Unipar Carbocloro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Unipar Carbocloro Bundle

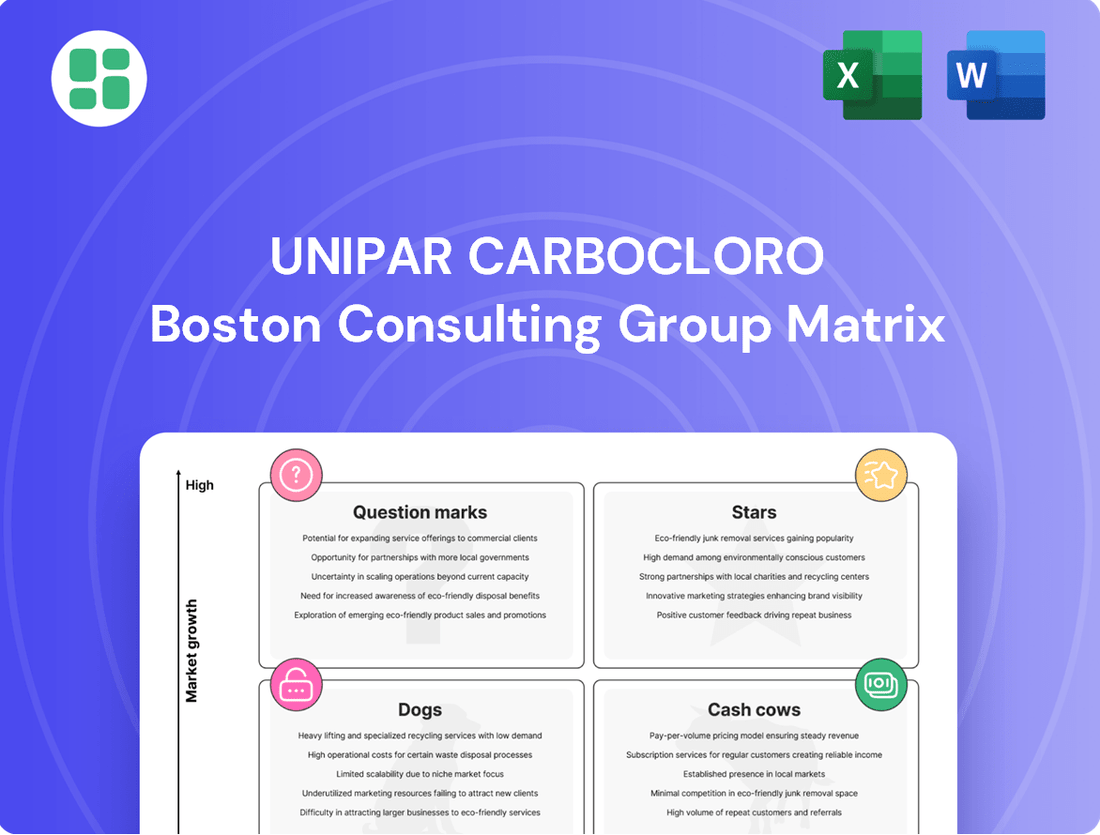

Unipar Carbocloro's BCG Matrix offers a critical snapshot of its product portfolio, highlighting potential growth areas and areas needing strategic attention. Understanding whether its offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making.

Dive deeper into Unipar Carbocloro's strategic positioning by purchasing the full BCG Matrix. Gain a clear, actionable view of where its products stand and unlock the insights needed for smarter investment and resource allocation.

Stars

Unipar's strategic investment in new electrolyzers at its Santo André plant is a clear indicator of its push into the high-growth green hydrogen market. This move is designed to meet the escalating demand for sustainable industrial inputs.

By producing green hydrogen, Unipar is positioning itself as a leader in eco-friendly chemical manufacturing. This initiative directly supports the company's commitment to integrating sustainable practices throughout its value chain.

The green hydrogen produced will be used to manufacture hydrochloric acid, a key component in Unipar's existing operations. This integration enhances the sustainability of its core business, demonstrating a practical application of its green hydrogen strategy.

Unipar's Advanced Sanitation Solutions are positioned as a Stars within the BCG Matrix due to Brazil's expanding focus on universal basic sanitation. This translates into a high-growth market for Unipar as a key supplier of water and sewage treatment chemicals.

The company's proactive engagement through social projects and partnerships, like the one in Jardim Planteucal, directly addresses a significant societal need. This strategic alignment is expected to bolster Unipar's market share in this vital sector. For instance, as of early 2024, Brazil's National Sanitation Information System (SNIS) reported that over 35 million people still lacked access to basic sewage collection, highlighting the substantial room for growth.

Unipar Carbocloro's expansion into Northeast Brazil, specifically with its new plant in Camaçari, Bahia, signifies a major strategic shift. This greenfield project is Unipar's first outside of São Paulo, targeting the burgeoning demand in the Northeast.

This move into a new geography is crucial for Unipar's growth trajectory. The Northeast region presents a high-growth market, particularly for chemicals supporting the vital agribusiness sector.

Energy Self-Sufficiency and Renewable Energy Projects

Unipar Carbocloro's commitment to energy self-sufficiency is a cornerstone of its sustainability strategy. The company is making significant investments in renewable energy sources, including joint ventures focused on wind and solar farms.

The goal is ambitious: to power all of Unipar's Brazilian factories entirely with renewable energy by the year 2025. This initiative is projected to dramatically cut operational expenses and lower the company's carbon footprint.

This strategic pivot not only enhances Unipar's environmental credentials but also positions it favorably in the market. By embracing green manufacturing, Unipar appeals to a growing segment of clients prioritizing sustainability in their supply chains, especially in the burgeoning market for eco-friendly products.

Key aspects of Unipar's renewable energy push include:

- Target: Achieve 100% renewable energy consumption in Brazilian operations by 2025.

- Investments: Joint ventures in wind and solar energy projects.

- Benefits: Reduced operational costs and significant CO2 emission reduction.

- Market Position: Enhanced appeal to environmentally conscious customers.

Innovation in Chlorine/Caustic Derivatives for Emerging Applications

While Unipar's established chlorine and caustic soda segments are mature, the company is actively pursuing innovation in derivatives for emerging applications. This strategic focus on new business ventures within basic chemistry and petrochemicals signals a pathway to high-growth potential.

By identifying and investing in specialized uses for chlorine, caustic soda, or PVC that cater to evolving industrial needs or technological breakthroughs, Unipar can cultivate these into future stars. For instance, advancements in water treatment technologies or the development of specialized polymers could create significant new markets for these foundational chemicals.

- Focus on niche applications: Exploring specialized uses for chlorine and caustic soda in sectors like advanced materials, pharmaceuticals, or electronics.

- PVC innovation: Developing new PVC formulations with enhanced properties for industries such as renewable energy infrastructure or advanced medical devices.

- Market analysis: Conducting thorough research to pinpoint emerging demands where Unipar's core competencies can be leveraged for derivative growth.

Unipar's Advanced Sanitation Solutions are a clear Star. Brazil's ongoing need for improved sanitation, with over 35 million people lacking basic sewage collection as of early 2024 according to SNIS, creates a high-growth market. Unipar's role as a key supplier of water and sewage treatment chemicals positions it to capture significant market share.

The company's strategic expansion into Northeast Brazil with its Camaçari plant is also a Star. This move targets the high-growth demand, particularly from the agribusiness sector, in a region where Unipar previously had no presence. This geographic diversification is a key growth driver.

Unipar's commitment to 100% renewable energy for its Brazilian operations by 2025 is another Star initiative. These investments in wind and solar power are projected to reduce operational costs and carbon emissions, enhancing its appeal to environmentally conscious customers.

Unipar's focus on developing specialized derivatives from its core chlorine and caustic soda products also falls into the Star category. By innovating in niche applications for sectors like advanced materials or pharmaceuticals, Unipar is creating new high-growth avenues for its established chemical base.

| Business Segment | BCG Category | Growth Driver | Key Data Point |

|---|---|---|---|

| Advanced Sanitation Solutions | Star | Expanding sanitation needs in Brazil | 35M+ people lacked basic sewage collection (early 2024) |

| Northeast Brazil Expansion (Camaçari) | Star | High demand in agribusiness and new geographic markets | First greenfield project outside São Paulo |

| 100% Renewable Energy by 2025 | Star | Cost reduction, carbon footprint, customer appeal | Target for all Brazilian operations |

| Chlorine/Caustic Soda Derivatives | Star | Niche applications in advanced materials, pharma | Focus on emerging industrial needs |

What is included in the product

This BCG Matrix overview for Unipar Carbocloro analyzes its product portfolio, identifying strategic growth opportunities and potential divestments.

Clear visualization of Unipar Carbocloro's portfolio, easing strategic decision-making.

Simplified understanding of business unit performance, reducing analytical burden.

Cash Cows

Unipar Carbocloro's core chlorine production stands as a robust Cash Cow within its portfolio. As a leading producer in South America, Unipar supplies a vital chemical used in everything from water purification to the creation of PVC, a fundamental material for numerous sectors.

The chlorine market, while mature, benefits from consistent and essential demand, which Unipar expertly leverages. In 2023, Unipar reported significant revenue generation from its chlorochemicals segment, underscoring the stable and high cash flow this business unit consistently provides, a hallmark of a Cash Cow.

Unipar's core caustic soda production stands as a prime example of a Cash Cow within its business portfolio. Its widespread application across vital sectors such as pulp and paper, alumina, and textiles ensures a consistently robust demand.

The inherent stability of the caustic soda market, driven by its essential nature, allows Unipar to generate substantial cash flow. This stability means that significant investment in marketing or expansion is often unnecessary, freeing up resources.

In 2024, Unipar continued to solidify its position as a key player in the Latin American caustic soda market. The company's operational efficiency and established market share in Brazil and Argentina contribute to its strong cash generation capabilities, reflecting the mature and steady nature of this business segment.

Unipar stands as the second-largest producer of PVC in South America, a vital material for both the construction and plastics industries. This strong market presence, coupled with a loyal customer base, ensures a consistent and dependable stream of revenue and cash flow for the company.

Despite the inherent cyclicality of the PVC market, Unipar's established position allows it to generate substantial profits. In 2024, Unipar's PVC segment demonstrated resilience, contributing significantly to its overall financial performance, with sales volumes remaining robust in key South American markets.

Established Industrial Plants in Brazil and Argentina

Unipar Carbocloro's established industrial plants in Brazil and Argentina are prime examples of Cash Cows. These facilities have a long history of efficient operation, converting raw materials like salt and energy into vital chemicals such as caustic soda and PVC. Their optimized processes and high capacity utilization, often exceeding 80% for key products, ensure consistent profitability in mature, stable markets.

These plants benefit from economies of scale and established market positions, contributing significantly to Unipar Carbocloro's overall financial health. For instance, in 2024, the Brazilian operations continued to be a major revenue driver, supported by strong domestic demand for chemicals in the construction and manufacturing sectors.

- Operational Efficiency: Plants boast optimized production lines and high capacity utilization rates, often above 80% for core products.

- Market Stability: They operate in mature markets with consistent demand for essential chemicals like caustic soda and PVC.

- Profitability: These established assets generate steady cash flows, contributing significantly to the company's financial stability.

- Contribution to Revenue: Brazilian operations, in particular, remain a substantial revenue contributor in 2024, driven by domestic industrial demand.

Modernization of Cubatão Plant

Unipar Carbocloro's Cubatão plant modernization, a significant investment in membrane technology, positions it as a prime cash cow. This initiative, the largest of its kind in South America, not only boosts operational efficiency but also actively reduces CO2 emissions.

The substantial capital expenditure on upgrading the Cubatão facility ensures its ongoing competitiveness and profitability. By optimizing this key production asset, Unipar Carbocloro reinforces its cash cow status through enhanced operational performance and sustainability.

- Investment in Membrane Technology: The Cubatão plant modernization represents a major capital outlay, positioning it as a leading facility in South America.

- Efficiency Gains: The adoption of membrane technology is projected to yield significant improvements in operational efficiency, reducing costs and increasing output.

- Environmental Benefits: A key outcome of the modernization is the substantial reduction in CO2 emissions, aligning with global sustainability goals.

- Sustained Profitability: This strategic investment secures the Cubatão plant's role as a consistent profit generator, vital for Unipar Carbocloro's portfolio.

Unipar Carbocloro's established chlor-alkali and PVC operations in Brazil and Argentina are clear Cash Cows. These mature businesses benefit from consistent demand in essential industries like water treatment, construction, and manufacturing, ensuring stable revenue streams. In 2024, Unipar's chlor-alkali segment alone continued to be a significant contributor to the company's robust financial performance, demonstrating the reliable cash generation typical of this business model.

The company's strategic investments, such as the modernization of the Cubatão plant with advanced membrane technology, further solidify these Cash Cow positions. This upgrade enhances operational efficiency and reduces environmental impact, ensuring long-term profitability and competitiveness in stable markets. For instance, the Cubatão facility's enhanced capacity and efficiency in 2024 directly translated into sustained high-margin output.

These operations excel due to high capacity utilization, often exceeding 80%, and optimized production processes, which are hallmarks of successful Cash Cows. The mature nature of the markets they serve means that while growth may be modest, the cash flow generated is substantial and predictable, supporting Unipar Carbocloro's overall financial stability and allowing for reinvestment in other areas of the business.

| Business Segment | Market Position | Cash Flow Generation | 2024 Performance Highlight |

|---|---|---|---|

| Chlor-Alkali (Caustic Soda & Chlorine) | Leading South American producer | High and stable | Significant revenue contributor, stable demand |

| PVC | Second-largest South American producer | Consistent and dependable | Resilient sales volumes, robust financial contribution |

| Cubatão Plant (Modernized) | State-of-the-art facility | Enhanced and sustained | Improved efficiency and reduced emissions driving profitability |

Delivered as Shown

Unipar Carbocloro BCG Matrix

The Unipar Carbocloro BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready BCG Matrix report for your strategic planning needs. You can confidently use this preview to assess the quality and comprehensiveness of the data and presentation, knowing the purchased version will be identical and immediately available for your business use. This ensures you get a professional and actionable tool without any hidden modifications or additional steps.

Dogs

Underperforming niche products within Unipar Carbocloro's portfolio, characterized by a low market share in stagnant or declining sub-markets, would fall into the Dogs category of the BCG Matrix. These items often drain resources without offering substantial returns or strategic advantages. For instance, if a specific specialty chemical, representing a small fraction of Unipar's overall sales, faces declining demand due to technological obsolescence or increased competition, it would exemplify a Dog.

Older, less efficient production lines, particularly those relying on outdated mercury or diaphragm cell technologies, would fall into the Dogs category of the BCG Matrix for Unipar Carbocloro. These methods are increasingly being phased out globally due to stringent environmental regulations, such as those stemming from the Minamata Convention on Mercury. In 2024, the ongoing transition away from these older technologies continued, with companies facing increased costs associated with compliance and potential liabilities.

If Unipar Carbocloro has product lines heavily dependent on industries in long-term decline within South America, these segments would likely be classified as Dogs in the BCG matrix. For example, if a significant portion of their chlor-alkali or PVC sales are directed towards sectors like traditional manufacturing that are shrinking due to automation or shifts in consumer demand, this creates a precarious situation. In 2024, the economic landscape in some South American nations still shows vulnerabilities in traditional industrial sectors, potentially impacting demand for basic chemicals.

Non-Core Assets with Low Strategic Value

Non-core assets with low strategic value represent business units or acquisitions that haven't aligned well with Unipar Carbocloro's primary operations or have struggled to capture significant market share. These might be smaller segments operating in mature or declining industries, offering limited growth potential and not contributing substantially to the company's overall competitive advantage. For instance, if Unipar acquired a niche chemical producer in 2023 that specialized in a low-demand application and showed only a 2% year-over-year revenue increase, this would likely fall into this category.

Such assets typically require significant resources for maintenance or turnaround without a clear path to substantial returns. Divesting these underperforming units allows Unipar to reallocate capital and management attention towards its core businesses, such as chlor-alkali products, which are central to its strategy and market position. In 2024, Unipar reported that its chlor-alkali segment represented approximately 70% of its net revenue, highlighting the importance of focusing on these core areas.

- Low Market Traction: Acquired units failing to achieve substantial market penetration or integrate smoothly into Unipar's existing value chain.

- Low-Growth Environments: Operations situated in industries characterized by minimal expansion or even contraction, limiting future profitability.

- Divestment Rationale: Candidates for sale to improve operational efficiency, reduce complexity, and concentrate resources on high-potential core businesses.

- Strategic Focus: Streamlining the portfolio to enhance Unipar's competitive strength in its key chlor-alkali and PVC markets.

Products with High Logistics Costs and Limited Regional Demand

Products with high logistics costs and limited regional demand, often found in the Dogs quadrant of the BCG Matrix, represent a significant challenge for companies like Unipar Carbocloro. These items typically have specialized handling requirements, such as those for corrosive chemicals, driving up transportation expenses. For instance, certain specialty chlorine derivatives might fall into this category, where the cost of secure, temperature-controlled shipping can easily exceed 20% of the product's value.

The combination of these elevated distribution costs and a narrow customer base, often confined to specific industrial zones with minimal growth prospects, severely impacts profitability. In 2024, for example, a product line with a 5% market share in a niche regional market might see its net profit margin shrink to near zero once freight and specialized packaging are factored in. This makes continued investment or even maintenance of such product lines financially unviable.

- High Logistics Costs: Products requiring specialized, often refrigerated or hazardous material transport, can see logistics expenses represent a substantial portion of their final sale price.

- Limited Regional Demand: These products serve a small, geographically concentrated customer base, often with stagnant or declining industrial activity.

- Eroded Profit Margins: The interplay of high shipping costs and low sales volume makes it difficult to achieve profitability, often leaving margins in the low single digits or even negative territory.

- Example Scenario: A specialty chemical with a market value of $1,000 per ton might incur $300 in specialized transport costs, making it uncompetitive in broader markets and a burden in its limited regional sphere.

Dogs within Unipar Carbocloro's portfolio represent products or business units with low market share in slow-growing or declining industries. These segments often consume resources without generating significant returns, necessitating careful management or divestment. For example, a legacy chemical product line facing obsolescence due to new technologies would be a prime candidate for the Dogs category.

Older production facilities, particularly those not meeting current environmental standards like those related to mercury cell technology, also fall into the Dogs quadrant. The increasing global focus on sustainability and stricter regulations, such as those from the Minamata Convention, make these assets costly to maintain and operate. In 2024, Unipar continued its strategic shift away from older, less efficient technologies.

Products with high logistical costs and limited regional demand also exemplify Dogs. The expense of transporting specialized chemicals, coupled with a shrinking customer base, can erode profit margins to the point of being unsustainable. In 2024, Unipar's strategic focus remained on optimizing its core chlor-alkali and PVC operations, which represent the majority of its revenue.

| Category | Description | Unipar Carbocloro Example | 2024 Relevance |

| Dogs | Low market share, low growth | Outdated chemical lines, non-core assets | Continued divestment of non-strategic units, focus on core business efficiency. |

| High resource consumption, low ROI | Legacy production technologies | Ongoing transition from mercury cell technology, compliance costs. | |

| Limited strategic value | Niche products with high logistics costs | Portfolio streamlining to enhance core market competitiveness. |

Question Marks

While green hydrogen currently finds application in HCl production, Unipar could explore more complex hydrogen derivatives. These represent potential high-growth markets, but Unipar's current market share is minimal, necessitating substantial investment in research and development.

Developing these advanced applications, such as hydrogen fuel cells or specialized chemical synthesis, requires significant capital outlay and a long-term strategic vision. For instance, the global hydrogen fuel cell market was valued at approximately USD 2.5 billion in 2023 and is projected to reach USD 15 billion by 2030, indicating substantial growth potential but also the need for pioneering efforts.

Unipar Carbocloro could explore pioneering PVC applications in nascent, high-growth sectors beyond conventional construction. Think about specialized medical equipment, like advanced tubing for dialysis machines, or components for cutting-edge renewable energy infrastructure, such as specialized coatings for offshore wind turbines. These emerging markets promise significant expansion, though they will necessitate considerable upfront capital to establish a foothold and gain market share.

Unipar's strategic vision includes expanding beyond its core markets of Brazil and Argentina. This move into other Latin American countries, particularly those exhibiting high growth potential, represents a significant opportunity for market share acquisition where the company currently has minimal or no presence.

However, this expansion necessitates substantial capital investment and a carefully crafted strategy to establish brand recognition and effectively compete against entrenched local and international players. For instance, in 2024, Unipar continued to assess opportunities for international growth, with a focus on regions demonstrating robust industrial demand for its chemical products.

Advanced Materials or Specialty Chemicals

Unipar's strategic vision extends to pioneering new ventures in basic and petrochemical chemistry, with advanced materials and specialty chemicals identified as key growth areas. These segments, while offering significant potential, currently represent a nascent market share for Unipar, necessitating considerable capital allocation to establish a foothold and demonstrate commercial viability.

These initiatives are positioned within high-growth markets, aligning with Unipar's ambition to diversify its portfolio. However, the early stage of these ventures means they require substantial investment to overcome market entry barriers and achieve competitive scale.

- High-Growth Potential: Advanced materials and specialty chemicals are experiencing robust global demand, driven by innovation in sectors like electronics, automotive, and healthcare.

- Low Current Market Share: Unipar's presence in these segments is minimal, indicating significant room for expansion but also the challenge of building brand recognition and customer relationships.

- Significant Investment Required: Developing new product lines, establishing manufacturing capabilities, and conducting extensive research and development will demand substantial financial commitment.

- Strategic Diversification: These ventures represent a move towards higher-value, differentiated products, aiming to reduce reliance on commodity chemicals and improve overall profitability.

Digitalization and Smart Chemical Solutions

Investing in digitalization, IoT, and AI for chemical production optimization represents a significant opportunity for Unipar Carbocloro, positioning it within the Question Mark quadrant of the BCG Matrix. These technologies offer the potential for substantial efficiency gains and cost reductions. For instance, AI-powered predictive maintenance can minimize downtime, a critical factor in chemical manufacturing where unplanned outages can be extremely costly. Companies are increasingly adopting these technologies; a 2024 report indicated that over 60% of chemical manufacturers are investing in digital transformation initiatives, with a focus on AI and IoT to improve operational performance.

Smart chemical delivery systems also fall under this strategic consideration. By leveraging IoT for real-time tracking and inventory management, Unipar can enhance supply chain reliability and customer service. This not only improves operational efficiency but also opens avenues for new service-based revenue streams. The global smart logistics market, which includes chemical delivery, is projected to reach over $50 billion by 2027, highlighting the substantial growth potential.

- High Growth Potential: Digitalization and smart solutions are rapidly evolving technological areas with significant market expansion anticipated.

- Low Current Penetration: Unipar's current adoption of these advanced technologies may be relatively low, indicating an opportunity to gain early market share.

- Investment Requirement: Significant investment in research and development, as well as robust adoption strategies, will be necessary to capitalize on these opportunities.

- Market Leadership: Successful implementation could establish Unipar as a leader in technologically advanced chemical solutions and production optimization.

Unipar Carbocloro's ventures into advanced materials, specialty chemicals, and digitalization of its operations represent significant Question Marks. These areas offer high growth potential, driven by technological advancements and evolving market demands in sectors like healthcare and renewable energy.

However, Unipar currently holds a minimal market share in these segments, indicating the substantial challenge of building brand recognition and customer bases against established competitors. For instance, the global specialty chemicals market, projected to grow significantly, requires considerable upfront investment for research, development, and market penetration.

The company must allocate significant capital to these ventures to overcome entry barriers, establish manufacturing capabilities, and achieve competitive scale. Successful execution could position Unipar as an innovator, but the inherent risks of new market development necessitate careful strategic planning and execution.

| Strategic Area | Market Growth Potential | Unipar's Current Market Share | Investment Needs | Key Challenges |

|---|---|---|---|---|

| Advanced Materials & Specialty Chemicals | High (driven by electronics, healthcare, renewables) | Minimal | Substantial (R&D, manufacturing) | Brand recognition, competition |

| Digitalization (IoT, AI in Production) | High (efficiency gains, cost reduction) | Low to Moderate | Significant (technology adoption, integration) | Implementation complexity, talent acquisition |

BCG Matrix Data Sources

Our Unipar Carbocloro BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market research, and official industry reports to provide strategic clarity.