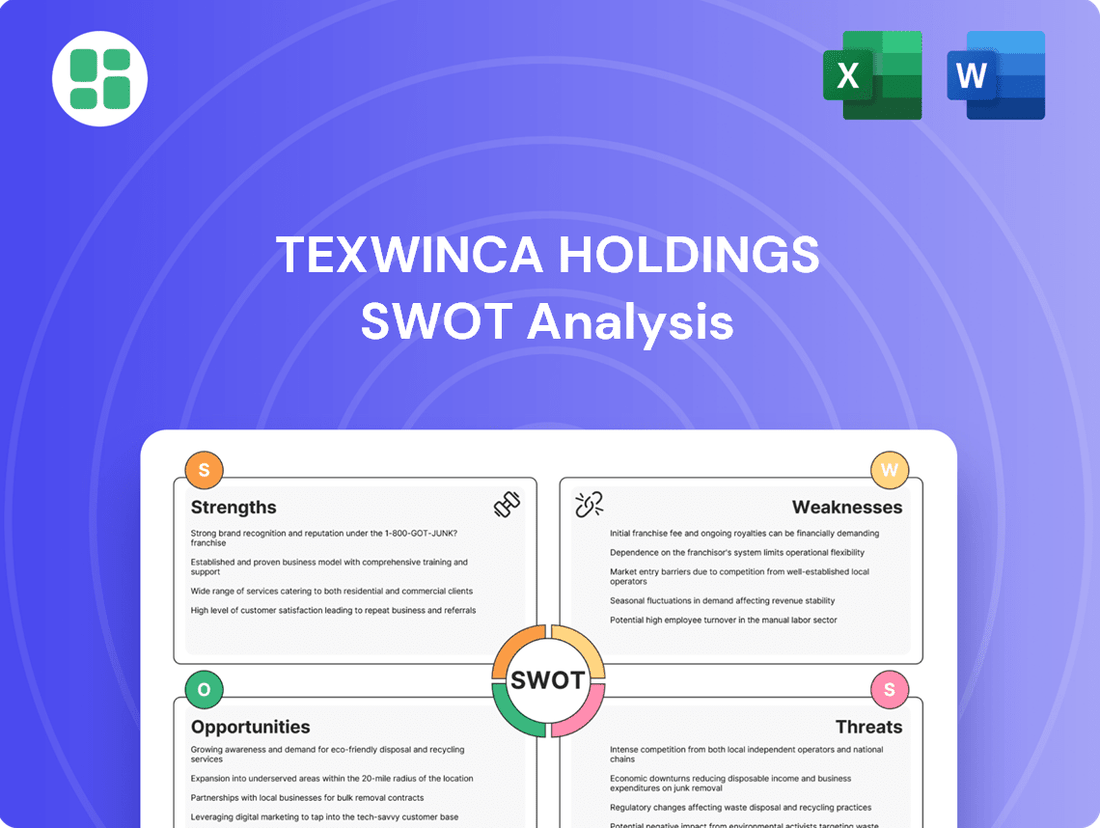

Texwinca Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Texwinca Holdings Bundle

Texwinca Holdings possesses significant strengths in its established market presence and operational efficiency, but also faces potential challenges from evolving industry trends. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Texwinca Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Texwinca Holdings boasts a robust and diversified business portfolio. This includes manufacturing and trading of knitted fabrics and garments, a retail apparel segment, and strategic property investments. This multi-faceted approach effectively spreads risk and generates multiple income streams.

The company's textile operations are a key driver of its financial performance. In the fiscal year 2024/25, the textile business experienced a notable surge in revenue, accounting for the lion's share of the Group's overall earnings. This demonstrates the strength and resilience of its core textile segment.

Texwinca Holdings boasts a significant manufacturing advantage with state-of-the-art production facilities strategically located in both Dongguan, Mainland China, and Vietnam. This dual-production base is a cornerstone of their operational strength, enabling them to offer unparalleled flexibility in meeting diverse customer demands and geographical requirements.

This robust manufacturing infrastructure has directly translated into tangible business gains. For instance, in 2024, this strategic positioning was key in securing substantial new orders from major global retailers, particularly those based in Japan and North America, highlighting the effectiveness of their dual-production model in capturing international market share.

Texwinca Holdings has demonstrated impressive agility by successfully pivoting its Baleno brand towards an e-commerce-centric strategy, even amidst difficulties in its physical retail operations. This strategic shift highlights the company's ability to adapt to changing consumer preferences.

The Group's commitment to digital transformation is underscored by a significant achievement: a 170.1% year-on-year surge in e-commerce gross merchandise value (GMV) for the fiscal year 2024/25. This substantial growth validates their efforts in capturing online market share and reflects a more efficient, asset-light operational approach.

Proven Track Record and Market Position

Texwinca Holdings boasts a proven track record, having been established in 1975 and listed on the Hong Kong Stock Exchange since 1992. This longevity underscores its resilience and deep understanding of the textile market, positioning it as a leading, comprehensive textile enterprise.

Its established market position is further solidified by its reputation as a top one-stop listed textile company. Texwinca consistently delivers a diverse portfolio of high-quality products to globally recognized brands, demonstrating its capability to meet and exceed international standards.

- Market Leadership: Recognized as a premier one-stop textile solutions provider.

- Brand Partnerships: Supplies a wide array of high-quality products to internationally renowned brands.

- Longevity and Stability: Founded in 1975 with a continuous listing on the Hong Kong Stock Exchange since 1992, indicating operational stability and market trust.

Commitment to Technological Advancement and Sustainability

Texwinca Holdings demonstrates a strong commitment to technological advancement, actively pursuing digital transformation to enhance operational efficiency and drive industry development. This focus is crucial in the rapidly evolving textile sector, where innovation is key to maintaining a competitive edge.

The company's dedication to sustainability is evident in its integration of energy-saving and environmentally friendly equipment. This strategic choice not only reduces its ecological footprint but also aligns with the increasing consumer and regulatory demand for sustainable practices in fashion.

Key strengths in this area include:

- Investment in R&D: Texwinca's ongoing investment in research and development fuels product innovation, ensuring its offerings meet evolving market needs and quality standards.

- Digital Transformation Initiatives: The company is accelerating digital transformation across its operations, aiming to streamline processes and improve data-driven decision-making.

- Sustainable Equipment Adoption: By adopting energy-saving and eco-friendly machinery, Texwinca is positioning itself as a responsible corporate citizen and a leader in sustainable manufacturing.

- Focus on Environmental Protection: A core tenet of Texwinca's strategy is environmental protection, reflecting a commitment to social responsibility and long-term viability in a resource-conscious global market.

Texwinca Holdings' manufacturing prowess is a significant strength, with state-of-the-art facilities in China and Vietnam providing operational flexibility. This dual-production base allowed them to secure substantial new orders from major global retailers, particularly from Japan and North America, in 2024. The company's agility is further demonstrated by its successful pivot to an e-commerce-centric strategy for its Baleno brand, evidenced by a 170.1% year-on-year surge in e-commerce GMV for FY2024/25.

| Metric | FY2024/25 Data | Significance |

|---|---|---|

| E-commerce GMV Growth | 170.1% | Demonstrates successful digital transformation and market capture. |

| New Orders Secured (2024) | Substantial | Highlights effectiveness of dual-production model for international market share. |

What is included in the product

Delivers a strategic overview of Texwinca Holdings’s internal and external business factors, highlighting its strengths in brand recognition and market position, while also identifying potential weaknesses in supply chain diversification and opportunities in emerging markets.

Offers a clear, actionable framework to identify and address Texwinca Holdings' strategic challenges and opportunities.

Weaknesses

Texwinca Holdings' retail and distribution segment faced a significant downturn, with revenue dropping 16.4% year-on-year in FY2024/25. This decline is largely attributed to a substantial reduction in its physical presence, evidenced by a net closure of 273 self-owned shops in mainland China by September 2024.

The company's struggles extend to Hong Kong, where sales performance has been weaker than anticipated, highlighting persistent challenges within its core retail operations. This contraction in its brick-and-mortar footprint directly impacts its ability to generate sales through traditional channels.

Texwinca Holdings' retail operations, particularly in Chinese Mainland and Hong Kong, face significant vulnerability to shifts in consumer spending and confidence. For instance, during the first half of 2024, the company noted a direct impact on sales from the lack of government consumption voucher programs, which had previously stimulated demand. This sensitivity means that economic downturns or reduced consumer sentiment can quickly translate into weaker financial performance for the group.

Texwinca Holdings experienced a notable dip in its net profit for FY2024/25, largely due to non-operating expenses. A significant HK$20 million increase in finance costs, stemming from the acquisition and expansion of its Vietnam facility, put a strain on the company's bottom line.

Furthermore, the introduction of HK$22 million in carbon emission charges added another layer of financial pressure. These escalating operational costs, both from financing and environmental compliance, pose a direct threat to Texwinca's profit margins, potentially hindering future growth and investment capacity.

Reliance on Textile Business for Revenue Growth

Texwinca Holdings' significant reliance on its textile segment presents a notable weakness. In FY2024/25, this business line generated a substantial 78.4% of the Group's total revenue, a slight decrease from 82.5% in the interim period. This concentration means that any adverse shifts in the textile market could disproportionately impact the company's overall financial performance.

The heavy weighting of the textile business in Texwinca's revenue structure, while indicative of past success, also highlights a vulnerability. A downturn in demand for textile products, or disruptions within the supply chain specific to this industry, could severely hinder the Group's growth trajectory. This dependence makes Texwinca susceptible to sector-specific headwinds.

- Dominant Revenue Source: The textile business accounted for 78.4% of Texwinca's total revenue in FY2024/25.

- Interim Period Comparison: This figure is down from 82.5% reported in the interim period, indicating a slight diversification effort.

- Risk of Sector Downturn: A significant drop in demand or unforeseen issues within the textile industry poses a substantial risk to the company's revenue growth.

- Limited Diversification: The continued high percentage from textiles suggests limited successful diversification into other revenue streams.

Geopolitical and Trade Policy Uncertainties

Geopolitical and trade policy shifts present a significant weakness for Texwinca Holdings. The Group experienced a slowdown in order growth during FY2024/25, directly attributed to these uncertainties. Specifically, major U.S. apparel retailers have adopted more cautious purchasing strategies as a reaction to evolving trade policies, impacting Texwinca's sales pipeline.

This cautious approach by key clients can translate into several negative outcomes:

- Weakened Demand: Retailers scaling back orders directly reduces Texwinca's revenue potential.

- Intensified Price Competition: To move inventory or secure limited orders, retailers may push for lower prices, squeezing Texwinca's margins, especially on basic apparel lines.

- Supply Chain Disruptions: Changes in trade agreements or tariffs can also disrupt the sourcing of raw materials or the logistics of finished goods, adding further cost and complexity.

Texwinca Holdings' reliance on its textile segment remains a significant weakness, with this business accounting for 78.4% of total revenue in FY2024/25. While down slightly from 82.5% in the interim period, this concentration leaves the company highly susceptible to sector-specific downturns or disruptions. The company's retail operations also show vulnerability, with a 16.4% revenue drop in FY2024/25 attributed to store closures and weaker sales in Hong Kong, further exacerbated by sensitivity to consumer spending shifts.

Increased finance costs, up by HK$20 million due to facility expansion, and HK$22 million in new carbon emission charges are directly impacting profit margins. Geopolitical uncertainties and evolving trade policies have also led to a slowdown in order growth as major retailers adopt more cautious purchasing strategies, potentially weakening demand and intensifying price competition.

| Segment | FY2024/25 Revenue Contribution | Key Challenges |

|---|---|---|

| Textile | 78.4% | High sector concentration risk, susceptibility to industry downturns. |

| Retail (China Mainland) | Declining | Net closure of 273 shops, 16.4% revenue drop, sensitivity to consumer spending. |

| Retail (Hong Kong) | Weaker than anticipated | Persistent challenges in core retail operations, impact of reduced stimulus. |

| Operational Costs | Increasing | HK$20M finance cost increase, HK$22M carbon emission charges impacting margins. |

| Order Growth | Slowdown | Impacted by geopolitical/trade policy uncertainty, cautious retailer purchasing. |

Preview Before You Purchase

Texwinca Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Texwinca is set to significantly boost its manufacturing capabilities by initiating the second phase of construction at its Vietnam facility in 2025. This strategic move is designed to accommodate increasing demand from international clients, reflecting a strong order pipeline.

The expansion underscores Texwinca's commitment to its dual-production strategy, leveraging both China and Vietnam to enhance operational flexibility and support future growth initiatives. This will allow the company to better serve its global customer base and capitalize on emerging market opportunities.

Texwinca's e-commerce gross merchandise volume (GMV) has already seen a remarkable threefold increase, and there's substantial room for even greater expansion. By forging strategic collaborations with a wider array of online marketplaces, Texwinca can unlock new customer segments and streamline its sales channels.

The global e-commerce apparel market is a dynamic sector, with projections indicating continued robust growth. For instance, Statista forecasts the global online fashion market to reach approximately $1.3 trillion by 2025, presenting a significant opportunity for Texwinca to capture a larger share through enhanced platform penetration.

Consumers and regulators are increasingly prioritizing fashion that is both sustainable and ethically produced. This shift presents a significant opportunity for Texwinca Holdings.

Texwinca's established dedication to environmental stewardship and social responsibility, coupled with its investment in eco-friendly machinery, perfectly aligns with this growing market demand. The company is well-positioned to leverage these strengths by expanding its portfolio with more sustainable textile options.

For instance, the global sustainable fashion market was valued at approximately $6.9 billion in 2023 and is projected to reach $15.1 billion by 2030, growing at a CAGR of 11.7%. This robust growth trajectory indicates a substantial market for Texwinca's potential new product lines.

Technological Advancements in Textile Manufacturing

The textile sector is witnessing rapid technological evolution, with automation, artificial intelligence, and 3D printing at the forefront. Texwinca can capitalize on these breakthroughs to streamline its manufacturing, boost efficiency, and minimize waste. These advancements also open doors for bespoke garment creation, strengthening Texwinca's market position.

Leveraging these technologies offers Texwinca significant advantages:

- Enhanced Production Efficiency: Automation and AI can reduce labor costs and increase output speed. For instance, automated cutting machines can improve precision and speed by up to 30% compared to manual methods.

- Waste Reduction: Advanced software and 3D printing technologies allow for more precise material utilization, potentially cutting fabric waste by 15-20%.

- Customization Capabilities: 3D printing and digital design tools enable on-demand, personalized garment production, catering to evolving consumer preferences.

- Improved Quality Control: AI-powered visual inspection systems can identify defects with greater accuracy than human inspectors, leading to higher product quality.

Strategic Expansion into Emerging Overseas Markets

Texwinca Holdings is strategically targeting overseas expansion as a key growth driver, aiming to build a diversified global footprint. This move is designed to reduce reliance on existing markets and capitalize on the economic potential of emerging economies, where increasing disposable incomes and urbanization present significant opportunities.

The company's expansion strategy is particularly focused on regions experiencing robust economic growth. For instance, Southeast Asia's textile market alone was projected to reach approximately $120 billion by 2025, with a compound annual growth rate (CAGR) of around 5%.

- Targeting high-growth emerging economies with increasing consumer spending power.

- Mitigating risks by diversifying revenue streams away from concentrated domestic or regional markets.

- Leveraging urbanization trends to tap into growing demand for textiles and apparel.

Texwinca's expansion of its Vietnam facility in 2025, coupled with its dual-production strategy, positions it to meet rising international demand and enhance operational flexibility. The company's e-commerce GMV has already tripled, with significant potential for further growth by partnering with more online marketplaces, tapping into the global online fashion market projected to reach $1.3 trillion by 2025.

The increasing consumer and regulatory focus on sustainable and ethical fashion presents a substantial opportunity for Texwinca, as its commitment to environmental stewardship and eco-friendly machinery aligns with this trend. The global sustainable fashion market, valued at $6.9 billion in 2023 and expected to reach $15.1 billion by 2030, offers a strong avenue for expanding its sustainable textile offerings.

Adopting advanced textile technologies like AI and 3D printing can significantly boost Texwinca's production efficiency, reduce waste by an estimated 15-20%, and enable greater customization capabilities, catering to evolving consumer preferences. Furthermore, Texwinca's strategic push into overseas markets, particularly in high-growth regions like Southeast Asia where the textile market is projected to reach $120 billion by 2025, diversifies revenue streams and capitalizes on increasing disposable incomes.

| Opportunity Area | Key Metric/Projection | Impact |

|---|---|---|

| Manufacturing Expansion (Vietnam) | Phase 2 construction in 2025 | Increased capacity to meet international demand |

| E-commerce Growth | GMV tripled; Global online fashion market to reach $1.3T by 2025 | Expanded customer reach and sales channels |

| Sustainable Fashion Market | Market valued at $6.9B (2023), projected $15.1B by 2030 (11.7% CAGR) | Leverage eco-friendly practices for new product lines |

| Technological Adoption | AI/Automation can improve efficiency by up to 30%; reduce waste by 15-20% | Streamlined operations, enhanced quality, and customization |

| Overseas Expansion | Southeast Asia textile market projected $120B by 2025 (5% CAGR) | Diversified revenue, reduced market concentration |

Threats

The global economic landscape in early 2025 is characterized by persistent recessionary risks, significantly impacting consumer confidence and leading to more restrained spending habits. This cautious consumer behavior directly translates to subdued demand for goods, including textiles and apparel, potentially hindering recovery for companies like Texwinca Holdings.

Overseas retailers are mirroring this caution, adopting conservative inventory management and purchasing strategies. This trend, evident throughout late 2024 and projected into 2025, could further dampen demand for Texwinca's products, creating a challenging market for sales growth and industry-wide recovery.

Texwinca operates in an apparel and textile sector known for its intense competition. This environment is further strained by a global economic slowdown, which could lead to increased price wars as companies fight for market share.

A significant threat comes from the potential influx of low-cost apparel and textiles, especially from China, facilitated by expanding e-commerce platforms. This could directly challenge Texwinca's pricing strategies and squeeze its profit margins as consumers opt for cheaper alternatives.

Inflationary pressures are significantly impacting Texwinca Holdings, with the cost of key raw materials like cotton seeing substantial increases. For instance, cotton futures prices have shown volatility, with some reports indicating year-over-year increases of over 20% in certain periods leading up to mid-2024, directly impacting Texwinca's cost of goods sold.

Furthermore, rising energy prices, driven by global supply chain disruptions and geopolitical factors, add another layer of cost pressure. This, combined with a tighter labor market leading to higher wages, is squeezing profit margins for textile manufacturers like Texwinca, making it harder to maintain profitability.

The challenge is compounded by increasing bank interest rates, which raise the cost of capital and financing for operations and expansion. This confluence of rising production expenses and higher borrowing costs presents a significant hurdle for Texwinca's financial performance and strategic growth initiatives.

Supply Chain Disruptions and Geopolitical Risks

Texwinca Holdings faces ongoing threats from a vulnerable global textile supply chain, susceptible to geopolitical tensions and trade disputes. These issues can cause significant shipping delays and escalate transportation costs, directly affecting sourcing and the ability to deliver products on time. For instance, disruptions in key manufacturing regions, exacerbated by ongoing international trade friction, have led to an average increase of 15-20% in shipping costs for many textile companies in late 2024 and early 2025.

Climate-related events also pose a substantial risk, impacting raw material availability and production schedules. The unpredictability of weather patterns can disrupt cotton harvests and other essential material supplies, leading to price volatility and potential shortages. Furthermore, restrictions on international trade, stemming from various geopolitical conflicts, can limit Texwinca's access to crucial markets and suppliers, creating operational hurdles.

- Geopolitical Instability: Continued trade tensions and regional conflicts threaten to disrupt established trade routes and increase the cost of international commerce.

- Climate Change Impacts: Extreme weather events in key agricultural regions could reduce yields of essential raw materials like cotton, impacting supply and pricing.

- Trade Policy Uncertainty: Shifting trade policies and tariffs between major economies can create unpredictable cost structures and market access challenges for Texwinca.

- Logistical Bottlenecks: Port congestion and shipping capacity constraints, which saw a resurgence in late 2024, can lead to extended lead times and higher freight expenses.

Shifting Consumer Preferences and Regulatory Demands on Sustainability

Texwinca Holdings faces a significant threat from rapidly changing consumer tastes, particularly the growing demand for sustainable and ethically sourced apparel. Failure to adapt to these shifting preferences, which saw sustainable fashion market value reach an estimated $7.7 billion in 2023, could alienate a key customer segment.

Furthermore, impending regulatory changes, such as the EU's proposed due diligence laws for supply chains, will require greater traceability and ethical sourcing. For instance, the German Supply Chain Due Diligence Act, implemented in 2023, already mandates human rights and environmental risk management. If Texwinca cannot quickly and cost-effectively meet these stricter standards, it risks facing penalties and reputational damage.

- Consumer Shift: Growing consumer preference for eco-friendly and ethically made clothing, a market segment projected for continued expansion.

- Regulatory Pressure: Increased government oversight and legislation focusing on supply chain transparency and sustainability practices.

- Adaptation Costs: Potential for substantial investment required to reconfigure supply chains and manufacturing processes to meet new standards.

- Market Lag: Risk of losing market share to competitors who are more agile in responding to sustainability demands.

Texwinca faces intense competition, exacerbated by a global economic slowdown that could trigger price wars. The rise of low-cost apparel from platforms like those in China presents a direct challenge to pricing strategies and profit margins, especially as consumers become more cost-conscious.

Rising raw material costs, particularly for cotton which saw year-over-year increases exceeding 20% in some periods leading up to mid-2024, coupled with higher energy prices and wages, are squeezing profitability. Increased interest rates also raise the cost of capital, further hindering financial performance.

Geopolitical instability and climate change pose significant threats to Texwinca's supply chain, leading to potential shipping delays and increased transportation costs, with freight expenses rising an average of 15-20% in late 2024. Shifting trade policies and tariffs add further uncertainty.

A growing consumer demand for sustainable and ethical apparel, a market valued at an estimated $7.7 billion in 2023, requires significant adaptation. Failure to meet impending regulatory changes, such as EU due diligence laws, risks penalties and market share loss to more agile competitors.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to provide a robust and insightful assessment of Texwinca Holdings.