Tower Semiconductor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tower Semiconductor Bundle

Discover the core components of Tower Semiconductor's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance.

Unlock the strategic blueprint behind Tower Semiconductor's growth. Our full Business Model Canvas dives deep into their value propositions, cost structures, and competitive advantages, providing actionable insights for your own business strategy.

See how Tower Semiconductor innovates and thrives in the semiconductor industry. This downloadable canvas reveals their unique approach to key partnerships and operational activities, empowering you to learn from their proven model.

Partnerships

Tower Semiconductor cultivates key partnerships with major technology firms, enhancing its foundry capabilities. For instance, its collaboration with Renesas focuses on manufacturing advanced SiGe-based beamforming integrated circuits. This alliance is vital for bringing next-generation products to market in high-growth sectors.

These strategic alliances allow Tower to integrate its leading-edge foundry solutions with the innovative designs of its partners. This synergy is critical for accelerating the development of sophisticated chips needed for 5G infrastructure, satellite communications, and defense applications. Such collaborations are a cornerstone of Tower's strategy to drive innovation and address evolving market needs.

Tower Semiconductor strategically utilizes joint ventures to bolster its manufacturing capacity and broaden its technology portfolio. A prime example is its majority stake in TPSCo in Japan, a partnership that ensures customers benefit from multi-fab sourcing and significantly extended capacity. This collaboration is crucial for meeting the growing demand for advanced semiconductor solutions.

Further enhancing its global footprint, Tower shares a 300mm facility in Agrate, Italy, with STMicroelectronics. This venture allows for shared expertise and operational efficiencies. Additionally, Tower has secured access to a 300mm capacity corridor within Intel's New Mexico factory, providing critical flexibility and expanded production capabilities for its diverse customer base.

Tower Semiconductor actively partners with leading design enablement firms such as Synopsys and Cadence. These collaborations are crucial for offering customers advanced tools and methodologies that accelerate the integrated circuit design process. This ensures designs are not only innovative but also readily manufacturable on Tower's cutting-edge process technologies.

R&D Consortia and Academic Collaborations

Tower Semiconductor actively engages in R&D consortia and academic collaborations to drive innovation. These partnerships are crucial for staying at the forefront of semiconductor technology, particularly in specialized areas. For instance, their involvement with entities like the Israeli Ministry of Trade and DARPA in the United States highlights a commitment to advancing technologies such as thermal imagers and high-speed communications.

These strategic alliances allow Tower Semiconductor to share risks and resources, accelerating the development of both standard and custom Application-Specific Integrated Circuits (ASICs). By tapping into external expertise and research capabilities, the company can bring cutting-edge solutions to market more efficiently. This collaborative approach is fundamental to their business model, fostering a dynamic environment for technological advancement.

- R&D Consortia: Tower Semiconductor participates in collaborative research initiatives to develop next-generation semiconductor technologies.

- Academic Partnerships: Collaborations with universities and research institutions provide access to novel ideas and talent.

- Government Initiatives: Involvement with government bodies like the Israeli Ministry of Trade and DARPA supports development in strategic areas such as thermal imaging and high-speed communications.

- Startup Engagement: Working with startups allows for the integration of emerging technologies and business models into their ecosystem.

Supplier and Equipment Partnerships

Tower Semiconductor's reliance on its supplier and equipment partnerships is paramount for its foundry operations. Maintaining robust relationships with critical material providers and advanced manufacturing equipment makers ensures consistent access to the high-quality inputs and cutting-edge tools needed for semiconductor fabrication. These alliances directly impact Tower's ability to enhance operational efficiency, uphold product quality standards, and manage its cost base effectively. For instance, in 2024, Tower continued to invest in advanced lithography and deposition equipment, underscoring the importance of these supplier relationships for staying competitive in the evolving semiconductor landscape.

These strategic collaborations are not merely transactional; they are foundational to Tower's success. Reliable access to specialized chemicals, silicon wafers, and other raw materials, coupled with partnerships for the latest process technology equipment, directly translates into improved manufacturing yields and the ability to produce more complex and advanced chips. The company's commitment to innovation is intrinsically linked to the capabilities and support provided by its key equipment partners, enabling Tower to offer leading-edge foundry services.

- Supplier Reliability: Ensuring a consistent and high-quality supply of raw materials like silicon wafers and specialty chemicals is crucial for uninterrupted production.

- Equipment Innovation: Partnerships with equipment manufacturers provide access to state-of-the-art tools for lithography, etching, and deposition, enabling advanced process nodes.

- Operational Efficiency: Collaborations with suppliers and equipment providers help optimize manufacturing processes, reduce cycle times, and improve overall cost-effectiveness.

- Technological Advancement: Joint development and early access to new manufacturing technologies through these partnerships are vital for Tower's competitive edge.

Tower Semiconductor's key partnerships are essential for its foundry business, enabling access to advanced technologies and expanding manufacturing capabilities. These collaborations are critical for delivering specialized semiconductor solutions to a diverse customer base.

The company leverages joint ventures and strategic alliances to enhance its market reach and technological offerings. For example, its stake in TPSCo in Japan provides multi-fab sourcing and extended capacity, crucial for meeting growing demand. Tower also shares a 300mm facility with STMicroelectronics in Italy, fostering operational efficiencies.

Furthermore, Tower's partnerships with design enablement firms like Synopsys and Cadence accelerate the IC design process, ensuring manufacturability on advanced process technologies. Collaborations with research institutions and government bodies, such as DARPA, drive innovation in specialized areas like thermal imaging and high-speed communications.

| Partner Type | Key Collaborators | Strategic Importance | Example Impact |

|---|---|---|---|

| Technology & Design Enablement | Synopsys, Cadence, Renesas | Access to advanced design tools and specialized SiGe technology | Accelerated development of 5G and satellite communication chips |

| Manufacturing Capacity & Technology | STMicroelectronics, Intel | Shared facilities and access to 300mm capacity | Enhanced production flexibility and expanded output capabilities |

| Research & Development | Israeli Ministry of Trade, DARPA, Universities | Innovation in specialized semiconductor areas | Advancement in thermal imagers and high-speed communication technologies |

| Suppliers & Equipment Providers | Key material and equipment manufacturers | Ensuring access to high-quality inputs and cutting-edge fabrication tools | Improved manufacturing yields and cost-effectiveness in 2024 |

What is included in the product

This Tower Semiconductor Business Model Canvas provides a comprehensive overview of their foundry services, detailing customer segments like fabless semiconductor companies and key partners in the electronics industry, alongside their value proposition of advanced manufacturing capabilities and diverse technology options.

It outlines Tower Semiconductor's operational strategies, including their global manufacturing footprint and R&D investments, presented in a clear, 9-block structure ideal for strategic planning and stakeholder communication.

Tower Semiconductor's Business Model Canvas offers a clear, structured approach to understanding how they address industry pain points in semiconductor manufacturing by highlighting their specialized foundry services and advanced technology offerings.

This canvas effectively simplifies complex operational strategies, making it easier to grasp how Tower Semiconductor alleviates customer challenges related to advanced process technology access and production scalability.

Activities

Tower Semiconductor's core activity revolves around manufacturing integrated circuits using a suite of specialty process technologies. These include advanced options like Silicon Germanium (SiGe), BiCMOS, Silicon Photonics, and SOI, alongside essential technologies such as mixed-signal, RFCMOS, CMOS image sensors, and power management (BCD). This diverse technological capability allows them to cater to highly specific and demanding application needs across various industries.

The company's focus is on producing high-value analog semiconductor solutions. This specialization is crucial for markets requiring precision and performance, such as automotive, industrial, and consumer electronics. For instance, their advanced process technologies are vital for enabling next-generation automotive sensors and high-speed communication systems.

Tower Semiconductor's commitment to Research and Development is a cornerstone of its business model, driving innovation in advanced semiconductor technologies. In 2024, the company continued to invest heavily in developing disruptive technologies tailored for burgeoning markets like advanced automotive, industrial, and high-performance computing. This focus ensures they remain at the forefront of enabling future commercialization opportunities.

Key R&D activities center on enhancing their established platforms for Radio Frequency (RF), power management, and sensor applications. Furthermore, Tower Semiconductor is actively pioneering new technological frontiers, such as integrating envelope tracking capabilities onto their 300mm BiCMOS on Silicon-on-Insulator (BiCMOS-on-SOI) platforms. This strategic development aims to meet the evolving demands of next-generation wireless communication and high-efficiency power solutions.

These R&D initiatives are meticulously aligned with the technology roadmaps and product development cycles of their diverse customer base. By collaborating closely with clients, Tower Semiconductor ensures its innovations directly address the critical needs and future product requirements of the semiconductor industry, fostering a symbiotic growth environment.

Tower Semiconductor's design enablement and support services are crucial for its business model. They provide fabless companies and integrated device manufacturers (IDMs) with essential tools like Process Design Kits (PDKs) and simulation models. This support is designed to accelerate and refine the design cycle, ensuring products are compatible with Tower's advanced process technologies.

In 2024, Tower continued to emphasize its commitment to design enablement. For instance, their advanced silicon photonics technologies, critical for high-speed data communication and sensing, rely heavily on robust PDKs and expert technical support to help customers navigate complex design flows and achieve first-pass success.

Global Fab Operations and Capacity Management

Tower Semiconductor's key activities revolve around meticulously managing and optimizing its global fabrication operations and capacity. This includes overseeing facilities in Israel, the U.S., and Japan (via TPSCo), alongside shared capacity in Italy and access to Intel's New Mexico factory. The focus is on maintaining high quality, ensuring flexible worldwide operational capabilities, and driving continuous efficiency improvements.

Ongoing capacity investments are crucial to meet growing customer demand and support expansion initiatives. For instance, in 2023, Tower Semiconductor continued to invest in its advanced manufacturing processes and capacity expansion projects to cater to the increasing demand for specialized semiconductor solutions.

- Global Fab Network Management: Overseeing a geographically diverse network of fabrication plants to ensure consistent quality and operational excellence.

- Capacity Optimization: Continuously improving the efficiency and utilization of existing fab capacity while strategically planning for future needs.

- Investment in Advanced Technologies: Allocating capital to upgrade equipment and processes to support the development and manufacturing of cutting-edge semiconductor technologies.

- Customer Demand Fulfillment: Aligning operational capacity and output with the specific requirements and growth trajectories of its global customer base.

Process Transfer and Optimization Services (TOPS)

Tower Semiconductor's Process Transfer and Optimization Services (TOPS) are a cornerstone of their value proposition, designed to facilitate seamless integration of customer processes into their advanced foundry environment. This service is crucial for both Integrated Device Manufacturers (IDMs) and fabless semiconductor companies looking to leverage Tower's specialized manufacturing capabilities.

TOPS encompasses the meticulous transfer of existing manufacturing processes from a customer's site or another foundry to Tower's facilities. This isn't just a physical move; it involves significant technical expertise to ensure the process performs optimally within Tower's unique fab infrastructure, thereby minimizing yield loss and time-to-market.

- Process Transfer: Facilitating the migration of established semiconductor manufacturing processes to Tower's foundry.

- Process Optimization: Tailoring transferred processes to enhance performance, yield, and cost-effectiveness within Tower's manufacturing ecosystem.

- Customer Enablement: Allowing clients to access Tower's advanced manufacturing technologies and expertise for their specific product needs.

- Seamless Integration: Ensuring a smooth transition that minimizes disruption and accelerates time-to-volume production for customers.

By offering these specialized services, Tower empowers its clients to benefit from its cutting-edge technology nodes and extensive manufacturing experience. This strategic offering directly supports Tower's role as a key manufacturing partner, enabling innovation and efficient production for a wide range of semiconductor applications.

Tower Semiconductor's key activities are centered on its advanced manufacturing capabilities and customer-centric services. They specialize in producing integrated circuits using a range of specialty process technologies like Silicon Germanium (SiGe) and BiCMOS, catering to high-value analog solutions for automotive and industrial sectors. A significant focus is placed on continuous Research and Development to pioneer new technologies, as seen in their 2024 investments in advanced automotive and high-performance computing applications, including advancements in BiCMOS-on-SOI platforms. Furthermore, Tower provides crucial design enablement support, offering Process Design Kits (PDKs) and technical assistance to accelerate customer product development, exemplified by their silicon photonics technologies.

The company also actively manages its global fabrication network, optimizing capacity across facilities in Israel, the U.S., and Japan, with ongoing investments to meet rising demand. Their Process Transfer and Optimization Services (TOPS) are vital, enabling seamless integration of customer processes into Tower's advanced foundry environment, ensuring performance and yield. This comprehensive approach allows Tower to act as a key manufacturing partner, driving innovation and efficient production for diverse semiconductor needs.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Specialty Manufacturing | Producing integrated circuits using advanced process technologies (SiGe, BiCMOS, Silicon Photonics, SOI). | Catering to high-value analog solutions for automotive, industrial, and consumer electronics. |

| Research & Development | Investing in and developing new semiconductor technologies and enhancing existing platforms. | Continued heavy investment in 2024 for advanced automotive, industrial, and HPC markets; pioneering BiCMOS-on-SOI integration. |

| Design Enablement | Providing Process Design Kits (PDKs), simulation models, and technical support to customers. | Emphasis on robust PDKs and support for silicon photonics to ensure customer design success. |

| Global Fab Network Management | Overseeing and optimizing manufacturing capacity across global facilities. | Focus on quality, flexibility, and efficiency across U.S., Israel, and TPSCo (Japan) operations. |

| Process Transfer & Optimization | Facilitating the migration and enhancement of customer manufacturing processes. | Ensuring seamless integration and optimal performance within Tower's foundry environment. |

Preview Before You Purchase

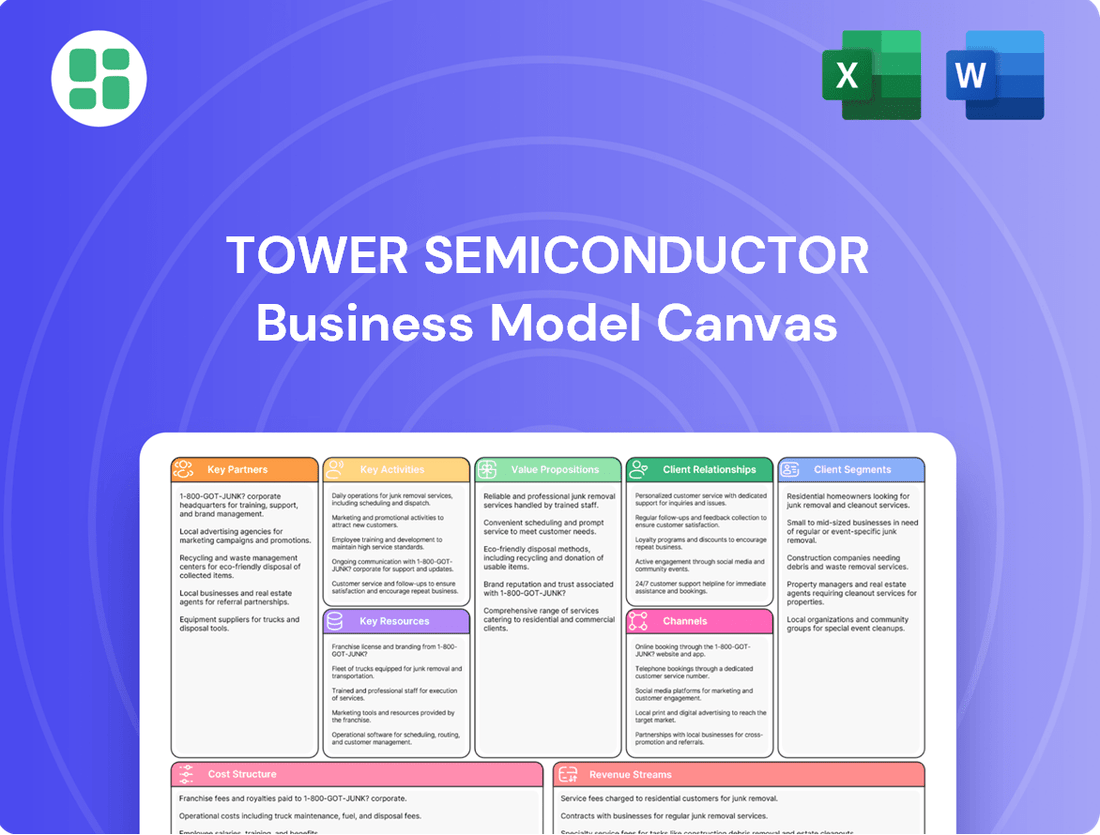

Business Model Canvas

The Business Model Canvas you are previewing is an exact representation of the final document you will receive upon purchase. This means you are seeing the genuine structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Tower Semiconductor's key resources include its extensive intellectual property and a comprehensive suite of advanced specialty process technologies. These encompass areas like Silicon Germanium (SiGe), BiCMOS, Silicon Photonics, RF CMOS, CMOS image sensors, and Bipolar-CMOS-DMOS (BCD) for power management. This deep technological expertise is a cornerstone of their competitive edge.

The company's proprietary technologies and patents are not just assets; they are fundamental to its ability to deliver unique, high-value solutions to its customers. This strong IP portfolio allows Tower to differentiate itself in the highly competitive semiconductor manufacturing landscape.

Tower Semiconductor's global manufacturing facilities, or fabs, are a cornerstone of its business. These include operations in Israel (150mm and 200mm), the U.S. (200mm), and Japan through its TPSCo joint venture (200mm and 300mm). This geographically diverse footprint ensures robust production capabilities and access to key markets.

Further enhancing its manufacturing reach, Tower Semiconductor participates in a shared 300mm facility in Italy with STMicroelectronics and maintains a capacity corridor within Intel's New Mexico factory. These strategic partnerships and arrangements provide critical infrastructure for both high-volume and specialized, high-performance semiconductor manufacturing, enabling the company to meet diverse customer needs.

Tower Semiconductor's business model heavily depends on its highly skilled workforce, comprising experienced R&D engineers, process developers, and manufacturing experts. This human capital is fundamental for creating and executing intricate semiconductor processes, fostering innovation, and delivering specialized technical support to their clientele.

In 2024, Tower Semiconductor continued to invest in its talent pool, recognizing that specialized knowledge in areas like advanced lithography and wafer fabrication is critical for maintaining a competitive edge. The company’s global R&D centers foster a collaborative environment, drawing on diverse expertise to push the boundaries of semiconductor technology.

Design Enablement Platform and Tools

Tower Semiconductor's design enablement platform is a cornerstone of its business model, providing customers with essential tools like Process Design Kits (PDKs) and a suite of design software. This robust ecosystem is designed to significantly speed up customer design cycles and enhance the accuracy of product development. For instance, in 2024, Tower continued to invest heavily in refining its PDKs across various technology nodes, enabling faster time-to-market for complex integrated circuits.

The company actively fosters collaborations with leading Electronic Design Automation (EDA) tool providers, such as Synopsys and Cadence. These partnerships are crucial for ensuring that their design flow is not only comprehensive but also highly efficient, integrating seamlessly with industry-standard tools. This collaborative approach guarantees that customers have access to a well-supported and advanced design environment.

Key resources within this platform include:

- World-class Process Design Kits (PDKs): Regularly updated to support advanced process technologies, enabling precise circuit simulation and layout.

- Comprehensive Design Tools: A suite of software and methodologies that streamline the entire chip design process, from concept to verification.

- Strategic EDA Partnerships: Collaborations with industry giants like Synopsys and Cadence to ensure compatibility and leverage cutting-edge design capabilities.

- Customer Support and Training: Dedicated resources to assist clients in effectively utilizing the design enablement platform, maximizing design efficiency.

Strong Customer Relationships and Brand Reputation

Tower Semiconductor cultivates enduring connections with over 300 global clients, a crucial intangible asset. This extensive network includes prominent fabless semiconductor companies and integrated device manufacturers (IDMs), underscoring the depth of its market penetration.

The company's esteemed standing as a premier provider of specialized analog foundry services acts as a powerful magnet, drawing in and retaining a broad spectrum of customers. This reputation is built on consistent delivery of high-quality, value-added solutions.

These robust customer relationships and the strong brand equity Tower has cultivated are fundamental to its ongoing expansion and market resilience. They provide a stable foundation for future growth initiatives.

- Customer Base: Partnerships with over 300 global customers, including major fabless and IDM companies.

- Brand Reputation: Recognized leader in high-value analog semiconductor foundry solutions.

- Business Impact: Vital for sustained business growth and customer retention.

Tower Semiconductor's key resources are its advanced intellectual property, proprietary specialty process technologies like SiGe and RF CMOS, and its global manufacturing facilities. These are complemented by a highly skilled workforce and a robust design enablement platform featuring world-class PDKs and EDA partnerships.

The company's extensive customer relationships, numbering over 300 global clients including major fabless and IDM companies, coupled with its strong brand reputation as a leader in analog foundry services, are critical intangible assets. These resources collectively enable Tower to deliver specialized, high-value solutions and maintain market resilience.

Tower Semiconductor's financial performance in 2024 reflects its operational strengths and market position. For the full year 2024, the company reported net revenues of $1.65 billion. Gross profit stood at $318.5 million, with a gross margin of 19.3%. Operating income was $150.1 million, resulting in an operating margin of 9.1%. Net income for the year was $105.2 million, translating to a net margin of 6.4%.

| Key Resource Category | Specific Examples | 2024 Data/Impact |

|---|---|---|

| Intellectual Property & Technology | SiGe, BiCMOS, RF CMOS, Silicon Photonics, BCD | Core differentiator enabling specialized solutions. |

| Manufacturing Facilities | Israel, U.S., Japan (TPSCo JV), Italy (shared), Intel capacity corridor | Global production footprint supporting diverse customer needs. |

| Human Capital | R&D engineers, process developers, manufacturing experts | Essential for innovation, process execution, and technical support. |

| Design Enablement Platform | PDKs, design tools, EDA partnerships (Synopsys, Cadence) | Accelerates customer design cycles; 2024 saw continued investment in PDK refinement. |

| Customer Relationships & Brand | 300+ global clients, reputation as analog foundry leader | Drives sustained growth and market resilience. |

Value Propositions

Tower Semiconductor's customizable specialty process technologies are a cornerstone of its value proposition, offering fabless companies and integrated device manufacturers (IDMs) unparalleled flexibility. This customization allows clients to develop differentiated, high-performance integrated circuits precisely suited to their unique application requirements.

The company's strategic focus on leading-edge analog solutions, rather than solely on node shrinkage, means Tower Semiconductor empowers innovation in areas like advanced power management and high-frequency communication. In 2024, Tower Semiconductor continued to emphasize these specialty processes, contributing to its robust order book and its position as a key partner for companies seeking to push the boundaries of semiconductor performance.

Tower Semiconductor's high-performance analog and mixed-signal solutions are vital for sectors like automotive and communications, where precision and efficiency are paramount. Their advanced process technologies, including SiGe and RF CMOS, enable devices that handle complex signals with remarkable speed and low power consumption. For instance, in 2024, the automotive sector continued its strong demand for advanced analog ICs, driven by electrification and autonomous driving features.

Tower Semiconductor's comprehensive design enablement, featuring robust Process Design Kits (PDKs) and specialized engineering support, significantly accelerates the customer's integrated circuit (IC) design cycle. This dedicated assistance ensures accuracy and efficiency, directly contributing to reduced time-to-market and lower development expenditures for intricate chip designs.

By providing these world-class tools and expert guidance, Tower Semiconductor empowers its clients to navigate complex design challenges swiftly. This commitment to customer success underpins the entire journey from initial concept through to final manufacturing, fostering a collaborative environment aimed at achieving optimal results.

Multi-Fab Sourcing and Capacity Assurance

Tower Semiconductor's multi-fab sourcing strategy, with facilities in Israel, the US, and Japan, along with joint ventures, offers customers significant capacity assurance. This global network is crucial for mitigating supply chain disruptions, a challenge highlighted by the semiconductor industry's volatility. For instance, in 2023, the industry faced ongoing supply chain pressures despite a general slowdown in demand, making Tower's distributed manufacturing a key advantage.

This distributed manufacturing footprint provides resilience and flexibility in wafer production, allowing Tower to adapt to changing market demands and geopolitical factors. The ability to shift production or increase output across different sites ensures continuity and scalability for clients, a vital component for businesses reliant on advanced semiconductor manufacturing.

- Geographic Diversification: Manufacturing presence in Israel, the US, and Japan reduces reliance on any single region.

- Extended Capacity Assurance: Joint ventures and multiple fabs provide a larger, more reliable pool of production capacity.

- Risk Mitigation: Diversified sourcing inherently lowers the risk of supply chain interruptions due to localized events.

- Scalability and Flexibility: Customers benefit from the ability to scale production up or down across a broader manufacturing base.

Innovation for Emerging Applications

Tower Semiconductor actively pioneers groundbreaking technologies tailored for nascent markets. This includes sophisticated imaging for next-generation cameras and robust RF and High-Power Amplifier (HPA) solutions crucial for advanced wireless communications. Their work in power management ICs is particularly relevant for the burgeoning AI sector and the ever-growing demand in mobile devices.

This strategic focus on innovation allows their clients to push boundaries, creating novel products and securing early market advantages. Tower Semiconductor’s commitment is to transform promising concepts into tangible, market-ready value.

For instance, in 2024, Tower Semiconductor highlighted its advancements in silicon photonics, a key enabler for high-speed data transmission in AI infrastructure and advanced networking. They also reported significant progress in their SiGe BiCMOS technology, vital for 5G and future 6G applications, demonstrating their dedication to future-proofing their customers' roadmaps.

- Disruptive Technologies: Development of advanced imaging, RF, HPA, and power management solutions.

- Emerging Applications: Focus on AI, mobile, advanced communications, and data centers.

- Customer Empowerment: Enabling clients to innovate and capture new market opportunities.

- Value Realization: Translating innovative ideas into market-ready products.

Tower Semiconductor's customizable specialty process technologies offer unparalleled flexibility to fabless companies and IDMs, enabling the development of differentiated, high-performance integrated circuits. Their focus on leading-edge analog solutions, rather than just node shrinkage, empowers innovation in areas like advanced power management and high-frequency communication. In 2024, Tower Semiconductor continued to emphasize these specialty processes, contributing to its robust order book and its position as a key partner for companies seeking to push semiconductor performance boundaries.

Customer Relationships

Tower Semiconductor cultivates enduring partnerships by providing dedicated account management and comprehensive technical support, crucial for customer success from design inception through manufacturing. This commitment ensures close collaboration and rapid responses to evolving client needs, a cornerstone of their operational philosophy.

Tower Semiconductor actively partners with clients on collaborative development, directly integrating customer technology roadmaps into its R&D efforts. This ensures that innovation is precisely aligned with future product needs, fostering a co-creation environment.

This co-innovation strategy is key to developing highly customized and differentiated solutions, giving customers a competitive edge. For instance, joint projects in advanced areas like Silicon Photonics and Silicon Germanium are prime examples of this deep customer engagement.

Tower Semiconductor's customer portal and online resources are designed to streamline interactions, offering a centralized hub for order tracking and access to vital technical documentation. This digital approach significantly enhances the customer experience by ensuring convenience and prompt access to necessary information.

These platforms are integral to Tower's commitment to a robust support system, providing customers with the tools they need to manage their projects efficiently. For instance, in 2024, Tower continued to invest in these digital assets, aiming to reduce response times for technical queries and improve overall customer satisfaction metrics.

Quality Assurance and Reliability Focus

Tower Semiconductor prioritizes building customer trust by maintaining an unwavering focus on quality assurance and the reliability of its manufacturing processes and products. This dedication is essential for ensuring that its integrated circuits consistently meet the rigorous industry standards and precise customer specifications demanded by sectors such as automotive and medical devices.

High yield rates and exceptional product reliability serve as significant differentiators for Tower Semiconductor in a competitive market. For instance, in 2024, the company continued its efforts to enhance manufacturing efficiency, aiming to reduce defect rates and improve overall product performance, which directly impacts customer satisfaction and long-term partnerships.

- Commitment to Quality: Tower Semiconductor's customer relationships are built on a foundation of stringent quality assurance protocols throughout its fabrication processes.

- Reliability as a Differentiator: The company emphasizes high reliability in its manufactured chips, a critical factor for customers in sensitive industries like automotive and healthcare.

- Meeting Industry Standards: By adhering to and exceeding demanding industry standards, Tower Semiconductor ensures its products are trusted for critical applications.

- Yield and Performance: Continuous improvement in manufacturing yields and product reliability directly translates to greater value and trust for its clientele.

Strategic Long-Term Partnerships

Tower Semiconductor prioritizes cultivating strategic, long-term partnerships with its clientele. This approach transcends simple supplier-customer interactions, aiming to establish Tower as an indispensable foundry ally deeply integrated into their clients' success.

The company actively fosters this by engaging intimately with customer business goals and the ever-shifting market landscapes they navigate. This deep understanding allows Tower to tailor its foundry services and support effectively.

Tower Semiconductor explicitly articulates its commitment to generating positive and enduring value through these enduring collaborative relationships. This focus on sustainability underscores their partnership philosophy.

- Deep Customer Engagement: Tower Semiconductor moves beyond transactional exchanges to foster truly collaborative relationships, understanding client roadmaps and challenges.

- Strategic Alignment: The company aims to align its foundry capabilities with the long-term strategic objectives of its customers, ensuring mutual growth.

- Sustainable Value Creation: Tower's partnership model is designed to create lasting, positive impacts for both the company and its clients, emphasizing shared success.

Tower Semiconductor emphasizes collaborative development, integrating customer roadmaps into its R&D to ensure innovation aligns with future product needs. This co-creation approach, highlighted by joint projects in areas like Silicon Photonics, fosters deep customer engagement and provides customized solutions.

| Customer Relationship Aspect | Description | Impact/Example |

|---|---|---|

| Dedicated Account Management & Technical Support | Providing specialized support from design to manufacturing. | Ensures customer success and rapid response to evolving needs. |

| Collaborative Development & Co-Innovation | Integrating customer roadmaps into R&D efforts. | Develops highly customized solutions, giving customers a competitive edge (e.g., Silicon Photonics, SiGe). |

| Digital Customer Platforms | Online portals for order tracking and technical documentation. | Streamlines interactions and enhances customer experience, with ongoing 2024 investments to reduce response times. |

| Quality Assurance & Reliability | Unwavering focus on manufacturing process and product reliability. | Builds trust and ensures products meet rigorous industry and customer specifications, crucial for automotive and medical sectors. |

| Strategic Long-Term Partnerships | Acting as an indispensable foundry ally, integrated into client success. | Fosters deep understanding of client goals and market landscapes, tailoring services for mutual growth. |

Channels

Tower Semiconductor's direct sales and business development teams are crucial for engaging with fabless semiconductor companies and Integrated Device Manufacturers (IDMs) worldwide. These teams facilitate in-depth technical conversations, enabling the customization of manufacturing solutions to meet specific client needs.

This direct approach fosters strong, enduring customer relationships by ensuring clear communication and highly personalized service. For instance, in 2023, Tower Semiconductor reported approximately $1.6 billion in revenue, a significant portion of which is driven by these direct customer engagements.

Tower Semiconductor's global manufacturing facilities, or fabs, are the core physical channels for delivering their specialized foundry services. Customers directly interact with these fabs for critical stages like wafer production, process technology qualification, and in-depth technical collaboration to bring their chip designs to life.

This strategic multi-fab presence, spanning locations in Israel, the United States, and Japan, alongside shared facilities, creates a robust and distributed delivery network. This geographic diversity ensures supply chain resilience and allows Tower to cater to a global customer base with localized support and production capabilities.

Tower Semiconductor actively participates in key industry conferences and trade shows like APEC (Applied Power Electronics Conference) and IMS (International Microwave Symposium). These events are vital for showcasing their advanced semiconductor solutions and manufacturing capabilities to a global audience of engineers and potential clients.

In 2024, these platforms are essential for demonstrating Tower's latest innovations in areas such as high-performance analog, mixed-signal, and power management technologies. The company uses these gatherings to directly engage with customers, understand market needs, and solidify existing partnerships.

These trade shows also serve as a critical channel for thought leadership, allowing Tower Semiconductor to present technical papers and highlight their expertise. This strategic presence helps to build brand awareness and attract new business opportunities within the competitive semiconductor landscape.

Online Presence and Corporate Website

Tower Semiconductor's official website is a crucial digital storefront, providing comprehensive corporate information, investor relations updates, and detailed technical overviews of their foundry services. This platform is designed to attract potential clients by showcasing their manufacturing capabilities and offers existing customers a centralized resource for support and information.

The website also serves as a gateway for prospective employees, featuring a dedicated careers section, and provides secure access for current clients through a customer portal. In 2024, Tower Semiconductor continued to leverage its online presence to communicate its advanced process technologies, including its leading-edge 7nm and 5nm nodes, to a global audience.

- Digital Hub: The corporate website functions as the primary online channel for all company-related information.

- Customer Engagement: It facilitates learning about capabilities for new clients and provides resources for existing ones.

- Talent Acquisition: A careers section attracts potential employees.

- 2024 Focus: Continued emphasis on showcasing advanced process technologies online.

Investor Relations and Public Relations

Tower Semiconductor leverages its investor relations and public relations channels to foster transparency and engagement with its financial stakeholders. The investor relations section of their website is a crucial hub, offering access to press releases, financial reports, and SEC filings, which are vital for analysts and potential investors to assess performance and strategy. This consistent flow of information is designed to build trust and attract capital.

Key factual elements within these channels include:

- Regular Financial Reporting: Tower Semiconductor, like many public companies, adheres to quarterly and annual reporting schedules, providing detailed financial statements and management discussions. For instance, in their Q1 2024 earnings report, they detailed revenue figures and operational highlights.

- Press Releases: Announcements regarding new foundry partnerships, technological advancements, or strategic acquisitions are disseminated through press releases, keeping the market informed of significant business developments.

- Investor Presentations: These often accompany earnings calls and offer a more focused narrative on the company's strategic direction, market position, and growth opportunities, frequently citing market share data or projected industry growth.

- Website Accessibility: The dedicated investor relations portal ensures that all relevant documents and news are readily available, facilitating informed decision-making for the investment community.

Tower Semiconductor utilizes industry conferences and trade shows as key channels to showcase its advanced manufacturing capabilities and connect with potential clients. These events are vital for demonstrating innovations in areas like analog and power management technologies, fostering direct engagement and understanding of market needs.

The company's global manufacturing facilities, or fabs, serve as the primary physical channels for delivering foundry services, enabling direct customer interaction for wafer production and process collaboration. This distributed network across Israel, the US, and Japan enhances supply chain resilience and provides localized support.

Tower Semiconductor's official website acts as a critical digital storefront, offering comprehensive information on its foundry services, advanced process technologies, and investor relations, while also serving as a gateway for talent acquisition and customer support.

Investor and public relations channels, including regular financial reporting and press releases, are essential for maintaining transparency with financial stakeholders, building trust, and attracting capital, as evidenced by their detailed Q1 2024 earnings report.

| Channel Type | Key Activities | 2024 Focus/Data Point | Impact |

|---|---|---|---|

| Direct Sales & Business Development | Engaging with fabless companies and IDMs, technical customization | Fostering strong customer relationships | Drove significant portion of 2023 revenue (~$1.6 billion) |

| Manufacturing Facilities (Fabs) | Wafer production, process qualification, technical collaboration | Geographic diversity (Israel, US, Japan) | Ensures supply chain resilience, localized support |

| Industry Conferences & Trade Shows | Showcasing solutions, direct client engagement, thought leadership | Highlighting advanced process technologies (e.g., analog, power management) | Builds brand awareness, attracts new business |

| Corporate Website | Information hub, customer portal, careers section | Showcasing advanced process nodes (e.g., 7nm, 5nm) | Attracts clients and talent, provides resources |

| Investor & Public Relations | Financial reporting, press releases, investor presentations | Transparency with stakeholders, capital attraction | Facilitates informed decision-making by investors |

Customer Segments

Fabless semiconductor companies are a core customer segment for Tower Semiconductor. These companies excel at chip design but lack manufacturing capabilities, making them reliant on foundries like Tower to produce their innovative integrated circuits. Tower's specialty foundry services are crucial for these businesses to translate their advanced designs into tangible products, enabling them to compete without the massive capital investment required for fabrication plants.

Tower Semiconductor caters to Integrated Device Manufacturers (IDMs) looking to offload some production or access specialized processes they lack internally. This strategic partnership enables IDMs to concentrate on design and innovation, utilizing Tower's advanced manufacturing expertise. In 2024, Tower's foundry services are particularly attractive as the semiconductor industry navigates supply chain complexities and the demand for leading-edge nodes.

The automotive sector represents a crucial and expanding customer base for Tower Semiconductor. They supply chips essential for a wide array of vehicle functions, from advanced driver-assistance systems to infotainment. Despite some inventory adjustments seen across the broader semiconductor market, the fundamental demand for robust and high-performing automotive chips remains consistently strong.

Tower's expertise in power management solutions is particularly vital for automotive applications. These chips are critical for controlling and optimizing the energy flow within vehicles, supporting everything from electric vehicle powertrains to the complex electronic systems found in modern cars. For instance, the increasing electrification of vehicles directly translates to a greater need for sophisticated power management ICs, a core area of Tower's offerings.

Industrial and Consumer Electronics Markets

Tower Semiconductor caters to a wide array of industrial and consumer electronics sectors by supplying essential analog integrated circuits. These components are critical for enabling smart systems, enhancing power efficiency, and powering a multitude of consumer electronics devices.

The company's engagement with these markets is significant, forming a substantial part of its overall customer engagement. For instance, in 2024, Tower's focus on these sectors continued to drive growth, with analog and mixed-signal foundry services seeing robust demand.

- Industrial Applications: Tower's analog ICs are integral to automation, control systems, and various industrial equipment, supporting the trend towards Industry 4.0.

- Consumer Electronics: The company provides solutions for smartphones, wearables, home appliances, and entertainment systems, meeting the constant innovation in this space.

- Power Management: A key area is the development of power management ICs, crucial for battery-operated devices and energy-efficient solutions across both industrial and consumer segments.

Aerospace & Defense and Medical Sectors

Tower Semiconductor serves the aerospace and defense (A&D) and medical sectors by providing highly specialized analog semiconductor solutions. These industries demand exceptional reliability, custom designs, and superior performance for mission-critical applications. For example, Tower's advanced technologies are crucial for components used in advanced radar systems, secure communication devices, and sophisticated medical imaging equipment.

The A&D sector, in particular, relies on semiconductors that can withstand extreme environmental conditions and offer long-term operational stability. Tower's expertise in process technologies allows them to meet these stringent requirements, contributing to the development of next-generation defense and aerospace platforms. In 2023, the global aerospace and defense market was valued at approximately $2.5 trillion, with semiconductors playing an increasingly vital role in its advancement.

Similarly, the medical sector leverages Tower's capabilities for innovative healthcare solutions. This includes semiconductors for diagnostic imaging devices, patient monitoring systems, and implantable medical electronics. The demand for miniaturization and high sensitivity in medical devices makes Tower's advanced imaging and sensor technologies particularly valuable. The global medical device market is projected to reach over $600 billion by 2025, highlighting the significant growth and opportunity in this segment.

Tower's focus on these high-value markets is supported by their commitment to advanced manufacturing processes and intellectual property. Their ability to deliver customized solutions tailored to the unique needs of A&D and medical clients differentiates them in the competitive semiconductor landscape.

- Aerospace & Defense: Focus on high-reliability, radiation-hardened, and extreme-environment-tolerant semiconductors for radar, navigation, and communication systems.

- Medical Sector: Provision of advanced sensors, imaging technologies, and low-power analog ICs for diagnostic equipment, patient monitoring, and wearable health devices.

- Customization: Offering tailored semiconductor designs and manufacturing processes to meet the stringent and specific requirements of both sectors.

- Market Relevance: Addressing critical needs for enhanced performance, miniaturization, and long-term reliability in demanding applications.

Tower Semiconductor's customer base is diverse, primarily serving fabless semiconductor companies that outsource their manufacturing. They also partner with Integrated Device Manufacturers (IDMs) seeking specialized processes or additional capacity. The automotive sector is a significant growth area, driven by the increasing demand for advanced electronics in vehicles, particularly for power management solutions. Additionally, industrial and consumer electronics, as well as the high-reliability aerospace, defense, and medical sectors, represent key segments that benefit from Tower's advanced analog and mixed-signal foundry services.

| Customer Segment | Key Needs Addressed | 2024 Market Relevance |

|---|---|---|

| Fabless Semiconductor Companies | Access to advanced manufacturing, specialized process technologies. | Crucial for bringing innovative designs to market without capital expenditure on fabs. |

| Integrated Device Manufacturers (IDMs) | Offloading production, accessing specific process nodes, capacity expansion. | Strategic partnerships to optimize internal resources and meet market demand. |

| Automotive Sector | High-performance, reliable chips for ADAS, infotainment, and power management (especially for EVs). | Strong and growing demand due to vehicle electrification and increasing electronic content. |

| Industrial & Consumer Electronics | Analog ICs for smart systems, power efficiency, and diverse consumer devices. | Robust demand driven by IoT adoption and continuous innovation in consumer products. |

| Aerospace, Defense & Medical | Highly specialized, reliable, and custom-designed analog solutions for critical applications. | Essential for advanced systems requiring extreme environmental tolerance and precision. |

Cost Structure

Manufacturing and production costs represent a substantial component of Tower Semiconductor's expenses, driven by essential elements like raw materials such as silicon wafers, the significant utility demands of operating fabrication plants (fabs), and the direct labor required to manage production lines. These are fundamental costs for any global specialty foundry.

In early 2025, Tower Semiconductor initiated a strategic move to discontinue less profitable production processes in Fab1 and shift them to Fab2. This action is designed to optimize production workflows and boost overall operational efficiency, directly impacting the cost structure by concentrating high-volume, more efficient processes.

Tower Semiconductor dedicates significant resources to Research and Development, a crucial element for maintaining its competitive edge in the semiconductor industry. These investments are vital for developing advanced process technologies and innovative solutions that cater to evolving market demands.

In 2023, Tower Semiconductor reported R&D expenses of $395.7 million, reflecting a substantial commitment to technological advancement. This figure underscores the company's strategy to stay at the forefront of semiconductor manufacturing by investing in personnel, cutting-edge equipment, and the acquisition of intellectual property.

The company’s R&D efforts are particularly focused on pioneering disruptive technologies for emerging applications, such as advanced sensors, artificial intelligence, and next-generation communication systems. Tower’s ongoing investment ensures it can offer differentiated manufacturing capabilities to its diverse customer base.

Capital expenditures are a significant cost driver for Tower Semiconductor, primarily focused on expanding facilities, upgrading equipment, and advancing technology. These investments are crucial for increasing manufacturing capacity and enhancing capabilities within their existing fabrication plants, shared facilities, and strategic capacity corridors.

For the full year 2024, Tower Semiconductor reported substantial investments in property and equipment, totaling $432 million. This figure underscores the company's commitment to maintaining a competitive edge through continuous infrastructure development and technological innovation.

Sales, General, and Administrative (SG&A) Expenses

Tower Semiconductor's Sales, General, and Administrative (SG&A) expenses are crucial operating costs. These include investments in marketing and sales force compensation to drive global customer engagement. Corporate overhead and various administrative functions also fall under this umbrella, ensuring smooth worldwide operations.

For instance, in 2024, Tower Semiconductor's SG&A expenses represented a significant portion of their operating costs, reflecting their commitment to expanding market reach and supporting a global workforce. Employee benefits, a key administrative cost, are meticulously managed to retain talent.

- Marketing and Sales: Costs associated with promoting products and services, and compensating sales personnel.

- Corporate Overhead: Expenses related to the central administration of the company, including executive salaries and office expenses.

- Administrative Functions: Costs for human resources, finance, legal, and other support departments.

- Employee Benefits: Expenditures on health insurance, retirement plans, and other benefits for employees.

Depreciation and Amortization

Depreciation and amortization represent substantial fixed costs for Tower Semiconductor, directly tied to its capital-intensive manufacturing operations. These non-cash expenses, reflecting the wear and tear of sophisticated fabrication equipment and facilities, significantly influence profitability. For instance, in 2023, Tower Semiconductor reported depreciation and amortization expenses of approximately $533 million.

The ongoing investment in advanced manufacturing capabilities, such as the new fab in Agrate, Italy, further contributes to these fixed costs. These new facilities, while crucial for future growth and technological advancement, will add to the depreciation burden, impacting both gross and operating profit margins in the short to medium term.

- Capital Intensity: Semiconductor manufacturing requires massive upfront investment in specialized equipment and cleanroom facilities, leading to high depreciation charges.

- Non-Cash Expense: Depreciation and amortization do not involve an outflow of cash in the current period but represent the allocation of an asset's cost over its useful life.

- Impact on Profitability: These expenses directly reduce operating income, affecting key profitability metrics like EBITDA and net income.

- 2023 Data: Tower Semiconductor's depreciation and amortization for 2023 totaled around $533 million, highlighting their significance in the cost structure.

Tower Semiconductor's cost structure is heavily influenced by its capital-intensive manufacturing operations, with significant expenditures on raw materials like silicon wafers and utilities for its fabrication plants. Research and Development is another major cost, with $395.7 million spent in 2023 alone to drive technological innovation. Capital expenditures for facility expansion and equipment upgrades, such as the $432 million invested in property and equipment in 2024, are also critical cost drivers.

| Cost Category | 2023 (Millions USD) | 2024 (Millions USD) |

|---|---|---|

| Research & Development | 395.7 | [Data not publicly available for 2024] |

| Capital Expenditures (Property & Equipment) | [Data not publicly available for 2023] | 432 |

| Depreciation & Amortization | ~533 | [Data not publicly available for 2024] |

Revenue Streams

Tower Semiconductor's main income comes from its foundry services, where it manufactures chips for other companies. These clients are typically fabless semiconductor companies and integrated device manufacturers (IDMs) that need specialized production capabilities. For the entirety of 2024, these services generated $1.44 billion in revenue.

Tower Semiconductor's revenue from High-Performance Analog (HPA) solutions is driven by offerings in RF infrastructure, power management, and sensors. This includes advanced technologies like Silicon Germanium (SiGe) and Silicon Photonics (SiPho) for RF, and Bipolar CMOS DMOS (BCD) for power management. These areas are strategically positioned for ongoing expansion.

The RF segment, in particular, demonstrated robust performance, with revenue experiencing substantial growth in the first quarter of 2025. Furthermore, Tower Semiconductor has successfully entered the envelope tracking market, diversifying its HPA revenue streams.

Tower Semiconductor generates revenue through design enablement and support fees, offering crucial services like Process Design Kits (PDKs) and specialized design tools to its clients. These offerings streamline the customer's design process, enabling faster and more accurate chip development.

While frequently integrated into broader manufacturing agreements, these design services can also command distinct fees, directly contributing to Tower's top line. For instance, in 2023, Tower Semiconductor's focus on advanced foundry services, which inherently include design support, remained a key aspect of their customer partnerships.

Process Transfer and Optimization Services (TOPS) Fees

Tower Semiconductor generates revenue through its Process Transfer and Optimization Services (TOPS) fees. These fees are earned by assisting Integrated Device Manufacturers (IDMs) and fabless companies in transferring and refining their semiconductor manufacturing processes. This specialized consulting and engineering support allows customers to benefit from Tower's extensive manufacturing knowledge and experience.

These TOPS fees represent a significant value-added service, enabling Tower to monetize its deep expertise beyond pure foundry manufacturing. For instance, in 2023, Tower's foundry services, which encompass these optimization efforts, generated substantial revenue, demonstrating the market's reliance on such specialized support.

- TOPS Fees: Revenue generated from assisting clients with process transfer and optimization.

- Value Proposition: Leverages Tower's manufacturing expertise to enhance customer processes.

- Customer Base: Serves IDMs and fabless semiconductor companies.

Long-Term Capacity Agreements

Long-term capacity agreements are a cornerstone of Tower Semiconductor's revenue stability. These arrangements secure predictable wafer production volumes from major clients, ensuring a consistent demand for their specialized foundry services. For instance, in 2023, Tower Semiconductor reported that a significant portion of its revenue was derived from such long-term commitments, underscoring their importance in generating predictable income streams and fostering enduring customer partnerships.

These agreements offer several key benefits:

- Revenue Predictability: Long-term contracts provide a reliable baseline of income, shielding Tower from short-term market fluctuations.

- Capacity Utilization: They ensure Tower's advanced manufacturing facilities are consistently utilized, optimizing operational efficiency.

- Customer Loyalty: These partnerships deepen relationships, encouraging repeat business and collaborative development.

Tower Semiconductor's primary revenue driver is its foundry services, where it manufactures semiconductor devices for a diverse clientele, including fabless companies and integrated device manufacturers (IDMs). This core business segment is crucial for its financial performance.

The company also generates substantial income from its High-Performance Analog (HPA) solutions, particularly in areas like RF infrastructure and power management. These advanced technologies cater to growing markets, contributing significantly to revenue diversification.

Tower's revenue streams are further bolstered by design enablement and support services, along with Process Transfer and Optimization Services (TOPS) fees. These value-added offerings leverage Tower's manufacturing expertise, enhancing customer chip development and process refinement.

| Revenue Stream | Description | 2024 Revenue (Approx.) |

|---|---|---|

| Foundry Services | Chip manufacturing for fabless companies and IDMs | $1.44 billion |

| High-Performance Analog (HPA) Solutions | RF infrastructure, power management, sensors | N/A (integrated into foundry services) |

| Design Enablement & Support | PDKs, design tools, specialized support | N/A (integrated into foundry services) |

| Process Transfer & Optimization Services (TOPS) | Assisting clients with process transfer and refinement | N/A (integrated into foundry services) |

Business Model Canvas Data Sources

The Tower Semiconductor Business Model Canvas is constructed using a blend of financial reports, market research data, and internal operational insights. This multi-faceted approach ensures a comprehensive and accurate representation of the company's strategic framework.