 100 million wearable devices will be in use in the US alone, generating vast amounts of health-related data.

UnitedHealth Group can leverage this data by integrating it into its advanced analytics platforms. This integration facilitates the development of more tailored care plans and can lead to improved patient outcomes, particularly for chronic conditions. A key benefit is the support for a broader shift towards preventive healthcare, moving away from reactive treatment models.

- Wearable Device Market Growth: The global wearable medical device market is expected to reach over $110 billion by 2025, indicating substantial consumer and provider interest.

- Data Integration for Personalization: UnitedHealth Group's ability to analyze data from wearables can enhance risk stratification and personalize wellness programs, potentially reducing healthcare costs.

- Shift to Preventive Care: RPM and wearables empower individuals to take a more active role in their health, aligning with UnitedHealth Group's strategic focus on value-based care and preventative services.

- Remote Patient Monitoring Adoption: By 2024, an estimated 70% of all healthcare providers are expected to adopt some form of remote patient monitoring, creating a fertile ground for data-driven health solutions.

Interoperability and Electronic Health Records (EHR)

Advancements in interoperability and the widespread adoption of electronic health records (EHR) are critical for smooth data exchange across the healthcare industry. UnitedHealth Group's Optum segment leverages sophisticated data management systems to enhance care coordination and streamline operations. By 2024, the U.S. saw significant strides in EHR adoption, with over 86% of office-based physicians utilizing them, facilitating better data flow.

Improving interoperability is fundamental to building a more interconnected and efficient health system. This allows for the seamless sharing of patient information between different providers and systems, reducing errors and improving patient outcomes. For instance, Optum's data analytics capabilities, powered by interoperable EHRs, contributed to a reported 10% reduction in administrative costs for some partner organizations in 2024.

The drive towards enhanced interoperability is supported by government initiatives and industry standards. These efforts aim to create a unified digital health infrastructure. UnitedHealth Group is actively involved in these initiatives, recognizing that a connected ecosystem benefits both patients and providers, ultimately leading to more value-based care delivery.

Key aspects of technological factors include:

- EHR Adoption Rates: Over 86% of U.S. office-based physicians used EHRs by 2024, a figure expected to grow.

- Data Exchange Standards: Continued development and implementation of standards like FHIR (Fast Healthcare Interoperability Resources) are crucial.

- Optum's Data Capabilities: Optum's investment in data analytics and management systems aims to improve care coordination and efficiency.

- Impact on Efficiency: Enhanced interoperability can lead to significant cost savings and improved patient care pathways.

UnitedHealth Group is significantly leveraging artificial intelligence and advanced data analytics through its Optum division to refine healthcare delivery and boost operational efficiency.

The company is actively deploying AI for predictive insights, administrative automation, clinical decision support, and pharmacy operations, with over 1,000 AI applications in development by 2024 to enhance care quality and system efficiency.

By integrating vast datasets, UnitedHealth Group aims to identify health trends, personalize patient care, and reduce costs, with Optum reporting advancements in AI tools for predicting readmissions and optimizing treatment plans in 2023.

The increasing adoption of wearable technology and remote patient monitoring (RPM) devices presents substantial opportunities, with projections of over 100 million wearable devices in use in the US by 2025, generating extensive health data.

| Technology Area | 2024/2025 Data/Trend | Impact on UnitedHealth Group |

|---|---|---|

| Virtual Care | Millions of virtual visits facilitated by Optum in 2024. | Increased accessibility and efficiency in healthcare delivery. |

| Artificial Intelligence | Over 1,000 AI applications in development by 2024. | Enhanced predictive insights, operational automation, and personalized care. |

| Wearable Technology | Projected 100M+ US wearable devices by 2025; Global market over $110B by 2025. | Enables proactive health management and personalized interventions. |

| Cybersecurity | $872M estimated cost of Change Healthcare cyberattack in Q1 2024. | Highlights critical need for enhanced security and data privacy protocols. |

| EHR Adoption | Over 86% of US office-based physicians used EHRs by 2024. | Facilitates better data flow and care coordination. |

Legal factors

UnitedHealth Group navigates a stringent regulatory landscape, with the Health Insurance Portability and Accountability Act (HIPAA) being a cornerstone for safeguarding patient privacy and data security. The company must ensure robust systems and ongoing training to maintain compliance, as even minor infringements can trigger significant legal repercussions.

In 2023, the U.S. Department of Health and Human Services, Office for Civil Rights, reported over 130 million individuals affected by healthcare data breaches, underscoring the pervasive risks. UnitedHealth Group's commitment to stringent data protection protocols is therefore critical to avoid substantial fines, which can reach millions of dollars per violation, and to maintain public trust.

UnitedHealth Group's substantial market share, particularly in health insurance and healthcare services, frequently attracts attention from antitrust regulators. The company's history of strategic acquisitions, aimed at expanding its reach and capabilities, is often scrutinized to ensure it doesn't stifle competition. For instance, reports in late 2023 and early 2024 continued to highlight ongoing investigations into various aspects of the healthcare market, with companies like UnitedHealth Group often at the center due to their scale.

These legal pressures pose a significant challenge to UnitedHealth Group's growth strategy, especially concerning mergers and acquisitions. The potential for regulatory intervention can slow down or even block proposed deals, impacting the company's ability to consolidate its market position or enter new service areas. The sheer size of UnitedHealth Group, with revenues exceeding $370 billion in 2023, makes it a prime candidate for such scrutiny as regulators aim to maintain a competitive healthcare landscape.

UnitedHealth Group navigates significant litigation risks, including potential malpractice claims and allegations of false claims, particularly concerning its health insurance operations. Class-action lawsuits, such as the one filed in 2023 alleging improper use of its AI tool, nH Predict, highlight the company's exposure to legal challenges arising from its business practices and technology implementation. These legal battles underscore the critical need for stringent compliance and effective legal defense strategies.

Insurance Mandates and Benefit Requirements

Legal mandates, like those established by the Affordable Care Act (ACA), directly shape UnitedHealthcare's product development and pricing strategies. These regulations dictate minimum essential coverage and essential health benefits that plans must offer, influencing the design and cost of health insurance products. For instance, the ACA's requirement for coverage of pre-existing conditions and preventive services impacts the actuarial assumptions used in pricing.

Compliance with evolving state and federal insurance laws is paramount for UnitedHealthcare. Periodic changes to these requirements, such as adjustments in coverage mandates or benefit levels, necessitate ongoing adaptation of service offerings and benefit structures. This dynamic legal landscape requires continuous monitoring and strategic adjustments to ensure adherence and maintain competitive positioning.

The financial impact of these mandates is substantial. In 2023, the U.S. health insurance market, where UnitedHealthcare is a dominant player, saw significant revenue streams directly tied to ACA-compliant plans. The Centers for Medicare & Medicaid Services (CMS) reported that millions of Americans gained coverage through ACA marketplaces, underscoring the market's reliance on these legal frameworks.

- Affordable Care Act (ACA) Provisions: Mandates for essential health benefits and coverage for pre-existing conditions directly influence plan design and pricing for UnitedHealthcare.

- State-Specific Regulations: Varying state insurance laws, including benefit mandates and network adequacy rules, require tailored compliance strategies for UnitedHealthcare's operations in different regions.

- Regulatory Changes: Periodic updates to federal and state healthcare laws, such as potential modifications to the ACA or new state-level initiatives, demand ongoing adaptation of UnitedHealthcare's product offerings and business practices.

- Compliance Costs: The need to adhere to complex legal requirements incurs significant operational costs for UnitedHealthcare, impacting administrative expenses and potentially influencing premium rates.

Drug Pricing Regulations and PBM Scrutiny

The pharmacy benefit management (PBM) sector, including UnitedHealth Group's Optum Rx, faces heightened regulatory attention concerning drug pricing and rebate structures. This scrutiny is driven by concerns over transparency and affordability in prescription drug markets.

The Inflation Reduction Act of 2022 introduced significant changes, particularly impacting Medicare Part D. These include provisions for Medicare drug price negotiation and a cap on out-of-pocket prescription drug costs for beneficiaries, which directly influence PBM operations and revenue streams, potentially affecting Optum Rx's financial performance.

- Increased PBM Oversight: Federal and state governments are intensifying their focus on PBM practices, leading to new reporting requirements and potential limitations on business models.

- Inflation Reduction Act Impact: Provisions like the Medicare Part D redesign, aiming to lower drug costs, will necessitate adjustments in how Optum Rx negotiates and manages drug formularies and pricing.

- Rebate Transparency Mandates: Regulations demanding greater transparency in how PBMs handle manufacturer rebates are becoming more common, impacting profitability and competitive positioning.

- State-Level Regulations: Numerous states are enacting their own PBM regulations, creating a complex compliance landscape for UnitedHealth Group's Optum Rx.

UnitedHealth Group's operations are deeply intertwined with evolving legal frameworks, particularly concerning data privacy and antitrust regulations. The company's vast data holdings necessitate strict adherence to HIPAA, with millions of individuals affected by breaches annually, underscoring the high stakes for UnitedHealth Group. Its significant market presence also draws scrutiny from antitrust bodies, as seen in ongoing investigations in late 2023 and early 2024, impacting its growth through acquisitions.

The Affordable Care Act (ACA) continues to be a foundational legal element, dictating essential health benefits and coverage requirements that shape UnitedHealthcare's product offerings and pricing strategies. These mandates, impacting millions of Americans who gained coverage through ACA marketplaces, directly influence the company's actuarial assumptions and operational costs. Furthermore, the pharmacy benefit management (PBM) arm, Optum Rx, faces increasing regulatory oversight driven by legislation like the Inflation Reduction Act of 2022, which aims to lower drug costs through measures such as Medicare drug price negotiation.

The company is also exposed to significant litigation risks, including class-action lawsuits related to its business practices and technology, such as the 2023 case concerning its nH Predict AI tool. Navigating these legal challenges requires robust compliance measures and effective legal defense strategies. The sheer scale of UnitedHealth Group, with revenues exceeding $370 billion in 2023, amplifies the impact of these legal factors, making compliance and strategic legal management critical for sustained success.

Environmental factors

UnitedHealth Group is actively pursuing sustainability in its operations, targeting carbon neutrality by 2030. This commitment translates into tangible actions like waste reduction programs and enhancing energy efficiency across its facilities. For instance, in 2023, the company reported a 15% reduction in energy consumption per employee compared to a 2019 baseline, demonstrating progress toward its environmental goals.

Climate change poses significant risks to public health, influencing healthcare demand and delivery. UnitedHealth Group recognizes this, understanding that extreme weather events, worsening air quality, and the increased spread of vector-borne diseases directly impact community well-being and necessitate adaptive healthcare strategies.

The company's commitment to minimizing its environmental footprint is directly tied to fostering healthier communities. For instance, in 2023, UnitedHealth Group reported reducing its Scope 1 and 2 greenhouse gas emissions by 30% against a 2019 baseline, demonstrating a tangible effort to mitigate these health-related environmental factors.

UnitedHealth Group, as a major player in healthcare, faces significant environmental considerations regarding waste management across its diverse operations. The company's environmental policy actively promotes diverting waste from landfills and reducing overall waste generation, underscoring a commitment to sustainable practices.

This commitment is demonstrated through the implementation of robust recycling and comprehensive waste management programs. For instance, in 2023, the healthcare sector globally generated an estimated 5.2 million tons of waste, with a significant portion originating from medical facilities, highlighting the scale of the challenge UnitedHealth Group addresses.

ESG Reporting and Investor Pressure

UnitedHealth Group (UNH) is experiencing heightened scrutiny from investors and stakeholders demanding comprehensive Environmental, Social, and Governance (ESG) reporting. This pressure is driving a greater focus on transparency regarding the company's environmental footprint and social impact.

The company actively engages in initiatives like the Corporate Sustainability Assessment, a key benchmark for evaluating ESG performance. UNH reports on critical metrics that demonstrate its commitment to sustainability and responsible business practices.

For instance, in its 2023 ESG report, UnitedHealth Group highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2019 baseline. They also reported that 85% of their global workforce had completed mandatory ESG training by the end of 2023.

- Investor Demand: A 2024 survey by Morgan Stanley found that 70% of investors consider ESG factors material to their investment decisions.

- ESG Reporting: UnitedHealth Group's participation in the Dow Jones Sustainability Index (DJSI) for North America in 2023, maintaining its listing for the 13th consecutive year, underscores its ESG efforts.

- Performance Indicators: The company tracks metrics such as renewable energy usage, waste diversion rates, and employee diversity and inclusion statistics.

- Socially Conscious Investing: Transparent and robust ESG reporting is vital for attracting and retaining capital from the growing segment of socially conscious investors who prioritize companies with strong sustainability credentials.

Supply Chain Environmental Impact

UnitedHealth Group is actively working to reduce the environmental footprint of its supply chain, a critical component of its overall sustainability efforts. This includes encouraging suppliers to adopt science-based targets for emissions reduction.

The company's strategy involves close collaboration with its partners to foster more sustainable practices across the entire value chain. This focus aims to minimize the environmental impact associated with the procurement and delivery of goods and services.

For instance, in 2023, UnitedHealth Group reported that 78% of its key suppliers had set or committed to setting greenhouse gas reduction targets, a significant step towards its environmental goals.

- Science-Based Targets: Encouraging suppliers to align their emissions reduction goals with climate science.

- Supplier Collaboration: Working directly with partners to implement sustainable operational practices.

- Value Chain Integration: Embedding environmental considerations throughout UnitedHealth Group's entire supply network.

- Progress Tracking: Monitoring supplier engagement and target setting to drive accountability and improvement.

UnitedHealth Group is committed to environmental sustainability, aiming for carbon neutrality by 2030 through waste reduction and energy efficiency initiatives. In 2023, the company achieved a 15% reduction in energy consumption per employee compared to 2019, demonstrating tangible progress. Climate change impacts public health, increasing healthcare demand, which UNH addresses through adaptive strategies.

The company actively works to reduce its environmental footprint, evidenced by a 30% reduction in Scope 1 and 2 greenhouse gas emissions against a 2019 baseline by the end of 2023. UnitedHealth Group also prioritizes waste management, implementing recycling programs to divert waste from landfills, a critical issue given the healthcare sector's significant waste generation, estimated at 5.2 million tons globally in 2023.

Investor and stakeholder demand for robust Environmental, Social, and Governance (ESG) reporting is increasing, with 70% of investors considering ESG factors material in their decisions as of 2024. UnitedHealth Group's sustained listing on the Dow Jones Sustainability Index (DJSI) for North America in 2023, for the 13th consecutive year, highlights its commitment. The company also reported that 85% of its global workforce completed mandatory ESG training by the end of 2023.

UnitedHealth Group is also focused on its supply chain's environmental impact, encouraging suppliers to adopt science-based emissions reduction targets. By the end of 2023, 78% of its key suppliers had set or committed to greenhouse gas reduction targets, reflecting a collaborative approach to sustainability across the value chain.

| Environmental Metric | 2019 Baseline | 2023 Progress | Target | Source |

|---|---|---|---|---|

| Energy Consumption Intensity | 100% | 85% | N/A | UNH ESG Report 2023 |

| Scope 1 & 2 GHG Emissions Intensity | 100% | 70% | N/A | UNH ESG Report 2023 |

| Suppliers with GHG Reduction Targets | N/A | 78% | N/A | UNH ESG Report 2023 |

| Workforce ESG Training Completion | N/A | 85% | N/A | UNH ESG Report 2023 |

PESTLE Analysis Data Sources

Our UnitedHealth Group PESTLE Analysis is built on a robust foundation of data from leading healthcare industry reports, government health agencies, and economic forecasting firms. We incorporate insights from regulatory bodies, market research, and technological advancements to provide a comprehensive view.