Tower Semiconductor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tower Semiconductor Bundle

Tower Semiconductor operates in a highly competitive foundry market, facing intense rivalry from established players and emerging threats. Understanding the intricate interplay of these forces is crucial for navigating this dynamic landscape.

The complete report reveals the real forces shaping Tower Semiconductor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The semiconductor industry's reliance on a concentrated group of specialized equipment and material providers significantly impacts bargaining power. For Tower Semiconductor, this translates to a limited number of vendors supplying essential manufacturing tools and crucial raw materials such as silicon wafers, photoresists, and specialized chemicals.

This limited supplier base grants these vendors considerable leverage, particularly concerning pricing and contract terms, especially when dealing with advanced technologies. For instance, ASML, a key supplier of advanced lithography systems, holds a near-monopoly on the most critical EUV machines, allowing it substantial pricing power.

Switching suppliers for critical components in semiconductor manufacturing presents significant hurdles for Tower Semiconductor. These challenges translate directly into higher costs and potential production delays. For instance, the rigorous qualification process for new materials alone can take months and involve substantial engineering resources, impacting Tower's operational agility.

The financial implications of switching are considerable. Beyond material qualification, re-calibrating highly specialized manufacturing equipment for a new supplier's products can cost millions of dollars. This investment, coupled with the risk of yield degradation during the transition, strengthens the leverage of current suppliers, making it financially punitive for Tower to seek alternatives even when facing price pressures.

The uniqueness of inputs significantly bolsters supplier bargaining power in the semiconductor industry. Many critical components and manufacturing equipment are highly specialized, with few, if any, alternative providers. For example, advanced lithography machines from companies like ASML are essential for cutting-edge chip production and represent a significant barrier to entry for competitors, granting ASML substantial leverage.

When these specialized inputs are crucial for Tower Semiconductor's proprietary foundry processes, the supplier's influence grows. Think of unique chemical formulations or specialized process equipment that enable Tower to offer distinct manufacturing capabilities. In 2024, the demand for advanced semiconductor manufacturing, particularly for AI and high-performance computing, intensified the need for these unique inputs, further concentrating power in the hands of a few key suppliers.

Threat of Forward Integration by Suppliers

While direct forward integration by suppliers into semiconductor foundry services is rare due to the massive capital investment and specialized knowledge required, it remains a theoretical consideration. For instance, a supplier of advanced photolithography equipment, a critical and costly component in chip manufacturing, could potentially explore offering specialized fabrication services. However, the sheer scale of operations at a company like Tower Semiconductor, which operates multiple fabs, presents a significant hurdle for such integration efforts.

The immense capital expenditure for a state-of-the-art semiconductor fabrication plant is a primary deterrent. Building a new fab can cost billions of dollars; for example, Intel announced plans for new fabs in Arizona with an estimated investment of $20 billion, and TSMC’s new fabs in Arizona are projected to cost upwards of $12 billion each. This financial barrier makes it exceedingly difficult for suppliers to directly compete with established foundries. Consequently, the direct threat of suppliers becoming competitors through forward integration is generally considered low for Tower Semiconductor.

- High Capital Barriers: The cost of building and operating semiconductor fabrication plants, often exceeding $10 billion, significantly limits supplier forward integration.

- Specialized Expertise: Running a foundry requires deep, specialized knowledge in process technology, yield management, and complex equipment operation, which suppliers may lack.

- Limited Direct Competition: While suppliers hold influence, their ability to directly enter the foundry market as competitors is constrained by these substantial economic and technical challenges.

Importance of Supplier's Input to Tower Semiconductor's Cost Structure

The cost of raw materials and specialized equipment represents a substantial segment of Tower Semiconductor's overall operating expenditures. Any shifts in the pricing of these critical inputs, influenced by the bargaining power of suppliers, can directly affect Tower Semiconductor's profit margins and its ability to maintain competitive pricing in the market.

The global semiconductor materials market, projected to reach $67.5 billion in 2024, underscores the significant scale and critical nature of these supplier relationships for foundries like Tower Semiconductor.

- High material and equipment costs: These are a major component of semiconductor manufacturing expenses.

- Price volatility impact: Fluctuations in input prices can directly squeeze Tower Semiconductor's profitability.

- Competitive pricing pressure: Increased input costs may force Tower Semiconductor to raise prices, impacting its market position.

- Supplier concentration: If a few suppliers dominate the market for essential materials or equipment, their bargaining power increases.

The bargaining power of suppliers for Tower Semiconductor is significant due to the industry's reliance on a few specialized providers for critical equipment and materials. For instance, ASML's dominance in EUV lithography systems grants it considerable pricing leverage, impacting Tower's costs.

Switching suppliers for these specialized inputs is difficult and expensive for Tower, often involving lengthy qualification processes and millions in re-tooling costs. This inertia reinforces the power of existing suppliers, particularly for unique materials crucial to Tower's proprietary processes.

While direct forward integration by suppliers into foundry services is unlikely due to immense capital requirements, estimated at over $10 billion for a new fab, their control over essential inputs remains a key factor. The global semiconductor materials market, projected at $67.5 billion in 2024, highlights the scale of these supplier relationships.

| Supplier Characteristic | Impact on Tower Semiconductor | Example |

|---|---|---|

| Concentrated Supplier Base | Increased leverage for suppliers on pricing and terms | ASML's near-monopoly on EUV lithography |

| Uniqueness of Inputs | Strengthens supplier power, especially for proprietary processes | Specialized chemicals or process equipment enabling unique capabilities |

| High Switching Costs | Financial and operational penalties for changing suppliers | Months-long qualification, millions in re-tooling, risk of yield loss |

| Capital Intensity of Foundries | Deters supplier forward integration into foundry services | New fabs cost $10B+ (e.g., TSMC Arizona ~$12B each) |

What is included in the product

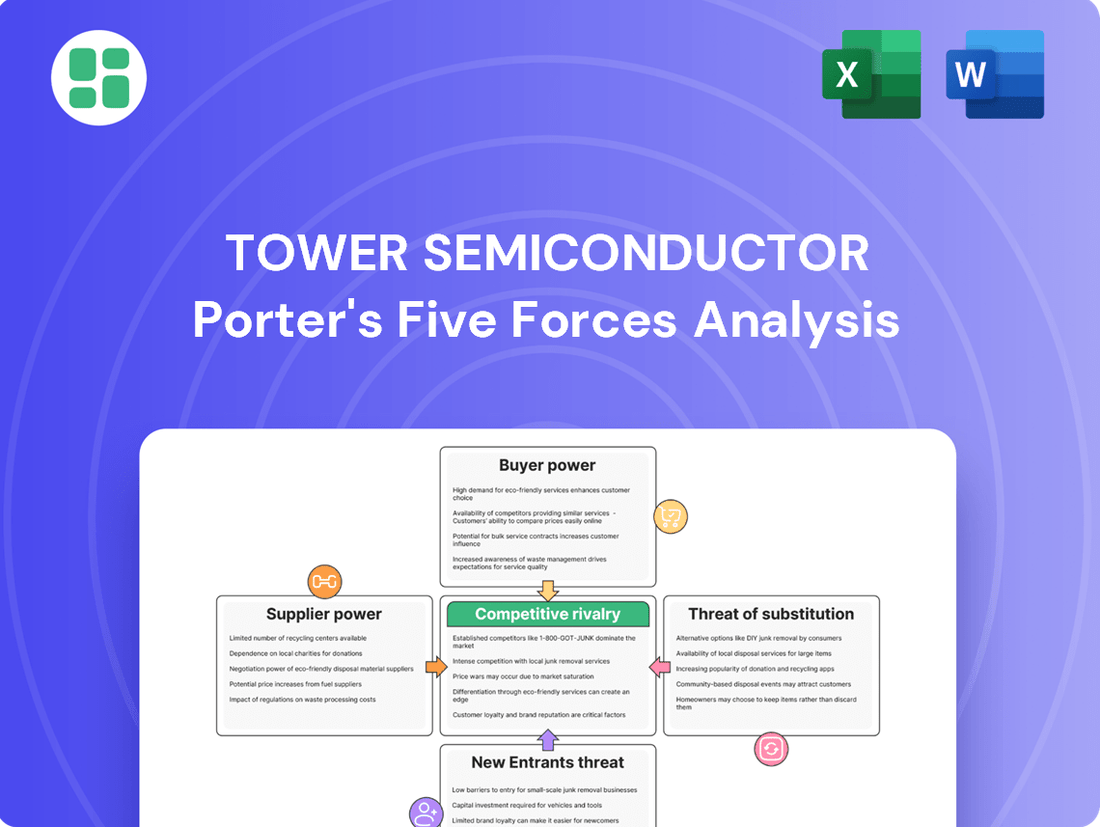

This analysis unpacks the competitive intensity within the semiconductor foundry industry, focusing on Tower Semiconductor's strategic position against rivals, buyer power, supplier leverage, and the threat of new entrants and substitutes.

Instantly gauge competitive intensity with a visual breakdown of Tower Semiconductor's industry landscape, simplifying complex strategic pressures.

Easily adapt to shifting market dynamics by updating threat levels for suppliers, buyers, rivals, and new entrants, ensuring agile decision-making.

Customers Bargaining Power

Tower Semiconductor caters to a diverse clientele, including fabless semiconductor companies and Integrated Device Manufacturers (IDMs). The concentration of these customers significantly impacts their bargaining power. If a substantial percentage of Tower's revenue is derived from a small number of key clients, those customers gain considerable leverage to negotiate more favorable pricing and terms.

Customer switching costs are a significant factor in Tower Semiconductor's bargaining power with its clients. These costs can be substantial, encompassing the expense and time required for chip redesigns to accommodate new foundry process technologies, rigorous product requalification procedures, and the risk of delayed market entry for their finished products.

Tower Semiconductor actively works to increase these switching costs. By offering highly customizable process technologies and comprehensive design services, they foster deeper, more integrated relationships with their customers, making it more challenging and costly for clients to move to a competitor. This strategy effectively dampens the bargaining power of customers.

Fabless companies and Integrated Device Manufacturers (IDMs) are typically well-informed buyers. Their sophisticated understanding of technology and market dynamics enables them to scrutinize foundry services and pricing. This knowledge empowers them to negotiate effectively with suppliers like Tower Semiconductor.

The intense competition within the sectors Tower Semiconductor serves, such as automotive and consumer electronics, directly translates into heightened price sensitivity for its customers. For instance, the automotive semiconductor market, a key segment for foundries, saw robust growth in 2024, with demand for advanced chips driving innovation but also intensifying price pressures as manufacturers strive for cost competitiveness.

This customer price sensitivity, combined with the ability to switch between foundries, gives buyers significant leverage. They can leverage competitive quotes and the availability of alternative manufacturing partners to push for lower prices, directly impacting Tower Semiconductor's profitability and pricing strategies.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large Integrated Device Manufacturers (IDMs), poses a potential challenge. These IDMs, already operating their own fabrication facilities, could theoretically increase in-house production, thereby reducing their need for external foundries like Tower Semiconductor. This capability, however, is heavily constrained by the immense capital expenditure and specialized technical knowledge required, creating a significant barrier to entry for most fabless semiconductor companies seeking to integrate backward.

Despite the theoretical possibility, the prevailing industry trend strongly favors the fabless semiconductor model, which inherently relies on outsourced manufacturing. This widespread adoption of outsourcing significantly dilutes the threat of backward integration for foundries. For instance, in 2024, the global fabless semiconductor market continued its robust growth, with revenue projected to reach hundreds of billions of dollars, underscoring the industry's reliance on foundry services.

- IDM Capability: Large IDMs can possess their own fabrication plants, enabling potential in-house production expansion.

- High Barriers: Full backward integration demands substantial capital investment and specialized expertise, making it difficult for many.

- Industry Trend: The dominant fabless model and outsourced manufacturing generally reduce this threat for foundries.

- Market Data: The global fabless semiconductor market demonstrated continued growth in 2024, highlighting reliance on foundries.

Volume and Strategic Importance of Orders

The bargaining power of Tower Semiconductor's customers is significantly influenced by the volume and strategic importance of their orders. Customers who place large-volume orders naturally have more leverage due to the substantial revenue they represent. For instance, Tower's reported revenue for the first quarter of 2024 was $305 million, highlighting the impact of customer order sizes on overall financial performance.

Furthermore, customers whose products are critical to Tower Semiconductor's strategic technology areas, such as RF, power management, and silicon photonics, can also wield considerable influence. These segments are key growth drivers for Tower. In 2023, Tower's revenue from its specialty foundry segment, which includes these areas, demonstrated robust performance, underscoring their importance.

- High-volume customers: Their substantial order sizes grant them greater negotiation power on pricing and terms.

- Strategic segment customers: Those whose demand is crucial for Tower's growth in areas like RF and power management have increased leverage.

- Critical technology integration: Customers whose chips are essential for next-generation devices in these strategic areas can command better terms.

Tower Semiconductor's customers, particularly large IDMs and fabless companies, possess considerable bargaining power. This stems from their technical sophistication, ability to switch foundries (though costly), and the intense price competition in end markets like automotive, which saw significant growth in 2024. The sheer volume of orders and the strategic importance of certain customer segments, such as those in RF and power management, further amplify this leverage, directly influencing Tower's pricing and terms.

| Factor | Impact on Bargaining Power | Supporting Data/Context |

|---|---|---|

| Customer Sophistication | High | Customers understand technology and market dynamics, enabling effective negotiation. |

| Switching Costs | Moderate to High | Costs include redesign, requalification, and market entry risks, but alternatives exist. |

| Price Sensitivity (End Markets) | High | Intense competition in sectors like automotive (growing in 2024) drives customer demand for lower prices. |

| Order Volume & Strategic Importance | High | Large orders and critical technology segments (e.g., RF, power management) give customers significant leverage. Tower's Q1 2024 revenue was $305 million, showing the impact of order sizes. |

| Threat of Backward Integration | Low | High capital and expertise barriers limit IDMs' ability to fully integrate, and the fabless model relies on outsourcing. The global fabless market's growth in 2024 reinforces this. |

Same Document Delivered

Tower Semiconductor Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Tower Semiconductor's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the semiconductor foundry industry.

Rivalry Among Competitors

The semiconductor foundry landscape is intensely competitive, featuring established players like UMC, SMIC, and GlobalFoundries, all vying for market share in specialized manufacturing processes. These dedicated foundries directly challenge Tower Semiconductor’s offerings.

Integrated Device Manufacturers (IDMs) with underutilized production capacity also represent a significant competitive force, often offering foundry services to offset their own costs. This indirect competition broadens the competitive set beyond pure-play foundries.

Tower Semiconductor's focus on specialty processes, such as analog, mixed-signal, and power management technologies, means it faces competition across various technology nodes and end-user markets, including automotive and industrial sectors.

The overall semiconductor market is experiencing robust growth, with forecasts indicating continued expansion through 2025 and beyond. This upward trend is largely fueled by the increasing demand from sectors like artificial intelligence, 5G deployment, and the automotive industry, which are all heavily reliant on advanced chip technology.

A growing market generally mitigates intense competitive rivalry. When demand outstrips supply, companies tend to focus on expanding their capacity and meeting new customer needs rather than engaging in aggressive price wars or market share battles for existing business.

Specifically, the semiconductor foundry market, where Tower Semiconductor operates, is projected to see a significant year-over-year increase of 11% in 2025. This expansion provides a favorable environment for foundries, allowing them to invest in new technologies and capacity without the immediate pressure of intense competition for a stagnant customer base.

Tower Semiconductor thrives as a global specialty foundry, distinguishing itself with highly customizable process technologies. These include advanced offerings like Silicon Germanium (SiGe), Silicon Photonics (SiPho), BiCMOS, and sophisticated power management platforms. This strategic focus on niche areas helps them avoid direct confrontation with larger foundries concentrated on mainstream, leading-edge logic production.

While Tower Semiconductor carves out its specialized space, it's not entirely alone. Certain competitors also provide advanced or specialty process capabilities, intensifying the need for Tower to consistently innovate. For instance, in 2024, the foundry sector saw continued investment in advanced packaging and heterogeneous integration, areas where specialization is key. Tower's ability to maintain its unique value proposition hinges on its ongoing commitment to developing and refining these differentiated technologies.

Exit Barriers

The semiconductor foundry industry, including players like Tower Semiconductor, faces extremely high exit barriers due to its capital-intensive nature. Building and equipping a modern fabrication plant (fab) requires billions of dollars, with advanced nodes demanding investments well over $20 billion. For instance, Intel announced a $20 billion investment in new fabs in Arizona in 2021, highlighting the scale of capital commitment.

These substantial fixed costs and the highly specialized nature of the assets mean that exiting the market is not a simple decision. Companies are often compelled to continue operations and compete, even in challenging market conditions, to recoup their investments. This can lead to prolonged periods of intense rivalry as firms strive to maintain utilization rates and avoid the significant losses associated with shutting down or selling highly depreciated, specialized assets.

The specialized nature of semiconductor manufacturing equipment and facilities further exacerbates exit barriers. Unlike more general industrial assets, these are not easily repurposed or sold. This lack of liquidity for specialized assets locks companies into the industry, contributing to sustained competitive pressure.

- Capital Investment: Building a leading-edge fab can cost upwards of $20 billion.

- Specialized Assets: Semiconductor manufacturing equipment has limited alternative uses, increasing exit costs.

- Industry Lock-in: High fixed costs incentivize continued operation, intensifying competition.

Strategic Alliances and Joint Ventures

Strategic alliances and joint ventures significantly shape competitive rivalry in the semiconductor industry. Tower Semiconductor's partnerships, like sharing a 300mm facility in Agrate, Italy, with STMicroelectronics, provide crucial access to advanced manufacturing capabilities. This collaboration, along with access to Intel's New Mexico factory, bolsters Tower's capacity and technological reach, directly impacting its competitive stance against rivals who may have similar or greater integrated resources.

These alliances, while beneficial, also introduce complex competitive dynamics. By sharing facilities and technology, Tower indirectly competes with its partners in certain market segments, creating a nuanced competitive landscape. This collaborative yet competitive environment necessitates careful strategic management to leverage the benefits of these partnerships without exacerbating direct rivalry.

- Tower Semiconductor's partnership with STMicroelectronics in Agrate, Italy, enhances its manufacturing capacity and technological access.

- Access to Intel's New Mexico factory further strengthens Tower's competitive position by expanding its operational footprint.

- These alliances create a dual dynamic of collaboration and indirect competition, influencing the overall rivalry in the foundry market.

Tower Semiconductor operates in a highly competitive foundry market, facing direct challenges from established players like UMC and SMIC, as well as integrated device manufacturers with excess capacity. Its specialization in niche areas like analog and power management technologies allows it to differentiate, but ongoing innovation is crucial to maintain this edge against competitors also investing in advanced processes.

The substantial capital required for semiconductor fabrication, with leading-edge fabs costing over $20 billion, creates high exit barriers. This industry lock-in means companies often continue competing to recoup investments, intensifying rivalry even in challenging conditions. Specialized equipment further limits asset liquidity, reinforcing this competitive pressure.

Strategic alliances, such as Tower's partnerships with STMicroelectronics and Intel, provide crucial access to advanced manufacturing capabilities and expand operational reach. However, these collaborations also introduce complex dynamics, as partners can become indirect competitors in certain market segments, requiring careful strategic navigation.

SSubstitutes Threaten

The primary threat of substitutes for Tower Semiconductor’s specialized foundry services comes from alternative manufacturing technologies that can achieve similar integrated circuit functionalities. This includes advancements in material sciences, such as the increasing adoption of silicon carbide (SiC) and gallium nitride (GaN) in power electronics, offering superior performance characteristics in certain applications.

While these alternative materials present a growing challenge, particularly in high-power and high-frequency markets where Tower Semiconductor has a strong presence, silicon-based manufacturing remains the industry standard for a vast majority of traditional integrated circuit applications. For example, the global market for SiC and GaN power semiconductors was projected to reach over $10 billion in 2024, indicating a significant but still niche segment compared to the broader silicon foundry market.

Integrated Device Manufacturers (IDMs) expanding their internal fabrication capabilities present a potential substitute for Tower Semiconductor's foundry services. However, the significant capital expenditure and technical expertise required for leading-edge semiconductor manufacturing make this a challenging alternative for most companies. For instance, building a new advanced fab can cost upwards of $20 billion, a barrier that favors outsourcing for many.

Advanced packaging solutions, like 2.5D/3D stacking and chiplets, offer alternative routes to enhanced performance. These technologies can integrate multiple smaller chips, potentially reducing the reliance on a single, monolithic, high-performance chip from a foundry. For instance, the growing adoption of chiplets in the CPU and GPU markets, projected to reach billions of dollars in value by 2024, demonstrates this shift. This could lessen the demand for Tower Semiconductor's leading-edge process nodes if customers opt for integrated chiplet solutions instead of custom-designed monolithic chips.

Software-Defined Solutions and FPGAs

Software-defined solutions and Field-Programmable Gate Arrays (FPGAs) present a potential threat of substitution for custom ASIC designs. FPGAs offer greater flexibility and faster time-to-market for certain applications where performance and power efficiency are not paramount. For example, in 2024, the FPGA market is projected to reach over $10 billion, indicating significant adoption of this alternative technology.

However, this threat is mitigated for Tower Semiconductor's core business. While FPGAs provide configurability, ASICs manufactured by foundries like Tower typically deliver superior performance, power efficiency, and lower per-unit costs in high-volume production. This cost-performance advantage often makes ASICs the preferred choice for mass-market applications, limiting the substitution risk for Tower's specialized foundry services.

- FPGA Market Growth: The global FPGA market is expected to grow at a CAGR of approximately 7% from 2023 to 2030, reaching an estimated $13.7 billion by 2030.

- ASIC vs. FPGA Performance: ASICs generally offer higher clock speeds and lower power consumption compared to FPGAs for equivalent functions.

- Cost Considerations: For high-volume production runs exceeding tens of thousands of units, ASICs typically achieve a lower cost per chip than FPGAs.

Lower-Cost, Less Advanced Technologies

For certain applications where advanced performance isn't critical, customers might choose older, more affordable semiconductor technologies. These could come from other foundries or integrated device manufacturers (IDMs). This represents a substitute threat if a client's needs don't justify Tower Semiconductor's specialized, higher-cost processes. For instance, a significant portion of the automotive sector, while growing in complexity, still relies on established, less cutting-edge chip designs for many standard functions.

Tower Semiconductor's strategic focus on differentiated, high-value analog solutions, including those for automotive and industrial markets, is designed to lessen the impact of these lower-cost substitutes. By offering unique capabilities and performance advantages in its specialty processes, Tower aims to retain customers who might otherwise be tempted by cheaper, albeit less capable, alternatives.

- Threat of Substitutes: Lower-Cost, Less Advanced Technologies

- Customers may opt for older, cheaper semiconductor technologies from other foundries or IDMs for less demanding applications.

- This substitute threat is most relevant when customer performance requirements do not necessitate Tower Semiconductor's specialty, high-value processes.

- Tower Semiconductor's focus on differentiated analog solutions, particularly for sectors like automotive, helps to mitigate this threat by offering unique value propositions.

The threat of substitutes for Tower Semiconductor's offerings is multifaceted, encompassing alternative materials, integrated manufacturing, advanced packaging, and programmable logic. While silicon remains dominant, emerging materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) are gaining traction in power electronics, a segment Tower serves. The market for these wide-bandgap semiconductors was estimated to exceed $10 billion in 2024, highlighting a growing, albeit still niche, competitive landscape. Furthermore, the increasing capability of Field-Programmable Gate Arrays (FPGAs) offers a flexible alternative to custom Application-Specific Integrated Circuits (ASICs) for certain applications, with the FPGA market projected to reach over $10 billion in 2024.

However, Tower's specialization in analog and mixed-signal technologies, particularly for automotive and industrial sectors, provides a degree of insulation. These markets often prioritize performance, reliability, and specific functionalities that custom ASICs, manufactured by foundries like Tower, are best suited to deliver. For instance, while FPGAs offer programmability, ASICs typically provide superior power efficiency and lower per-unit costs in high-volume production, a key consideration for many of Tower's clients. The significant capital investment required for in-house fabrication, often exceeding $20 billion for a leading-edge fab, also limits the threat from Integrated Device Manufacturers (IDMs) bringing production in-house.

| Substitute Type | Key Characteristics | Market Relevance for Tower | Estimated 2024 Market Size |

| Alternative Materials (SiC, GaN) | Superior performance in high-power/high-frequency applications | Growing, particularly in power electronics | >$10 billion (combined SiC & GaN power semiconductors) |

| FPGAs | Flexibility, faster time-to-market for certain applications | Potential substitute for custom ASICs where extreme performance is not critical | >$10 billion (FPGA market) |

| Advanced Packaging (Chiplets) | Integration of multiple smaller chips, potentially reducing monolithic ASIC demand | Emerging threat, impacting demand for large, complex monolithic designs | Billions of dollars (chiplet market) |

| In-house Manufacturing (IDMs) | Control over production, potential cost savings at scale | Limited by high capital expenditure and technical expertise | N/A (strategic decision) |

Entrants Threaten

The semiconductor foundry sector demands staggering capital investments, with building and equipping a single fabrication plant, or fab, often costing billions of dollars. For instance, constructing a leading-edge fab can easily surpass $20 billion, a figure that continues to rise with technological advancements. This immense financial hurdle significantly deters potential new entrants, as securing such substantial funding is a major challenge.

Developing and mastering advanced semiconductor manufacturing processes, particularly specialty technologies like those Tower Semiconductor offers, demands decades of dedicated research and development, robust intellectual property, and a highly skilled engineering workforce. This deep technical expertise and proprietary process platforms represent a formidable barrier to entry. New competitors would find it exceedingly difficult and time-consuming to replicate this accumulated know-how. For instance, Tower Semiconductor's significant investment in R&D, often running into hundreds of millions of dollars annually, underscores the capital and knowledge intensity required to compete in this space.

Tower Semiconductor, like other established foundries, benefits greatly from economies of scale. This means their massive production facilities allow them to spread costs over a larger volume of chips, making each chip cheaper to produce. For instance, in 2024, the semiconductor industry continued to see consolidation and investment in larger, more advanced fabrication plants, further entrenching these scale advantages.

New entrants would struggle to match these existing scale efficiencies. They would need to invest billions in new fabs and ramp up production significantly before they could even begin to compete on cost. This high capital requirement acts as a substantial barrier, deterring many potential competitors from entering the market.

Customer Relationships and Trust

The semiconductor foundry business, like Tower Semiconductor's, thrives on deep customer relationships. Building long-term, trusted partnerships with fabless companies and integrated device manufacturers (IDMs) is a significant barrier to entry. These relationships often involve intricate co-development projects and highly customized manufacturing solutions, which demand substantial time and a demonstrated history of success.

Newcomers face a steep climb in earning the confidence of established players. Customers in this sector depend heavily on consistent product quality, unwavering supply chain reliability, and robust design enablement support from their chosen foundry partners. Tower Semiconductor, for instance, has cultivated these relationships over years, making it difficult for new entrants to displace existing, trusted providers.

- High Switching Costs: Customers invest heavily in qualifying foundry partners and integrating their processes, making switching costly and time-consuming.

- Co-development and IP: Foundries often engage in joint development efforts, creating proprietary intellectual property and shared knowledge that binds them to customers.

- Reputation and Track Record: A foundry's reputation for yield, reliability, and on-time delivery is paramount, and new entrants lack this established credibility.

Regulatory and Environmental Hurdles

The construction and operation of semiconductor fabrication plants (fabs) face significant regulatory and environmental hurdles. These include obtaining numerous permits and adhering to strict environmental regulations governing waste disposal, water usage, and emissions. For instance, in 2024, the ongoing focus on sustainability means that new fab projects must demonstrate robust environmental impact assessments and mitigation strategies, adding substantial time and cost to the entry process.

Navigating these complex regulatory landscapes is a major barrier. Furthermore, evolving geopolitical considerations and government incentives, such as those provided by the CHIPS and Science Act of 2022 in the United States which offers billions in subsidies and tax credits for domestic semiconductor manufacturing, often favor established players. These initiatives increase the capital requirements and complexity for potential new entrants, effectively raising the cost of entry and deterring new competition.

- Environmental Compliance: Semiconductor manufacturing involves hazardous materials and significant resource consumption, necessitating strict adherence to environmental laws.

- Permitting Processes: Obtaining the necessary permits for constructing and operating a fab can be a lengthy and complex process, often taking years.

- Geopolitical Factors: Increasing global attention on semiconductor supply chain security influences government policies and incentives, potentially disadvantaging new, unproven entrants.

- Government Incentives: Programs like the CHIPS Act in 2024 provide substantial financial support to existing or expanding semiconductor operations, creating a more challenging environment for newcomers.

The threat of new entrants in the semiconductor foundry sector, including Tower Semiconductor's market, is significantly mitigated by extremely high capital requirements. Building a state-of-the-art fabrication plant can cost tens of billions of dollars, a sum that deters most new players. For example, in 2024, the ongoing demand for advanced nodes meant that new fab investments continued to exceed $20 billion.

Furthermore, established players like Tower Semiconductor possess deep technical expertise and proprietary process technologies developed over decades. Replicating this accumulated knowledge and intellectual property is a formidable challenge for any newcomer. Tower's consistent investment in research and development, often in the hundreds of millions of dollars annually, highlights the knowledge intensity of the industry.

Economies of scale also present a substantial barrier, as larger foundries can spread fixed costs over higher production volumes, leading to lower per-unit costs. In 2024, the trend of consolidation and investment in larger fabs reinforced these scale advantages, making it difficult for new, smaller operations to compete on price.

Finally, strong customer relationships built on trust, consistent quality, and reliable supply chains are critical. New entrants must overcome the hurdle of establishing credibility and displacing incumbent foundry partners, a process that is both time-consuming and capital-intensive.

Porter's Five Forces Analysis Data Sources

Our analysis of Tower Semiconductor's competitive landscape is built upon a foundation of industry-leading data, including financial reports, market research from firms like Gartner and IDC, and government regulatory filings. This comprehensive approach ensures a thorough understanding of the semiconductor manufacturing sector.