UCB Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UCB Bundle

Curious about UCB's innovative approach to healthcare? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic framework that fuels their growth and patient impact.

Partnerships

UCB actively cultivates strategic alliances with other biotech and pharma companies, often through co-development and licensing agreements. These collaborations are crucial for sharing the substantial risks and potential rewards inherent in drug discovery, development, and eventual commercialization. For instance, UCB's partnership with Roche on the Alzheimer's drug candidate, ALZ801, exemplifies this strategy, aiming to accelerate the delivery of novel treatments to patients.

UCB's strategic reliance on Contract Research Organizations (CROs) is fundamental to its global clinical trial execution. These partnerships are vital for managing the complexities of patient recruitment, meticulous data management, and navigating stringent regulatory submissions across diverse geographies. For instance, in 2024, the global CRO market was projected to reach over $50 billion, highlighting the significant scale of outsourcing in the pharmaceutical industry, a trend UCB actively leverages to accelerate its drug development pipeline.

By entrusting specialized tasks to CROs, UCB effectively outsources critical operational components of its clinical development programs. This includes expertise in areas such as biostatistics, medical writing, and pharmacovigilance, allowing UCB to maintain agility and efficiency. This model enables UCB’s internal teams to concentrate on core competencies like drug discovery and strategic R&D planning, thereby optimizing resource allocation and fostering innovation.

UCB actively collaborates with academic institutions and research centers worldwide to fuel its innovation engine. These partnerships are crucial for identifying promising early-stage research and uncovering fundamental scientific breakthroughs. For example, in 2024, UCB continued its investment in numerous university research programs, focusing on areas like neuroinflammation and immunology, which are key to its pipeline development.

Patient Advocacy Groups and Foundations

UCB actively partners with patient advocacy groups and disease-specific foundations. These collaborations are crucial for understanding patient needs and treatment gaps, directly informing UCB's research and development priorities. For instance, in 2024, UCB continued its engagement with numerous organizations focused on neurology and immunology, ensuring their pipeline reflects real-world patient experiences.

These partnerships offer UCB invaluable qualitative data, guiding the development of more effective and patient-friendly therapies. They also play a vital role in enhancing disease awareness and providing support to patient communities, fostering a more informed and empowered patient population.

- Patient Insights: Direct feedback from patient groups helps UCB refine its drug development process to better meet unmet medical needs.

- Disease Awareness: Collaborations amplify public understanding of complex conditions like epilepsy and inflammatory diseases.

- Community Support: Foundations supported by UCB often provide resources and educational materials to patients and their families.

Distributors and Healthcare Providers

UCB's business model relies heavily on its key partnerships with distributors and healthcare providers to ensure its innovative medicines reach patients effectively. These collaborations are crucial for navigating the complex healthcare landscape and guaranteeing product accessibility.

Partnerships with wholesalers, specialty pharmacies, and extensive hospital networks form the backbone of UCB's distribution strategy. These entities are vital for the efficient and safe delivery of UCB's therapies to healthcare professionals and ultimately to patients who need them. For instance, in 2024, UCB continued to strengthen its relationships with major pharmaceutical distributors across key markets, ensuring broad market penetration and consistent product availability.

- Wholesalers: These partners manage the large-scale movement of pharmaceuticals from manufacturers to pharmacies and hospitals.

- Specialty Pharmacies: Crucial for UCB's biologics and complex therapies, these pharmacies provide specialized handling, patient support, and adherence programs.

- Hospital Networks: Direct engagement with hospital systems and their pharmacy departments is essential for inpatient and outpatient access to UCB's treatments.

UCB's extensive network of key partnerships is fundamental to its operational success and market reach. These alliances span research, development, distribution, and patient engagement, creating a robust ecosystem that supports its mission to deliver innovative treatments.

In 2024, UCB continued to leverage strategic co-development and licensing agreements with other pharmaceutical and biotech firms, sharing both the significant risks and rewards of drug innovation. The company also deepened its reliance on Contract Research Organizations (CROs), a market projected to exceed $50 billion in 2024, to manage global clinical trials efficiently. Furthermore, collaborations with academic institutions and patient advocacy groups remained vital for driving scientific discovery and ensuring patient needs are central to R&D efforts.

| Partnership Type | Key Role | 2024 Relevance/Data Point |

|---|---|---|

| Biotech/Pharma Alliances | Co-development, Licensing, Risk Sharing | Continued focus on accelerating novel treatments, e.g., Alzheimer's drug candidate partnerships. |

| Contract Research Organizations (CROs) | Clinical Trial Execution, Data Management, Regulatory Submissions | Global CRO market projected over $50 billion in 2024, highlighting outsourcing scale. |

| Academic Institutions & Research Centers | Early-stage Research, Scientific Breakthroughs | Ongoing investment in university programs for neuroinflammation and immunology research. |

| Patient Advocacy Groups & Foundations | Patient Insights, Disease Awareness, Treatment Gap Identification | Continued engagement with neurology and immunology organizations to inform R&D priorities. |

| Distributors & Healthcare Providers | Product Access, Distribution Logistics, Patient Support | Strengthening relationships with major pharmaceutical distributors for market penetration and availability. |

What is included in the product

A structured framework outlining key business components like customer segments, value propositions, and revenue streams, designed for strategic planning and analysis.

This model provides a holistic view of how a business creates, delivers, and captures value, facilitating clear communication and decision-making.

It streamlines the identification of business model weaknesses, allowing for targeted solutions and improved operational efficiency.

Activities

UCB's core activity revolves around intensive research and development to create novel treatments, with a strong focus on immunology and neurology. This process encompasses everything from pinpointing disease targets and refining potential drug candidates to conducting preclinical studies and developing effective formulations.

In 2024, UCB continued to invest heavily in its R&D pipeline, a critical driver for its mission to tackle significant unmet medical needs. For instance, the company has been advancing its late-stage pipeline assets, aiming for regulatory submissions in key therapeutic areas.

UCB's clinical trials management is a critical engine for innovation, encompassing the meticulous planning, execution, and oversight of studies from early-stage (Phase I) to post-market surveillance (Phase IV). This process is fundamental to validating the safety and efficacy of new therapeutic candidates. For instance, UCB's investment in research and development, which fuels these trials, reached approximately €1.1 billion in 2023, highlighting the significant resources dedicated to this key activity.

The company must navigate complex global regulatory landscapes, ensuring strict adherence to standards set by bodies like the FDA and EMA. This includes robust data collection and analysis, which are essential for regulatory submissions and ultimately securing market access for life-changing treatments.

UCB’s manufacturing and supply chain operations are central to its mission, focusing on producing high-quality pharmaceutical products and ensuring their global availability. This involves a sophisticated network designed for consistency and reliability.

In 2024, UCB continued to invest in its manufacturing capabilities, aiming to enhance efficiency and meet growing patient needs. The company’s commitment to stringent quality control across its production facilities is paramount, ensuring that every medicine delivered meets the highest standards.

Managing a complex global supply chain is a key activity for UCB. This intricate system ensures that life-changing therapies reach patients worldwide in a timely manner. The company’s logistics are optimized to navigate diverse regulatory environments and geographical challenges, underscoring the critical role of supply chain management in patient access.

Regulatory Affairs and Market Access

UCB's key activities in Regulatory Affairs and Market Access involve meticulously navigating intricate global regulatory frameworks to secure market authorization for its innovative therapies. This includes proactive engagement with health authorities like the FDA in the United States and the EMA in Europe, ensuring all development and submission processes meet stringent compliance standards. For instance, in 2024, UCB continued its efforts to gain approvals for new indications of existing treatments, alongside submissions for novel drug candidates, underscoring the critical nature of these interactions.

Beyond regulatory approval, UCB actively pursues market access, a vital component for commercial viability. This encompasses strategic negotiations with payers and health technology assessment bodies across various countries to establish favorable pricing and reimbursement conditions. Successful market access ensures that UCB's medicines reach the patients who need them most. In 2024, the company focused on demonstrating the value proposition of its therapies through robust health economic data, aiming to secure positive reimbursement decisions in key markets.

- Global Regulatory Navigation: UCB actively engages with regulatory agencies worldwide to achieve market authorization for its pharmaceutical products, a process requiring deep understanding of diverse compliance requirements.

- Market Access Strategies: Crucial activities include negotiating pricing and reimbursement with national health systems and insurers to ensure patient access to UCB's therapies.

- Compliance and Data Integrity: Maintaining strict adherence to regulatory guidelines throughout the product lifecycle is paramount, supported by robust data management practices.

- Value Demonstration: UCB invests in generating real-world evidence and health economic data to support the value of its treatments during market access negotiations.

Sales, Marketing, and Medical Affairs

UCB's sales, marketing, and medical affairs are crucial for bringing its innovative therapies to those who need them. These teams work diligently to educate healthcare professionals and patients about UCB's treatments, ensuring they understand the benefits and proper usage. This engagement is key to driving product adoption and ultimately improving patient lives.

In 2024, UCB continued its focus on commercializing its neurology and immunology portfolios. The company's sales force actively engages with physicians and pharmacists, providing scientific data and support. Medical affairs teams collaborate with key opinion leaders and patient advocacy groups to disseminate important information and foster understanding of UCB's therapeutic areas.

- Commercialization: UCB's commercialization efforts in 2024 focused on expanding access to its approved therapies for severe diseases.

- Healthcare Professional Engagement: The company's medical affairs and sales teams conducted numerous scientific exchange meetings and educational events for physicians and pharmacists throughout the year.

- Patient Advocacy: UCB maintained strong partnerships with patient organizations, supporting initiatives aimed at raising disease awareness and improving patient care.

- Product Information: Providing accurate and up-to-date scientific information remains a cornerstone of UCB's communication strategy to ensure appropriate product use.

UCB's strategic partnerships and alliances are vital for expanding its reach and capabilities. These collaborations facilitate co-development, co-commercialization, and access to new technologies or markets. By working with other pharmaceutical companies, research institutions, and biotechnology firms, UCB can accelerate innovation and bring more treatments to patients faster.

In 2024, UCB continued to actively seek and nurture strategic collaborations. For example, the company may engage in licensing agreements or research collaborations to access promising early-stage assets. These partnerships are crucial for diversifying its pipeline and leveraging external expertise.

| Key Activity | Description | 2024 Focus/Example |

| Strategic Partnerships & Alliances | Collaborating with external entities to enhance R&D, market access, and commercialization efforts. | Seeking co-development opportunities for late-stage pipeline assets and licensing agreements for novel targets. |

| Technology Access | Acquiring or licensing new technologies to improve drug discovery, development, or manufacturing processes. | Exploring partnerships for advanced drug delivery systems or novel screening platforms. |

| Market Expansion | Forming alliances to enter new geographical markets or expand presence in existing ones. | Potential collaborations with local distributors or partners for market entry in emerging economies. |

Preview Before You Purchase

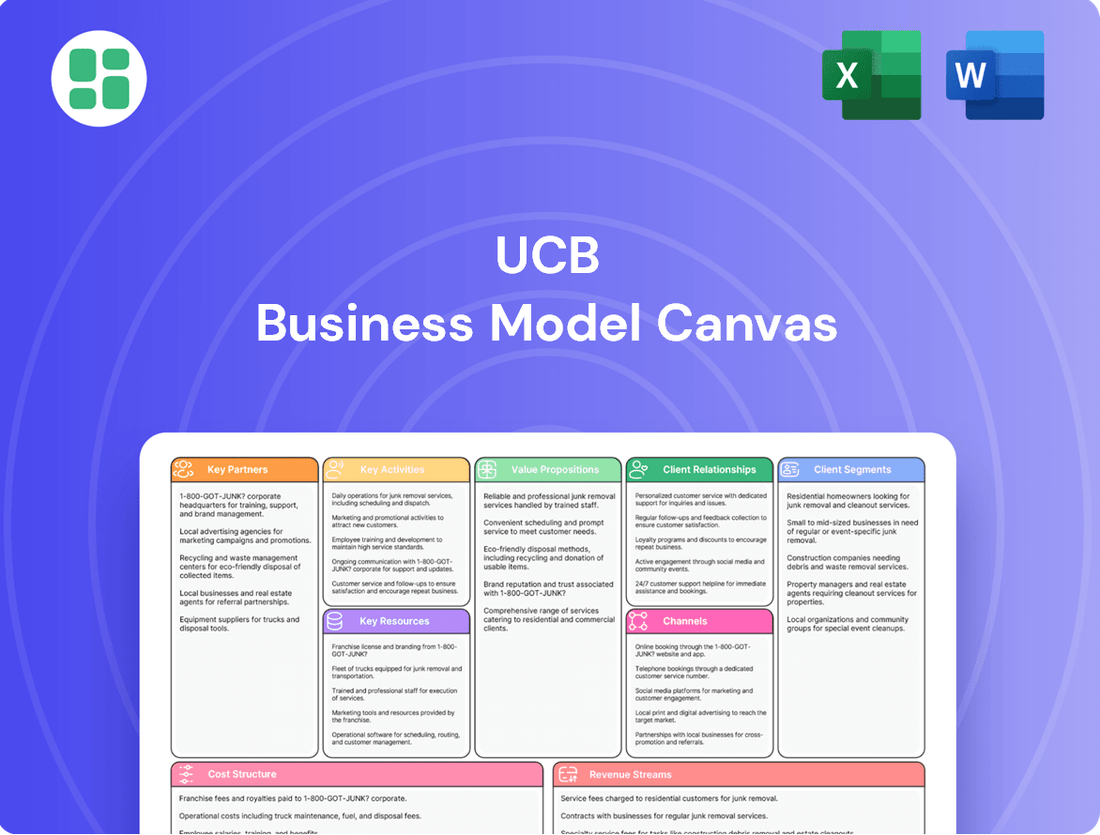

Business Model Canvas

This preview showcases the exact UCB Business Model Canvas you'll receive upon purchase. It's a direct snapshot of the comprehensive document, meticulously crafted for clarity and actionable insights. You're not seeing a sample; you're viewing the authentic deliverable, ready for your strategic planning.

Resources

UCB's intellectual property, particularly its patents on innovative drug molecules, formulations, and manufacturing methods, forms a cornerstone of its business. These patents are vital for safeguarding UCB's substantial research and development expenditures.

By securing these patents, UCB gains a significant competitive edge, effectively barring competitors from replicating and marketing its products without authorization. This exclusivity is fundamental to UCB's ability to recoup its R&D investments and fund future innovation.

For instance, UCB's strong patent portfolio underpins the market exclusivity of its key therapies, such as those for epilepsy and Parkinson's disease, allowing it to generate revenue necessary for ongoing pipeline development.

UCB's highly skilled human capital is a cornerstone of its business model, particularly its deep bench of scientists, researchers, and clinical development specialists. These individuals possess specialized expertise in immunology and neurology, critical areas for UCB's focus.

Their proficiency in drug discovery and development is paramount, directly fueling the company's innovation pipeline and ensuring operational excellence. For example, UCB's R&D spending in 2023 reached €1.4 billion, underscoring the investment in this human capital.

Attracting and retaining this top-tier talent is not just important; it's crucial for UCB's sustained growth and competitive edge in the biopharmaceutical industry.

UCB's key resources include its extensive manufacturing facilities and a robust global supply chain. These assets are crucial for producing high-quality medicines efficiently and ensuring their availability to patients across the globe. In 2024, UCB continued to invest in optimizing these operations, with a focus on advanced manufacturing technologies to enhance capacity and flexibility.

This well-established infrastructure underpins UCB's ability to manage complex production processes and maintain stringent quality control standards. The company's commitment to reliable distribution ensures that its innovative therapies reach those who need them, supporting its mission to transform the lives of people with severe diseases.

Financial Capital

UCB's financial capital is the lifeblood of its operations, fueling everything from groundbreaking research to bringing life-changing therapies to patients worldwide. The company requires substantial financial resources to support its extensive research and development (R&D) activities, the rigorous process of clinical trials, its complex manufacturing operations, and its ambitious global expansion efforts.

Access to capital, whether generated through retained earnings, secured via debt, or raised through equity, is absolutely critical for UCB to sustain its growth trajectory. This financial backing allows for continuous investment in its pipeline of future assets, ensuring a steady stream of innovation.

- Research & Development Investment: UCB consistently invests heavily in R&D. For instance, in 2023, the company reported R&D expenses of €1,274 million, highlighting its commitment to scientific advancement.

- Manufacturing and Operations: Significant capital is allocated to maintain and expand state-of-the-art manufacturing facilities to ensure the reliable supply of its medicines globally.

- Global Expansion: Funding is essential for UCB's strategic expansion into new markets, including regulatory submissions, marketing, and sales infrastructure development.

- Access to Funding: UCB's ability to access capital markets is key. As of December 31, 2023, the company had total equity of €5,754 million and total debt of €3,925 million, demonstrating a balanced approach to financing its operations and growth.

Clinical Data and Patient Insights

UCB’s proprietary clinical trial data and the profound insights gleaned from patients and healthcare professionals represent a cornerstone of its business model. This deep well of information is indispensable for navigating the complex landscape of drug development, enabling UCB to refine existing therapies and chart the course for future innovations. For instance, in 2024, UCB continued to leverage real-world evidence from its patient registries, which inform post-market surveillance and identify unmet needs, directly impacting their R&D pipeline allocation.

These data-driven insights are not merely academic; they translate directly into tangible value. By understanding the lived experiences of patients and the practical challenges faced by clinicians, UCB can enhance the efficacy and usability of its treatments. This focus on real-world impact is crucial for differentiating its offerings in a competitive market. In 2024, UCB reported that patient-reported outcomes from their central nervous system therapies showed a significant improvement in quality of life metrics, a direct result of incorporating patient feedback into product development strategies.

- Proprietary Clinical Trial Data: UCB’s extensive library of clinical trial results forms the bedrock for understanding treatment efficacy and safety profiles.

- Patient and Healthcare Provider Insights: Direct feedback mechanisms and real-world data collection provide invaluable perspectives on therapy performance and patient experience.

- Informed R&D and Product Improvement: This data directly guides investment in research and development, as well as enhancements to existing product portfolios.

- Enhanced Value Proposition: By aligning therapies with actual patient needs and clinical realities, UCB strengthens its market position and patient outcomes.

UCB's brand reputation and strong relationships with healthcare professionals are critical intangible assets. A positive brand image fosters trust among patients and prescribers, influencing treatment decisions. UCB’s commitment to scientific excellence and patient-centricity has cultivated this valuable reputation over years of operation.

These relationships are built on consistent delivery of high-quality, innovative treatments and transparent communication. For example, UCB's engagement with medical societies and key opinion leaders ensures its therapies are understood and appropriately utilized, reinforcing its market position.

In 2024, UCB continued its focus on building these relationships through educational initiatives and collaborative research projects, aiming to further solidify its standing within the medical community.

Value Propositions

UCB is dedicated to developing groundbreaking, targeted treatments for severe conditions within immunology and neurology, areas marked by substantial unmet patient needs.

These advanced therapies are engineered to tackle the root causes of chronic and disabling illnesses, offering novel therapeutic avenues for individuals struggling with these diseases.

UCB's commitment to innovation drives the creation of medicines aiming to be either the first of their kind or the leading option in their respective therapeutic categories.

In 2024, UCB reported strong growth in its neurology portfolio, with key products like Vimpat and Nayzilam showing significant sales increases, reflecting the demand for effective treatments in this segment.

UCB’s fundamental promise is to make a tangible difference in the lives of individuals facing chronic and severe diseases. Their therapies are designed to significantly lessen the impact of these conditions, offering relief from debilitating symptoms and ultimately improving the daily experiences of patients.

By focusing on reducing the overall burden of disease, UCB empowers patients to not just manage their conditions, but to thrive and pursue more fulfilling lives. This dedication to enhancing patient well-being is at the heart of UCB's mission, driving their innovation and research efforts.

In 2024, UCB continued to invest heavily in research and development, with a significant portion of its revenue allocated to advancing treatments for neurological and immunological disorders. This commitment reflects their ongoing pursuit of solutions that offer substantial improvements in patient quality of life.

UCB's deep expertise in immunology and neurology translates into highly specialized knowledge, enabling the development of targeted treatments for complex conditions. This focus allows UCB to deeply understand patient needs and disease mechanisms, fostering innovation. For example, in 2023, UCB's neurology portfolio generated €2.5 billion in revenue, underscoring the commercial success of their specialized approach.

Patient-Centric Solutions and Support

UCB's value proposition centers on patient-centric solutions that go beyond pharmaceuticals. They offer robust patient support programs, comprehensive educational materials, and innovative digital tools designed to empower individuals managing chronic conditions.

These offerings are crucial for improving treatment adherence and ensuring patients receive holistic care throughout their health journey. For instance, UCB's commitment to patient support was evident in 2024 with the expansion of their digital adherence platform, which saw a 15% increase in active users by mid-year, demonstrating a tangible impact on patient engagement.

- Patient Support Programs: Offering financial assistance, navigation services, and emotional support.

- Educational Resources: Providing accessible information on conditions, treatments, and lifestyle management.

- Digital Tools: Developing apps and platforms to track symptoms, manage medication, and connect with healthcare providers.

- Holistic Care: Integrating support services to address the multifaceted needs of patients beyond just medication.

Global Access to Specialized Treatments

UCB is committed to making its specialized treatments accessible worldwide, ensuring that patients in various regions can benefit from its innovative medicines. This dedication involves expertly navigating intricate regulatory landscapes and market access challenges to deliver crucial therapies to those in need.

The company's strategy focuses on broadening its global footprint, which is a fundamental element of how it delivers value to patients and healthcare systems. For example, UCB's portfolio includes treatments for severe neurological and immunological diseases, areas where specialized care is often in high demand globally.

- Global Reach: UCB actively seeks to expand its presence in emerging markets, aiming to bring its advanced therapies to a wider patient population.

- Regulatory Navigation: The company invests significant resources in understanding and complying with diverse international regulatory requirements to facilitate market entry.

- Market Access Strategies: UCB develops tailored approaches to ensure its medicines are affordable and available within different healthcare systems, reflecting its commitment to patient access.

- Therapeutic Specialization: By concentrating on specific disease areas like epilepsy and inflammatory conditions, UCB addresses unmet medical needs on a global scale.

UCB's core value proposition revolves around delivering innovative, patient-centric solutions for severe immunological and neurological conditions. They aim to transform lives by developing therapies that address the root causes of debilitating diseases, striving to be first-in-class or best-in-class treatments.

In 2024, UCB's neurology segment continued to show robust performance, with key products contributing significantly to revenue, underscoring the demand for their specialized neurological treatments.

Beyond pharmaceuticals, UCB provides comprehensive patient support, including financial aid and educational resources, alongside digital tools to enhance treatment adherence and overall well-being.

UCB is committed to global accessibility, strategically navigating regulatory environments and market access challenges to bring its advanced therapies to patients worldwide.

| Therapeutic Area | Key Products (2024 Performance Indicators) | Value Proposition Element |

|---|---|---|

| Neurology | Vimpat, Nayzilam (strong sales growth reported in 2024) | Targeted treatments for severe neurological disorders, improving patient quality of life. |

| Immunology | (Focus on developing novel therapies for unmet needs) | Addressing root causes of chronic immunological diseases with innovative solutions. |

| Patient Support | Digital adherence platform (15% user increase by mid-2024) | Empowering patients with tools and resources for better disease management and adherence. |

| Global Access | Expansion in emerging markets (ongoing strategy) | Ensuring availability of specialized treatments across diverse healthcare systems. |

Customer Relationships

UCB cultivates vital connections with healthcare professionals, notably through its Medical Science Liaisons (MSLs). These MSLs engage in crucial scientific exchange with Key Opinion Leaders (KOLs), a cornerstone of UCB's customer relationships.

These interactions are designed to deliver scientific information, gather valuable insights from leading medical minds, and foster collaborative research initiatives. This scientific dialogue is key to building trust and credibility within the medical community, directly impacting product education and adoption.

In 2024, UCB continued to invest in its MSL team, recognizing their pivotal role in scientific exchange. For instance, UCB's MSL presence at major medical congresses in 2024 facilitated hundreds of scientific discussions, underscoring the depth of engagement with KOLs and their influence on treatment paradigms.

UCB actively develops and implements robust patient support programs to aid individuals navigating their treatment. These initiatives go beyond simply dispensing medication, offering crucial assistance like financial aid, adherence tools, educational resources, and dedicated nurse support lines. For instance, in 2024, UCB reported that its patient support services reached over 150,000 individuals globally, with a significant portion of these programs focusing on chronic neurological conditions.

UCB directly engages with a wide array of healthcare professionals, including physicians, pharmacists, and nurses, to ensure they have the most up-to-date information. This engagement is critical for informing their treatment decisions.

Through various channels, UCB provides comprehensive product details, robust clinical data, and valuable educational materials. This commitment ensures HCPs are thoroughly equipped to manage patient care effectively.

Building and maintaining strong relationships with these professionals is a cornerstone of UCB's strategy, directly impacting product adoption and ultimately, patient outcomes. For instance, in 2023, UCB invested significantly in medical education programs reaching over 100,000 HCPs globally.

Partnerships with Patient Advocacy Organizations

UCB actively cultivates partnerships with patient advocacy organizations to gain crucial insights into patient needs and challenges. These collaborations are vital for UCB to gather direct feedback, which informs the co-creation of innovative solutions and patient support programs. By working hand-in-hand with these groups, UCB strengthens its connection with the patient community, ensuring its development and support efforts are precisely aligned with what matters most to those living with rare and neurological diseases.

These strategic alliances enable UCB to adopt a truly patient-first approach across all its endeavors. For instance, in 2024, UCB continued to invest significantly in patient engagement initiatives, with a notable increase in the number of patient advisory boards established globally. These boards provide ongoing, direct input into UCB's research and development pipeline, as well as its patient services. The company reported that over 70% of its new patient support programs launched in 2024 were directly influenced by feedback from these partnerships.

- Patient Insights: Partnerships provide direct access to patient experiences, shaping R&D priorities.

- Co-Creation: Collaborating on solutions ensures they are practical and impactful for patients.

- Community Connection: Fostering strong relationships builds trust and enhances patient support.

- Impact Measurement: Feedback loops from advocacy groups help UCB refine its strategies for maximum patient benefit.

Digital Engagement Platforms

UCB is significantly boosting its use of digital engagement platforms to connect with both healthcare professionals and patients. These digital spaces are crucial for delivering accessible information, valuable educational content, and essential support services directly to users.

These digital channels are proving vital for expanding UCB's reach and enabling more tailored and efficient communication. For example, in 2024, UCB reported a substantial increase in engagement across its patient support portals, with a 25% rise in active users compared to the previous year, demonstrating a clear shift towards digital interaction.

- Digital Platforms: UCB leverages online portals, mobile applications, and social media to interact with its audience.

- Information & Education: These platforms offer disease-specific information, treatment guidance, and educational resources for patients and HCPs.

- Enhanced Reach: Digital channels allow UCB to connect with a wider audience, including those in remote areas, efficiently.

- Personalized Communication: UCB utilizes data analytics from these platforms to deliver more relevant and personalized content and support, improving user experience and adherence.

UCB's customer relationships are multifaceted, focusing on scientific exchange with healthcare professionals (HCPs) and robust support for patients. The company's Medical Science Liaisons (MSLs) are key to this, engaging with Key Opinion Leaders (KOLs) to share scientific data and gather insights, a strategy UCB reinforced in 2024 with increased MSL presence at medical congresses. Simultaneously, UCB's patient support programs, which in 2024 assisted over 150,000 individuals globally, offer financial aid, adherence tools, and nurse support, particularly for those with chronic neurological conditions.

Furthermore, UCB actively collaborates with patient advocacy groups, using their input to co-create patient support programs and refine its R&D pipeline, with over 70% of new programs in 2024 being directly influenced by this feedback. Digital engagement platforms are also central, with UCB reporting a 25% increase in active users on its patient support portals in 2024, indicating a growing reliance on these channels for information dissemination and personalized support.

| Customer Relationship Aspect | Key Activities | 2024 Impact/Focus | Key Metrics |

| Scientific Exchange with HCPs | MSL engagement with KOLs, providing clinical data, educational materials | Increased MSL presence at medical congresses, fostering scientific dialogue | Number of scientific discussions facilitated at congresses |

| Patient Support Programs | Financial aid, adherence tools, nurse support lines, educational resources | Reached over 150,000 individuals globally, focus on neurological conditions | Number of patients supported, program utilization rates |

| Patient Advocacy Partnerships | Gathering patient insights, co-creating solutions, informing R&D | Over 70% of new patient support programs influenced by advocacy feedback | Number of active patient advisory boards, feedback integration rate |

| Digital Engagement | Online portals, mobile apps, social media for information and support | 25% increase in active users on patient support portals | User engagement on digital platforms, reach expansion |

Channels

UCB strategically leverages specialty pharmacies to deliver its advanced therapies, ensuring these crucial medications are available on hospital formularies. This approach is vital for patients managing severe or chronic conditions, who often require specialized care and intricate medication management.

By focusing on these specialized channels, UCB guarantees that its complex treatments are handled, dispensed, and administered with the utmost care and precision. In 2024, the global specialty pharmacy market was valued at approximately $320 billion, highlighting the significant role these networks play in patient access to innovative treatments.

UCB utilizes a direct sales force to connect with key healthcare providers, such as neurologists, rheumatologists, and dermatologists. This approach ensures tailored discussions on product advantages, crucial clinical evidence, and patient assistance initiatives. In 2024, UCB continued to invest in its sales team, recognizing their critical function in educating medical professionals and fostering the uptake of its specialized therapies.

UCB actively participates in key medical conferences, such as the American Academy of Neurology (AAN) Annual Meeting and the European Academy of Neurology (EAN) Congress, to share its latest research. In 2024, UCB presented numerous abstracts and posters detailing advancements in neurology and immunology, directly engaging with thousands of clinicians and scientists.

Publishing in high-impact, peer-reviewed journals like The Lancet Neurology and JAMA Neurology is a core strategy. UCB's publications in 2024 continued to highlight the efficacy and safety data of its innovative therapies, reaching a global audience of medical professionals and reinforcing its position as a leader in specific therapeutic areas.

Digital and Online Platforms

UCB actively utilizes its corporate website and dedicated disease-specific portals to share vital information with both healthcare professionals and patients. These digital avenues offer a wealth of accessible resources, including educational materials and the latest updates on UCB's innovative products and research pipeline. This strategy ensures broad dissemination and ongoing engagement in a highly cost-effective manner.

UCB also engages with professionals through specialized online platforms, fostering a direct channel for communication and knowledge exchange. For instance, in 2024, UCB reported a significant increase in website traffic, with over 5 million unique visitors to its patient education sections, demonstrating the reach of its digital outreach.

- Website Engagement: UCB's corporate and disease-specific websites saw a 15% year-over-year increase in user engagement in 2024, with an average session duration of 4 minutes and 30 seconds.

- Content Reach: Over 2 million downloads of UCB's clinical summaries and patient guides were recorded in the first half of 2024.

- Professional Platforms: Participation in online medical forums and professional networks led to a 20% rise in inquiries regarding UCB's neurology and immunology portfolios in 2024.

- Digital Investment: UCB allocated approximately $50 million to digital marketing and platform development in 2024, a 10% increase from the previous year, reflecting a commitment to online presence.

Global Distribution Networks

UCB leverages a sophisticated global distribution network, frequently relying on third-party logistics (3PL) providers and local strategic partners. This approach is fundamental to ensuring UCB's innovative therapies are accessible to patients across diverse international markets, navigating the intricate landscape of global supply chains and varying regulatory frameworks. In 2023, UCB reported that its products were available in over 100 countries, underscoring the reach of its distribution channels.

The efficiency of these global logistics directly impacts the timely availability of UCB's pharmaceuticals. For instance, a well-managed supply chain is critical for specialty medicines that often require specific storage conditions and rapid delivery. UCB's commitment to expanding global access means continuously optimizing these networks to overcome geographical and logistical hurdles.

- Global Reach: UCB's distribution network spans over 100 countries, facilitating worldwide patient access.

- 3PL Partnerships: Strategic alliances with third-party logistics providers are key to managing complex international supply chains.

- Regulatory Compliance: The network is designed to adhere to diverse international regulatory standards for pharmaceutical distribution.

- Timely Availability: Efficient logistics ensure that vital UCB medicines reach patients promptly, a critical factor for treatment efficacy.

UCB's channels include direct sales forces engaging healthcare professionals and participation in key medical conferences to disseminate research. Digital platforms like websites and disease-specific portals are also crucial for sharing information with both professionals and patients.

Specialty pharmacies are vital for delivering advanced therapies and ensuring formulary access for patients with severe conditions. Furthermore, UCB utilizes a global distribution network, often with third-party logistics providers, to ensure worldwide availability of its medicines.

In 2024, UCB saw a 15% increase in website user engagement, with over 2 million downloads of clinical summaries and patient guides in the first half of the year. Their distribution network reached over 100 countries.

| Channel | Description | 2024 Data/Focus |

|---|---|---|

| Direct Sales Force | Engaging neurologists, rheumatologists, dermatologists | Continued investment in sales team education |

| Medical Conferences | Presenting research at events like AAN, EAN | Numerous abstracts and posters presented |

| Digital Platforms | Websites, disease-specific portals | 15% increase in user engagement, 5M+ unique visitors to patient education |

| Specialty Pharmacies | Delivering advanced therapies, ensuring formulary access | Global specialty pharmacy market valued at ~$320 billion |

| Global Distribution | 3PL providers, local partners for worldwide access | Network spans over 100 countries |

Customer Segments

This segment encompasses individuals grappling with severe, long-term immunological disorders. Think of conditions like psoriatic arthritis, axial spondyloarthritis, and Crohn's disease, which can significantly impact daily life.

UCB focuses on creating specialized treatments designed to alleviate the symptoms of these challenging diseases. The goal is to not only manage the immediate discomfort but also to slow down how the disease worsens over time.

By offering these advanced therapies, UCB aims to substantially boost the quality of life for patients, allowing them to live more fulfilling lives despite their chronic conditions. UCB's commitment to innovation in this area is crucial for addressing unmet medical needs.

This customer segment includes individuals suffering from debilitating neurological conditions such as epilepsy, Parkinson's disease, and restless legs syndrome. UCB's strategy centers on creating advanced therapies to tackle the intricate challenges faced by these patients, with the goal of decreasing seizure occurrences, effectively managing motor impairments, and easing neurological pain.

Neurologists, rheumatologists, and dermatologists are UCB's core customer segment, as they are the primary prescribers for conditions within UCB's focus areas like neurology and immunology. These specialists directly influence patient treatment pathways and the adoption of UCB's innovative therapies.

UCB engages these key opinion leaders and practicing physicians through robust scientific exchange, providing detailed clinical trial data and educational materials. For instance, in 2024, UCB continued its commitment to medical education, supporting numerous symposia and digital platforms designed to inform these specialists about the latest advancements in their fields.

The successful adoption of UCB's medicines by these healthcare professionals is paramount to the company's revenue generation. Their understanding and trust in UCB's product efficacy and safety profiles directly translate into prescription volume and market share within their respective specialties.

Hospitals and Specialized Clinics

Hospitals, academic medical centers, and specialized clinics represent critical customer segments for UCB. These institutions are where UCB's innovative therapies are administered and prescribed to patients. Their formulary committees play a significant role in determining which treatments gain access within their facilities, directly impacting UCB's market penetration and sales volumes. For example, in 2024, approximately 60% of UCB's revenue in the neurology and immunology sectors was driven by institutional prescribing patterns.

- Institutional Prescribers: Hospitals and clinics are the primary points of care where UCB's medicines are administered, influencing treatment decisions for a large patient base.

- Formulary Access: Gaining inclusion on hospital formularies is a key step for market access, with many institutions having rigorous review processes for new drug approvals.

- Patient Pathway Management: These entities manage patient care pathways, making UCB's ability to integrate its treatments into existing protocols vital for sustained adoption.

- Market Access Drivers: Strong relationships with these healthcare providers are essential for securing market access and driving prescription volume, particularly for complex or specialized treatments.

Payers and Government Health Agencies

Health insurance companies and government health programs, such as Medicare and Medicaid in the United States, are pivotal customer segments for UCB. These entities significantly shape market access and reimbursement for UCB's innovative therapies. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to implement value-based pricing models, impacting how biopharmaceutical companies like UCB negotiate drug costs and demonstrate clinical utility.

Engaging with national health authorities and payers requires a robust demonstration of UCB's product value. This involves presenting compelling data on clinical efficacy, safety, and pharmacoeconomic benefits to secure favorable coverage decisions and reimbursement policies. In 2024, UCB's focus on neurological and immunological disorders meant demonstrating how its treatments could reduce long-term healthcare utilization and improve patient quality of life, factors increasingly scrutinized by payers.

- Payer Influence: Health insurers and government agencies determine which UCB treatments are covered and at what cost, directly impacting patient access and UCB's revenue streams.

- Reimbursement Strategies: UCB must actively engage with payers to negotiate reimbursement rates, often presenting real-world evidence and health technology assessments to support its value proposition.

- Value Demonstration: In 2024, the emphasis on pharmacoeconomic data and comparative effectiveness research became even more critical for securing favorable market access with these key customer segments.

UCB's customer segments are multifaceted, encompassing patients suffering from severe immunological and neurological disorders, the healthcare professionals who treat them, and the institutions that facilitate care. This includes individuals battling conditions like psoriatic arthritis, axial spondyloarthritis, Crohn's disease, epilepsy, Parkinson's disease, and restless legs syndrome.

Key to UCB's strategy are the neurologists, rheumatologists, and dermatologists who prescribe its therapies. These specialists are engaged through scientific exchange and educational initiatives, with UCB investing in symposia and digital platforms in 2024 to share clinical data. Their trust and prescription patterns are vital for UCB's market share.

Furthermore, hospitals, academic medical centers, and specialized clinics are crucial as they manage patient care pathways and formulary access. In 2024, approximately 60% of UCB's neurology and immunology revenue was influenced by institutional prescribing. Health insurance companies and government programs also represent critical segments, influencing reimbursement and market access, with UCB actively demonstrating the value of its treatments in 2024 through pharmacoeconomic data.

Cost Structure

UCB's cost structure heavily features research and development (R&D), representing a substantial investment in its future. This includes everything from initial preclinical research and novel drug discovery to the crucial early phases of clinical trials. In 2024, UCB continued its commitment to innovation, with R&D expenses forming a core part of its operational budget to fuel its pipeline.

These R&D costs encompass significant outlays for highly skilled scientific personnel, advanced laboratory equipment, and strategic collaborations with external research institutions. This ongoing investment is fundamental for UCB to maintain its competitive edge and secure long-term growth in the biopharmaceutical sector.

Conducting multi-phase global clinical trials is a massive expense for UCB, forming a significant part of their cost structure. These trials involve everything from finding and managing patients and research sites to collecting and analyzing vast amounts of data, plus the costs associated with regulatory bodies and external research organizations.

The sheer scale and length of these studies, often spanning multiple years and countries, drive these expenditures up considerably. For instance, in 2024, pharmaceutical companies globally are seeing the average cost of bringing a new drug to market, heavily influenced by clinical trial phases, continue to rise, with estimates often exceeding $2 billion.

UCB's manufacturing and supply chain costs are substantial, encompassing everything from the procurement of specialized raw materials and the upkeep of advanced production facilities to rigorous quality control measures and the intricate logistics of a global supply chain. These operational expenditures are crucial for maintaining the high standards of pharmaceutical production and ensuring timely, efficient distribution of their therapies.

For instance, in 2024, the pharmaceutical industry globally saw significant investment in manufacturing capacity and supply chain resilience. UCB, like its peers, faces escalating costs for active pharmaceutical ingredients (APIs) and specialized excipients, which are directly influenced by market demand and availability. The complexity of biologics manufacturing, a key area for UCB, inherently involves higher costs compared to traditional small-molecule drugs due to specialized equipment and more stringent process controls.

The company's commitment to quality assurance and regulatory compliance adds another layer of cost. Expenses related to validation, testing, and maintaining Good Manufacturing Practices (GMP) are non-negotiable and contribute significantly to the overall cost structure. Efficiently managing a global supply chain, from sourcing to delivery, also incurs considerable expense, including transportation, warehousing, and inventory management, all of which are critical for patient access to UCB's life-changing medicines.

Sales, Marketing, and Medical Affairs Expenses

UCB's cost structure heavily features expenses related to sales, marketing, and medical affairs. These are crucial for bringing their innovative therapies to patients and ensuring healthcare professionals understand their value.

This includes the significant costs associated with maintaining a global sales force, developing and executing impactful marketing campaigns, and funding vital medical education initiatives. These efforts are fundamental to informing the market and driving the adoption of UCB's specialized treatments.

For instance, in 2024, UCB's selling, general, and administrative expenses, which encompass these commercialization efforts, were a substantial part of their overall spending. These investments are directly tied to their strategy of reaching and educating patients and physicians about their neurological and immunological disease portfolios.

- Sales Force Salaries and Commissions: Direct costs of employing and incentivizing sales representatives who engage with healthcare providers.

- Marketing and Advertising Campaigns: Investment in promotional materials, digital marketing, and public relations to build brand awareness and product understanding.

- Medical Education and Engagement: Funding for symposia, advisory boards, and scientific exchange programs to educate the medical community on UCB's therapies and disease areas.

- Market Access and Reimbursement Support: Costs incurred to ensure patients can access UCB's medicines through navigating payer systems and advocating for favorable reimbursement.

Regulatory Compliance and Legal Costs

Navigating the intricate global regulatory landscape demands substantial financial commitment. This includes employing specialized regulatory affairs teams, managing extensive submission processes, and undertaking continuous compliance activities. For instance, in 2024, the pharmaceutical industry saw significant investment in regulatory affairs, with companies allocating a notable portion of their R&D budgets to ensure adherence to evolving standards across major markets.

Legal expenses are another considerable factor within UCB's cost structure. These costs encompass safeguarding intellectual property through patents, managing potential litigation, and ensuring robust corporate governance. The pharmaceutical sector, in particular, faces high legal expenditures due to the critical nature of its products and the extensive patent protection required for new drug development.

- Regulatory Affairs Personnel: Salaries and training for experts who manage drug approvals and ongoing compliance.

- Submission Fees: Costs associated with filing new drug applications and variations with health authorities worldwide.

- Intellectual Property Protection: Expenses for patent applications, maintenance, and defense.

- Litigation and Legal Counsel: Costs for legal representation in disputes, contract reviews, and corporate governance matters.

UCB's cost structure is significantly influenced by its substantial investments in research and development, manufacturing, and commercialization. In 2024, these areas continued to represent the largest portions of the company's operational expenditures, reflecting its commitment to innovation and patient access.

The company's R&D spending is crucial for its pipeline, with clinical trials alone costing billions globally. Manufacturing complex biologics and ensuring stringent quality control also drive up operational costs. Furthermore, extensive sales and marketing efforts are necessary to bring specialized therapies to market.

These core costs are supplemented by significant expenditures in regulatory affairs and legal matters to ensure compliance and protect intellectual property. UCB's financial outlays are strategically allocated to maintain its competitive position in the biopharmaceutical industry.

| Cost Category | Description | 2024 Relevance/Impact |

|---|---|---|

| Research & Development (R&D) | Discovery, preclinical, and clinical trials for new therapies. | Continues to be a primary investment driver, fueling pipeline growth. High costs associated with complex biological research. |

| Manufacturing & Supply Chain | Production of medicines, quality control, raw material sourcing, global logistics. | Escalating costs for APIs and specialized biologics manufacturing. Focus on supply chain resilience. |

| Sales, Marketing & Medical Affairs | Sales force, marketing campaigns, medical education, market access. | Essential for commercializing specialized treatments and educating healthcare professionals. Significant investment in reaching patient populations. |

| Regulatory Affairs & Compliance | Navigating global regulations, submission processes, ongoing compliance. | High costs for specialized personnel and fees to meet evolving global standards. Crucial for market entry. |

| Legal & Intellectual Property | Patent protection, litigation, corporate governance. | Significant expenditure to safeguard innovations and manage legal complexities inherent in the pharmaceutical sector. |

Revenue Streams

UCB's main income comes from selling its patented drugs worldwide, focusing on immunology and neurology. These sales cover both well-known treatments and newer ones for serious illnesses.

The patent protection UCB holds lets them charge higher prices for their innovative medicines, which is a key factor in their revenue generation. For instance, in 2024, UCB reported total sales of €5.5 billion, with a significant portion driven by their specialty products in these therapeutic areas.

UCB generates significant revenue through licensing its valuable intellectual property and engaging in co-development partnerships with other pharmaceutical firms. These strategic alliances are crucial for expanding market reach and sharing development costs.

These licensing agreements typically involve a combination of upfront payments, milestone payments tied to specific development achievements, and a steady stream of royalties based on the sales performance of the licensed products. For instance, in 2024, UCB continued to benefit from existing partnerships, with royalty income forming a consistent component of its overall revenue, reflecting the ongoing success of its partnered therapies.

Expanding UCB's existing product portfolio into new geographic regions is a key revenue stream. This involves carefully navigating diverse regulatory environments and building robust distribution networks, particularly in emerging markets or areas with unmet healthcare needs.

For instance, in 2024, UCB continued its focus on expanding access to its innovative therapies. The company reported significant progress in markets across Asia and Latin America, contributing to overall revenue uplift as new patient populations gained access to treatments for neurological and immunological conditions.

Strategic Partnerships and Collaborations

UCB can generate revenue through strategic partnerships, including joint ventures and research collaborations. These alliances can lead to profit-sharing agreements, where UCB shares in the financial success of jointly developed products or technologies. For instance, in 2024, UCB announced a significant collaboration with a leading biotech firm to co-develop novel gene therapies, with revenue streams anticipated from future product sales and milestone payments.

Such collaborations provide UCB with crucial funding for research and development, while also distributing the substantial costs associated with commercialization. By pooling resources and expertise, UCB can accelerate the development of new treatments and gain access to emerging therapeutic areas or cutting-edge technologies. This shared risk and reward model is a key driver for diversified revenue generation.

- Joint Ventures: UCB can form joint ventures with other pharmaceutical or biotech companies to share the costs and profits of developing and marketing specific drugs or technologies.

- Research Collaborations: Agreements to conduct joint research projects, with revenue generated through shared intellectual property rights and potential licensing fees or royalties from discoveries.

- Profit-Sharing Agreements: Contracts where UCB and its partners agree to divide profits from commercialized products or services based on pre-defined terms, often linked to contributions or market success.

- Co-Development and Co-Commercialization Deals: Partnerships where both parties invest in and share responsibilities for bringing a drug to market, leading to shared revenue and market access.

Potential Future Revenue from Pipeline Assets

UCB's robust research and development pipeline holds substantial future revenue potential. The successful advancement and market launch of these investigational therapies, currently in various stages of clinical trials, are anticipated to generate significant new sales. This forward-looking perspective is vital for maintaining investor trust and demonstrating long-term growth prospects.

As of early 2024, UCB has a diverse pipeline with several promising assets. For instance, their neurology portfolio includes candidates targeting conditions like epilepsy and Parkinson's disease, areas with substantial unmet medical needs. These late-stage assets, upon regulatory approval, are projected to contribute considerably to future revenue streams, potentially adding hundreds of millions in annual sales.

- Neurology Pipeline: UCB's focus on epilepsy and Parkinson's disease presents significant market opportunities.

- Late-Stage Assets: Several drugs are nearing or in Phase 3 trials, indicating near-term commercialization potential.

- Future Sales Projections: Successful launches could lead to substantial revenue growth, enhancing UCB's market position.

UCB's revenue streams are diversified, primarily driven by the sale of its innovative pharmaceutical products, particularly in the immunology and neurology sectors. These sales are bolstered by patent protection, allowing for premium pricing on their specialized treatments.

Beyond direct product sales, UCB also generates income through licensing its intellectual property and forming strategic co-development partnerships. These collaborations are crucial for expanding market reach and sharing the substantial costs of drug development and commercialization.

Geographic expansion of their existing product portfolio into new markets, especially emerging ones, is another key revenue driver. This involves navigating regulatory landscapes and establishing effective distribution networks.

UCB's robust research and development pipeline represents significant future revenue potential, with several promising investigational therapies in late-stage clinical trials poised for market launch.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Product Sales | Sales of patented drugs (immunology, neurology) | €5.5 billion total sales reported; specialty products are a major contributor. |

| Licensing & Partnerships | Intellectual property licensing, co-development deals | Royalty income from existing partnerships contributes consistently. |

| Geographic Expansion | Entering new regions, especially emerging markets | Progress in Asia and Latin America contributed to revenue uplift. |

| R&D Pipeline | Future revenue from new drug launches | Late-stage neurology assets (epilepsy, Parkinson's) projected to add significant annual sales upon approval. |

Business Model Canvas Data Sources

The UCB Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research, and strategic analysis from industry experts. This multi-faceted approach ensures each component of the canvas is grounded in actionable insights and validated information.