Unipar Carbocloro PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Unipar Carbocloro Bundle

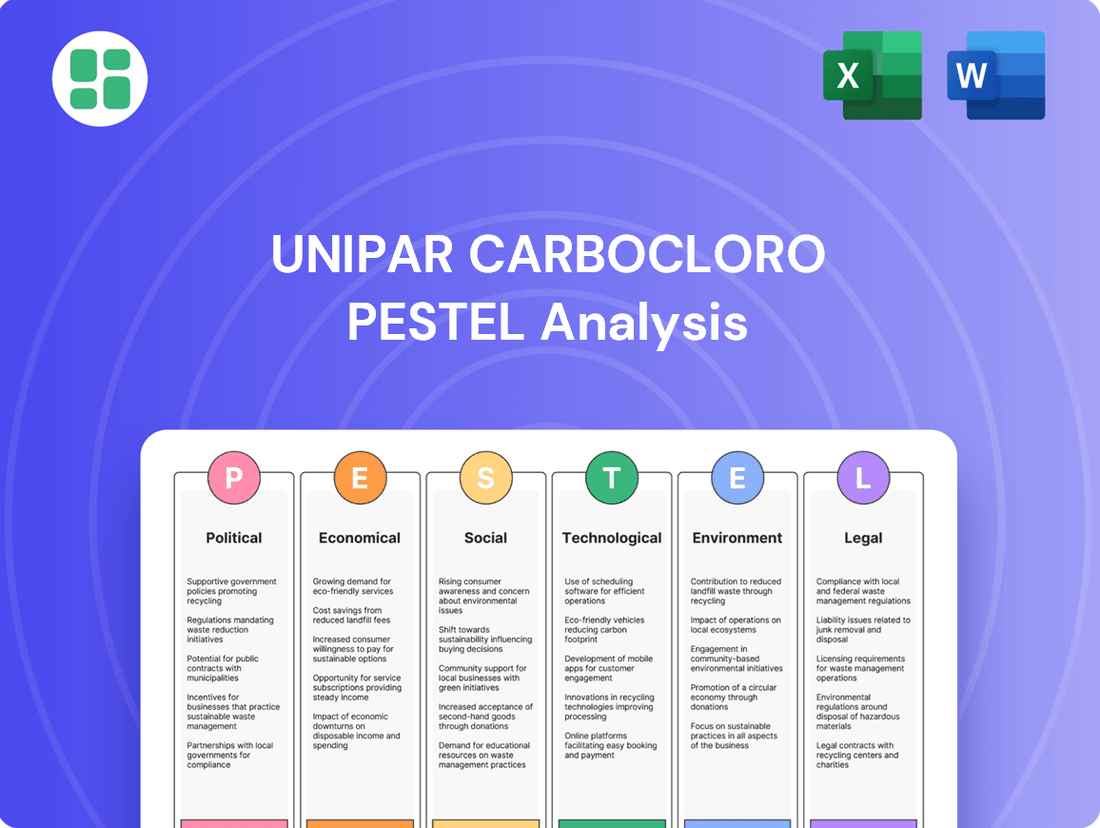

Gain a critical understanding of the external forces shaping Unipar Carbocloro's operations and future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategy and anticipate market shifts. Download the full PESTLE analysis now for a comprehensive overview.

Political factors

The political landscape in Brazil and Argentina significantly shapes Unipar Carbocloro's operational framework and strategic investments. For instance, Brazil's presidential approval ratings, which saw fluctuations throughout 2024, can impact the predictability of economic policies affecting the chemical industry.

Government initiatives focused on industrial development, such as incentives for chemical production or infrastructure upgrades for logistics, directly influence Unipar's cost structure and market access. Conversely, shifts in trade policies or tariffs, like those debated in late 2024 regarding import duties on certain chemical precursors, could present considerable challenges.

Potential changes in government leadership or a pivot in policy direction, as seen in some South American nations during 2024, introduce regulatory uncertainty. This can affect the cost and availability of key inputs, such as energy, a critical factor for Unipar's chlor-alkali production, and alter the competitive dynamics within its operating markets.

International trade agreements and regional tariffs significantly influence Unipar Carbocloro's operational landscape, affecting both the procurement of essential raw materials and the distribution of its finished chemical products globally. Changes in these trade policies, such as the renegotiation of agreements or the introduction of new import/export duties, can directly impact Unipar's cost structure and its competitiveness in key markets. For instance, a shift in trade policy could alter the price of imported inputs, thereby influencing the final price of Unipar's chlor-alkali products.

Government regulations specific to the chemical industry, such as those governing production quotas, chemical handling, and transportation, directly impact Unipar Carbocloro's operational landscape. For instance, Brazil's National Agency of Petroleum, Natural Gas and Biofuels (ANP) sets standards for fuel additives, a sector Unipar participates in, requiring adherence to quality and safety protocols.

Compliance with these regulations is non-negotiable, and any tightening of standards, such as stricter emissions controls or chemical waste disposal mandates, can necessitate substantial capital investments for Unipar. In 2024, the chemical industry globally saw increased scrutiny on environmental, social, and governance (ESG) factors, potentially leading to higher compliance costs for companies like Unipar.

Political Risk in South America

The broader political landscape across South America, marked by potential for social unrest and shifts in government ideology, introduces significant risks for industrial companies like Unipar. For instance, the 2023 political climate in countries like Peru saw periods of significant civil unrest following presidential impeachment, impacting economic activity and potentially supply chains.

Such instability can directly affect Unipar's operations by disrupting logistics, altering consumer spending patterns, or precipitating policy changes detrimental to large-scale chemical manufacturers. For example, a sudden imposition of new environmental regulations or trade tariffs, driven by a change in government's economic focus, could increase operational costs or limit market access.

Strategic planning must therefore incorporate robust risk assessments of these political variables.

- Social Unrest: Countries like Ecuador experienced widespread protests in mid-2022 due to economic policies, highlighting the potential for disruptions.

- Government Ideology Shifts: Changes in leadership can lead to policy reversals, impacting foreign investment and industrial sector support.

- Supply Chain Vulnerability: Political instability can directly affect transportation networks and the availability of raw materials, crucial for Unipar's production.

- Regulatory Uncertainty: New administrations may introduce unpredictable regulatory frameworks affecting environmental compliance and operational permits.

Government Incentives and Subsidies

Government incentives, such as tax breaks or direct subsidies for industries like chemical production or those focused on sustainable practices, can offer a significant advantage to Unipar Carbocloro. For instance, Brazil's national development bank, BNDES, has historically provided financing for large industrial projects, and in 2024, it continued to prioritize investments in green technologies and sustainable infrastructure, which could directly benefit Unipar's operational upgrades or new ventures.

These financial supports can directly translate into lower operational expenses, making Unipar more competitive. They also serve as a powerful catalyst for investing in advanced, environmentally friendly technologies and can underwrite the costs associated with expansion plans. For example, a subsidy for adopting more energy-efficient processes could reduce Unipar's electricity bills, a major cost component in chemical manufacturing.

To fully capitalize on these opportunities, Unipar must maintain proactive engagement with governmental agencies and regulatory bodies. Understanding the nuances of existing and emerging support programs is crucial for leveraging them effectively. This strategic approach allows Unipar to secure financial advantages that bolster its market position and drive innovation.

Key areas where government support could impact Unipar include:

- Investment Tax Credits: For new plant construction or upgrades to energy-efficient equipment.

- Subsidies for Green Technologies: Supporting the adoption of cleaner production methods or renewable energy sources.

- Research and Development Grants: Funding innovation in chemical processes and product development.

- Export Promotion Programs: Assisting in expanding international market reach for Unipar's products.

Government policies on industrial development and trade significantly influence Unipar Carbocloro's cost structure and market access. For instance, Brazil's focus on industrial incentives in 2024 could offer advantages, while potential shifts in regional tariffs, as debated in late 2024, pose challenges.

Regulatory frameworks, such as environmental standards and chemical handling mandates, require significant capital investment for compliance. The global trend towards stricter ESG compliance in 2024 means Unipar must adapt to potentially higher operational costs.

Political stability and shifts in government ideology across South America create uncertainty, impacting supply chains and potentially leading to unpredictable policy changes affecting Unipar's operations and raw material availability.

Government incentives, like those from Brazil's BNDES in 2024 for green technologies, can lower expenses and drive investment in cleaner production methods, offering a competitive edge.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Unipar Carbocloro, providing a comprehensive overview of its operating landscape.

Unipar Carbocloro's PESTLE analysis offers a structured approach to navigating complex external factors, acting as a pain point reliever by clarifying potential risks and opportunities for strategic decision-making.

Economic factors

Brazil's economy is projected to grow by 2.0% in 2024, according to the IMF, with Argentina's economy expected to contract by 2.8% in the same year. This divergence impacts Unipar's demand, as a stronger Brazilian economy typically boosts sales of its core products like caustic soda and PVC, which are vital for construction and industrial sectors.

Argentina's economic contraction, however, presents a headwind, potentially dampening demand for Unipar's offerings in that market. Unipar's performance is thus closely tied to the economic health of its primary operating regions.

High inflation rates across Unipar Carbocloro's key operating regions, particularly Brazil and Argentina, present a significant challenge. For instance, Brazil experienced an inflation rate of 4.62% in 2023, a notable increase from previous years, impacting the cost of essential inputs like energy and raw materials. This upward pressure on production costs directly affects Unipar's ability to maintain competitive pricing and healthy profit margins.

Managing these escalating input costs is paramount for Unipar's financial stability. The company must implement proactive strategies to offset inflationary impacts. This could involve exploring long-term supply contracts for raw materials, investing in energy efficiency technologies to reduce utility expenses, and optimizing logistics to control transportation costs. For example, Unipar's focus on operational efficiency in its chlor-alkali and PVC production lines aims to absorb some of these cost increases.

Volatility in the Brazilian Real (BRL) and Argentine Peso (ARS) significantly impacts Unipar's financial performance. For instance, in early 2024, the BRL experienced fluctuations, trading around 4.9 to 5.3 BRL per USD, while the ARS saw more pronounced depreciation, moving from approximately 800 ARS to over 1200 ARS per USD by mid-2024.

These currency swings directly affect Unipar's cost structure for imported equipment and raw materials, as well as the repatriated value of its export revenues. A weaker local currency can inflate operational expenses in dollar terms, while simultaneously making exports more competitive but potentially reducing the dollar value of sales earned in local currencies.

Raw Material and Energy Prices

Unipar Carbocloro's operations are deeply intertwined with the cost of essential raw materials, particularly salt, and substantial energy consumption. These are critical inputs for its chlor-alkali and PVC production. Changes in the global prices of these commodities directly impact the company's manufacturing expenses and, consequently, its ability to set competitive product prices.

The volatility in raw material and energy markets presents a significant challenge. For instance, the price of natural gas, a key energy source, saw considerable fluctuations in early 2024, impacting industrial energy costs globally. Unipar needs to proactively manage this price risk.

To mitigate these risks, Unipar often employs strategies such as securing long-term supply contracts for its key inputs and utilizing financial hedging instruments. These measures help to stabilize costs and provide greater predictability in its financial planning, especially as energy prices remain a critical factor for profitability.

- Salt Dependency: Unipar's chlor-alkali process requires significant quantities of salt, making its price a direct cost driver.

- Energy Intensity: The electrolysis of brine and subsequent production processes are energy-intensive, with electricity and natural gas being major cost components.

- Market Volatility: Global commodity markets, including those for salt and energy, are subject to supply and demand dynamics, geopolitical events, and economic conditions, leading to price swings.

- Risk Management: Strategies like long-term contracts and hedging are crucial for Unipar to manage the financial impact of fluctuating input costs.

Interest Rates and Investment Climate

Prevailing interest rates in Brazil and Argentina directly influence Unipar Carbocloro's financial operations. For instance, the Central Bank of Brazil's Selic rate, which stood at 10.50% as of May 2024, impacts the cost of capital for Unipar's investments and ongoing operations. Similarly, Argentina's monetary policy, with its own benchmark rates, affects borrowing expenses. High interest rates in either country can significantly increase Unipar's debt servicing costs, potentially hindering expansion plans and impacting profitability.

A favorable investment climate, often signaled by lower interest rates and improved access to credit, is crucial for Unipar's strategic growth. For example, if Brazil were to maintain a stable or declining Selic rate, it would likely reduce Unipar's cost of borrowing for its planned capital expenditures, such as those in its chlor-alkali segment. Conversely, elevated rates can create a more challenging environment, potentially slowing down investment decisions and impacting the company's overall financial health and ability to pursue new opportunities.

The interplay between interest rates and the broader investment climate directly shapes Unipar's strategic decision-making. Lower borrowing costs, often associated with a positive investment outlook, enable companies like Unipar to undertake large-scale projects more readily.

- Brazil's Selic Rate (May 2024): 10.50%

- Impact on Borrowing Costs: Higher rates increase Unipar's debt servicing expenses.

- Investment Climate Correlation: Lower rates and credit access support strategic initiatives.

- Growth Deterrent: High interest rates can stifle investment and slow down expansion.

Brazil's projected 2.0% GDP growth for 2024, contrasted with Argentina's anticipated 2.8% contraction, directly influences Unipar's demand for essential chemicals like caustic soda and PVC, vital for industrial and construction sectors in these key markets.

High inflation, with Brazil's 4.62% rate in 2023, escalates Unipar's production costs for energy and raw materials, squeezing profit margins and necessitating proactive cost management strategies.

Currency volatility, evidenced by the BRL trading around 4.9-5.3 per USD and the ARS depreciating significantly in early 2024, impacts Unipar's import costs and the repatriated value of export earnings.

Fluctuations in global commodity prices, particularly for energy like natural gas, directly affect Unipar's manufacturing expenses, making strategies like long-term supply contracts crucial for cost stabilization.

Interest rates, such as Brazil's Selic rate at 10.50% in May 2024, influence Unipar's cost of capital, with higher rates potentially hindering investment and expansion plans.

| Economic Factor | 2024 Projection/Data Point | Impact on Unipar Carbocloro |

|---|---|---|

| Brazil GDP Growth | 2.0% (IMF) | Boosts demand for chemicals |

| Argentina GDP Growth | -2.8% (Projected) | Dampens demand for chemicals |

| Brazil Inflation Rate | 4.62% (2023) | Increases production costs |

| Brazilian Real (BRL) to USD | ~4.9-5.3 (Early 2024) | Affects import costs and export revenue repatriation |

| Argentine Peso (ARS) to USD | ~800-1200+ (Early-Mid 2024) | Significant depreciation impacts costs and revenues |

| Brazil Selic Rate | 10.50% (May 2024) | Influences cost of capital and investment |

Same Document Delivered

Unipar Carbocloro PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Unipar Carbocloro PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Unipar Carbocloro's strategic landscape, enabling informed decision-making.

Sociological factors

South America's population is projected to reach over 460 million by 2025, with a significant portion migrating to urban centers. This trend directly fuels demand for Unipar's core products. For instance, increased urbanization necessitates more housing and infrastructure, boosting the need for PVC, a key component in pipes and construction materials. The demand for clean water also escalates, directly benefiting Unipar's chlorine production.

Public perception of the chemical industry significantly impacts Unipar Carbocloro's social license to operate. Widespread concerns about safety and environmental impact can translate into increased regulatory pressure and community resistance, as seen with heightened public awareness following incidents in the broader chemical sector. For instance, a 2024 survey indicated that 65% of Brazilians are concerned about the environmental footprint of industrial activities, directly affecting companies like Unipar.

Negative public sentiment can lead to stricter environmental regulations and operational limitations, potentially increasing compliance costs for Unipar. The company's ability to maintain public trust hinges on its proactive engagement in transparent communication and demonstrable commitment to responsible environmental stewardship and safety protocols. Unipar's 2023 sustainability report highlighted investments of R$ 50 million in environmental control technologies to address these concerns.

The chemical industry, including Unipar Carbocloro, relies heavily on a skilled labor pool in areas like chemical engineering, plant operations, and maintenance. In Brazil, for example, a 2024 report indicated a growing demand for specialized technical roles, with a projected shortage in advanced manufacturing skills. This scarcity directly impacts operational efficiency and the ability to maintain high safety standards at Unipar's facilities.

Demographic trends and evolving educational standards play a significant role in shaping the available workforce. As Brazil's population ages and the education system adapts, the pipeline of qualified candidates for chemical engineering positions may fluctuate. Furthermore, intense competition for talent, particularly from other industrial sectors, can drive up labor costs for Unipar, affecting overall profitability.

To mitigate these challenges, Unipar must prioritize robust investment in training and development. Initiatives focused on upskilling existing employees and attracting new talent through apprenticeships and partnerships with educational institutions are vital. For instance, by 2025, Unipar aims to increase its internal training hours by 15% to ensure its workforce remains competent and adaptable to new technologies and safety protocols.

Corporate Social Responsibility (CSR) Expectations

Societal pressure for companies to act responsibly is growing, directly impacting how Unipar Carbocloro operates. This means looking at everything from where they get their materials to how they interact with local communities. Stakeholders, like investors and everyday consumers, are paying more attention, wanting businesses to be good for the planet and society.

For Unipar, meeting these expectations isn't just about being a good corporate citizen; it's a strategic advantage. Companies with robust Corporate Social Responsibility (CSR) programs often see a boost in their public image and are more attractive to investors focused on sustainability. For instance, in 2024, a significant portion of global investment funds are screened for ESG (Environmental, Social, and Governance) criteria, with a strong emphasis on social impact.

- Growing Investor Demand: In 2024, ESG-focused investments are projected to reach over $3.7 trillion globally, highlighting a clear trend towards valuing social responsibility.

- Consumer Preferences: Surveys from 2024 indicate that over 70% of consumers consider a company's social and environmental impact when making purchasing decisions.

- Reputational Capital: Strong CSR can translate into tangible benefits, such as improved brand loyalty and a reduced risk of negative publicity, which are crucial in competitive markets.

Health and Safety Standards

Societal expectations for robust health and safety in industrial environments significantly shape Unipar Carbocloro's operational strategies and capital allocation towards safety infrastructure and employee development. A commitment to stringent safety protocols is crucial not only for safeguarding personnel but also for mitigating the financial repercussions of accidents and preserving brand integrity within the chemical sector.

Unipar Carbocloro's focus on a strong safety culture is a direct response to increasing public and regulatory scrutiny. For instance, in 2024, the chemical industry globally saw a rise in safety-related investments, with companies allocating an average of 5-7% of their operational budgets to health and safety initiatives, according to industry reports. This emphasis directly translates into Unipar's need for advanced safety equipment, continuous training programs, and rigorous adherence to international safety benchmarks like ISO 45001.

- Employee Well-being: Prioritizing worker safety minimizes injuries and fatalities, fostering a more stable and productive workforce.

- Regulatory Compliance: Meeting and exceeding health and safety standards prevents fines and legal challenges, safeguarding financial performance.

- Reputational Capital: A strong safety record enhances public trust and brand image, which is vital in the chemical industry.

- Operational Continuity: Preventing accidents ensures uninterrupted production, avoiding costly downtime and supply chain disruptions.

Societal expectations for corporate responsibility are increasingly influencing Unipar Carbocloro's operations, driving demand for transparency and ethical practices. This heightened awareness means stakeholders, from consumers to investors, scrutinize a company's social and environmental impact more closely. For Unipar, demonstrating a commitment to sustainability and community well-being is becoming a critical factor for maintaining its social license to operate and attracting investment, especially as ESG criteria gain prominence in global finance.

Technological factors

Continuous advancements in chlor-alkali and PVC production technologies are key for Unipar Carbocloro. These innovations can boost efficiency, cut energy use, and lessen environmental impact. For instance, membrane cell technology, widely adopted in the chlor-alkali industry, offers significant energy savings compared to older mercury or diaphragm methods.

To stay competitive and meet stricter environmental regulations, Unipar must invest in research and development or adopt these new technologies. For example, the global chlor-alkali market is projected to reach USD 125.5 billion by 2028, with technological upgrades being a major driver of growth and efficiency.

Keeping up with these innovations is crucial for enhancing operational performance. Companies that embrace advanced production techniques often see improved product quality and reduced operational costs, positioning them favorably in the market.

Unipar Carbocloro is significantly enhancing its manufacturing through automation and digitalization. By integrating robotics and advanced digital tools, the company aims to streamline production, elevate product quality, and bolster workplace safety. This strategic move is crucial for staying competitive in the evolving chemical industry landscape.

The company's embrace of Industry 4.0 principles, including the deployment of Internet of Things (IoT) sensors and sophisticated data analytics, enables real-time operational oversight. This allows Unipar to proactively identify maintenance requirements and build greater resilience into its operations. For instance, in 2023, Unipar reported a 15% increase in production efficiency at its Cubatão plant following the implementation of new automated systems.

Unipar's commitment to research and development in new applications for chlorine, caustic soda, and PVC is a key driver for future growth. For instance, in 2024, the company continued to explore innovative uses for PVC in sustainable construction materials, aiming to tap into growing eco-conscious markets.

Investing in R&D allows Unipar to discover novel applications for its core products, potentially opening up new revenue streams. For example, advancements in chlorine chemistry could lead to more efficient water treatment solutions, a market projected to see significant expansion in the coming years.

By diversifying beyond traditional sectors, Unipar can mitigate risks associated with market fluctuations. Exploring the use of caustic soda in advanced battery technologies, for instance, represents a strategic move to align with the burgeoning electric vehicle industry.

Waste Treatment and Byproduct Utilization

Technological advancements in waste treatment present a compelling avenue for Unipar Carbocloro to enhance its sustainability and profitability. Innovations allow for the transformation of industrial byproducts, previously considered waste, into valuable resources or energy sources. This aligns directly with the growing emphasis on circular economy principles, where materials are kept in use for as long as possible.

For Unipar, this translates into a dual benefit: reducing its environmental footprint and potentially unlocking new revenue streams. For instance, advancements in chemical recycling or waste-to-energy technologies could allow Unipar to convert byproducts from its chlor-alkali processes into marketable commodities or clean energy. This strategic focus on byproduct utilization is becoming increasingly critical as regulatory pressures and market demands for sustainable practices intensify.

- Waste-to-Value Technologies: Unipar can explore technologies that convert chemical byproducts into saleable materials, such as recovered salts or specialized chemicals.

- Energy Recovery Systems: Implementing systems to capture and utilize waste heat or convert organic byproducts into biogas can offset energy costs and reduce reliance on fossil fuels.

- Circular Economy Integration: By embracing these technologies, Unipar can position itself as a leader in sustainable chemical manufacturing, aligning with global trends and investor expectations for environmental, social, and governance (ESG) performance.

Cybersecurity and Data Management

As Unipar Carbocloro integrates more digital technologies, cybersecurity is paramount. Protecting sensitive operational data, intellectual property, and industrial control systems from evolving cyber threats is crucial. In 2024, global cybersecurity spending is projected to reach $230 billion, highlighting the increasing investment in this area.

Maintaining the integrity and security of Unipar's digital infrastructure is vital for uninterrupted operations and safeguarding proprietary information. A breach could disrupt production, leading to significant financial losses. Effective data management, in turn, underpins informed strategic decision-making and operational efficiency.

- Cybersecurity Investment: Global cybersecurity spending is expected to hit $230 billion in 2024, indicating the growing importance of digital defense.

- Data Integrity: Ensuring the security and accuracy of digital data is essential for Unipar's operational continuity and competitive advantage.

- Informed Decision-Making: Robust data management practices directly support better strategic choices and operational improvements.

- Threat Landscape: The increasing sophistication of cyber threats necessitates continuous adaptation and investment in security protocols.

Unipar Carbocloro's technological trajectory is marked by significant investments in automation and digitalization, aiming to boost efficiency and product quality. For instance, the company reported a 15% production efficiency increase at its Cubatão plant in 2023 due to new automated systems, reflecting a commitment to Industry 4.0 principles.

The company is also focusing on research and development for new applications of its core products, such as PVC in sustainable construction materials in 2024, and exploring caustic soda's use in advanced battery technologies to align with emerging markets.

Technological advancements in waste treatment offer Unipar opportunities to adopt circular economy principles, transforming byproducts into valuable resources or energy. This strategic focus on byproduct utilization is increasingly critical due to intensifying regulatory pressures and market demands for sustainability.

Cybersecurity is a paramount concern as Unipar integrates more digital technologies, with global cybersecurity spending projected to reach $230 billion in 2024, underscoring the critical need for robust digital defense to protect operational data and ensure continuity.

Legal factors

Unipar Carbocloro navigates a landscape of rigorous environmental regulations in both Brazil and Argentina, covering everything from air emissions and waste management to water consumption and the safe handling of chemicals. Failure to adhere to these mandates, which are strictly enforced, necessitates ongoing investment in pollution abatement technologies and meticulous record-keeping.

The financial implications of non-compliance are substantial, with penalties ranging from hefty fines to complete operational halts, alongside the severe damage to Unipar's public image. For instance, Brazil's National Environmental Policy (PNMA) sets broad standards, while specific state regulations, like those in São Paulo where Unipar has significant operations, can impose even tighter controls and monitoring requirements.

Unipar Carbocloro operates under stringent Occupational Health and Safety (OHS) laws, which dictate comprehensive requirements for its industrial facilities. These regulations cover everything from necessary safety equipment and employee training to emergency response plans, ensuring a safe working environment.

Compliance with these OHS laws is paramount not only for protecting employee well-being and preventing accidents but also for avoiding significant legal penalties and reputational damage. For instance, in Brazil, where Unipar has a strong presence, the Ministry of Labor and Employment actively enforces these standards. In 2023, workplace accidents in the chemical industry led to substantial compensation claims, underscoring the financial risks of non-compliance.

Unipar Carbocloro, as a dominant player in the South American chlor-alkali market, must navigate a complex web of competition and anti-trust regulations across its operating regions. These laws are designed to prevent monopolistic practices and ensure fair market competition, a critical aspect for Unipar's continued growth and stability.

Failure to adhere to these regulations can result in severe consequences, including hefty fines and legal disputes that could disrupt operations and damage its reputation. For instance, Brazil's Administrative Council for Economic Defense (CADE) actively monitors market concentration and anti-competitive behavior within various sectors, including chemicals.

Unipar's commitment to compliance is therefore paramount, safeguarding its market position and ensuring sustainable profitability by fostering an environment of fair play. The company's proactive approach to regulatory adherence is a key factor in mitigating risks associated with market dominance.

Product Liability and Safety Standards

Laws governing product liability and safety standards are paramount for Unipar Carbocloro, especially concerning chemicals like chlorine, caustic soda, and PVC. The company must rigorously ensure its products adhere to stringent quality and safety specifications from production through to their end-use. Failure to comply can result in costly product recalls, significant legal battles, and severe damage to its reputation, directly impacting customer confidence and revenue streams.

In 2023, the chemical industry globally saw increased scrutiny on safety protocols. For instance, regulatory bodies like the European Chemicals Agency (ECHA) continue to update REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, influencing how companies like Unipar manage chemical safety and compliance. While specific Unipar Carbocloro recall data for 2024/2025 is not publicly available, the trend indicates a heightened risk profile for non-compliance. For example, in 2022, a major chemical producer faced fines exceeding $5 million for safety standard violations, highlighting the financial repercussions.

- Stringent Compliance: Unipar must maintain adherence to evolving national and international chemical safety regulations.

- Lifecycle Responsibility: Ensuring product safety extends from manufacturing to transportation and customer handling.

- Reputational Risk: Non-compliance can lead to substantial fines, legal liabilities, and a significant loss of market trust.

- Market Access: Meeting safety standards is crucial for continued access to key markets and for maintaining competitive advantage.

Import and Export Regulations

Unipar Carbocloro navigates a landscape shaped by intricate import and export regulations. These rules encompass everything from customs duties and potential trade barriers to the necessity of obtaining specific licenses for international transactions. Staying compliant is paramount for Unipar to maintain a smooth supply chain and ensure access to global markets for its chemical products.

Fluctuations in these regulations can significantly impact Unipar's operational costs and the practicality of its international sourcing and distribution strategies. For instance, a sudden increase in import duties on key raw materials could directly affect production expenses. Conversely, streamlined export procedures can enhance market competitiveness.

- Customs Duties: Tariffs on imported raw materials and exported finished goods directly influence Unipar's cost structure and pricing strategies.

- Trade Barriers: Quotas or non-tariff barriers imposed by trading partners can limit market access and require strategic adjustments in sales and distribution.

- Licensing Requirements: Obtaining and maintaining necessary permits for chemical imports and exports is critical for legal operation and avoiding disruptions.

Unipar Carbocloro faces legal mandates concerning labor practices, including minimum wage laws, collective bargaining rights, and regulations on working hours and benefits. Adherence to these labor laws is crucial for maintaining employee relations and avoiding costly disputes or sanctions. For example, in Brazil, the Consolidation of Labor Laws (CLT) outlines extensive employee protections, and in 2023, labor claims in the industrial sector often involved disputes over overtime pay and working conditions, with significant financial settlements awarded.

The company must also comply with consumer protection laws that govern product information, labeling, and advertising, ensuring transparency and fairness in its dealings with customers. Strict adherence to these regulations prevents reputational damage and legal challenges related to misrepresentation or product quality. For instance, consumer protection agencies in both Brazil and Argentina actively monitor product claims and can impose penalties for non-compliance, as seen in various sectors where misleading advertising has led to substantial fines.

Unipar Carbocloro's operations are subject to intellectual property laws, protecting its proprietary technologies and brand identity. Safeguarding these assets is vital for maintaining its competitive edge and preventing unauthorized use. In 2024, the global focus on digital intellectual property protection continues to intensify, impacting how companies manage and defend their innovations. For example, patent infringement cases in the chemical industry can result in significant financial damages and loss of market share.

Environmental factors

Growing global concern over climate change is intensifying pressure on industrial players like Unipar to significantly curb their carbon footprint and greenhouse gas emissions. This translates into a demand for cleaner production processes and a greater reliance on renewable energy sources.

Unipar is likely to encounter increased expectations for investments in sustainable technologies and potentially face the implementation of carbon pricing mechanisms, impacting operational costs. For instance, the chemical industry, a key sector for Unipar, is a significant energy consumer, making emission reduction a critical strategic imperative.

Measuring and actively reducing emissions are no longer optional but are becoming essential for Unipar's long-term viability and market competitiveness. Companies in Brazil, where Unipar operates, are increasingly aligning with national and international climate goals, such as those outlined in the Paris Agreement.

Water resource management is a critical environmental consideration for chemical producers like Unipar Carbocloro, as their operations are often water-intensive. Efficient water consumption, robust recycling programs, and strict adherence to discharge regulations are therefore paramount for sustainability and operational continuity.

In 2023, Unipar reported that its operations, particularly at the Cubatão plant in Brazil, rely on significant water intake. Potential impacts of water scarcity or more stringent water usage laws in regions where Unipar operates, such as Brazil, could lead to increased operational costs and potentially constrain production volumes.

Unipar faces growing pressure to manage industrial waste and embrace circular economy principles. In 2024, global waste generation reached an estimated 2.3 billion tonnes, highlighting the urgency of sustainable practices. Unipar must responsibly handle its byproducts, like caustic soda production residues, and explore avenues for waste valorization, potentially turning these into revenue streams.

The company's products, such as PVC, are also under scrutiny for their end-of-life management. By 2025, many regions are implementing stricter regulations on plastic waste, driving demand for more recyclable materials. Unipar has an opportunity to innovate, developing products that are easier to recycle or incorporating recycled content, aligning with the 2024 EU Circular Economy Action Plan which aims to make sustainable products the norm.

Biodiversity and Ecosystem Impact

Unipar's industrial activities, such as those at its chlor-alkali facilities, can influence local biodiversity through water discharge and land use. For instance, in 2023, Unipar reported investments in environmental management systems aimed at minimizing operational impacts.

Ensuring compliance with environmental impact assessments and deploying effective mitigation strategies are paramount for Unipar to safeguard natural habitats and ecosystems. This proactive approach is key to responsible environmental stewardship.

Maintaining a strong social license to operate and preventing ecological harm are directly linked to Unipar's commitment to responsible environmental practices. This commitment is increasingly scrutinized by stakeholders and regulators alike.

- Environmental Stewardship: Unipar's commitment to minimizing its ecological footprint is a critical aspect of its operational strategy.

- Regulatory Compliance: Adherence to environmental regulations and impact assessments is essential for sustainable operations.

- Social License: Responsible environmental management directly supports Unipar's reputation and its ability to operate without significant public opposition.

Sustainable Sourcing and Supply Chain

The global push for sustainable sourcing of raw materials and environmentally responsible supply chains is intensifying. Unipar, like many chemical producers, faces growing pressure to ensure its suppliers meet stringent environmental standards and that its logistics are optimized for reduced emissions. For instance, by 2024, many European Union directives aim to increase the traceability and sustainability of chemical supply chains, impacting companies like Unipar that operate internationally.

Optimizing transportation methods is crucial for lowering Unipar's carbon footprint. This could involve shifting towards more fuel-efficient fleets or exploring alternative, lower-emission transport options for its products. The company's commitment to these practices directly influences its environmental performance and builds resilience against future regulations and market expectations.

- Growing Regulatory Scrutiny: Expect stricter regulations in 2024-2025 regarding supply chain emissions and raw material sourcing, particularly from the EU.

- Supplier Audits: Unipar will likely increase audits of its suppliers to verify compliance with environmental and social governance (ESG) criteria.

- Logistics Optimization: Investments in greener logistics, such as electric or hydrogen-powered trucks for shorter hauls, are becoming more common in the chemical industry.

- Transparency Demands: Investors and consumers are increasingly demanding transparency about the environmental impact of a company's entire value chain.

Unipar faces increasing pressure to reduce its environmental impact, particularly concerning carbon emissions and water usage. The company's operations, especially in Brazil, are water-intensive, making efficient management and compliance with stricter water regulations crucial for 2024 and 2025. Additionally, the growing global emphasis on circular economy principles necessitates responsible waste management and innovation in product recyclability to meet evolving market demands and regulatory landscapes.

| Environmental Factor | 2023/2024 Context | 2025 Outlook |

|---|---|---|

| Carbon Emissions | Global pressure to curb footprint; chemical industry is energy-intensive. | Increased investment in cleaner processes; potential carbon pricing impacts. |

| Water Resource Management | Unipar's Cubatão plant is water-intensive; risk of scarcity and stricter laws. | Higher operational costs due to water constraints; potential production limits. |

| Waste Management & Circularity | Global waste generation rising (2.3 billion tonnes in 2024); scrutiny on plastic end-of-life. | Stricter regulations on plastic waste; demand for recyclable materials and recycled content. |

| Biodiversity & Land Use | Chlor-alkali facilities can impact local ecosystems; Unipar invested in environmental management systems in 2023. | Continued focus on compliance with environmental impact assessments and mitigation strategies. |

PESTLE Analysis Data Sources

Our Unipar Carbocloro PESTLE Analysis is built on a comprehensive review of publicly available data. This includes reports from regulatory bodies, industry associations, financial news outlets, and economic forecasting agencies.