Texwinca Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Texwinca Holdings Bundle

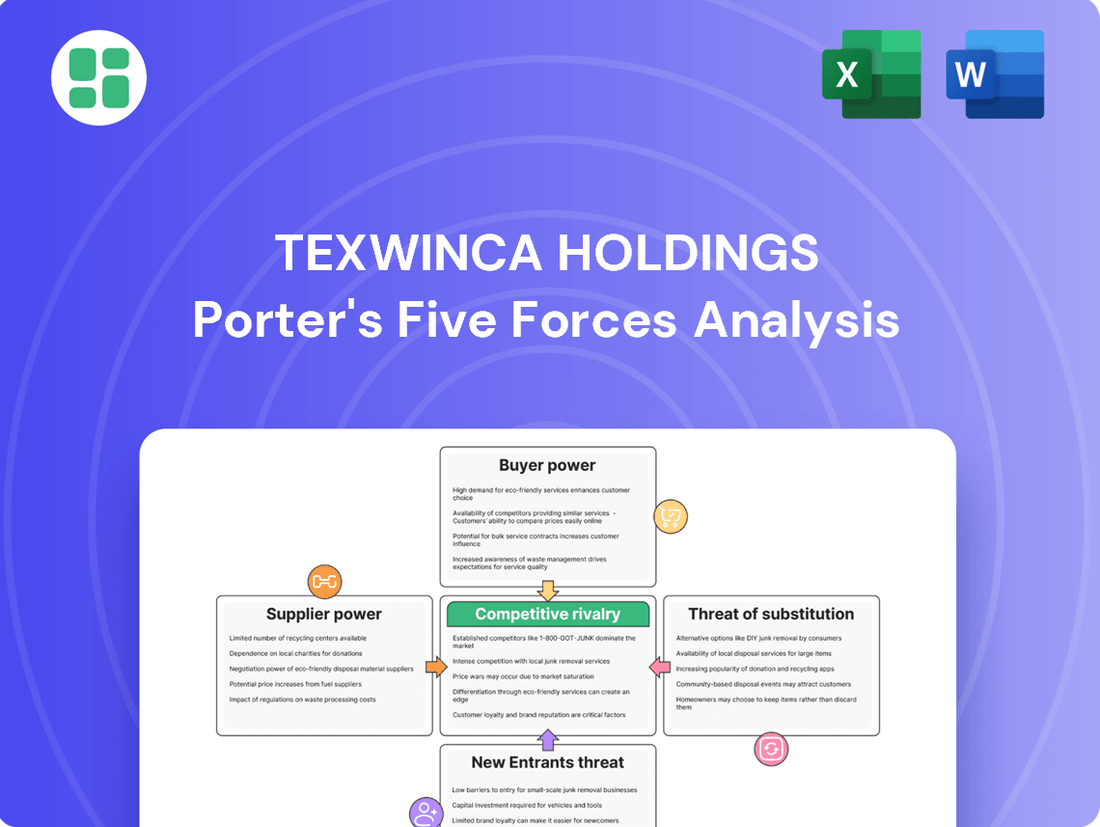

Texwinca Holdings navigates an industry shaped by intense rivalry and the ever-present threat of substitutes. Understanding the delicate balance of buyer and supplier power is crucial for any strategic move.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Texwinca Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for critical inputs significantly impacts Texwinca Holdings. If only a handful of companies dominate the supply of raw fibers like cotton and synthetic yarns, or provide specialized textile machinery, they hold considerable leverage. This means Texwinca could face higher prices or less favorable payment terms, directly affecting its profitability.

For instance, global cotton prices can fluctuate based on the output of major producing countries, and a limited number of large-scale cotton traders can influence these prices. Similarly, advanced textile machinery often comes from a few key international manufacturers, giving them pricing power. While Texwinca's presence in both China and Vietnam offers some sourcing diversification, the underlying global markets for these essential materials and equipment can still be quite concentrated, reinforcing supplier bargaining power.

The uniqueness of inputs significantly influences supplier bargaining power for companies like Texwinca Holdings. If Texwinca relies on specialized or patented materials, such as advanced performance fibers or proprietary sustainable dyes, suppliers of these unique inputs hold considerable leverage. This is particularly true if only a limited number of suppliers can provide these essential components.

The growing market demand for sustainable and eco-friendly textiles further amplifies this supplier power. For example, suppliers of certified organic cotton, recycled polyester, or innovative materials like Tencel are increasingly sought after. In 2023, the global sustainable textile market was valued at approximately $10.5 billion and is projected to grow, meaning suppliers of these in-demand materials can command higher prices and more favorable terms, strengthening their bargaining position against Texwinca.

Texwinca's switching costs from its current suppliers are a significant factor in supplier bargaining power. If Texwinca were to change suppliers, it could face substantial expenses related to retooling its manufacturing equipment to accommodate new material specifications. For instance, in the textile industry, adapting machinery for different yarn types or fabric weaves can involve considerable capital investment and downtime, potentially costing millions.

Beyond machinery, re-certifying materials to meet Texwinca's quality standards adds another layer of complexity and expense. This process can take months and require rigorous testing, impacting production schedules. Furthermore, disrupting established supply chain relationships, built over years, can lead to delays and increased logistical costs as new partnerships are forged and integrated.

Retraining personnel on handling and processing new materials or components also represents a tangible cost. In 2024, the average cost of retraining a manufacturing employee can range from $1,000 to $5,000, depending on the skill set required. These combined costs and complexities give existing suppliers leverage, as the financial and operational burden of switching often outweighs the perceived benefits of a new supplier.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to Texwinca Holdings. This occurs when suppliers, particularly those providing specialized chemicals or advanced fibers, possess the capability and incentive to move into fabric or garment manufacturing, thereby becoming direct competitors. For instance, a major chemical producer supplying specialized dyes or performance fibers to Texwinca could potentially invest in weaving or finishing facilities, directly entering Texwinca's market.

If suppliers can readily transition into manufacturing downstream products, their bargaining power is substantially enhanced. This is because they gain the option to bypass Texwinca altogether, selling their integrated products directly to garment manufacturers or even retailers. Such a scenario would diminish Texwinca's control over its supply chain and potentially erode its profit margins.

- Potential for Supplier Competition: Suppliers of specialized inputs like advanced synthetic fibers or performance-enhancing chemicals could establish their own fabric production lines.

- Increased Bargaining Leverage: If suppliers can integrate forward, they gain the ability to dictate terms more forcefully or even cut out intermediaries like Texwinca.

- Market Disruption Risk: Texwinca must monitor its suppliers for any signs of investment in downstream manufacturing capabilities, which could signal a future competitive threat.

Importance of Texwinca to Suppliers

Texwinca Holdings, as a leading integrated fabric and apparel manufacturer in Asia, holds significant sway with its suppliers. If Texwinca constitutes a substantial portion of a supplier's revenue, it gains considerable bargaining power to negotiate better pricing and terms. For instance, if a key textile supplier derives 20% of its annual sales from Texwinca, that supplier is more likely to accommodate Texwinca's demands to maintain such a valuable relationship.

Conversely, the bargaining power shifts if Texwinca is a minor client to a large, diversified global supplier. In such scenarios, the supplier's reliance on Texwinca is minimal, granting the supplier greater leverage in pricing and contract negotiations. This dynamic is crucial for understanding the overall supplier power within Texwinca's operational ecosystem.

Here's a breakdown of the supplier importance:

- High Importance: Texwinca represents a significant percentage of a supplier's total sales, increasing Texwinca's negotiation leverage.

- Low Importance: Texwinca is a small client to a large supplier, increasing the supplier's bargaining power.

- Supplier Concentration: The number of alternative suppliers available for critical raw materials or components impacts Texwinca's dependence and thus bargaining power.

The concentration of suppliers for critical inputs significantly impacts Texwinca Holdings. If only a handful of companies dominate the supply of raw fibers like cotton and synthetic yarns, or provide specialized textile machinery, they hold considerable leverage. This means Texwinca could face higher prices or less favorable payment terms, directly affecting its profitability.

The uniqueness of inputs also significantly influences supplier bargaining power. If Texwinca relies on specialized or patented materials, such as advanced performance fibers or proprietary sustainable dyes, suppliers of these unique inputs hold considerable leverage, especially if only a limited number can provide them. The growing market demand for sustainable textiles, valued at approximately $10.5 billion in 2023, further amplifies this power, as suppliers of certified organic cotton or recycled polyester can command higher prices.

Texwinca's switching costs from its current suppliers are a significant factor. Retooling machinery for new material specifications or re-certifying materials can involve substantial capital investment and downtime, potentially costing millions. In 2024, retraining manufacturing employees can range from $1,000 to $5,000 per person, adding to the overall burden of switching.

The threat of forward integration by suppliers poses a significant challenge. Suppliers of specialized chemicals or advanced fibers could invest in fabric or garment manufacturing, becoming direct competitors and diminishing Texwinca's control over its supply chain.

What is included in the product

Tailored exclusively for Texwinca Holdings, analyzing its position within its competitive landscape by examining buyer and supplier power, threat of new entrants and substitutes, and competitive rivalry.

Texwinca Holdings' Porter's Five Forces analysis provides a visual, interactive dashboard to instantly gauge competitive intensity and identify strategic vulnerabilities.

Customers Bargaining Power

Customer concentration is a critical factor for Texwinca Holdings. If a handful of major global apparel brands or retailers represent a substantial percentage of Texwinca's revenue, these key clients gain significant leverage. This means they can more effectively negotiate for lower prices, expedited production timelines, or stringent quality and sustainability mandates, directly impacting Texwinca's profitability and operational flexibility.

Customer price sensitivity is a significant factor for Texwinca Holdings. In the competitive apparel and fabric sectors, consumers and businesses often have numerous alternative suppliers, making them quite responsive to price fluctuations. This means Texwinca must carefully manage its pricing strategies to remain competitive.

For mass-market retail brands like Baleno, this price sensitivity is amplified. Consumers in this segment are typically more budget-conscious, scrutinizing their spending. This directly translates into pressure on Texwinca's profit margins across both its manufacturing and retail divisions, as it strives to offer attractive prices while maintaining profitability.

The bargaining power of customers for Texwinca Holdings is significantly influenced by the availability of substitutes. The global textile market is densely populated with manufacturers of knitted fabrics, garments, and apparel. In 2024, the sheer volume of textile producers worldwide, particularly in Asia, means customers have a broad spectrum of sourcing options, directly increasing their leverage.

This abundance of choices, from raw material suppliers to finished apparel brands, empowers both business-to-business and business-to-consumer customers. They can readily compare prices, quality, and delivery terms from numerous competitors, making it easier to switch away from Texwinca if their demands aren't met.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant challenge to Texwinca Holdings. Large apparel brands and retailers, who are Texwinca's primary customers, possess the financial resources and market influence to potentially establish their own manufacturing operations. This could involve setting up in-house fabric production or garment assembly, thereby reducing their dependence on external suppliers like Texwinca.

For instance, some major fashion retailers have already invested in or acquired manufacturing capabilities. In 2023, several leading global apparel companies reported increased vertical integration, with a notable percentage of their production now managed internally or through exclusive joint ventures. This trend directly impacts Texwinca by potentially shrinking its customer base and eroding its pricing power.

The implications for Texwinca are clear: a diminished bargaining position. When customers can credibly threaten to produce goods themselves, they gain leverage in price negotiations and contract terms. This pressure is amplified if Texwinca’s customers perceive fabric or garment manufacturing as a core competency they can effectively control, further weakening Texwinca’s market standing.

- Customer Integration Risk: Large apparel brands and retailers may integrate backward into fabric or garment manufacturing.

- Financial Capacity: Major brands possess the capital to establish their own production facilities.

- Strategic Partnerships: Some brands utilize strategic partnerships to reduce reliance on external manufacturers like Texwinca.

- Market Impact: Backward integration by customers weakens Texwinca's bargaining power and market position.

Information Asymmetry

Information asymmetry, or the lack thereof, significantly impacts customer bargaining power. When customers possess comprehensive knowledge about product costs, prevailing market prices, and alternative supplier offerings, their ability to negotiate favorable terms increases substantially. This heightened transparency, fueled by readily accessible market data and increasingly transparent supply chains, empowers customers to exert greater pressure on Texwinca Holdings' pricing strategies and overall terms across both its textile manufacturing and retail segments.

In 2024, the digital landscape continued to democratize information, making it easier than ever for consumers to compare prices and product quality. For instance, online marketplaces and review platforms provide detailed insights into competitor offerings, directly influencing customer expectations and their willingness to pay. This trend suggests that Texwinca must remain competitive not only in product quality but also in its pricing and value proposition to counter the informed consumer.

The bargaining power of customers is amplified when they have access to information that levels the playing field:

- Price Transparency: Customers can easily compare Texwinca's prices with those of competitors, especially for standardized textile products.

- Product Knowledge: Detailed product specifications and quality comparisons available online allow customers to assess value more accurately.

- Supplier Alternatives: A wide array of textile suppliers globally means customers can readily switch if Texwinca's terms are not met.

- Retail Market Data: In the retail division, customer access to sales data and promotional information empowers them to seek better deals.

Texwinca Holdings faces significant customer bargaining power due to a fragmented customer base with numerous sourcing options. The ease with which customers can switch suppliers, coupled with increasing price sensitivity, particularly in the mass-market retail segment represented by brands like Baleno, pressures Texwinca's profit margins. Furthermore, the potential for large apparel brands to engage in backward integration, as observed with increased vertical integration in the industry in 2023, directly diminishes Texwinca's leverage.

The widespread availability of information in 2024 further empowers customers, allowing for easy price and quality comparisons across a multitude of global textile suppliers. This transparency means Texwinca must consistently offer competitive pricing and a strong value proposition to retain its customer base and maintain its market position.

| Factor | Impact on Texwinca | Customer Leverage |

|---|---|---|

| Customer Concentration | High reliance on key clients | Significant negotiation power for major buyers |

| Price Sensitivity | Pressure on profit margins | Customers readily switch for better prices |

| Availability of Substitutes | Broad sourcing options for customers | Easy to find alternative suppliers globally |

| Threat of Backward Integration | Potential loss of customer base | Customers can bring production in-house |

| Information Asymmetry (Lack thereof) | Increased transparency on pricing and quality | Customers are well-informed and demanding |

Preview Before You Purchase

Texwinca Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Texwinca Holdings, detailing the competitive landscape and strategic implications. The document you see here is the exact, fully formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. This analysis will equip you with actionable insights into the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Texwinca Holdings' market.

Rivalry Among Competitors

Texwinca operates in a highly fragmented global textile and apparel market, facing intense competition from a vast number of players. This includes large multinational corporations and smaller, specialized firms across key manufacturing hubs like China, Vietnam, Bangladesh, and India.

The sheer volume and diversity of these competitors, spanning knitted fabrics, garment manufacturing, and apparel retail, significantly amplify rivalry within the industry. For instance, the global apparel market was valued at approximately $1.7 trillion in 2023, underscoring the scale of competition Texwinca navigates.

The textile and apparel industry's growth trajectory is a key factor in competitive rivalry. While the global textile market was projected for growth, 2024 saw economic slowdowns and weakened consumer demand impacting the sector. This sluggish growth environment intensifies competition as companies vie for a limited pool of market share.

In such slow-growth or declining segments, competition often devolves into a zero-sum game. This means that one company's gain is another's loss, leading to more aggressive pricing strategies and intensified marketing efforts as businesses battle for every available customer. For instance, reports indicated that apparel sales in many developed markets saw only modest single-digit growth in early 2024, putting pressure on margins.

Texwinca Holdings' product differentiation strategy centers on its knitted fabrics, garments, and retail apparel. The company highlights its commitment to quality and a unique dual-production model leveraging both China and Vietnam. However, the broader textile and apparel sector frequently grapples with commoditization, where products become largely interchangeable, intensifying price-based competition and rivalry among players.

Exit Barriers for Competitors

Exit barriers in the textile and apparel industry, like those faced by Texwinca Holdings, can significantly impact competitive rivalry. These barriers represent the difficulties or costs companies encounter when trying to leave the market.

High exit barriers mean that even struggling companies may remain operational, contributing to market saturation and intensified competition. For instance, specialized textile machinery, with limited alternative uses, represents a substantial sunk cost. In 2024, the global textile machinery market was valued at approximately USD 15 billion, highlighting the significant capital investment involved.

Furthermore, large workforces with specialized skills in textile manufacturing create another layer of exit difficulty. Severance packages and retraining obligations can be substantial. The need to maintain brand reputation and manage inventory liquidation also adds to the costs of exiting, potentially keeping unprofitable firms in the market longer than they otherwise would be. This sustained presence can lead to persistent overcapacity and aggressive pricing strategies among competitors.

- Specialized Assets: Textile manufacturing often requires highly specific machinery, making it difficult and costly to repurpose or sell.

- Labor Commitments: Significant workforces with specialized skills in weaving, dyeing, and finishing create substantial severance and retraining costs upon closure.

- Brand and Inventory: The need to maintain brand presence and the challenge of liquidating large inventories of specialized apparel can deter quick exits.

- Market Dynamics: High exit barriers can foster overcapacity and price wars, as weaker firms are incentivized to stay and compete aggressively.

Fixed Costs and Capacity Utilization

Texwinca Holdings operates in an industry characterized by substantial fixed costs. These include significant investments in manufacturing plants, advanced machinery, and ongoing research and development for new textile technologies and designs. For instance, the global textile machinery market was valued at approximately USD 15.5 billion in 2023 and is projected to grow, indicating the capital-intensive nature of the sector.

High fixed costs create a strong incentive for companies like Texwinca to achieve high capacity utilization. Operating below optimal levels means these substantial overheads are spread over fewer units, increasing the cost per item. This pressure intensifies competition, particularly when demand falters.

During economic downturns or periods of reduced consumer spending on apparel, Texwinca may face intense pressure to lower prices to maintain sales volume and cover its fixed expenses. This price-cutting behavior can trigger aggressive responses from competitors, escalating the intensity of rivalry within the industry.

- High Fixed Asset Investment: The textile industry requires substantial capital for factories and machinery, with global textile machinery sales reflecting this significant expenditure.

- Capacity Utilization Imperative: Companies must operate at high utilization rates to amortize fixed costs effectively, impacting profitability.

- Price Wars during Low Demand: Weak market demand can force price reductions to maintain sales volume, intensifying competitive pressures.

Texwinca faces intense rivalry due to the industry's fragmentation and the presence of numerous global competitors, from large corporations to niche players. The sheer volume of participants across manufacturing hubs like China and Vietnam amplifies this competition. The global apparel market's significant size, valued at approximately $1.7 trillion in 2023, highlights the scale of this rivalry.

The competitive landscape is further intensified by the industry's sensitivity to economic conditions. In 2024, economic slowdowns and weakened consumer demand led to sluggish growth, forcing companies to fight harder for market share, often resulting in aggressive pricing strategies. For instance, modest single-digit growth in apparel sales in developed markets in early 2024 put considerable pressure on profit margins.

Commoditization of textile products means that differentiation is challenging, leading to price-based competition. Texwinca's strategy of emphasizing quality in knitted fabrics and garments aims to counter this, but the broader industry trend remains a significant factor. The high exit barriers, such as specialized machinery and large workforces, also contribute to market saturation, as struggling firms remain operational, fueling persistent overcapacity and price wars.

SSubstitutes Threaten

The threat of substitutes for Texwinca Holdings is significant, particularly within the garment manufacturing sector. Customers can readily switch to alternative fabric types like woven fabrics or non-knitted materials that fulfill similar functional needs. For instance, the growing demand for sustainable fashion has seen a rise in bio-based fibers and recycled textiles, directly challenging Texwinca's core knitted fabric business.

The rise of alternative apparel sourcing models presents a significant threat to traditional retailers like Texwinca's Baleno brand. The growing popularity of the second-hand market, exemplified by platforms like Depop and Vinted, diverts consumer spending away from new purchases. For instance, the global second-hand apparel market was projected to reach $77 billion by 2025, indicating a substantial shift in consumer behavior.

Apparel rental services also offer a substitute, allowing consumers to access fashion without ownership, thereby reducing demand for traditional retail. Furthermore, direct-to-consumer (DTC) brands bypass established wholesale and retail channels, directly engaging customers and often offering competitive pricing or unique value propositions. This forces companies like Texwinca to increasingly invest in and refine their e-commerce strategies to remain competitive.

The price-performance trade-off of substitutes poses a significant threat to Texwinca Holdings. If alternative materials, such as advanced synthetic blends or recycled fabrics, can deliver comparable comfort and durability at a lower cost, customers may switch. For instance, the global market for sustainable textiles, a key substitute area, was projected to reach USD 10.6 billion in 2024, indicating growing consumer interest in cost-effective and environmentally friendly options.

Customer Propensity to Substitute

Customer propensity to substitute for Texwinca Holdings is influenced by evolving consumer values. For instance, a significant portion of consumers, around 60% in 2024 surveys, are actively seeking more sustainable fashion options, making them more open to alternatives that offer eco-friendly materials or ethical production practices. This growing awareness directly impacts Texwinca's ability to retain customers if it doesn't adequately address these shifting preferences.

The rise of slow fashion and the demand for personalized clothing also present considerable substitution threats. As consumers increasingly value unique, durable pieces over mass-produced items, they might turn to independent designers or custom tailoring services. This trend is supported by market research indicating a 15% year-over-year growth in the bespoke apparel sector, suggesting a tangible shift away from conventional retail models.

Texwinca's customers are becoming more discerning, weighing factors beyond price and convenience. The desire for clothing that reflects personal values, such as environmental impact and fair labor, is a key driver for considering alternatives. This is evident in the increasing popularity of brands that transparently communicate their supply chains and sustainability efforts, potentially drawing customers away from less transparent competitors.

- Growing Environmental Consciousness: Over 55% of global consumers reported making more environmentally friendly purchasing decisions in 2024, directly impacting fashion choices.

- Shift Towards Slow Fashion: The market for sustainable and ethically produced apparel saw an estimated 10% growth in 2024, indicating a preference for longevity over trend-driven consumption.

- Demand for Personalization: Reports show that 40% of consumers are willing to pay a premium for personalized fashion items, creating an avenue for smaller, niche players.

- Brand Transparency: Consumers are increasingly scrutinizing brand practices; companies with opaque supply chains may face higher substitution rates as customers seek ethical assurance.

Technological Advancements in Substitutes

Technological advancements are continually introducing novel materials and production methods that could challenge traditional knitted fabrics and garments. Innovations in smart textiles, for example, offer integrated functionalities like health monitoring or temperature regulation, potentially drawing consumers away from conventional apparel. By mid-2024, the global smart textiles market was projected to reach over $10 billion, indicating a growing consumer interest in these advanced alternatives.

Furthermore, the rise of 3D printing for garments presents a significant substitute threat. This technology allows for on-demand, customized production, reducing waste and potentially offering new design possibilities that traditional knitting might struggle to replicate efficiently. The global 3D printing market, encompassing various applications including textiles, saw substantial growth in 2024, with projections indicating continued expansion.

Biomimicry in textiles, which involves creating materials inspired by nature's designs, also poses a threat. These bio-based fabrics can offer enhanced sustainability, biodegradability, or unique performance characteristics, appealing to environmentally conscious consumers. For instance, advancements in lab-grown leather and mushroom-based textiles are gaining traction, presenting a direct substitute for conventionally produced fabrics.

These technological shifts create a dynamic landscape where:

- Smart textiles offer integrated functionalities beyond basic wear.

- 3D printing enables customized and potentially more sustainable garment production.

- Biomimicry introduces eco-friendly materials with novel properties.

The threat of substitutes for Texwinca Holdings is amplified by the increasing availability and consumer acceptance of alternative apparel sourcing and material options. The growing second-hand market, rental services, and direct-to-consumer brands all divert spending and challenge traditional retail models. For instance, the global second-hand apparel market was projected to reach $77 billion by 2025, highlighting a significant shift in consumer behavior away from new purchases.

Furthermore, evolving consumer values, particularly a heightened focus on sustainability and personalization, drive the adoption of substitutes. A significant portion of consumers, around 60% in 2024 surveys, actively seek more sustainable fashion options. This trend makes them more receptive to alternatives that offer eco-friendly materials or ethical production practices, directly impacting Texwinca's ability to retain customers if these preferences are not met.

Technological advancements continuously introduce novel materials and production methods that serve as substitutes for Texwinca's core knitted fabrics. Innovations in smart textiles, offering integrated functionalities, and 3D printing for customized garment production present direct challenges. By mid-2024, the global smart textiles market was projected to exceed $10 billion, indicating growing consumer interest in these advanced alternatives.

| Substitute Category | Key Examples | Impact on Texwinca | Market Trend Data (2024/2025 Projections) |

| Alternative Sourcing | Second-hand market, Apparel rental, DTC brands | Diverts consumer spending, challenges traditional retail | Second-hand market projected to reach $77 billion by 2025 |

| Sustainable Materials | Bio-based fibers, Recycled textiles, Mushroom-based textiles | Appeals to environmentally conscious consumers, offers cost-performance trade-offs | Global sustainable textiles market projected to reach USD 10.6 billion in 2024 |

| Advanced Technologies | Smart textiles, 3D printed garments, Biomimicry | Offers novel functionalities, customization, and eco-friendly properties | Global smart textiles market projected to exceed $10 billion by mid-2024 |

Entrants Threaten

The textile industry, particularly for integrated operations with dyeing capabilities, demands substantial upfront capital. Establishing a modern manufacturing facility can easily run into tens of millions of dollars for machinery, land, and construction. For instance, a new, mid-sized textile mill with advanced dyeing and finishing equipment could require an investment exceeding $50 million in 2024.

Similarly, building a widespread retail apparel chain necessitates significant investment in inventory, store leases or purchases, and supply chain infrastructure. A national retail presence could easily demand hundreds of millions in initial capital. These high capital requirements act as a formidable barrier, effectively deterring many potential new entrants from challenging established players like Texwinca Holdings.

Texwinca Holdings benefits significantly from economies of scale in its fabric manufacturing and sourcing operations. This means that as Texwinca produces more, its cost per unit decreases, giving it a competitive edge.

New companies entering the fabric market would struggle to match Texwinca's production volumes. Without this scale, they would face higher per-unit costs, making it challenging to compete on price with Texwinca's offerings.

For example, in 2024, the global textile industry saw significant consolidation, with larger players like Texwinca leveraging their scale to absorb market fluctuations. This trend makes it increasingly difficult for smaller, new entrants to achieve cost parity.

New companies entering the textile and apparel market often struggle to gain access to established distribution channels. Texwinca Holdings benefits from its existing relationships with a global customer base and its own retail network, Baleno. These established channels are difficult and costly for new entrants to replicate, creating a significant barrier.

Brand Loyalty and Customer Switching Costs

Texwinca Holdings, particularly through its retail brand Baleno, benefits from significant brand loyalty. This loyalty acts as a substantial barrier to new entrants in the apparel market. For instance, in 2024, Baleno maintained a strong presence, with reports indicating consistent customer engagement and repeat purchases, a testament to its established brand equity.

The switching costs for Texwinca's manufacturing clients are also considerable. These clients often have complex, long-term supply chain relationships and substantial investments in integrating Texwinca's products into their own operations. The effort, risk, and potential disruption associated with onboarding a new, unproven textile supplier for large-scale orders significantly deter potential new entrants.

- Brand Loyalty: Baleno's established reputation and customer base in 2024 create a strong shield against new retail competitors.

- Customer Switching Costs (Manufacturing): The deep integration of Texwinca's products into client supply chains makes switching to a new supplier a complex and costly endeavor.

- Reduced Threat: High brand loyalty and significant switching costs collectively diminish the threat of new entrants challenging Texwinca's market position.

Government Policy and Regulations

Government policy and regulations significantly influence the threat of new entrants in the textile and apparel sector where Texwinca Holdings operates. Increasingly stringent sustainability mandates, such as those being implemented in the European Union and North America, can raise compliance costs for new players. For instance, new regulations around chemical usage and waste management require substantial investment in new technologies and processes, potentially deterring smaller or less capitalized entrants.

Trade policies, including tariffs and import quotas, also act as barriers. The World Trade Organization (WTO) reported that in 2023, textile and apparel trade faced ongoing complexities due to various national trade measures. For Texwinca, operating in regions like China and Vietnam, understanding and navigating these evolving trade landscapes is crucial, as they can directly impact the cost-competitiveness of new market entrants.

Licensing requirements and environmental standards, particularly concerning water usage and emissions, add further layers of complexity. New entrants must invest heavily to meet these standards, which can be substantial. For example, meeting the water discharge standards in many Asian textile manufacturing hubs requires advanced wastewater treatment facilities, a significant upfront investment that can limit the number of new companies able to enter the market.

The overall impact of these government-imposed requirements is a heightened barrier to entry:

- Increased Compliance Costs: New entrants face substantial upfront and ongoing expenses to meet evolving environmental and sustainability regulations.

- Trade Policy Uncertainty: Fluctuations in tariffs and quotas create unpredictable market access and cost structures for potential competitors.

- Capital Investment Requirements: Meeting stringent licensing and operational standards necessitates significant capital outlay for technology and infrastructure.

The threat of new entrants for Texwinca Holdings is generally low due to significant barriers. High capital requirements for setting up integrated textile operations, exceeding $50 million for a mid-sized mill in 2024, deter many. Furthermore, established economies of scale, as seen in the 2024 market consolidation favoring larger players, make it difficult for newcomers to achieve cost parity.

Brand loyalty, particularly for Texwinca's retail arm Baleno, which showed consistent customer engagement in 2024, and substantial customer switching costs in manufacturing due to deep supply chain integration, further solidify Texwinca's market position. These factors make it challenging and expensive for new companies to gain a foothold.

Government regulations and trade policies also serve as deterrents. Increasingly strict sustainability mandates and compliance costs, coupled with trade policy uncertainties reported by the WTO in 2023, raise the ante for new entrants. Meeting stringent licensing and environmental standards requires significant capital investment in advanced technology and infrastructure, effectively limiting the number of viable new market participants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Texwinca Holdings is built upon a foundation of publicly available financial reports, industry-specific market research, and reputable trade publications.