Tower Semiconductor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tower Semiconductor Bundle

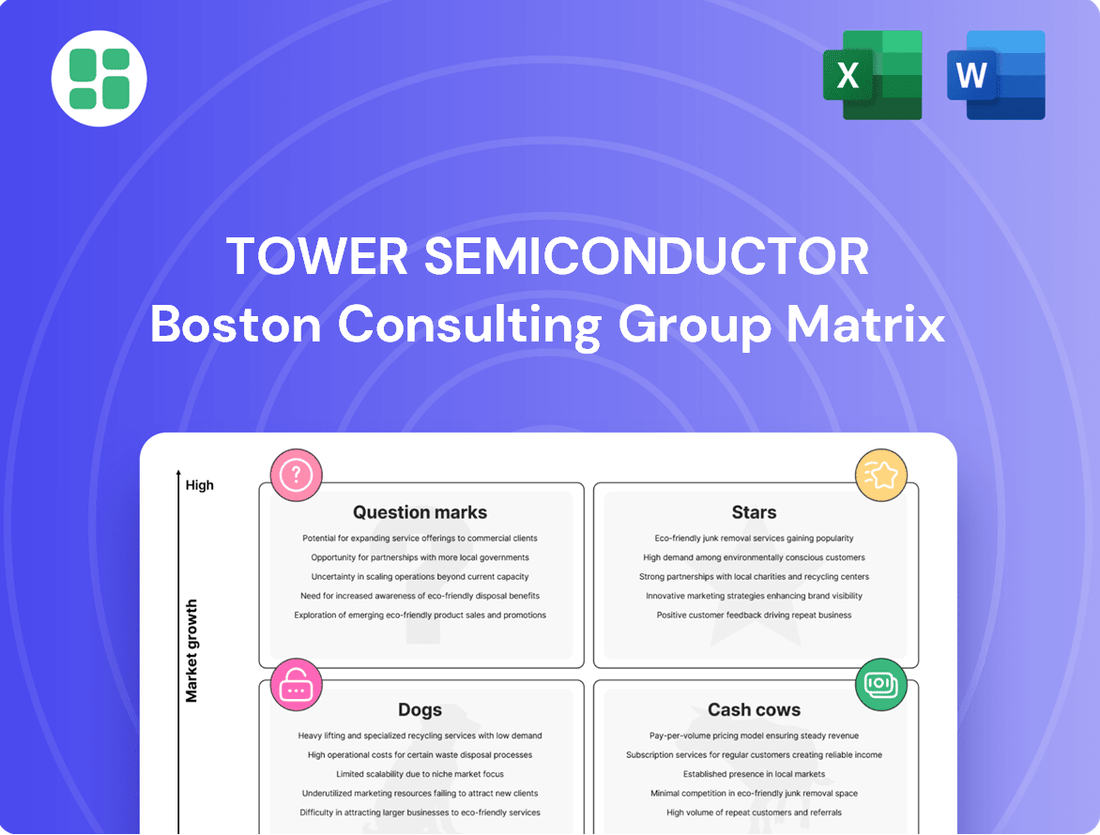

Uncover Tower Semiconductor's strategic positioning with our comprehensive BCG Matrix analysis. Discover which of their offerings are market leaders (Stars), consistent revenue generators (Cash Cows), potential growth opportunities requiring investment (Question Marks), or underperforming assets (Dogs).

This preview offers a glimpse into the power of understanding Tower Semiconductor's product portfolio. For a complete, actionable roadmap to optimize investments and drive future growth, purchase the full BCG Matrix report.

Gain a competitive edge by understanding exactly where Tower Semiconductor's business units stand. The full report provides detailed quadrant placements and data-driven recommendations, empowering you to make informed strategic decisions.

Stars

Tower Semiconductor's Silicon Photonics (SiPho) and Silicon Germanium (SiGe) technologies are experiencing significant growth, with the company achieving record revenue levels. This surge is directly fueled by the insatiable demand from the expanding data center and artificial intelligence (AI) sectors.

These advanced semiconductor technologies are the backbone of high-speed optical fiber communications, essential for the massive data transfer required by modern data centers and AI computations. Tower's leadership in this critical and rapidly expanding market segment is solidified by this demand.

To capitalize on this trend, Tower announced a substantial $350 million investment to boost capacity for its high-margin SiPho and SiGe offerings. This strategic expansion will focus on its 8-inch fabs in Israel and Texas, alongside its 12-inch Uozu fab in Japan, underscoring a clear strategic focus on these growth areas.

Tower Semiconductor is making waves with its advanced power management solutions, particularly its 300mm 65nm BCD technology. You can see them demonstrating this at events like APEC 2025, which is a big deal for sectors like automotive, AI, mobile power management, and even data centers. These aren't just any components; they're designed to handle the intense power needs of these cutting-edge fields.

The automotive sector, for instance, is booming. Think electric vehicles and advanced driver-assistance systems (ADAS). These technologies rely heavily on sophisticated power management ICs to function efficiently and safely. Tower's commitment to improving power efficiency directly addresses this growing demand, positioning them as a key player in a market that's projected to reach over $100 billion by 2027.

The RF Infrastructure segment, encompassing SiPho and SiGe technologies, demonstrated robust growth, climbing from 14% to 22% of Tower Semiconductor's overall revenue by Q1 2025, on an elevated corporate revenue base.

This expansion is primarily driven by the widespread adoption of 5G technology and the rapid development of the satellite communication (Satcom) market. Tower's advanced SiGe BiCMOS technology is a key enabler for high-performance beamforming integrated circuits crucial for these applications.

Strategic partnerships, including a notable collaboration with Renesas, underscore significant design wins and substantial volume shipments, reflecting Tower's strong position in these dynamic and expanding communication sectors.

CMOS Image Sensors for Emerging Applications

Tower Semiconductor's CMOS image sensors are designed for a wide array of emerging applications, leveraging unique pixel design flexibility. This allows them to cater to diverse needs across various sectors.

The broader image sensor market is experiencing robust growth, with projections indicating continued expansion through 2024 and beyond. This surge is fueled by the increasing demand in areas such as future mobility, the Internet of Things (IoT), and the proliferation of connected devices, all of which rely heavily on advanced imaging capabilities.

Tower Semiconductor's ongoing commitment to innovation, including advancements in non-imaging sensors and MEMS technology, strategically positions the company to capitalize on these high-growth market trends. The increasing importance of sophisticated sensing solutions across industries underscores the potential for Tower's offerings.

- Targeted Applications: CMOS image sensors for automotive, industrial, medical, and consumer electronics.

- Market Growth Drivers: IoT adoption, advanced driver-assistance systems (ADAS), and smart home devices.

- Tower's Strengths: Pixel design flexibility, process innovation, and integration of complementary sensing technologies.

- Future Outlook: Significant opportunities in a market where enhanced sensing is becoming a critical differentiator.

Specialty Foundry Services for Differentiated Products

Tower Semiconductor's specialty foundry services for differentiated products position it favorably in the market. By offering tailored process technologies and design assistance, Tower empowers fabless firms and integrated device manufacturers (IDMs) to create unique products across diverse sectors. This strategic focus on specialized solutions, rather than the high-volume, rapid node advancement of mainstream digital chips, helps Tower maintain a robust competitive edge.

The company's commitment to building enduring relationships and delivering added value in analog semiconductor solutions underpins its standing in an expanding, specialized market segment. For instance, in 2023, Tower's revenue from specialty technologies, which include analog and mixed-signal processes, represented a significant portion of its overall sales, highlighting the strength of its differentiated offerings.

- Focus on Niche Markets: Tower targets specific application areas like automotive, industrial, and medical, where advanced analog and mixed-signal capabilities are critical.

- Customization and IP: The foundry provides highly customizable process flows and a rich intellectual property (IP) portfolio, enabling customers to achieve unique performance characteristics.

- Long-Term Partnerships: Tower cultivates deep relationships with its clients, often involving co-development and long-term capacity commitments, fostering stability and mutual growth.

- Market Growth: The demand for specialized analog semiconductors is projected to grow steadily, driven by trends such as electrification, IoT, and advanced sensor integration, benefiting Tower's strategic positioning.

Tower Semiconductor's CMOS image sensors, with their flexible pixel designs, are well-positioned for growth in emerging markets like automotive and IoT. The broader image sensor market is expected to expand significantly through 2024 and beyond, driven by demand for advanced imaging in connected devices and smart systems.

Tower's commitment to innovation, including advancements in non-imaging sensors and MEMS, further strengthens its ability to capture opportunities in high-growth sensing applications. The increasing reliance on sophisticated sensing across industries highlights the strategic importance of Tower's sensor technologies.

The company's strengths lie in its pixel design flexibility and process innovation, enabling it to cater to diverse needs. This focus on enabling enhanced sensing capabilities positions Tower favorably for continued success in a market where advanced imaging is becoming a critical differentiator.

What is included in the product

Tower Semiconductor's BCG Matrix offers a strategic overview of its business units, categorizing them by market share and growth potential.

This analysis identifies which segments are Stars for investment, Cash Cows for stable returns, Question Marks for potential growth, and Dogs for divestment.

A clear BCG Matrix visualizes Tower Semiconductor's portfolio, easing the pain of strategic resource allocation by identifying Stars and Cash Cows for investment.

Cash Cows

Tower Semiconductor's mature analog and mixed-signal CMOS technologies, particularly at nodes like 0.18μm, represent a significant cash cow. These foundational technologies are the backbone for a vast array of applications, from industrial control systems and consumer electronics to increasingly sophisticated automotive components. The demand in these sectors is characterized by stability and long product lifecycles, ensuring a steady revenue stream for Tower Semiconductor.

The consistent cash flow generated by these mature technologies is a direct result of their widespread adoption and the company's established reputation for reliability and long-term support. For instance, in 2024, Tower Semiconductor continued to see robust demand for its 0.18μm processes, which are critical for many automotive sensors and power management ICs, sectors experiencing steady, albeit not explosive, growth. These established relationships and the proven performance of these nodes solidify their position as reliable cash generators.

Tower Semiconductor's industrial and consumer electronics components segment functions as a Cash Cow. These markets, while not experiencing the explosive growth of leading-edge sectors, benefit from widespread adoption and a consistent need for dependable, cost-efficient semiconductors. This steady demand provides a reliable revenue stream, underpinning Tower's financial stability.

Tower Semiconductor's integrated power management platforms, specifically BCD and 700V technologies, serve as significant cash cows by supporting established markets beyond high-growth areas like automotive and AI. These platforms are crucial for industrial and consumer electronics, sectors that, while mature, exhibit consistent demand for efficient power solutions.

These established product lines are characterized by high profit margins and reduced ongoing R&D expenditure, making them reliable sources of capital. This financial stability allows Tower to reinvest in more innovative and speculative ventures, thereby fueling future growth. For instance, in 2023, Tower reported revenue of $1.56 billion, with a substantial portion likely attributable to these mature but profitable power management segments.

Legacy 200mm Fab Production

Tower Semiconductor's legacy 200mm fabrication plants are a prime example of a cash cow in the BCG matrix. These facilities are strategically positioned to produce a diverse array of analog, mixed-signal, and power management integrated circuits.

Despite the industry's shift towards 300mm for cutting-edge digital chips, Tower's 200mm fabs continue to be highly lucrative for specialized analog production. This profitability stems from their fully depreciated assets and highly optimized production lines, allowing for efficient, high-volume output of stable products.

These operations consistently generate substantial cash flow with minimal need for further capital investment. For instance, in 2024, Tower Semiconductor reported strong performance from its specialty processes, a segment heavily reliant on its 200mm capacity.

- 200mm Fabs: Tower operates multiple 200mm fabs globally, adept at producing analog, mixed-signal, and power management ICs.

- Profitability Drivers: Fully depreciated assets and optimized production lines make these fabs highly profitable for specialty analog processes.

- Cash Flow Generation: They efficiently produce high-volume, stable products, yielding significant cash flow with limited new investment.

- Market Relevance: While the industry moves to 300mm for leading-edge digital, 200mm remains crucial for specific analog and specialty applications.

Process Transfer Services

Tower Semiconductor’s Process Transfer Services fit squarely into the Cash Cow quadrant of the BCG Matrix. These services allow Integrated Device Manufacturers (IDMs) and fabless semiconductor companies to tap into Tower's deep expertise for the development, transfer, and refinement of their intricate process technologies.

This business segment benefits from Tower's established knowledge base and existing infrastructure, creating a revenue stream characterized by high margins and relatively low growth. Crucially, it demands less capital expenditure compared to outright manufacturing operations, positioning it as a reliable and consistent generator of cash for the company.

For instance, in 2024, Tower Semiconductor continued to highlight its process transfer capabilities as a key offering, enabling clients to accelerate time-to-market for their advanced semiconductor designs. The company's focus on specialized process technologies, such as those for advanced sensors and power management ICs, allows for premium pricing on these transfer services.

- Leverages Existing Expertise: Tower’s process transfer services capitalize on years of accumulated knowledge and operational experience in semiconductor manufacturing.

- High Margin, Low Growth: This segment typically generates strong profit margins due to its reliance on intellectual property and expertise rather than high-volume production, with growth often tied to the adoption rate of specific technologies.

- Reduced Capital Intensity: Compared to building and operating new fabrication plants, process transfer requires significantly less capital investment, freeing up resources.

- Consistent Cash Generation: The predictable nature of technology transfer projects makes this a stable source of revenue and profit, contributing significantly to Tower's overall financial health.

Tower Semiconductor's mature analog and mixed-signal CMOS technologies, particularly at nodes like 0.18μm, represent a significant cash cow. These foundational technologies are the backbone for a vast array of applications, from industrial control systems and consumer electronics to increasingly sophisticated automotive components. The demand in these sectors is characterized by stability and long product lifecycles, ensuring a steady revenue stream for Tower Semiconductor.

The consistent cash flow generated by these mature technologies is a direct result of their widespread adoption and the company's established reputation for reliability and long-term support. For instance, in 2024, Tower Semiconductor continued to see robust demand for its 0.18μm processes, which are critical for many automotive sensors and power management ICs, sectors experiencing steady, albeit not explosive, growth. These established relationships and the proven performance of these nodes solidify their position as reliable cash generators.

Tower Semiconductor's integrated power management platforms, specifically BCD and 700V technologies, serve as significant cash cows by supporting established markets beyond high-growth areas like automotive and AI. These platforms are crucial for industrial and consumer electronics, sectors that, while mature, exhibit consistent demand for efficient power solutions. These established product lines are characterized by high profit margins and reduced ongoing R&D expenditure, making them reliable sources of capital.

Tower Semiconductor's legacy 200mm fabrication plants are a prime example of a cash cow in the BCG matrix. These facilities are strategically positioned to produce a diverse array of analog, mixed-signal, and power management integrated circuits. Despite the industry's shift towards 300mm for cutting-edge digital chips, Tower's 200mm fabs continue to be highly lucrative for specialized analog production. This profitability stems from their fully depreciated assets and highly optimized production lines, allowing for efficient, high-volume output of stable products.

Tower Semiconductor’s Process Transfer Services fit squarely into the Cash Cow quadrant of the BCG Matrix. These services allow Integrated Device Manufacturers (IDMs) and fabless semiconductor companies to tap into Tower's deep expertise for the development, transfer, and refinement of their intricate process technologies. This business segment benefits from Tower's established knowledge base and existing infrastructure, creating a revenue stream characterized by high margins and relatively low growth.

| Segment | BCG Classification | Key Characteristics | 2024 Relevance | Financial Contribution |

| Mature Analog/Mixed-Signal CMOS (e.g., 0.18μm) | Cash Cow | Stable demand, long product lifecycles, established customer base. | Continued robust demand in automotive sensors and power management ICs. | Steady, predictable revenue stream, high profit margins. |

| Integrated Power Management Platforms (BCD, 700V) | Cash Cow | Support for mature industrial and consumer electronics markets, efficient power solutions. | Crucial for consistent demand in non-high-growth sectors. | Reliable cash generation with reduced R&D needs. |

| 200mm Fabrication Plants | Cash Cow | Specialized analog production, fully depreciated assets, optimized lines. | Strong performance in specialty processes, efficient high-volume output. | Substantial cash flow with minimal new capital investment. |

| Process Transfer Services | Cash Cow | Leverages existing expertise, high margins, lower capital intensity. | Enables clients to accelerate time-to-market for advanced designs. | Stable revenue and profit, predictable project-based income. |

What You See Is What You Get

Tower Semiconductor BCG Matrix

The Tower Semiconductor BCG Matrix preview you're viewing is the identical, fully formatted report you'll receive upon purchase, offering immediate strategic insights without any watermarks or demo content. This comprehensive document has been meticulously crafted by industry analysts to provide a clear and actionable overview of Tower Semiconductor's product portfolio within the Boston Consulting Group framework. You can be confident that the detailed analysis and professional presentation you see now will be exactly what you download, ready for immediate integration into your business planning and decision-making processes.

Dogs

Tower Semiconductor strategically phased out its lower-margin legacy 150mm manufacturing processes in Fab1 by the end of Q4 2024. This move, with the final product shipments in January 2025, aligns with a broader strategy to optimize resource allocation. These older technologies, often characterized by declining market demand and reduced profitability, fit the profile of 'dogs' within the BCG matrix, requiring divestment or discontinuation.

The discontinuation of these 150mm flows signifies a deliberate effort to shed less profitable product lines. By transferring strategic manufacturing to more efficient 200mm fabs, Tower Semiconductor is streamlining its operations. This strategic shift allows the company to focus on higher-growth, higher-margin segments, effectively divesting from its 'dog' category products.

While Tower Semiconductor primarily thrives in specialty foundry services, any general-purpose standard products they might have produced, likely on older, less differentiated process nodes, would fit into the Dogs category of the BCG Matrix. These products typically contend with fierce price wars and thin profit margins, representing a drain on resources rather than a source of growth or substantial profit. For instance, if Tower were to produce basic microcontrollers on a mature 180nm node, these would likely face intense competition from numerous foundries offering similar, undifferentiated solutions.

Prior to strategic consolidations or transfers, underperforming or inefficient production lines not optimized for Tower's high-value analog focus were considered 'Dogs'. These lines may have incurred high operational costs relative to their output, or supported declining product segments. For instance, in 2024, Tower Semiconductor continued its focus on optimizing its manufacturing footprint, a process that inherently identifies and addresses such underutilized assets to improve overall profitability and resource allocation.

Segments with Weak End-Market Demand for Mature Nodes

Segments relying on mature nodes like 28/22 nm and older are facing a slow recovery. This is primarily due to weaker demand from key sectors such as consumer electronics, networking equipment, automotive components, and general industrial applications. For instance, the global semiconductor market for automotive applications, while growing, saw some segments within mature nodes experience softer demand in late 2023 and early 2024 compared to advanced nodes.

Tower Semiconductor, despite its specialization, may find certain mature node capacities serving these challenged markets categorized as 'Dogs'. This classification arises if these areas exhibit low growth potential and a limited market share, especially if there isn't a strategic shift or re-alignment in their offerings. The company's exposure to these segments can impact overall growth metrics.

The persistent weakness in demand for mature nodes in specific end-markets directly impacts Tower Semiconductor's capacity utilization and revenue generation in those areas. For example, a significant portion of the automotive sector's mature node requirements, particularly for less advanced functionalities, faced inventory corrections and demand normalization in 2024, impacting foundries with substantial capacity in these technologies.

- Mature Node Demand Weakness: Consumer electronics, networking, automotive, and industrial sectors are experiencing sluggish demand for chips manufactured on nodes 28nm and older.

- Tower's Exposure: Tower Semiconductor's specialty focus may still include mature node capacity serving these broadly challenged areas, potentially leading to low growth and market share.

- Strategic Implications: Capacity not strategically re-aligned to more robust end-markets or higher-value applications within mature nodes could be classified as 'Dogs' in a BCG matrix analysis.

- Market Data Context: For example, certain automotive applications, a key user of mature nodes, saw demand adjustments in early 2024, highlighting the sensitivity of these segments.

Niche Analog Products with Limited Market Adoption

Certain highly specialized or niche analog products that Tower Semiconductor might develop or manufacture could fall into the Dogs category if they fail to gain sufficient market adoption or if the target market experiences unexpected contraction. These products, despite their technical sophistication, would generate low returns on investment due to limited volume and difficulty in scaling. For instance, if a new, highly specific sensor for a niche industrial application doesn't meet projected sales volumes, it could become a Dog. In 2023, the global analog semiconductor market was valued at approximately $30.8 billion, with niche segments often facing higher risks of low adoption.

Such products, even with advanced manufacturing capabilities, would struggle to achieve profitability. This is because the cost of development and production might outweigh the revenue generated from limited sales. Tower Semiconductor, like other foundries, must carefully manage its product portfolio to avoid accumulating too many low-performing assets.

While specific examples are not publicly detailed for competitive reasons, potential scenarios include:

- Custom analog chips for a declining legacy technology: If a particular industry segment using older technology shrinks faster than anticipated, custom chips designed for it would see reduced demand.

- Highly specialized RF components for an emerging but unproven market: If a new wireless technology fails to gain traction, the analog components developed for it would likely become Dogs.

- Niche power management ICs for a specific, low-volume consumer device: If the consumer device itself doesn't achieve widespread popularity, the associated power management chips will have limited market reach.

Tower Semiconductor's divestment of legacy 150mm manufacturing by the end of 2024 exemplifies its 'dog' strategy, phasing out low-margin, declining demand processes. This move, impacting final shipments in early 2025, allows focus on higher-value segments by shedding underperforming assets. The discontinuation of these older technologies, often characterized by intense price competition and reduced profitability, aligns with a deliberate effort to streamline operations and improve overall financial health.

Mature node capacities serving sectors with weaker demand, such as certain consumer electronics and industrial applications, can also be classified as 'dogs' if they exhibit low growth and market share without strategic re-alignment. For instance, the global semiconductor market for automotive, while generally growing, saw some mature node segments experience softer demand in early 2024. Tower's exposure to these challenged areas, particularly if not strategically repositioned, could negatively impact growth metrics.

Niche analog products that fail to gain market traction or serve contracting markets also fall into the 'dog' category, generating low returns due to limited volume. For example, a specialized sensor for a niche industrial application not meeting sales projections would be a dog. In 2023, the analog semiconductor market was valued at approximately $30.8 billion, with niche segments carrying higher adoption risks.

| Category | Description | Tower Semiconductor Context | Example Scenario | 2024 Market Insight |

| Dogs | Low market share, low growth potential | Legacy 150mm fabs, certain mature node capacities | Custom analog chips for declining legacy tech | Mature nodes (28nm & older) face weak demand in consumer electronics, networking, automotive, and industrial sectors. |

| High costs, low profitability | Inefficient production lines | Niche power management ICs for low-volume devices | Global analog market valued at $30.8B in 2023, niche segments face adoption risks. |

Question Marks

Tower Semiconductor's move into envelope trackers utilizing their 300mm technology platform marks an entry into a high-growth market driven by advancements in mobile communications. While this new venture offers substantial potential, Tower's current market share in this specific segment is expected to be minimal as they establish their presence.

To transition this promising opportunity from a question mark to a star in the BCG matrix, significant investments in research and development, coupled with successful customer qualifications, will be crucial. For instance, the global envelope tracker market was projected to reach approximately $2.5 billion by 2024, highlighting the attractive growth trajectory.

The advanced packaging market is poised for significant expansion, with projections indicating robust growth through 2025, fueled by the increasing demand for AI-powered devices and the ongoing expansion of data centers. This surge is particularly notable as we approach 2025, with substantial increases anticipated in market value.

While Tower Semiconductor operates as a foundry, its emphasis on an advanced and innovative analog technology offering, coupled with industry trends, hints at potential engagement or developing expertise in advanced packaging. This segment represents a high-growth opportunity where Tower might be looking to increase its currently modest market share.

The demand for chips powering generative AI is exploding, with the market for these specialized chips forecasted to surpass $150 billion by 2025. This surge is driven by the increasing adoption of AI across various industries, creating a significant opportunity for hardware component manufacturers.

While TSMC currently leads in manufacturing cutting-edge AI chips, Tower Semiconductor's expertise in advanced power management and analog solutions positions them to be crucial enablers for AI hardware. These components are vital for the efficient and reliable operation of AI systems, even if they aren't the primary processing units.

This emerging AI hardware sector represents a high-growth market where Tower Semiconductor is a relatively new entrant with a low existing market share. To become a major player, Tower will likely need substantial investment in research, development, and manufacturing capacity to compete effectively.

New Sensor Technologies for IoT and Edge Computing

The global sensor market is projected to reach $135 billion by 2027, with IoT and edge computing being significant growth drivers. Tower Semiconductor, a key player in semiconductor manufacturing, offers CMOS image sensors and non-imaging sensors. Their investment in developing advanced sensor technologies for these burgeoning, yet diverse, markets positions them to capture future market share.

New sensor technologies for IoT and edge computing represent a strategic investment area for Tower Semiconductor, likely falling into the 'Question Marks' category of the BCG Matrix. This means they are investing in high-growth potential markets but currently hold a relatively small market share.

- Market Growth: The IoT sensor market alone was valued at approximately $20 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030.

- Tower's Role: Tower's foundry services enable the production of specialized sensors, including those for environmental monitoring, industrial automation, and wearable devices.

- Strategic Focus: Developing novel sensor platforms that offer improved accuracy, lower power consumption, and enhanced connectivity for edge AI applications are key to their strategy.

Strategic Partnerships in New Geographic Markets (e.g., India)

Tower Semiconductor's strategic partnership with the Adani Group in India exemplifies a move into a high-growth potential market. This collaboration aims to explore new manufacturing capabilities, a crucial step for expanding its global footprint and catering to escalating market demands.

While these ventures offer significant upside, penetrating and capturing market share in a new territory like India is a long-term strategic play. It aligns with the characteristics of a question mark in the BCG matrix, representing high market growth but currently a low market share for Tower.

- Strategic Focus: Tower Semiconductor's investment in India, including partnerships like the one with Adani Group, targets the rapidly expanding semiconductor market in the region.

- Market Potential: India's semiconductor market is projected to reach $80.2 billion by 2026, presenting a substantial growth opportunity for Tower.

- Current Standing: Despite the potential, Tower's market share in India is nascent, reflecting the question mark status in the BCG matrix.

- Investment Rationale: These partnerships are designed to build manufacturing capabilities and establish a foundational presence, aiming to convert the question mark into a future star.

New sensor technologies for IoT and edge computing represent a strategic investment area for Tower Semiconductor, likely falling into the 'Question Marks' category of the BCG Matrix. This means they are investing in high-growth potential markets but currently hold a relatively small market share.

The IoT sensor market alone was valued at approximately $20 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030. Tower's foundry services enable the production of specialized sensors for environmental monitoring, industrial automation, and wearable devices.

Developing novel sensor platforms that offer improved accuracy, lower power consumption, and enhanced connectivity for edge AI applications are key to their strategy. Tower's investment in India, including partnerships like the one with Adani Group, targets the rapidly expanding semiconductor market in the region, projected to reach $80.2 billion by 2026.

Despite the potential, Tower's market share in India is nascent, reflecting the question mark status in the BCG matrix. These partnerships are designed to build manufacturing capabilities and establish a foundational presence, aiming to convert the question mark into a future star.

BCG Matrix Data Sources

Our Tower Semiconductor BCG Matrix is constructed using a blend of financial disclosures, market research reports, and competitive intelligence to accurately assess product portfolio performance.