TPG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TPG Bundle

Unlock critical insights into TPG's operating environment with our comprehensive PESTLE analysis. Discover how political stability, economic fluctuations, and technological advancements are shaping its trajectory. Equip yourself with the knowledge to anticipate challenges and capitalize on opportunities.

Political factors

Government regulation significantly shapes the Australian telecommunications landscape, with the Australian Competition and Consumer Commission (ACCC) and the Australian Communications and Media Authority (ACMA) being key oversight bodies. Recent ACCC decisions, like approving TPG's regional network sharing agreement with Optus, directly influence TPG's strategic direction and ability to expand its market presence.

The government's ongoing focus on fostering competition and encouraging infrastructure development continues to mold the industry's future. This policy environment directly impacts TPG's strategic planning for network expansion and its overall competitive standing within the market.

The Australian Competition and Consumer Commission (ACCC) continues to prioritize competition in crucial sectors like telecommunications, directly impacting TPG Telecom. In 2024, the ACCC's active enforcement, including investigations into potential anti-competitive practices, means TPG must adhere to stringent rules regarding market conduct and network sharing.

This heightened regulatory attention, exemplified by the ACCC's ongoing scrutiny of exclusive agreements, compels TPG to ensure its operations foster fair competition. The regulator's objective is to curb market dominance and cultivate a more dynamic marketplace for consumers, a key consideration for TPG's strategic planning.

The National Broadband Network (NBN) policy remains a critical factor for TPG Telecom's fixed-line broadband business. NBN Co's ongoing efforts to upgrade its network, including the planned introduction of new speed tiers in 2025, directly influence TPG's competitive positioning and revenue potential in the Australian market.

TPG's ability to leverage its own fiber infrastructure and navigate regulatory discussions around wholesale-only access and anti-cherry-picking rules are key to its strategy. For instance, TPG's significant investments in its own fiber-to-the-premises (FTTP) network, estimated to cover millions of premises, provide a distinct advantage, but are subject to the broader NBN Co framework.

Digital Economy Regulation

Australia's proposed digital competition reforms aim to level the playing field for digital platform services. These changes could introduce new obligations for major digital players, potentially influencing how telecommunications companies like TPG interact with these platforms. While TPG is not a digital platform itself, its role as a major internet service provider means it could be indirectly impacted by regulations concerning data usage, online content, and consumer protection within the digital ecosystem. For instance, the Australian Competition and Consumer Commission (ACCC) has been actively investigating digital platforms, highlighting concerns that could shape future regulatory approaches impacting the broader digital economy.

The government's focus on digital economy regulation, particularly concerning competition, could lead to broader obligations for digital services. TPG, as a significant internet service provider, may find its engagement with digital content and service providers affected by these evolving policies. This could include aspects related to data access, content delivery, and fair trading practices, all of which are central to the ACCC's ongoing scrutiny of the digital sector. The Australian government's commitment to fostering competition in the digital sphere underscores a trend towards greater oversight.

Key areas of potential impact for TPG include:

- Data Usage Policies: Regulations may influence how data is collected, used, and shared between telecommunications providers and digital platforms.

- Consumer Protection: Stricter rules on online content and platform interactions could necessitate changes in TPG's service delivery and customer agreements.

- Fair Trading: Policies aimed at ensuring fair competition might affect TPG's partnerships and commercial arrangements with digital service providers.

International Relations and Trade Agreements

While specific impacts on TPG from recent international relations and trade agreements aren't detailed, these broader factors significantly shape the telecommunications landscape. Changes in global trade policies, for instance, could affect the cost and accessibility of essential network equipment, impacting TPG's infrastructure investment plans. Geopolitical tensions might also influence supply chain stability and the international movement of skilled technology professionals, potentially delaying network build-outs or increasing operational expenses.

Consider these potential influences:

- Supply Chain Vulnerability: Trade disputes or sanctions could disrupt the sourcing of critical components for TPG's network infrastructure, leading to increased costs or delays. For example, the global semiconductor shortage experienced in 2021-2022, partly influenced by geopolitical factors, impacted various tech sectors.

- Talent Mobility: Evolving immigration policies and international relations can affect TPG's ability to recruit and retain specialized talent in areas like 5G deployment and cybersecurity.

- Market Access and Competition: Trade agreements can open or close markets, influencing TPG's expansion opportunities and the competitive environment it operates within, especially concerning international equipment vendors.

Government policy remains a dominant force in Australia's telecommunications sector, with regulatory bodies like the ACCC actively shaping market dynamics. The ACCC's continued focus on competition, as seen in its oversight of network sharing agreements, directly impacts TPG's strategic maneuvers and market expansion capabilities. Furthermore, the ongoing evolution of the National Broadband Network (NBN) policy, including planned speed upgrades for 2025, presents both opportunities and challenges for TPG's fixed-line business.

What is included in the product

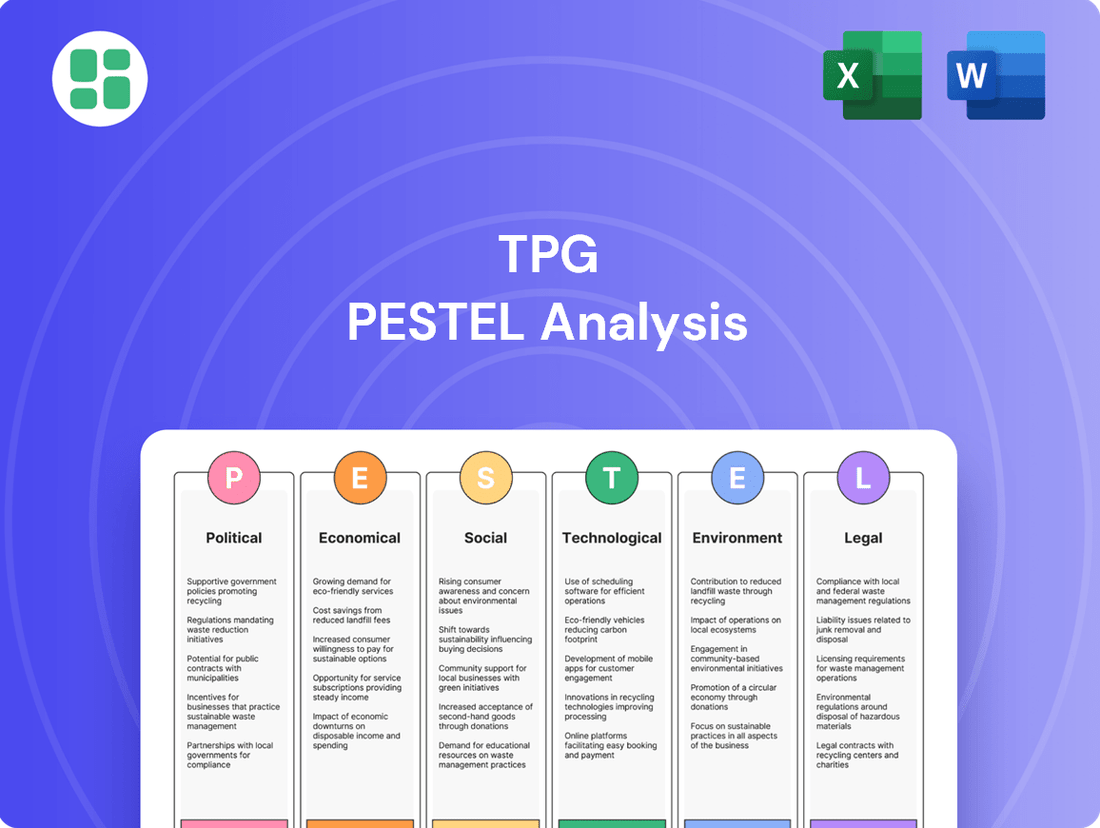

This PESTLE analysis for TPG provides a comprehensive examination of the external macro-environmental forces impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise and actionable summary of external factors, enabling quicker decision-making and mitigating the risk of overlooking critical market shifts.

Economic factors

Persistent inflation in Australia is directly affecting how much consumers can spend on essential services like telecommunications. This means even though TPG's services are generally needed, customers are becoming more price-sensitive. We're seeing that around half of Australian mobile users switch providers every two years, a trend likely to accelerate as people look for savings.

TPG must navigate this challenging economic landscape by offering attractive, competitive pricing without compromising its ability to remain profitable. Balancing these two crucial aspects is key to maintaining market share and financial health during this period of economic uncertainty.

The Australian telecommunications sector is projected for moderate growth, with an estimated average annual rate of 1.4% between 2025 and 2032, anticipating a market value of USD 29 billion by 2032. This suggests a mature yet stable industry landscape.

TPG's future expansion hinges on its strategic capacity to increase market share. This will be achieved through compelling product offerings and continued network development, particularly in the mobile segment where subscriber growth remains robust.

Telecommunications operators are maintaining robust capital expenditure, even as the peak driven by the NBN initiative subsides. This sustained investment is crucial for handling the ever-increasing demand for data and broadening mobile network coverage. For instance, in 2023, the Australian telecommunications sector saw significant Capex, with major players continuing to invest heavily in network upgrades.

TPG's strategic capital allocation is evident in its substantial investments in the 5G rollout and its network sharing agreement with Optus in regional areas. Furthermore, the sale of its fibre assets to Vocus for $807 million in late 2023 demonstrates a clear focus on optimizing its network infrastructure and enhancing financial efficiency. These moves are designed to position TPG effectively in a competitive market.

Consumer Spending and ARPU

Consumer demand for high-speed internet and mobile data remains a strong revenue driver for TPG Telecom. This trend is supported by the ongoing need for reliable connectivity, particularly with increased remote work and digital entertainment consumption.

TPG's mobile service revenue has shown resilience, notably increasing due to a rise in Average Revenue Per User (ARPU) and a growing prepaid subscriber base. For instance, in the first half of 2024, TPG reported a 1.4% increase in mobile ARPU, reaching $31.70.

While TPG experienced a dip in postpaid subscribers, largely attributed to aggressive competitor pricing, the overall increase in ARPU signals a positive shift. Maintaining and growing this ARPU is paramount for TPG's financial stability.

- Increased Mobile ARPU: TPG's mobile ARPU grew to $31.70 in H1 2024, up from $31.25 in H1 2023.

- Prepaid Subscriber Growth: The company saw a notable increase in prepaid subscribers, contributing to overall revenue.

- Postpaid Subscriber Challenges: Aggressive competitor discounting impacted postpaid subscriber numbers.

- Strategic Focus on ARPU: Future financial health hinges on TPG's ability to sustain and enhance ARPU.

Impact of Mergers and Acquisitions

The Australian telecom landscape has experienced substantial consolidation, with TPG's merger with Vodafone being a prime example. These strategic transactions are reshaping the competitive dynamics and market structure.

TPG's recent divestment of its fibre network and EGW fixed business to Vocus Group for AUD 5.25 billion, pending regulatory approval, is a significant move. This transaction is designed to simplify TPG's operations and improve its financial health by optimizing its capital structure.

The sale fundamentally alters TPG's asset portfolio and financial standing, reflecting a broader trend of specialization and strategic realignment within the Australian telecommunications sector. This move allows TPG to focus on core competencies and potentially pursue new growth avenues.

- Market Consolidation: The TPG-Vodafone merger exemplifies the ongoing trend of consolidation in the Australian telecom market.

- Strategic Divestment: TPG's AUD 5.25 billion sale of its fibre network and EGW business to Vocus Group aims to streamline operations.

- Financial Optimization: The divestment is a key step in optimizing TPG's capital structure and enhancing its financial flexibility.

- Asset Reshaping: This transaction significantly reshapes TPG's asset base, allowing for a more focused business strategy.

Persistent inflation in Australia is making consumers more budget-conscious, impacting spending on services like telecommunications. With around half of mobile users switching providers every two years, TPG needs to offer competitive pricing to retain customers in this environment.

The Australian telecommunications market is expected to see steady growth, with projections indicating an average annual rate of 1.4% from 2025 to 2032, reaching an estimated USD 29 billion by 2032. TPG's strategy to increase market share will rely on strong product offerings and continued network investment, particularly in mobile services.

| Metric | Value (H1 2024) | Previous Period (H1 2023) | Trend |

|---|---|---|---|

| Mobile ARPU | $31.70 | $31.25 | Increase |

| Prepaid Subscribers | Growing | N/A | Positive |

| Postpaid Subscribers | Decreased | N/A | Negative |

Preview the Actual Deliverable

TPG PESTLE Analysis

The preview you see here is the exact TPG PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready for immediate use, providing comprehensive insights into the political, economic, social, technological, legal, and environmental factors affecting TPG. This detailed analysis is delivered exactly as shown, ensuring you get the complete, professionally structured report you're expecting.

Sociological factors

Australian consumers' reliance on digital services is soaring, fueling demand for robust internet. In 2024, over 85% of Australian households have internet access, with a significant portion subscribing to NBN broadband, essential for streaming, gaming, and remote work. This digital dependency underscores the need for reliable connectivity.

Consumer habits are shifting towards value and flexibility in mobile services. A substantial number of Australians, estimated at around 30% in 2024, switch mobile providers annually, prioritizing competitive pricing and bundled deals. This trend highlights a move away from brand loyalty towards cost-effectiveness, with family plans and bulk data offerings gaining traction.

Australians are consuming mobile data at an unprecedented rate, a trend poised for further acceleration with the ongoing 5G network expansion. TPG Telecom is strategically positioned to capitalize on this, actively increasing its 4G and 5G coverage, notably by doubling its mobile network's reach in regional Australia. This expansion directly caters to the surging demand for reliable and high-speed mobile connectivity.

The telecommunications landscape is clearly shifting from traditional voice services to data-centric offerings. TPG's investment in network infrastructure, including its 2024 commitment to expand 5G coverage to over 85% of the population, underscores its understanding of this evolution and its strategy to meet the growing appetite for data-intensive applications and services.

Expanding network coverage in Australia's regional and remote areas is a crucial social goal. TPG's network sharing deal with Optus is set to significantly boost its mobile footprint. This agreement is projected to double TPG's network coverage, aiming to reach 98.4% of the Australian population.

This expansion will offer greater choice and improved services for communities and businesses outside major urban centers. It directly addresses the digital divide, fostering greater digital inclusion across the nation. For instance, in 2023, telecommunications infrastructure investment in regional Australia was a key focus, with government initiatives aiming to connect underserved areas.

Customer Service Expectations

In 2024, the telecommunications sector, including TPG, faces heightened customer service expectations. With mobile market loyalty at a low, maintaining impeccable service and actively managing online reviews are paramount for subscriber retention. A recent report indicated that over 60% of consumers consider customer service a key factor when choosing a mobile provider, and a negative online review can deter a significant portion of potential customers.

TPG must therefore continuously evolve to meet shifting consumer demands. This includes prioritizing seamless connectivity, offering personalized service plans, and enhancing the overall user experience. By 2025, telcos that fail to adapt risk losing market share, as consumers increasingly seek providers that offer more than just basic network coverage, demanding proactive support and tailored digital interactions.

- Customer Service as a Differentiator: In a saturated market, superior customer service is a primary driver of customer loyalty and acquisition.

- Online Reputation Management: Proactive monitoring and response to online reviews are critical for mitigating negative sentiment and building trust.

- Personalization and Experience: Consumers expect tailored offers and a smooth, intuitive experience across all touchpoints.

- Adaptability to Preferences: Telcos must remain agile in responding to evolving consumer needs for seamless connectivity and enhanced digital engagement.

Remote Work and Education Trends

The ongoing shift to remote work and online learning significantly boosts the need for robust home internet and mobile services. TPG's diverse portfolio, encompassing fixed-line broadband, fixed wireless, and mobile plans, aligns perfectly with these changing consumer habits, thereby underpinning Australia's digital infrastructure.

For instance, in 2024, the Australian Bureau of Statistics reported that approximately 37% of employed Australians worked from home at least one day a week, highlighting a persistent trend. This sustained demand translates directly into TPG's market opportunity.

- Increased Demand: The pandemic accelerated remote work, with many businesses continuing hybrid or fully remote models in 2024-2025.

- Connectivity Needs: Reliable, high-speed internet is now a non-negotiable for productivity in both work and education.

- TPG's Position: TPG's diverse network infrastructure, including fibre-to-the-premises (FTTP) and 5G mobile, is well-suited to meet these evolving connectivity requirements.

- Economic Impact: Supporting these trends strengthens the digital economy, creating opportunities for TPG to expand its service offerings and customer base.

Sociological factors significantly influence TPG's market position in Australia. The increasing reliance on digital services, with over 85% of Australian households having internet access in 2024, underscores the demand for robust connectivity. Consumer habits are also shifting towards value and flexibility, leading around 30% of Australians to switch mobile providers annually for better pricing and bundled deals.

The trend towards remote work and online learning further amplifies the need for reliable home internet and mobile services. In 2024, about 37% of employed Australians worked from home at least one day a week, a persistent trend that TPG's diverse network infrastructure is well-positioned to support. This sustained demand creates significant market opportunities for TPG to expand its service offerings and customer base, strengthening the digital economy.

| Factor | Description | Impact on TPG | 2024/2025 Data Point |

|---|---|---|---|

| Digital Dependency | Growing reliance on internet for daily activities | Increased demand for broadband and mobile data | 85%+ Australian households with internet access |

| Consumer Value Seeking | Prioritizing cost-effectiveness and flexibility in services | Need for competitive pricing and bundled offers | ~30% annual mobile provider switching rate |

| Remote Work/Learning | Shift towards flexible work and education models | Sustained demand for reliable home and mobile connectivity | ~37% of employed Australians working from home weekly |

Technological factors

The ongoing and accelerated rollout of 5G networks represents a significant technological catalyst for TPG. The company is actively working to expand its 5G footprint, with ambitious plans to expedite its network deployment in crucial regions.

TPG aims to effectively double its overall mobile network coverage by leveraging a strategic regional sharing agreement. This expansion is designed to provide customers with substantially faster speeds and to create a robust infrastructure capable of supporting a new wave of emerging technologies and services.

TPG Telecom, a major player in Australia's telecommunications landscape, is heavily influenced by technological advancements. As Australia's largest provider of fixed wireless services, the company has seen this segment deliver robust growth and improved profit margins, effectively counterbalancing a decrease in its NBN subscriber base.

The ongoing transformation of the National Broadband Network (NBN) is a critical technological factor. With the rollout of fibre-to-the-premises (FTTP) upgrades and the introduction of new, higher speed tiers, TPG faces a dynamic environment. These developments create both avenues for expanding its fixed broadband services and potential hurdles as it adapts its offerings to meet evolving customer demands for faster, more reliable internet.

TPG is actively modernizing its network infrastructure, a crucial technological factor. By fiscal year 2026, the company plans to consolidate its operations onto a unified technology stack, significantly reducing its application footprint.

This strategic shift towards a 'lean architecture' is designed to accelerate product innovation and deepen customer engagement. A key objective is to move beyond the limitations of complex legacy systems, thereby unlocking greater efficiency and agility.

The modernization effort is projected to yield substantial capital and operating cost reductions. For instance, TPG's IT modernization program is a significant undertaking, with the company investing heavily to achieve these streamlined operations and technological advancements.

Integration of AI and Automation

The telecommunications sector is rapidly adopting AI and automation to boost customer service and streamline operations. For TPG, this translates to potential investments in AI for smarter network management, more personalized customer interactions, and improved service delivery, all aimed at staying competitive and cutting expenses. The global AI market in telecommunications was projected to reach over $20 billion by 2024, highlighting the significant investment in this area.

TPG's strategic direction likely includes leveraging AI for predictive maintenance of its network infrastructure, reducing downtime and enhancing service reliability. Furthermore, AI-powered chatbots and virtual assistants are becoming standard for handling customer inquiries, offering 24/7 support and freeing up human agents for more complex issues. This trend is supported by industry reports indicating that AI adoption in customer service can lead to a 15-30% reduction in operational costs.

- AI-driven network optimization: TPG can use AI to predict and prevent network failures, ensuring consistent service quality.

- Enhanced customer experience: Automation in customer service, through AI chatbots, can provide faster resolutions and personalized support.

- Operational cost reduction: Implementing AI across various functions can lead to significant savings by automating repetitive tasks and improving efficiency.

- Data analytics for service improvement: AI enables TPG to analyze vast amounts of customer data to identify trends and proactively improve service offerings.

3G Network Shutdown and Spectrum Reallocation

TPG's completion of its 3G network shutdown by December 2023 is a significant technological shift. This move frees up valuable spectrum, which is now being strategically reallocated. The primary goal is to bolster TPG's 5G network expansion and overall enhancement.

This spectrum reallocation is vital for improving data speeds and network reliability across both urban centers and more remote rural locations. It directly addresses the growing consumer and business demand for higher bandwidth services, essential for advanced mobile applications and data-intensive operations.

- Spectrum Redeployment: 3G spectrum vacated by TPG is now available for 5G deployment, enhancing network capacity.

- Enhanced 5G Coverage: This strategic move enables TPG to expand and strengthen its 5G network, particularly in underserved areas.

- Improved User Experience: Reallocated spectrum is expected to deliver faster speeds and more reliable connections for TPG customers.

- Future-Proofing: The shutdown and reallocation position TPG to better meet future demands for data-intensive services.

Technological factors are pivotal for TPG, particularly its aggressive 5G rollout and network modernization. The company is consolidating its operations onto a unified technology stack by fiscal year 2026, aiming to reduce its application footprint and accelerate innovation. This strategic shift towards a 'lean architecture' is projected to yield significant capital and operating cost reductions, with IT modernization a key investment area.

TPG's completion of its 3G network shutdown by December 2023 is freeing up valuable spectrum for 5G expansion, enhancing both speed and reliability. The telecommunications sector's adoption of AI and automation is also a major trend, with TPG potentially investing in AI for smarter network management and improved customer service, aiming for cost reductions and enhanced efficiency.

| Technological Factor | TPG's Action/Impact | Data/Projection |

|---|---|---|

| 5G Network Expansion | Accelerated rollout and regional sharing agreement | Aim to double mobile network coverage |

| Network Modernization | Consolidation onto unified tech stack | By fiscal year 2026 |

| 3G Network Shutdown | Spectrum reallocation for 5G | Completed December 2023 |

| AI & Automation Adoption | Potential investment in AI for operations | Global AI in telecom market projected >$20B by 2024 |

Legal factors

The Australian Competition and Consumer Commission (ACCC) actively monitors TPG Telecom's operations, ensuring fair competition within the telecommunications sector. The ACCC's 2022 decision to approve TPG's regional network sharing agreement with Optus, following its earlier rejection of a similar deal with Telstra, underscores its commitment to preventing market dominance. This scrutiny extends to TPG's digital services, with the ACCC vigilant against anti-competitive practices and misleading advertising.

TPG Telecom must strictly adhere to the Telecommunications Act 1997, particularly its carrier separation mandates designed to keep wholesale and retail operations distinct. This separation is crucial for preventing any unfair advantage TPG's retail arm might gain through access to wholesale network information.

Recent enforcement actions highlight the critical nature of this compliance. For instance, TPG has faced penalties for alleged breaches of its functional separation undertaking. In 2023, the Australian Competition and Consumer Commission (ACCC) reported that TPG paid $100,000 in penalties for failing to comply with its undertaking regarding the separation of its wholesale and retail functions.

Failure to maintain this separation can lead to significant financial and reputational damage, impacting TPG's ability to operate competitively and maintain customer trust in its services.

The telecommunications sector, including TPG, faces increasingly stringent data privacy and cybersecurity regulations. For instance, the EU's General Data Protection Regulation (GDPR) and similar frameworks globally mandate strict data handling protocols. TPG, managing extensive customer data, must continually adapt its practices to comply with these evolving laws, which often include hefty fines for breaches, such as the potential €20 million or 4% of global annual turnover penalties under GDPR.

Investing in robust cybersecurity is paramount for TPG to safeguard sensitive customer information and uphold consumer trust. In 2024, global cybersecurity spending is projected to reach over $200 billion, reflecting the critical need for advanced protective measures. TPG's commitment to these investments directly impacts its reputation and ability to retain customers in a competitive market where data security is a key differentiator.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for TPG. The Australian Competition and Consumer Commission (ACCC) has highlighted misleading pricing and product claims in essential services, including telecommunications, as a key compliance and enforcement priority for 2024/25. This means TPG must be exceptionally diligent in ensuring its advertising and service descriptions are accurate and transparent. Failure to comply with consumer guarantee laws can result in substantial penalties and damage to consumer trust.

TPG's adherence to these regulations is crucial for maintaining its market standing. For instance, the ACCC has previously taken action against telecommunications companies for misleading advertising practices, leading to significant fines. In 2023, the ACCC secured over $1 million in penalties against a telecommunications provider for misleading advertising regarding its NBN plans. This underscores the importance of TPG ensuring its marketing materials and service contracts are crystal clear and fully compliant with all consumer protection legislation.

- ACCC's 2024/25 Priorities: Focus on misleading pricing and product claims in essential services, including telcos.

- TPG's Obligation: Ensure transparency in advertising and service offerings, adhering to consumer guarantee laws.

- Potential Consequences: Penalties and loss of consumer trust for non-compliance.

- Industry Precedent: Significant fines imposed on telcos for similar misleading practices in the past.

Foreign Investment Review Board (FIRB) Approvals

Foreign investment in Australia, particularly in critical infrastructure sectors, is closely monitored by the Foreign Investment Review Board (FIRB). TPG Telecom's strategic divestments, such as the sale of its fibre network infrastructure and EGW fixed business to Vocus Group, necessitate FIRB approval. This regulatory oversight ensures that foreign investments align with Australia's national interests.

The completion of these transactions is vital for TPG's financial health and strategic repositioning. For instance, the FIRB approval secured in July 2025 for the Vocus sale was a significant milestone, enabling TPG to unlock capital and reduce debt. Such approvals are a key legal factor impacting the timing and success of major corporate deals.

- FIRB Approval Process: Transactions exceeding certain thresholds or involving sensitive sectors require FIRB review.

- National Interest Test: FIRB assesses whether a foreign investment is contrary to Australia's national interest.

- Deal Enabler: FIRB clearance is a prerequisite for many significant M&A activities, including TPG's divestments.

- Strategic Impact: Successful FIRB approvals facilitate TPG's debt reduction and strategic focus on core assets.

TPG Telecom operates under a rigorous legal framework, including the Telecommunications Act 1997, which mandates functional separation between wholesale and retail operations to ensure fair competition. Penalties for non-compliance, such as TPG's $100,000 fine in 2023 for breaching separation undertakings, underscore the critical importance of these regulations.

Data privacy and cybersecurity laws are increasingly stringent, with potential fines under frameworks like GDPR reaching significant percentages of global turnover. TPG's investment in cybersecurity, a sector projected to exceed $200 billion in global spending in 2024, is vital for protecting customer data and maintaining trust.

Consumer protection laws, particularly regarding misleading advertising and pricing, are a key focus for the ACCC in 2024/25. TPG must ensure transparency to avoid penalties and reputational damage, as evidenced by past actions against telcos for similar practices, which have resulted in fines exceeding $1 million.

Foreign investment in Australia, especially in critical infrastructure, is subject to Foreign Investment Review Board (FIRB) approval. TPG's divestments, like the sale to Vocus Group approved in July 2025, require FIRB clearance, impacting deal timelines and TPG's ability to achieve strategic financial objectives such as debt reduction.

Environmental factors

TPG Telecom is actively addressing climate change, setting ambitious goals to achieve net-zero greenhouse gas (GHG) emissions across its entire operations by 2050. This commitment is underscored by its validated science-based targets, which include a significant 95% reduction in Scope 1 and 2 emissions by 2030. These targets, confirmed by the Science Based Target initiative in late 2023, highlight TPG's proactive approach to mitigating its environmental footprint.

TPG's commitment to powering its operations with 100% renewable electricity from 2025 is a significant environmental strategy. This move is crucial for meeting its Scope 1 and 2 emissions reduction goals, aiming for a 45% decrease in Scope 1 and 2 emissions intensity by FY2025 compared to FY2020. This aligns with Australia's broader transition towards a low-carbon economy, a trend supported by government incentives and increasing consumer demand for sustainable practices.

TPG acknowledges the substantial electronic waste (e-waste) produced by the telecommunications sector. The company is committed to product stewardship, a strategy designed to lessen the environmental footprint of its offerings across their entire lifespan. This involves diligently tracking waste generated during operations and collaborating with suppliers and industry peers on effective e-waste handling and material reclamation.

In 2023, global e-waste generation reached an estimated 62 million tonnes, a figure projected to climb. TPG's efforts in resource recovery and responsible disposal are crucial in mitigating this growing environmental challenge, aligning with broader industry trends towards circular economy principles.

Sustainability Reporting and Disclosures

TPG Telecom is committed to transparent environmental reporting. They align with key industry frameworks like the GSMA's Climate Action Taskforce and the Australian Climate Leaders Coalition, demonstrating a proactive approach to sustainability. This commitment ensures stakeholders have access to crucial environmental data.

These disclosures are vital for investors and other stakeholders who need to understand TPG's environmental impact and how they manage climate-related risks. For instance, in their 2023 Sustainability Report, TPG detailed its progress towards emissions reduction targets.

- Emissions Reduction: TPG aims to reduce its Scope 1 and 2 greenhouse gas emissions by 30% by 2030 from a 2019 baseline.

- Renewable Energy: The company is increasing its use of renewable energy sources to power its operations.

- Climate Risk Assessment: TPG conducts regular assessments to identify and manage the physical and transitional risks associated with climate change.

Supply Chain Sustainability

TPG's commitment to supply chain sustainability is evident through its Supplier Engagement Program. This initiative aims to integrate environmental and social responsibility across its network, targeting key areas like energy consumption, emissions reduction, human rights adherence, and waste management. By actively working with suppliers, TPG seeks to foster a more responsible and resilient supply chain.

A significant focus for TPG involves collaborative efforts with suppliers to enhance packaging efficiency and boost resource recoverability. These actions are directly linked to achieving TPG's overarching sustainability objectives, such as reducing its environmental footprint and promoting circular economy principles. For instance, in 2023, TPG reported that 89% of its packaging was recyclable or reusable, a testament to these ongoing supplier collaborations.

- Supplier Engagement Program: TPG actively involves its suppliers in sustainability initiatives.

- Key Focus Areas: Energy, emissions, human rights, and waste are prioritized.

- Collaboration for Impact: Working with suppliers on packaging reduction and resource recovery is vital.

- 2023 Packaging Data: 89% of TPG's packaging was recyclable or reusable, reflecting progress.

TPG Telecom is actively working to reduce its environmental impact, aiming for net-zero emissions by 2050 with validated science-based targets including a 95% reduction in Scope 1 and 2 emissions by 2030. The company plans to power its operations with 100% renewable electricity from 2025, a move critical for achieving its emissions intensity reduction goals. TPG also focuses on managing electronic waste through product stewardship and supplier collaboration, with 89% of its packaging being recyclable or reusable as of 2023.

| Environmental Factor | TPG's Commitment/Action | Key Data/Target |

|---|---|---|

| Climate Change & Emissions | Net-zero GHG emissions goal; Science-based targets for Scope 1 & 2 reduction | Net-zero by 2050; 95% Scope 1 & 2 reduction by 2030; 45% Scope 1 & 2 intensity reduction by FY2025 (vs FY2020) |

| Renewable Energy | Transitioning to 100% renewable electricity | 100% renewable electricity from 2025 |

| Electronic Waste (E-waste) | Product stewardship; Tracking waste; Collaborating on e-waste handling | 89% of packaging recyclable/reusable (2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We meticulously gather insights on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to ensure a comprehensive and accurate assessment.