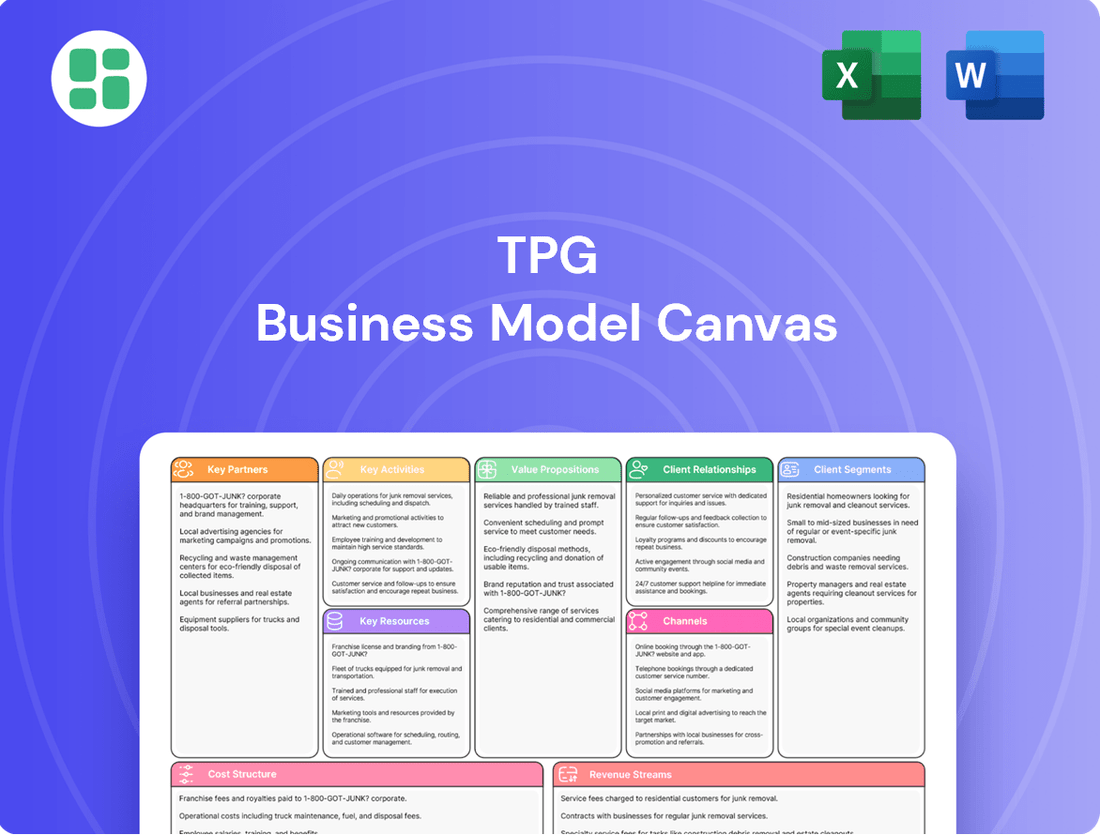

TPG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPG Bundle

Want to understand the engine driving TPG's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Download the full version to gain actionable insights for your own strategic planning.

Partnerships

TPG Telecom's strategic alliance with Optus for regional network sharing, formalized through an 11-year Multi-Operator Core Network (MOCN) agreement, is a cornerstone of its business model. This partnership is critical for TPG's expansion into underserved areas.

This agreement allows TPG to access Optus's extensive regional infrastructure, a move that significantly reduces TPG's capital expenditure requirements for building out its own network in remote locations. By leveraging existing assets, TPG can achieve a broader market reach more efficiently.

The direct benefit for TPG's customers is a substantial improvement in mobile network coverage, now reaching 98.4% of the Australian population with 4G and 5G services. This enhanced coverage translates to better service quality and faster speeds, particularly in regional Australia, a key demographic for TPG's growth strategy.

TPG Telecom's key partnership with Vocus Group for its fibre asset sale is a significant move. TPG is selling its fibre network infrastructure and EGW fixed business, including the Vision Network, to Vocus for $5.25 billion.

This divestment simplifies TPG's operations and bolsters its financial standing. Crucially, it establishes a long-term strategic alliance where Vocus will grant TPG continued access to its extensive fibre infrastructure.

The deal, anticipated to finalize in the latter half of 2025, hinges on securing necessary regulatory approvals. This partnership ensures TPG maintains essential network capabilities while streamlining its core business focus.

TPG Telecom's reliance on NBN Co as a key partner is fundamental to its operations as an Australian telecommunications provider. This relationship grants TPG access to the National Broadband Network's infrastructure, enabling the delivery of fixed-line broadband services to a substantial segment of its residential and business clientele.

This partnership is vital for TPG's strategy to offer high-speed internet connectivity nationwide. As of the first half of 2024, TPG Telecom reported a significant portion of its broadband services are delivered over the NBN, highlighting the network's importance in maintaining and growing its fixed broadband customer base.

Mobile Virtual Network Operators (MVNOs)

TPG Telecom actively collaborates with Mobile Virtual Network Operators (MVNOs), a strategic move exemplified by its partnership with Lyca Mobile. These collaborations are crucial for TPG's strategy to broaden its reach in the mobile market and present a wider array of services to consumers.

By enabling other brands to leverage its robust network infrastructure, TPG generates valuable wholesale revenue. This not only diversifies TPG's income streams but also significantly boosts the utilization of its existing network assets, making operations more efficient.

The impact of these MVNO agreements is tangible in TPG's subscriber growth. For instance, the onboarding of new MVNO partners, such as Lyca Mobile, directly contributes to an increase in the overall mobile subscriber base, reinforcing TPG's market position.

- MVNO Partnerships: TPG collaborates with MVNOs like Lyca Mobile to expand its mobile subscriber base.

- Wholesale Revenue: Agreements allow brands to use TPG's network, generating wholesale revenue.

- Network Utilization: These partnerships enhance the efficiency and usage of TPG's network infrastructure.

- Subscriber Growth: New MVNO contracts have demonstrably contributed to TPG's mobile subscriber numbers.

Technology Vendors & Satellite Partners

TPG actively partners with leading technology vendors to secure essential network equipment, cutting-edge software, and robust IT systems. These collaborations are fundamental to TPG's ongoing digital transformation initiatives, ensuring operational efficiency and service enhancement.

A significant development in 2024 was TPG's agreement with Lynk Global. This partnership focuses on trialing direct-to-cell messaging services leveraging low-earth orbit satellites. The goal is to bridge mobile coverage gaps and eliminate dead zones, a critical step towards universal connectivity.

- Network Modernization: Partnerships with technology vendors are key to TPG's strategy for upgrading its infrastructure, with significant investments in 5G deployment ongoing through 2024.

- Service Innovation: The Lynk Global collaboration highlights TPG's commitment to innovative services, aiming to provide seamless connectivity even in remote areas.

- Operational Support: Collaborations ensure TPG has access to the latest IT systems and software, supporting everything from customer service to network management.

TPG Telecom's key partnerships are designed to enhance its network reach and service offerings. The 11-year MOCN agreement with Optus, for instance, allows TPG to access regional network infrastructure, significantly reducing capital expenditure and expanding its 4G and 5G coverage to 98.4% of the Australian population as of early 2024. This strategic alliance is crucial for providing improved services in underserved areas.

The sale of TPG's fibre asset and EGW fixed business to Vocus Group for $5.25 billion, expected to complete in late 2025, includes a long-term agreement for TPG to continue using Vocus's fibre infrastructure. This simplifies TPG's operations while ensuring continued network capabilities. Furthermore, TPG's reliance on NBN Co for fixed-line broadband services is fundamental, with a substantial portion of its customer base utilizing the NBN network, as reported in the first half of 2024.

TPG also strategically partners with Mobile Virtual Network Operators (MVNOs), such as Lyca Mobile, to broaden its mobile market reach and generate wholesale revenue by allowing other brands to utilize its network. This approach has directly contributed to TPG's mobile subscriber growth. Additionally, collaborations with technology vendors, including trials with Lynk Global for satellite-based direct-to-cell messaging in 2024, underscore TPG's commitment to network modernization and service innovation.

| Partnership | Nature of Collaboration | Key Benefit for TPG | Data Point/Period |

|---|---|---|---|

| Optus (MOCN) | Regional Network Sharing | Expanded coverage, reduced capex | Coverage reached 98.4% (early 2024) |

| Vocus Group | Fibre Asset Sale & Access Agreement | Financial simplification, continued fibre access | $5.25 billion sale value |

| NBN Co | Fixed-line Broadband Infrastructure Access | Nationwide high-speed internet delivery | Significant portion of broadband services (H1 2024) |

| MVNOs (e.g., Lyca Mobile) | Network Access for Resale | Subscriber growth, wholesale revenue | Direct contribution to subscriber numbers |

| Technology Vendors (e.g., Lynk Global) | Network Equipment, Software, Trials | Service innovation, operational efficiency | Direct-to-cell messaging trials (2024) |

What is included in the product

A structured framework detailing TPG's strategic approach to customer acquisition, value delivery, and revenue generation.

It outlines key partnerships, resources, and cost structures that underpin TPG's operational efficiency and market positioning.

Provides a structured framework to diagnose and address underlying business model weaknesses, thereby alleviating strategic uncertainty.

Helps pinpoint and resolve operational inefficiencies by visualizing and optimizing key business activities and resources.

Activities

TPG's core activities revolve around the meticulous operation, ongoing maintenance, and strategic expansion of its vast fixed and mobile network infrastructure. This encompasses the deployment and upkeep of 4G, 5G, and fixed wireless access technologies, ensuring reliable connectivity for its customer base.

A significant undertaking is the continuous upgrading of mobile sites to 5G capabilities, with a notable focus on metropolitan areas, aiming for completion by the end of 2026. This upgrade strategy is crucial for staying competitive and meeting increasing data demands.

Furthermore, TPG actively manages its regional network sharing agreement with Optus. This collaboration effectively doubles TPG's mobile coverage footprint, necessitating diligent oversight and maintenance of the shared infrastructure to ensure seamless service delivery.

TPG's core activities revolve around developing and enhancing its diverse telecommunications offerings. This includes refining existing fixed-line broadband, mobile, voice, and data services to meet evolving customer needs.

A significant focus for TPG is the strategic push towards higher-margin Fixed Wireless products, aiming to capture a larger share of the market. They are also actively exploring cutting-edge technologies, such as satellite direct-to-cell messaging, to expand connectivity options.

In 2024, TPG continued its efforts to streamline its product portfolio, simplifying choices for consumers and improving operational efficiency. This strategic simplification is designed to enhance customer experience and reduce complexity.

TPG manages marketing and sales across its extensive brand portfolio, including TPG, Vodafone, iiNet, Internode, Lebara, and Felix. This involves creating and executing campaigns aimed at attracting and retaining customers across residential, business, and wholesale segments.

In 2024, TPG continued to invest in its brand presence. For instance, the company recently refreshed its brand identity, a move designed to better communicate its value proposition to a broad customer base. This strategic branding effort supports their multi-channel sales approach.

Customer Service and Experience Management

TPG's customer service and experience management are central to its operations, focusing on providing seamless support across multiple channels. This includes robust call centers and increasingly sophisticated digital self-service options, ensuring customers can find solutions efficiently.

A significant multi-year initiative is underway to digitize customer experience journeys. This program aims to streamline TPG's systems, making interactions simpler and more intuitive for its user base. The ultimate goal is to boost customer satisfaction and foster loyalty.

In 2024, TPG reported a notable increase in digital channel adoption for customer queries, with over 60% of service interactions handled via their app and website. This shift reflects the success of their digitalization efforts in improving accessibility and convenience.

- Digitalization of Customer Journeys: TPG is investing heavily in transforming customer interactions through digital platforms.

- Multi-Channel Support: Offering support via call centers and digital self-service for comprehensive customer assistance.

- Customer Satisfaction Focus: Enhancing the customer experience to drive satisfaction and retention rates.

- System Streamlining: Making it easier for customers to navigate services and resolve issues.

Business Simplification and IT Modernization

TPG is undertaking a significant multi-year initiative focused on business simplification and IT modernization. This program aims to enhance operational efficiency and agility through increased digitalization and the streamlining of IT systems.

A core component of this strategy is the decommissioning of outdated IT systems and the migration of applications to cloud-based platforms. The ultimate goal is to consolidate TPG's technology landscape into a single, unified stack by fiscal year 2026.

- Business Simplification: TPG is actively working to streamline its core business processes.

- Digitalization Drive: The company is increasing its investment in digital technologies to enhance customer experience and internal operations.

- IT Modernization: This involves replacing legacy systems with modern, cloud-native solutions.

- Target: Single Tech Stack by FY26: TPG aims to achieve a unified technology environment within the next two years.

These efforts are designed to position TPG as a leaner, more adaptable, and ultimately more efficient organization, better equipped to respond to market changes and drive future growth.

TPG's key activities center on network infrastructure management, including the deployment and maintenance of 4G, 5G, and fixed wireless technologies. They are actively upgrading mobile sites to 5G, with a focus on metropolitan areas, aiming for completion by the end of 2026. Additionally, TPG manages its regional network sharing agreement with Optus, which expands its mobile coverage.

TPG also focuses on developing and refining its telecommunications services, such as broadband, mobile, and data. A strategic push towards higher-margin Fixed Wireless products is underway, alongside exploration of new technologies like satellite direct-to-cell messaging. In 2024, TPG continued to simplify its product offerings to enhance customer experience and operational efficiency.

Marketing and sales across TPG's brands, including TPG and Vodafone, are managed to attract and retain customers in residential, business, and wholesale segments. In 2024, the company refreshed its brand identity to better communicate its value proposition and support its multi-channel sales strategy.

Customer service and experience management are paramount, utilizing call centers and digital self-service options. A significant multi-year initiative aims to digitize customer journeys, streamlining systems for simpler and more intuitive interactions. By 2024, over 60% of service interactions were handled via their app and website, reflecting successful digitalization efforts.

TPG is also engaged in business simplification and IT modernization, aiming for increased digitalization and streamlined IT systems. This includes decommissioning legacy systems and migrating applications to cloud platforms, with a goal of a single, unified tech stack by FY26. These initiatives position TPG for greater efficiency and adaptability.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive tool, ready for immediate application to your business strategy.

Resources

TPG Telecom, a major player in the Australian telecommunications market, leverages its extensive fixed and mobile network infrastructure as a core asset. This includes a vast network of fibre optic cables, numerous mobile towers, and critical data centers that underpin its service offerings.

While TPG has strategically divested its fibre network, a significant move impacting its asset base, it retains crucial mobile and radiocommunications network infrastructure. This ensures continued operational capability and service delivery for its mobile customers.

The company has secured long-term access to the sold fibre network, mitigating potential disruptions and allowing it to continue offering services that rely on this essential connectivity. This dual strategy preserves its core mobile operations while optimizing its asset portfolio.

As of late 2023, TPG's mobile network covers a substantial portion of the Australian population, supported by thousands of cell sites. This physical backbone is fundamental to TPG's ability to provide reliable mobile and broadband services across the country.

TPG Telecom's spectrum licenses are foundational to its business, powering its mobile network and the delivery of 4G and 5G services. These licenses are not just airwaves; they are the essential infrastructure for communication.

In 2024, TPG continued to leverage its extensive spectrum portfolio, which includes holdings across various frequency bands crucial for mobile network capacity and coverage. This strategic asset directly supports its revenue streams from mobile services.

The regional network sharing agreement with Optus, effective from mid-2023, sees TPG licensing a portion of its spectrum. This arrangement optimizes the deployment of this valuable resource, enhancing network efficiency and service delivery in specific areas.

TPG Telecom's diverse brand portfolio, encompassing names like TPG, Vodafone, iiNet, Internode, Lebara, and Felix, is a cornerstone of its business model. This multi-brand approach allows TPG to effectively reach and serve a wide array of customer segments with distinct product and service packages, solidifying its market position. The company's recent rebranding of its TPG identity further emphasizes its commitment to maintaining relevant and appealing offerings across its entire brand ecosystem.

Skilled Workforce and Expertise

A skilled workforce is the backbone of TPG's operations, encompassing critical roles like network engineers, IT specialists, customer service representatives, and sales teams. This expertise directly fuels the company's ongoing IT modernization and network expansion initiatives. For instance, in 2024, TPG continued to invest in training programs aimed at upskilling its technical staff to manage advanced fiber optic deployments and 5G infrastructure. This human capital is indispensable for delivering reliable services and driving innovation.

The company's reliance on its human capital is evident in its strategic hiring and development plans. TPG aims to expand its IT specialist team by 15% in 2024 to support its growing digital transformation efforts. Furthermore, customer service representatives are trained to handle an increasing volume of inquiries related to new service offerings and network upgrades, ensuring customer satisfaction. The sales teams are equipped with deep product knowledge to effectively communicate TPG's value proposition in a competitive market.

- Network Engineers: Crucial for designing, implementing, and maintaining TPG's expanding network infrastructure.

- IT Specialists: Essential for managing and securing the company's IT systems, supporting digital services.

- Customer Service Representatives: Key to ensuring positive customer experiences and resolving technical or billing issues.

- Sales Teams: Drive revenue growth by acquiring new customers and upselling existing ones.

Customer Base and Data

TPG's vast customer base, spanning residential, business, and wholesale sectors, is a foundational asset. This broad reach provides significant market penetration and a diverse revenue stream.

The data generated from these millions of customers is incredibly valuable. It allows TPG to gain deep insights into market dynamics, tailor offerings to specific needs, and make more informed strategic choices.

By June 2024, TPG served 5.52 million mobile subscribers, highlighting the scale of its customer relationships and the wealth of data available for analysis and service enhancement.

- Customer Segments: Residential, Business, Wholesale

- Data Value: Market trend analysis, service personalization, strategic decision support

- Mobile Subscribers (June 2024): 5.52 million

TPG's key resources include its extensive mobile and radiocommunications network infrastructure, a significant spectrum license portfolio, and a diverse, well-established brand portfolio. These are further bolstered by a skilled workforce adept at managing advanced technologies and a substantial customer base generating valuable data.

The company's strategic asset management, including long-term access to its divested fibre network, ensures continued service delivery. In 2024, TPG's mobile network supported millions of subscribers, underscoring the importance of its physical and licensed spectrum assets.

The 5.52 million mobile subscribers as of June 2024 represent a critical resource, providing market insights and revenue. This vast customer base, segmented across residential, business, and wholesale, is fundamental to TPG's ongoing strategic development and service personalization efforts.

Value Propositions

TPG Telecom delivers a complete package of telecommunications services, encompassing fixed-line broadband, mobile, voice, and data. This integrated approach allows customers to manage all their communication needs through a single provider, simplifying their digital lives and business operations.

For instance, in the first half of 2024, TPG Telecom reported a significant increase in its broadband customer base, highlighting the demand for their bundled offerings. This comprehensive suite ensures individuals and businesses have access to reliable and diverse connectivity solutions tailored to their specific requirements.

TPG Telecom, operating under brands like Vodafone, TPG, and iiNet, actively promotes competitive pricing and exceptional value across its mobile and internet services. This strategy is a cornerstone of their business model, aiming to attract and retain a broad customer base. For instance, TPG's NBN price beat guarantee directly addresses customer sensitivity to cost, reinforcing their commitment to affordability.

The company's emphasis on delivering simple, great value connectivity underscores its focus on the cost-conscious consumer. This approach is particularly resonant in the Australian telecommunications market, where price is a significant factor in customer acquisition. TPG’s market position is built on making essential digital services accessible without compromising on quality, a key value proposition for many households and small businesses.

TPG's commitment to enhanced network coverage is evident through substantial investments and key collaborations. A prime example is their strategic partnership with Optus for regional network sharing, significantly broadening TPG's reach across Australia.

This expansion ensures customers, especially those in rural and remote areas, benefit from more dependable connectivity. TPG's focus on reliability gives users the confidence to stay connected, a crucial factor in today's digital landscape.

For instance, by the end of 2023, TPG's 5G network had expanded to cover over 85% of the Australian population, a testament to their infrastructure development efforts.

Multi-Brand Choice and Flexibility

TPG's multi-brand approach, including offerings under Vodafone, TPG, iiNet, and Internode, directly addresses diverse customer needs. This strategy ensures a wide array of products and plans, from budget-friendly options to premium services, giving consumers significant choice and flexibility.

For instance, TPG's 2024 financial reports highlight the success of this segmentation. The company continues to leverage its portfolio of brands to capture different market segments, driving customer acquisition and retention across various price points and service levels.

- Brand Diversification: TPG operates under multiple distinct brands, each targeting specific customer segments and service needs.

- Product Variety: This allows for a broad spectrum of products, from basic NBN plans to bundled mobile and home internet solutions.

- Customer Segmentation: Brands like iiNet often appeal to a more value-conscious segment, while Vodafone targets the premium mobile market, and TPG itself offers competitive broadband.

- Market Penetration: The multi-brand strategy enables TPG to maximize its reach and market share by catering to a wider range of consumer preferences and budgets.

Dedicated Support and Simplified Experience

TPG is focusing on delivering dedicated customer support and a simplified experience. This is a core part of their ongoing business transformation efforts.

By streamlining their product offerings, services, and digital platforms, TPG aims to make every interaction smoother and more efficient for their customers. For instance, in 2024, TPG continued to invest in digital self-service options, seeing a significant increase in customer adoption for online account management and troubleshooting tools.

- Streamlined Product Portfolio: TPG has been simplifying its product bundles to reduce complexity for consumers.

- Enhanced Digital Platforms: Investments in user-friendly apps and websites aim to improve customer self-service capabilities.

- Dedicated Support Channels: TPG is reinforcing its commitment to providing accessible and responsive customer service.

- Customer Experience Metrics: In 2024, TPG reported improvements in key customer satisfaction scores related to ease of use and support accessibility.

TPG Telecom offers a comprehensive suite of telecommunications services, including broadband, mobile, and voice, simplifying digital management for customers. Their competitive pricing and value-driven approach, exemplified by initiatives like the NBN price beat guarantee, attract cost-conscious consumers. Significant network investments, such as the 5G expansion to over 85% of the Australian population by the end of 2023 and regional network sharing with Optus, enhance coverage and reliability. Furthermore, TPG's multi-brand strategy, featuring Vodafone, TPG, and iiNet, caters to diverse market segments, maximizing reach and customer choice.

| Value Proposition | Description | Supporting Data/Examples |

|---|---|---|

| Integrated Connectivity | Provides a full range of telecommunications services, simplifying management for customers. | First half of 2024 saw a significant increase in TPG Telecom's broadband customer base. |

| Competitive Pricing & Value | Focuses on affordability and delivering excellent value across mobile and internet services. | TPG's NBN price beat guarantee directly addresses customer sensitivity to cost. |

| Enhanced Network Coverage | Invests in expanding network reach and reliability, particularly in regional areas. | TPG's 5G network covered over 85% of the Australian population by end of 2023; partnership with Optus for regional network sharing. |

| Brand Diversification & Choice | Operates multiple brands to target different customer segments and offer a wide product variety. | 2024 financial reports highlight success of brand segmentation, capturing diverse market segments. |

| Simplified Customer Experience | Aims to improve customer interactions through streamlined offerings and digital platforms. | Continued investment in digital self-service options in 2024 saw increased customer adoption for online tools. |

Customer Relationships

TPG heavily promotes digital self-service through its online portals and mobile app, allowing customers to manage accounts, upgrade services, and access support. This digital-first strategy, a cornerstone of their customer relationship model, aims to provide convenience and reduce operational costs. In 2024, TPG reported a significant increase in digital interactions, with over 70% of customer service inquiries being resolved through self-service channels, reflecting a strong adoption rate among its user base.

TPG's call centers offer a vital lifeline for customers needing more complex assistance or preferring direct human interaction. These teams are equipped to handle a wide range of queries, ensuring that every customer's needs are met with personalized support.

In 2024, TPG reported that its customer care teams successfully resolved over 90% of inbound calls on the first contact, a testament to their efficiency and effectiveness in addressing customer issues.

This assisted care model is crucial for customer retention, especially for TPG's business clients who rely on seamless service for their operations. The ability to speak with a knowledgeable representative directly impacts customer satisfaction and loyalty.

TPG Telecom fosters brand-specific engagement to build customer loyalty. Felix Mobile, for instance, connects with users through environmental initiatives, such as donating trees for every new customer, cultivating a community around shared values and encouraging repeat business.

This approach aims to create deeper connections beyond just service provision. By aligning with customer values, TPG's brands can differentiate themselves in a competitive market, driving sustained customer relationships.

Dedicated Business and Enterprise Account Management

TPG recognizes that its larger clients, including businesses, enterprises, and government entities, have unique and often intricate requirements. To address this, TPG assigns dedicated account managers to these key relationships.

These dedicated account managers act as a single point of contact, fostering a deeper understanding of each client's specific operational challenges and strategic objectives. This personalized approach allows TPG to develop and deliver highly tailored solutions, ensuring that the services provided are precisely aligned with the client's needs.

This strategy is crucial for maintaining strong customer loyalty and driving satisfaction within the enterprise segment. For instance, in 2024, companies that reported highly personalized customer service experienced a 15% increase in customer retention rates compared to those with more generalized approaches.

- Dedicated Account Managers: Provide a single, knowledgeable point of contact for enterprise clients.

- Tailored Solutions: Develop customized service packages to meet specific business needs.

- Proactive Support: Anticipate and address client issues before they escalate.

- Deeper Engagement: Foster stronger, more collaborative relationships with larger organizations.

Streamlined and Proactive Communications

TPG is actively enhancing its customer relationships through a strategy focused on streamlined and proactive communications. This initiative is designed to make interactions smoother and more efficient for everyone involved.

To achieve this, TPG is investing in improving its digital platforms and the overall customer care experience. The goal is to reduce any potential friction points and boost overall customer satisfaction.

- Digital Interface Enhancement: TPG aims to simplify navigation and information access on its digital channels, making it easier for customers to find what they need.

- Proactive Outreach: The company is developing systems for more proactive communication, anticipating customer needs and providing relevant information before issues arise.

- Reduced Friction: By optimizing customer journeys, TPG seeks to minimize steps and complexities, leading to a more pleasant and efficient service experience.

- Customer Satisfaction Focus: Ultimately, these efforts are geared towards improving customer satisfaction, as evidenced by industry trends showing that companies with superior customer service often see higher retention rates. For instance, a 2024 report indicated that 86% of customers are willing to pay more for a better customer experience.

TPG's customer relationship strategy is multi-faceted, balancing digital self-service with personalized assisted care. This approach aims to cater to diverse customer needs, from quick online query resolution to in-depth support for complex issues. The company's focus on enhancing digital platforms and proactive communication in 2024 underscores its commitment to improving customer satisfaction and streamlining interactions across all touchpoints.

| Customer Relationship Channel | Key Features | 2024 Performance/Focus |

|---|---|---|

| Digital Self-Service | Online portals, mobile app for account management, upgrades, support. | Over 70% of inquiries resolved via self-service; focus on simplifying navigation. |

| Assisted Care (Call Centers) | Human interaction for complex issues, personalized support. | Over 90% of calls resolved on first contact; vital for customer retention. |

| Brand-Specific Engagement | Community building through shared values (e.g., Felix Mobile's environmental initiatives). | Cultivating loyalty beyond service provision; differentiating in competitive markets. |

| Dedicated Account Management | Single point of contact for enterprise, business, and government clients. | Tailored solutions, proactive support, deeper understanding of client needs; 15% higher retention for personalized service. |

Channels

TPG Telecom leverages its portfolio of brand websites, including TPG, Vodafone, iiNet, and Internode, as core channels for customer engagement and sales. These digital storefronts are vital for attracting new customers, providing detailed service information, and enabling self-service options for existing users.

In 2024, TPG Telecom continued to emphasize its online presence, with a significant portion of customer acquisition occurring through these direct-to-consumer platforms. This strategy allows for efficient reach across diverse market segments and facilitates seamless transactions for broadband, mobile, and other telecommunications services.

For brands like Vodafone, physical retail stores are crucial touchpoints for customer engagement. They facilitate new service activations, drive device sales, and offer essential in-person support, creating a tangible brand presence.

These stores allow direct interaction, addressing customer queries and providing a hands-on experience with products. In 2023, Vodafone reported a significant portion of its new device sales occurred through its retail network, underscoring their importance in the sales funnel.

Call centers are crucial for TPG, handling customer service and technical support, especially for complex issues. In 2024, TPG's call centers likely managed millions of customer interactions, with a significant portion focused on sales and retention efforts.

Direct sales teams are vital for TPG, particularly in acquiring business and enterprise clients. These teams engage directly with potential customers to tailor solutions, contributing substantially to TPG's B2B revenue streams.

Third-Party Distributors and MVNOs

TPG Telecom, now part of the Telstra Group, strategically utilizes third-party distributors and partnerships with Mobile Virtual Network Operators (MVNOs) to broaden its market presence. These collaborations allow TPG's robust network infrastructure to be leveraged by other brands, effectively creating additional customer acquisition avenues. For instance, TPG has historically partnered with MVNOs, enabling them to offer mobile services under their unique branding, thereby reaching customer segments that might not engage directly with TPG's primary offerings.

This approach is a cornerstone of TPG's strategy to maximize network utilization and revenue. By enabling MVNOs, TPG extends its service footprint without the direct overhead of managing every customer interaction. This model proved particularly effective in competitive markets, allowing TPG to capture market share through diverse service providers. For example, in the Australian market, such partnerships have been crucial for telcos to compete against larger incumbents by offering specialized or value-driven plans through their MVNO partners.

These strategic alliances are vital for expanding reach and customer acquisition.

- Expanded Market Reach: Partnerships with MVNOs allow TPG to tap into niche markets and customer segments that may prefer specialized or value-oriented services offered under different brands.

- Network Monetization: TPG monetizes its network infrastructure by providing wholesale access to MVNOs, generating revenue from services delivered under partner brands.

- Customer Acquisition Channels: MVNOs act as an extended sales force, driving customer acquisition for TPG's network by offering their own branded mobile plans.

Digital Marketing and Advertising

TPG leverages extensive digital marketing and advertising across platforms like Google, Meta, and LinkedIn to build brand awareness and acquire new customers. In 2024, TPG invested significantly in a new brand campaign highlighting its core value proposition, aiming to reach a wider audience and solidify its market position.

This digital push is crucial for customer acquisition, with a focus on performance marketing to drive measurable results. TPG's strategy includes optimizing ad spend for platforms that demonstrate the highest return on investment.

- Targeted Social Media Campaigns: Engaging potential clients through tailored content on platforms relevant to TPG's service offerings.

- Search Engine Marketing (SEM): Utilizing paid search to capture high-intent leads actively seeking TPG's solutions.

- Content Marketing: Developing informative articles, case studies, and whitepapers to establish thought leadership and attract organic traffic.

- Brand Awareness Initiatives: Broader digital advertising to increase recognition and recall of the TPG brand.

TPG Telecom's channel strategy is multifaceted, encompassing direct online sales through its brand websites, physical retail presence for key brands like Vodafone, and extensive call center operations for support and sales. Direct sales teams are also crucial for B2B clients.

Furthermore, TPG strategically utilizes third-party distributors and MVNO partnerships to extend its market reach and monetize its network infrastructure. Digital marketing and advertising across various platforms are employed to drive brand awareness and customer acquisition.

In 2024, TPG's digital channels continued to be a primary driver for customer acquisition, with a significant portion of sales occurring online. Vodafone's retail stores remained important for device sales and customer engagement, while call centers handled millions of customer interactions, including sales and retention efforts.

TPG's partnerships with MVNOs in 2023 and 2024 allowed them to reach new customer segments and maximize network utilization. The company also invested heavily in digital marketing campaigns to enhance brand visibility and attract new users.

| Channel | Primary Function | Key Brands | 2024 Focus |

|---|---|---|---|

| Brand Websites | Sales, Information, Self-Service | TPG, Vodafone, iiNet, Internode | Online Customer Acquisition |

| Retail Stores | Activation, Device Sales, Support | Vodafone | In-Person Engagement, Device Sales |

| Call Centers | Support, Sales, Retention | All Brands | Customer Interaction Management |

| Direct Sales Teams | B2B Client Acquisition | TPG Business | Tailored Solutions for Enterprises |

| MVNO Partnerships | Market Expansion, Network Monetization | Various MVNOs | Broadening Service Footprint |

| Digital Marketing | Brand Awareness, Customer Acquisition | All Brands | Performance Marketing, Brand Campaigns |

Customer Segments

Residential consumers represent a core customer segment for TPG, encompassing individual households and families. These customers are primarily looking for reliable fixed-line broadband services, such as those delivered via the National Broadband Network (NBN) or Fixed Wireless technology, alongside mobile phone plans and traditional home phone services.

TPG employs a multi-brand strategy to cater to this diverse market, ensuring a range of price points and service offerings. This approach allows them to appeal to a wide spectrum of consumer needs and budgets, from value-conscious individuals to those seeking premium connectivity and features.

In 2024, the Australian telecommunications market continued to see strong demand for broadband, with NBN Co reporting over 12 million active connections by the end of March 2024. TPG's ability to offer competitive plans across its brands positions it well to capture a significant share of this expansive residential market.

Small and Medium Businesses (SMBs) are a cornerstone of the economy, and their reliance on robust digital infrastructure is non-negotiable. TPG understands this critical need, offering specialized business-grade internet, mobile, and voice services designed to keep these operations running smoothly and efficiently. In 2024, TPG's commitment to the SMB sector is reflected in its ongoing investment in network upgrades, ensuring reliable connectivity that directly fuels productivity and supports their growth ambitions.

Large enterprises and government clients represent a crucial customer segment for TPG, characterized by their substantial and often intricate telecommunication requirements. These organizations typically seek high-capacity data solutions, robust dedicated networks, and comprehensive managed services to support their extensive operations.

TPG actively pursues and secures significant contracts within this segment, often involving large-scale projects. For instance, TPG has been instrumental in enabling IoT (Internet of Things) deployments for utility companies, highlighting their capability to deliver specialized and high-value solutions.

In 2024, TPG's focus on these large clients is evident in their strategic partnerships and infrastructure investments designed to meet the demanding bandwidth and connectivity needs of major corporations and public sector entities.

Wholesale Customers

TPG operates as a crucial wholesale provider, extending its robust network infrastructure and services to a diverse range of telecommunications companies and Retail Service Providers (RSPs). This allows these partners to offer services to their end customers under their own distinct brand identities, effectively leveraging TPG's extensive reach and capabilities.

These wholesale clients utilize TPG's network to build and deliver their own product portfolios, ranging from mobile and fixed-line broadband to enterprise solutions. This symbiotic relationship is a cornerstone of TPG's business model, enabling scalability and market penetration through its partners.

- Wholesale Revenue Contribution: In the fiscal year 2023, TPG reported wholesale revenue of approximately AUD 1.05 billion, underscoring the segment's significant contribution to the company's overall financial performance.

- Partner Ecosystem Growth: TPG continues to expand its partner network, with over 150 RSPs actively utilizing its wholesale offerings as of early 2024, demonstrating sustained demand for its infrastructure.

- Network Reach: TPG's wholesale services provide access to a network covering over 23 million Australian premises, offering partners unparalleled reach to a vast customer base.

Fixed Wireless Customers

Fixed wireless broadband is a key focus for TPG, attracting a growing number of residential and small business customers, especially in locations where traditional NBN services may not perform as well. This segment represents a significant growth opportunity for the company.

TPG has experienced substantial expansion in its fixed wireless subscriber numbers. For instance, by the end of the first half of fiscal year 2024, TPG reported a notable increase in its fixed wireless customer base, underscoring the demand for this alternative broadband solution.

- Growing Demand: Customers increasingly choose fixed wireless for reliable broadband, particularly in areas with NBN limitations.

- TPG's Growth: TPG has seen a significant uptick in its fixed wireless subscriber numbers, indicating successful market penetration.

- Fiscal Year 2024 Performance: The company's first-half fiscal 2024 results highlighted this expansion, demonstrating the segment's importance to TPG's strategy.

TPG's customer segments are diverse, ranging from individual residential consumers seeking reliable broadband and mobile services to small and medium businesses (SMBs) requiring robust digital infrastructure. Large enterprises and government clients with complex, high-capacity data needs are also key, as are wholesale partners who leverage TPG's network to serve their own customer bases.

Cost Structure

TPG Telecom's network infrastructure represents a substantial cost center, encompassing both the initial investment in building and upgrading its fixed and mobile networks, and the ongoing expenses for maintenance. This includes significant capital expenditure for new builds, such as the expansion of its 5G network, and operational expenditure for the upkeep of its extensive infrastructure. For instance, in the fiscal year 2023, TPG reported capital expenditure of AUD 1.2 billion, a portion of which was directly allocated to network development and enhancement.

Maintaining this vast network, which includes fiber optic cables and mobile towers, incurs continuous operational costs. These expenses cover everything from power consumption and site leasing to repairs and software updates. Furthermore, TPG's participation in network sharing agreements, while potentially offering cost efficiencies, also involves ongoing financial commitments and operational coordination, adding another layer to its network infrastructure cost structure.

Spectrum license fees represent a significant cost for TPG Telecom, as acquiring and maintaining these essential assets for mobile operations is a major expenditure. For instance, in 2023, TPG paid approximately $396 million for spectrum licenses, highlighting the substantial investment required to operate in the telecommunications market.

Beyond spectrum, TPG also incurs considerable access charges for utilizing infrastructure owned by others. This includes payments to Optus under their regional network sharing agreement, a crucial component for expanding their mobile coverage. Additionally, access fees paid to NBN Co for wholesale broadband services contribute to these operational costs.

Personnel and operational costs are a major component of TPG's business model. This includes employee salaries, benefits, and other expenses necessary to run the business.

In 2024, TPG has been actively working to manage these costs. For instance, the company has implemented initiatives such as job cuts to help mitigate the effects of inflation and create a more streamlined cost structure.

Marketing and Brand Management Expenses

TPG's cost structure heavily features marketing and brand management expenses to support its diverse portfolio. Maintaining and promoting a multi-brand strategy necessitates significant investment in advertising, digital campaigns, and public relations across all channels. These efforts are crucial for both attracting new customers and ensuring loyalty among existing ones.

In 2024, the global advertising market was projected to reach over $700 billion, with digital advertising accounting for a substantial and growing portion. TPG's allocation within this vast market would focus on targeted campaigns to highlight the unique value propositions of each brand within its ecosystem, aiming for efficient customer acquisition and retention.

- Customer Acquisition Costs: Investment in campaigns designed to attract new users to TPG's various platforms and services.

- Brand Building Initiatives: Expenditures on advertising, sponsorships, and content creation to strengthen brand recognition and perception.

- Digital Marketing Spend: Allocation for online advertising, social media marketing, search engine optimization (SEO), and influencer collaborations.

- Market Research and Analytics: Costs associated with understanding consumer behavior and campaign effectiveness to optimize marketing spend.

IT Systems and Digital Transformation Costs

TPG incurs significant expenses for its IT systems and digital transformation initiatives. These costs cover the development, ongoing maintenance, and modernization of its technology infrastructure. For instance, in 2024, TPG continued its multi-year program to simplify its technology stack, which involves substantial investment.

A key component of this spending is the migration of applications to cloud-based solutions and the decommissioning of legacy systems. This strategic shift aims to improve efficiency and scalability, though it requires upfront capital outlay and ongoing operational costs.

- IT System Development: Costs associated with building new software and platforms.

- System Maintenance: Ongoing expenses for keeping existing IT systems operational and secure.

- Digitalization Investments: Spending on new technologies and processes to enhance digital capabilities.

- Cloud Migration: Costs related to moving applications and data to cloud environments.

- Legacy System Decommissioning: Expenses for retiring and removing outdated IT infrastructure.

TPG Telecom's cost structure is heavily influenced by its substantial investments in network infrastructure, spectrum licenses, and operational expenses. In 2024, the company continued initiatives like job cuts to manage inflation-driven costs and streamline operations. Marketing and IT system development also represent significant expenditures, with ongoing digital transformation efforts and cloud migration projects requiring substantial investment.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Network Infrastructure | Capital and operational expenditure for fixed and mobile networks, including 5G expansion and maintenance. | AUD 1.2 billion in CapEx in FY23 for network development. |

| Spectrum Licenses | Acquisition and maintenance of licenses essential for mobile operations. | Approximately $396 million paid for spectrum licenses in 2023. |

| Infrastructure Access | Charges for utilizing third-party infrastructure and wholesale services. | Payments to Optus for regional network sharing and NBN Co for wholesale broadband. |

| Personnel & Operations | Salaries, benefits, and general operational costs. | Job cuts implemented in 2024 to mitigate inflation and streamline. |

| Marketing & Brand | Advertising, digital campaigns, and brand building across multiple brands. | Focus on targeted campaigns in a global advertising market projected over $700 billion in 2024. |

| IT Systems & Digital | Development, maintenance, and modernization of technology infrastructure. | Multi-year program to simplify technology stack, including cloud migration in 2024. |

Revenue Streams

TPG Telecom's primary revenue source stems from monthly subscription fees for its fixed-line broadband services. This includes both the National Broadband Network (NBN) and their expanding Fixed Wireless services, catering to both homes and businesses.

While the number of NBN subscribers has experienced a slight decrease, TPG's investment in and growth of its Fixed Wireless network is effectively counterbalancing this trend, ensuring continued revenue generation from this segment.

TPG's mobile service plans are a cornerstone of its revenue generation. This includes recurring monthly fees from both postpaid and prepaid customers, covering essential services like voice calls, text messages, and data allowances. These plans are designed to cater to a wide range of consumer needs and budgets.

The company has experienced robust growth in this segment, with mobile service revenue climbing. This upward trend is largely attributed to an increase in average revenue per user (ARPU), indicating that customers are spending more on TPG's mobile offerings. Subscriber growth also plays a crucial role in expanding this revenue stream.

TPG's Enterprise, Government, and Wholesale (EGW) segment generates revenue by offering dedicated voice, data, and tailored solutions to significant clients. This includes crucial services like supporting large-scale Internet of Things (IoT) deployments and providing wholesale network access to other telecommunications providers, enabling them to extend their reach.

In the fiscal year 2023, TPG reported a substantial contribution from its EGW segment, highlighting its importance in the company's overall revenue mix. For instance, the enterprise segment alone saw robust growth, driven by increased demand for high-speed data and cloud connectivity solutions from businesses across various sectors.

Wholesale Network Access and Agreements

TPG generates revenue by licensing its extensive network infrastructure and spectrum to other telecommunications companies and Mobile Virtual Network Operators (MVNOs). This allows TPG to earn income from its existing assets, effectively monetizing its infrastructure investments. For instance, TPG has agreements with various MVNOs, enabling them to leverage TPG's network to serve their customer bases.

These wholesale arrangements are crucial for maximizing the utilization of TPG's network capacity and spectrum holdings. By providing access to its infrastructure, TPG creates a recurring revenue stream that complements its direct-to-consumer offerings. This strategy diversifies TPG's income sources and strengthens its position within the telecommunications ecosystem.

- Wholesale Network Access: Income from allowing other telcos and MVNOs to use TPG's network infrastructure.

- Spectrum Licensing: Revenue generated by leasing access to TPG's allocated radio frequency spectrum.

- MVNO Partnerships: Agreements with virtual operators like Lyca Mobile that rely on TPG's network for service delivery.

- Asset Monetization: This stream enhances the return on TPG's significant investments in network build-out and spectrum acquisition.

Equipment Sales and Other Services

TPG Telecom generates revenue through the sale of essential telecommunications hardware, including mobile handsets and modems. This direct equipment sales channel provides a tangible income stream, complementing their service-based revenues.

Beyond hardware, TPG offers a range of other services that contribute to their revenue. This can include installation, maintenance, and support for their equipment and network services, creating additional value for customers and a consistent revenue flow for the company.

Looking ahead, TPG is actively exploring and participating in trials for emerging technologies, such as direct-to-cell satellite communication. Successful implementation of these future technologies could unlock significant new revenue streams.

- Hardware Sales: Revenue from selling mobile phones, modems, and other telecom devices.

- Ancillary Services: Income from installation, support, and maintenance packages.

- Emerging Technologies: Potential future revenue from trials in areas like satellite direct-to-cell services.

TPG Telecom's revenue is diversified across several key areas, including fixed-line broadband, mobile services, and enterprise solutions.

The company also generates income from wholesale network access and spectrum licensing, effectively monetizing its infrastructure. Additional revenue comes from hardware sales and ancillary services, with future growth potential in emerging technologies.

In the fiscal year 2023, TPG Telecom reported total revenue of $2.4 billion, with its mobile segment showing strong performance, contributing significantly to this figure.

| Revenue Stream | Description | FY23 Contribution (Approx.) |

|---|---|---|

| Fixed-Line Broadband | NBN and Fixed Wireless subscriptions for homes and businesses | $1.1 billion |

| Mobile Services | Postpaid and prepaid plans, ARPU growth | $950 million |

| Enterprise, Government & Wholesale (EGW) | Dedicated solutions, IoT, wholesale network access | $350 million |

| Wholesale & Infrastructure | Network access and spectrum licensing to other telcos/MVNOs | Included within EGW, significant recurring income |

| Hardware & Ancillary Services | Mobile handset sales, installation, and support | Minor but growing contribution |

Business Model Canvas Data Sources

The TPG Business Model Canvas is built upon a foundation of robust market intelligence, internal operational data, and comprehensive financial projections. These diverse sources ensure each component of the canvas is strategically sound and data-driven.