Unipar Carbocloro SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Unipar Carbocloro Bundle

Unipar Carbocloro's strengths lie in its established market presence and vertical integration, but it faces potential threats from fluctuating raw material costs and increasing competition.

Discover the complete picture behind Unipar Carbocloro's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Unipar Carbocloro stands as a dominant force in South America's chemical sector, holding a leading position in the production of vital chemicals such as chlorine, caustic soda, and PVC. This extensive market presence translates into considerable competitive advantages, allowing Unipar to leverage economies of scale and benefit from robust brand recognition built over years of operation.

The company's established distribution networks across the South American continent are a significant asset, ensuring efficient product delivery and customer reach. This regional leadership not only secures a stable demand for its products but also grants Unipar a degree of influence over market pricing, reinforcing its competitive edge.

Unipar Carbocloro's core products, like caustic soda and chlorine derivatives, are vital building blocks for numerous essential industries. These chemicals are indispensable in sectors ranging from water treatment and sanitation to construction materials, textiles, and the production of plastics. This wide-ranging applicability means Unipar isn't overly dependent on any single market, which is a significant strength.

For instance, caustic soda is crucial for pulp and paper production, aluminum manufacturing, and chemical processing, while chlorine is fundamental for PVC production, pharmaceuticals, and disinfectants. The essential nature of these inputs ensures a baseline level of demand, even during periods of economic uncertainty. In 2024, the global demand for caustic soda was projected to grow steadily, driven by these diverse industrial applications, underscoring Unipar's robust market position.

Unipar Carbocloro's strategic geographical presence, with industrial plants in Brazil and Argentina, offers a significant advantage. Operating within two of South America's largest economies allows for reduced logistics costs and less vulnerability to international trade disruptions. This localized production model, as of early 2024, enables Unipar to be highly responsive to regional market dynamics and ensures efficient access to essential raw materials and a skilled labor pool.

Commitment to Sustainability and ESG Initiatives

Unipar's dedication to sustainability and ESG principles is a significant strength, aiming to be a catalyst for a more sustainable future. This commitment is evident in their strategic integration of ESG across operations and their public reporting on progress. For instance, Unipar has invested in renewable energy sources, such as solar and wind power, as part of its energy transition efforts.

These initiatives not only bolster Unipar's brand image, attracting investors focused on environmental and social responsibility, but also offer potential for long-term operational cost reductions through enhanced efficiency. By aligning with global sustainability trends, Unipar positions itself favorably in a market increasingly valuing corporate responsibility.

- ESG Integration: Unipar embeds Environmental, Social, and Governance factors into its core strategy, values, and mission.

- Energy Transition: Significant investments are being made in renewable energy sources like solar and wind power.

- Brand Reputation: Commitment to sustainability enhances brand image and appeals to socially responsible investors.

- Operational Efficiency: ESG initiatives can lead to long-term cost savings through improved resource management and efficiency.

Operational Excellence and Modernization Investments

Unipar Carbocloro's dedication to operational excellence is a significant strength, covering critical areas like safety, production efficiency, maintenance, and logistics. This focus ensures smooth and reliable operations across the board.

The company's substantial investments in plant modernization are key. For instance, a $200 million program at the Cubatão plant is upgrading it with advanced membrane technology. This initiative is designed to boost both efficiency and sustainability in its production processes.

These continuous improvement efforts and adoption of new technologies are vital. They help Unipar Carbocloro maintain its cost competitiveness in the market and ensure the dependability of its production output.

- Safety, Production, Maintenance, and Logistics: Core pillars of Unipar's operational focus.

- Cubatão Plant Modernization: A $200 million investment in membrane technology for enhanced efficiency and sustainability.

- Cost Competitiveness: Achieved through ongoing technological advancements and operational improvements.

- Production Reliability: Underpinned by a commitment to modernization and continuous improvement.

Unipar Carbocloro's leading market share in South America for key chemicals like PVC, caustic soda, and chlorine provides substantial economies of scale and strong brand recognition. Its established distribution network across the continent ensures efficient delivery and broad customer reach, securing stable demand and pricing influence.

The essential nature of Unipar's products, serving diverse industries from water treatment to construction and plastics, diversifies its revenue streams and mitigates reliance on any single sector. For example, the global demand for caustic soda was projected for steady growth in 2024, bolstered by these varied industrial applications.

Unipar's strategic plant locations in Brazil and Argentina reduce logistics costs and trade disruption risks, allowing for greater responsiveness to regional market dynamics. As of early 2024, this localized production model also facilitates efficient access to raw materials and skilled labor.

The company's commitment to sustainability, including investments in renewable energy like solar and wind power, enhances its brand reputation and appeals to ESG-focused investors. These initiatives also promise long-term operational cost reductions through improved efficiency and resource management.

Unipar Carbocloro's focus on operational excellence, exemplified by a $200 million modernization program at its Cubatão plant using advanced membrane technology, drives both efficiency and sustainability. This dedication to continuous improvement and technological adoption ensures cost competitiveness and production reliability.

| Key Strength | Description | Impact | Supporting Data/Example |

| Market Leadership | Dominant position in South America for chlorine, caustic soda, and PVC. | Economies of scale, brand recognition, pricing power. | Leading market share in key product segments. |

| Diversified Product Demand | Products are essential inputs for numerous industries. | Reduced reliance on single markets, stable baseline demand. | Caustic soda demand growth projected for 2024 across various sectors. |

| Strategic Geographical Presence | Manufacturing facilities in Brazil and Argentina. | Lower logistics costs, reduced trade risk, regional responsiveness. | Efficient access to raw materials and labor in major South American economies. |

| Sustainability Focus | Investment in renewables (solar, wind) and ESG integration. | Enhanced brand image, investor appeal, potential cost savings. | Commitment to energy transition and ESG reporting. |

| Operational Excellence | Modernization of plants, focus on safety and efficiency. | Cost competitiveness, production reliability. | $200 million Cubatão plant upgrade with advanced membrane technology. |

What is included in the product

Unipar Carbocloro's SWOT analysis provides a comprehensive view of its internal strengths and weaknesses alongside external market opportunities and threats. This assessment helps to understand the company's competitive standing and strategic direction.

Unipar Carbocloro's SWOT analysis offers a clear roadmap to identify and address strategic vulnerabilities, acting as a pain point reliever by highlighting areas for improvement and competitive advantage.

Weaknesses

Unipar's core business as a basic chemicals producer means its profits are directly tied to the ups and downs of raw material costs, like energy and salt, and the selling prices of its key products such as chlorine, caustic soda, and PVC. These commodity markets are inherently unpredictable, influenced by global supply and demand, which can squeeze Unipar's profit margins. For instance, recent data from early 2024 shows continued volatility in caustic soda prices across Latin America, impacting producers like Unipar.

Unipar's performance is heavily influenced by the economic climate in South America, particularly Brazil and Argentina. Economic instability, such as high inflation and currency fluctuations in these key markets, can directly reduce demand for Unipar's chemical products and increase operating expenses, impacting profitability.

For example, Argentina has experienced persistent macroeconomic challenges, including significant inflation rates that reached over 200% in early 2024, which can erode consumer purchasing power and business investment, thereby affecting Unipar's sales volumes and pricing power in that crucial market.

Unipar Carbocloro faces significant environmental and regulatory compliance risks due to the chemical industry's inherent need to adhere to stringent laws. Operations in both Brazil and Argentina are subject to evolving local and national regulations concerning emissions, waste management, and the safe handling of chemicals. For instance, Brazil's recent strengthening of climate change regulations may introduce new compliance requirements and associated costs.

Operational Disruptions and Plant Reliability

Unipar Carbocloro's chemical production processes are susceptible to operational disruptions, such as unplanned outages or maintenance challenges at its industrial plants. These events can directly translate into lost production volume and elevated operational expenses. For instance, in the first quarter of 2024, Unipar reported a temporary halt in operations at its Cubatão facility due to a technical issue, which impacted its overall production output for that period.

Such disruptions pose a significant risk to Unipar's ability to consistently meet customer demand, potentially leading to a decline in revenue and a weakening of its market position. The company's reliance on continuous plant operation means that even short-term interruptions can have a cascading effect on its financial performance and customer relationships.

- Production Halts: Instances of temporary production stoppages at facilities like Cubatão have occurred, impacting output.

- Cost Increases: Unplanned outages often necessitate emergency repairs and overtime, driving up operational costs.

- Market Share Risk: Inability to meet demand due to disruptions can lead to customers seeking alternative suppliers.

Competition in the Chemical Market

Unipar Carbocloro faces significant competitive pressures in the chemical industry. Despite its strong market standing, the presence of major regional and global competitors like Dow, Olin, and Solvay means pricing and margin control are constant challenges. This necessitates ongoing investment in operational efficiency and product innovation to maintain its edge.

The competitive landscape is dynamic, with rivals actively engaging in strategic alliances and expanding their production capacities. For instance, in early 2024, several key players announced expansions or new joint ventures aimed at capturing market share in high-demand chemical segments. This aggressive posture by competitors underscores the need for Unipar to remain agile and responsive to market shifts.

- Intense Rivalry: Unipar competes with global chemical giants such as Dow, Olin, and Solvay, impacting pricing power.

- Margin Pressure: Constant competition demands efficiency gains and quality improvements to protect profit margins.

- Strategic Moves by Competitors: Competitors are actively pursuing partnerships and capacity expansions, requiring Unipar to adapt.

Unipar's profitability is highly sensitive to fluctuations in commodity prices, particularly for inputs like energy and salt, and its main products such as caustic soda and PVC. This commodity dependence exposes the company to market volatility, as seen in early 2024 with ongoing price swings in caustic soda across Latin America, directly impacting Unipar's margins.

The company's reliance on the South American economic landscape, especially Brazil and Argentina, presents a significant weakness. Macroeconomic instability, including high inflation and currency depreciation, as evidenced by Argentina's inflation exceeding 200% in early 2024, directly curtails demand and escalates operating costs, thereby hindering Unipar's financial performance.

Unipar faces substantial environmental and regulatory compliance burdens inherent to the chemical sector. Evolving regulations in Brazil and Argentina concerning emissions and chemical handling necessitate continuous investment in compliance measures, potentially increasing operational expenses. For instance, Brazil's recent tightening of climate regulations may introduce new cost pressures.

Operational disruptions, such as unplanned plant outages, pose a direct threat to Unipar's production continuity and ability to meet customer demand. A reported temporary halt at its Cubatão facility in Q1 2024 exemplifies this risk, leading to reduced output and potential revenue loss.

Same Document Delivered

Unipar Carbocloro SWOT Analysis

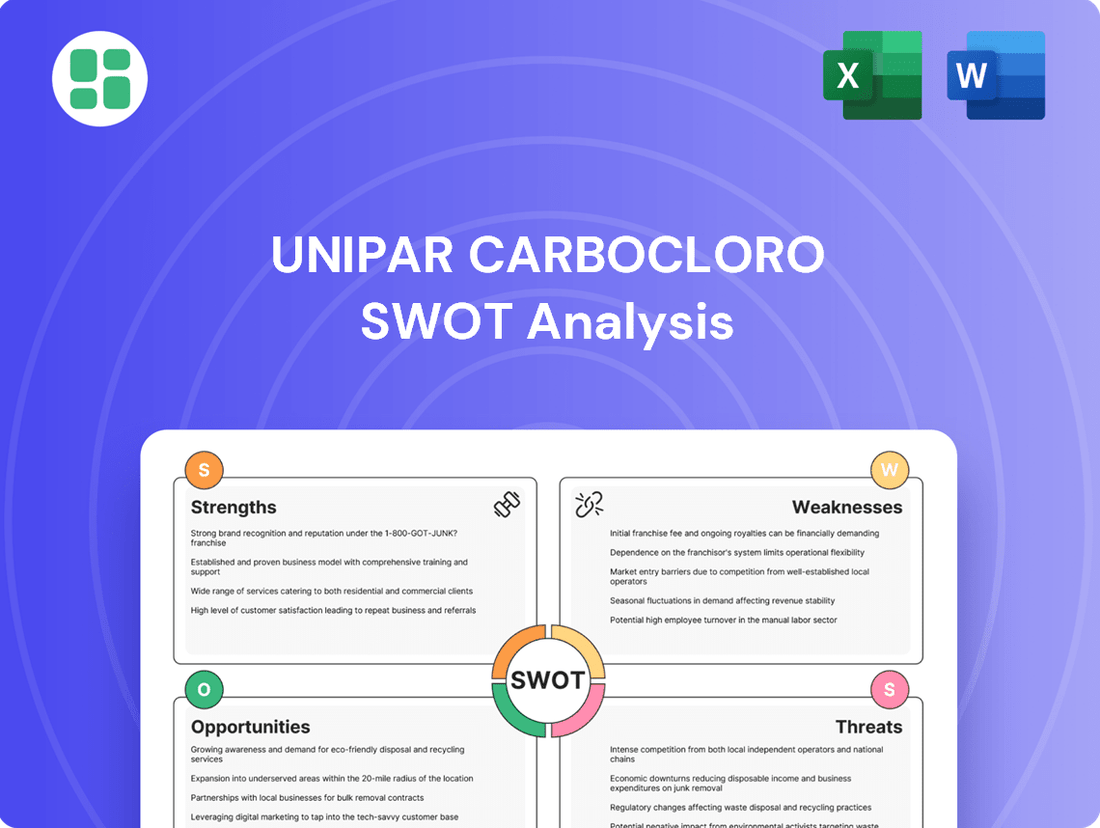

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Unipar Carbocloro's strategic positioning.

This is a real excerpt from the complete document, showcasing the detailed breakdown of Unipar Carbocloro's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version for your strategic planning.

Opportunities

South America's increasing emphasis on sanitation and water treatment infrastructure is a prime opportunity for Unipar. Its core products, chlorine and caustic soda, are fundamental to water purification and wastewater management, directly benefiting from this trend. For instance, Brazil's National Sanitation Information System (SNIS) data for 2023 indicated that investments in sanitation infrastructure are on the rise, signaling a growing market for Unipar's offerings.

Government-led initiatives and heightened public awareness surrounding clean water and effective wastewater treatment are expected to fuel consistent demand for Unipar's products. Unipar's stated commitment to enhancing access to clean water and sanitation in key markets like Brazil and Argentina aligns perfectly with these societal and governmental priorities, positioning the company for sustained growth in this vital sector.

Urbanization and infrastructure projects in Brazil and Argentina, like the ongoing expansion of transportation networks and housing initiatives, are fueling a significant increase in construction activity. This trend directly translates to higher demand for PVC, a key product for Unipar Carbocloro. For instance, Brazil's infrastructure investment plans for 2024-2029, focusing on logistics and sanitation, are expected to boost construction material consumption.

The automotive and packaging industries are also experiencing a resurgence, further contributing to the demand for Unipar's basic chemicals. As manufacturing output rises, so does the need for materials like chlorine and caustic soda. In 2024, the Brazilian automotive sector saw a notable uptick in production, signaling robust demand for its supply chain inputs.

Unipar is well-positioned to leverage this growth by potentially expanding its production capacity or streamlining its logistics to ensure timely delivery of chemicals to these expanding sectors. The South American PVC market, in particular, is anticipated to see consistent growth through 2025, presenting a clear opportunity for Unipar to solidify its market share and increase sales volumes.

Unipar's strategic investments in technological modernization, like the adoption of membrane technology at its Cubatão facility, are a significant opportunity. This upgrade is designed to boost operational efficiency and reduce energy consumption.

By embracing these advanced processes, Unipar can expect to lower its production costs, making it more competitive in the market. This also translates to a reduced environmental footprint, aligning with growing sustainability demands.

For instance, the Cubatão plant's modernization project, completed in 2023, aimed to increase its chlor-alkali production capacity by 15%. This efficiency gain directly impacts Unipar's ability to capture market share and improve profit margins, especially with energy costs being a major factor in chemical production.

Strategic Acquisitions and Partnerships

Unipar Carbocloro can leverage strategic acquisitions and partnerships to broaden its product offerings and enter new geographic markets. The company could also benefit from integrating further into the value chain through these strategic moves.

While the current merger and acquisition landscape might be cautious, projections suggest an improving market for such deals, presenting Unipar with avenues to enhance its market standing. For instance, in 2024, the chemical industry saw significant M&A activity, with companies actively seeking consolidation and expansion opportunities, indicating a favorable environment for strategic growth.

- Expand Product Portfolio: Acquire companies with complementary chemical products to offer a wider range to customers.

- Geographic Expansion: Partner with or acquire businesses in regions where Unipar currently has limited presence.

- Value Chain Integration: Invest in or acquire suppliers or downstream distributors to secure supply chains and capture more value.

- Market Share Growth: Combine forces with competitors or acquire smaller players to increase overall market share.

Renewable Energy Integration and Green Chemistry

Unipar's strategic focus on renewable energy integration and green chemistry presents a significant opportunity. The company's commitment to increasing its renewable electricity consumption, aiming for 100% by 2030, directly supports this. This transition not only aligns with global sustainability trends but also enhances Unipar's environmental, social, and governance (ESG) credentials.

By actively reducing its greenhouse gas emissions, Unipar can improve its market perception and potentially unlock access to favorable green financing options. Furthermore, a strong sustainability narrative can attract environmentally conscious customers and investors, providing a competitive edge in the evolving chemical industry landscape.

- Renewable Energy Adoption: Targeting 100% renewable electricity by 2030, as announced by Unipar, demonstrates a concrete commitment to cleaner operations.

- Green Chemistry Focus: Investing in processes that minimize waste and use less hazardous substances aligns with the growing demand for sustainable chemical solutions.

- Market Appeal: Enhanced ESG performance can attract environmentally aware consumers and investors, potentially leading to increased market share and improved access to capital.

- Operational Efficiency: Transitioning to renewables can also offer long-term cost savings and greater energy price stability compared to fossil fuel reliance.

The growing demand for clean water and sanitation in South America, driven by government initiatives and urbanization, presents a significant opportunity for Unipar. Its core products, chlorine and caustic soda, are essential for these processes. Brazil's 2023 sanitation data shows increasing infrastructure investment, directly benefiting Unipar's market. Furthermore, the construction sector's expansion in Brazil and Argentina, fueled by infrastructure projects, boosts demand for PVC, another key Unipar product, with Brazil's 2024-2029 infrastructure plans expected to further increase consumption.

Unipar's modernization efforts, such as the Cubatão plant's 2023 upgrade increasing chlor-alkali capacity by 15% through membrane technology, enhance efficiency and competitiveness. This focus on operational improvements and sustainability, including a goal of 100% renewable electricity by 2030, aligns with market trends and can attract ESG-focused investors and customers.

Strategic acquisitions and partnerships offer Unipar avenues to expand its product portfolio and geographic reach. The chemical industry's M&A activity in 2024 indicates a favorable environment for such growth, allowing Unipar to enhance its market standing and integrate further into value chains.

Threats

Persistent economic instability and high inflation rates in key operating regions like Brazil and Argentina present a significant threat to Unipar Carbocloro. These macroeconomic challenges can directly impact the company's financial health by diminishing consumer purchasing power and escalating operational expenses, particularly for imported inputs or machinery. For instance, Argentina's inflation rate reached an estimated 211.4% by the end of 2023, a figure that significantly impacts cost structures and pricing strategies.

Unipar faces significant threats from intensifying regulatory scrutiny, particularly concerning environmental protection and climate change. New regulations, such as Brazil's recent establishment of a carbon market, could directly impact Unipar's operational costs and potentially restrict certain activities as they adapt to stricter environmental standards.

A global oversupply of key chemicals like chlorine, caustic soda, and PVC presents a significant threat. This situation, potentially exacerbated by new production facilities entering the market or decreased demand elsewhere, can drive down prices. For Unipar Carbocloro, this means tighter profit margins, particularly if their operational costs don't decrease proportionally. For example, the US PVC market is anticipating challenges due to excess supply, which could ripple through global pricing.

Geopolitical Risks and Supply Chain Disruptions

Geopolitical tensions and trade disputes pose a significant threat to Unipar Carbocloro. Events like the ongoing conflicts in Eastern Europe and the Middle East, coupled with potential trade wars, can directly impact the availability and price of essential raw materials like salt and energy. For instance, disruptions to major shipping lanes, such as those experienced in the Red Sea in early 2024 due to Houthi attacks, led to increased shipping times and surcharges, affecting global logistics.

These disruptions can translate into higher operational costs for Unipar Carbocloro, potentially squeezing profit margins. Furthermore, a slowdown in global economic activity stemming from geopolitical instability could dampen demand for its core products, chlor-alkali and PVC. The company's reliance on international trade for both inputs and outputs makes it particularly vulnerable to these external shocks.

- Geopolitical Instability: Ongoing conflicts and trade disputes create uncertainty in global markets.

- Supply Chain Vulnerability: Disruptions to shipping routes, like those in the Red Sea in early 2024, increase logistics costs and delivery times.

- Raw Material Volatility: International tensions can lead to unpredictable fluctuations in the cost of key inputs such as salt and energy.

- Demand Fluctuations: Global economic slowdowns linked to geopolitical events can reduce demand for chemical products.

Competition from Substitute Products or Technologies

Unipar faces a persistent threat from substitute products and evolving technologies that could diminish the demand for its primary offerings like chlorine, caustic soda, and PVC. For instance, advancements in material science might introduce new, more sustainable or cost-effective alternatives to PVC in construction and manufacturing sectors.

While these substitutes are not yet widespread in 2024, the potential for disruptive innovation remains a long-term concern. Companies in sectors like automotive and packaging are actively exploring bio-based plastics and recycled materials, which could gradually displace traditional PVC.

The chemical industry, in general, is under pressure to adopt greener processes. Innovations in electrolysis, such as the development of more energy-efficient membrane cell technology, could also indirectly impact Unipar if competitors adopt these more sustainable and potentially cheaper production methods, thereby increasing competitive pressure.

Intensifying competition, particularly from new market entrants or expanded production capacities by existing players in the chlor-alkali and PVC sectors, poses a significant threat. This can lead to price wars and reduced market share for Unipar Carbocloro. Furthermore, the company's reliance on specific raw materials, like salt, makes it vulnerable to supply disruptions or significant price hikes by suppliers.

SWOT Analysis Data Sources

This Unipar Carbocloro SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and insightful expert commentary, ensuring a data-driven and accurate assessment.