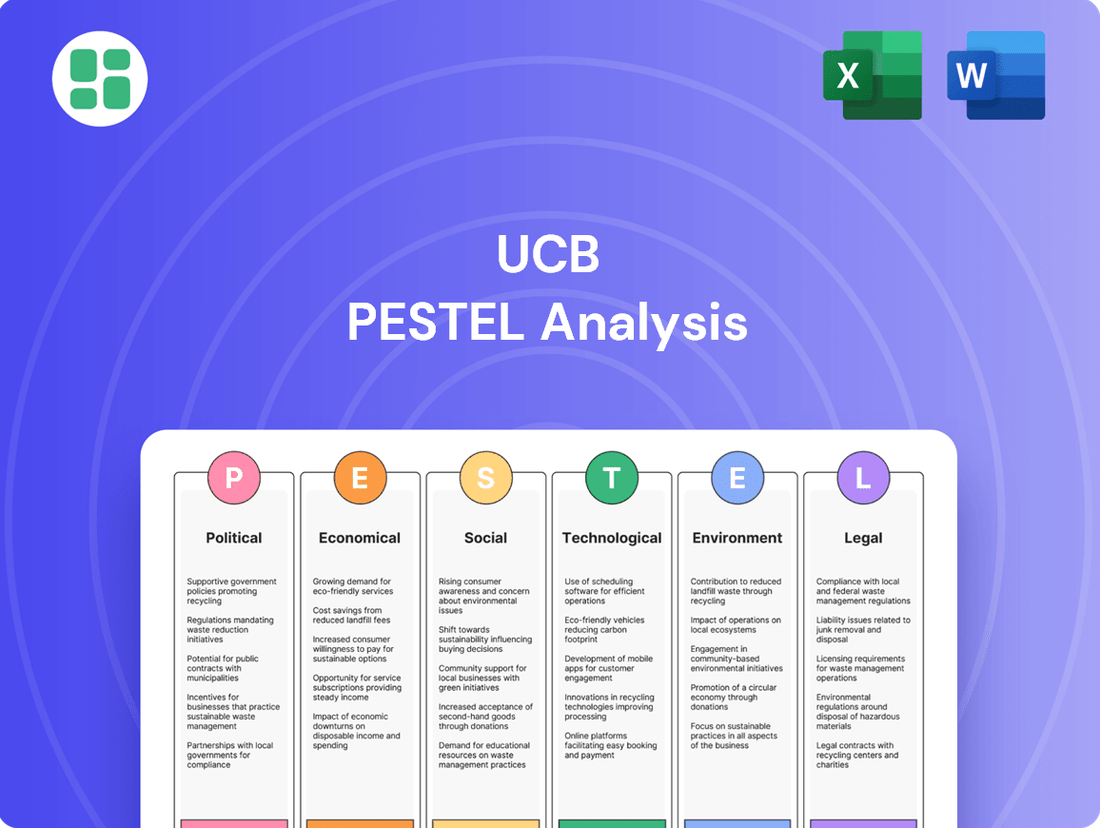

UCB PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UCB Bundle

Unlock the critical external factors shaping UCB's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis now for immediate insights.

Political factors

Government healthcare policies are a major driver for UCB, directly affecting how its innovative medicines are priced, reimbursed, and accessed by patients. For instance, shifts towards universal healthcare coverage in key markets can expand patient populations but may also introduce tighter budget controls on drug spending, impacting UCB's revenue. In 2023, many European countries continued to implement stringent health technology assessments (HTAs) to evaluate the cost-effectiveness of new therapies, a trend expected to persist through 2024 and 2025, influencing market access for UCB's neurological and immunological treatments.

Drug pricing and reimbursement regulations are a major political factor for UCB. Governments globally are scrutinizing drug costs, leading to measures aimed at controlling healthcare spending. For instance, the Inflation Reduction Act (IRA) in the U.S. and the upcoming Health Technology Assessment Regulation (HTAR) in the EU, effective from 2025, will significantly influence UCB's profitability and the market access for its new therapies.

These evolving policies, designed to balance innovation with affordability, compel companies like UCB to rigorously prove the clinical and economic value of their treatments. This means UCB must present compelling data to justify pricing and secure reimbursement, directly impacting its revenue streams and the commercial viability of its product pipeline.

Global political stability directly impacts UCB's extensive international operations, influencing everything from its supply chains to its market access and crucial R&D partnerships. Geopolitical tensions, such as trade disputes or the imposition of international sanctions, can significantly disrupt the flow of essential raw materials, manufacturing, and the distribution of its life-changing therapies, posing tangible risks to UCB's global footprint.

For instance, ongoing geopolitical shifts in key markets could affect UCB's ability to conduct clinical trials or secure regulatory approvals, impacting its product pipeline. The company must remain vigilant, actively monitoring these evolving risks to ensure uninterrupted business continuity and protect its strategic interests worldwide.

Intellectual Property Protection

UCB's reliance on patent protection for its innovative pharmaceuticals makes robust intellectual property (IP) enforcement by governments paramount. Weakening IP rights or shifts in patent litigation could significantly increase generic and biosimilar competition, directly impacting UCB's market exclusivity and financial performance. For instance, the European Union's Unified Patent Court (UPC), operational since June 2023, is already influencing how patent disputes are handled across member states, a critical consideration for UCB's global IP strategy.

The effectiveness of IP protection directly influences UCB's ability to recoup substantial R&D investments. In 2024, UCB continued to invest heavily in its pipeline, with R&D expenses totaling CHF 1,145 million for the first half of the year. This investment underscores the critical need for strong patent enforcement to ensure these innovations translate into sustained revenue streams.

- Patent Exclusivity: UCB's key products, like Skyrizi (risankizumab), have patent protection periods that are vital for their commercial success.

- Generic Competition: The expiry of patents, or challenges to their validity, can lead to rapid market share erosion by lower-cost generic alternatives.

- Unified Patent Court (UPC): The UPC offers a streamlined approach to patent litigation in participating European countries, potentially affecting the cost and speed of enforcing UCB's patents.

International Trade Agreements and Regulations

International trade agreements and regulations significantly shape UCB's operational landscape, particularly within the pharmaceutical and healthcare sectors. Harmonization efforts, such as those advanced by the European Medicines Agency (EMA) and Health Canada, aim to simplify and expedite market approvals for new therapies, potentially reducing time-to-market and associated costs. For instance, the EMA's centralized procedure allows for a single marketing authorization valid in all EU member states, a process UCB likely leverages.

Conversely, protectionist trade policies or shifts in regulatory alignment could erect substantial barriers, impacting UCB's ability to access key markets or increasing the cost of doing business. The ongoing evolution of trade relationships, including potential changes to existing agreements or the introduction of new tariffs, requires UCB to maintain agile global market strategies. By closely monitoring these developments, UCB can better navigate the complexities and capitalize on emerging opportunities in international trade.

- Harmonized Regulations: Efforts by the EMA and Health Canada to align regulatory standards can streamline UCB's drug approval processes across multiple jurisdictions.

- Trade Barriers: Protectionist policies or disputes could lead to increased tariffs or non-tariff barriers for UCB's pharmaceutical products, impacting pricing and market access.

- Market Access: UCB's global market strategies are directly influenced by the terms of international trade agreements, affecting its ability to launch and distribute its medicines worldwide.

- Regulatory Landscape: Staying abreast of evolving trade regulations and their impact on healthcare policy is crucial for UCB's long-term planning and investment decisions.

Government policies on drug pricing and reimbursement significantly impact UCB's revenue, with initiatives like the US Inflation Reduction Act and the EU's upcoming HTAR from 2025 directly influencing market access and profitability for its therapies.

Strong intellectual property (IP) protection is critical for UCB, given its substantial R&D investments, with the operationalization of the European Union's Unified Patent Court (UPC) since June 2023 altering patent litigation landscapes.

International trade agreements and regulatory harmonization, such as those facilitated by the EMA, are key for UCB's market access and time-to-market, though protectionist policies pose risks to its global operations.

Political stability influences UCB's supply chains and R&D partnerships, with geopolitical tensions potentially disrupting raw material flow and regulatory approvals for its treatments.

What is included in the product

This UCB PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the organization, offering a comprehensive view of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factor discussions.

Economic factors

Global economic growth is a significant driver for UCB, as a strong economy typically translates to increased healthcare spending. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, which can impact the pace of new drug adoption and reimbursement negotiations.

Economic downturns, however, can put a strain on healthcare budgets. If economies falter, governments and private insurers might reduce their spending on pharmaceuticals, potentially affecting UCB's revenue streams. This was evident in some regions during the 2008 financial crisis, where healthcare spending growth slowed.

Conversely, periods of economic expansion, like the anticipated 3.2% global growth in 2024, generally foster greater investment in healthcare infrastructure and innovation. This environment is more favorable for companies like UCB, which rely on market access for their advanced therapies.

Inflationary pressures directly impact UCB's operational costs, from sourcing raw materials like active pharmaceutical ingredients to managing complex manufacturing processes and global logistics. For instance, rising energy prices in 2024 and early 2025 have been a significant factor across industries, and the biopharmaceutical sector is no exception, potentially increasing UCB's cost of goods sold.

The capital-intensive nature of biopharmaceutical research, development, and production means that even modest increases in operational expenses can significantly squeeze profit margins. UCB's substantial investments in R&D and advanced manufacturing facilities are particularly vulnerable to escalating costs for specialized equipment, utilities, and skilled labor.

To counter these effects, UCB is likely focusing on optimizing its supply chain and enhancing operational efficiencies. Strategies such as long-term supplier contracts, vertical integration where feasible, and leveraging advanced analytics to streamline production can help mitigate the financial impact of rising inflation on its performance.

Economic conditions significantly impact UCB's ability to fund research and development, which is the lifeblood of its innovation and future growth. When the economy is robust, there's typically more capital available from both venture capitalists and internal budgets for the substantial investments needed in new drug discovery and development.

Conversely, economic downturns or periods of uncertainty can lead to tighter funding, potentially slowing down critical R&D projects. UCB's commitment to innovation is underscored by its substantial R&D expenditure, with the company reporting a 29% R&D to revenue ratio in 2024, highlighting the critical role of sustained investment in its pipeline for long-term success.

Currency Exchange Rate Fluctuations

As a global pharmaceutical company, UCB's reported financial results are directly influenced by currency exchange rate fluctuations. When UCB converts earnings from its operations in various countries into its reporting currency, typically the Euro, variations in exchange rates can significantly alter reported revenues and profits. For instance, a stronger Euro can make UCB's foreign earnings worth less when translated back, impacting its top and bottom lines.

These currency shifts also affect the price competitiveness of UCB's products in international markets. If the Euro strengthens against a local currency, UCB's medicines may become more expensive for customers in that region, potentially dampening demand. Conversely, a weaker Euro could make its products more affordable abroad, boosting sales volume.

Managing this currency risk is a crucial aspect of UCB's financial strategy. The company employs various hedging techniques to mitigate the impact of adverse currency movements. For example, in the first quarter of 2024, UCB noted that foreign exchange had a negative impact on its net sales growth, highlighting the ongoing relevance of this economic factor.

- Impact on Reported Earnings: Fluctuations in exchange rates directly affect the value of UCB's foreign earnings when converted to Euros, influencing reported revenue and profit figures.

- Market Competitiveness: Changes in currency values can alter the pricing of UCB's products in different markets, impacting sales volumes and market share.

- Hedging Strategies: UCB actively manages currency risk through financial instruments and operational strategies to protect its financial performance from adverse exchange rate movements.

- Q1 2024 Performance: In early 2024, foreign exchange negatively impacted UCB's net sales growth, underscoring the real-world financial consequences of currency volatility.

Competition from Generics and Biosimilars

The economic environment for pharmaceutical companies like UCB is increasingly shaped by the influx of generic and biosimilar competitors. As crucial patents for established drugs expire, originator companies face significant revenue erosion. This trend is amplified by the growing market for biosimilars; for instance, the European Medicines Agency (EMA) recommended 28 new biosimilar products in 2024 alone.

This competitive pressure necessitates a robust innovation pipeline for UCB. To counteract potential market share decline, the company must focus on developing novel treatments and securing new blockbuster drugs.

- Patent Expirations: A key economic factor impacting originator drug revenues.

- Biosimilar Market Growth: 28 new biosimilar products were recommended by the EMA in 2024, indicating intensified competition.

- Revenue Erosion: Generic and biosimilar entry directly reduces sales for original pharmaceutical products.

- Innovation Imperative: UCB must continuously innovate to maintain market leadership and profitability.

Global economic growth directly influences healthcare spending, with the IMF projecting 3.2% global growth in 2024, which can affect UCB's revenue from new drug adoption and reimbursement. Economic downturns can strain healthcare budgets, potentially reducing pharmaceutical spending, a concern highlighted during the 2008 financial crisis. Conversely, economic expansion generally supports increased investment in healthcare innovation, creating a more favorable environment for companies like UCB.

What You See Is What You Get

UCB PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive UCB PESTLE analysis provides a detailed examination of the external factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. You’ll gain immediate access to this in-depth UCB PESTLE analysis upon completing your purchase.

The content and structure shown in the preview is the same document you’ll download after payment. This UCB PESTLE analysis is designed to offer clear insights into political, economic, social, technological, legal, and environmental influences.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly one in six people globally will be 65 or older. This demographic shift significantly boosts the demand for healthcare, especially for chronic and severe conditions. UCB, with its focus on neurology and immunology, is well-positioned to address the rising needs of this expanding patient demographic.

As the global population ages, the incidence of neurological disorders like Parkinson's and Alzheimer's, as well as autoimmune diseases, is expected to climb. For instance, the World Health Organization reported in 2023 that neurological disorders are a leading cause of disability worldwide. This sustained and growing patient pool directly supports the long-term market potential for UCB's specialized treatments.

Public awareness regarding health and well-being has surged, with individuals increasingly taking charge of their healthcare journeys. This heightened awareness, coupled with the growing influence of patient advocacy groups, directly impacts treatment choices and the demand for innovative therapies. Patients are more informed than ever, actively researching and demanding effective solutions, which in turn places significant pressure on healthcare providers and pharmaceutical firms like UCB to deliver accessible, high-quality care.

This shift towards patient empowerment is a critical factor for UCB. For instance, in 2024, the global digital health market, a key enabler of patient information access, was projected to reach over $300 billion, indicating the scale of patient engagement with health information. UCB's commitment to a patient-centric model, focusing on understanding patient needs and co-creating solutions, is therefore vital for navigating this evolving healthcare landscape and ensuring its treatments meet the demands of an empowered patient population.

Modern lifestyles, characterized by increased sedentary behavior and processed food consumption, are fueling a rise in chronic diseases. For example, the World Health Organization reported in 2024 that over 1 billion people globally are living with obesity, a key risk factor for cardiovascular diseases, diabetes, and certain cancers. This trend presents UCB with significant opportunities in developing treatments for these prevalent conditions.

Access to Healthcare and Health Equity

Societal expectations for fair access to healthcare and medications are growing, especially in emerging markets. UCB is actively working to expand the reach of its treatments, targeting 82% access coverage for its solutions in 2024, demonstrating a dedication to global health equity.

However, existing gaps in healthcare access can hinder the widespread availability of UCB's innovative therapies.

- Growing Demand for Equity: There's a clear societal push for equitable healthcare access worldwide, particularly in regions with developing healthcare infrastructures.

- UCB's Access Goals: UCB has set an ambitious target of achieving 82% access coverage for its medicines in 2024, underscoring its commitment to global health.

- Barriers to Reach: Significant disparities in healthcare infrastructure and affordability remain challenges that can limit how many patients benefit from UCB's advanced treatments.

Public Perception and Trust in Pharmaceutical Companies

Public perception and trust are critical for pharmaceutical companies like UCB. Negative sentiment around drug pricing, as highlighted by ongoing debates and scrutiny from organizations like the U.S. Government Accountability Office (GAO) regarding prescription drug costs, can significantly impact market acceptance and patient adherence. For instance, a 2023 Gallup poll indicated that a substantial portion of Americans still view pharmaceutical companies unfavorably, often citing high prices as a primary concern.

UCB's strategic focus on patient-centric innovation and sustainability initiatives aims to counter these perceptions. By emphasizing its commitment to developing treatments for severe diseases and improving patient quality of life, UCB seeks to build a more positive public image. Their investments in environmental, social, and governance (ESG) factors, which are increasingly scrutinized by investors and the public, are also key to fostering trust. Companies demonstrating strong ethical conduct in clinical trials and transparent communication about drug development processes tend to garner greater public confidence.

The trust factor directly influences policy decisions and regulatory landscapes. Public outcry over drug costs can lead to increased government intervention, such as price negotiation mandates or stricter approval processes. For example, the Inflation Reduction Act of 2022 in the United States allows Medicare to negotiate prices for certain high-cost drugs, a direct response to public and political pressure. UCB's ability to navigate these evolving expectations by showcasing value beyond just the price point, such as improved patient outcomes and reduced healthcare system burden, is paramount for sustained market success.

UCB's efforts to enhance public trust are evident in their approach to R&D and patient engagement. For example, in 2024, UCB continued to highlight its pipeline advancements in areas like neurology and immunology, often featuring patient testimonials and data demonstrating the real-world impact of their therapies. This focus on tangible patient benefits, coupled with transparent reporting on clinical trial results and corporate social responsibility efforts, forms the bedrock of their strategy to build and maintain public confidence in a highly scrutinized industry.

Societal expectations for equitable healthcare access are a significant driver for UCB. The company aims for 82% access coverage for its medicines in 2024, reflecting a commitment to global health equity, though disparities in healthcare infrastructure and affordability remain considerable challenges.

Public trust is paramount, particularly concerning drug pricing. A 2023 Gallup poll showed a significant portion of Americans hold unfavorable views of pharmaceutical companies due to high costs, a sentiment that can influence policy, as seen with the Inflation Reduction Act of 2022 allowing Medicare to negotiate drug prices.

UCB's patient-centric approach and ESG investments are key to building trust. By highlighting R&D in neurology and immunology and showcasing patient testimonials, UCB aims to demonstrate tangible benefits and foster confidence in a scrutinized industry.

Technological factors

Technological leaps, especially in artificial intelligence, machine learning, and genomics, are fundamentally reshaping how new medicines are found and developed. These tools are accelerating the identification of potential drug compounds and streamlining clinical testing, paving the way for personalized treatments. UCB's research and development strategy is deeply intertwined with these advancements, aiming to expedite the delivery of novel therapies to patients.

Breakthroughs in biotechnology, particularly in gene and cell therapies, are fundamentally reshaping how severe diseases are treated. UCB, with its strategic focus on immunology and neurology, is well-positioned to harness these advanced therapeutic approaches to create highly precise and impactful treatments.

The rapid advancement of this sector is underscored by the U.S. Food and Drug Administration's approval of seven cell and gene therapies in 2024 alone, highlighting the increasing significance and commercial viability of these innovative medical technologies.

The increasing adoption of digital health tools like remote patient monitoring and telemedicine is transforming patient care and how drug effectiveness is tracked. UCB can harness vast amounts of data from clinical trials and real-world evidence to refine drug development, improve post-market safety monitoring, and ultimately enhance patient results.

The European Medicines Agency's (EMA) emphasis on utilizing real-world evidence (RWE) and developing data analysis networks underscores the growing importance of these technological advancements in the pharmaceutical sector. For instance, by mid-2024, the EMA was actively expanding its RWE capabilities, aiming to integrate diverse data sources for regulatory decision-making, which UCB can leverage.

Manufacturing Technologies and Automation

Innovations in pharmaceutical manufacturing, such as continuous manufacturing and advanced process analytical technology (PAT), are transforming how companies like UCB produce medicines. These advancements promise greater efficiency and improved product quality. For instance, the global pharmaceutical manufacturing market was valued at approximately $360 billion in 2023 and is projected to grow, indicating a strong trend towards adopting these new technologies.

Increased automation in production lines is a key technological factor. By integrating robotics and AI-driven quality control systems, UCB can streamline operations, reduce human error, and potentially lower manufacturing costs. This is crucial for scaling up production of novel therapies and ensuring a consistent supply chain, especially given the increasing complexity of biologic drugs.

Regulatory bodies worldwide are actively adapting to facilitate the adoption of these advanced manufacturing techniques. For example, the U.S. Food and Drug Administration (FDA) has been promoting advanced manufacturing, with initiatives aimed at encouraging the use of innovative technologies. This supportive regulatory environment is vital for UCB to leverage these technological shifts effectively.

- Increased Efficiency: Advanced manufacturing techniques can reduce batch cycle times and improve yields, leading to faster product availability.

- Cost Reduction: Automation and process optimization can lower labor, energy, and material costs in the long run.

- Enhanced Quality: Real-time monitoring and control systems, powered by PAT, ensure consistent product quality and reduce the risk of defects.

- Supply Chain Resilience: Flexible and scalable manufacturing processes enable quicker responses to market demand and potential disruptions.

Intellectual Property in Emerging Technologies

Protecting intellectual property (IP) in cutting-edge fields like AI for drug discovery and gene editing is a significant hurdle. UCB must develop strong IP strategies to safeguard its innovations in these fast-paced areas.

The legal landscape for emerging technologies is still developing, making patenting and enforcement complex. For instance, the ongoing disputes surrounding foundational technologies like CRISPR-Cas9 highlight the challenges in securing rights for groundbreaking scientific advancements.

- AI in Drug Discovery: Companies are investing heavily, with the AI drug discovery market projected to reach \$5.5 billion by 2027, according to Grand View Research. Protecting the proprietary algorithms driving these discoveries is paramount.

- Gene Editing IP: The intellectual property surrounding gene-editing technologies, particularly CRISPR, has seen significant patent litigation, with billions of dollars in potential market value at stake.

- UCB's Strategy: UCB's commitment to innovation in areas like neurology and immunology necessitates a proactive approach to IP, ensuring its competitive edge through patents, trade secrets, and strategic licensing.

Technological advancements in AI and machine learning are revolutionizing drug discovery and development, accelerating the identification of new therapeutic targets. UCB's strategic focus on these areas, particularly in neurology and immunology, allows it to leverage these tools for faster innovation. The global AI in drug discovery market was projected to reach \$5.5 billion by 2027, underscoring the significant investment and potential in this field.

Legal factors

UCB navigates a highly regulated landscape, with the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) being key oversight bodies. These agencies mandate rigorous, multi-phase clinical trials to demonstrate both safety and efficacy before any new drug can reach the market.

The path to drug approval is notoriously long and expensive, often spanning many years and costing hundreds of millions of dollars. For instance, the average cost to develop a new drug exceeded $2 billion in recent years, a figure UCB must factor into its R&D investments.

Upcoming changes, such as the EMA's planned expanded clinical data publication policy from Q2 2025, will introduce greater transparency requirements. This necessitates robust data management and compliance strategies for UCB to meet evolving regulatory expectations.

Intellectual property laws, especially patent protection, are crucial for UCB to recover its substantial research and development costs and secure market exclusivity for its new medicines. These patents are the bedrock of its competitive advantage.

The looming threat of patent cliffs, where a drug's exclusive marketing rights expire, directly impacts UCB's revenue streams. For instance, the patent expiry of key products can lead to significant revenue declines as generic competitors enter the market.

UCB actively manages a complex web of patent litigation and employs various strategies to extend the commercial life of its patented products, aiming to mitigate the impact of these expirations.

UCB must navigate a complex web of data privacy and security regulations, with GDPR in Europe being a prime example. These laws dictate how UCB can collect, store, and utilize sensitive patient data for crucial activities like research, clinical trials, and commercial operations. Failure to comply can result in significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher.

The evolving landscape of data privacy demands UCB to implement stringent internal controls and advanced security measures. This is essential not only for legal compliance but also to safeguard patient trust, which is paramount in the pharmaceutical industry. For instance, the increasing volume of health data generated, estimated to grow significantly in the coming years, amplifies the importance of robust data protection strategies.

Anti-Corruption and Compliance Laws

UCB, like all global pharmaceutical companies, operates under a stringent regulatory environment governed by anti-bribery and anti-corruption laws. These include major legislation like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, which carry significant penalties for violations. Ensuring robust compliance in all dealings, particularly with healthcare professionals and government entities, is paramount to avoid legal repercussions and protect UCB's reputation.

The pharmaceutical sector's interactions with prescribers and policymakers make it a focal point for these regulations. UCB must maintain transparent and ethical practices in its sales, marketing, and research collaborations. For instance, in 2023, the U.S. Department of Justice collected over $2.6 billion in settlements related to FCPA enforcement actions, underscoring the substantial financial risks associated with non-compliance.

- Global Reach, Local Enforcement: UCB must navigate varying anti-corruption laws across its operating regions, with a particular focus on markets with heightened enforcement, such as China, where authorities have intensified efforts against bribery in the healthcare sector.

- FCPA and UK Bribery Act: Adherence to these foundational laws is critical, covering bribery of foreign officials, as well as commercial bribery, impacting all UCB employees and third-party intermediaries.

- Reputational and Financial Risks: Non-compliance can lead to severe financial penalties, debarment from government contracts, and significant damage to UCB's brand and public trust.

- Proactive Compliance Programs: UCB's investment in comprehensive compliance training, due diligence on partners, and internal controls is essential to mitigate these legal and reputational exposures.

Product Liability and Consumer Protection Laws

UCB operates under stringent product liability and consumer protection laws. If UCB's pharmaceuticals lead to unexpected adverse effects or do not meet established safety benchmarks, the company could face significant product liability claims. For instance, in 2023, the pharmaceutical industry globally saw numerous settlements related to product safety, with some companies allocating billions for litigation and remediation efforts.

Consumer protection regulations also govern how UCB can market and advertise its medicines. These laws ensure that patients and healthcare providers receive accurate and unbiased information about drug efficacy and potential risks. In 2024, regulatory bodies like the FDA continued to emphasize transparent communication, issuing new guidelines for direct-to-consumer advertising of prescription drugs, which UCB must meticulously follow.

To effectively manage these legal exposures, UCB must maintain rigorous quality control processes and robust pharmacovigilance systems. Transparent communication regarding product performance and potential side effects is paramount. A proactive approach to safety monitoring and clear disclosure practices are essential for mitigating legal risks and maintaining consumer trust. For example, UCB's investment in pharmacovigilance technology in 2024 was aimed at improving early detection of adverse events, thereby reducing the likelihood of large-scale liability issues.

Key legal considerations for UCB include:

- Product Liability: Potential lawsuits arising from adverse drug reactions or product defects.

- Consumer Protection: Adherence to regulations on drug marketing, advertising, and labeling.

- Regulatory Compliance: Meeting standards set by health authorities like the FDA and EMA regarding drug safety and efficacy.

- Pharmacovigilance: Implementing systems to monitor and report drug safety post-market.

UCB operates within a strict legal framework, requiring adherence to global and local regulations governing drug development, marketing, and patient data. Key agencies like the FDA and EMA set high bars for safety and efficacy, necessitating extensive clinical trials, which can cost upwards of $2 billion per drug. Upcoming regulatory shifts, such as the EMA's expanded data publication policy from Q2 2025, will demand greater transparency from UCB.

Intellectual property law, particularly patent protection, is vital for UCB to recoup R&D investments and maintain market exclusivity. The expiration of patents, known as patent cliffs, poses a significant revenue risk, prompting UCB to actively manage patent litigation and lifecycle strategies.

Data privacy laws like GDPR are critical for UCB's handling of sensitive patient information, with non-compliance potentially leading to fines of up to 4% of global annual revenue. The increasing volume of health data underscores the need for robust data protection and security measures to maintain patient trust.

Anti-bribery and anti-corruption laws, such as the FCPA and UK Bribery Act, apply to UCB's interactions with healthcare professionals and government bodies. In 2023, FCPA enforcement actions yielded over $2.6 billion in settlements, highlighting the substantial financial and reputational risks of violations.

UCB faces product liability and consumer protection laws, which govern drug safety and marketing. In 2023, the pharmaceutical industry saw significant settlements related to product safety, and in 2024, regulatory bodies like the FDA continued to emphasize transparent advertising. UCB's investment in pharmacovigilance technology in 2024 aims to mitigate these risks.

| Legal Factor | Description | Example/Impact for UCB | Relevant Year/Period |

| Regulatory Approval | Mandatory multi-phase clinical trials for safety and efficacy. | Average drug development cost >$2 billion. | Ongoing, with EMA data publication from Q2 2025. |

| Intellectual Property | Patent protection for market exclusivity. | Patent cliffs can cause significant revenue decline. | Ongoing. |

| Data Privacy | Compliance with GDPR and similar regulations. | Fines up to 4% of global annual revenue for violations. | Ongoing, with increasing data volumes. |

| Anti-Corruption | Adherence to FCPA and UK Bribery Act. | FCPA settlements in 2023 exceeded $2.6 billion. | Ongoing. |

| Product Liability | Responsibility for adverse drug reactions. | Industry saw significant product safety settlements in 2023. | Ongoing, with FDA focus on advertising in 2024. |

Environmental factors

Pharmaceutical production inherently involves chemical usage and waste generation, placing UCB under the purview of ever-tightening global environmental regulations. The company must adhere to directives concerning waste disposal, air quality, and water effluent to mitigate its ecological impact.

For instance, the EU's upcoming stringent sustainability regulations, particularly those set to take effect from 2025, are anticipated to significantly influence UCB's operational expenditures and manufacturing methodologies. These regulations often mandate specific treatment processes for chemical waste and emissions, potentially increasing capital investment in compliance technologies.

Growing concerns about climate change are pushing pharmaceutical companies like UCB to embrace greener operations and set ambitious environmental goals. UCB's dedication to cutting its CO2e emissions, demonstrated by its strong ESG ratings, shows a clear alignment with worldwide sustainability objectives. This proactive approach involves embedding sustainability deep within its daily business activities.

UCB faces potential disruptions from the scarcity of key natural resources like water and specific raw materials essential for its pharmaceutical manufacturing. For instance, the pharmaceutical industry's reliance on complex chemical compounds means that disruptions in the supply of precursor materials, often sourced globally, can directly impact UCB's production capacity and timelines. By 2024, concerns over water stress in various manufacturing regions are escalating, potentially impacting operational continuity.

Climate change is increasingly a factor, with extreme weather events in 2024 and projected for 2025 posing risks to transportation networks and the availability of critical ingredients. These events can lead to unforeseen delays and increased costs in UCB's global supply chain, affecting everything from sourcing to final product delivery. Building robust supply chain resilience, perhaps through diversified sourcing and strategic inventory management, is crucial for UCB to navigate these environmental challenges.

Waste Management and Drug Disposal

The pharmaceutical industry faces increasing scrutiny regarding waste management, particularly the disposal of drugs. Improper handling can lead to environmental contamination, with pharmaceutical residues found in water bodies becoming a growing concern. For instance, studies in 2024 continued to highlight the presence of various pharmaceuticals in surface and groundwater samples globally, impacting aquatic ecosystems.

Regulatory frameworks are adapting to these challenges. In 2024, several regions saw proposed or enacted legislation aimed at stricter controls on pharmaceutical waste, from manufacturing byproducts to post-consumer disposal. This includes enhanced requirements for the treatment of wastewater from production facilities and programs to encourage safe return of unused medications.

UCB, like other major pharmaceutical companies, must proactively invest in and implement sustainable waste management strategies. This involves not only compliance with current regulations but also anticipating future environmental standards. Key areas of focus include:

- Responsible disposal of hazardous pharmaceutical waste generated during manufacturing processes.

- Development of take-back programs or partnerships to facilitate safe post-consumer drug disposal.

- Investment in advanced treatment technologies to minimize the environmental footprint of its operations.

Eco-friendly Packaging and Green Chemistry

The pharmaceutical industry, including companies like UCB, faces increasing pressure to adopt eco-friendly packaging and green chemistry. Consumers and regulators are demanding more sustainable options, pushing for materials that are recyclable, biodegradable, or made from renewable resources. For instance, the global green packaging market is projected to reach USD 411.7 billion by 2027, growing at a CAGR of 6.2% from 2020, indicating a significant shift in consumer preference and industry investment.

UCB can bolster its environmental stewardship by actively integrating green chemistry principles into its research and development, aiming for processes that minimize hazardous substances and waste. This includes exploring solvent alternatives and optimizing reaction pathways to reduce energy consumption. The company's commitment to sustainability can be further demonstrated through its packaging choices, moving towards materials that support a circular economy model and lessen the overall ecological footprint of its products.

Key areas for UCB's focus include:

- Sustainable Material Sourcing: Investigating and implementing packaging materials derived from recycled content or bio-based sources.

- Process Optimization: Adopting green chemistry techniques to reduce waste, energy use, and the reliance on hazardous chemicals in drug manufacturing.

- Life Cycle Assessment: Conducting thorough evaluations of packaging and production processes to identify and mitigate environmental impacts.

- Circular Economy Integration: Designing packaging for recyclability and exploring partnerships to ensure materials are effectively reused or repurposed.

Environmental regulations are becoming increasingly stringent, impacting UCB's production and waste management. For instance, the EU's sustainability regulations, set to intensify from 2025, will likely increase compliance costs and necessitate investments in advanced treatment technologies for waste and emissions.

Climate change presents risks to UCB's supply chain, with extreme weather events in 2024 and projected for 2025 potentially disrupting transportation and ingredient availability. The company's focus on reducing CO2e emissions and its strong ESG ratings demonstrate a commitment to greener operations and global sustainability goals.

The pharmaceutical industry, including UCB, faces growing pressure for eco-friendly packaging and green chemistry. The global green packaging market's growth, projected to reach USD 411.7 billion by 2027, signals a strong industry shift toward sustainable materials and processes.

UCB must address potential resource scarcity, particularly water, which is critical for pharmaceutical manufacturing. Supply chain disruptions due to the scarcity of precursor materials, a concern in 2024, can directly affect production capacity and timelines.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. This ensures that each factor, from political stability to technological advancements, is informed by credible and current information.