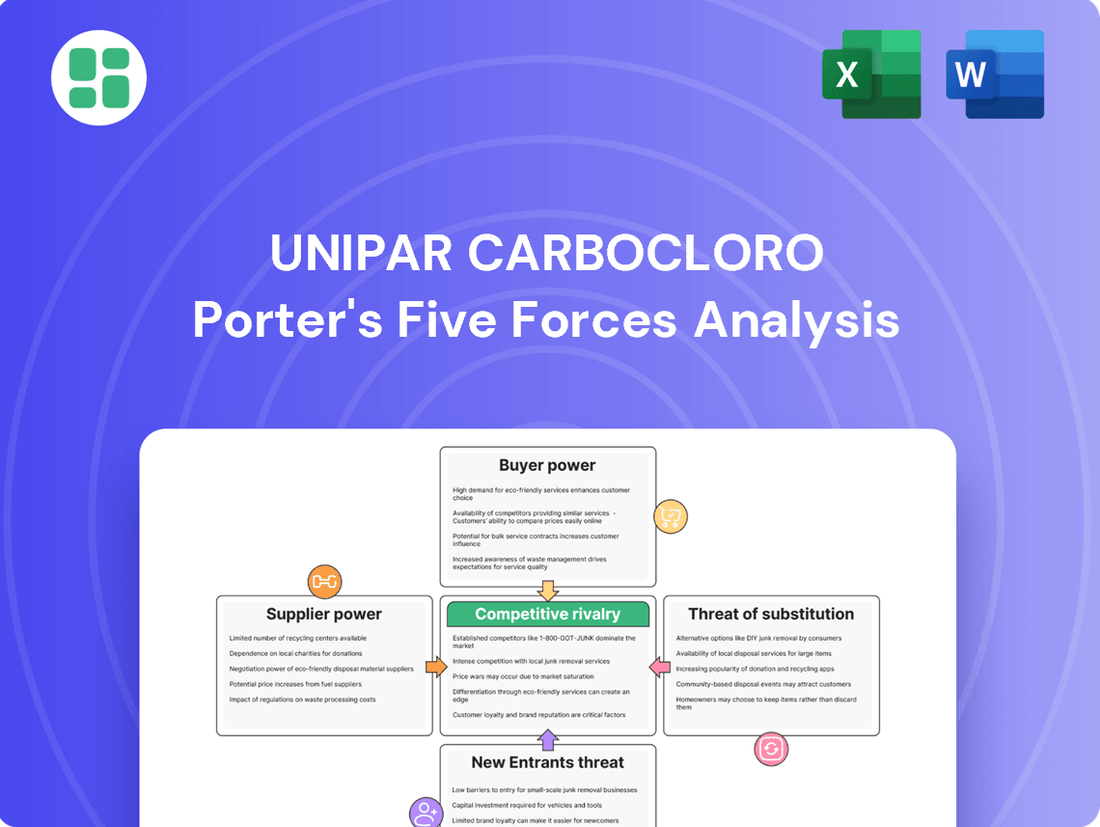

Unipar Carbocloro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Unipar Carbocloro Bundle

Unipar Carbocloro faces moderate rivalry, with established players and potential for differentiation impacting profitability. The threat of substitutes is a key consideration, as alternative materials could erode market share.

The complete report reveals the real forces shaping Unipar Carbocloro’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Unipar's reliance on key raw materials like salt, electricity, and ethylene means the bargaining power of these suppliers is a significant factor. The concentration of providers for these essential inputs directly influences their ability to dictate terms.

Unipar mitigates this supplier power through strategic, long-term contracts for its primary inputs. Furthermore, the company's investment in self-production of renewable energy, specifically wind and solar, and its ownership of a salt operation in Argentina, significantly reduces its dependence on external suppliers for these critical components.

The availability of substitutes for essential inputs significantly impacts supplier bargaining power. When few alternatives exist for critical raw materials like salt, electricity, and ethylene, suppliers can exert greater influence over pricing and terms. This is particularly relevant for Unipar Carbocloro, where these inputs are fundamental to its production processes.

However, Unipar has strategically mitigated this risk. By generating 51% of its electricity from renewable sources like wind and solar in the second quarter of 2024, the company has reduced its dependence on external electricity providers. Furthermore, Unipar's ownership of its salt operations directly addresses the availability and cost of another key input, thereby diminishing the bargaining power of external suppliers for these crucial resources.

For Unipar, a major player in the chemical industry, the bargaining power of suppliers is significantly influenced by switching costs. In large-scale chemical production, changing suppliers isn't a simple task. It often involves substantial investments in re-tooling manufacturing equipment to accommodate new raw materials or processes, along with the time and expense of negotiating entirely new supply contracts.

These considerable switching costs effectively bolster the leverage of Unipar's current suppliers. If Unipar were to seek out a new provider, the expense and disruption associated with adapting its operations could outweigh any potential short-term benefits, making it economically challenging to pivot away from established relationships.

Unipar's Backward Integration

Unipar's strategic backward integration significantly curtails the bargaining power of its suppliers. By operating its own salt mine in Argentina, Unipar secures a vital raw material, lessening reliance on external salt providers. This move directly counters potential price hikes or supply disruptions from third-party salt producers.

Furthermore, Unipar's proactive approach to energy sourcing, including long-term contracts and self-production of wind and solar energy, insulates it from the volatility of energy markets. This reduces dependence on traditional energy suppliers, thereby diminishing their leverage.

- Salt Supply: Unipar's internal salt production in Argentina directly mitigates the bargaining power of external salt suppliers.

- Energy Security: Long-term energy contracts and investments in renewable energy (wind and solar) reduce Unipar's vulnerability to energy supplier price increases and supply constraints.

- Reduced Dependency: This integration strategy lowers Unipar's overall dependence on key input suppliers, strengthening its negotiating position.

Importance of Unipar to Suppliers

Unipar's substantial market presence in South America, particularly in the chlor-alkali and PVC sectors, significantly influences its supplier relationships. As a major buyer, Unipar's demand volume can make it a crucial customer for many of its raw material providers.

If Unipar accounts for a large percentage of a supplier's total sales, that supplier will likely be more accommodating to Unipar's terms. This is because losing Unipar's business could have a substantial negative impact on the supplier's revenue and profitability. For instance, if Unipar represents 15% or more of a key chemical feedstock supplier's revenue, the supplier's bargaining power is considerably diminished.

Conversely, if Unipar is a minor client for a supplier, the supplier has less incentive to concede to Unipar's demands. They can afford to lose Unipar's business without jeopardizing their overall financial health. However, given Unipar's scale as a leading producer in South America, it is highly probable that Unipar holds a considerable position with its key suppliers, thereby reducing their individual bargaining power.

- Reduced Supplier Leverage: Unipar's significant purchasing volume likely makes it a key client for many suppliers, limiting their ability to dictate terms.

- Revenue Dependence: Suppliers who rely heavily on Unipar for a substantial portion of their revenue are incentivized to maintain a positive relationship and offer favorable terms.

- Market Position Impact: Unipar's status as a leading player in the South American chlor-alkali and PVC markets enhances its negotiating strength with raw material providers.

Unipar's strategic backward integration, including its own salt production in Argentina and significant investment in renewable energy sources like wind and solar, directly counters the bargaining power of its key suppliers for salt and electricity. By generating 51% of its electricity from renewables in Q2 2024, Unipar has substantially reduced its reliance on external energy providers, thereby limiting their ability to dictate terms.

The company's substantial market share in South America's chlor-alkali and PVC sectors means Unipar is often a critical customer for its raw material suppliers. This strong purchasing position, where Unipar can represent a significant portion of a supplier's revenue, inherently weakens the supplier's leverage and bargaining power.

Switching costs for Unipar's essential inputs are high, involving significant investment in re-tooling and new contract negotiations, which generally favors existing suppliers. However, Unipar's proactive diversification of energy sources and internal salt production effectively mitigates the impact of these high switching costs and strengthens its negotiating stance.

| Input | Unipar's Mitigation Strategy | Impact on Supplier Bargaining Power |

|---|---|---|

| Salt | Internal production in Argentina | Significantly Reduced |

| Electricity | 51% renewable generation (Q2 2024), long-term contracts | Substantially Reduced |

| Ethylene | Large buyer volume, potential long-term contracts | Moderate to Reduced |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Unipar Carbocloro's position in the chlor-alkali industry.

Uncover the precise impact of each Porter's Five Forces on Unipar Carbocloro, enabling targeted strategies to mitigate competitive pressures.

Customers Bargaining Power

Unipar Carbocloro's customer base is remarkably diverse, serving approximately 30 distinct industries. This broad reach significantly dilutes the bargaining power of any single customer segment.

Key sectors like pulp and paper, metallurgy, and petrochemicals account for a substantial 25% of Unipar's sales. Another 23% comes from civil construction and laminates, while the sanitation, cleaning, and hospital products sectors contribute 15%.

This wide distribution of sales across various industries means that no single customer group holds enough sway to unilaterally impose unfavorable terms on Unipar Carbocloro, thereby limiting customer bargaining power.

For industries heavily reliant on chlorine, caustic soda, and PVC, like the vinyl flooring or water treatment sectors, switching suppliers isn't a simple matter of changing an order. These transitions often necessitate significant technical adjustments to existing equipment and rigorous re-qualification processes for new materials, potentially causing costly production disruptions. For instance, a change in caustic soda purity could impact a chemical manufacturer's reaction yields, requiring extensive testing and process recalibration.

These inherent switching costs effectively anchor customers to their current suppliers, limiting their leverage to negotiate lower prices or more favorable terms. This stability in customer relationships significantly strengthens Unipar Carbocloro's bargaining power. In 2023, the global PVC market, a key area for Unipar, was valued at approximately $75 billion, highlighting the substantial economic implications of customer retention in this sector.

Customers' sensitivity to price is a significant factor in Unipar Carbocloro's market. When Unipar's products represent a large portion of a customer's overall costs, they are naturally more inclined to seek lower prices. This is particularly true in industries with intense competition, where even small price variations can impact profitability.

For example, a downturn in the construction sector, a key market for PVC, directly affects demand and puts downward pressure on prices. In 2023, the global construction industry experienced mixed performance, with some regions seeing growth while others faced challenges, directly influencing the bargaining power of customers in the PVC market.

Threat of Customer Backward Integration

The threat of customer backward integration for Unipar Carbocloro, while theoretically present, is significantly mitigated by the substantial barriers to entry in chemical production. For instance, establishing a chlorine and caustic soda plant requires billions of dollars in capital investment and highly specialized operational knowledge. This makes it an impractical option for most customers, even large industrial consumers.

While a large customer might consider producing their own chlorine, caustic soda, or PVC, the immense capital expenditure and the need for sophisticated technical expertise present formidable challenges. These hurdles effectively limit the likelihood of widespread backward integration by Unipar Carbocloro's customer base.

- High Capital Investment: Building a chlor-alkali facility can cost upwards of $500 million to $1 billion, making it prohibitive for most buyers.

- Technical Expertise Required: Operating such plants demands specialized knowledge in chemical engineering, safety protocols, and environmental compliance.

- Economies of Scale: Unipar Carbocloro benefits from economies of scale in production, which smaller, integrated operations would struggle to match.

- Regulatory Hurdles: Chemical manufacturing is subject to stringent environmental and safety regulations, adding complexity and cost to new entrants.

Availability of Customer Alternatives

The availability of alternatives significantly influences customer bargaining power for Unipar Carbocloro. Customers can source chlorine, caustic soda, and PVC from numerous regional and international producers, meaning they aren't solely reliant on Unipar.

This competitive landscape is amplified by the influx of foreign products, a trend observed in markets like Brazil's chemical sector. For instance, in 2024, the Brazilian chemical industry experienced increased competition from imported goods, putting downward pressure on prices and enhancing buyer leverage.

- Customers can choose from various domestic and international suppliers of essential chemicals.

- Competitive pricing strategies from alternative producers directly impact Unipar's pricing power.

- Global market dynamics, including import levels, can shift bargaining power towards customers.

Unipar Carbocloro's diverse customer base across approximately 30 industries significantly limits the bargaining power of any single customer segment. While key sectors like pulp and paper, metallurgy, and petrochemicals represent a substantial portion of sales, the broad distribution prevents any one group from dictating terms. Switching suppliers for essential chemicals like chlorine, caustic soda, and PVC involves considerable technical and financial hurdles, including equipment adjustments and re-qualification processes, which effectively anchors customers and reduces their leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Context |

|---|---|---|

| Customer Diversification | Lowers individual customer power | Serves ~30 industries; no single segment dominates sales. |

| Switching Costs | Lowers customer power | Technical adjustments, re-qualification processes; costly disruptions. |

| Price Sensitivity | Can increase customer power | High when Unipar's products are a large cost component; intense competition amplifies this. |

| Backward Integration Threat | Very Low | Billions in capital investment and specialized expertise required for chemical plant setup. |

| Availability of Alternatives | Can increase customer power | Numerous regional/international suppliers; increased competition from imports (e.g., Brazil 2024). |

Full Version Awaits

Unipar Carbocloro Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Unipar Carbocloro, detailing the competitive landscape and key strategic factors. The document you see is the exact, professionally formatted report you'll receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Rivalry Among Competitors

Unipar operates in a market characterized by a limited number of significant players. As the largest chlorine and caustic soda producer in South America, Unipar faces a concentrated competitive landscape. For instance, in the PVC sector, Braskem stands as its primary competitor, holding the largest market share.

This concentration suggests that the actions of each major competitor can have a substantial impact on the overall market dynamics. The rivalry is therefore intense, as these few large firms vie for market dominance and share. This situation often leads to strategic maneuvering and price competition.

The South American chemical industry is navigating a complex landscape, marked by potential feedstock shortages and the competitive pressure of imports. This environment creates a degree of uncertainty regarding the overall industry growth rate.

While specific segments, such as chemicals for sanitation, are showing promising demand growth, the broader industry's expansion pace significantly shapes competitive intensity. A slower overall growth rate tends to amplify rivalry, as companies become more aggressive in their pursuit of market share.

The competitive rivalry in the chlorine, caustic soda, and PVC markets is intense, largely because these are commodity chemicals. Differentiation primarily hinges on factors beyond product features, such as cost-effectiveness, operational efficiency, and dependable supply chains. Unipar's strategic investment in membrane technology, for instance, offers a pathway to greener production, potentially attracting environmentally conscious customers.

Exit Barriers

The chemical industry, where Unipar Carbocloro operates, is inherently capital-intensive. Companies like Unipar must make substantial investments in specialized plants, sophisticated equipment, and extensive infrastructure. For instance, building a new chlor-alkali facility can easily run into hundreds of millions of dollars, representing a significant sunk cost.

These high upfront investments create formidable exit barriers. Once a company has committed such vast sums, leaving the market becomes economically unviable. This forces firms to continue operating and competing, even when market conditions are unfavorable, thereby intensifying competitive rivalry.

- Capital Intensity: The chemical sector requires massive investments in fixed assets, making divestment difficult.

- Sunk Costs: Significant expenditures on specialized plants and equipment are largely irrecoverable if a company exits.

- Sustained Rivalry: High exit barriers compel firms to remain in the market, leading to persistent competition.

Competitive Strategies and Capacity Expansion

Unipar's strategic investments, like the $200 million modernization of its Cubatao plant by the end of 2025, directly fuel competitive rivalry. This initiative aims to boost efficiency and environmental performance, setting a higher bar for competitors in the chlor-alkali sector.

Such substantial capacity expansions and technological upgrades by industry leaders like Unipar invariably intensify competition. This pressure compels other players to either match these advancements through their own innovation or find ways to significantly reduce their operating costs to remain competitive.

- Unipar's Cubatao Plant Modernization: A $200 million investment program targeting completion by the end of 2025.

- Goals of Investment: Enhance operational efficiency and minimize environmental impact.

- Industry Impact: Capacity expansions and technological upgrades by major players increase competitive pressure across the sector.

- Rival Response: Competitors are pressured to innovate or implement cost-reduction strategies to maintain market position.

Competitive rivalry within the South American chlor-alkali and PVC markets is fierce, driven by a concentrated industry structure with few dominant players like Unipar and Braskem. The commodity nature of these chemicals intensifies competition on cost, efficiency, and supply chain reliability, rather than product differentiation. Unipar's significant investments, such as the $200 million modernization of its Cubatao plant by the end of 2025, aim to bolster efficiency and environmental credentials, directly escalating competitive pressures across the sector and compelling rivals to innovate or cut costs.

| Competitor | Primary Products | Market Position (South America) | Key Competitive Factor |

|---|---|---|---|

| Unipar Carbocloro | Chlorine, Caustic Soda, PVC | Largest producer in South America | Operational efficiency, green production |

| Braskem | Petrochemicals, including PVC | Largest PVC producer in South America | Market share, integrated operations |

| Other Regional Players | Various chemicals | Varying market shares | Cost competitiveness, niche markets |

SSubstitutes Threaten

For Unipar Carbocloro's caustic soda, the threat of substitutes is moderate. While alternatives like potassium hydroxide, sodium citrate, borax, and enzymes are gaining traction in industrial cleaning due to their safer and eco-friendlier profiles, caustic soda remains a cost-effective and powerful alkali for many heavy-duty applications. The market for these alternatives is growing, but they often come with higher price points or different performance characteristics.

Regarding PVC, the threat of functional substitutes is generally low for Unipar Carbocloro's core markets. While materials like glass, metal, and wood can replace PVC in certain construction or packaging uses, PVC's unique combination of durability, cost-effectiveness, and energy efficiency, largely due to its high chlorine content, makes it difficult to substitute in many critical applications. For instance, PVC pipes are valued for their corrosion resistance and longevity, properties not easily replicated by all alternatives.

The threat of substitutes for Unipar Carbocloro's products like chlorine, caustic soda, and PVC hinges significantly on their price-performance ratio. For instance, in the cleaning sector, if alternative eco-friendly cleaning agents offer comparable efficacy at a lower overall cost, including reduced waste disposal fees, this directly impacts demand for chlorine-based disinfectants.

In 2024, the global PVC market experienced price fluctuations. While Unipar's PVC prices are influenced by raw material costs, the availability and cost of alternative plastics or building materials, such as engineered wood or aluminum, directly affect its competitiveness. If these substitutes become more economically attractive, the pressure on Unipar's PVC segment intensifies.

Customer willingness to switch from Unipar Carbocloro's products, like caustic soda, is largely dictated by how easy it is to make that change. If a new chemical or process offers a simpler integration, customers are more likely to consider it. For instance, growing environmental regulations, such as those impacting the production or use of traditional caustic soda, can significantly push industries towards greener alternatives, even if the initial switch requires some investment.

Industries with a strong focus on sustainability are particularly receptive to substitutes. Companies aiming to reduce their carbon footprint or comply with stricter environmental standards might actively seek out and adopt newer, more eco-friendly chemicals, even if they come at a slightly higher initial cost. This willingness to prioritize environmental benefits over immediate cost savings can be a key driver for substitute adoption.

Innovation in Substitute Technologies

Ongoing research and development into alternative chemicals, especially those offering better environmental performance or superior functionality, pose a growing threat of substitution. For instance, breakthroughs in bio-based degreasers and novel acid replacements could significantly impact the demand for traditional products like caustic soda.

The chemical industry is actively exploring greener and more efficient alternatives. Companies are investing heavily in R&D to develop products that meet evolving regulatory standards and consumer preferences. This innovation cycle means that established chemicals could face increasing pressure from newer, more sustainable options.

- Advancements in bio-based degreasers are creating viable alternatives to traditional caustic soda-based cleaning agents.

- Development of eco-friendly acid replacements offers potential substitutes for corrosive chemicals used in various industrial processes.

- Increased focus on sustainability in chemical manufacturing drives innovation towards materials with lower environmental footprints.

- Potential for improved performance in new chemical formulations could accelerate the adoption of substitutes, even in demanding applications.

Impact of Regulatory and Environmental Trends

Increasing environmental regulations and a global push for sustainable practices can accelerate the adoption of substitutes, especially for chemicals with known hazards like caustic soda. For instance, by 2024, many regions are expected to have stricter emission standards for chemical production, potentially increasing the cost of traditional caustic soda manufacturing.

Unipar's own investments in greener production technologies aim to mitigate this risk by making their core products more sustainable. The company has allocated significant capital towards modernizing its plants, with a notable portion of its 2024 capital expenditure focused on reducing its environmental footprint.

- Rising environmental standards: Global regulatory bodies are increasingly scrutinizing chemical production, favoring cleaner alternatives.

- Consumer demand for sustainability: End-users are actively seeking products manufactured with environmentally responsible processes, driving demand for greener chemicals.

- Unipar's strategic response: The company's investments in sustainable technologies are designed to preemptively address these evolving market demands and regulatory pressures.

The threat of substitutes for Unipar Carbocloro's products is a dynamic factor, influenced by technological advancements and evolving market preferences. For caustic soda, while it remains cost-effective for heavy-duty tasks, alternatives like potassium hydroxide are gaining traction due to their perceived safety and environmental benefits, though often at a higher price point. The PVC market, however, sees a lower threat from substitutes like glass or metal in its core applications, owing to PVC's unique blend of durability and cost-efficiency.

In 2024, the global chemical landscape continues to emphasize sustainability, pushing for greener alternatives across industries. This trend, coupled with stricter environmental regulations, directly impacts the demand for traditional chemicals like caustic soda. Unipar Carbocloro’s strategic investments in sustainable production technologies, representing a significant portion of their 2024 capital expenditure, aim to counter this by enhancing the eco-friendliness of their existing product lines and mitigating the pressure from emerging substitutes.

| Product | Threat of Substitutes (2024 Assessment) | Key Substitute Factors |

|---|---|---|

| Caustic Soda | Moderate | Cost-effectiveness vs. eco-friendliness of alternatives (e.g., potassium hydroxide), regulatory pressures, ease of integration for customers. |

| PVC | Low (in core markets) | Durability, cost-efficiency, energy efficiency of PVC vs. properties of glass, metal, wood; specific application requirements (e.g., pipe longevity). |

Entrants Threaten

The chemical industry, especially for foundational products like chlorine, caustic soda, and PVC, demands massive upfront investment in manufacturing facilities and essential infrastructure. This high capital intensity naturally discourages new players from entering the market.

For instance, Unipar's ongoing modernization initiative at its Cubatão plant is a clear demonstration of this. The company is allocating more than 1 billion Brazilian reais, roughly equivalent to €190 million, by the close of 2025. Such substantial financial commitments create a formidable barrier, making it exceptionally difficult for potential newcomers to compete.

The chemical industry, especially in regions like Brazil and Argentina where Unipar Carbocloro operates, is heavily regulated. New companies entering this space must navigate a complex web of environmental and safety standards. These regulations often translate into significant upfront investment and ongoing compliance costs, acting as a substantial barrier.

For instance, new entrants face high compliance costs and intricate permitting processes to operate legally. The chemical safety management landscape in South America is tightening, with new regulations requiring substance registration by 2025. This adds another layer of complexity and expense for any potential new competitor.

Established players like Unipar Carbocloro possess robust and extensive distribution networks, cultivated over years of operation and solidified through enduring relationships with a wide array of industrial clients throughout South America. This deep market penetration presents a significant barrier.

For any new competitor seeking to enter the chlor-alkali market, replicating Unipar's established distribution infrastructure would require substantial capital investment and considerable time, making it a challenging and potentially unviable undertaking.

In 2023, Unipar reported a consolidated net revenue of R$11.4 billion (approximately US$2.3 billion), underscoring the scale of its operations and the reach of its distribution capabilities, which are crucial for serving its diverse customer base.

Proprietary Technology and Expertise

Even though chlorine, caustic soda, and PVC are established products, their manufacturing relies on proprietary technologies and specialized know-how. This creates a barrier for new companies trying to enter the market, as developing efficient and cost-effective production methods requires significant investment and expertise. Unipar Carbocloro, for instance, has invested in state-of-the-art membrane technology for electrolysis, giving it a competitive edge in production efficiency.

New entrants face substantial hurdles in replicating the technological sophistication and operational efficiencies that established players like Unipar have cultivated. The capital expenditure required to acquire and implement advanced manufacturing processes, such as Unipar's membrane electrolysis technology, is considerable. This technological moat means that newcomers must either secure access to similar advanced systems or accept a significant cost disadvantage.

- Proprietary Process Know-How: Manufacturing efficiency in chlorine, caustic soda, and PVC is heavily dependent on proprietary process technologies and specialized expertise, making replication difficult for new entrants.

- Technological Investment: Companies like Unipar have invested in advanced technologies, such as state-of-the-art membrane electrolysis, which provide significant operational and cost advantages.

- Capital Intensity: The high capital costs associated with acquiring and implementing advanced manufacturing technologies act as a substantial deterrent to new market participants.

- Efficiency and Cost Advantages: Established firms leverage their technological and expertise base to achieve superior efficiency and lower production costs, creating a challenging environment for newcomers.

Brand Loyalty and Switching Costs for Customers

While Unipar Carbocloro's products, like caustic soda and chlorine derivatives, are often viewed as commodities, the company benefits from significant brand loyalty and customer switching costs. These aren't built on perceived product differences, but rather on the reliability of supply and the integration of Unipar's products into complex, long-established industrial processes. For instance, a major steel producer relying on Unipar's caustic soda for its pickling operations faces substantial disruption and cost if it were to switch suppliers, involving requalification of materials and potential process adjustments.

Unipar's expansive customer base, serving approximately 30 diverse industries, further insulates it from new entrants. This broad market penetration means that a new competitor would need to replicate Unipar's extensive distribution network and deep understanding of varied customer needs across sectors like pulp and paper, water treatment, and chemical manufacturing. In 2023, Unipar reported sales revenue of R$15.7 billion, underscoring its scale and the entrenched nature of its customer relationships, making it challenging for newcomers to gain a foothold.

- Established Supply Chains: Long-term contracts and integrated logistics create barriers to entry.

- Customer Integration: Unipar's products are often critical components in customer production processes.

- Diverse Industry Reach: Serving 30 industries reduces reliance on any single sector and builds broad market loyalty.

- Economies of Scale: Unipar's large production capacity allows for competitive pricing, a hurdle for smaller new entrants.

The threat of new entrants in the chlor-alkali sector, where Unipar Carbocloro operates, is significantly mitigated by substantial capital requirements for plant construction and technology acquisition. Established players benefit from economies of scale and proprietary know-how, creating a high barrier for newcomers. Furthermore, stringent environmental regulations and the need for extensive distribution networks add further complexity and cost for potential new competitors.

| Factor | Description | Impact on New Entrants |

| Capital Intensity | High upfront investment for manufacturing facilities and infrastructure. | Significant financial barrier, requiring billions in investment. |

| Technology & Know-How | Proprietary processes and specialized expertise in electrolysis. | New entrants need to invest heavily in advanced technology or face cost disadvantages. |

| Regulatory Environment | Complex environmental and safety standards, permitting processes. | Increased compliance costs and time-consuming approvals deter new market participants. |

| Distribution Networks | Established, extensive networks and long-term customer relationships. | Replicating Unipar's reach requires substantial time and capital investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Unipar Carbocloro is built upon a foundation of verified data, including Unipar's annual reports, industry-specific publications from chemical sector associations, and regulatory filings from relevant government bodies.

We leverage a blend of primary and secondary data, drawing from market research reports on the chlor-alkali industry, government economic databases, and Unipar's own investor disclosures to precisely assess competitive dynamics.