TPG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPG Bundle

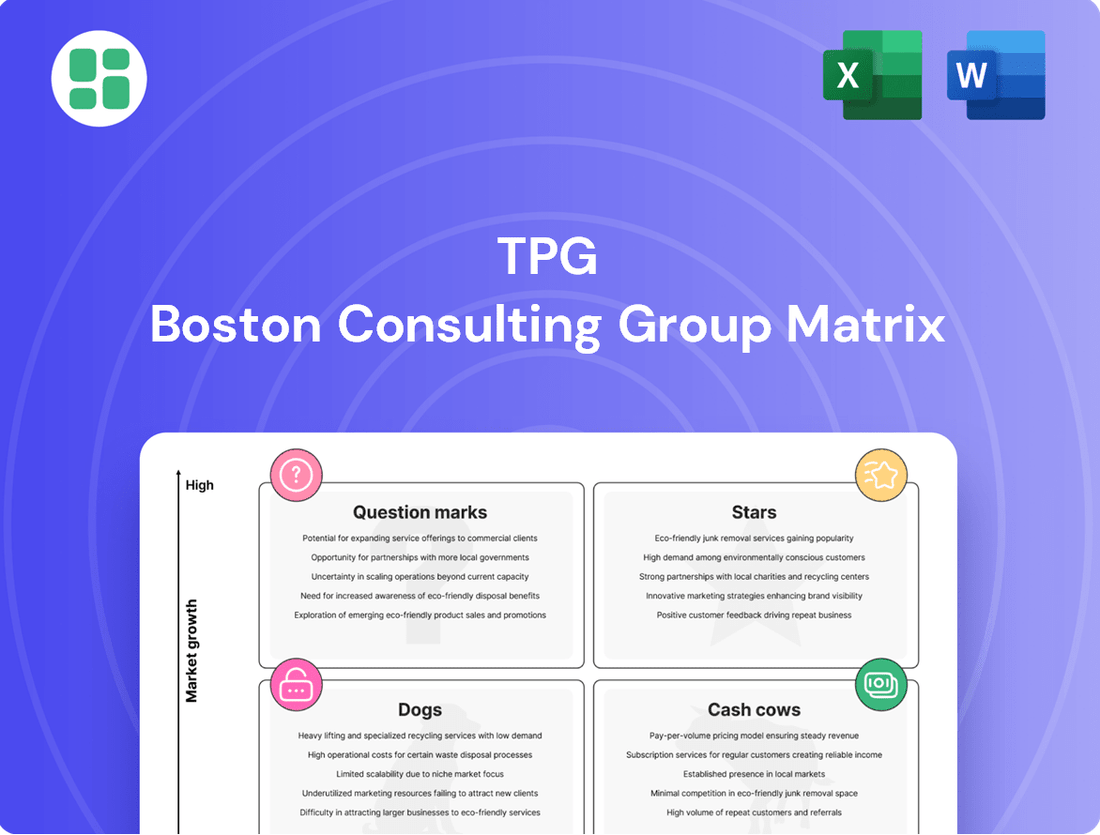

This BCG Matrix offers a glimpse into a company's product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications is crucial for informed strategic decisions. Purchase the full BCG Matrix to unlock detailed analysis, actionable insights, and a clear roadmap for optimizing your product investments and achieving market dominance.

Stars

TPG Telecom's mobile services, especially under the Vodafone banner and its various MVNOs, are performing strongly as Stars in the BCG Matrix. This is largely due to a significant boost in their market reach.

The crucial network sharing deal with Optus, which kicked off in January 2025, has effectively doubled TPG's mobile network coverage. This expansion now reaches an impressive 98.4% of the Australian population, opening up a much wider customer base.

This enhanced coverage, coupled with a solid 5.4% jump in mobile service revenue during FY24, highlights TPG's strong growth trajectory. The company is actively working to capture more market share in what remains a highly competitive telecommunications landscape.

The ongoing deployment and expansion of TPG Telecom's 5G network positions it as a strong contender in a high-growth market segment. TPG has made significant strides, upgrading over 3400 mobile sites to 5G, with a clear target to complete metropolitan site upgrades by the end of 2026.

This investment aligns with robust Australian market growth in 5G adoption, creating a fertile ground for TPG to expand its market share. The increasing demand for 5G services, including fixed wireless access, presents a substantial opportunity for TPG to capitalize on this expanding technological landscape.

TPG Telecom stands as Australia's leading provider of fixed wireless services, a segment that has shown robust growth and an uptick in gross margins. This is particularly noteworthy as the fixed broadband landscape evolves.

Fixed wireless presents a strong alternative to traditional NBN services, especially in regions where NBN performance might be inconsistent. This makes it a high-growth product for TPG, solidifying its strong market position.

Managed IoT Connectivity Solutions

TPG's Managed IoT Connectivity Solutions, a partnership with Vodafone IoT, are poised for significant growth, especially within smart city and utility applications. TPG highlights its leadership in enabling IoT for water utilities, a clear indicator of its strong standing in a rapidly expanding sector.

This area benefits from advanced 4G and 5G technologies, providing businesses with solutions that are both scalable and secure. The market for IoT connectivity is a key growth driver, with global IoT connections projected to reach over 29 billion by 2030, according to Statista.

- Market Growth: The IoT connectivity market is experiencing robust expansion, driven by increasing demand for connected devices across various industries.

- TPG's Niche Strength: TPG's established presence in the water utility sector demonstrates a strategic advantage in a high-potential IoT niche.

- Technological Foundation: The solutions are built on advanced 4G and 5G networks, ensuring reliable and efficient data transmission for a wide range of IoT applications.

- Scalability and Security: Businesses benefit from solutions designed to grow with their needs and provide robust security for sensitive data.

Prepaid Mobile Digital Brands

TPG's prepaid digital brands have been a significant growth engine, boosting mobile service revenue and subscriber counts. These brands are particularly attractive to budget-aware customers seeking flexible plans, a segment that continues to expand within the telecommunications landscape. This strategic focus enables TPG to grow its customer base cost-effectively and stay competitive.

In 2024, TPG's prepaid segment demonstrated robust performance. For instance, the company reported a notable increase in its prepaid subscriber base, driven by targeted digital marketing campaigns. This growth directly contributed to an uplift in overall mobile service revenue, with prepaid services accounting for a substantial portion of this increase.

- Prepaid Growth: TPG's digital prepaid brands have experienced strong year-over-year growth in subscriber numbers.

- Revenue Contribution: These brands have directly fueled an increase in TPG's mobile service revenue.

- Market Appeal: The flexibility and cost-effectiveness of these offerings resonate with a growing segment of price-sensitive consumers.

TPG Telecom's mobile services, particularly under the Vodafone brand and its MVNOs, are performing as Stars in the BCG Matrix due to significant market reach expansion. The network sharing deal with Optus, effective January 2025, doubled TPG's mobile network coverage to 98.4% of the Australian population, opening up a vast customer base.

This enhanced coverage, coupled with a 5.4% increase in mobile service revenue in FY24, signals strong growth. TPG's ongoing 5G network expansion, with over 3400 sites upgraded and a target for metropolitan upgrades by the end of 2026, positions it well in a high-growth market segment driven by increasing 5G adoption.

TPG's leadership in fixed wireless, offering a strong alternative to NBN, and its growing Managed IoT Connectivity Solutions, especially in smart city and utility applications, further solidify its Star status. The prepaid digital brands have also been a key growth engine, boosting subscriber counts and revenue.

| Metric | FY24 Performance | Significance |

|---|---|---|

| Mobile Network Coverage | 98.4% of Australian Population | Doubled via Optus deal, vast customer access |

| Mobile Service Revenue Growth | +5.4% | Indicates strong market traction |

| 5G Site Upgrades | Over 3400 | Positions for high-growth 5G market |

| Prepaid Subscriber Growth | Notable increase | Drives revenue and market share |

What is included in the product

The TPG BCG Matrix offers a strategic framework for analyzing a company's product portfolio by categorizing business units based on market growth and relative market share.

It provides actionable insights into which units to invest in, divest from, or maintain to optimize resource allocation.

One-page overview placing each business unit in a quadrant, simplifying complex portfolio analysis.

Cash Cows

TPG and iiNet's established fixed-line broadband services cater to a large residential segment in a mature market. Despite some subscriber erosion in the competitive NBN landscape, these offerings remain robust cash generators for TPG Telecom, leveraging their strong infrastructure and brand equity. These services require minimal marketing spend to sustain their market position, highlighting their cash cow status.

TPG's legacy wholesale data and internet solutions, despite the recent sale of its EGW fixed business, have historically been a strong source of consistent revenue. These mature products serve other service providers, leveraging existing network infrastructure to generate cash with very little need for further investment to maintain their operations.

While the sale of the EGW fixed business was a strategic move to streamline operations, the underlying wholesale services themselves were reliable cash generators. For instance, in the fiscal year ending June 30, 2023, TPG's wholesale segment contributed significantly to its overall revenue, demonstrating the ongoing value of these established offerings.

Traditional fixed-line voice services, despite the overall market decline driven by mobile and over-the-top (OTT) messaging, continue to offer TPG a stable, low-growth revenue stream.

These services are often bundled for loyal, long-term customers, serving as a high-margin, predictable cash flow contributor that requires minimal additional investment from TPG.

For instance, in the first half of 2024, TPG reported that its legacy fixed-line services, while experiencing a slight year-on-year decline in subscriber numbers, maintained strong profitability, underpinning its overall financial stability.

Legacy DSL Customer Base

The legacy DSL customer base for TPG, while declining, functions as a cash cow within the BCG matrix. This is because these services, despite the shift towards the National Broadband Network (NBN), still generate revenue with minimal incremental investment. The existing infrastructure supports these connections, allowing TPG to capture passive income from customers who haven't yet migrated.

The ongoing revenue from these legacy customers provides a stable income stream that can be reinvested into more promising growth areas. For instance, in 2024, while the NBN rollout continued to impact the DSL market, TPG's focus on customer migration meant that the remaining DSL subscribers were largely on established, low-maintenance plans. This stability is crucial for funding future strategic initiatives.

- Declining but Stable Revenue: Legacy DSL subscribers continue to pay for basic connectivity, contributing to TPG's revenue even as the overall DSL market shrinks.

- Low Investment Requirement: The existing infrastructure for DSL requires minimal ongoing capital expenditure from TPG, maximizing profit margins.

- Passive Income Generation: These customers provide a predictable income stream that can be utilized to support other business units or strategic growth opportunities.

Fixed-Line Infrastructure Assets (Pre-Sale)

Before TPG Telecom's agreement to sell its fibre network infrastructure to Vocus Group for $1.2 billion in May 2024, these fixed-line assets were a prime example of a cash cow. This extensive network, developed over many years, was a mature, high-value asset that consistently generated substantial revenue. Its profitability stemmed from a mix of retail services and wholesale agreements with other telecommunications providers.

The strategic divestment was intended to strengthen TPG's balance sheet and optimize its capital structure. However, the underlying performance of these infrastructure assets prior to the sale highlighted their role as a reliable, cash-generating engine for the company. In the financial year ending December 31, 2023, TPG's infrastructure segment contributed significantly to its overall financial health.

- Mature and Stable Revenue: The fixed-line infrastructure, a result of years of investment, provided a predictable and consistent revenue stream through broadband and other connectivity services.

- Wholesale Agreements: A key driver of cash flow was the company's wholesale business, where its network was leased to other operators, ensuring high utilization and revenue.

- Significant Asset Value: The sheer scale and quality of the fibre network represented a substantial capital asset, underpinning its cash-generating capabilities.

- Strategic Divestment Rationale: The sale to Vocus Group for $1.2 billion in 2024 aimed to unlock capital for debt reduction and future growth initiatives, demonstrating the assets' high market valuation.

Cash cows in TPG's portfolio, like their established fixed-line broadband services, represent mature offerings in a stable market. These services, despite some subscriber shifts, continue to be strong revenue generators due to existing infrastructure and brand loyalty. They require minimal ongoing investment, making them reliable sources of cash flow for the company.

TPG's legacy wholesale data and internet solutions, even after the sale of some assets, have historically provided consistent revenue. These mature products leverage existing network infrastructure to generate cash with little need for further investment. For example, in the fiscal year ending June 30, 2023, TPG's wholesale segment remained a significant revenue contributor.

Traditional fixed-line voice services, while facing market decline, offer TPG a predictable, low-growth revenue stream. Often bundled for loyal customers, these services contribute high-margin, stable cash flow with minimal additional capital expenditure. In the first half of 2024, these legacy fixed-line services demonstrated strong profitability despite slight subscriber declines.

The legacy DSL customer base, though shrinking, functions as a cash cow. These services generate revenue with minimal investment, with existing infrastructure supporting connections and providing passive income. In 2024, TPG's focus on customer migration meant remaining DSL subscribers were on low-maintenance plans, ensuring stable income to fund growth.

| Business Unit | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Fixed-line Broadband (Residential) | Cash Cow | Mature market, strong infrastructure, brand equity | Robust cash generation despite NBN competition |

| Legacy Wholesale Data/Internet | Cash Cow | Leverages existing infrastructure, low investment | Significant revenue contribution in FY23 |

| Traditional Fixed-line Voice | Cash Cow | Stable, low-growth, bundled for loyal customers | Maintained strong profitability in H1 2024 |

| Legacy DSL Customers | Cash Cow | Declining but stable revenue, minimal investment | Passive income generation from established plans |

Full Transparency, Always

TPG BCG Matrix

The BCG Matrix analysis you're previewing is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, ready for your strategic planning and business analysis without any alterations or demo content.

Dogs

Following its regional network sharing agreement with Optus, TPG Telecom recorded a significant non-cash impairment charge in 2024. This charge directly relates to mobile network sites that have been decommissioned, meaning they are no longer operational or contributing to the company's revenue streams.

These decommissioned sites are essentially classified as 'Dogs' within the TPG BCG Matrix. They represent investments from the past that are now being retired or divested, yielding minimal to no future return while still incurring costs associated with their decommissioning and maintenance.

The decision to divest the Enterprise, Government, and Wholesale (EGW) fixed business to Vocus Group strongly suggests this segment was classified as a Dog in the TPG BCG Matrix. This move highlights a strategic recognition that while the segment showed resilience, its growth prospects and market share were insufficient to warrant continued significant investment.

The Vision Network wholesale brand's revenue decline and inability to attract new customers are key indicators of its Dog status. In 2024, this underperformance would have solidified its position as a low-growth, low-market-share entity, making divestiture the logical step to unlock capital for more promising ventures.

TPG's strategic business simplification includes a significant effort to retire outdated IT systems and migrate applications to the cloud. This multi-year program targets legacy platforms that were consuming resources without contributing to competitive advantage or growth.

These legacy systems are often categorized as Dogs in the TPG BCG Matrix due to their low market share and low growth prospects. Their continued operation likely represented a cash drain, necessitating substantial maintenance and support costs. For instance, many companies in 2024 are still grappling with the financial burden of maintaining systems that are decades old, with some reports indicating that IT maintenance alone can consume up to 70% of an IT budget, diverting funds from innovation.

Internode and Westnet Brands

TPG Telecom is phasing out its Internode and Westnet brands, no longer accepting new customers and migrating existing ones to its iiNet brand. This move signals that these brands likely represented low-growth areas within TPG's portfolio, possibly facing declining market share, aligning with the characteristics of 'Dogs' in a BCG Matrix.

The divestment of Internode and Westnet is a strategic effort by TPG to streamline its offerings and concentrate resources on brands with greater growth potential. This simplification allows TPG to focus on core assets and improve overall operational efficiency.

By exiting these brands, TPG aims to reduce complexity and potentially improve its financial performance by shedding underperforming units. This strategy is common for companies looking to optimize their business structure and capital allocation.

- Brand Consolidation: TPG is merging Internode and Westnet customers into the iiNet brand.

- Strategic Rationale: This action suggests Internode and Westnet were considered 'Dogs' due to low growth prospects.

- Resource Allocation: TPG is reallocating resources to focus on its more successful brands.

- Portfolio Simplification: The move aims to create a more streamlined and efficient product portfolio.

Low-Speed NBN Plans (12 Mbps)

Low-speed NBN plans, specifically those at the 12 Mbps tier, are positioned in the Dogs quadrant of the TPG BCG Matrix. This is due to a declining subscriber base as the NBN migration continues, indicating a shrinking market for these offerings.

These plans typically operate with very slim profit margins and hold minimal appeal in a market where consumers increasingly expect faster internet speeds.

- Declining Subscriber Base: As of late 2023 and early 2024, there's a clear trend of customers moving away from the slowest NBN speed tiers.

- Low Profitability: The revenue generated from 12 Mbps plans is unlikely to cover the costs associated with network maintenance and customer support, leading to very low or negative margins.

- Limited Market Appeal: In a digital landscape demanding high-definition streaming, online gaming, and efficient remote work, 12 Mbps is often insufficient, making these plans unattractive to most new customers.

Within the TPG BCG Matrix, 'Dogs' represent business units or products with low market share and low growth prospects. These are often considered cash traps, consuming resources without generating significant returns. TPG's strategic decisions in 2024, such as the decommissioning of mobile network sites and the phasing out of brands like Internode and Westnet, clearly indicate their classification as Dogs.

These underperforming assets, like the 12 Mbps NBN plans, are being divested or retired to free up capital and management focus for more promising ventures. The financial burden of maintaining these low-return units, especially legacy IT systems, often outweighs their contribution, making their removal a crucial step in portfolio optimization.

TPG's actions in 2024 highlight a clear strategy to prune its portfolio, shedding assets that no longer align with its growth objectives or offer competitive advantages. This includes retiring outdated IT systems, a common practice for companies seeking to reduce operational costs and improve efficiency. For instance, many companies in 2024 are still dealing with the significant expense of maintaining legacy systems, which can consume a large portion of IT budgets and hinder innovation.

The divestment of the Enterprise, Government, and Wholesale (EGW) fixed business and the consolidation of brands like Internode and Westnet into iiNet are prime examples of TPG addressing its 'Dogs'. These moves are driven by a recognition that these segments have limited growth potential and market share, necessitating a strategic shift to more profitable areas of the business.

Question Marks

TPG is exploring direct-to-cell satellite messaging through trials with Lynk Global, aiming for deployment by 2025. This initiative targets the burgeoning market for remote connectivity, a sector with substantial growth prospects.

While the technology itself signals high potential, TPG's current market share in this nascent direct-to-cell segment is minimal. Success hinges on significant investment and positive trial outcomes to establish this as a robust revenue stream.

TPG’s strategic shift involves migrating applications to the cloud and introducing new enterprise services, notably leveraging 5G’s network slicing capabilities. This aligns with a market experiencing significant growth, with the global cloud computing market projected to reach $1.3 trillion by 2025, according to Statista.

These new cloud-based offerings target the enterprise sector, a segment where TPG is actively building its presence. While the overall market for enterprise cloud services is expanding, TPG's specific market share and competitive standing within these specialized, high-competition solutions are still in the formative stages of development.

Following the sale of its EGW fixed business to Vocus, TPG Telecom is strategically positioned to concentrate on its mobile segment and explore new wholesale partnerships. This divestment frees up capital and resources, allowing TPG to pursue growth avenues it may have previously deprioritized.

While the broader wholesale market is established, TPG can carve out high-growth niches by forging specific partnerships. Leveraging its enhanced mobile network footprint, which reached 23.4 million people by the end of 2023, or its developing fixed wireless access (FWA) capabilities, TPG can target underserved segments or offer differentiated services. Gaining significant traction in these specialized wholesale areas is crucial for future revenue expansion.

Expansion into New Regional Mobile Markets

TPG's expansion into regional Australian mobile markets following its network sharing deal with Optus positions it in a high-growth area. This move aims to capture subscribers in regions historically dominated by Telstra and Optus. The challenge lies in TPG's current low market share in these specific areas, necessitating substantial investment in marketing and competitive pricing to transform this into a 'Star' segment.

In 2024, TPG Telecom reported a 9.3% increase in its mobile average revenue per user (ARPU) to $36, highlighting the potential for revenue growth in its expanded network footprint. The company's strategy to target regional markets aims to leverage this ARPU growth by acquiring new customers in underserved areas.

- Market Share Growth: TPG aims to significantly increase its subscriber base in regional Australia, which currently has limited competition outside of incumbent players.

- Investment Required: Aggressive marketing campaigns and competitive pricing strategies are crucial for TPG to gain traction and convert potential customers into loyal subscribers.

- ARPU Potential: The average revenue per user in regional markets, once captured, offers a strong opportunity for revenue enhancement, as seen in TPG's overall ARPU growth.

Advanced 5G Use Cases (e.g., Network Slicing)

TPG's strategic investment in its 5G standalone core, bolstered by its partnership with Ericsson, is a critical enabler for advanced 5G applications. This infrastructure is designed to support sophisticated functionalities like network slicing, which allows for the creation of dedicated virtual networks tailored to specific service requirements, ensuring guaranteed quality of service for demanding applications. This is crucial for enabling low-latency communications essential for real-time interactions.

These advanced capabilities are foundational for high-growth, innovative sectors. For instance, TPG's 5G network is being developed to support connected cars, enabling vehicle-to-everything (V2X) communication for enhanced safety and traffic management. Similarly, smart city initiatives, which rely on massive data exchange and real-time analytics, will benefit from this robust 5G deployment. The potential for revenue generation in these specialized enterprise solutions is significant, though currently in its nascent stages.

- Network Slicing: Allows TPG to create customized, isolated virtual networks on its 5G infrastructure, each optimized for specific use cases with guaranteed performance levels.

- Low-Latency Communications: Essential for applications like autonomous driving, remote surgery, and industrial automation, where near-instantaneous data transfer is paramount.

- Enterprise Solutions: Focus on sectors like automotive (connected cars) and urban development (smart cities), requiring dedicated and high-performance network capabilities.

- Market Penetration: While the technology is in place, TPG's market penetration and revenue generation from these highly specialized 5G services are still developing, necessitating significant market education and customer acquisition efforts.

Question marks in TPG's BCG Matrix represent initiatives with high growth potential but currently low market share. These are areas where TPG is investing heavily to establish a strong foothold. The success of these ventures is uncertain, requiring significant capital and strategic execution to transition them into future revenue drivers.

TPG's direct-to-cell satellite messaging and advanced 5G enterprise solutions fall into this category. While the markets are expanding rapidly, TPG's presence is nascent, demanding substantial investment to build brand recognition and customer adoption.

The regional mobile expansion also presents question mark characteristics. TPG aims to capture market share in underserved areas, but faces intense competition and requires aggressive marketing to succeed. The potential for high ARPU in these regions, however, makes it a strategic focus.

The company's strategic pivot towards cloud and new enterprise services, particularly those leveraging 5G capabilities like network slicing, also fits the question mark profile. These are high-growth sectors, but TPG's market share and competitive positioning are still in early development stages.

| Initiative | Market Growth Potential | Current Market Share | Strategic Focus | Key Challenge |

|---|---|---|---|---|

| Direct-to-Cell Satellite Messaging | High | Minimal | Trials with Lynk Global for 2025 deployment | Establishing market presence and positive trial outcomes |

| Advanced 5G Enterprise Solutions (Network Slicing, V2X, Smart Cities) | High | Nascent | Investment in 5G standalone core with Ericsson | Market education and customer acquisition for specialized services |

| Regional Mobile Market Expansion | High | Low | Network sharing deal with Optus | Aggressive marketing and competitive pricing to gain subscribers |

| New Cloud-Based Enterprise Services | High (Global Cloud Market projected $1.3T by 2025) | Formative Stages | Migrating applications to the cloud | Building presence in high-competition specialized solutions |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data, including financial disclosures, market research, and industry growth trends, to provide accurate strategic insights.