Tower Semiconductor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tower Semiconductor Bundle

Tower Semiconductor operates within a dynamic global landscape, significantly influenced by political stability, economic fluctuations, and rapid technological advancements. Understanding these external forces is crucial for anyone looking to invest or strategize within the semiconductor industry. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable intelligence. Download the full version now and gain the strategic clarity you need to navigate Tower Semiconductor's future.

Political factors

Governments globally are prioritizing semiconductor manufacturing, with significant investments like the U.S. CHIPS and Science Act and similar EU initiatives. These programs aim to bolster domestic production capabilities. For Tower Semiconductor, these subsidies can substantially lower the massive capital outlays required for building or expanding fabrication plants, thereby enhancing their competitive position in strategically important markets.

Escalating geopolitical tensions, especially between the US and China, continue to shape global trade policies. These tensions directly affect the semiconductor industry, a critical sector for national security and economic growth. For Tower Semiconductor, this translates to potential disruptions in its supply chain and market access.

Tariffs and export controls, like those implemented by the US on advanced chip technology, can significantly impact companies like Tower. These measures might restrict access to key manufacturing equipment or limit sales in certain regions. In 2023, for instance, the global semiconductor market faced headwinds due to these trade restrictions, with some analysts predicting continued volatility in 2024.

Semiconductors are now considered critical for national security, driving governments to enact industrial policies. These policies aim to bolster domestic chip manufacturing capabilities, which could directly impact Tower Semiconductor's investment decisions, partnership opportunities, and market access for its advanced technologies.

For instance, the US CHIPS and Science Act, enacted in 2022 with over $52 billion allocated for domestic semiconductor production and research, highlights this trend. Similarly, the EU's European Chips Act aims to double the bloc's share of global semiconductor production by 2030. Such initiatives create both opportunities and potential restrictions for companies like Tower Semiconductor, influencing global supply chain dynamics and strategic alliances.

Regulatory Stability and Investment Climate

Tower Semiconductor's operations are significantly influenced by the regulatory stability in its key markets, including Israel, the United States, and Japan. Predictable government policies and a stable investment climate are vital for attracting the substantial capital needed for advanced semiconductor manufacturing. For instance, the US CHIPS and Science Act of 2022, which aims to boost domestic semiconductor production, provides a framework for potential incentives and R&D support, fostering a more favorable environment for companies like Tower. Conversely, sudden shifts in trade policies or geopolitical tensions can introduce considerable risk, impacting supply chains and market access.

The semiconductor industry, in particular, is subject to evolving regulations concerning intellectual property, environmental standards, and export controls. Tower Semiconductor's ability to navigate these complex and sometimes rapidly changing rules directly affects its operational efficiency and growth potential. As of early 2025, ongoing discussions around global semiconductor supply chain resilience and national security implications continue to shape the regulatory landscape, requiring companies to remain agile in their strategic planning and compliance efforts.

- Regulatory Stability: Predictable and consistent government policies in operating regions are crucial for long-term investment and planning.

- Investment Climate: A favorable investment climate, potentially bolstered by government incentives like those seen in the US CHIPS Act, attracts necessary capital for expansion.

- Policy Changes: Frequent or unpredictable policy shifts can deter foreign direct investment and create operational uncertainty.

- Geopolitical Impact: Global trade tensions and national security concerns influence regulatory frameworks, impacting supply chains and market access.

International Relations and Alliances

The strength of international alliances significantly impacts Tower Semiconductor's ability to forge cross-border collaborations and expand into new markets. Favorable diplomatic relations between countries, for instance, can streamline market access and encourage vital technological exchange, crucial for a fabless semiconductor company.

Conversely, geopolitical tensions can erect substantial barriers, potentially disrupting supply chains and limiting investment opportunities. For example, as of early 2024, ongoing trade discussions and potential tariffs between major economic blocs could influence Tower Semiconductor's strategic partnerships and manufacturing locations.

- Facilitated Market Access: Strong alliances can reduce trade barriers, enabling Tower Semiconductor to more easily enter and operate in new geographic regions.

- Technological Exchange: Collaborative agreements fostered by good international relations can lead to shared research and development, accelerating innovation.

- Supply Chain Resilience: Stable diplomatic ties can help secure critical raw materials and components, bolstering the company's manufacturing capabilities.

- Investment Climate: Favorable political climates attract foreign direct investment, which can be vital for expanding fabrication capacity or acquiring new technologies.

Governments worldwide are actively promoting domestic semiconductor production through substantial financial incentives, exemplified by the U.S. CHIPS and Science Act, which allocated over $52 billion. These policies aim to enhance national security and economic competitiveness, directly benefiting Tower Semiconductor by potentially reducing the immense capital costs associated with expanding its fabrication facilities.

Geopolitical tensions, particularly between major economic powers, continue to create uncertainty in global trade, impacting the semiconductor supply chain. For Tower Semiconductor, this translates to risks in market access and potential disruptions in sourcing essential manufacturing equipment or components, a situation observed throughout 2023 and expected to persist into 2024.

Trade policies, including tariffs and export controls, directly influence the semiconductor industry. Measures like those implemented by the U.S. can restrict access to advanced technologies or key markets, affecting companies like Tower. The semiconductor market experienced volatility in 2023 due to these restrictions, with analysts anticipating continued challenges in 2024.

The increasing recognition of semiconductors as critical national security assets drives governments to implement industrial policies that favor domestic manufacturing. These policies can shape Tower Semiconductor's investment decisions, partnership opportunities, and access to advanced technologies, reflecting a global trend towards supply chain regionalization.

What is included in the product

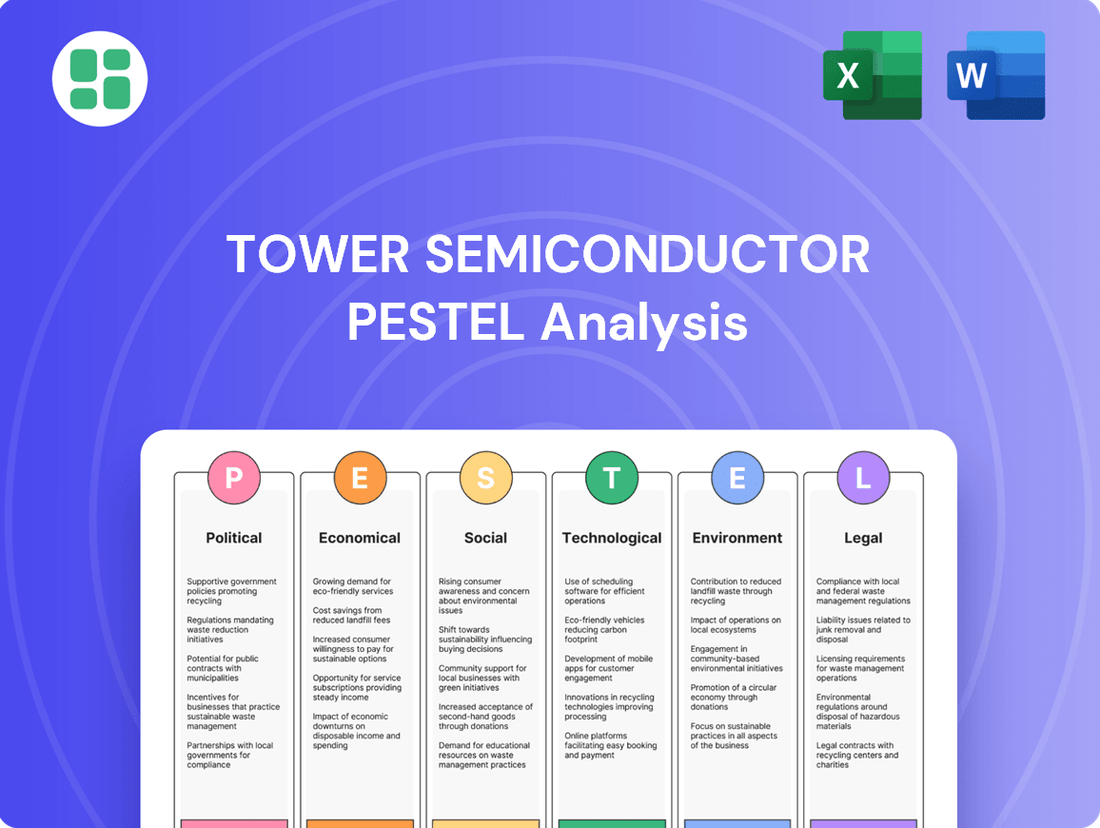

This PESTLE analysis provides a comprehensive examination of the external forces impacting Tower Semiconductor, covering political stability, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks.

It offers strategic insights into how these macro-environmental factors create both challenges and opportunities for Tower Semiconductor's operations and future growth.

A concise PESTLE analysis of Tower Semiconductor's external environment, highlighting key political, economic, social, technological, environmental, and legal factors, serves as a pain point reliever by providing clarity and strategic focus for decision-making.

Economic factors

The health of the global economy is a major driver for Tower Semiconductor. When the world economy is growing well, people and businesses tend to spend more on things like cars, smart devices, and factory equipment, all of which use the chips Tower makes. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from the previous year, which bodes well for increased demand for semiconductors.

Rising inflation presents a significant challenge for Tower Semiconductor, directly impacting its cost of operations. For instance, the Producer Price Index (PPI) for manufactured goods in the US saw an increase of 2.2% year-over-year in April 2024, indicating upward pressure on input costs. This translates to higher expenses for raw materials, essential energy for fabrication plants, and potentially increased labor wages as companies compete for talent.

Managing these escalating operational costs is paramount for Tower Semiconductor to sustain its profitability and competitive edge in the foundry market. The semiconductor industry is capital-intensive, and higher inflation can inflate the cost of new equipment and facility expansions. For example, the average cost of advanced semiconductor manufacturing equipment has been on an upward trend, and inflationary pressures can further exacerbate this.

Fluctuations in global interest rates directly affect the cost of capital for Tower Semiconductor's investments. For instance, if the US Federal Reserve maintains its benchmark interest rate at elevated levels, as seen through much of 2024, borrowing for significant capital expenditures like building new fabrication plants or upgrading existing ones becomes more expensive. This increased cost of debt can dampen enthusiasm for new projects, potentially impacting Tower Semiconductor's ability to expand capacity or invest in cutting-edge manufacturing technologies at a competitive pace.

Supply Chain Resilience and Costs

Global supply chains have faced significant headwinds, with disruptions from geopolitical tensions and extreme weather events impacting availability and driving up costs. For Tower Semiconductor, this translates to a constant need to manage potential shortages of essential materials and increased expenses for shipping and logistics. For instance, the semiconductor industry, heavily reliant on specialized materials and complex manufacturing processes, experienced an average increase in shipping costs of over 50% in 2024 compared to pre-pandemic levels, directly affecting profitability.

These ongoing supply chain vulnerabilities necessitate robust risk management strategies for Tower Semiconductor. The company must invest in diversified sourcing and maintain higher inventory levels for critical components, which can tie up capital but is essential for operational continuity. In 2024, major chip manufacturers reported that inventory holding costs increased by an average of 15% due to these precautionary measures.

- Increased Logistics Expenses: Global shipping rates saw a significant surge in 2024, impacting the cost of transporting raw materials and finished goods.

- Component Shortages: Geopolitical instability and natural disasters continued to create bottlenecks, leading to potential delays in production for Tower Semiconductor.

- Inventory Management Costs: To mitigate risks, companies like Tower are holding more inventory, increasing associated carrying costs.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Tower Semiconductor, a global entity with operations and sales across various currencies. Fluctuations in exchange rates can directly affect the company's reported revenues and profitability. For instance, a stronger US dollar against currencies where Tower operates or sells could reduce the dollar value of those foreign earnings.

These swings also impact the cost of international transactions, including the purchase of raw materials or components from different countries. To manage this exposure, Tower Semiconductor likely employs hedging strategies to lock in exchange rates and minimize the impact of adverse currency movements. For example, in early 2024, the Israeli Shekel (ILS) experienced some fluctuations against the US Dollar (USD), which could have influenced Tower's reported financials given its significant presence in Israel.

The company's financial performance is therefore sensitive to the relative strength of currencies like the USD, Euro (EUR), and Japanese Yen (JPY), among others. Effective currency risk management is crucial for maintaining stable financial results and predictable international business costs.

- Impact on Revenue: A strengthening USD can decrease the reported USD value of sales made in weaker foreign currencies.

- Transaction Costs: Volatility affects the cost of importing materials or exporting finished goods, influencing profit margins.

- Hedging Necessity: Tower Semiconductor likely utilizes financial instruments to hedge against unfavorable currency movements.

- Geographic Exposure: Operations and sales in regions like North America, Europe, and Asia mean exposure to multiple currency pairs.

Global economic growth is a primary driver for Tower Semiconductor. As the IMF projected global growth around 3.2% for 2024, this indicates a favorable environment for increased demand in the semiconductor sector, directly benefiting Tower. However, rising inflation, with US Producer Prices up 2.2% year-over-year in April 2024, increases operational costs for raw materials and energy, impacting profitability.

Fluctuating interest rates, like the elevated US Federal Reserve rates seen through 2024, make capital investments more expensive, potentially slowing Tower's expansion and technology upgrades. Global supply chain disruptions, with shipping costs up over 50% in 2024, also raise expenses and necessitate careful inventory management, as indicated by a 15% increase in holding costs for chip manufacturers in 2024.

Currency exchange rate volatility, such as the fluctuations of the Israeli Shekel against the US Dollar in early 2024, directly impacts Tower Semiconductor's reported revenues and transaction costs, requiring robust hedging strategies to mitigate financial risks.

Same Document Delivered

Tower Semiconductor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Tower Semiconductor.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Tower Semiconductor.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Tower Semiconductor.

Sociological factors

The semiconductor industry, including Tower Semiconductor, heavily relies on a skilled workforce. In 2024, the global demand for semiconductor engineers is projected to remain high, with an estimated shortage of over 260,000 workers in the US alone by 2030, according to the Semiconductor Industry Association. This scarcity makes attracting and retaining top talent a significant challenge.

Furthermore, an aging workforce in developed nations, coupled with intense global competition for specialized engineers and technicians, presents a hurdle for Tower Semiconductor. For instance, many experienced professionals in the field are approaching retirement age, creating a knowledge gap that needs to be filled by new talent. This demographic shift necessitates proactive strategies for knowledge transfer and recruitment.

Societal shifts towards embracing cutting-edge technologies like artificial intelligence, the Internet of Things, electric vehicles, and 5G are directly translating into a surge in demand for specialized semiconductors. Tower Semiconductor is well-positioned to capitalize on this growing consumer desire for sophisticated, high-performing, and energy-efficient electronic gadgets, which necessitates its advanced manufacturing capabilities.

For instance, the global market for AI chips alone was projected to reach over $100 billion by 2024, highlighting the immense opportunity. Similarly, the expanding electric vehicle market, which saw global sales surpass 10 million units in 2023, relies heavily on advanced semiconductor solutions for power management and control systems, areas where Tower Semiconductor offers expertise.

The educational landscape directly impacts Tower Semiconductor's access to skilled labor. Countries with robust STEM programs, particularly in Israel and the United States, are crucial for talent acquisition. For instance, in 2023, Israel's Technion – Israel Institute of Technology, a key talent source, reported a significant increase in engineering and computer science graduates, bolstering the available pool of potential employees.

Work-Life Balance and Employee Well-being

Societal expectations are increasingly prioritizing work-life balance and employee well-being, directly influencing how companies attract and keep talent. This shift means that organizations like Tower Semiconductor need to actively adapt their workplace culture and benefits packages to align with these evolving demands, ensuring they can secure and retain a committed and productive workforce.

In 2024, many tech companies, including those in the semiconductor industry, reported increased employee demand for flexible work arrangements and robust mental health support. For instance, surveys from late 2024 indicated that over 60% of tech professionals considered flexible work options a key factor when choosing an employer. Tower Semiconductor's ability to offer competitive benefits in these areas, such as enhanced parental leave or subsidized wellness programs, will be crucial for its talent acquisition and retention efforts.

- Employee Well-being Initiatives: Companies are investing more in mental health resources and flexible work policies.

- Talent Attraction: A strong work-life balance offering is becoming a significant differentiator in the competitive tech labor market.

- Retention Rates: Improved employee well-being directly correlates with higher retention, reducing costly turnover.

- Productivity Impact: Happier, less stressed employees tend to be more engaged and productive.

Ethical Consumption and Corporate Social Responsibility (CSR)

Growing consumer and investor awareness regarding ethical practices and corporate social responsibility significantly influences company perception. In 2024, a significant portion of global consumers, estimated around 70%, stated they consider a company's ethical stance when making purchasing decisions. This trend is expected to continue its upward trajectory through 2025.

Tower Semiconductor's dedication to fair labor practices, community involvement, and transparent operations is crucial for its brand image. Companies demonstrating strong CSR, like Tower Semiconductor, often see enhanced brand loyalty and are better positioned to attract socially conscious investors. For instance, a 2024 report indicated that companies with robust ESG (Environmental, Social, and Governance) scores outperformed their peers by an average of 10% in market capitalization growth.

- Ethical Consumerism: Consumers increasingly scrutinize supply chains and production methods, favoring brands with ethical sourcing and manufacturing.

- Investor Scrutiny: Institutional investors are prioritizing ESG factors, with sustainable investing assets projected to reach over $50 trillion globally by 2025.

- Brand Reputation: Strong CSR initiatives, including fair labor and community engagement, directly correlate with improved brand perception and trust.

- Talent Acquisition: A commitment to social responsibility makes companies more attractive to potential employees, particularly younger generations entering the workforce.

Societal trends highlight a growing demand for advanced electronics, driven by AI, IoT, and electric vehicles, which directly fuels the need for Tower Semiconductor's specialized manufacturing. The global AI chip market alone was projected to exceed $100 billion in 2024, and electric vehicle sales surpassed 10 million units in 2023, underscoring the market opportunities. These shifts necessitate continuous innovation and capacity expansion to meet evolving consumer and industry needs.

Technological factors

The semiconductor industry thrives on relentless technological advancement, particularly in process technology. Tower Semiconductor's ability to stay ahead hinges on its investment in areas like new materials, shrinking node sizes, and sophisticated packaging techniques. For instance, the ongoing push towards 3nm and 2nm process nodes by leading foundries highlights the critical need for foundries like Tower to offer advanced capabilities to remain competitive.

Continuously investing in research and development is paramount for Tower Semiconductor to provide its fabless clients with state-of-the-art, customizable process technologies. This ensures they can meet the ever-changing demands of the market, such as the increasing need for specialized analog, mixed-signal, and RF technologies that power everything from 5G communications to advanced automotive systems.

The manufacturing sector is rapidly adopting advanced automation and artificial intelligence, with the global industrial automation market projected to reach $316.4 billion by 2027, growing at a CAGR of 7.4% from 2020. This trend is particularly impactful for foundries like Tower Semiconductor, where AI can optimize complex processes, boosting efficiency and yield.

Tower Semiconductor can harness AI and robotics to refine its fabrication processes, leading to higher quality chips and reduced production times. For instance, AI-driven predictive maintenance can minimize equipment downtime, a critical factor in semiconductor manufacturing where even minor disruptions can be costly.

Tower Semiconductor's success hinges on its ability to provide comprehensive design services and develop robust intellectual property (IP) blocks, crucial for its fabless semiconductor clients. These services empower companies that lack their own manufacturing facilities to bring innovative chips to market.

By offering advanced design enablement tools and a rich IP portfolio, Tower Semiconductor enhances its value proposition and fosters strong customer loyalty. This integrated approach is vital in the competitive semiconductor landscape, where time-to-market and design efficiency are paramount.

In 2024, the demand for specialized IP cores, particularly for AI and advanced connectivity, continued to surge, with the global IP market projected to reach over $10 billion. Tower's investment in these areas directly addresses this growing need.

Cybersecurity and Data Protection

The increasing reliance on interconnected systems in semiconductor manufacturing, where vast amounts of sensitive design and proprietary data are processed, makes robust cybersecurity measures absolutely critical for Tower Semiconductor. Protecting intellectual property and operational data from evolving cyber threats is paramount for maintaining customer trust and ensuring uninterrupted business operations. For instance, the semiconductor industry experienced a significant rise in cyberattacks targeting intellectual property and manufacturing processes in 2023, with estimates suggesting billions in potential losses.

Tower Semiconductor must continually invest in advanced cybersecurity protocols to safeguard its operations and client data. This includes implementing multi-layered security defenses, regular vulnerability assessments, and employee training to mitigate risks. The global cybersecurity market is projected to reach over $300 billion by 2025, reflecting the growing importance and investment in this area.

- Data Breach Costs: The average cost of a data breach in the technology sector reached $4.45 million in 2023, highlighting the financial implications of inadequate cybersecurity.

- Intellectual Property Theft: Semiconductors are high-value targets for IP theft, which can cripple a company's competitive advantage and future revenue streams.

- Operational Disruption: Ransomware attacks and other cyber threats can halt manufacturing lines, leading to significant production delays and financial losses for foundries like Tower Semiconductor.

Emerging Technologies and Applications

The semiconductor industry is constantly reshaped by technological advancements. Emerging technologies like quantum computing and neuromorphic chips are creating entirely new demands for specialized silicon. For instance, the quantum computing market is projected to reach $64.9 billion by 2030, according to some industry estimates, highlighting a significant future opportunity for foundries capable of producing the highly complex components required. Tower Semiconductor's ability to adapt its foundry services to cater to these nascent, high-growth markets is crucial for unlocking future revenue streams and maintaining a competitive edge.

Advanced sensors also represent a growing area. The global market for sensors is expected to grow, with some projections indicating it could reach over $200 billion by 2027, driven by applications in IoT, automotive, and healthcare. Tower Semiconductor's foundry capabilities, particularly in areas like image sensors and specialized analog technologies, position it to capitalize on this trend. By offering tailored manufacturing processes for these advanced sensor applications, Tower can secure a strong position in these expanding sectors.

Tower Semiconductor's strategic investments in R&D and flexible manufacturing processes are key enablers for addressing these technological shifts. The company's focus on advanced nodes and specialized technologies, such as its 65nm and 45nm processes, are already relevant for certain emerging applications. For example, the development of next-generation AI accelerators, which often require specialized analog and mixed-signal capabilities, aligns well with Tower's existing strengths. The company's commitment to innovation ensures it can meet the evolving needs of these cutting-edge markets.

The demand for specialized semiconductor solutions in these emerging fields is substantial. For example, the automotive sector's increasing reliance on advanced driver-assistance systems (ADAS) and autonomous driving technology is driving demand for high-performance sensors and processors. Tower Semiconductor's foundry services are well-positioned to support the production of these critical components. The company's ongoing efforts to enhance its process technology portfolio directly address the need for higher integration and performance in these rapidly evolving applications.

Technological advancements are the lifeblood of the semiconductor industry, directly impacting Tower Semiconductor's competitiveness. The company's ability to innovate in areas like advanced node scaling, new materials, and sophisticated packaging is crucial. For instance, the ongoing race to 2nm process nodes by industry leaders underscores the need for foundries like Tower to offer cutting-edge manufacturing capabilities to attract and retain fabless clients.

Tower Semiconductor's commitment to research and development is vital for providing clients with specialized analog, mixed-signal, and RF technologies, essential for sectors like 5G and automotive. The increasing adoption of AI in manufacturing, with the global industrial automation market projected to exceed $316 billion by 2027, offers opportunities for Tower to enhance process efficiency and yield through AI-driven optimization and predictive maintenance.

The company's strength also lies in its comprehensive design services and intellectual property (IP) portfolio, empowering fabless clients. The global IP market, expected to surpass $10 billion in 2024, highlights the demand for specialized IP cores, particularly for AI and advanced connectivity, areas where Tower is strategically investing.

Emerging technologies like quantum computing and neuromorphic chips present new frontiers, with the quantum computing market potentially reaching nearly $65 billion by 2030. Tower Semiconductor's adaptability in offering foundry services for these complex components will be key to future growth. Similarly, the sensor market, projected to exceed $200 billion by 2027, offers opportunities for Tower's specialized analog and image sensor capabilities.

| Key Technological Area | Description | Relevance to Tower Semiconductor | Market Projection/Data |

| Advanced Node Scaling | Shrinking transistor sizes (e.g., 3nm, 2nm) for increased performance and efficiency. | Essential for offering leading-edge manufacturing to fabless clients. | Industry leaders are actively developing 2nm processes. |

| AI in Manufacturing | Utilizing AI for process optimization, predictive maintenance, and yield improvement. | Enhances operational efficiency and reduces downtime in fabrication. | Global industrial automation market projected to reach $316.4 billion by 2027. |

| Specialized IP & Design Services | Providing custom IP cores and design enablement for fabless semiconductor companies. | Adds significant value and fosters client loyalty in a competitive market. | Global IP market projected to exceed $10 billion in 2024. |

| Emerging Technologies (Quantum, Neuromorphic) | Developing foundry capabilities for highly complex components for new computing paradigms. | Opens new, high-growth revenue streams and ensures long-term competitiveness. | Quantum computing market projected to reach $64.9 billion by 2030. |

| Advanced Sensors | Manufacturing capabilities for sensors used in IoT, automotive, and healthcare. | Leverages existing strengths in analog and image sensors for expanding markets. | Global sensor market projected to exceed $200 billion by 2027. |

Legal factors

Intellectual property (IP) protection laws are crucial for Tower Semiconductor, shielding its advanced process technologies and proprietary designs. These robust legal frameworks are essential for maintaining a competitive edge and preventing unauthorized use of innovations, a cornerstone of the semiconductor sector's value chain.

In 2024, the global semiconductor market, valued at approximately $600 billion, heavily relies on IP protection. Tower Semiconductor, as a leading foundry, invests significantly in R&D, making its IP a prime asset. The strength of IP laws directly impacts the company's ability to secure licensing agreements and protect its technological leadership against infringement.

Tower Semiconductor must meticulously adhere to international trade regulations and export controls, a complex web that directly influences its global reach. Failure to comply can result in significant penalties and operational disruptions.

Navigating these rules is particularly challenging for technologies with potential dual-use applications, affecting market access and customer relationships. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) imposes stringent controls on exports of advanced semiconductor manufacturing equipment and related technologies, impacting companies like Tower Semiconductor that operate globally.

Environmental regulations significantly impact semiconductor manufacturing, a sector known for its chemical usage and high resource consumption. Tower Semiconductor, like its peers, faces strict oversight regarding emissions, waste management, and water usage, with compliance costs being a substantial factor. For instance, in 2023, the semiconductor industry globally invested billions in environmental, social, and governance (ESG) initiatives, directly addressing these regulatory pressures.

Compliance with evolving environmental laws, both domestically and internationally, is critical for Tower Semiconductor's operational continuity and reputation. Failure to adhere to standards for hazardous waste disposal or air and water quality can lead to significant fines and operational disruptions. The company's ongoing investments in advanced filtration systems and waste treatment technologies reflect the substantial financial commitment required to meet these stringent environmental mandates in 2024 and beyond.

Labor Laws and Employment Regulations

Tower Semiconductor, as a global manufacturer, navigates a complex web of labor laws and employment regulations across its operational sites. These laws dictate everything from minimum wage requirements and working hour limits to employee safety standards and the right to unionize. For instance, in Israel, where Tower has significant operations, the Working Hours and Rest Law sets limits on weekly hours and mandates rest periods.

Failure to comply with these diverse legal frameworks can lead to substantial penalties, reputational damage, and operational disruptions. Tower's commitment to ethical labor practices and legal adherence is crucial for maintaining a productive workforce and avoiding costly litigation.

Key areas of focus for Tower Semiconductor include:

- Compliance with minimum wage laws: Adhering to varying national and regional minimum wage rates, such as those in Israel and the United States, ensuring fair compensation for all employees.

- Workplace safety regulations: Meeting stringent safety standards in manufacturing environments, which are particularly critical in semiconductor fabrication plants to prevent accidents and ensure employee well-being.

- Employee rights and collective bargaining: Respecting employees' rights to organize and bargain collectively, as recognized in many of the countries where Tower operates, fostering positive labor relations.

- Data privacy and employee records: Managing employee data in accordance with data protection laws, like the EU's GDPR, which impacts how personnel information is collected, stored, and processed globally.

Antitrust and Competition Laws

As a significant entity in the specialized semiconductor foundry sector, Tower Semiconductor operates under stringent antitrust and competition laws. These regulations are in place globally to foster a competitive marketplace and prevent any single company from dominating the industry. For instance, in 2023, the proposed acquisition of Tower Semiconductor by Intel faced significant regulatory review in multiple jurisdictions, including China, highlighting the intense scrutiny such deals undergo. This underscores the need for meticulous compliance and proactive engagement with regulatory bodies to navigate potential hurdles.

Tower Semiconductor's strategic moves, including mergers, acquisitions, and partnerships, are therefore subject to rigorous examination by competition authorities. Failure to comply can result in substantial fines and the disruption of crucial business operations. The ongoing global focus on semiconductor supply chain resilience and national security interests further intensifies regulatory oversight on M&A activities within the industry.

- Regulatory Scrutiny: Antitrust laws worldwide aim to prevent market monopolization in the semiconductor industry.

- Merger Compliance: Tower Semiconductor must ensure all acquisitions and alliances adhere to competition regulations to avoid penalties.

- Global Impact: International regulatory reviews, as seen with Intel's attempted acquisition, demonstrate the broad implications of antitrust compliance.

- Strategic Alliances: Partnerships require careful legal vetting to maintain fair competition and market access.

Tower Semiconductor's global operations necessitate strict adherence to diverse legal and regulatory frameworks, impacting everything from intellectual property to labor practices and market competition.

The semiconductor industry, characterized by rapid innovation and global supply chains, faces intense scrutiny under antitrust laws, as evidenced by the significant regulatory reviews of proposed mergers. Tower must navigate these complexities to maintain market access and avoid substantial penalties, with global regulatory bodies actively monitoring industry consolidation.

Compliance with international trade regulations and export controls, particularly concerning dual-use technologies, is paramount for Tower Semiconductor's operational continuity and market reach, with entities like the US BIS imposing stringent controls.

Environmental factors

Semiconductor fabrication, or "fab," operations are notoriously power-hungry, making energy consumption a major environmental consideration for companies like Tower Semiconductor. These facilities require immense amounts of electricity to maintain precise temperature and humidity controls, power sophisticated machinery, and run cleanroom environments. This high energy demand directly translates into a significant carbon footprint, a metric increasingly scrutinized by investors, regulators, and the public.

Tower Semiconductor, like its peers, is under mounting pressure to decarbonize its operations. This involves not only reducing overall energy usage through efficiency improvements in its manufacturing processes but also actively transitioning towards renewable energy sources. For instance, many semiconductor companies are setting ambitious targets for renewable energy procurement, aiming to power a substantial portion of their global operations with wind, solar, or other clean sources. Meeting these sustainability goals is crucial for maintaining brand reputation and complying with evolving environmental regulations, which can impact operational costs and market access.

Water is absolutely essential for semiconductor fabrication, used in everything from rinsing wafers to cooling complex machinery. Tower Semiconductor, like others in the industry, relies heavily on this resource. In 2023, the semiconductor industry globally consumed an estimated 100 billion gallons of water, highlighting the scale of this requirement.

Effectively managing this usage is paramount. Tower Semiconductor likely employs sophisticated water recycling systems to minimize intake and reduce waste. For instance, some advanced facilities can recycle up to 90% of their process water. Additionally, stringent wastewater treatment is crucial to meet environmental discharge standards, preventing pollution and addressing growing concerns about water scarcity in manufacturing regions.

Tower Semiconductor's fabrication processes, particularly in semiconductor manufacturing, inherently produce various waste streams, including potentially hazardous materials. In 2023, the company reported managing substantial volumes of chemical waste and solvents, necessitating rigorous protocols for their containment and disposal to comply with environmental standards.

The company's commitment to responsible waste management is crucial. For instance, in 2024, Tower Semiconductor invested significantly in advanced wastewater treatment facilities to neutralize and safely discharge process water, minimizing the risk of environmental contamination and ensuring worker safety around these materials.

Supply Chain Environmental Standards

There's a rising demand for businesses to be environmentally conscious across their entire supply chain, from where materials originate to how products are disposed of. Tower Semiconductor needs to work closely with its suppliers to encourage sustainable methods and ensure everyone in its extended value chain adheres to environmental regulations.

This focus on sustainability is driven by increasing consumer and regulatory pressure. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting supply chain requirements for all industries, including semiconductors. Tower Semiconductor's efforts in this area are crucial for maintaining market access and brand reputation.

- Supplier Audits: Implementing regular environmental audits for key suppliers to verify compliance with sustainability standards.

- Sustainable Sourcing: Prioritizing raw material suppliers who demonstrate responsible environmental practices, such as reduced water usage and waste management.

- Circular Economy Initiatives: Exploring partnerships for product end-of-life management and material recycling within the supply chain.

- Emissions Reduction Targets: Collaborating with suppliers to set and achieve shared goals for reducing greenhouse gas emissions across logistics and manufacturing processes.

Climate Change and Physical Risks

Climate change presents tangible threats to Tower Semiconductor's operations. The escalating frequency and severity of extreme weather events, such as floods, heatwaves, and storms, can directly impact manufacturing sites and disrupt critical supply chains. For instance, in 2024, several semiconductor manufacturing hubs experienced temporary shutdowns due to severe weather, highlighting the vulnerability of such facilities.

Tower Semiconductor must proactively address these physical risks. This involves evaluating the resilience of its existing infrastructure and considering investments in more robust designs that can withstand adverse conditions. Diversifying sourcing strategies for raw materials and components is also crucial to mitigate the impact of localized disruptions.

The economic consequences of climate-related disruptions are significant. In 2023, the global semiconductor industry faced an estimated $30 billion in losses attributed to supply chain disruptions, a portion of which was linked to climate events. This underscores the financial imperative for robust risk management.

- Infrastructure Resilience: Assessing and upgrading facilities to withstand extreme weather events.

- Supply Chain Diversification: Reducing reliance on single geographic locations for critical inputs.

- Operational Continuity Planning: Developing strategies to maintain production during climate-related disruptions.

Tower Semiconductor's environmental responsibilities are significant, particularly concerning its high energy consumption for fabrication processes. In 2024, the company, like many in the semiconductor industry, is focusing on increasing its reliance on renewable energy sources to reduce its carbon footprint. This push is driven by both regulatory pressures and investor demand for sustainable operations.

PESTLE Analysis Data Sources

Our Tower Semiconductor PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic institutions like the IMF and World Bank, and respected industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the semiconductor industry.