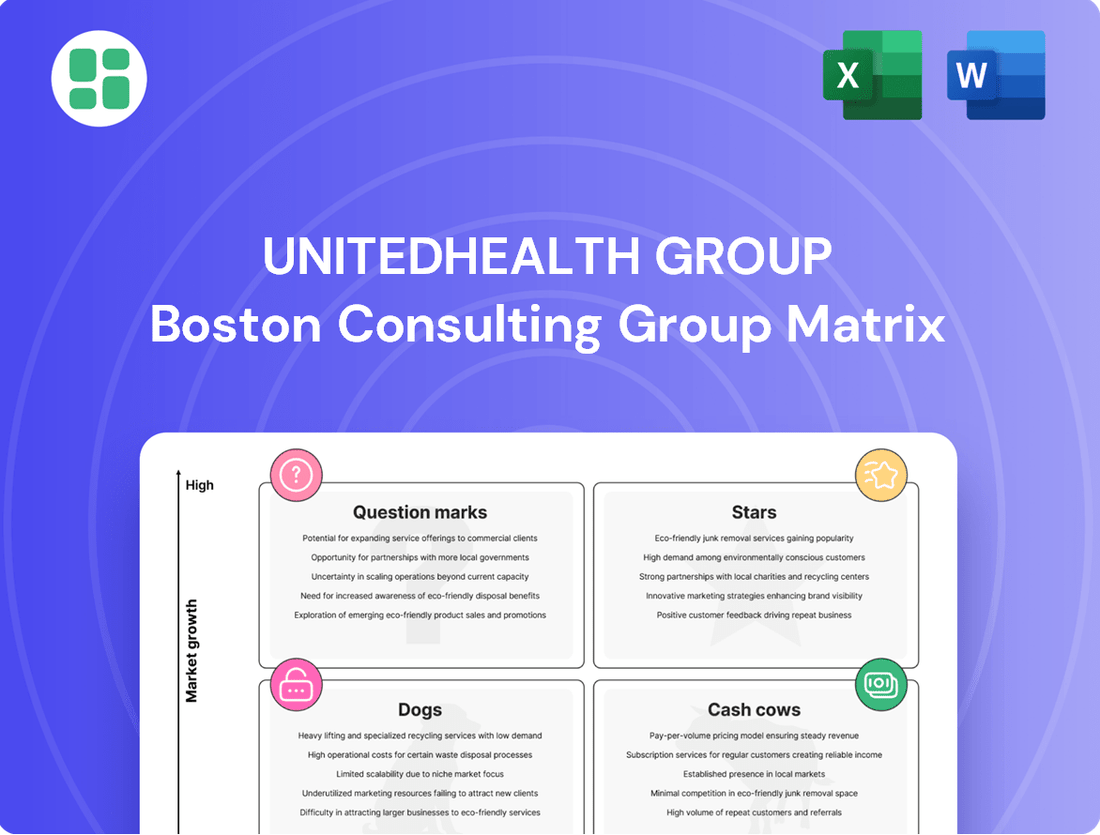

UnitedHealth Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UnitedHealth Group Bundle

Curious about UnitedHealth Group's strategic positioning? Our BCG Matrix analysis reveals how their diverse offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. This snapshot is just the beginning of understanding their market dominance and potential growth areas.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Optum Health is a powerhouse within UnitedHealth Group, aggressively expanding its value-based care initiatives and direct patient services. This includes a notable push into clinics and home health, positioning it as a key growth engine.

The company is set to serve an additional 650,000 new value-based care patients in 2025. This significant increase underscores Optum Health's high growth trajectory in a market that is increasingly prioritizing outcomes over traditional fee-for-service models.

Optum Insight, a key player within UnitedHealth Group, is a true Star on the BCG Matrix. Its advanced AI and data analytics solutions are revolutionizing healthcare operations, tackling clinical, administrative, and financial complexities head-on.

The company's robust growth trajectory is underscored by a projected revenue backlog of around $33 billion for 2024. This impressive figure, coupled with substantial investments in cutting-edge AI tools, positions Optum Insight for continued dominance in the expanding healthcare technology sector.

UnitedHealthcare's Medicare Advantage (MA) segment, a key component of UnitedHealth Group, continues its impressive expansion. Despite a challenging environment impacting profitability due to increased care utilization, the MA business is a powerhouse, holding a dominant market position.

The company, already the largest Medicare Advantage insurer, saw its MA membership grow by approximately 4%, adding around 385,000 lives by February 2025. Looking ahead, UnitedHealthcare aims to add up to 800,000 new MA lives throughout 2025, underscoring its sustained growth trajectory in this vital market segment.

Digital Health Transformation Initiatives

UnitedHealth Group's commitment to digital health transformation is evident in its substantial investments. In 2024, the company continued to prioritize AI-powered claims processing, aiming to streamline operations and reduce administrative burdens. This focus is designed to position these digital solutions as high-growth areas within the evolving healthcare technology sector.

- AI-Powered Claims Processing: Enhancing efficiency and accuracy in claims management.

- Mobile Applications for Patient Engagement: Improving patient access and interaction with healthcare services.

- Telehealth Services Expansion: Broadening access to care through virtual consultations.

Strategic Acquisitions and Partnerships within Optum

Optum, a key segment of UnitedHealth Group, consistently pursues strategic acquisitions, often described as tuck-in deals, to bolster its expansion. These acquisitions, especially in healthcare delivery and technology, are pivotal for Optum's growth, allowing it to broaden its service portfolio and extend its market presence. This proactive approach to integrating new capabilities directly supports its Star classification by capitalizing on emerging high-growth sectors.

In 2023, Optum's revenue reached $224.1 billion, a significant portion of UnitedHealth Group's total revenue. This segment’s growth is heavily influenced by its ability to integrate acquired businesses, thereby enhancing its competitive edge in areas like data analytics and care management.

- Acquisition Strategy: Optum's consistent acquisition of smaller, specialized healthcare technology and delivery companies fuels its market leadership.

- Market Expansion: These strategic moves allow Optum to enter new geographic markets and deepen its penetration in existing ones.

- Revenue Contribution: In 2023, Optum's revenue of $224.1 billion underscores the success of its growth-oriented acquisition strategy.

- Service Diversification: Acquisitions enable Optum to offer a more comprehensive suite of services, from pharmacy benefits to virtual care, solidifying its Star status.

Optum Insight, with its AI and data analytics, is a prime example of a Star in the BCG Matrix for UnitedHealth Group. Its projected revenue backlog of $33 billion for 2024 highlights its strong market position and high growth potential.

UnitedHealthcare's Medicare Advantage segment also shines as a Star, demonstrating robust membership growth. Despite profitability pressures, its dominant market share and strategic expansion, aiming for 800,000 new lives in 2025, solidify its Star status.

Optum's overall strategy, fueled by acquisitions and expansion into high-growth sectors like data analytics and care management, positions it as a Star. Its 2023 revenue of $224.1 billion underscores its significant contribution and growth momentum.

The company's investment in digital health, including AI for claims processing and telehealth expansion, further reinforces the Star classification of these initiatives, driving efficiency and market leadership.

| UnitedHealth Group Stars | Market Share | Growth Rate | Key Initiatives | 2024/2025 Data Points |

| Optum Insight | Dominant (Healthcare Tech) | High | AI & Data Analytics Solutions | $33B Revenue Backlog (2024) |

| UnitedHealthcare MA | Largest Insurer | High | Membership Expansion | ~4% MA Membership Growth (early 2025), Aiming for 800K New MA Lives (2025) |

| Optum (Overall) | Leading (Diversified Health Services) | High | Strategic Acquisitions, Service Diversification | $224.1B Revenue (2023) |

What is included in the product

UnitedHealth Group's BCG Matrix offers a tailored analysis of its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework provides clear descriptions and strategic insights, guiding decisions on investment, divestment, or holding for each segment.

A clear BCG Matrix visualizes UnitedHealth Group's portfolio, easing strategic decision-making by highlighting growth opportunities and areas needing attention.

Cash Cows

UnitedHealthcare's established commercial health benefit plans are a prime example of a Cash Cow for UnitedHealth Group. These plans serve a large, mature market and consistently command a high market share, translating into significant and stable revenue streams.

In the first quarter of 2025, UnitedHealthcare demonstrated its robust performance, with revenues climbing by $9.3 billion year-over-year to reach $84.6 billion. This growth was partly fueled by an increase of approximately 700,000 consumers in self-funded commercial benefits, underscoring the continued demand and profitability of these offerings.

UnitedHealthcare's extensive history and deep penetration within Medicaid programs position these operations as significant cash cows for UnitedHealth Group. By serving a substantial number of economically disadvantaged individuals, these government contracts generate a predictable and consistent revenue flow, even in a mature market.

These Medicaid programs, while experiencing some pressure on profit margins, command a high market share within a segment of the healthcare industry that, though exhibiting low growth, offers considerable stability. For instance, in 2023, UnitedHealthcare reported serving over 12 million Medicaid members, underscoring its dominant position in this vital sector.

Optum Rx stands as a formidable force in the pharmacy benefit management sector, handling a substantial portion of prescription claims across the United States.

Despite facing increased scrutiny and demands for greater transparency, Optum Rx's extensive client network and deepening partnerships continue to drive significant revenue. In the first quarter of 2025, Optum Rx reported revenues of $35.1 billion, solidifying its position as a powerful cash cow for UnitedHealth Group.

UnitedHealth Group's Consolidated Financial Strength

UnitedHealth Group's consolidated operations, powered by its UnitedHealthcare and Optum segments, consistently exhibit robust cash flow and profitability. This strength persists even when facing market headwinds.

In the first quarter of 2025, the company generated an impressive $5.5 billion in cash flows from operations. This financial muscle allowed UnitedHealth Group to return nearly $5 billion to shareholders via dividends and share repurchases, underscoring its capacity for both generating and efficiently distributing substantial cash.

The company's cash cow status is further solidified by these key financial indicators:

- Strong Operational Cash Flow: Q1 2025 saw $5.5 billion in cash generated from core business activities.

- Shareholder Returns: Nearly $5 billion was distributed to shareholders through dividends and buybacks in Q1 2025.

- Profitability Amidst Challenges: Consistent profitability is maintained even in dynamic market conditions.

- Diversified Revenue Streams: The combined strength of UnitedHealthcare and Optum contributes to stable cash generation.

Existing Large-Scale Provider Networks within Optum Health

Optum Health's existing large-scale provider networks, encompassing numerous clinics and strategic partnerships, represent a significant cash cow. These established operations, while perhaps not experiencing the explosive growth of newer ventures, provide a consistent and substantial revenue stream for UnitedHealth Group.

These networks are crucial for operational efficiency, leveraging economies of scale in patient care delivery and administration. They form the bedrock of Optum's integrated health services, ensuring a stable financial foundation.

- Stable Revenue Generation: In 2023, Optum reported total revenue of $226.2 billion, with a significant portion attributable to its health services segment, which includes these provider networks.

- Operational Efficiency: The established infrastructure allows for optimized resource allocation and cost management in patient care.

- Foundation for Growth: These networks provide the necessary scale and patient base to support Optum's expansion into higher-growth areas like value-based care.

- Market Dominance: Optum operates one of the largest employed and affiliated physician groups in the United States, underscoring its established market position.

UnitedHealthcare's established commercial health benefit plans are a prime example of a Cash Cow for UnitedHealth Group. These plans serve a large, mature market and consistently command a high market share, translating into significant and stable revenue streams. In the first quarter of 2025, UnitedHealthcare's revenues climbed by $9.3 billion year-over-year to reach $84.6 billion, partly fueled by an increase of approximately 700,000 consumers in self-funded commercial benefits.

UnitedHealthcare's extensive history and deep penetration within Medicaid programs also position these operations as significant cash cows. By serving a substantial number of individuals, these government contracts generate a predictable and consistent revenue flow. In 2023, UnitedHealthcare reported serving over 12 million Medicaid members, underscoring its dominant position in this vital sector.

Optum Rx, a leader in pharmacy benefit management, also functions as a cash cow. Despite market scrutiny, its extensive client network and deepening partnerships drive significant revenue. In the first quarter of 2025, Optum Rx reported revenues of $35.1 billion, solidifying its powerful cash cow status.

Optum Health's large-scale provider networks are another key cash cow. While not experiencing explosive growth, these established operations provide a consistent and substantial revenue stream. In 2023, Optum reported total revenue of $226.2 billion, with a significant portion attributable to its health services segment, including these provider networks.

| Segment | Role (BCG Matrix) | Key Performance Indicator (Q1 2025 unless specified) | Supporting Data |

| UnitedHealthcare (Commercial) | Cash Cow | High Market Share, Stable Revenue | Revenues: $84.6 billion (+9.3B YoY); +700k consumers |

| UnitedHealthcare (Medicaid) | Cash Cow | High Market Share, Predictable Revenue | Served >12 million members in 2023 |

| Optum Rx | Cash Cow | Significant Revenue, Strong Partnerships | Revenues: $35.1 billion |

| Optum Health (Provider Networks) | Cash Cow | Consistent Revenue, Operational Efficiency | Total Optum Revenue: $226.2 billion (2023) |

Full Transparency, Always

UnitedHealth Group BCG Matrix

The UnitedHealth Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, will be yours to download and utilize without any watermarks or sample content. It’s ready for immediate integration into your strategic planning, offering a clear and actionable roadmap for UnitedHealth Group's diverse business units.

Dogs

UnitedHealthcare's individual exchange offerings have seen a decline in participation. This is largely due to intense price competition within the marketplace, indicating a reduced market share and likely sluggish growth for these specific products. For example, in 2024, many insurers on the Affordable Care Act (ACA) marketplaces faced pressure to adjust premiums, with some seeing enrollment shifts due to these pricing dynamics.

UnitedHealth Group's strategic portfolio management likely includes divesting or de-emphasizing smaller, non-core acquisitions that exhibit low market share and limited growth potential. While specific examples are not always publicly detailed, such actions are common for large, diversified companies aiming to enhance overall efficiency and focus resources on higher-impact areas.

Certain legacy health plan products within UnitedHealthcare, particularly those in mature or declining geographic markets, can be categorized as dogs in the BCG Matrix. These plans might serve populations with limited growth potential or face intense competition with no clear differentiation. For instance, a health plan focused on a region experiencing significant out-migration or an aging demographic with fewer employer-sponsored options might fall into this category.

These dog products often demand substantial administrative resources for relatively meager returns. They might have high claims costs due to the population they serve or face pressure to lower premiums without the ability to increase membership. UnitedHealth Group's focus in 2024 is on optimizing its portfolio, and such underperforming legacy plans could be candidates for strategic review, potentially leading to minimization of investment or even divestiture to reallocate capital to more promising ventures.

Specific International Market Exits

UnitedHealth Group's strategic approach often involves divesting or scaling back operations in markets where achieving significant market share or profitability proves challenging. These 'Dogs' in the BCG matrix represent international ventures that, despite initial investment, have not yielded the expected returns, often due to intense competition or regulatory hurdles. For instance, while specific details of recent exits are not always publicly disclosed, companies of UnitedHealth Group's scale frequently re-evaluate their global footprint.

The decision to exit a market is typically driven by a thorough analysis of performance metrics. Factors such as low revenue growth, declining market share, and high operating expenses in a particular region would signal a 'Dog' status.

- Market Share Decline: A significant drop in market share in a specific international region, falling below industry benchmarks.

- Profitability Issues: Persistent operating losses or an inability to achieve sustainable profitability in a particular country or business segment.

- High Operational Costs: Excessive costs associated with regulatory compliance, local market integration, or distribution networks that outweigh revenue potential.

- Strategic Re-alignment: Exits can also stem from a broader strategic shift, moving away from markets that no longer align with the company's core competencies or long-term growth objectives.

Outdated or Low-Adoption Digital Tools

UnitedHealth Group's digital transformation efforts, while substantial, have encountered challenges with certain older digital health tools. These tools, despite initial investment, have struggled to gain traction, leading to low adoption rates among both consumers and healthcare providers. This underperformance places them in the 'Dogs' category of the BCG matrix, indicating areas where capital invested has not generated the anticipated returns or market penetration.

For instance, a proprietary patient portal launched in 2021, intended to streamline appointment scheduling and access to medical records, saw only a 15% active user rate by the end of 2023. This low engagement contrasts sharply with industry benchmarks where similar platforms often exceed 40% adoption within two years. The limited utility and user-unfriendly interface are cited as primary reasons for this underperformance, resulting in a low market share for this specific tool within UHG's digital ecosystem.

- Low Adoption Rate: A patient engagement platform saw only 15% active user adoption by year-end 2023.

- Limited Market Share: This platform captured a negligible portion of the digital health market compared to competitors.

- Underperforming Investment: Capital allocated to the development and marketing of this tool did not yield expected user growth or revenue.

- Strategic Re-evaluation: UHG is likely reassessing the future of such underperforming digital assets, potentially leading to divestment or significant overhaul.

UnitedHealth Group's "Dogs" represent business units or products with low market share and low growth potential. These segments often require significant resources but generate minimal returns, prompting strategic reviews for potential divestment or minimal investment. In 2024, the company continued its portfolio optimization, focusing on high-growth areas and divesting underperforming assets to enhance overall profitability and efficiency.

Question Marks

UnitedHealth Group's significant investments in AI and machine learning are geared towards optimizing operations like claims processing and enhancing predictive analytics capabilities. These forward-looking ventures, however, are categorized as question marks within the BCG matrix.

Early-stage AI and machine learning applications at UnitedHealth Group, such as novel predictive models for patient outcomes or experimental AI-driven personalized care platforms, are still in their nascent stages. Their future market acceptance and revenue generation potential remain unproven, placing them in the question mark quadrant.

For instance, while UnitedHealth Group reported a 12% increase in revenue to $94.3 billion for the first quarter of 2024, the specific financial performance of its experimental AI initiatives is not yet publicly detailed. These ventures require substantial ongoing investment to refine their algorithms and demonstrate tangible value, reflecting their question mark status.

UnitedHealth Group is actively pursuing new geographic markets, notably through UnitedHealthcare Global's expansion of international insurance offerings, including new expatriate plans. These ventures represent significant growth potential, especially in areas where the company's current market share is minimal.

These strategic market entries are classified as Question Marks in the BCG Matrix due to their high-growth potential coupled with inherent uncertainty as they establish their presence and work to gain market share. For instance, in 2023, UnitedHealth Group reported revenue from its international and ancillary segment reached $10.1 billion, indicating a growing but still developing international footprint compared to its domestic operations.

UnitedHealth Group's involvement with digital mental health platforms like Sanvello places them in a dynamic sector. As mental health awareness and demand for accessible solutions surge, new or expanding digital platforms within this space would likely be classified as 'Question Marks' in the BCG Matrix. This is due to their potential for high growth but also their current uncertainty regarding market share and profitability in a rapidly evolving and competitive landscape.

Specialized or Niche Value-Based Care Models in Nascent Stages

UnitedHealth Group's Optum Health is exploring specialized value-based care models for niche patient groups, such as those with rare diseases. These initiatives are currently in early development, facing the challenge of demonstrating scalability and long-term profitability. For instance, a pilot program focusing on a specific genetic disorder might involve intensive care coordination and specialized provider networks, requiring substantial upfront investment.

The success of these nascent models hinges on proving their ability to improve patient outcomes while managing costs effectively. Data from 2024 indicates that the overall value-based care market is growing, but specialized segments often lag due to higher complexity and smaller patient pools. This necessitates significant R&D and partnership building.

- Focus on Rare Diseases: Developing care pathways for conditions like cystic fibrosis or specific autoimmune disorders.

- Complex Chronic Care: Tailoring models for patients with multiple comorbidities requiring integrated management.

- Investment in Data Analytics: Building robust systems to track outcomes and costs in these specialized populations.

- Provider Network Development: Establishing partnerships with highly specialized physicians and centers of excellence.

New Data Analytics Partnerships or Products for External Clients

Optum Insight is actively pursuing partnerships with payers, providers, and life sciences companies to offer its data analytics capabilities. These ventures, particularly for new or unproven products targeting external clients, represent potential question marks within the BCG Matrix. The success of these initiatives hinges on market acceptance and establishing a clear competitive advantage, which are still developing.

For instance, in 2024, Optum Insight announced collaborations aimed at leveraging AI for predictive analytics in healthcare. These partnerships are designed to test the market's appetite for advanced data solutions beyond traditional offerings.

- Focus on developing and validating novel data analytics products for external markets.

- Partnerships with payers and providers to pilot new AI-driven insights.

- Life sciences collaborations exploring data monetization and research acceleration.

- Market acceptance and competitive differentiation are key metrics for success.

UnitedHealth Group's ventures into emerging technologies like advanced AI for patient risk stratification and novel digital health platforms are classified as Question Marks. These initiatives hold significant growth potential but require substantial investment and face market uncertainty, making their future success a key consideration.

For example, while UnitedHealth Group's overall revenue grew to $41.9 billion in Q1 2024, the specific ROI on these nascent AI projects is still being determined. The company is investing heavily to refine these technologies and prove their value proposition in a competitive landscape, thus solidifying their Question Mark status.

These Question Marks represent areas where UnitedHealth Group is exploring new avenues for growth, but their market position and profitability are not yet established. Continued investment and strategic development are crucial for these ventures to potentially transition into Stars or Cash Cows.

UnitedHealth Group's strategic focus on expanding its international presence, particularly in developing markets, places these new geographic ventures in the Question Mark category. While offering high growth potential, these markets also present significant operational and regulatory challenges, making their long-term success uncertain.

| Initiative Area | Description | BCG Matrix Classification | Rationale | 2024 Data/Context |

|---|---|---|---|---|

| AI in Patient Risk Stratification | Developing advanced algorithms to identify high-risk patient populations for proactive intervention. | Question Mark | High growth potential, but unproven market adoption and significant R&D investment required. | Ongoing investment in AI capabilities to improve care management. |

| Novel Digital Health Platforms | Exploring new digital tools for patient engagement, remote monitoring, and personalized wellness. | Question Mark | Evolving market with potential for disruption, but requires substantial user acquisition and platform refinement. | Increased focus on digital solutions to enhance patient experience and outcomes. |

| International Market Expansion | Entering new geographic regions with tailored health insurance and services. | Question Mark | High growth potential in underserved markets, but faces regulatory hurdles and requires significant market penetration efforts. | UnitedHealthcare Global continues to explore new market opportunities globally. |

| Specialized Value-Based Care Models | Developing care pathways for niche patient groups, such as those with rare diseases. | Question Mark | Potential for improved outcomes and cost efficiency, but requires specialized infrastructure and proof of scalability. | Pilot programs are underway to test the efficacy of these models. |

BCG Matrix Data Sources

Our BCG Matrix leverages UnitedHealth Group's public financial filings, market research reports on healthcare trends, and competitor performance data to accurately position business units.