UnitedHealth Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UnitedHealth Group Bundle

UnitedHealth Group navigates a complex healthcare landscape shaped by powerful forces. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is crucial for strategic advantage. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore UnitedHealth Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

UnitedHealth Group (UNH) depends on a wide array of suppliers, from drug makers to device manufacturers and healthcare facilities. When a supplier market is highly concentrated, like for specific high-cost drugs or specialized medical equipment, these suppliers wield considerable bargaining power. For instance, in 2024, the market for certain biologic drugs, often supplied by a limited number of pharmaceutical giants, demonstrated this concentration, potentially driving up costs for payers like UNH.

The bargaining power of suppliers for UnitedHealth Group is significantly influenced by switching costs. When it's difficult or costly for UnitedHealth Group to change its suppliers, those suppliers gain leverage.

For example, integrating a new technology vendor or reconfiguring extensive networks of healthcare providers can involve substantial disruption and expense for UnitedHealth Group. These high switching costs limit UnitedHealth Group's ability to negotiate favorable terms, increasing its reliance on current supplier relationships.

In 2023, UnitedHealth Group reported operating expenses of $250.9 billion, a significant portion of which is tied to its provider networks and technology infrastructure. The complexity and cost associated with changing these fundamental operational components underscore the supplier bargaining power.

Suppliers offering highly specialized or unique services, such as cutting-edge medical technologies or niche healthcare provider networks, significantly enhance their bargaining power. For instance, if UnitedHealth Group relies on a particular provider for advanced diagnostic imaging not widely available, that supplier can command higher prices. This is especially true when these specialized offerings are critical for delivering comprehensive or advanced patient care, directly impacting UnitedHealth Group's service quality and market competitiveness.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to UnitedHealth Group's bargaining power. If key suppliers, such as large pharmaceutical manufacturers or major hospital networks, were to establish their own pharmacy benefit management (PBM) services or insurance plans, they could directly compete with UnitedHealth Group. This potential competition compels UnitedHealth Group to negotiate favorable terms, as failure to do so could result in a powerful competitor emerging from its own supply chain.

For instance, a large hospital system with substantial market share could leverage its existing infrastructure and patient base to launch an insurance product, directly challenging UnitedHealth Group's market position. Similarly, a major pharmaceutical company could expand its existing PBM operations or acquire a smaller PBM, thereby controlling drug pricing and distribution in a way that bypasses UnitedHealth Group’s established model. This strategic maneuver by suppliers would fundamentally alter the competitive landscape, increasing their leverage in negotiations.

- Increased Supplier Leverage: Suppliers capable of forward integration can dictate terms more aggressively, knowing they can capture UnitedHealth Group's profit margins if negotiations fail.

- Competitive Threat: The prospect of suppliers becoming direct competitors forces UnitedHealth Group to be more accommodating to maintain its market share and avoid direct rivalry.

- Strategic Implications: UnitedHealth Group must constantly assess the integration capabilities of its suppliers and develop strategies to mitigate this threat, potentially through long-term contracts or strategic partnerships.

Labor and Talent Supply in Healthcare

The availability and cost of skilled healthcare professionals are a major supplier cost for UnitedHealth Group's Optum segment, impacting its healthcare delivery operations. Labor shortages, especially for specialized roles like critical care nurses and oncologists, amplify the bargaining power of these professionals. This directly translates to increased wages and recruitment expenses for UnitedHealth Group's extensive provider network.

In 2024, the healthcare industry continued to grapple with significant staffing challenges. For instance, a report from the American Association of Colleges of Nursing indicated a projected shortage of registered nurses, potentially reaching over 400,000 by 2025. This persistent scarcity empowers healthcare professionals, allowing them to negotiate higher compensation and benefits.

- Increased Wage Pressure: Persistent shortages of nurses and specialized physicians in 2024 drove up average salaries and signing bonuses.

- Recruitment and Retention Costs: UnitedHealth Group faced higher expenses for attracting and keeping qualified staff within its OptumCare network.

- Impact on Service Delivery: Staffing limitations can affect the capacity and efficiency of healthcare services provided by UnitedHealth Group's owned or affiliated facilities.

- Negotiating Leverage: High demand for limited talent gives healthcare professionals considerable leverage in salary and working condition negotiations.

The bargaining power of suppliers for UnitedHealth Group is moderated by the number of available suppliers and the uniqueness of their offerings. When there are many suppliers for a similar product or service, UnitedHealth Group can more easily switch, reducing supplier leverage. Conversely, a lack of alternatives, particularly for specialized medical equipment or pharmaceuticals, grants suppliers significant pricing power.

In 2024, the concentration in the market for certain advanced medical devices, often produced by a few key manufacturers, meant these suppliers could command premium pricing. This situation directly impacts UnitedHealth Group's cost structure for its insurance plans and care delivery services.

The bargaining power of suppliers is also shaped by the overall health of the economy and specific industry trends. During periods of high demand for healthcare services, suppliers may find themselves with increased leverage. For example, in early 2024, the sustained demand for elective procedures, coupled with supply chain challenges for certain surgical instruments, allowed some suppliers to increase their prices.

| Supplier Characteristic | Impact on UNH Bargaining Power | Example (2024) |

|---|---|---|

| Supplier Concentration | High concentration = High supplier power | Limited manufacturers of specific biologic drugs |

| Switching Costs | High switching costs = High supplier power | Integration of new electronic health record systems |

| Uniqueness of Offering | Unique offerings = High supplier power | Proprietary diagnostic imaging technology |

| Forward Integration Threat | High threat = High supplier power | Large hospital systems launching their own insurance plans |

| Labor Availability | Shortages = High supplier power (for labor) | Shortage of specialized nurses impacting wage demands |

What is included in the product

This analysis reveals how UnitedHealth Group navigates intense industry rivalry, buyer and supplier power, the threat of new entrants, and the impact of substitutes, all within the dynamic healthcare sector.

Instantly understand the competitive landscape of the healthcare industry by visualizing UnitedHealth Group's Porter's Five Forces, revealing key pressures and opportunities.

Customers Bargaining Power

UnitedHealth Group's substantial customer base, especially large employers and government programs like Medicare and Medicaid, wield considerable bargaining power. These major clients represent a vast number of insured individuals, enabling them to negotiate for better rates and more comprehensive benefits, which can impact UnitedHealth Group's profitability.

The government's influence as a price setter in programs such as Medicare and Medicaid significantly curtails UnitedHealth Group's flexibility in adjusting prices. For instance, in 2024, Medicare Advantage plans faced scrutiny over payment rates, highlighting the government's role in shaping the financial landscape for health insurers.

Individual consumers, particularly those relying on the Affordable Care Act (ACA) marketplace, exhibit significant price sensitivity. This means they are very aware of and influenced by the cost of health insurance plans.

As premiums continue to climb and out-of-pocket expenses like deductibles and copays increase, consumers are increasingly motivated to seek out more budget-friendly options. For instance, in 2024, a substantial portion of ACA marketplace enrollees are expected to be highly cost-conscious due to economic pressures.

This strong price sensitivity directly impacts UnitedHealth Group's pricing power. It means the company must carefully consider the potential for losing members if it attempts to raise premiums too aggressively, compelling a continuous focus on operational efficiency and delivering demonstrable value to retain its customer base.

Customers now have unprecedented access to information, thanks to digital tools. Websites and apps allow easy comparison of health plans, coverage, costs, and provider networks. This transparency significantly lowers switching costs for consumers.

In 2024, the proliferation of health insurance comparison websites and patient review platforms means consumers can readily assess UnitedHealth Group's offerings against competitors. This readily available data empowers them to negotiate better terms or switch providers if value is not perceived, thereby increasing their bargaining power.

Consolidation of Healthcare Providers (as Optum's Customers)

The bargaining power of customers in the healthcare sector is significantly influenced by provider consolidation. As hospitals and physician groups merge, they form larger entities that can exert greater influence when negotiating with service providers like Optum.

These consolidated healthcare systems, often referred to as integrated delivery networks, possess increased leverage to demand more favorable terms for Optum's technology solutions, data analytics services, and pharmacy benefit management contracts. For instance, a large hospital system acquiring smaller practices can present a unified front, potentially negotiating lower fees or demanding customized service packages.

- Increased Negotiating Clout: Larger, consolidated healthcare providers can negotiate more effectively on pricing and contract terms with Optum.

- Potential for Reduced Margins: This increased customer power can lead to pressure on Optum's service fees and profit margins.

- Demand for Customized Solutions: Consolidated entities may require tailored services, increasing complexity and potentially impacting Optum's standardized offerings.

- Impact on Revenue Growth: A stronger customer bargaining position could temper Optum's revenue growth if significant concessions are required.

Customer Switching Costs (for beneficiaries)

For UnitedHealth Group, the bargaining power of customers, particularly individual beneficiaries, is shaped by switching costs. While large employers, a significant customer segment, can exert considerable influence, individual beneficiaries often encounter moderate hurdles when considering a change. These can include established relationships with healthcare providers, a desire to maintain continuity of care and benefits, and the inherent complexity involved in navigating and comparing different health insurance plans.

However, the landscape is evolving. Initiatives aimed at simplifying the health insurance selection process and the increasing availability of tailored, personalized plans are gradually lowering these barriers. This trend suggests a potential for increased customer power in the future, as it becomes easier for individuals to switch plans if they find better value or services elsewhere.

- Moderate Switching Costs for Individuals: While large employers hold significant sway, individual beneficiaries typically face moderate costs when switching health insurance plans, often due to provider relationships and benefit continuity.

- Factors Influencing Switching: Key considerations for beneficiaries include existing provider networks, the desire for uninterrupted coverage, and the perceived complexity of comparing and enrolling in new plans.

- Evolving Customer Power: Efforts to streamline health insurance navigation and the growth of personalized plans are actively reducing these switching barriers, which could lead to greater customer influence over time.

UnitedHealth Group faces significant customer bargaining power, particularly from large employers and government programs like Medicare and Medicaid. These major clients, representing millions of insured individuals, can negotiate for better rates and benefits, directly impacting profitability. For instance, in 2024, the government's role in setting Medicare Advantage payment rates continues to influence insurer pricing flexibility.

Individual consumers are increasingly price-sensitive, driven by rising premiums and out-of-pocket costs. In 2024, many ACA marketplace enrollees are highly cost-conscious, making them more likely to switch providers if better value is perceived, especially with readily available comparison tools.

Consolidated healthcare systems also wield greater power, demanding more favorable terms from UnitedHealth Group's services like Optum. This can pressure margins and necessitate customized solutions, potentially impacting revenue growth.

| Customer Segment | Bargaining Power Drivers | Impact on UnitedHealth Group |

|---|---|---|

| Large Employers | Volume of lives insured, negotiation leverage | Pressure on premiums, demand for tailored benefits |

| Government Programs (Medicare/Medicaid) | Price setting authority, regulatory influence | Limited pricing flexibility, compliance costs |

| Individual Consumers (ACA Marketplace) | Price sensitivity, access to information, switching ease | Need for competitive pricing, retention challenges |

| Consolidated Healthcare Providers | Market concentration, negotiation strength | Reduced service fees for Optum, demand for customization |

Preview the Actual Deliverable

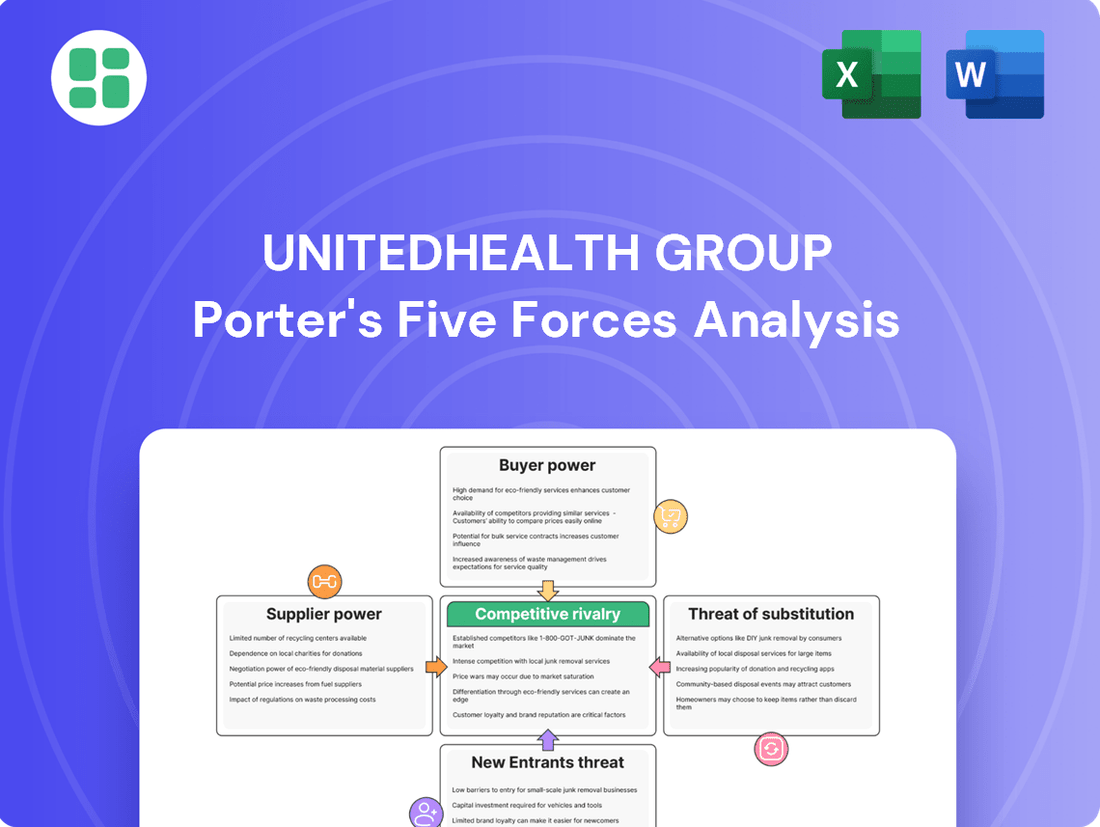

UnitedHealth Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for UnitedHealth Group, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The U.S. health insurance landscape is fiercely competitive, featuring a multitude of national and regional players. Giants like Elevance Health, CVS Health (Aetna), Cigna Group, and Humana consistently challenge UnitedHealth Group's dominance. This intense rivalry, particularly evident in regional and specialized market segments, forces constant innovation and strategic pricing to maintain market share across both UnitedHealthcare and Optum services.

While the health insurance landscape features numerous companies, many local and national markets are dominated by a handful of large insurers. UnitedHealth Group, for instance, leverages its substantial scale, especially within the Medicare Advantage sector, to gain a significant competitive edge.

This high degree of market concentration fuels fierce competition, particularly for lucrative customer segments. The top-tier insurers are locked in intense rivalry, constantly vying for market share and profitability, a dynamic evident in the ongoing consolidation and strategic maneuvers within the industry.

Competitive rivalry in the healthcare sector, particularly for giants like UnitedHealth Group, is intensely fueled by a relentless pursuit of innovation and technology adoption. This isn't just about staying current; it's about leading the charge in how health plans are structured, how care is delivered, and how technology underpins it all.

Competitors are making significant investments across the board, pouring resources into areas like telemedicine, artificial intelligence for streamlining claims processing, sophisticated data analytics, and the development of highly personalized health plans. For instance, in 2024, many health tech startups and established players alike announced substantial funding rounds dedicated to AI-driven healthcare solutions, aiming to improve efficiency and patient outcomes.

UnitedHealth Group, through its Optum arm, must continuously leverage its formidable technological capabilities to stay ahead. This ongoing innovation is crucial not only for maintaining its competitive position in a crowded market but also for attracting and retaining its vast customer base who increasingly expect seamless, data-driven, and personalized healthcare experiences.

Regulatory and Policy Shifts

The healthcare sector is heavily regulated, and shifts in government policies directly influence competitive rivalry for companies like UnitedHealth Group. For instance, changes in Medicare Advantage reimbursement rates, which are a significant revenue driver, can alter the competitive landscape. In 2024, CMS proposed a 3.3% increase for Medicare Advantage plans, a figure that insurers closely monitor for its impact on profitability and market strategy.

Medicaid redeterminations also play a crucial role. As states reassess eligibility, millions of individuals may transition between coverage types, creating opportunities and challenges for insurers. The Affordable Care Act (ACA) subsidies also affect market dynamics by influencing enrollment numbers and the affordability of plans, thus shaping how insurers compete for members.

- Policy Impact: Changes in Medicare Advantage rates and Medicaid redeterminations directly affect insurer profitability and market share.

- Competitive Response: Insurers must quickly adapt to regulatory shifts, intensifying competition as they seek advantageous market positions.

- ACA Influence: Affordable Care Act subsidies impact enrollment and plan affordability, further shaping competitive strategies.

Integration and Diversification Strategies

UnitedHealth Group's aggressive vertical integration, particularly through its Optum segment, significantly heightens competitive rivalry. Optum's expansion into care delivery and pharmacy services allows UnitedHealth to offer more comprehensive, cost-controlled solutions, directly challenging rivals who may not possess similar integrated capabilities. This trend forces other major health insurers to either replicate these strategies or risk losing market share to more holistic healthcare providers.

The competitive landscape is increasingly shaped by the ability to manage entire healthcare ecosystems, not just insurance products. For instance, in 2024, Optum continued its robust growth, contributing substantially to UnitedHealth Group's overall revenue and demonstrating the financial power of integrated models. Competitors like CVS Health, through its acquisition of Oak Street Health, and Amazon, with its Haven joint venture (though later dissolved, its ambitions remain), are also investing heavily in similar integration strategies. This dynamic creates an intense battleground where innovation in service delivery and cost management is paramount.

- Vertical Integration as a Competitive Lever: UnitedHealth Group's Optum, a prime example of vertical integration, directly competes with traditional insurers by owning and operating care facilities and pharmacies, offering bundled services.

- Industry-Wide Integration Trend: Major competitors, including CVS Health and Elevance Health, are also actively pursuing vertical integration, acquiring physician groups and expanding their pharmacy benefit management (PBM) operations to counter UnitedHealth's integrated approach.

- Focus on Cost Control and Member Experience: Integrated models aim to improve care coordination and reduce costs, giving companies like UnitedHealth a competitive edge in attracting and retaining members by offering a more seamless and potentially more affordable healthcare experience.

- Intensified Competition Beyond Insurance: The rivalry now extends beyond premium pricing and network breadth to encompass the entire value chain of healthcare delivery, forcing all players to innovate and adapt to a more complex competitive environment.

The competitive rivalry for UnitedHealth Group is intense, driven by large national insurers like Elevance Health, CVS Health (Aetna), and Cigna Group. These players constantly vie for market share, particularly in lucrative segments like Medicare Advantage, where UnitedHealth Group holds a strong position. The battleground extends beyond traditional insurance to integrated care delivery, forcing constant innovation in technology and service offerings.

In 2024, the healthcare industry saw continued strategic investments in technology and care models. For instance, UnitedHealth Group's Optum segment demonstrated robust growth, highlighting the financial strength of integrated healthcare delivery. Competitors are also actively pursuing similar strategies, such as CVS Health's acquisitions of physician groups, to enhance their competitive standing.

This dynamic creates a highly competitive environment where companies must excel in cost management, member experience, and innovation. The rivalry is not just about pricing but about offering comprehensive, seamless healthcare solutions across the entire value chain.

Key competitors are actively investing in technology and care integration to counter UnitedHealth Group's advantages.

| Competitor | Key Strategy/Focus | 2024 Market Activity Highlight |

|---|---|---|

| Elevance Health | Integrated care, digital health solutions | Continued expansion of care delivery services |

| CVS Health (Aetna) | Pharmacy benefit management, primary care | Acquisition of primary care providers (e.g., Oak Street Health) |

| Cigna Group | Specialty care, behavioral health | Focus on expanding employer-sponsored health plans with integrated benefits |

| Humana | Medicare Advantage, home health services | Strategic partnerships to enhance care coordination for seniors |

SSubstitutes Threaten

For some consumers and employers, direct primary care (DPC) and concierge medicine models present a substitute for certain UnitedHealth Group services. These models bypass traditional insurance for routine care, offering an alternative way to access medical attention, particularly for those prioritizing personalized service or clear pricing for basic health needs.

While not a complete substitute for UnitedHealth Group's broad insurance plans, these alternative care models are gaining traction. For instance, the DPC movement has seen steady growth, with estimates suggesting that by 2024, a significant portion of primary care physicians might explore or adopt such models, impacting how individuals access foundational healthcare services.

The burgeoning telehealth and digital health sectors represent a significant threat of substitutes for UnitedHealth Group. These platforms offer convenient, often lower-cost alternatives for specific healthcare needs, bypassing traditional in-network services. For instance, by the end of 2023, over 70% of Americans had used telehealth services at least once, a substantial increase from pre-pandemic levels, demonstrating a clear shift in consumer behavior.

Large employers increasingly opt for self-funded health benefit plans, bypassing traditional fully insured offerings. This trend directly substitutes UnitedHealthcare's core insurance products, as these employers manage their own risk and costs.

While UnitedHealth Group, through its Optum segment, still provides administrative services to many self-funded employers, the fundamental insurance revenue stream is bypassed. This shift grants employers greater autonomy over plan design and financial management, making it a potent substitute.

In 2024, a significant portion of the employer-sponsored health insurance market, estimated to be around 60%, consists of self-funded plans, highlighting the substantial threat these pose to fully insured plan providers like UnitedHealth Group.

Government-Provided Healthcare Systems

Government-provided healthcare systems can act as a substitute for private insurance, particularly for specific demographics or if private options are seen as costly or complicated. For instance, the Veterans Affairs (VA) healthcare system serves millions of U.S. veterans, offering a direct government alternative to private plans. In 2023, the VA reported serving over 9 million veterans, demonstrating the scale of such a substitute.

While the United States predominantly utilizes private healthcare insurance, ongoing discussions about expanding public options or moving towards a single-payer system represent a potential long-term threat of substitution. These public alternatives could attract individuals seeking more affordable or simplified coverage, potentially impacting the market share of private insurers like UnitedHealth Group.

- Government Healthcare Systems as Substitutes: For segments of the population, government-run healthcare, such as the VA or direct public health services, offers an alternative, especially when private insurance is perceived as expensive or complex.

- U.S. Healthcare Landscape: Although the U.S. largely relies on private insurance, the ongoing debate and potential for expanded public healthcare options or single-payer models pose a future substitute threat.

- Scale of Public Systems: The Veterans Affairs system alone, which served approximately 9 million individuals in 2023, illustrates the significant reach and potential impact of government-provided healthcare as a substitute.

Wellness Programs and Preventive Care Initiatives

The growing emphasis on wellness programs and preventive care presents a significant threat of substitutes for UnitedHealth Group. As individuals and employers increasingly invest in proactive health management, the reliance on traditional, reactive healthcare services may diminish. This shift could lead to reduced demand for comprehensive health insurance plans.

For instance, employer-sponsored wellness programs, which saw continued investment through 2024, aim to lower healthcare costs by promoting healthier lifestyles. These initiatives, by reducing the incidence of chronic diseases and the need for extensive medical interventions, directly compete with the core service offering of health insurers like UnitedHealth Group. If these external wellness solutions prove highly effective, they could decrease the overall utilization of healthcare services, thereby impacting the revenue streams of insurance providers.

Consider the potential impact:

- Reduced Medical Claims: Effective preventive care can lower the frequency and cost of medical claims, a primary driver of insurance profitability.

- Shifting Consumer Behavior: A population more focused on wellness might opt for lighter insurance coverage or prioritize services outside traditional insurance networks.

- Growth of Niche Wellness Providers: Specialized companies offering fitness, nutrition, and mental health support could capture a segment of the healthcare spend previously allocated to insurance premiums.

Alternative care models like direct primary care and concierge medicine offer personalized, often transparently priced services, presenting a substitute for certain UnitedHealth Group offerings, especially for routine medical needs. By 2024, a notable percentage of primary care physicians were exploring or adopting these models, indicating a growing shift in how individuals access foundational healthcare.

The rise of telehealth and digital health platforms provides convenient, cost-effective alternatives for specific healthcare needs, bypassing traditional insurance. By the close of 2023, over 70% of Americans had utilized telehealth services, underscoring a significant change in consumer healthcare preferences.

Self-funded employer health plans are increasingly prevalent, directly substituting UnitedHealthcare's fully insured products by allowing employers to manage their own risk. In 2024, approximately 60% of the employer-sponsored health insurance market comprised self-funded plans, highlighting a substantial threat to traditional insurance providers.

| Substitute Type | Description | Impact on UnitedHealth Group | 2023/2024 Data Point |

| Direct Primary Care/Concierge Medicine | Personalized, direct access to medical care, bypassing insurance for routine services. | Reduces reliance on traditional insurance plans for primary care. | Growing adoption by physicians, impacting foundational healthcare access. |

| Telehealth & Digital Health | Convenient, often lower-cost online platforms for medical consultations and services. | Offers alternatives for specific health needs, potentially reducing in-network utilization. | Over 70% of Americans used telehealth by end of 2023. |

| Self-Funded Employer Plans | Employers manage their own health benefit plans and risks. | Directly bypasses UnitedHealthcare's core insurance products for employer markets. | Approximately 60% of employer-sponsored market in 2024. |

Entrants Threaten

The health insurance and diversified healthcare services sector demands significant upfront capital. Establishing robust provider networks, implementing sophisticated IT systems for claims processing and member management, and meeting stringent regulatory compliance requirements necessitate billions of dollars. For instance, in 2023, UnitedHealth Group reported revenues exceeding $371 billion, illustrating the scale of operations required to compete effectively.

The healthcare industry's labyrinthine regulatory landscape presents a substantial threat of new entrants for UnitedHealth Group. Navigating the intricate web of federal and state laws governing insurance, patient data privacy under HIPAA, and provider operations demands considerable expertise and resources.

Newcomers must contend with significant compliance costs and licensing hurdles, making it difficult to establish a foothold. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine payment models and quality reporting requirements, adding layers of complexity for any new player seeking to operate within these programs.

UnitedHealth Group enjoys substantial economies of scale across its insurance and healthcare services. This scale translates into lower per-member administrative expenses and enhanced negotiating leverage with healthcare providers and drug manufacturers, a significant barrier for newcomers.

For instance, in 2023, UnitedHealth Group reported total revenue of $371.6 billion, underscoring its vast operational footprint. Achieving comparable scale and efficiency would require immense capital investment and time, making it exceedingly difficult for new entities to enter and compete effectively on price or breadth of services.

Established Brand Loyalty and Network Effects

UnitedHealth Group benefits from deeply entrenched brand loyalty and significant network effects. Decades of operation have allowed them to cultivate trust and establish vast networks of healthcare providers and a large member base. For instance, as of the first quarter of 2024, UnitedHealth Group served over 160 million people globally, a testament to their established reach.

New entrants find it difficult to replicate this scale and trust. Building a comparable network and gaining consumer confidence requires substantial time and capital investment, creating a formidable barrier.

- Established Brand Loyalty: UnitedHealth Group's long history fosters deep customer trust, making it hard for newcomers to attract members.

- Extensive Network Effects: A larger network of providers and members creates a more valuable service for all participants, a difficult advantage for new entrants to overcome.

- Capital Intensity: Building a comparable infrastructure and marketing presence demands significant financial resources, deterring many potential new competitors.

- Customer Inertia: The hassle and perceived risk of switching health insurance providers also contribute to customer retention for established players like UnitedHealth Group.

Technological Disruptors and Niche Entrants

While UnitedHealth Group (UHG) benefits from substantial entry barriers like regulatory hurdles and economies of scale, the threat of new entrants persists, particularly from technology-focused disruptors. These agile companies, often specializing in areas like artificial intelligence for diagnostics or virtual care delivery, can bypass traditional infrastructure and target specific, profitable niches within the healthcare market. For instance, by 2024, the digital health market saw significant investment, with AI in healthcare projected to reach over $150 billion by 2028, indicating a fertile ground for innovative startups to challenge established players.

These specialized entrants pose a unique threat by offering highly efficient or personalized solutions that established providers may struggle to replicate quickly. For example, a virtual primary care platform could offer a more convenient and cost-effective alternative for routine consultations, potentially siphoning off a segment of UHG's member base. The rapid adoption of telehealth services, which saw a surge in usage during recent years, underscores the potential for these niche players to gain traction and erode market share if UHG does not actively integrate or compete with such innovative approaches.

- Technological disruption from AI and virtual care startups.

- Niche entrants targeting specific services or patient segments.

- Potential for erosion of market share if established players are slow to adapt.

- The digital health market is expected to continue its rapid expansion, creating opportunities for new entrants.

The threat of new entrants for UnitedHealth Group is moderate, primarily due to high capital requirements, regulatory complexity, and established economies of scale. However, the burgeoning digital health sector presents a growing challenge.

Technology-driven startups can bypass traditional infrastructure, focusing on niche services like AI diagnostics or virtual care. The digital health market's projected growth, with AI in healthcare expected to surpass $150 billion by 2028, highlights this potential.

These specialized entrants can offer more efficient or personalized solutions, potentially attracting specific member segments. The continued adoption of telehealth services demonstrates the viability of these niche models.

While UHG's scale and brand loyalty are significant barriers, the agility of tech-focused newcomers necessitates continuous adaptation and integration of innovative approaches to maintain market leadership.

Porter's Five Forces Analysis Data Sources

Our UnitedHealth Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including UnitedHealth Group's annual reports, SEC filings, and investor relations materials. We supplement this with industry-specific research from reputable sources like IBISWorld and healthcare market intelligence reports.