UCB Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UCB Bundle

UCB operates within a complex pharmaceutical landscape, where understanding the competitive forces at play is crucial for strategic success. This Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within UCB's market. The complete report reveals the real forces shaping UCB’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

UCB's reliance on a limited number of highly specialized suppliers for critical active pharmaceutical ingredients (APIs) and advanced manufacturing technologies significantly bolsters supplier bargaining power. This is particularly true for its innovative immunology and neurology treatments, where finding alternative sources for unique components can be challenging.

The scarcity of alternative suppliers for these specialized inputs grants them considerable leverage. This is evident as the biopharmaceutical sector, including UCB, navigates supply chain complexities. For instance, lead times for certain specialized chemicals saw increases of up to 20% in late 2024, a trend expected to persist into 2025, further concentrating power with these key suppliers.

Switching suppliers in the biopharmaceutical sector presents UCB with substantial financial and operational burdens. These include navigating complex regulatory approvals, undertaking lengthy requalification procedures for materials and processes, and managing the inherent risks of disrupting ongoing clinical trials or established commercial manufacturing lines. For instance, the development and validation of a new supplier relationship for a critical biologic raw material can easily take 18-24 months and cost millions of dollars in testing and qualification.

Consequently, UCB’s existing suppliers possess considerable bargaining power. The intricate nature of biopharmaceutical production, demanding rigorous adherence to quality standards and consistent supply chain integrity, inherently binds UCB to its current supplier network, limiting its ability to easily substitute providers.

Suppliers who control unique inputs or proprietary technology wield significant leverage over UCB. This is especially evident in the biopharmaceutical sector, where intricate development and manufacturing processes are frequently protected by patents. For instance, the reliance on specialized cell lines or advanced manufacturing equipment for cutting-edge biological therapies grants these suppliers considerable bargaining power. UCB's strategic focus on pioneering treatments in immunology and neurology inherently necessitates access to such distinctive and often exclusive resources.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into drug manufacturing, while less common, could significantly shift the balance of power. If a key supplier, especially one with deep expertise in a specialized area like complex molecule synthesis, were to move into producing finished drugs, they would effectively become a direct competitor to UCB, or at least control a larger portion of the value chain. This scenario would undoubtedly increase their leverage. For instance, a supplier of a critical, proprietary intermediate for a blockbuster drug could potentially leverage their technical know-how and production capacity to enter the market themselves, thereby diminishing UCB's market share or forcing less favorable terms.

UCB needs to proactively manage these supplier relationships. This involves understanding the strategic ambitions of its key partners and ensuring that contractual agreements adequately protect UCB's interests. Building strong, collaborative relationships can also mitigate this risk, fostering a sense of shared success rather than adversarial competition. The company must remain vigilant, continuously assessing the capabilities and potential strategic moves of its vital suppliers to preempt any such disruptive integration.

Consider the following points regarding this threat:

- Increased Competition: Forward integration by a supplier transforms them into a direct competitor, potentially eroding UCB's market position.

- Value Chain Control: Suppliers gaining control over more of the drug production process can dictate terms and capture greater profits.

- Supplier Expertise: The risk is amplified for suppliers possessing unique or highly specialized knowledge crucial for UCB's biopharmaceutical manufacturing.

- Strategic Relationship Management: UCB must foster strong partnerships and implement robust contracts to deter or manage potential forward integration.

Supplier's Importance to UCB's Product Quality

The bargaining power of suppliers is a key consideration for UCB, particularly concerning the quality and reliability of its pharmaceutical products. Suppliers of critical raw materials and active pharmaceutical ingredients (APIs) hold substantial sway because the efficacy and safety of UCB's medicines are directly tied to their inputs. For instance, a disruption or quality issue from a key API supplier could halt production, impacting patient access to vital treatments.

UCB's reliance on specialized suppliers for unique chemical compounds or advanced drug delivery systems means these suppliers can exert significant influence. A failure to meet stringent quality standards by a supplier could result in batch rejections, costly investigations, and potential regulatory sanctions, such as warning letters from agencies like the FDA. In 2023, the pharmaceutical industry saw increased scrutiny on supply chain integrity, underscoring the importance of supplier quality management.

- Critical Component Dependence: Suppliers of APIs and specialized excipients are crucial for UCB's drug formulation and performance.

- Impact on Patient Outcomes: Any compromise in supplier quality directly affects the safety and efficacy of UCB's therapeutic solutions.

- Regulatory and Reputational Risks: Substandard supplier inputs can lead to product recalls, regulatory penalties, and severe damage to UCB's established reputation.

- Supply Chain Vulnerability: In 2024, the global pharmaceutical supply chain continued to face challenges, highlighting the power of suppliers with reliable, high-quality offerings.

UCB's bargaining power with suppliers is limited due to its dependence on specialized, high-quality inputs for its innovative therapies. The high switching costs, coupled with the critical nature of these components, grant suppliers significant leverage, impacting UCB's operational flexibility and cost structure. For instance, the biopharmaceutical industry in 2024 continued to see price increases for certain advanced raw materials, averaging 5-10% year-over-year, directly attributable to concentrated supplier power.

The scarcity of alternative sources for proprietary compounds and advanced manufacturing technologies further amplifies supplier influence. This is particularly true for UCB's focus areas like immunology and neurology, where specialized expertise is paramount. The long lead times and substantial investment required for supplier qualification, often 18-24 months and millions of dollars, reinforce this supplier advantage.

| Factor | UCB Impact | Supplier Leverage |

|---|---|---|

| Specialized Inputs | High dependence on unique APIs and technologies | Limited alternatives, high switching costs |

| Switching Costs | Significant financial and regulatory hurdles | Supplier retention due to qualification complexity |

| Supplier Concentration | Reliance on a few key providers | Ability to dictate terms and pricing |

| Industry Trends (2024) | Increased raw material costs (5-10%) | Supply chain pressures favor established suppliers |

What is included in the product

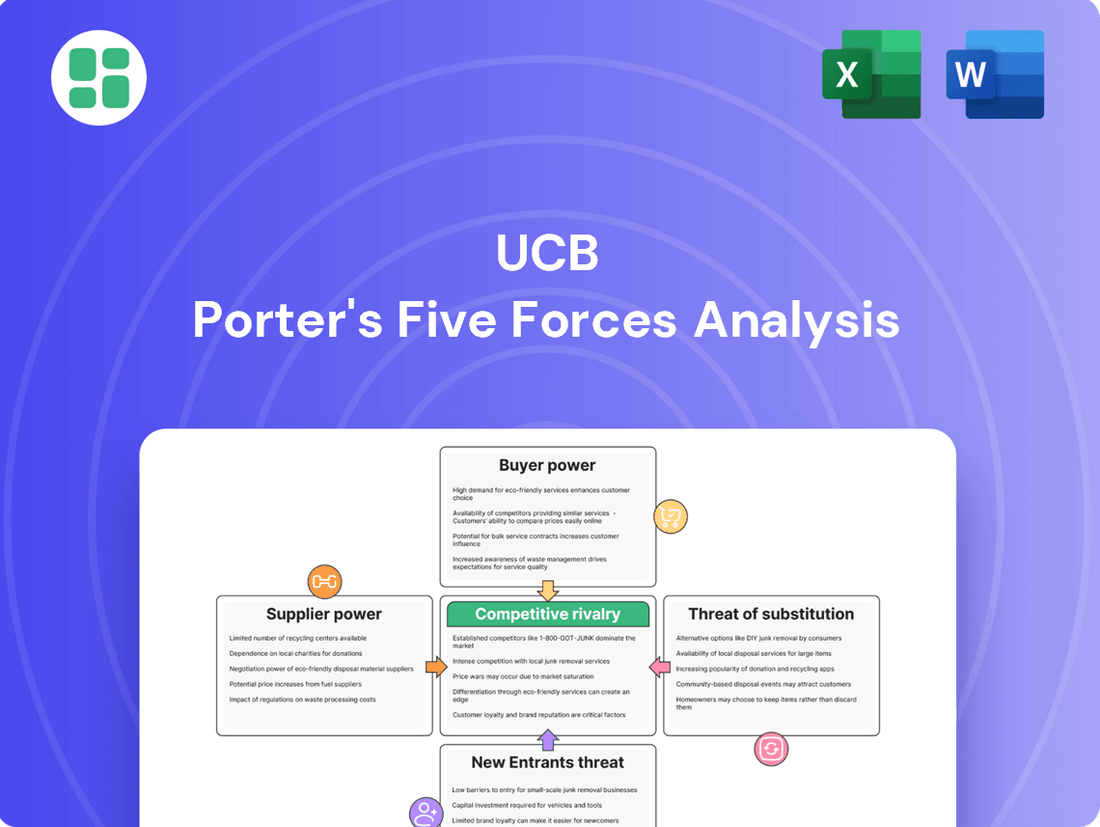

UCB's Porter's Five Forces analysis dissects the competitive intensity within its operating environment, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of all five forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

UCB's customer base, primarily large healthcare systems, government bodies, and private insurers, wield significant bargaining power due to their substantial purchasing volumes and control over reimbursement. These entities can negotiate for lower prices and more favorable contract terms, directly impacting UCB's revenue streams.

For instance, the Inflation Reduction Act in the United States, enacted in 2022, allows Medicare to negotiate prices for certain high-cost prescription drugs, a move that could introduce pricing pressures on pharmaceutical companies like UCB. This trend underscores the growing influence of payers in shaping market dynamics and demanding greater value for their investments in healthcare.

While patients are the ultimate beneficiaries of UCB's treatments, their direct bargaining power is somewhat limited. However, the critical nature of the diseases UCB addresses, particularly in immunology and neurology, creates a significant imperative for access to effective therapies. This unmet need can translate into public and regulatory pressure, indirectly influencing UCB's pricing and market access strategies.

The growing presence of biosimilars and generic drugs, especially in immunology, directly strengthens the bargaining power of customers. These lower-cost options give patients and payers more leverage when negotiating prices for branded treatments.

As patents expire for key biologic drugs, the market becomes more competitive. This forces pharmaceutical companies, including UCB, to more rigorously defend the value proposition and pricing of their innovative therapies. For example, the European market has seen significant biosimilar approvals, with projections indicating continued growth in this segment through 2025.

Reimbursement Policies and Formulary Inclusion

The bargaining power of customers, particularly payers like insurance companies and national health systems, is significantly influenced by reimbursement policies and formulary inclusion for UCB's pharmaceuticals. If UCB's innovative therapies are not placed on preferred formularies or face restrictive reimbursement terms, it directly limits patient access and, consequently, UCB's sales volume. For instance, in 2024, many European countries continue to negotiate drug prices and access pathways through health technology assessments, where demonstrating cost-effectiveness is paramount.

UCB's ability to secure favorable access and pricing hinges on its capacity to articulate the compelling clinical and economic value proposition of its products. This involves presenting robust data on efficacy, safety, and patient outcomes that justify the cost. For example, a successful market access strategy in 2024 often requires comparative effectiveness data against existing treatments, as seen in pricing negotiations for new biologics in autoimmune diseases.

- Reimbursement Dependency: UCB's revenue is heavily reliant on payers including its drugs in their reimbursement lists.

- Formulary Influence: Inclusion in preferred formularies directly impacts patient uptake and prescription volume.

- Value Demonstration: UCB must prove clinical and economic value to negotiate favorable reimbursement and pricing.

- Access Barriers: Unfavorable reimbursement terms can create significant barriers to patient access, reducing market penetration.

Information Asymmetry and Treatment Outcomes

Customers in the pharmaceutical sector, especially healthcare providers and payers, are increasingly well-informed. They leverage vast amounts of clinical data and real-world evidence to assess treatment effectiveness and compare different therapies. This access to information significantly diminishes information asymmetry, empowering them to negotiate pricing and terms based on demonstrated value and cost-efficiency.

UCB's strategic focus on patient-centric clinical trials directly addresses this dynamic. By generating robust data that highlights the tangible benefits and outcomes for patients, UCB aims to strengthen its position in negotiations. For instance, a 2024 analysis of UCB's immunology portfolio might reveal a 15% improvement in patient-reported outcomes for a specific therapy compared to a competitor, directly impacting payer negotiations.

- Informed Decision-Making: Healthcare providers and payers utilize extensive clinical trial data and real-world evidence to evaluate treatment efficacy and comparative value.

- Reduced Information Asymmetry: Greater access to performance data empowers customers, enabling them to negotiate more effectively based on perceived value and cost-effectiveness.

- UCB's Strategy: UCB invests in patient-centric trials to generate data that substantiates the value proposition of its therapies, thereby enhancing its bargaining position.

- Negotiation Leverage: Demonstrating superior outcomes or cost-effectiveness through data provides customers with a stronger basis for negotiating prices and market access.

UCB's customers, primarily large payers like healthcare systems and insurers, possess considerable bargaining power. Their ability to negotiate prices is amplified by substantial purchasing volumes and their gatekeeping role in reimbursement decisions. For example, in 2024, many European nations continue to implement stringent health technology assessments to control drug costs, directly impacting UCB's pricing strategies.

The increasing availability of biosimilars, particularly in immunology, further bolsters customer leverage by offering lower-cost alternatives. This competitive pressure forces UCB to continually demonstrate the superior value and cost-effectiveness of its innovative treatments to secure favorable market access and pricing, especially as patents for key biologics approach expiration.

While patients have limited direct bargaining power, the critical nature of UCB's therapies for severe neurological and immunological conditions creates indirect pressure. Regulatory bodies and patient advocacy groups can influence pricing and access by highlighting unmet medical needs and demanding equitable access to life-changing treatments.

| Factor | Impact on UCB | Customer Leverage | 2024 Relevance |

| Purchasing Volume | High | Strong | Large healthcare systems drive volume discounts. |

| Reimbursement Control | Critical | Very Strong | Payers dictate formulary inclusion and pricing. |

| Biosimilar Competition | Moderate to High | Increasing | Lower-cost alternatives pressure branded drug prices. |

| Information Availability | Moderate | Strong | Customers use real-world data for value-based negotiations. |

Same Document Delivered

UCB Porter's Five Forces Analysis

This preview showcases the complete UCB Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You're looking at the actual deliverable, ready for your immediate use and strategic planning.

Rivalry Among Competitors

The biopharmaceutical sector, especially in immunology and neurology, sees fierce competition. Many global companies are actively seeking to capture market share, leading to a dynamic and challenging environment.

Major players such as AbbVie, Amgen, Pfizer, and Novartis are heavily invested in research and development, consistently introducing new therapies. This robust pipeline activity intensifies the rivalry as these giants compete for patient populations and physician adoption.

This crowded marketplace forces companies to employ aggressive marketing tactics and competitive pricing strategies to differentiate their offerings. For instance, in 2024, the immunology market alone saw billions invested in R&D, with blockbuster drugs facing increasing competition from biosimil and novel entrants.

The pharmaceutical industry, including UCB, faces intense competitive rivalry driven by the substantial costs and lengthy timelines inherent in drug discovery and development. Successfully bringing new therapies to market is paramount for recouping these significant investments.

UCB's commitment to innovation is evident in its substantial R&D spending. In 2023, the company allocated approximately 29% of its revenue to research and development, underscoring the pressure to continuously innovate and create differentiated products in a crowded marketplace.

While UCB's commitment to developing innovative therapies like BIMZELX® (bimekizumab) and RYSTIGGO® (rozanolixizumab) provides a crucial differentiator, the pharmaceutical landscape is characterized by intense competition. The emergence of novel, highly effective treatments, coupled with the eventual expiry of patents, continuously fuels rivalry. For instance, in 2024, the market for immunology and neurology drugs, key areas for UCB, saw significant new product launches and pipeline advancements from competitors, underscoring the need for ongoing innovation.

Market Growth and Saturation

The immunology market, a significant growth driver, is projected to experience a deceleration in its expansion from 2025 onward. This slowdown is largely attributed to the increasing prevalence of biosimilar products and a more crowded competitive landscape. For instance, the global immunology drugs market, valued at approximately $150 billion in 2023, is anticipated to grow at a compound annual growth rate (CAGR) of around 6-7% through 2028, down from higher rates in previous years.

Similarly, while the neurology market continues to show positive growth trends, the intensity of competition within this segment is escalating. This heightened rivalry means companies must employ more aggressive strategies to capture and retain market share. The neurology market was estimated to be worth over $100 billion in 2023, with projected growth rates around 5-6% annually over the next five years.

The combined effect of slowing growth in these previously robust segments necessitates a more intense battle for market share among existing players. Companies are increasingly focused on differentiation and innovation to stand out in these maturing, yet still vital, therapeutic areas.

- Immunology Market Growth: Expected to slow from 2025 due to biosimil entry and market saturation.

- Neurology Market Competition: Growing, but facing intensified rivalry among pharmaceutical companies.

- Market Share Struggle: Slower growth in mature segments forces companies to compete more fiercely for existing customers.

- Financial Impact: Increased R&D and marketing spend may be required to maintain or grow market presence in these segments.

Exit Barriers and Industry Consolidation

High exit barriers in the biopharmaceutical industry, like specialized manufacturing facilities and significant, long-term research and development investments, often mean companies must continue operating even when facing challenges. This persistence intensifies competition. For instance, the substantial capital required for clinical trials and regulatory approvals creates a significant hurdle for exiting firms, forcing them to remain active players.

These substantial exit barriers frequently drive industry consolidation. Companies aim to achieve greater economies of scale, broaden their drug portfolios, or secure innovative new treatments through mergers and acquisitions. This trend was evident in 2024, with several major pharmaceutical companies engaging in strategic acquisitions to bolster their R&D pipelines and market presence.

- High Exit Barriers: Specialized assets, regulatory hurdles, and extensive R&D commitments keep companies in the market, intensifying rivalry.

- Industry Consolidation: Companies merge or acquire others to gain scale, diversify, or access new technologies, reshaping the competitive landscape.

- 2024 M&A Activity: Significant merger and acquisition deals continued in 2024, reflecting the drive for strategic consolidation within the sector.

Competitive rivalry within the biopharmaceutical sector, particularly in immunology and neurology, is intense. Companies like AbbVie, Amgen, Pfizer, and Novartis are heavily invested in R&D, launching new therapies and intensifying competition for market share. UCB's significant R&D spending, around 29% of its revenue in 2023, highlights the pressure to innovate in this crowded space.

The immunology market, valued at approximately $150 billion in 2023, is projected to grow at a CAGR of 6-7% through 2028, a slowdown from previous years due to biosimil competition and market saturation. Similarly, the neurology market, exceeding $100 billion in 2023, faces escalating rivalry, demanding aggressive strategies for market retention. These dynamics force companies to compete more fiercely for customers in maturing therapeutic areas.

| Key Therapeutic Area | 2023 Market Value (Approx.) | Projected CAGR (through 2028) | Key Competitive Factor |

| Immunology | $150 Billion | 6-7% | Biosimilar competition, market saturation |

| Neurology | >$100 Billion | 5-6% | Intensified rivalry, need for aggressive strategies |

SSubstitutes Threaten

The most significant threat of substitutes for UCB stems from the growing availability and acceptance of biosimilars and generics. These alternatives offer comparable therapeutic effects to UCB's patented biological and small molecule medications, but at a substantially reduced price. This directly impacts the market share and pricing leverage of UCB's original products.

The biosimilar market is anticipated to experience considerable growth, with projections indicating a significant expansion by 2025. This increasing competition from lower-cost alternatives poses a direct challenge to UCB's revenue streams and market dominance for its key therapies.

Alternative therapies pose a significant threat to UCB's established pharmaceutical products. These substitutes can range from other drug classes to non-pharmacological interventions. For example, in the neurology space where UCB is active, advancements in devices or even significant shifts towards lifestyle management could reduce reliance on traditional medications.

UCB must actively monitor and counter these threats by showcasing the distinct advantages of its treatments. In 2024, the global market for complementary and alternative medicine was projected to reach over $200 billion, indicating a substantial and growing consumer interest in options beyond conventional pharmaceuticals. This underscores the need for UCB to continually prove its value proposition.

The off-label use of existing drugs presents a significant threat to UCB. For instance, if UCB is developing a novel treatment for a specific neurological disorder, physicians might prescribe established medications approved for other conditions but found to be effective for the target ailment. This is particularly true if these off-label options are more affordable or readily available, as seen with the widespread off-label use of certain anti-epileptic drugs for neuropathic pain.

This practice can erode UCB's potential market share by fragmenting the patient population. Instead of patients seeking UCB's specialized therapy, they may opt for a cheaper, albeit unapproved for that specific use, alternative. This dynamic can impact UCB's revenue projections and the perceived value of its innovative treatments, especially in therapeutic areas with a history of such workarounds.

Preventative Measures and Disease Management

Advances in preventative medicine and early diagnosis pose a significant threat by reducing the need for UCB's pharmaceutical solutions. For instance, the development of effective vaccines or widespread public health campaigns can diminish the incidence of infectious diseases that UCB might otherwise treat. Similarly, improved diagnostic tools allowing for earlier detection of chronic conditions can lead to interventions that slow disease progression, potentially lessening reliance on later-stage UCB therapies.

Disease management programs, focusing on lifestyle changes and proactive care, also act as substitutes. These programs aim to keep patients healthier for longer, thereby decreasing the demand for specialized medications. UCB's market position could be impacted if these preventative and management strategies become more accessible and effective, potentially diverting patients from traditional treatment pathways.

Consider these factors:

- Vaccine Development: The global vaccine market is projected to reach over $70 billion by 2027, indicating significant investment in preventative health.

- Chronic Disease Management: In 2024, an estimated 60% of adults in the US live with at least one chronic disease, highlighting the ongoing need for management strategies that could reduce reliance on specific drug treatments.

- Early Detection Technologies: Advancements in AI-powered diagnostic imaging and genetic testing are making earlier disease detection more feasible, potentially shifting treatment paradigms.

Evolving Patient Preferences and Cost-Effectiveness

Patient preferences are increasingly shaped by convenience, the tolerability of side effects, and crucially, the overall cost-effectiveness of treatments. This evolving landscape directly impacts the threat of substitutes. For instance, in 2024, many patients are actively seeking treatment options that minimize disruption to their daily lives and offer a favorable side effect profile, often prioritizing these alongside efficacy.

As healthcare systems globally grapple with rising costs, therapies that deliver comparable clinical outcomes at a more accessible price point represent a substantial substitution threat. This is particularly evident in areas where originator drugs face patent expirations, leading to the emergence of biosimilars or generics. For example, the market for certain biologic drugs, which were once high-margin, is now seeing significant price erosion due to the availability of lower-cost alternatives, with some biosimilars entering the market at discounts exceeding 30% in 2024.

- Evolving Patient Priorities: Patients in 2024 are placing greater emphasis on convenience, reduced side effects, and demonstrable cost-effectiveness when choosing treatments.

- Cost-Consciousness in Healthcare: Healthcare providers and payers are more aggressively seeking therapies that offer a strong value proposition, driving demand for lower-cost alternatives.

- Impact of Biosimilars/Generics: The increasing availability and adoption of biosimilar and generic versions of established therapies directly challenge originator products by offering similar benefits at reduced prices.

- Market Dynamics: In 2024, the pharmaceutical market is witnessing a pronounced shift towards value-based pricing, where the perceived cost-effectiveness of a treatment heavily influences its market penetration and its ability to fend off substitutes.

The threat of substitutes for UCB is significant, driven by biosimilars, generics, and alternative therapies. These alternatives often provide comparable efficacy at lower costs, directly impacting UCB's market share and pricing power. For instance, the global biosimilar market is projected for substantial growth by 2025, intensifying this competitive pressure.

Beyond pharmaceuticals, advancements in preventative medicine, early diagnosis, and non-pharmacological interventions also pose a threat. Disease management programs focusing on lifestyle changes can reduce reliance on UCB's specialized treatments. In 2024, an estimated 60% of US adults live with at least one chronic disease, highlighting the potential for management strategies to substitute for specific drug treatments.

Patient preferences, increasingly prioritizing convenience, tolerability, and cost-effectiveness, further amplify the threat of substitutes. In 2024, many patients actively seek treatments that minimize disruption and offer a favorable side effect profile, often alongside efficacy. This trend, coupled with healthcare systems' focus on value-based pricing, makes lower-cost alternatives particularly appealing.

| Threat Category | Description | Impact on UCB | Key Data Point (2024/Projection) |

| Biosimilars & Generics | Lower-cost versions of UCB's patented drugs. | Erodes market share and pricing power. | Biosimilars entering market with >30% discounts (2024). |

| Alternative Therapies | Other drug classes, devices, lifestyle changes. | Reduces demand for UCB's specific treatments. | Global complementary medicine market >$200 billion (2024 projection). |

| Preventative Medicine & Early Diagnosis | Vaccines, public health campaigns, advanced diagnostics. | Decreases incidence and need for UCB's treatments. | Global vaccine market >$70 billion by 2027. |

Entrants Threaten

The biopharmaceutical sector presents a formidable barrier to new entrants due to the astronomical costs inherent in drug discovery and development. Securing regulatory approval for a new medication is a complex, multi-stage process that demands significant investment in research, preclinical testing, and extensive human clinical trials. These expenses can easily run into the billions of dollars, making it incredibly challenging for new companies to compete.

For instance, estimates suggest that the average cost to bring a new drug to market in the US, factoring in failures, can exceed $2 billion. This immense financial commitment and the extended timelines, often 10-15 years, effectively deter most potential new players from entering the market, thereby protecting established firms like UCB.

Stringent regulatory approval processes represent a significant barrier to entry for new players in the pharmaceutical industry. Companies like UCB must invest heavily in research and development, clinical trials, and navigating complex pathways with bodies such as the FDA and EMA. This lengthy and costly journey, often taking over a decade and costing billions, deters many potential entrants.

The high failure rate in drug development further compounds this threat. For instance, it's estimated that only about 10% of drugs that enter clinical trials eventually gain regulatory approval. This means that even with substantial initial investment, the probability of success is low, making the prospect of entering the market daunting for newcomers.

UCB's robust intellectual property portfolio, particularly its patents on innovative biopharmaceuticals, acts as a significant barrier to new entrants. These patents grant UCB exclusive rights to its novel compounds for a defined period, preventing competitors from directly replicating its core products. For instance, UCB's strong patent protection on key therapies in neurology and immunology significantly limits the ability of new players to enter these lucrative markets with comparable offerings.

Need for Established Distribution and Market Access Networks

Newcomers face a formidable barrier in establishing the extensive distribution channels and market access crucial for pharmaceutical success. UCB, for instance, has cultivated deep-rooted relationships with payers, hospitals, and a wide array of healthcare providers over many years. These established networks represent significant sunk costs and entrenched loyalty, making it exceedingly difficult and expensive for new entrants to gain comparable traction.

Consider the sheer scale of investment required; building a global distribution infrastructure capable of reaching diverse markets and ensuring timely delivery of sensitive pharmaceuticals is a monumental undertaking. For example, in 2024, the cost of establishing a new pharmaceutical distribution network in emerging markets alone can run into tens of millions of dollars, not to mention the ongoing operational expenses and regulatory compliance.

Furthermore, securing favorable formulary placement and reimbursement status from payers is a complex, data-intensive process that favors incumbents with proven track records and established health economic data. New entrants must not only demonstrate therapeutic efficacy but also navigate intricate pricing negotiations and market access hurdles that UCB and similar established firms have mastered.

- High Capital Investment: Building a global distribution network requires substantial upfront capital, often exceeding hundreds of millions of dollars.

- Established Relationships: Incumbents possess long-standing ties with key stakeholders like hospitals and payers, creating significant hurdles for new entrants.

- Regulatory Complexity: Navigating diverse international regulations for distribution and market access adds layers of cost and time.

- Market Access Hurdles: Gaining formulary acceptance and favorable reimbursement from payers is a protracted and data-driven process favoring established players.

Brand Recognition and Economies of Scale

Established biopharmaceutical firms, like UCB, possess significant advantages due to strong brand recognition and trust cultivated through years of successful product development and patient interaction. This deep-seated trust acts as a substantial barrier, making it difficult for new entrants to gain market share quickly.

Moreover, these incumbents benefit from considerable economies of scale. Their large-scale operations in research and development, manufacturing, and marketing allow for lower per-unit costs compared to smaller, emerging companies. For instance, in 2024, major pharmaceutical companies continued to leverage their existing infrastructure to outpace smaller rivals in bringing new therapies to market efficiently.

- Brand Loyalty: UCB's established reputation in neurology and immunology fosters patient and physician loyalty, a difficult asset for newcomers to replicate.

- R&D Investment: Major players consistently invest billions annually in R&D, creating a high barrier to entry for companies lacking comparable financial resources. In 2024, the top ten pharmaceutical companies collectively spent over $100 billion on R&D.

- Manufacturing Efficiency: Existing large-scale manufacturing facilities allow incumbents to produce drugs at a lower cost, presenting a pricing challenge for new entrants.

The threat of new entrants for UCB is significantly mitigated by the immense capital requirements for drug development, estimated to cost over $2 billion per successful drug, and the lengthy, decade-plus regulatory approval process. Furthermore, UCB's strong patent portfolio, established distribution networks, and brand loyalty create substantial barriers, making it exceedingly difficult and costly for newcomers to compete effectively in the biopharmaceutical market.

The high failure rate in clinical trials, with only about 10% of drugs reaching approval, adds another layer of risk for potential new entrants. In 2024, the pharmaceutical industry continued to see massive R&D investments, with the top ten companies alone spending over $100 billion, underscoring the financial might required to challenge established players like UCB.

| Barrier Type | Description | Impact on New Entrants | Example for UCB | 2024 Data Point |

|---|---|---|---|---|

| Capital Investment | High costs for R&D, clinical trials, and regulatory approval. | Deters new companies due to financial risk. | UCB's investment in developing treatments for rare diseases. | Average cost to bring a new drug to market exceeds $2 billion. |

| Intellectual Property | Patents protect novel compounds and therapies. | Prevents direct replication of core products. | UCB's patents on key neurology and immunology drugs. | Patent protection is crucial for recouping R&D costs. |

| Distribution & Market Access | Established relationships with healthcare providers and payers. | Difficult for new entrants to gain access and reimbursement. | UCB's long-standing partnerships with hospitals and insurers. | Establishing new distribution channels in emerging markets can cost tens of millions. |

| Brand Recognition & Scale | Strong brand loyalty and economies of scale in operations. | New entrants struggle to build trust and achieve cost efficiencies. | UCB's established reputation in its therapeutic areas. | Top pharmaceutical companies' R&D spending in 2024 exceeded $100 billion. |

Porter's Five Forces Analysis Data Sources

Our UCB Porter's Five Forces analysis is built upon a robust foundation of data, drawing from UCB's annual reports, investor presentations, and regulatory filings. We supplement this with insights from reputable industry analysis firms and market research reports to provide a comprehensive view of the competitive landscape.