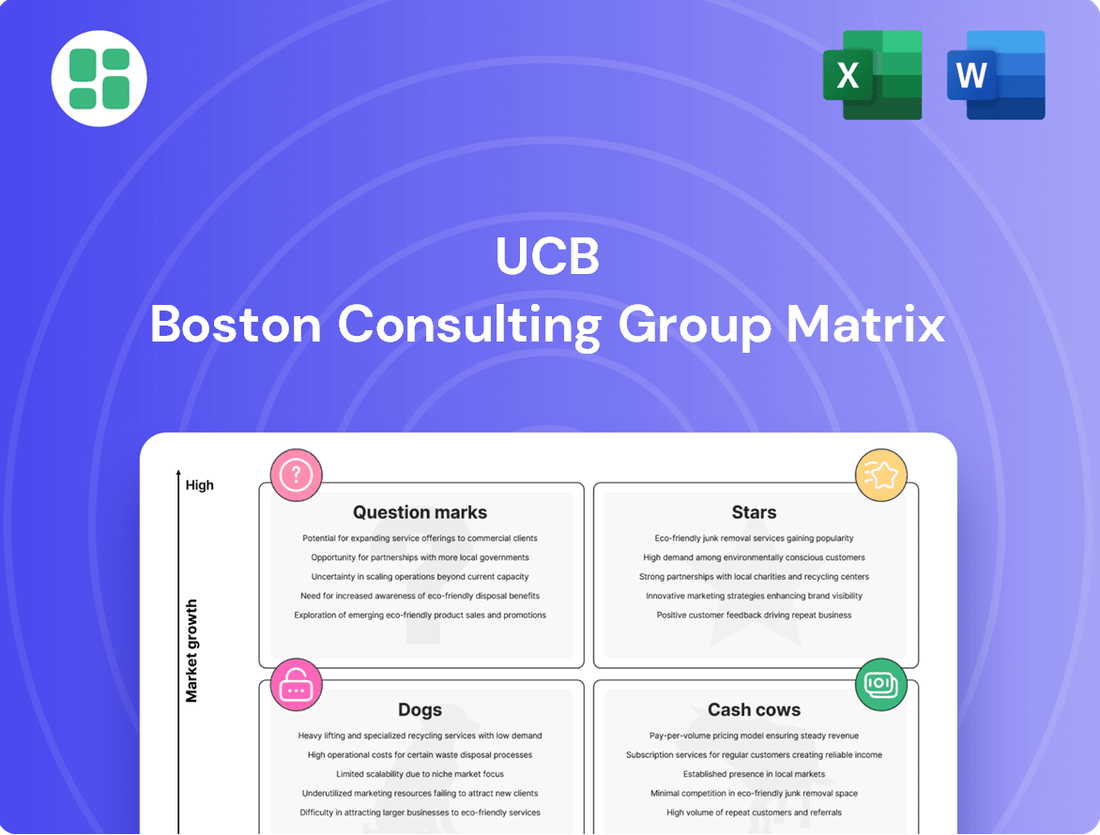

UCB Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UCB Bundle

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This preview offers a glimpse into how these strategic quadrants can illuminate your business's current standing.

To truly unlock the potential of this analysis and gain actionable insights for optimizing your product mix and resource allocation, dive deeper with the full BCG Matrix report. It's your essential guide to making informed strategic decisions and driving sustainable growth.

Stars

Bimzelx is a significant growth driver for UCB, demonstrating robust sales momentum. In 2024, it secured approvals for psoriatic arthritis, axial spondyloarthritis, and hidradenitis suppurativa, expanding its market reach.

The drug is projected to reach blockbuster status by 2025, making it a central pillar of UCB's future revenue expansion. UCB is making substantial investments in Bimzelx's global rollout to capitalize on its strong market potential.

Rystiggo (rozanolixizumab) is a significant player in UCB's portfolio, positioned as a Star in the BCG Matrix. Its rapid sales growth since its 2023 U.S. launch and global expansion in Q1 2024 underscores its high market share in the burgeoning generalized myasthenia gravis (gMG) segment.

As one of UCB's five core growth drivers, Rystiggo's trajectory indicates strong potential for continued investment and market penetration. The company is actively leveraging this momentum to solidify its position in a therapeutic area with substantial unmet needs and expanding treatment options.

Zilbrysq (zilucoplan), launched globally in April 2024, is a significant new revenue driver for UCB. This targeted C5 complement inhibitor for generalized myasthenia gravis (gMG) is rapidly gaining market acceptance, aligning perfectly with UCB's long-term growth ambitions.

Fintepla (fenfluramine)

Fintepla, a key product for UCB, is demonstrating robust performance, particularly in its approved indications for rare epileptic syndromes like Dravet Syndrome and Lennox-Gastaut Syndrome. Its classification as a star within the BCG matrix is well-supported by its consistent growth trajectory and its role as a central pillar for UCB's future expansion. The drug's market penetration is expected to increase with its recent approval and launch in Japan during 2024, signaling significant upside potential in a specialized but expanding therapeutic area.

- Fintepla's Market Position: Identified as a star due to strong growth in rare epilepsy treatments.

- Key Growth Driver: Central to UCB's strategy for future revenue generation.

- Geographic Expansion: Entry into Japan in 2024 enhances its global reach and market share potential.

- Therapeutic Niche: Addresses significant unmet needs in Dravet Syndrome and Lennox-Gastaut Syndrome.

Evenity (romosozumab)

Evenity, a treatment for severe postmenopausal osteoporosis co-developed by UCB, is a notable performer within the company's portfolio. Its robust growth trajectory is evident in UCB's reported net sales figures for Europe, showing a positive trend.

The drug's substantial contribution to UCB's other operating income highlights its financial significance. Evenity's strong market presence, even as a co-marketed product, solidifies its position as a high-growth asset for UCB.

- Evenity's European net sales have shown an increase, indicating strong market adoption.

- The product significantly bolsters UCB's other operating income, demonstrating its commercial success.

- Despite being co-marketed, Evenity maintains a strong market presence, classifying it as a high-growth product.

Bimzelx is a prime example of a Star in UCB's portfolio, showing impressive sales growth. Its 2024 approvals for psoriatic arthritis, axial spondyloarthritis, and hidradenitis suppurativa significantly broadened its market access. With projections to achieve blockbuster status by 2025, Bimzelx is a key driver for UCB's future revenue. UCB's strategic investments in its global rollout are designed to maximize its considerable market potential.

| Product | BCG Category | Key Growth Factor | 2024 Milestones | Projected Impact |

|---|---|---|---|---|

| Bimzelx | Star | Broadening therapeutic indications | Approvals for PsA, axSpA, HS | Blockbuster status by 2025 |

| Rystiggo | Star | High market share in gMG | Global expansion in Q1 2024 | Continued strong market penetration |

| Zilbrysq | Star | New revenue driver for gMG | Global launch in April 2024 | Alignment with long-term growth |

| Fintepla | Star | Consistent growth in rare epilepsies | Japan launch in 2024 | Increased market share in niche indication |

| Evenity | Star | Strong sales growth and operating income contribution | Increased European net sales | High-growth asset status |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Clear visual mapping of business units to strategic actions, alleviating the pain of indecision.

Cash Cows

Cimzia, UCB's anti-TNF biologic, continues to be a strong performer, demonstrating resilience even with anticipated pricing pressures and the U.S. patent expiry in 2024. It remains a significant contributor to UCB's net sales, underscoring its role as a cash cow.

With a high market share in established immunology indications such as rheumatoid arthritis, Cimzia consistently generates substantial cash flow for UCB. This reliable revenue stream is crucial for funding the company's investments in its pipeline and other strategic initiatives.

Briviact, UCB's epilepsy medication, has surpassed its peak sales projections, reaching this milestone ahead of schedule. This strong performance solidifies its position as a significant revenue generator for the company.

As a dependable product in the established epilepsy market, Briviact functions as a cash cow for UCB. Its consistent cash flow generation requires minimal additional investment, freeing up resources for other strategic initiatives.

Nayzilam, UCB's midazolam nasal spray approved in 2019, is a key player in the acute repetitive seizure market. Its established presence in the U.S. signifies a stable, cash-generating asset within UCB's portfolio.

While not a high-growth product, Nayzilam's consistent commercialization efforts ensure it contributes reliably to UCB's revenue stream. In 2024, its performance is expected to remain steady, reflecting its mature status in a niche neurological segment.

Levetiracetam (generic sales)

Levetiracetam, the active pharmaceutical ingredient behind the epilepsy medication Keppra, continues to be a significant cash generator for UCB, even as its branded version faces generic competition in developed markets. This mature product, now widely available as a generic, demonstrates sustained global sales, particularly in emerging economies where its accessibility is growing.

The broad availability of levetiracetam as a generic means it functions as a cash cow for UCB. Its established efficacy and relatively low cost compared to newer treatments ensure consistent demand.

- Global Levetiracetam Market: The global levetiracetam market was estimated to be worth approximately $2.5 billion in 2023, with projections indicating continued steady demand.

- Emerging Market Growth: Sales in emerging markets are a key driver, with an estimated 8-10% annual growth rate for generic antiepileptic drugs like levetiracetam.

- Sustained Demand: Despite generic erosion, the sheer volume of prescriptions globally ensures significant, reliable cash flow from levetiracetam.

Older Epilepsy Portfolio

UCB's older epilepsy portfolio represents a stable cash cow. These established treatments, while not exhibiting rapid market expansion, consistently cater to a significant patient population, ensuring reliable revenue streams for the company. This segment is crucial for funding UCB's investments in newer, high-growth areas.

These products are characterized by their maturity and established market presence. For instance, as of late 2024, UCB's portfolio includes several well-recognized epilepsy medications that have been available for many years, contributing a substantial portion to the company's overall revenue without requiring significant new investment for growth.

- Stable Revenue Generation: The older epilepsy drugs provide a predictable and consistent income, acting as a reliable financial foundation for UCB.

- Established Market Position: These treatments have a proven track record and a loyal patient base, minimizing the risk associated with market fluctuations.

- Funding for Innovation: The cash generated by these mature products is vital for UCB's research and development efforts in pioneering new therapies.

Cash cows in UCB's portfolio are established products with high market share that generate consistent revenue with minimal investment. Cimzia, an anti-TNF biologic, and Briviact, an epilepsy medication, exemplify this category. Nayzilam, a midazolam nasal spray, also contributes steadily to UCB's revenue. These mature products provide a stable financial foundation, crucial for funding research and development in new therapeutic areas.

| Product | Market Status | Role | Key Data Point (2024/Latest) |

|---|---|---|---|

| Cimzia | Established Immunology | Cash Cow | Strong performer despite U.S. patent expiry in 2024. |

| Briviact | Established Epilepsy | Cash Cow | Surpassed peak sales projections ahead of schedule. |

| Nayzilam | Established Neurology | Cash Cow | Stable contributor with consistent commercialization. |

| Levetiracetam (Keppra API) | Mature Epilepsy Market | Cash Cow | Sustained global sales, particularly in emerging markets. |

Preview = Final Product

UCB BCG Matrix

The UCB BCG Matrix preview you are viewing is the identical, fully finalized document you will receive upon purchase. This means no watermarks or placeholder content, ensuring you get a complete, professionally formatted strategic tool. You can confidently expect the same in-depth analysis and clear presentation that will aid your business planning immediately after acquisition. This is your direct access to a ready-to-use BCG Matrix for informed decision-making.

Dogs

Keppra, a cornerstone epilepsy medication from UCB, has transitioned into a mature product within the company's portfolio. Its status as an off-patent drug for over ten years, coupled with significant generic competition, places it firmly in the 'Dog' category of the BCG Matrix.

In 2023, Keppra's sales continued to reflect this challenging market dynamic, experiencing a notable decline. This erosion is particularly pronounced in key developed markets such as North America and Japan, where generic alternatives have captured substantial market share.

The intense competitive landscape, characterized by numerous generic entrants, has led to significant price erosion. Consequently, Keppra exhibits both low market share and low growth prospects, aligning with the typical profile of a 'Dog' in strategic portfolio analysis.

Vimpat, a key epilepsy treatment from UCB, is now facing significant challenges. The drug lost its patent protection in both the U.S. and European Union back in 2022. This opened the door for generic versions, which naturally put downward pressure on Vimpat's sales figures.

Further illustrating its shift in strategic importance, UCB completed the divestment of its rights for Vimpat in China in November 2024. This move signals that Vimpat is no longer considered a core, high-growth asset within UCB's portfolio, placing it in a category likely to generate lower returns and experience reduced investment.

Neupro, a key treatment for Parkinson's disease, is currently positioned as a question mark in UCB's BCG Matrix. While it has a significant market presence, the looming threat of generic competition, with a crucial trial set for 2024 to clarify launch timelines, casts uncertainty over its future growth trajectory.

This potential for market erosion, coupled with its established position in a mature therapeutic area, firmly places Neupro in the low-growth, low-market-share quadrant. The outcome of the 2024 trial will be a critical determinant in its strategic reclassification.

Atarax (hydroxyzine)

Atarax, a well-known allergy medication, was divested by UCB in November 2024 for its European and certain Asia-Pacific and Latin American markets. This move places Atarax in the Dogs category of the BCG Matrix, indicating it's a non-core asset with limited growth prospects for UCB. The divestment generated an undisclosed amount, reflecting its mature market position.

The strategic decision to divest Atarax aligns with UCB's focus on its core therapeutic areas, such as neurology and immunology. This allows UCB to reallocate resources towards products with higher growth potential, a common strategy for companies managing a diverse portfolio.

- Divestment Date: November 2024

- Market Focus: Europe, selected Latin America and Asia-Pacific countries

- BCG Matrix Classification: Dogs

- Strategic Implication: Non-core asset with low future growth potential for UCB

Nootropil (piracetam)

Nootropil, a well-established pharmaceutical brand, was divested by UCB in November 2024 across Europe and other key markets. This divestiture aligns with UCB's strategic decision to shed mature, lower-growth assets.

The sale of Nootropil suggests it occupied a position in the BCG matrix characterized by low market growth and likely a relatively low market share within UCB's portfolio. Such products are often considered cash cows or question marks, depending on their specific growth trajectory and competitive standing, but the divestment points towards a strategic pruning of less impactful brands.

The financial impact of this divestiture would reflect the sale of a mature product line, potentially freeing up capital for UCB to reinvest in its pipeline of innovative, high-growth therapies.

- Divestiture Date: November 2024

- Geographic Scope: Europe and other regions

- Product Status: Established, mature brand

- BCG Matrix Implication: Likely low growth, low market share

UCB's strategic portfolio management includes divesting products that no longer align with its growth objectives. Atarax and Nootropil, both divested in November 2024, exemplify this. These products, having reached maturity and facing limited growth prospects, are now classified as Dogs in the BCG Matrix. This classification indicates they possess low market share and low market growth, making them non-core to UCB's future strategy.

The divestment of these established brands allows UCB to redirect resources towards its pipeline of innovative therapies, particularly in neurology and immunology. This strategic reallocation is crucial for maintaining a competitive edge and driving future revenue growth. The decision to exit markets for Atarax in Europe and select Asia-Pacific and Latin American regions, alongside Nootropil's divestiture across Europe and other key markets, underscores this focus on high-potential assets.

By shedding these 'Dog' category products, UCB aims to optimize its portfolio, ensuring that investments are concentrated on areas with the greatest potential for significant returns and market leadership. This approach is vital for long-term financial health and scientific advancement.

UCB's portfolio management strategy involves identifying and divesting mature products with limited growth potential, such as Atarax and Nootropil, which were divested in November 2024. These products fall into the 'Dogs' category of the BCG Matrix, characterized by low market share and low market growth. This strategic pruning allows UCB to concentrate resources on its core therapeutic areas, neurology and immunology, and invest in promising pipeline assets.

Question Marks

Dapirolizumab pegol, an investigational therapy for systemic lupus erythematosus (SLE), is positioned as a potential star in UCB's BCG matrix. Its Phase 3 development signifies substantial future growth prospects in a market with significant unmet needs.

While dapirolizumab pegol currently holds no market share due to its investigational status, its late-stage development suggests a strong potential to capture significant market share upon regulatory approval, making it a high-potential, albeit currently unproven, asset.

UCB9741/galvokimig, a bispecific antibody, is currently in Phase 2a trials for atopic dermatitis. This innovative therapy targets a significant and expanding dermatology market, indicating substantial future growth potential.

As a product in the early-to-mid stages of development, UCB9741/galvokimig would be classified as a question mark in the UCB BCG Matrix. It represents a high-potential investment due to its promising Phase 2a data and the growing market it addresses, but currently holds minimal to no market share.

Donzakimig, a promising pipeline asset in Phase 2 clinical trials, is targeting IL-13 and IL-22, with crucial data anticipated in the second half of 2025. This ongoing development signifies substantial future growth potential within its specific therapeutic niche, positioning it as a potential star in UCB's portfolio.

While its clinical progress suggests strong future prospects, Donzakimig's market share is yet to be determined, placing it in a category that requires careful monitoring. Its classification within the BCG matrix would likely be as a question mark, given its high growth potential but uncertain market position.

STACCATO alprazolam

STACCATO alprazolam, as an investigational therapy for prolonged seizures, would likely be positioned as a Question Mark in the UCB BCG Matrix. Its status as an unapproved treatment signifies high future growth potential within a specialized neurology market, but it currently possesses zero market share.

This classification highlights the inherent risk and reward. While STACCATO alprazolam aims to address a significant unmet need, its success hinges on regulatory approval and market adoption, making its future market share uncertain. For instance, the global market for epilepsy drugs was valued at approximately $11.4 billion in 2023 and is projected to grow, indicating a potentially lucrative space for effective new treatments.

The strategic imperative for STACCATO alprazolam would be to invest heavily to build market share, or consider divesting if the investment required to move it towards a Star is deemed too risky or unlikely to succeed. UCB’s focus would be on clinical trial success and preparing for a strong market launch.

- Investigational Status: STACCATO alprazolam is in development, not yet approved.

- Market Opportunity: Targets a niche but potentially high-growth area in neurology.

- Current Market Share: Zero, as it is not yet commercialized.

- Strategic Consideration: Requires significant investment to gain market share or faces potential divestment.

Doxecitine and doxribtimine

Doxecitine and doxribtimine, investigational treatments for thymidine kinase 2 deficiency (TK2d), represent potential future stars in UCB's portfolio. Both have secured priority review status in the U.S. and EU, indicating strong regulatory progress and a clear path toward market introduction.

While their current market share is zero due to their investigational status, their advanced regulatory standing suggests a significant opportunity for rapid market penetration and subsequent growth once approved. This positions them as high-potential, yet unproven, assets.

- Therapy Focus: Investigational treatments for thymidine kinase 2 deficiency (TK2d).

- Regulatory Status: Filed for review in U.S. and EU with priority review granted.

- Market Potential: High potential for market entry and rapid growth post-approval.

- Current Market Share: Absent, as therapies are still investigational.

Question Marks in UCB's BCG Matrix represent products with high growth potential but low market share. These are typically new products or those in early development stages that require significant investment to capture market share.

UCB's pipeline includes several such assets, like UCB9741/galvokimig and Donzakimig, which are in clinical trials for conditions like atopic dermatitis and targeting IL-13/IL-22 respectively. STACCATO alprazolam for prolonged seizures also falls into this category.

These products are crucial for UCB's future growth but carry inherent risks, demanding careful strategic decisions regarding investment or potential divestment based on trial outcomes and market dynamics.

The strategic imperative for these Question Marks is to invest to build market share or to divest if the required investment is too high or the probability of success is low.

| Product | Therapeutic Area | Development Stage | Market Share | BCG Classification |

|---|---|---|---|---|

| UCB9741/galvokimig | Atopic Dermatitis | Phase 2a | Minimal to none | Question Mark |

| Donzakimig | IL-13/IL-22 related conditions | Phase 2 | None | Question Mark |

| STACCATO alprazolam | Prolonged Seizures | Investigational | Zero | Question Mark |

| Doxecitine | Thymidine Kinase 2 Deficiency (TK2d) | Investigational (Priority Review) | Zero | Question Mark |

| Doxribtimine | Thymidine Kinase 2 Deficiency (TK2d) | Investigational (Priority Review) | Zero | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages financial disclosures, market share data, and industry growth projections to provide a comprehensive strategic overview.