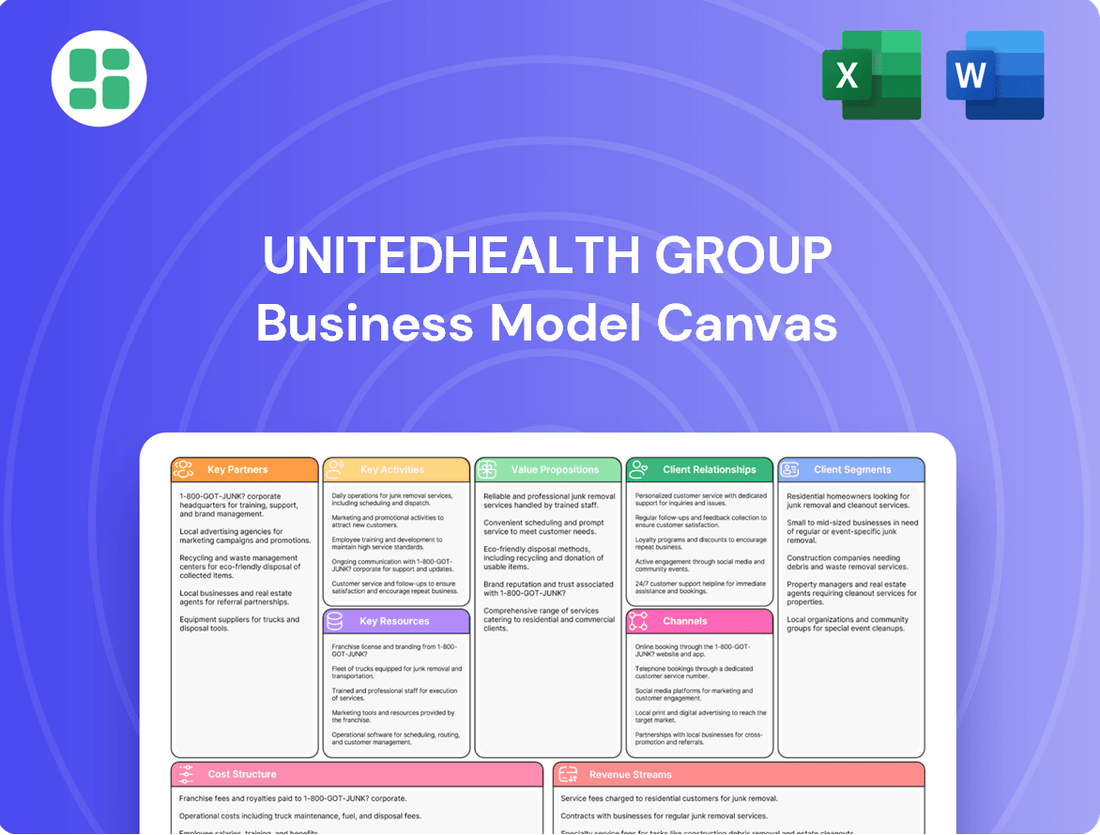

UnitedHealth Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UnitedHealth Group Bundle

Unlock the strategic blueprint of UnitedHealth Group with our comprehensive Business Model Canvas. Discover how they leverage diverse customer segments and key partnerships to deliver innovative health solutions and manage a complex revenue stream. This detailed analysis is essential for anyone seeking to understand market leadership in healthcare.

Dive deeper into UnitedHealth Group’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

UnitedHealth Group's key partnerships with healthcare providers and systems are fundamental to its operations. They maintain extensive relationships with thousands of hospitals, clinics, and individual physicians across the nation. These collaborations are essential for fulfilling their commitment to providing comprehensive healthcare services and ensuring their health insurance plans have adequate provider networks.

These strategic alliances are designed to achieve several critical objectives. UnitedHealth Group works with these partners to elevate the quality of care delivered to patients, broaden access to medical services, and successfully implement value-based care arrangements. For instance, in 2023, UnitedHealth Group reported that its Optum division generated $226.2 billion in revenue, a significant portion of which is driven by its integrated care delivery and management through these provider partnerships.

UnitedHealth Group, through its Optum Rx division, cultivates key partnerships with pharmaceutical companies. These collaborations are crucial for negotiating drug prices and managing formularies, directly impacting the cost of prescription medications for UnitedHealth Group's members.

Furthermore, Optum Rx also partners with other Pharmacy Benefit Managers (PBMs). These relationships are vital for the efficient distribution of prescription medications, ensuring members receive their necessary treatments while aiming to lower overall drug expenditures.

In 2024, Optum Rx managed a significant portion of prescription drug claims, processing billions of prescriptions. These partnerships are fundamental to UnitedHealth Group's strategy of controlling healthcare costs and enhancing patient access to affordable medications.

UnitedHealth Group actively partners with technology and data analytics vendors to bolster its digital capabilities. These collaborations are crucial for refining its AI, improving data infrastructure, and enhancing its digital health platforms. For instance, in 2023, Optum, UnitedHealth Group's health services arm, continued to expand its AI Marketplace, showcasing a commitment to integrating cutting-edge solutions from external tech partners to drive innovation in areas like claims processing and predictive health insights.

Employers and Government Agencies

UnitedHealthcare's key partnerships with employers are crucial for offering comprehensive health benefit plans to their workforces. In 2024, the employer-sponsored insurance market remains a cornerstone of healthcare access for millions. These employer relationships facilitate direct customer acquisition and ensure policy adherence by integrating benefits into employment packages.

Furthermore, partnerships with government agencies are vital for UnitedHealthcare's participation in Medicare and Medicaid programs. These collaborations allow the company to serve a vast and diverse population of beneficiaries, including seniors and low-income individuals. Navigating the intricate regulatory landscapes of these government programs is essential for successful service delivery and policy compliance.

- Employer Partnerships: Facilitate access to health benefits for employees, driving significant membership growth. For instance, in 2023, UnitedHealthcare served millions of individuals through employer-sponsored plans.

- Government Agency Collaborations: Enable participation in Medicare and Medicaid, expanding reach to vulnerable populations and government-funded healthcare markets. In 2024, these government programs represent a substantial portion of the US healthcare spend.

- Customer Acquisition and Policy Adherence: These partnerships are foundational for acquiring new members and ensuring they understand and utilize their benefits effectively.

- Service Delivery and Regulatory Navigation: Tailoring solutions to meet the specific needs of diverse beneficiary groups while adhering to stringent government regulations is paramount.

Community Organizations and Non-Profits

UnitedHealth Group actively partners with community organizations and non-profits to tackle social determinants of health and enhance community well-being. These collaborations are crucial for delivering comprehensive care that extends beyond medical treatment, focusing on areas like food security and access to essential social services.

For instance, UnitedHealth Group's commitment to addressing food insecurity is exemplified by its partnership with Fairview Health Services. This initiative highlights the organization's dedication to holistic care, recognizing that factors outside traditional healthcare significantly impact overall health outcomes.

- Partnerships for Social Determinants of Health: Collaborations with local non-profits and community groups to address issues like food insecurity and access to social services.

- Holistic Care Approach: Initiatives aim to provide comprehensive support by integrating social needs with medical care, improving overall community well-being.

- Example of Collaboration: Partnership with Fairview Health Services specifically targets food insecurity programs, demonstrating a tangible commitment to community health.

UnitedHealth Group's key partnerships with healthcare providers and systems are fundamental to its operations, enabling it to fulfill its commitment to comprehensive healthcare services and robust provider networks. These alliances are crucial for improving care quality, expanding access, and implementing value-based care models, with Optum's revenue in 2023 reaching $226.2 billion, underscoring the financial impact of these collaborations.

Collaborations with pharmaceutical companies and other Pharmacy Benefit Managers (PBMs), particularly through Optum Rx, are vital for managing drug formularies and negotiating prices, directly impacting medication affordability for members. In 2024, Optum Rx's significant role in managing billions of prescription claims highlights the strategic importance of these partnerships in controlling healthcare costs.

Partnerships with technology and data analytics vendors are essential for enhancing UnitedHealth Group's digital capabilities, including AI development and data infrastructure improvements. The expansion of Optum's AI Marketplace in 2023 demonstrates a clear commitment to integrating external tech solutions for innovation in areas like claims processing.

Key relationships with employers and government agencies are foundational for UnitedHealthcare's business model, facilitating access to health benefits for employees and enabling participation in vital Medicare and Medicaid programs. These partnerships are critical for customer acquisition, policy adherence, and navigating complex regulatory environments, with government programs representing a substantial portion of US healthcare spending in 2024.

| Partnership Type | Key Function | Impact/Example | 2023/2024 Data Point |

| Healthcare Providers & Systems | Network Access, Care Delivery | Fulfills service commitments, enables value-based care | Optum revenue: $226.2 billion (2023) |

| Pharmaceutical Companies & PBMs | Drug Pricing, Formulary Management | Controls medication costs, ensures access | Optum Rx managed billions of prescriptions (2024) |

| Technology & Data Vendors | Digital Capabilities, AI Integration | Enhances platforms, drives innovation | Optum AI Marketplace expansion (2023) |

| Employers | Benefit Plan Distribution | Drives membership growth, direct acquisition | Millions served via employer-sponsored plans (2023) |

| Government Agencies | Program Participation (Medicare/Medicaid) | Access to large beneficiary populations, regulatory compliance | Government programs a substantial part of US healthcare spend (2024) |

What is included in the product

UnitedHealth Group's business model focuses on providing a broad spectrum of health services and insurance, leveraging technology and data analytics to manage costs and improve patient outcomes across diverse customer segments.

This model emphasizes integrated care delivery, strategic partnerships, and a commitment to innovation, all designed to create value for consumers, employers, and healthcare providers.

UnitedHealth Group's Business Model Canvas acts as a pain point reliever by simplifying complex healthcare challenges into actionable segments, allowing for focused problem-solving.

It provides a clear, visual framework to address the intricate pain points within the healthcare ecosystem, from patient access to provider efficiency.

Activities

UnitedHealthcare's primary function is the meticulous design, ongoing administration, and strategic management of a wide array of health benefit plans. This service caters to a broad spectrum of clients, encompassing employer-sponsored plans, government programs like Medicare and Medicaid, and individual market offerings. In 2023, UnitedHealthcare served approximately 52 million people in its benefits business, a testament to its extensive reach and operational capacity.

Key operational components include the seamless processing of member enrollments, efficient handling of claims, robust management of its extensive provider network, and strict adherence to all relevant healthcare regulations. This intricate process is designed to streamline the healthcare journey for millions of members, aiming for clarity and ease of access to care.

Optum Rx, UnitedHealth Group's Pharmacy Benefit Manager, is central to its operations. Key activities include negotiating drug prices with manufacturers, a crucial step in managing healthcare costs. In 2024, Optum Rx continued to focus on value-based pricing models, aiming to align drug costs with patient outcomes.

The processing of pharmacy claims is another core function, ensuring timely and accurate reimbursement for prescriptions. This efficiency is vital for member satisfaction and provider relationships. Optum Rx also operates mail-order pharmacies, offering a convenient and often cost-effective option for members to receive their medications.

Modernizing pharmacy payment models and simplifying consumer access are ongoing priorities. This includes efforts to make prescription drug costs more transparent and easier for individuals to understand and manage, contributing to overall healthcare affordability.

UnitedHealth Group's Optum Health is actively expanding its direct care delivery through a growing network of clinics and physician groups, with a significant emphasis on value-based care models. This approach focuses on managing the health of defined patient populations, coordinating care seamlessly across various settings, and prioritizing preventive measures to enhance outcomes and control costs.

As of the first quarter of 2024, Optum Health served approximately 4.5 million individuals under value-based care arrangements, a number UnitedHealth Group aims to substantially increase. This strategy directly aligns with the company's objective to improve patient health and reduce overall healthcare expenditures by rewarding providers for quality outcomes rather than the volume of services rendered.

Data Analytics and Technology Development

UnitedHealth Group heavily leans on data analytics and technology development to streamline its operations and elevate healthcare delivery. This involves creating advanced technology solutions, such as AI-driven tools that significantly speed up claims processing, and predictive analytics that enable proactive health management for individuals.

These technological advancements are crucial for enhancing patient engagement through various digital platforms. A prime example of this commitment is Optum's AI Marketplace, a significant initiative designed to foster innovation and leverage artificial intelligence across the healthcare spectrum.

- AI-powered claims processing: Reduces administrative burdens and improves accuracy.

- Predictive analytics: Enables early intervention and personalized care plans.

- Digital patient engagement platforms: Enhance communication and access to health information.

- Optum AI Marketplace: A hub for developing and deploying advanced AI solutions in healthcare.

Research and Innovation

UnitedHealth Group's commitment to research and innovation is a cornerstone of its strategy, driving the development of novel healthcare solutions and enhancing existing services. This focus ensures the company remains at the forefront of evolving industry trends and challenges.

The company actively pursues intellectual property, evidenced by its consistent patent filings. For instance, in 2023, UnitedHealth Group was granted numerous patents covering areas from digital health platforms to advanced diagnostic tools, underscoring its dedication to innovation.

Exploration into new care delivery models, such as telehealth and remote patient monitoring, is a significant aspect of their innovation efforts. They are also integrating data from wearable technologies to create more personalized and proactive care plans, aiming to improve patient outcomes and operational efficiency.

- Patenting new technologies: UnitedHealth Group actively secures patents for its innovations, protecting its advancements in areas like AI-driven diagnostics and personalized medicine.

- Exploring new care models: The company invests heavily in telehealth, virtual care platforms, and remote patient monitoring to expand access and improve care delivery.

- Integrating wearable technology: Data from wearables is being incorporated into care management programs to provide real-time insights and enable proactive interventions.

- Addressing healthcare challenges: Innovation efforts are directed at tackling key issues such as chronic disease management, mental health access, and healthcare affordability.

UnitedHealth Group's key activities revolve around managing health benefits and delivering care through its UnitedHealthcare and Optum segments. This includes designing and administering health plans for millions, processing claims efficiently, and negotiating drug prices via Optum Rx. Optum Health is actively expanding its direct care delivery, focusing on value-based models to improve patient outcomes and manage costs.

Technological innovation is a core activity, with AI-powered claims processing and predictive analytics enhancing operational efficiency and patient engagement. Research and development are also critical, leading to new care delivery models like telehealth and the integration of wearable technology data. UnitedHealth Group actively patents its innovations, ensuring it remains at the forefront of healthcare advancements.

| Activity Area | Key Functions | 2023/2024 Data Point |

|---|---|---|

| Health Benefits Management | Plan design, administration, claims processing | Served ~52 million people in benefits business (2023) |

| Pharmacy Benefit Management (Optum Rx) | Drug price negotiation, claims processing, mail-order pharmacy | Focus on value-based pricing models (2024) |

| Direct Care Delivery (Optum Health) | Clinic operations, physician group management, value-based care | Served ~4.5 million under value-based care (Q1 2024) |

| Technology & Data Analytics | AI for claims, predictive analytics, digital engagement platforms | Optum AI Marketplace fostering innovation |

| Research & Innovation | New care models (telehealth), wearable tech integration, patenting | Granted numerous patents in 2023 for healthcare tech |

Delivered as Displayed

Business Model Canvas

The UnitedHealth Group Business Model Canvas you are previewing is the actual document you will receive upon purchase, offering a comprehensive overview of their strategic operations. This is not a sample or mockup; it's a direct representation of the detailed analysis you'll gain access to, complete with all sections and insights intact. Upon completing your transaction, you will download this exact, ready-to-use document, allowing you to immediately leverage its valuable information for your own business strategy or understanding.

Resources

UnitedHealth Group's extensive provider networks are a cornerstone of its business model, encompassing millions of contracted physicians, hospitals, and pharmacies. These vast networks are crucial for delivering accessible and comprehensive healthcare services to its diverse membership base. In 2024, UnitedHealth Group continued to focus on strengthening these relationships, ensuring members have access to a wide range of care options.

UnitedHealth Group's sophisticated IT systems, including robust data centers and advanced data analytics platforms, are foundational to its operations. These resources are essential for efficiently processing claims, ensuring secure data management, and enabling population health analytics. For example, in 2023, UnitedHealth Group invested $4.4 billion in technology and data infrastructure, reflecting a significant commitment to digital transformation and the development of AI-powered solutions.

UnitedHealth Group's business model heavily relies on its skilled human capital, a vast workforce encompassing medical professionals, data scientists, technology experts, and administrative staff. This diverse talent pool is the engine driving the company's capacity to deliver intricate healthcare services, effectively manage extensive health plans, and pioneer innovative solutions. For instance, as of early 2024, UnitedHealth Group employs over 400,000 people worldwide, a significant portion of whom are directly involved in patient care and health plan administration.

The expertise housed within UnitedHealth Group is crucial for maintaining operational efficiency and developing cutting-edge healthcare technologies. Their data scientists analyze vast amounts of health information to improve patient outcomes and reduce costs, while technology experts build and maintain the complex systems that underpin their operations. This commitment to skilled talent ensures they can navigate the complexities of the healthcare landscape.

Furthermore, UnitedHealth Group emphasizes fostering an inclusive and diverse environment to attract and retain top talent. This strategic approach to human capital management not only enhances innovation but also better reflects the diverse patient populations they serve, ensuring a more empathetic and effective approach to healthcare delivery across their various business segments.

Intellectual Property and Proprietary Technology

UnitedHealth Group's intellectual property, particularly within its Optum segment, is a cornerstone of its business model. This includes a robust portfolio of patents, proprietary software, and unique healthcare methodologies designed to drive efficiency and innovation.

Key resources in this area are the AI algorithms powering Optum's data analytics and care management solutions, alongside established clinical guidelines like InterQual. These specialized assets create a significant competitive advantage by enabling more precise, effective, and cost-efficient healthcare delivery.

- Patents and Proprietary Software: UnitedHealth Group actively protects its technological advancements through patents and proprietary software development, especially within Optum's analytics and digital health platforms.

- Unique Healthcare Methodologies: The company leverages proprietary clinical guidelines, such as InterQual, and specialized care delivery models to differentiate its services and improve patient outcomes.

- AI and Data Analytics: Advanced AI algorithms are central to Optum's ability to process vast amounts of health data, identify trends, and personalize care, enhancing both operational efficiency and strategic insights.

Financial Capital and Brand Reputation

UnitedHealth Group's substantial financial capital, evidenced by its robust balance sheet, allows for significant strategic investments and acquisitions. In 2023, the company reported revenues of $371.6 billion, demonstrating its capacity to manage and absorb large medical claims and fund innovative healthcare solutions. This financial strength is crucial for maintaining market leadership and pursuing growth opportunities.

A cornerstone of UnitedHealth Group's business model is its powerful brand reputation, cultivated over decades of consistent performance and customer-centricity. This strong reputation fosters deep trust among its diverse customer base, healthcare providers, and investors. For instance, in 2024, UnitedHealth Group was recognized for its industry leadership, further solidifying its market penetration and enhancing customer loyalty and retention rates across its various service offerings.

- Financial Resources: UnitedHealth Group's revenue of $371.6 billion in 2023 highlights its immense financial capacity for strategic investments and managing significant medical claims.

- Brand Trust: Decades of operation have built a strong brand reputation, crucial for customer acquisition, provider partnerships, and investor confidence in 2024.

- Market Penetration: Financial strength and brand equity facilitate deeper market penetration and sustained customer retention in the competitive healthcare landscape.

UnitedHealth Group's extensive provider networks are a cornerstone of its business model, encompassing millions of contracted physicians, hospitals, and pharmacies. These vast networks are crucial for delivering accessible and comprehensive healthcare services to its diverse membership base. In 2024, UnitedHealth Group continued to focus on strengthening these relationships, ensuring members have access to a wide range of care options.

UnitedHealth Group's sophisticated IT systems, including robust data centers and advanced data analytics platforms, are foundational to its operations. These resources are essential for efficiently processing claims, ensuring secure data management, and enabling population health analytics. For example, in 2023, UnitedHealth Group invested $4.4 billion in technology and data infrastructure, reflecting a significant commitment to digital transformation and the development of AI-powered solutions.

UnitedHealth Group's business model heavily relies on its skilled human capital, a vast workforce encompassing medical professionals, data scientists, technology experts, and administrative staff. This diverse talent pool is the engine driving the company's capacity to deliver intricate healthcare services, effectively manage extensive health plans, and pioneer innovative solutions. For instance, as of early 2024, UnitedHealth Group employs over 400,000 people worldwide, a significant portion of whom are directly involved in patient care and health plan administration.

The expertise housed within UnitedHealth Group is crucial for maintaining operational efficiency and developing cutting-edge healthcare technologies. Their data scientists analyze vast amounts of health information to improve patient outcomes and reduce costs, while technology experts build and maintain the complex systems that underpin their operations. This commitment to skilled talent ensures they can navigate the complexities of the healthcare landscape.

Furthermore, UnitedHealth Group emphasizes fostering an inclusive and diverse environment to attract and retain top talent. This strategic approach to human capital management not only enhances innovation but also better reflects the diverse patient populations they serve, ensuring a more empathetic and effective approach to healthcare delivery across their various business segments.

UnitedHealth Group's intellectual property, particularly within its Optum segment, is a cornerstone of its business model. This includes a robust portfolio of patents, proprietary software, and unique healthcare methodologies designed to drive efficiency and innovation.

Key resources in this area are the AI algorithms powering Optum's data analytics and care management solutions, alongside established clinical guidelines like InterQual. These specialized assets create a significant competitive advantage by enabling more precise, effective, and cost-efficient healthcare delivery.

- Patents and Proprietary Software: UnitedHealth Group actively protects its technological advancements through patents and proprietary software development, especially within Optum's analytics and digital health platforms.

- Unique Healthcare Methodologies: The company leverages proprietary clinical guidelines, such as InterQual, and specialized care delivery models to differentiate its services and improve patient outcomes.

- AI and Data Analytics: Advanced AI algorithms are central to Optum's ability to process vast amounts of health data, identify trends, and personalize care, enhancing both operational efficiency and strategic insights.

UnitedHealth Group's substantial financial capital, evidenced by its robust balance sheet, allows for significant strategic investments and acquisitions. In 2023, the company reported revenues of $371.6 billion, demonstrating its capacity to manage and absorb large medical claims and fund innovative healthcare solutions. This financial strength is crucial for maintaining market leadership and pursuing growth opportunities.

A cornerstone of UnitedHealth Group's business model is its powerful brand reputation, cultivated over decades of consistent performance and customer-centricity. This strong reputation fosters deep trust among its diverse customer base, healthcare providers, and investors. For instance, in 2024, UnitedHealth Group was recognized for its industry leadership, further solidifying its market penetration and enhancing customer loyalty and retention rates across its various service offerings.

- Financial Resources: UnitedHealth Group's revenue of $371.6 billion in 2023 highlights its immense financial capacity for strategic investments and managing significant medical claims.

- Brand Trust: Decades of operation have built a strong brand reputation, crucial for customer acquisition, provider partnerships, and investor confidence in 2024.

- Market Penetration: Financial strength and brand equity facilitate deeper market penetration and sustained customer retention in the competitive healthcare landscape.

UnitedHealth Group's extensive provider networks are a foundational resource, linking millions of healthcare professionals and facilities to its members. These networks ensure access to a broad spectrum of medical services, vital for member health and satisfaction. By continually strengthening these partnerships, UnitedHealth Group solidifies its ability to deliver comprehensive and convenient care in 2024.

The company's significant investment in technology, totaling $4.4 billion in 2023 for IT and data infrastructure, underpins its operational efficiency and innovation. These advanced systems are critical for managing claims, ensuring data security, and leveraging analytics for improved health outcomes. This technological backbone is essential for staying competitive and responsive to evolving healthcare needs.

UnitedHealth Group's vast workforce of over 400,000 employees as of early 2024 represents a key resource, comprising skilled medical professionals, data scientists, and administrative staff. This human capital is instrumental in delivering complex healthcare services, managing health plans, and driving innovation across the organization. Their expertise is the driving force behind the company's ability to navigate the intricacies of the healthcare industry.

Intellectual property, especially within the Optum segment, including AI algorithms and proprietary clinical guidelines like InterQual, provides a significant competitive edge. These assets enable more precise, cost-effective care delivery and enhance data analytics capabilities. UnitedHealth Group's commitment to developing and protecting its intellectual property is central to its strategy for innovation and market leadership.

| Key Resource | Description | 2023/2024 Data/Impact |

| Provider Networks | Extensive network of contracted physicians, hospitals, and pharmacies. | Ensures broad access to care for members; focus on strengthening relationships in 2024. |

| IT Systems & Data Analytics | Sophisticated IT infrastructure and advanced data analytics platforms. | $4.4 billion invested in 2023 for technology and data infrastructure; enables efficient operations and AI solutions. |

| Human Capital | Over 400,000 employees globally, including medical professionals and data scientists. | Drives healthcare service delivery, health plan management, and innovation; diverse talent pool is crucial. |

| Intellectual Property | Patents, proprietary software, AI algorithms, and clinical guidelines (e.g., InterQual). | Differentiates services, improves patient outcomes, and enhances cost-efficiency; core to Optum's competitive advantage. |

| Financial Capital | Robust balance sheet and significant revenue generation. | $371.6 billion in revenue for 2023; funds strategic investments, acquisitions, and innovative solutions. |

| Brand Reputation | Strong brand built on consistent performance and customer-centricity. | Fosters trust among customers, providers, and investors; enhances market penetration and customer loyalty in 2024. |

Value Propositions

UnitedHealthcare offers a broad spectrum of health benefit plans, designed to deliver extensive coverage at competitive price points. These plans serve diverse populations, including individuals, businesses of all sizes, and recipients of government healthcare programs, ensuring flexibility and dependable benefits.

In 2024, UnitedHealthcare continued its commitment to expanding access to quality care. For instance, the company serves over 50 million individuals across its various health benefit plans, demonstrating its significant reach in making healthcare more attainable.

UnitedHealth Group, through its Optum segment, is deeply committed to enhancing patient health outcomes and the overall quality of care delivered. Their approach centers on integrated care delivery models, leveraging data analytics to pinpoint areas for improvement and personalize patient treatment plans.

A key strategy involves a strong emphasis on preventive care, aiming to catch potential health issues early and reduce the burden of chronic diseases. For instance, Optum's chronic condition management programs are designed to support individuals with ongoing health needs, ensuring they receive consistent and effective support. This focus is crucial, as chronic diseases represent a significant portion of healthcare costs.

Furthermore, UnitedHealth Group champions value-based care initiatives. This model shifts the focus from the volume of services to the quality and effectiveness of care provided, directly aligning with the goal of improved health outcomes. In 2024, Optum's continued investment in care coordination and data-driven interventions aims to make healthcare more efficient and patient-centric.

UnitedHealth Group's value proposition of a simplified healthcare experience is central to its business model. They focus on cutting through the complexity that often frustrates both patients and healthcare providers.

This simplification is achieved through a strategic embrace of digital tools and artificial intelligence. For instance, by the end of 2023, UnitedHealth Group reported a significant increase in the use of its digital platforms for member engagement, with millions of interactions handled annually, streamlining access to care and information.

The company leverages AI-powered automation to reduce administrative burdens, allowing healthcare professionals to focus more on patient care. This digital transformation is not just about convenience; it's about creating a more efficient and user-friendly healthcare journey for everyone involved.

Cost Savings and Efficiency for Stakeholders

UnitedHealth Group (UHG) delivers substantial cost savings and operational efficiencies to its diverse stakeholders. By leveraging its scale, UHG negotiates favorable rates with healthcare providers, directly reducing expenses for individuals, employers, and government payers. This focus on cost containment is a cornerstone of their value proposition.

Optum, UHG's health services arm, plays a critical role in driving these efficiencies. Through services like Optum Rx, a leading pharmacy benefit manager, and Optum Health's care delivery and revenue cycle management solutions, UHG streamlines operations and reduces administrative burdens. These integrated services generate significant savings across the healthcare ecosystem.

- Negotiated Rates: UHG's extensive network and purchasing power allow for the negotiation of lower prices for medical services and pharmaceuticals, directly impacting affordability.

- Efficient Claims Processing: Advanced technology and streamlined processes within UHG reduce administrative overhead and speed up reimbursements, saving money for providers and payers.

- Population Health Management: UHG's focus on proactive care and wellness programs aims to prevent costly chronic conditions, leading to long-term healthcare cost reductions.

- Optum's Contribution: Optum Rx's drug cost management and Optum Health's operational efficiencies in patient care and billing contribute billions in annual savings for UHG's clients.

Data-Driven Insights and Advanced Technology Solutions

Optum, a key component of UnitedHealth Group's business model, leverages advanced technology and data analytics to deliver sophisticated health services. This focus on information and technology-enabled solutions empowers healthcare providers and payers with actionable insights derived from vast datasets. By utilizing AI-powered tools, Optum helps streamline clinical workflows and administrative tasks, ultimately improving efficiency and patient care outcomes.

These data-driven insights are crucial for identifying critical care gaps and supporting more informed decision-making throughout the healthcare ecosystem. The Optum AI Marketplace, launched in 2023, exemplifies this commitment by offering a platform for innovative AI solutions that address complex healthcare challenges. In 2024, Optum's technology segment continued to be a significant growth driver for UnitedHealth Group, reflecting the increasing demand for data-driven optimization in healthcare.

- Data Analytics: Optum processes and analyzes massive health datasets to uncover trends and patterns.

- AI-Powered Tools: The company employs artificial intelligence to optimize processes and predict outcomes.

- Informed Decision-Making: Insights generated help providers and payers make better strategic and clinical choices.

- Optum AI Marketplace: This platform showcases and deploys advanced AI solutions for the healthcare industry.

UnitedHealth Group offers a comprehensive suite of health benefit plans, catering to a wide array of individuals and organizations. Their value proposition centers on delivering extensive coverage at competitive price points, ensuring accessibility and dependability for over 50 million members in 2024.

Customer Relationships

UnitedHealth Group (UHG) cultivates strong customer relationships by offering comprehensive digital self-service platforms and mobile applications. These tools empower members to actively manage their health benefits, access virtual care services, locate healthcare providers, conveniently refill prescriptions, and review claim information, all contributing to enhanced convenience and member autonomy.

The increased adoption of these digital channels is evident, with UHG reporting significant growth in digital engagement. For instance, in 2024, Optum Rx, a UHG subsidiary, saw a substantial rise in the use of its digital tools for prescription management, reflecting a growing preference for self-service options among consumers.

UnitedHealth Group, particularly through its Optum Health and Medicare Advantage segments, cultivates deep customer relationships via personalized care management. This strategy deploys dedicated care navigators, health coaches, and integrated care teams to offer tailored support and manage complex health needs.

This personalized approach is crucial for improving health outcomes and boosting patient satisfaction. For instance, Optum's integrated care model aims to reduce hospital readmissions and enhance the overall patient experience, a key differentiator in competitive healthcare markets.

UnitedHealth Group excels in customer relationships through dedicated account management, particularly for its employer clients and large healthcare systems. These teams focus on understanding unique organizational needs, tailoring benefit plans, and offering continuous strategic advice.

This personalized approach fosters robust business-to-business relationships, driving client retention. For instance, in 2023, UnitedHealth Group reported strong client retention rates across its employer and government segments, underscoring the effectiveness of its dedicated support model.

Call Centers and Member Services

UnitedHealth Group's call centers and member services are a cornerstone of its customer relationships, providing essential support for benefits and services. These human-led interactions remain critical for navigating complex health insurance inquiries and ensuring members receive comprehensive assistance. In 2024, the company continued to invest in training and technology to enhance the effectiveness of these vital touchpoints.

While digital self-service options are expanding to manage inquiries more efficiently and reduce call center volume, the human element is indispensable for resolving intricate issues. This hybrid approach ensures that members can access support through their preferred channel, whether it's a quick digital query or a detailed conversation with a service representative. UnitedHealth Group aims to optimize this balance for improved member satisfaction.

- Continued reliance on call centers: Traditional call centers remain a primary channel for member support, addressing a wide range of inquiries and issues.

- Importance of human interaction: Complex cases and the need for thorough guidance underscore the ongoing necessity of human interaction in member services.

- Digital channel growth: UnitedHealth Group is actively promoting digital channels to streamline support and reduce reliance on traditional call centers for routine matters.

- Focus on efficiency and satisfaction: Efforts are concentrated on improving the efficiency of call center operations and enhancing overall member satisfaction through personalized support.

Community Engagement and Wellness Programs

UnitedHealth Group actively fosters community engagement through a variety of wellness programs and health education initiatives. For instance, their Optum division partners with local organizations to deliver tailored health services and resources, aiming to improve overall public health outcomes. These programs are particularly vital for Medicare and Medicaid beneficiaries, building trust and extending relationships beyond standard healthcare transactions.

In 2024, UnitedHealth Group continued to invest in these community-focused efforts. Their commitment to wellness is demonstrated through programs designed to address specific health needs within diverse populations. These initiatives not only enhance the well-being of individuals but also solidify UnitedHealth Group's role as a committed partner in community health improvement.

- Community Health Focus: UnitedHealth Group's programs prioritize improving public health and building trust.

- Partnership Approach: Collaboration with local organizations is key to delivering effective wellness and education initiatives.

- Beneficiary Support: Special attention is given to Medicare and Medicaid beneficiaries, enhancing their health journey.

- Beyond Transactions: These efforts cultivate deeper relationships, moving beyond simple service provision.

UnitedHealth Group prioritizes strong customer relationships through a blend of digital self-service, personalized care management, and dedicated account support. This multi-faceted approach caters to individual members and large organizational clients alike, fostering loyalty and driving retention.

Digital engagement saw continued growth in 2024, with Optum Rx reporting increased use of its prescription management tools. Personalized care, exemplified by Optum's integrated model, focuses on improving outcomes and patient satisfaction, a strategy that contributed to strong client retention in 2023.

Community engagement through wellness programs and health education, particularly for Medicare and Medicaid beneficiaries, further solidifies relationships beyond transactional interactions.

Channels

UnitedHealth Group leverages direct sales forces and a vast network of brokers and agents to connect with both individuals and employers. These channels are vital for navigating the complexities of health insurance, simplifying enrollment, and broadening market penetration, especially for their commercial and individual exchange offerings.

In 2024, UnitedHealth Group's OptumRx segment, which handles pharmacy benefits, demonstrated the importance of these distribution channels by managing over 1.5 billion prescriptions, showcasing the scale at which they interact with customers and plan sponsors.

UnitedHealth Group's digital channels, including their websites and mobile applications, are crucial for members to manage health benefits, locate providers, and access virtual care. This digital-first strategy empowers consumers with self-service capabilities, offering unparalleled convenience and accessibility to health management tools.

Employer partnerships are a cornerstone channel for UnitedHealthcare, serving businesses of all sizes. These companies select UnitedHealthcare plans to offer as part of their employee benefits, creating a vast and consistent customer base. This approach effectively uses established corporate relationships for product distribution.

In 2024, UnitedHealthcare's employer-sponsored health insurance segment remained a dominant force. The company reported significant revenue from this channel, reflecting the ongoing demand for comprehensive employee health benefits. This strategy capitalizes on the employer's role as a primary provider of healthcare access for millions of Americans.

Healthcare Facilities and Provider Networks

Optum Health utilizes its owned and affiliated clinics, urgent care centers, and outpatient facilities as direct channels to deliver healthcare services. These physical locations are crucial for managing care, particularly within value-based arrangements where integrated patient management is key. For example, in 2024, Optum continued to expand its footprint in ambulatory care settings, reflecting a strategic shift towards convenient, community-based access points.

Provider networks also function as vital channels, enabling UnitedHealthcare members to access a broad spectrum of medical services. These networks ensure that patients can find care from a wide range of specialists and primary care physicians, facilitating choice and accessibility. By managing these extensive networks, UnitedHealth Group can negotiate favorable terms and ensure quality of care for its beneficiaries.

- Direct Care Delivery: Optum Health operates over 2,000 physician practices and numerous ambulatory care sites as of early 2024, directly engaging patients.

- Network Access: UnitedHealthcare's provider network encompasses over 1.5 million physicians and care providers across the United States, offering broad patient choice.

- Value-Based Care Focus: These channels are instrumental in Optum's pursuit of value-based care models, aiming to improve health outcomes while managing costs.

Government Programs (Medicare/Medicaid)

UnitedHealth Group leverages government programs like Medicare and Medicaid as crucial channels to access large, specific populations. In 2024, these programs represent a substantial portion of the healthcare landscape, with millions of Americans relying on them for coverage.

These government channels necessitate a deep understanding of regulatory frameworks and compliance. UnitedHealth Group's participation involves offering a diverse range of health plans tailored to the unique needs of Medicare and Medicaid beneficiaries, ensuring accessibility and affordability.

- Medicare Enrollment: Over 65 million Americans were enrolled in Medicare as of early 2024, a significant segment UnitedHealth Group actively serves.

- Medicaid Reach: Medicaid covers a substantial portion of low-income individuals and families, with UnitedHealth Group playing a key role in providing managed care services.

- Regulatory Compliance: Adherence to strict government regulations is paramount for operating within these programs, impacting plan design and member services.

- Enrollment Periods: Strategic engagement during annual enrollment periods is vital for maximizing reach and member acquisition within these government-dependent markets.

UnitedHealth Group utilizes a multi-faceted approach to reach its diverse customer base, ensuring comprehensive service delivery across various segments. These channels are critical for both acquiring new members and retaining existing ones, facilitating engagement and access to healthcare services.

The company's extensive network of brokers and agents remains a primary conduit for commercial and individual health plans. In parallel, its digital platforms provide members with self-service options and convenient access to health management tools. Furthermore, Optum Health's owned clinics and affiliated facilities offer direct patient care, emphasizing a growing trend towards integrated, value-based healthcare delivery.

| Channel Type | Description | Key Metrics/Data (2024) |

|---|---|---|

| Direct Sales & Intermediaries | Brokers, agents, and direct sales forces for commercial and individual plans. | Facilitates enrollment and market penetration for millions of members. |

| Digital Platforms | Websites and mobile applications for member self-service and virtual care. | Enhances member engagement and provides convenient access to health management tools. |

| Employer Partnerships | Offering plans through businesses as employee benefits. | A cornerstone for UnitedHealthcare, serving a vast and consistent customer base. |

| Owned & Affiliated Facilities | Clinics, urgent care centers, and outpatient sites for direct care delivery. | Optum Health operates thousands of care sites, focusing on integrated, value-based care. |

| Provider Networks | Extensive networks of physicians and specialists. | Encompasses over 1.5 million providers, ensuring broad patient choice and access. |

| Government Programs | Medicare and Medicaid managed care offerings. | Serves millions of beneficiaries, requiring deep regulatory understanding and tailored plans. |

Customer Segments

UnitedHealth Group serves individuals and families who directly purchase health insurance, often via ACA marketplaces. These consumers prioritize comprehensive benefits, manageable costs, and a wide selection of doctors and hospitals. UnitedHealthcare provides a range of plans designed to meet these diverse needs.

For instance, in 2024, UnitedHealthcare continued to offer various individual and family plans, including options with different deductible levels and coverage scopes. The company's focus on network breadth ensures members have access to a substantial number of healthcare providers, a key factor for this customer segment.

Employers, from small businesses to large corporations, represent a crucial customer segment for UnitedHealth Group. They actively seek comprehensive health benefit plans designed to cover their workforce. A key driver for these employers is securing solutions that are not only cost-effective but also simplify the administrative burden associated with managing benefits.

Furthermore, employers prioritize health plans that demonstrably contribute to employee well-being and, consequently, enhance overall productivity. UnitedHealthcare addresses this by offering a spectrum of choices, including both fully insured plans and self-funded options, catering to diverse organizational needs and risk appetites.

In 2024, the demand for employer-sponsored health insurance remains robust, with a significant portion of the U.S. workforce relying on these benefits. For instance, data from the Kaiser Family Foundation consistently shows that a substantial majority of Americans receive their health coverage through their employer, underscoring the critical role UnitedHealthcare plays in this market.

Medicare beneficiaries, primarily individuals aged 65 and older or those with specific disabilities, represent a crucial customer segment. They seek robust health coverage, including prescription drugs and specialized senior care, often opting for Medicare Advantage or Medicare Supplement plans.

UnitedHealthcare is a dominant player, serving millions within this demographic. In 2024, the company continued to expand its Medicare Advantage offerings, aiming to provide comprehensive and accessible healthcare solutions to this growing population.

Medicaid Beneficiaries

Medicaid beneficiaries represent a significant customer segment for UnitedHealth Group, encompassing individuals and families with low incomes or specific health needs who qualify for state-sponsored healthcare. This group relies on Medicaid for access to essential medical services, often with limited personal financial contribution. In 2024, UnitedHealthcare continued its extensive partnerships with states to manage and deliver these vital healthcare benefits, serving millions of Americans across various programs.

UnitedHealth Group's involvement with Medicaid beneficiaries is substantial, reflecting the program's broad reach. For instance, in 2023, the company served approximately 12.5 million people in its Medicaid business. This extensive network allows UnitedHealthcare to provide a wide array of services, from routine check-ups to specialized care, tailored to the diverse needs of this population.

- Low-income individuals and families: This core group relies on Medicaid for affordable healthcare access.

- Individuals with specific health conditions: Those with chronic illnesses or disabilities often find essential support through Medicaid.

- State partnerships: UnitedHealthcare collaborates with numerous states to administer Medicaid programs effectively.

- Focus on essential services: The segment prioritizes access to primary care, prescription drugs, and specialist treatments.

Healthcare Providers and Pharmaceutical Companies

Optum's Healthcare Providers segment includes hospitals and physician groups. They leverage Optum's technology, data analytics, and consulting to enhance operational efficiency and patient care delivery. For instance, in 2024, Optum Health continued to expand its network of care facilities, aiming to integrate more providers into its value-based care models.

Pharmaceutical companies represent another key B2B customer segment for Optum. Through its Pharmacy Benefit Management (PBM) services, Optum helps these companies optimize drug access and manage costs. In 2024, Optum Rx played a significant role in negotiating drug pricing and formulary management, impacting the market access for new therapies.

- Healthcare Providers: Hospitals, physician groups, and other care facilities seeking to improve efficiency and patient outcomes through technology and data.

- Pharmaceutical Companies: Drug manufacturers and biotech firms looking to optimize prescription drug access, cost management, and market penetration via PBM services.

- Value Proposition for Providers: Enhanced operational performance, data-driven insights for care improvement, and support for value-based care initiatives.

- Value Proposition for Pharma: Improved formulary placement, cost-effective drug distribution, and data analytics on drug utilization patterns.

UnitedHealth Group's customer segments are diverse, encompassing individuals and families seeking health insurance, employers providing benefits for their workforce, and government program beneficiaries like Medicare and Medicaid recipients. Additionally, its Optum segment serves healthcare providers and pharmaceutical companies.

In 2024, the company continued to cater to these varied needs, offering a broad spectrum of health plans and services. For instance, its employer-sponsored coverage remains a cornerstone, reflecting the significant portion of the U.S. population relying on employer-provided health benefits.

The company's extensive reach within the Medicare and Medicaid markets is also notable, with millions of beneficiaries depending on UnitedHealthcare for their healthcare needs. Optum's engagement with providers and pharmaceutical firms highlights its role in shaping healthcare delivery and drug management.

| Customer Segment | Key Needs/Priorities | 2024 Focus/Data Point |

| Individuals & Families | Comprehensive benefits, manageable costs, provider access | Continued offering of diverse ACA marketplace plans. |

| Employers | Cost-effectiveness, administrative simplification, employee well-being | Robust demand for employer-sponsored plans; significant portion of US workforce covered. |

| Medicare Beneficiaries | Robust coverage (Rx, senior care), Medicare Advantage/Supplement plans | Expansion of Medicare Advantage offerings to millions of seniors. |

| Medicaid Beneficiaries | Affordable access to essential medical services | Partnerships with states to manage programs, serving millions (e.g., ~12.5M in Medicaid business in 2023). |

| Healthcare Providers (Optum) | Operational efficiency, patient care improvement via technology/data | Expansion of care facilities and integration into value-based care models. |

| Pharmaceutical Companies (Optum) | Optimized drug access, cost management, market penetration | Significant role in drug pricing and formulary management via Optum Rx. |

Cost Structure

The largest expense for UnitedHealth Group is the direct cost of medical services and prescription drugs, reflecting payments made on behalf of its members. This significant outlay covers everything from hospital stays and doctor appointments to the cost of medications. For instance, in 2023, UnitedHealth Group's total medical costs were substantial, with a medical loss ratio (MLR) that directly impacts profitability.

UnitedHealth Group's administrative and operating expenses are substantial, reflecting the complexities of managing vast health insurance plans and providing extensive healthcare services. These costs are crucial for maintaining the infrastructure that supports millions of members and providers.

Significant outlays are directed towards the administration of health plans, customer service operations, sales and marketing efforts, and overall corporate overhead. These expenditures are essential for day-to-day operations and strategic growth initiatives.

Key components of these expenses include personnel costs for a large workforce, maintaining office spaces, investing in robust technology infrastructure, and ensuring rigorous regulatory compliance across all business segments. For instance, in 2023, UnitedHealth Group reported selling, general, and administrative expenses of approximately $33.2 billion, highlighting the scale of these operational necessities.

The company actively pursues technological advancements and operational efficiencies to manage these costs effectively. This focus aims to streamline processes, reduce waste, and ultimately improve the cost-effectiveness of their service delivery, a critical factor in maintaining competitive pricing and profitability.

UnitedHealth Group's commitment to technology development is evident in its substantial R&D spending. In 2023, the company reported $2.8 billion in technology and development expenses, a significant portion of which fuels innovation in AI, data analytics, and digital health platforms. These investments are critical for creating advanced service offerings and streamlining operations, ensuring UnitedHealth Group remains at the forefront of healthcare technology.

Salaries and Benefits for Employees

Salaries and benefits for UnitedHealth Group's extensive workforce constitute a significant portion of its cost structure. This encompasses compensation for a diverse range of employees, from clinical staff and IT professionals to administrative and sales teams operating within both the Optum and UnitedHealthcare segments.

As a major player in the healthcare industry, investing in human capital is paramount, and this investment directly translates into substantial personnel expenses. These costs are fundamental to delivering services and driving innovation across the organization.

- Employee Compensation: UnitedHealth Group's total compensation and benefits expense for 2023 was $41.9 billion, reflecting the significant investment in its workforce.

- Workforce Diversity: The company employs a broad spectrum of professionals, including doctors, nurses, data scientists, customer service representatives, and sales personnel, each contributing to its operational success.

- Strategic Investment: Recognizing human capital as a critical resource, the company allocates substantial funds to attract, retain, and develop talent, which is essential for maintaining its competitive edge.

Acquisition and Integration Costs

UnitedHealth Group's cost structure heavily features acquisition and integration expenses. In 2023, the company spent $12.1 billion on acquisitions, a significant portion of which was for the Optum segment. These costs encompass extensive due diligence, the complex process of merging new entities, and the potential for goodwill impairment charges if acquired businesses underperform expectations.

These strategic acquisitions are crucial for UnitedHealth Group's continuous business portfolio refinement, allowing them to enter new markets or bolster existing service lines. For instance, the integration of Change Healthcare, a $13 billion deal finalized in early 2023, represents a substantial investment aimed at enhancing data analytics and payment technology within Optum.

- Acquisition Spending: UnitedHealth Group allocated $12.1 billion to acquisitions in 2023.

- Key Acquisition: The integration of Change Healthcare, valued at $13 billion, was a major 2023 initiative.

- Cost Components: Expenses include due diligence, integration efforts, and potential goodwill impairments.

- Strategic Rationale: These costs support the ongoing refinement and expansion of the company's business portfolio.

The largest expense for UnitedHealth Group is the direct cost of medical services and prescription drugs, reflecting payments made on behalf of its members. This significant outlay covers everything from hospital stays and doctor appointments to the cost of medications. For instance, in 2023, UnitedHealth Group's total medical costs were substantial, with a medical loss ratio (MLR) that directly impacts profitability.

UnitedHealth Group's administrative and operating expenses are substantial, reflecting the complexities of managing vast health insurance plans and providing extensive healthcare services. These costs are crucial for maintaining the infrastructure that supports millions of members and providers.

Significant outlays are directed towards the administration of health plans, customer service operations, sales and marketing efforts, and overall corporate overhead. These expenditures are essential for day-to-day operations and strategic growth initiatives.

Key components of these expenses include personnel costs for a large workforce, maintaining office spaces, investing in robust technology infrastructure, and ensuring rigorous regulatory compliance across all business segments. For instance, in 2023, UnitedHealth Group reported selling, general, and administrative expenses of approximately $33.2 billion, highlighting the scale of these operational necessities.

The company actively pursues technological advancements and operational efficiencies to manage these costs effectively. This focus aims to streamline processes, reduce waste, and ultimately improve the cost-effectiveness of their service delivery, a critical factor in maintaining competitive pricing and profitability.

UnitedHealth Group's commitment to technology development is evident in its substantial R&D spending. In 2023, the company reported $2.8 billion in technology and development expenses, a significant portion of which fuels innovation in AI, data analytics, and digital health platforms. These investments are critical for creating advanced service offerings and streamlining operations, ensuring UnitedHealth Group remains at the forefront of healthcare technology.

Salaries and benefits for UnitedHealth Group's extensive workforce constitute a significant portion of its cost structure. This encompasses compensation for a diverse range of employees, from clinical staff and IT professionals to administrative and sales teams operating within both the Optum and UnitedHealthcare segments.

As a major player in the healthcare industry, investing in human capital is paramount, and this investment directly translates into substantial personnel expenses. These costs are fundamental to delivering services and driving innovation across the organization.

- Employee Compensation: UnitedHealth Group's total compensation and benefits expense for 2023 was $41.9 billion, reflecting the significant investment in its workforce.

- Workforce Diversity: The company employs a broad spectrum of professionals, including doctors, nurses, data scientists, customer service representatives, and sales personnel, each contributing to its operational success.

- Strategic Investment: Recognizing human capital as a critical resource, the company allocates substantial funds to attract, retain, and develop talent, which is essential for maintaining its competitive edge.

UnitedHealth Group's cost structure heavily features acquisition and integration expenses. In 2023, the company spent $12.1 billion on acquisitions, a significant portion of which was for the Optum segment. These costs encompass extensive due diligence, the complex process of merging new entities, and the potential for goodwill impairment charges if acquired businesses underperform expectations.

These strategic acquisitions are crucial for UnitedHealth Group's continuous business portfolio refinement, allowing them to enter new markets or bolster existing service lines. For instance, the integration of Change Healthcare, a $13 billion deal finalized in early 2023, represents a substantial investment aimed at enhancing data analytics and payment technology within Optum.

- Acquisition Spending: UnitedHealth Group allocated $12.1 billion to acquisitions in 2023.

- Key Acquisition: The integration of Change Healthcare, valued at $13 billion, was a major 2023 initiative.

- Cost Components: Expenses include due diligence, integration efforts, and potential goodwill impairments.

- Strategic Rationale: These costs support the ongoing refinement and expansion of the company's business portfolio.

UnitedHealth Group's cost structure is dominated by direct medical costs, representing payments for healthcare services and pharmaceuticals, which are the largest expense category. Significant operational costs include administrative and sales, general, and administrative (SG&A) expenses, totaling $33.2 billion in 2023, which cover managing health plans and providing services. The company also invests heavily in its workforce, with compensation and benefits reaching $41.9 billion in 2023, and strategically allocates capital to acquisitions, such as the $13 billion Change Healthcare deal, to expand its capabilities.

| Cost Category | 2023 Expense (in billions) | Key Components |

| Medical Costs | Substantial (MLR reflects this) | Hospital stays, doctor visits, prescription drugs |

| SG&A Expenses | $33.2 | Plan administration, customer service, sales, marketing, overhead |

| Compensation & Benefits | $41.9 | Salaries and benefits for a diverse workforce |

| Technology & Development | $2.8 | AI, data analytics, digital health platforms, innovation |

| Acquisitions | $12.1 | Due diligence, integration, potential impairments (e.g., Change Healthcare $13B) |

Revenue Streams

UnitedHealthcare's core revenue engine is health plan premiums, collected from a diverse customer base including individuals, employers, and government programs. This encompasses revenue from commercial plans, Medicare Advantage offerings, and Medicaid managed care contracts.

The first quarter of 2025 demonstrated robust growth in this critical revenue segment, indicating strong demand for UnitedHealthcare's health benefit solutions across its various markets.

UnitedHealth Group, primarily through its Optum segment, generates significant revenue from service and administrative fees. These fees are often tied to the provision of information and technology-enabled health services, operating on a fee-for-service or administrative fee model.

Key revenue drivers include pharmacy benefit management fees, where Optum negotiates drug prices and manages prescription drug benefits for employers and health plans. In 2023, Optum's revenues reached $226.2 billion, with a substantial portion attributed to these service-based fee structures.

Further contributing to this revenue stream are fees from data analytics, consulting services offered to healthcare providers, and revenue cycle management solutions designed to optimize billing and collections for hospitals and physician groups.

Optum Rx, a key component of UnitedHealth Group, generates substantial revenue through the sale of prescription medications. This revenue stream is primarily driven by its extensive retail pharmacy network and efficient mail-order services, directly facilitating pharmaceutical sales through its pharmacy benefit manager (PBM) operations.

In 2024, Optum Rx experienced robust revenue growth, underscoring the increasing demand for its pharmacy services. This expansion reflects its ability to manage prescription drug costs and provide convenient access to medications for millions of Americans, contributing significantly to UnitedHealth Group's overall financial performance.

Value-Based Care Payments

UnitedHealth Group's Optum Health is increasingly shifting its revenue streams towards value-based care payments. This means Optum gets paid based on the quality of care and patient outcomes, not just the number of services provided. This approach directly incentivizes better health results and cost efficiency for patients.

This strategic pivot is a significant driver of growth for Optum Health. By focusing on value, the company aligns its financial success with improving patient health and reducing overall healthcare spending. This model fosters stronger relationships with providers and payers alike.

In 2023, Optum Health's revenues saw substantial growth, with a notable portion attributed to its expanding value-based care patient base. This segment is becoming a cornerstone of Optum's strategy, demonstrating the financial viability of prioritizing outcomes over volume.

- Value-Based Care Growth: Optum Health's revenue is more closely linked to achieving specific health outcomes and cost savings, moving away from traditional fee-for-service models.

- Incentive Alignment: This payment structure effectively aligns financial incentives with the delivery of high-quality, efficient healthcare services.

- Revenue Driver: Optum Health experienced revenue increases in 2023, with value-based care patients playing a key role in this expansion.

Data Licensing and Software Solutions

UnitedHealth Group, through its Optum Insight division, generates significant revenue by licensing its extensive data, advanced analytics capabilities, and specialized software solutions. These offerings are crucial for other healthcare entities, including payers and providers, looking to optimize their operations.

These technology-driven services are designed to empower clients to streamline workflows, effectively control expenditures, and ultimately elevate the quality of patient care. This segment leverages UnitedHealth Group's vast datasets to provide actionable intelligence.

- Data Licensing: Optum Insight licenses access to its proprietary health data, enabling clients to perform their own analysis and gain insights.

- Software Solutions: Revenue is also derived from the sale and subscription of software platforms that support various healthcare management functions, such as revenue cycle management and population health.

- Analytics Services: Clients pay for advanced analytics and reporting services that help them identify trends, predict outcomes, and make data-informed decisions.

UnitedHealth Group's revenue streams are diverse, with health plan premiums from individuals, employers, and government programs forming the bedrock. Optum's services, including pharmacy benefit management and technology solutions, represent a substantial and growing portion of the company's income. The company's strategic shift towards value-based care, particularly within Optum Health, is increasingly driving revenue by rewarding quality outcomes.

| Revenue Stream | Primary Source | 2023 Data (Illustrative) | 2024 Outlook (General Trend) |

|---|---|---|---|

| Health Plan Premiums | Individuals, Employers, Government Programs | Formed the largest portion of total revenue | Continued growth expected |

| Optum Service & Admin Fees | PBM, IT Services, Consulting, Revenue Cycle Management | Optum revenues reached $226.2 billion in 2023 | Strong performance anticipated |

| Optum Rx Sales | Prescription Medication Sales | Significant contributor to Optum's top line | Robust growth observed |

| Value-Based Care | Quality Outcomes & Cost Savings | Growing patient base driving revenue increases | Key strategic growth area |

| Optum Insight Licensing & Software | Data, Analytics, Software Solutions | Provided actionable intelligence to clients | Continued demand for data-driven insights |

Business Model Canvas Data Sources

The UnitedHealth Group Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research on healthcare trends, and operational data from its diverse business segments. These sources provide a comprehensive view of customer needs, competitive landscapes, and cost structures.