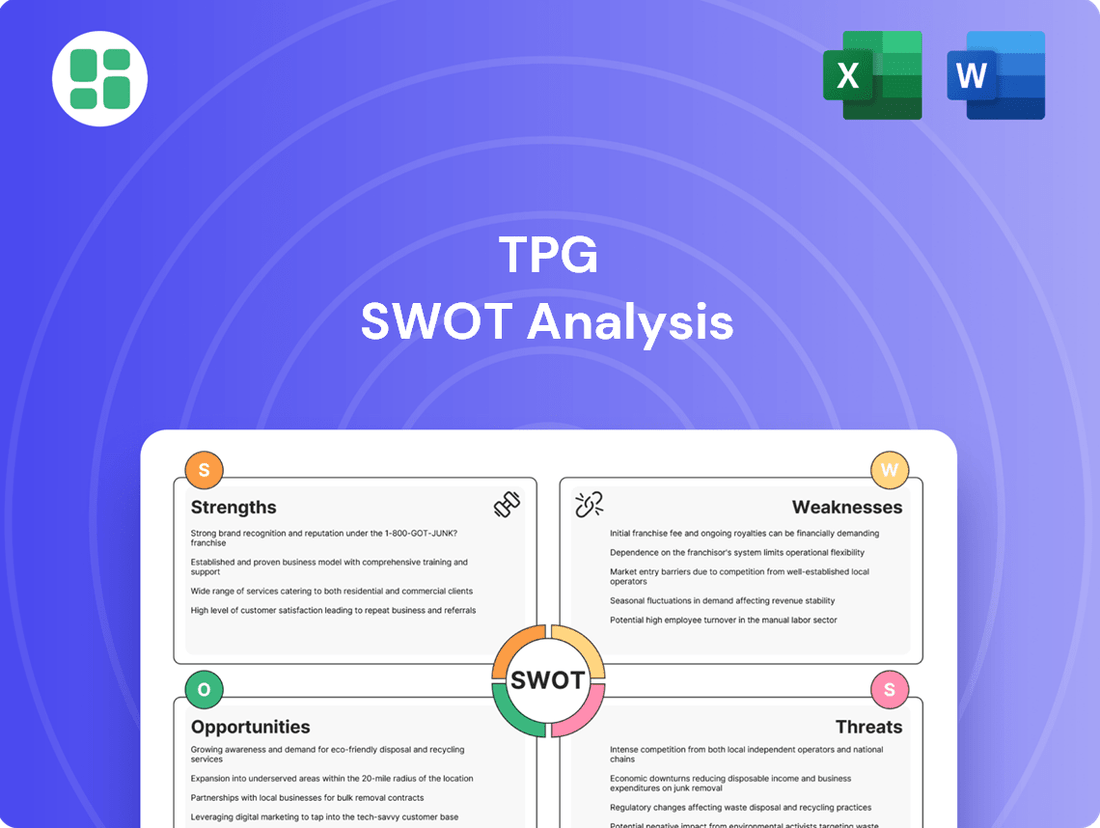

TPG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPG Bundle

TPG's market position is shaped by its strong brand recognition and extensive global network, but also faces challenges from evolving consumer preferences and intense competition. Our comprehensive SWOT analysis dives deep into these factors, revealing crucial opportunities for growth and potential threats to mitigate.

Want the full story behind TPG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

TPG Telecom boasts a robust network infrastructure, a key strength that underpins its market presence. This extensive fixed and mobile network across Australia provides a solid foundation for service delivery and future growth.

The strategic regional Multi-Operator Core Network (MOCN) partnership with Optus, which went live in January 2025, is a game-changer. This collaboration dramatically extended TPG's mobile network coverage to an impressive 1 million square kilometers.

This expanded coverage now reaches 98.4% of the Australian population, significantly enhancing TPG's ability to serve customers, especially those in regional and underserved areas. This broad reach strengthens its competitive edge in the Australian telecommunications landscape.

TPG's strength lies in its multi-brand strategy, effectively reaching residential, business, and wholesale markets with established names like TPG, Vodafone, iiNet, and Internode. This broad reach across diverse customer segments allows for significant market penetration and cushions the company against sector-specific downturns.

The company's mobile segment, particularly its prepaid brands and wholesale agreements with MVNOs such as Lyca Mobile, demonstrates the success of this diversified approach. This strategy not only captures a wider customer base but also leverages different market dynamics for robust growth.

TPG Telecom's strategic divestment of its fibre network infrastructure and EGW fixed business to Vocus Group for AUD 5.25 billion, announced in October 2024 and slated for completion in H2 2025, is a significant strength. This move is expected to streamline TPG's operations by focusing on its core mobile and consumer broadband segments.

The substantial net cash proceeds from this sale will provide TPG with considerable financial flexibility. This capital infusion is anticipated to optimize the company's capital structure and fuel future investments in growth areas, as well as support capital management initiatives, thereby strengthening its overall financial health.

Strong Mobile Service Revenue Growth and Subscriber Gains

TPG Telecom demonstrated robust performance in its mobile division during FY24, with mobile service revenue climbing by 5.4%. This growth was fueled by an increase in average revenue per user (ARPU) and a significant influx of prepaid subscribers.

The company's total mobile subscriber base expanded by 1.8% to reach 5.51 million, indicating successful customer acquisition and retention strategies. While the postpaid segment experienced some minor challenges, the overall subscriber growth highlights TPG's competitive positioning in the mobile market.

Looking ahead to 2025, TPG anticipates an acceleration in mobile growth, particularly following the recent launch of its MOCN (Multi-Operator Core Network) technology. Aggressive marketing campaigns are already in motion to capitalize on this development, aiming to further solidify TPG's presence and market share.

- FY24 Mobile Service Revenue Growth: 5.4% increase.

- Total Mobile Subscribers: Grew by 1.8% to 5.51 million.

- Key Growth Drivers: Higher ARPU and strong prepaid subscriber acquisition.

- Future Outlook: Expected acceleration in mobile growth in 2025, boosted by MOCN launch and marketing efforts.

Focus on Operational Efficiency and Simplification

TPG Telecom is aggressively simplifying its operations to become a more agile and cost-effective player in the Australian telecommunications market. This focus on operational efficiency is a key strength, with the company actively reducing its consumer mobile and fixed plans. For instance, TPG has significantly streamlined its product portfolio, a move designed to enhance customer understanding and reduce internal complexity.

The modernization of IT systems and streamlining of operations are central to TPG's strategy. These efforts are projected to yield substantial benefits, with the company anticipating incremental annual operating expenditure efficiencies following the Vocus acquisition. By simplifying its offerings and improving its technological backbone, TPG aims to enhance the customer experience while simultaneously driving down costs.

These strategic initiatives are expected to translate into tangible financial improvements. TPG has highlighted its commitment to extracting value through these efficiency gains, contributing to a leaner and more competitive business model. The company’s pursuit of simplification is a direct response to market demands for clearer, more accessible services.

Key aspects of this operational focus include:

- Product Simplification: A significant reduction in the number of consumer mobile and fixed plans offered.

- IT Modernization: Upgrading and simplifying IT systems to support streamlined operations.

- Cost Efficiencies: Anticipated incremental annual operating expenditure savings, particularly post-Vocus integration.

- Customer Experience: Improving customer journeys through simpler offerings and more efficient service delivery.

TPG Telecom's strengths are deeply rooted in its extensive network and strategic partnerships. The company's robust fixed and mobile infrastructure across Australia, coupled with the January 2025 MOCN partnership with Optus, has dramatically expanded its mobile coverage to 1 million square kilometers, reaching 98.4% of the Australian population. This broad reach is a significant competitive advantage.

The multi-brand strategy, encompassing TPG, Vodafone, iiNet, and Internode, allows TPG to effectively target diverse customer segments, from residential to wholesale. This diversification strengthens market penetration and resilience. Furthermore, the AUD 5.25 billion divestment of its fibre network to Vocus Group, expected to finalize in H2 2025, will provide substantial financial flexibility for future investments and capital management.

TPG's mobile segment is a clear area of strength, evidenced by a 5.4% increase in mobile service revenue in FY24, driven by higher ARPU and strong prepaid subscriber growth. The total mobile subscriber base grew by 1.8% to 5.51 million. The company anticipates accelerated mobile growth in 2025, leveraging its MOCN technology and marketing initiatives.

Operational simplification and IT modernization are also key strengths, aimed at enhancing efficiency and customer experience. TPG anticipates incremental annual operating expenditure savings, particularly following the Vocus integration, contributing to a leaner business model. This focus on streamlining product offerings and operations positions TPG for greater agility and cost-effectiveness.

| Metric | FY24 Value | Significance |

| Mobile Service Revenue Growth | 5.4% | Indicates strong performance and customer demand. |

| Total Mobile Subscribers | 5.51 million | Shows successful customer acquisition and retention. |

| MOCN Coverage Reach | 98.4% of population | Expands market access and competitive positioning. |

| Fibre Divestment Proceeds | AUD 5.25 billion | Provides significant financial flexibility for future growth. |

What is included in the product

Analyzes TPG’s competitive position through key internal and external factors, mapping out its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights for immediate strategic adjustments.

Weaknesses

TPG Telecom faced a setback in its postpaid mobile segment during FY24, with subscriber numbers dipping due to intense competition, particularly from aggressive handset discounts offered by rivals. The ongoing shutdown of its 3G network also contributed to this decline as customers migrated.

Furthermore, TPG's fixed broadband business saw a contraction, with the total fixed subscriber base shrinking by 2.4% to 2.08 million in the same period. A notable portion of this loss came from its fixed NBN customers, highlighting difficulties in customer retention within this crucial market segment.

TPG Telecom's financial position shows a growing debt burden. In FY24, net debt rose to AUD 4.1 billion from AUD 4.0 billion, and total debt stood at AUD 6.3 billion by December 2024. Projections indicate this net debt could climb to around AUD 7.6 billion in 2025, potentially straining future financial flexibility.

The company's decision to issue an unfranked final dividend for FY24, a result of depleted franking credits, could diminish its attractiveness to certain investors. This move might signal a need to conserve franking credits for future taxable profits or reflect current profitability levels.

TPG's statutory profit took a hit in FY24, reporting a loss of AUD 107 million compared to a profit of AUD 49 million in FY23. This significant swing was largely due to a substantial AUD 250 million non-cash impairment charge.

The impairment was specifically related to decommissioned mobile network sites, a consequence of the regional sharing deal TPG entered into with Optus. Such non-cash charges, while not affecting cash flow directly, significantly distort reported profitability and can impact investor perception.

Intense Competition and Pricing Pressure

The Australian telco market is a battleground, with TPG Telecom facing off against entrenched players like Telstra and Optus, alongside nimble smaller competitors. This fierce rivalry often translates into aggressive pricing and significant handset subsidies. For instance, in the first half of 2024, the industry saw continued promotional activity, impacting ARPU across the sector.

This intense competition directly challenges TPG's ability to maintain healthy profit margins, particularly in its core mobile and NBN services. The need to match competitor pricing can erode the average revenue per user (ARPU), a key metric for subscriber-based businesses. TPG's reported ARPU for its mobile services in the first half of 2024 reflected this pressure, hovering around AUD 30-35, a figure sensitive to market dynamics.

- Intense Competition: TPG operates in a market dominated by Telstra and Optus, with numerous smaller providers also vying for market share.

- Pricing Pressure: Aggressive pricing strategies and handset discounts are common, impacting ARPU across the industry.

- ARPU Sensitivity: TPG's average revenue per user, particularly in mobile and NBN, is vulnerable to these competitive pressures.

Regulatory Scrutiny and Delays in Strategic Initiatives

TPG Telecom faces significant hurdles due to ongoing regulatory scrutiny, which can stall crucial strategic moves. For instance, their proposed regional network sharing agreement with Optus, designed to expand 5G coverage, has been under intense review by the Australian Competition and Consumer Commission (ACCC). While TPG's sale of fibre assets to Vocus did secure ACCC approval in 2023, a prior attempt to sell similar assets to Telstra was blocked, underscoring the sensitive nature of infrastructure deals in the telecommunications sector.

These regulatory processes introduce considerable delays and uncertainty, impacting TPG's ability to execute its long-term strategic vision efficiently. The ACCC's cautious approach, as evidenced by the Telstra deal blockage, suggests that future large-scale infrastructure transactions or network sharing arrangements will likely face rigorous examination, potentially impacting TPG's competitive positioning and growth trajectory.

- Regulatory Hurdles: TPG's strategic initiatives, including network sharing and asset sales, are frequently subject to ACCC approval.

- Past Precedents: The ACCC's past blocking of TPG's Telstra asset deal highlights the challenges in gaining regulatory clearance for significant infrastructure transactions.

- Impact on Strategy: Delays and potential rejections from regulators can significantly disrupt TPG's strategic planning and execution timelines.

- Market Uncertainty: The ongoing regulatory oversight creates an environment of uncertainty for TPG's future growth and competitive strategies.

TPG Telecom's subscriber base is shrinking, with postpaid mobile customers declining due to aggressive competitor promotions and the 3G network shutdown impacting customer retention. Its fixed broadband segment is also contracting, particularly within the NBN customer base, indicating challenges in holding onto market share.

The company is facing a growing debt burden, with net debt projected to reach approximately AUD 7.6 billion by the end of 2025, which could limit its financial flexibility. Additionally, TPG reported a statutory loss of AUD 107 million in FY24, largely due to a AUD 250 million non-cash impairment charge related to decommissioned mobile network sites.

TPG's strategic initiatives often encounter regulatory hurdles, as seen with the ACCC's scrutiny of its regional network sharing agreement with Optus. Past instances, like the blocked sale of fibre assets to Telstra, underscore the difficulties in securing regulatory approval for significant infrastructure deals, potentially impacting TPG's growth plans.

Preview Before You Purchase

TPG SWOT Analysis

You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

TPG Telecom's activation of the Multi-Operator Core Network (MOCN) agreement with Optus has effectively doubled its mobile network coverage. This strategic move significantly enhances TPG's ability to compete, particularly in regional and underserved areas, presenting a prime opportunity for substantial mobile market share expansion.

This expanded network reach is a critical enabler for TPG to attract a broader customer base, directly addressing a key weakness. By offering a more robust and widespread service, TPG can expect to see an increase in its overall mobile subscriber numbers, driving revenue growth throughout 2024 and into 2025.

The substantial net cash proceeds, projected to reach up to AUD 4.75 billion from the Vocus fibre asset sale anticipated in H2 2025, present a significant chance for TPG to strengthen its financial standing.

These funds offer a strategic avenue for capital management, including debt reduction, which could improve TPG's financial flexibility and reduce interest expenses.

Furthermore, this capital can be strategically reinvested into TPG's core mobile operations, a crucial segment for driving future profitability and market competitiveness.

The expansion of 5G networks and the increasing demand for fixed wireless access (FWA) represent a substantial opportunity for TPG. As 5G infrastructure continues to be deployed, TPG is well-positioned to capitalize on this technological shift. In 2024, the global 5G services market is projected to reach over $200 billion, a figure expected to grow significantly in the coming years, offering TPG a vast potential customer base.

TPG's strategic emphasis on higher-margin fixed wireless services has already proven effective in counteracting declines in traditional fixed-line subscriptions. This focus allows TPG to leverage existing infrastructure while tapping into new revenue streams. For instance, by Q3 2024, TPG reported a substantial increase in FWA subscribers, demonstrating the market's appetite for these solutions.

Continued investment in 5G infrastructure will not only enhance TPG's service capabilities but also open doors to innovative revenue-generating opportunities. This includes offering enhanced broadband speeds, supporting IoT devices, and potentially developing new enterprise solutions. The company's commitment to 5G rollout is a key driver for future growth and competitive advantage in the telecommunications sector.

Enhanced Digitalization and Customer Experience Improvements

TPG's commitment to simplifying its business and modernizing its IT infrastructure presents a significant opportunity. This strategic pivot towards increased digitalization is designed to directly improve the customer experience and boost operational efficiency across the board.

By streamlining its product offerings and bolstering its digital sales channels, TPG is well-positioned to attract and retain a larger customer base. This enhanced digital engagement can translate into greater customer satisfaction and a noticeable reduction in customer churn rates.

For instance, in 2024, many telecommunications companies reported that investments in digital customer service platforms led to a 15% increase in customer retention. TPG's focus on these areas aligns with industry trends showing that improved digital touchpoints are crucial for competitive advantage.

- Streamlined Product Portfolios: Reducing complexity to make offerings clearer and more appealing.

- IT Modernization: Upgrading systems for better performance and scalability.

- Digital Sales Capabilities: Enhancing online platforms for easier customer acquisition and service.

- Customer Experience Enhancement: Focusing on user-friendly interfaces and responsive support.

Demand for High-Speed Internet and Unified Communication Platforms

The Australian telecommunications landscape is experiencing a significant surge in demand for high-speed internet, fueled by the widespread adoption of streaming services and the sustained growth of remote work. This trend presents a clear opportunity for TPG.

Concurrently, there's a rising need for unified communication platforms as businesses seek to streamline operations. TPG is well-positioned to leverage this by enhancing its portfolio.

TPG can expand its cloud-based PBX systems, VoIP solutions, and integrated collaboration tools. This strategic move will help diversify its revenue streams, moving beyond traditional fixed-line and mobile services and tapping into the lucrative business solutions market. For instance, the Australian business broadband market was valued at approximately AUD 10 billion in 2023 and is projected to grow further.

Key opportunities include:

- Expanding cloud-based PBX and VoIP offerings for businesses.

- Developing integrated collaboration tools to meet remote work demands.

- Capitalizing on the increasing consumer and business reliance on high-speed internet for streaming and digital services.

TPG's expanded network coverage through the MOCN agreement with Optus is a significant opportunity to capture more mobile market share, especially in underserved regions. This enhanced reach is projected to drive subscriber growth throughout 2024 and 2025.

The sale of Vocus fibre assets, expected to yield up to AUD 4.75 billion in H2 2025, provides substantial capital for debt reduction and strategic reinvestment into core mobile operations, bolstering financial flexibility and competitiveness.

The growing demand for 5G services and fixed wireless access (FWA) presents a prime opportunity for TPG. With the global 5G services market exceeding $200 billion in 2024 and continuing to expand, TPG's focus on FWA, which has already shown strong subscriber growth by Q3 2024, is well-positioned to capitalize on this trend.

TPG's modernization of IT infrastructure and simplification of product portfolios offer a chance to improve customer experience and operational efficiency. This digital transformation is crucial for customer retention, with industry data showing a 15% increase in retention for companies investing in digital platforms in 2024.

The increasing demand for high-speed internet and unified communication platforms in Australia, a market valued at around AUD 10 billion for business broadband in 2023, creates an opportunity for TPG to expand its cloud-based PBX, VoIP, and collaboration tools.

| Opportunity Area | Key Driver | TPG's Position/Action | Market Impact/Projection | Financial Implication |

| Network Expansion (MOCN) | Increased mobile coverage | Doubled coverage via Optus agreement | Mobile market share growth | Revenue increase |

| Capital Infusion (Vocus Sale) | Asset divestment | Up to AUD 4.75 billion proceeds (H2 2025) | Strengthened financial position | Debt reduction, reinvestment |

| 5G & FWA Growth | Demand for high-speed data | Focus on FWA, 5G infrastructure deployment | Global 5G market >$200bn (2024) | New revenue streams |

| Digital Transformation | Customer experience & efficiency | IT modernization, simplified portfolios | 15% customer retention increase (industry trend 2024) | Reduced churn, improved satisfaction |

| Business Solutions | High-speed internet & UC demand | Expanding cloud PBX, VoIP, collaboration tools | Australian business broadband market ~AUD 10bn (2023) | Diversified revenue |

Threats

The Australian telecommunications landscape is a fierce battleground, with established giants like Telstra and Optus setting a relentless pace. TPG also faces pressure from nimble challengers and Mobile Virtual Network Operators (MVNOs) who are adept at carving out niche markets. This intense rivalry means TPG must constantly adapt to aggressive pricing strategies and heavy handset promotions from competitors, which can directly impact its market share and financial performance.

TPG Telecom operates within a heavily regulated telecommunications sector, facing ongoing scrutiny over network sharing and market power. Recent regulatory actions, such as the blocked Telstra network sharing deal in 2023, underscore the potential for future interventions that could hinder TPG's strategic growth or impose stricter operating terms.

This regulatory environment, coupled with increasing anti-competition concerns, poses a significant threat to TPG's ability to pursue mergers, acquisitions, or even certain infrastructure-sharing arrangements. For instance, the Australian Competition and Consumer Commission (ACCC) actively monitors market concentration, and any perceived dominance by TPG could trigger investigations or penalties, impacting its financial performance and strategic flexibility.

TPG Telecom, like others in the Australian telecommunications sector, is navigating a landscape marked by economic uncertainty and persistent inflation. These factors directly influence consumer discretionary spending, potentially dampening demand for premium telecommunications services.

The ongoing cost-of-living pressures are a significant concern. Australians are increasingly scrutinizing household budgets, which could translate into a shift towards more affordable mobile and internet plans. This trend directly challenges TPG's Average Revenue Per User (ARPU) and could elevate customer churn rates, particularly for those on higher-tier service packages.

For instance, in the March quarter of 2024, Australian inflation remained elevated, impacting household disposable incomes. While specific TPG customer data isn't public, the broader economic climate suggests a heightened sensitivity to price among consumers, forcing telcos to balance competitive pricing with profitability.

Technological Disruption and Rapid Innovation

The telecommunications landscape is evolving at an unprecedented pace, with advancements like 6G, widespread AI integration, and the burgeoning Internet of Things (IoT) presenting significant challenges. TPG's ability to innovate and adapt swiftly to these technological shifts is crucial. Failure to invest in and deploy next-generation infrastructure could erode its competitive standing in the market.

For instance, the global IoT market is projected to reach $1.567 trillion by 2025, according to Statista, highlighting the massive growth potential in connected devices. If TPG cannot seamlessly integrate and support these expanding networks, it risks being sidelined. Furthermore, the ongoing development of AI in network management and customer service requires continuous investment to maintain efficiency and customer satisfaction. TPG's 2024 capital expenditure plans will be a key indicator of its commitment to staying ahead of these technological curves.

Key considerations for TPG in this area include:

- Keeping pace with 6G development: Early adoption and infrastructure build-out for future wireless standards are vital.

- AI integration: Leveraging AI for network optimization, predictive maintenance, and enhanced customer experiences is becoming a necessity.

- IoT ecosystem support: Ensuring robust connectivity and services for the rapidly expanding IoT sector is paramount.

- Infrastructure investment: Significant capital allocation is required to upgrade and expand network capabilities to meet future demands.

Cybersecurity Risks and Data Breaches

TPG Telecom, as a significant player in the telecommunications sector, is inherently exposed to escalating cybersecurity threats and the persistent risk of data breaches. These threats are not hypothetical; in 2023, Australian businesses reported an average of 307 cyber incidents per month, highlighting the pervasive nature of these risks across industries.

A successful cyberattack on TPG could result in substantial financial penalties, potentially running into millions of dollars, especially with stricter data protection regulations. Beyond financial repercussions, the damage to TPG's reputation and the erosion of customer trust could be profound, impacting long-term subscriber loyalty and market share. Furthermore, the operational costs associated with responding to and recovering from a breach, including forensic investigations, system remediation, and enhanced security investments, can be considerable.

- Increased regulatory scrutiny: Following major breaches, regulators often impose stricter compliance requirements and higher penalties.

- Customer churn: Loss of confidence due to a data breach can lead to significant customer attrition.

- Operational disruption: Remediation efforts can halt or slow down critical business operations.

- Reputational damage: Negative publicity can deter new customers and damage brand perception.

Intense competition from established players and agile MVNOs forces TPG to engage in aggressive pricing and promotions, potentially impacting market share and profitability. Regulatory interventions, such as the blocked Telstra network sharing deal in 2023, highlight the risk of future actions that could hinder strategic growth or impose stricter operating terms, particularly concerning anti-competition concerns monitored by the ACCC.

Economic headwinds, including persistent inflation and cost-of-living pressures, are likely to dampen consumer spending on premium telecommunications services, potentially reducing ARPU and increasing churn. The rapid evolution of technologies like 6G, AI, and IoT demands significant and continuous investment in infrastructure and innovation to avoid falling behind, with the global IoT market projected to reach $1.567 trillion by 2025.

Cybersecurity threats pose a substantial risk, with Australian businesses reporting an average of 307 cyber incidents per month in 2023. A successful breach could lead to severe financial penalties, operational disruptions, and significant reputational damage, eroding customer trust and loyalty.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from TPG's official financial reports, comprehensive market intelligence, and expert industry analysis to provide a clear and actionable strategic overview.