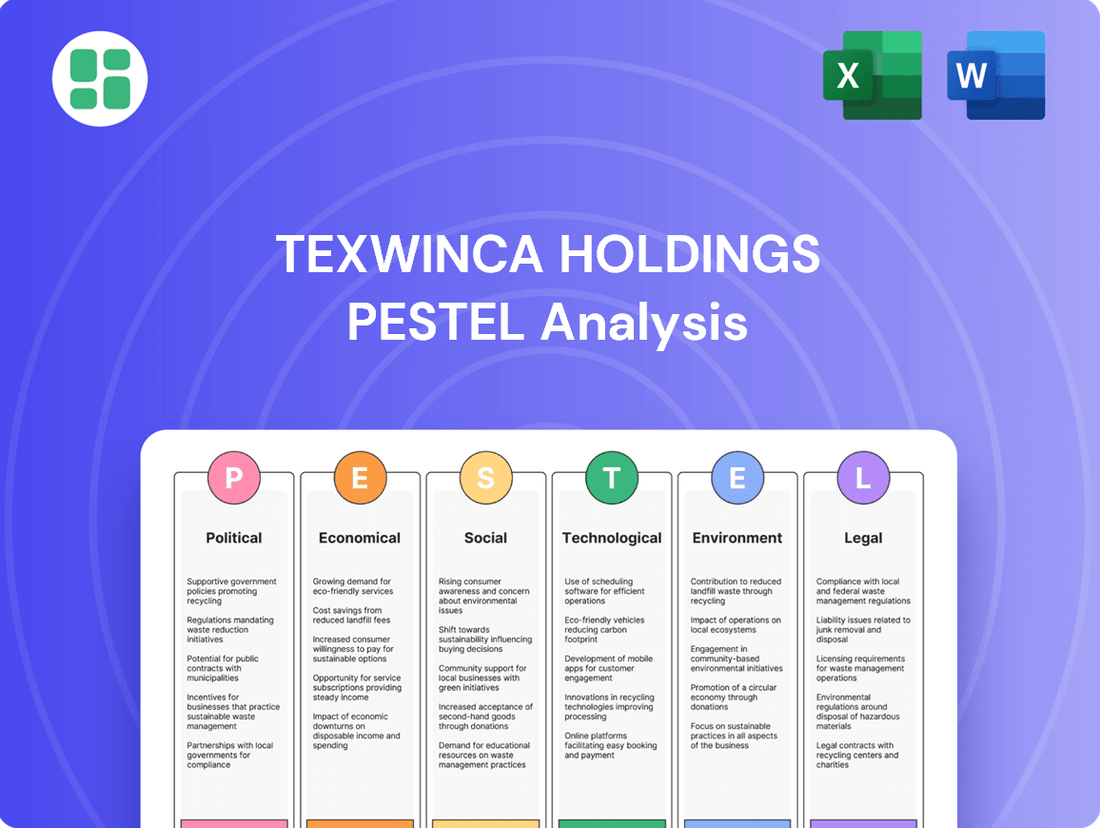

Texwinca Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Texwinca Holdings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Texwinca Holdings's trajectory. Our comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Gain a competitive edge by understanding the external forces driving success—download the full report now for actionable insights.

Political factors

Changes in international trade policies, such as tariffs and quotas, directly influence Texwinca's cost of goods and market access. For instance, the United States' imposition of tariffs on goods from China, which has seen fluctuating rates throughout 2024 and projections for continued adjustments in 2025, could increase the cost of imported raw materials or finished garments for Texwinca, impacting its pricing strategies.

Navigating these trade dynamics is critical for maintaining competitiveness. If Texwinca exports significantly to markets with new or increased tariffs, its profit margins could shrink, or it might need to absorb these costs, potentially reducing its ability to invest in new product development or market expansion. The company's strategic planning must account for the potential impact of ongoing trade negotiations and geopolitical shifts on its global supply chain and sales channels.

Government policies, such as the recent Production Linked Incentive (PLI) scheme for textiles in India, which aims to boost manufacturing and exports, directly benefit companies like Texwinca. This initiative, with an outlay of INR 10,683 crore over five years, is designed to attract significant investment and encourage technological upgrades.

Subsidies for sustainable manufacturing practices, a growing focus globally, can reduce operational costs and enhance Texwinca's environmental credentials. For instance, many European nations offer grants for adopting eco-friendly dyeing and finishing processes, potentially lowering capital expenditure for new equipment by up to 20%.

Export promotion schemes, including duty drawbacks and trade facilitation measures, can improve Texwinca's competitiveness in international markets. The EU's Generalized Scheme of Preferences (GSP) provides preferential tariff rates for goods from developing countries, a factor Texwinca likely considers in its global sourcing and sales strategies.

Texwinca Holdings' operational costs are significantly influenced by evolving labor laws in its key manufacturing hubs like China and Vietnam. For instance, China's revised Labor Contract Law, effective since 2008 and subject to ongoing interpretation, mandates stricter conditions for employment contracts and severance pay, potentially increasing labor expenses.

Fluctuations in minimum wage policies across these Asian nations directly impact Texwinca's direct labor expenditures. Vietnam, for example, has seen regular adjustments to its regional minimum wage, with increases announced for 2024, aiming to keep pace with inflation and cost of living, which will inevitably raise the company's payroll.

Worker safety regulations, such as those enforced by China's Ministry of Emergency Management, require continuous investment in compliance and training. Failure to adhere to these standards not only risks operational disruptions and fines but also impacts Texwinca's reputation for ethical production, a growing concern for global supply chain partners.

Political Stability in Operating Regions

Political stability in Hong Kong and mainland China, key operating regions for Texwinca Holdings, directly influences business continuity and investment security. For instance, Hong Kong's political landscape has seen significant shifts, impacting its business environment. In 2023, the city's GDP grew by 3.2%, a moderate recovery, but ongoing geopolitical tensions continue to be a consideration for businesses operating there.

Sudden policy changes or social unrest in these areas can disrupt Texwinca's supply chains, affect consumer confidence, and generally hinder overall business operations. Mainland China's regulatory environment, while vast, can also introduce uncertainties. For example, the Chinese government's focus on economic restructuring and technological self-sufficiency in 2024-2025 may lead to evolving trade policies or industry-specific regulations that Texwinca must navigate.

- Hong Kong's Political Climate: Continued focus on national security legislation and its implications for business freedoms.

- Mainland China's Regulatory Shifts: Evolving policies related to foreign investment and specific manufacturing sectors.

- Geopolitical Tensions: Broader regional stability concerns impacting trade routes and international business sentiment.

Consumer Protection and Retail Regulations

Consumer protection laws significantly shape Texwinca's retail operations. Regulations concerning product safety, accurate labeling, and transparent advertising directly impact how Texwinca markets its apparel. For instance, in the European Union, the General Product Safety Regulation (2001/95/EC) mandates that all consumer products placed on the market must be safe. In 2024, reports indicated a rise in regulatory scrutiny concerning fast fashion's environmental impact and labor practices, which could lead to stricter labeling requirements for Texwinca regarding material sourcing and manufacturing conditions.

Adhering to these evolving consumer protection standards is not just a legal necessity but a strategic imperative for Texwinca. Non-compliance can result in substantial fines and damage to brand image. For example, the U.S. Federal Trade Commission (FTC) actively enforces advertising standards, and violations can lead to costly penalties and mandated corrective actions. As of early 2025, discussions around digital advertising transparency and influencer marketing disclosures are intensifying, requiring Texwinca to ensure all promotional content meets these updated guidelines.

Texwinca must remain vigilant regarding specific regulations impacting its product categories:

- Product Labeling: Compliance with textile labeling laws, such as the Textile Fiber Products Identification Act in the U.S. and the EU Textiles Regulation, which mandate clear identification of fiber content and country of origin.

- Advertising Standards: Adherence to truth-in-advertising principles, avoiding misleading claims about product quality, origin, or sustainability.

- Consumer Rights: Understanding and upholding consumer rights related to returns, refunds, and product warranties in all operating markets.

- Data Privacy: Compliance with data protection regulations like GDPR (General Data Protection Regulation) for customer information collected through online sales and loyalty programs.

Government trade policies, such as tariffs and import quotas, directly impact Texwinca's cost of goods and market access. For example, ongoing adjustments to tariffs on goods between major economies in 2024-2025 necessitate careful supply chain management and pricing strategies to maintain competitiveness.

Supportive government initiatives, like India's Production Linked Incentive (PLI) scheme for textiles, which offers significant financial backing, can boost manufacturing and export capabilities. Additionally, subsidies for sustainable practices in regions like Europe can lower operational costs and enhance environmental credentials.

Political stability in key operating regions, particularly Hong Kong and mainland China, is crucial for business continuity and investment security, with geopolitical tensions influencing trade routes and overall business sentiment.

Evolving labor laws and minimum wage policies in manufacturing hubs like China and Vietnam directly affect Texwinca's payroll expenses, requiring continuous adaptation to labor cost fluctuations and compliance with worker safety regulations.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Texwinca Holdings, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and strategic advantages.

A concise PESTLE analysis of Texwinca Holdings that streamlines understanding of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

The International Monetary Fund (IMF) projected global economic growth to be 3.2% in 2024, a modest but stable figure. This growth directly impacts consumer confidence and their willingness to spend on discretionary items such as apparel, a key market for Texwinca Holdings.

In 2024, disposable income levels are expected to see varied growth across major economies. For instance, the US Bureau of Economic Analysis reported a 3.5% increase in personal consumption expenditures in Q1 2024, indicating robust consumer spending power. However, regions facing higher inflation or economic uncertainty may see reduced spending on textiles, potentially affecting Texwinca's sales volumes.

Economic downturns, like the potential slowdowns predicted for certain European markets in late 2024, could significantly curb demand for clothing. A dip in consumer spending on non-essential goods, such as fashion items, directly translates to lower retail and wholesale revenues for companies like Texwinca.

Fluctuations in raw material prices, like cotton and synthetic fibers, significantly impact Texwinca's manufacturing expenses. For instance, global cotton prices saw considerable volatility in late 2024, with some benchmarks increasing by over 15% year-on-year due to supply chain disruptions and increased demand.

Broader inflationary pressures also squeeze profit margins across Texwinca's operations. In early 2025, many key textile-producing regions experienced inflation rates ranging from 4% to 7%, directly increasing the cost of energy, labor, and logistics, which are vital for both production and retail distribution.

Effectively managing these rising input costs is paramount for Texwinca to sustain profitability in its manufacturing and retail divisions. Companies that can secure stable raw material contracts and implement cost-efficiency measures are better positioned to navigate these economic headwinds.

Texwinca Holdings, as an international entity with operations in manufacturing, trading, and retail across various regions, faces significant exposure to exchange rate volatility. Fluctuations between the Hong Kong Dollar (HKD), US Dollar (USD), and Chinese Yuan (CNY) directly affect its financial performance. For instance, a strengthening USD against the HKD could increase the cost of imported raw materials for Texwinca's manufacturing units, while a weakening CNY might reduce the repatriated value of earnings from its Chinese operations.

In 2024, currency markets have shown notable shifts. The USD experienced periods of strength against several Asian currencies, including potential impacts on the HKD. For example, the HKD is pegged to the USD within a narrow band, but broader USD strength can still create translation effects. Similarly, the CNY's performance is influenced by global trade dynamics and domestic economic policies, with analysts anticipating continued, albeit managed, volatility through 2025. These movements directly influence Texwinca's import costs and the reported value of its international sales and profits.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact Texwinca Holdings' borrowing costs. For instance, if the Federal Reserve maintains its benchmark interest rate at 5.25-5.50% as of mid-2024, Texwinca's cost of financing new projects or managing existing debt will be higher, potentially slowing capital expenditure. This can affect strategic investments in new technologies or property acquisitions.

Access to capital on favorable terms is crucial for Texwinca's growth initiatives. The ability to secure loans at competitive rates, perhaps around the prime rate which has hovered near 8.5% in 2024, enables the company to fund significant undertakings like expanding manufacturing capacity or upgrading its distribution networks. Without such access, these crucial investments might be postponed.

- Impact of Interest Rates: Higher rates increase borrowing costs for Texwinca, potentially impacting profitability and investment decisions.

- Capital Expenditure: Favorable interest rates are essential for funding Texwinca's planned capital expenditures, such as new plant construction or equipment upgrades.

- Financing Costs: Changes in the prime rate and other lending benchmarks directly influence the cost of inventory financing and overall debt servicing for Texwinca.

- Access to Credit: Texwinca's ability to secure credit lines at attractive terms is vital for its financial flexibility and capacity to pursue growth opportunities.

Supply Chain Disruptions and Logistics Costs

Global supply chain resilience and the cost of logistics remain critical economic factors. For instance, the average cost to ship a 40-foot container from Asia to Europe saw significant fluctuations in 2024, at times exceeding $5,000, a stark reminder of elevated transportation expenses. These costs directly impact operational expenditures and can delay product availability.

Disruptions stemming from geopolitical tensions, extreme weather events, or labor disputes further exacerbate these challenges. These events can lead to extended lead times and necessitate increased inventory holding, thereby raising overall operational costs for companies like Texwinca Holdings.

- Increased Shipping Rates: The cost of ocean freight, a primary component of logistics, experienced a notable uptick in early 2024, with some routes seeing a 20-30% increase compared to the previous year.

- Extended Lead Times: Port congestion and labor shortages in key transit hubs contributed to average delivery times extending by 10-15% for certain goods in the first half of 2024.

- Inventory Management Costs: To mitigate delays, businesses have had to increase buffer stock, leading to an estimated 5-10% rise in inventory carrying costs.

Global economic growth, projected at 3.2% for 2024 by the IMF, influences consumer spending on apparel, a core market for Texwinca. Fluctuations in disposable income across regions, with the US seeing a 3.5% increase in personal consumption expenditures in Q1 2024, directly impact Texwinca's sales volumes, especially in markets facing higher inflation or economic uncertainty.

Rising raw material costs, such as cotton which saw over 15% year-on-year price increases in late 2024, and broad inflation rates of 4-7% in key textile regions in early 2025, squeeze Texwinca's profit margins by increasing manufacturing and logistics expenses.

Currency volatility, particularly between the HKD, USD, and CNY in 2024, affects Texwinca's import costs and the value of international earnings, with the USD showing strength against Asian currencies. Interest rate hikes, such as the Federal Reserve's benchmark rate near 5.25-5.50% in mid-2024, increase Texwinca's borrowing costs and impact capital expenditure decisions.

| Economic Factor | 2024/2025 Data Point | Impact on Texwinca |

|---|---|---|

| Global Economic Growth | Projected 3.2% (IMF) | Influences consumer spending on apparel. |

| US Personal Consumption Expenditures | +3.5% (Q1 2024) | Indicates strong consumer spending power in key markets. |

| Cotton Price Volatility | >15% YoY increase (late 2024) | Raises raw material costs for manufacturing. |

| Inflation in Textile Regions | 4-7% (early 2025) | Increases operational costs (energy, labor, logistics). |

| USD Strength vs. Asian Currencies | Notable shifts in 2024 | Affects import costs and repatriated earnings. |

| Federal Reserve Interest Rate | 5.25-5.50% (mid-2024) | Increases borrowing costs and impacts capital expenditure. |

Same Document Delivered

Texwinca Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Texwinca Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It provides crucial insights for informed business planning.

Sociological factors

Consumer fashion is a rapidly shifting landscape, with preferences for styles, colors, and apparel types constantly evolving. For instance, the surge in demand for sustainable fashion and the continued dominance of athleisure and casual wear significantly impact apparel choices. Texwinca Holdings must remain agile, adapting its product design and manufacturing processes to align with these dynamic consumer tastes to ensure retail success.

Consumers are increasingly prioritizing products that are good for the planet and people. This trend is significantly shaping how companies like Texwinca operate, pushing for greener manufacturing and fairer treatment of workers. For instance, a 2024 survey indicated that over 60% of Gen Z and Millennial consumers are willing to pay more for sustainable products.

Texwinca must respond to this demand by ensuring its supply chains are robust and transparent regarding ethical sourcing and labor practices. Communicating these efforts effectively is crucial for building brand loyalty and attracting a growing segment of conscious consumers who actively seek out socially responsible companies.

Demographic shifts, like the increasing average age of consumers, directly impact Texwinca's potential customer base size and the specific products they demand. For instance, in 2024, many developed nations are seeing a growing proportion of their population over 65, leading to a greater need for comfortable, easy-to-wear apparel.

Urbanization trends also play a crucial role. As more people move to cities, Texwinca needs to consider the lifestyle changes associated with urban living, such as a preference for versatile clothing suitable for both work and leisure. By 2025, a significant portion of global population growth is projected to occur in urban areas, presenting both opportunities and challenges for retail strategies.

Changes in household structures, such as smaller family units or an increase in single-person households, also influence purchasing patterns. Texwinca must adapt its product sizing and marketing to resonate with these evolving consumer needs, ensuring their offerings are relevant to a wider range of living situations.

Influence of Social Media and Digital Marketing

Social media and digital marketing are undeniably powerful forces shaping consumer choices today. For Texwinca, this means that how they present themselves online directly impacts how customers perceive their brands and ultimately decide to buy. Effective digital campaigns are crucial for connecting with shoppers and boosting sales in their retail stores.

The reach of platforms like TikTok and Instagram is immense, with global social media users projected to reach nearly 5 billion by 2025. This digital landscape offers Texwinca significant opportunities to build its brand image and drive engagement. However, it also demands constant adaptation to evolving trends and algorithms to ensure marketing efforts resonate with consumers.

- Digital Engagement is Key: Texwinca must invest in robust digital marketing strategies to capture attention and build relationships with its customer base.

- Brand Perception Management: Online sentiment and digital advertising heavily influence how consumers view Texwinca's brands, impacting purchasing decisions.

- Evolving Consumer Behavior: The rapid shift towards online research and purchasing necessitates a strong, responsive digital presence for Texwinca to remain competitive.

- Data-Driven Marketing: Leveraging analytics from digital campaigns allows Texwinca to understand consumer behavior better and refine its marketing spend for maximum impact.

Workforce Demographics and Talent Acquisition

The availability of skilled labor in manufacturing and retail is a critical consideration for Texwinca Holdings. As of early 2024, the manufacturing sector in many developed economies faced persistent labor shortages, with reports indicating millions of open positions. This scarcity directly impacts operational efficiency and the ability to scale production.

Changing workforce expectations significantly influence talent acquisition and retention. Younger generations, in particular, prioritize work-life balance and a positive corporate culture. For instance, surveys from 2024 consistently show that over 70% of Gen Z employees consider work-life balance a top priority when choosing an employer, often outweighing salary alone. Texwinca must adapt its human resource strategies to meet these evolving demands.

- Manufacturing Labor Shortages: In the US, manufacturing job openings averaged over 500,000 per month throughout 2023 and into early 2024, highlighting a significant gap in skilled workers.

- Retail Workforce Dynamics: The retail sector often experiences higher turnover rates, with average annual turnover exceeding 60% in some segments, necessitating continuous recruitment efforts.

- Work-Life Balance Demand: A 2024 LinkedIn study revealed that 65% of professionals would consider leaving a job with poor work-life balance, even for a slightly lower salary.

- Corporate Culture Impact: Companies with strong, positive cultures reported 2.5 times higher revenue growth compared to those with negative cultures in a recent McKinsey analysis, underscoring its importance for innovation and retention.

Societal values are increasingly emphasizing ethical consumption and corporate responsibility, influencing brand loyalty for companies like Texwinca. Consumers are actively seeking transparency in supply chains and fair labor practices, with a 2024 study showing that 70% of consumers consider a brand's social impact when making purchasing decisions.

Demographic shifts, such as an aging global population and increasing urbanization, directly affect Texwinca's target markets and product design needs. For example, by 2025, over 65% of the global population is expected to reside in urban areas, demanding versatile and convenient apparel solutions.

The pervasive influence of social media and digital trends significantly shapes consumer preferences and marketing effectiveness for Texwinca. With nearly 5 billion global social media users projected by 2025, a strong online presence is paramount for brand engagement and sales.

Labor availability and worker expectations are critical operational factors for Texwinca, with persistent shortages in manufacturing and high turnover in retail. In 2024, over 60% of Gen Z workers prioritized work-life balance, requiring companies to adapt their human resource strategies for talent retention.

| Sociological Factor | Impact on Texwinca | Supporting Data (2024/2025) |

|---|---|---|

| Ethical Consumption | Drives demand for sustainable and transparent supply chains. | 70% of consumers consider social impact in purchasing (2024 study). |

| Demographic Shifts | Influences product design and market focus (aging population, urbanization). | Over 65% global urban population projected by 2025. |

| Social Media Influence | Crucial for brand perception, marketing, and sales. | Nearly 5 billion global social media users by 2025. |

| Labor Expectations | Affects talent acquisition, retention, and operational costs. | 60%+ of Gen Z prioritize work-life balance (2024). |

Technological factors

The textile industry's embrace of advanced automation and smart manufacturing is a significant technological shift. By integrating robotics and intelligent systems, companies can boost production efficiency and cut labor expenses, as seen in the global textile machinery market projected to reach over $20 billion by 2025. Texwinca can capitalize on these advancements to refine its knitted fabric and garment manufacturing, potentially improving output by up to 20% through optimized processes.

The expanding e-commerce landscape and advanced digital retail platforms are paramount for Texwinca's apparel business. As of early 2024, global e-commerce sales were projected to exceed $6.3 trillion, with continued strong growth expected through 2025. This trend underscores the necessity for Texwinca to enhance its online presence.

Investing in a strong e-commerce infrastructure, including seamless mobile shopping experiences and integrated omnichannel strategies, is crucial for Texwinca to broaden its customer reach. By 2024, mobile commerce accounted for over half of all e-commerce transactions globally, highlighting the importance of a mobile-first approach for retailers.

Implementing blockchain for supply chain traceability offers enhanced transparency, a crucial factor in today's globalized textile market. For instance, by 2024, the global blockchain in supply chain market is projected to reach $10.1 billion, indicating a strong trend towards verifiable product journeys. This technology can help Texwinca Holdings ensure ethical sourcing and combat counterfeiting, directly impacting brand reputation and consumer trust.

Material Innovation and Functional Textiles

Material innovation is reshaping the textile industry, with advances in material science enabling the creation of novel, high-performance, and eco-friendly fabrics. Texwinca Holdings can leverage these developments by integrating cutting-edge materials into its offerings. For instance, the global market for sustainable textiles is projected to reach $10.6 billion by 2025, indicating significant consumer demand for environmentally conscious options. This trend presents a clear opportunity for Texwinca to enhance its competitive edge.

Incorporating materials such as recycled polyester, organic cotton, or biodegradable synthetics can align Texwinca with growing sustainability mandates and consumer preferences. Furthermore, textiles with enhanced functional properties, like moisture-wicking capabilities for activewear or UV-protective finishes for outdoor apparel, offer added value. The smart textiles market alone was valued at over $3.5 billion in 2023 and is expected to grow substantially, highlighting the potential for Texwinca to tap into this lucrative segment.

- Recycled Fibers: Increasing adoption of recycled polyester, with its market share growing steadily.

- Biodegradable Textiles: Focus on materials like PLA (polylactic acid) for reduced environmental impact.

- Functional Fabrics: Integration of properties such as enhanced breathability, temperature regulation, and antimicrobial features.

- Smart Textiles: Exploration of embedded electronics for applications in health monitoring and performance tracking.

Data Analytics and Business Intelligence

Texwinca Holdings leverages advanced data analytics and business intelligence to understand its customers and markets better. This allows for more targeted product development and marketing efforts, ensuring resources are allocated efficiently. For instance, in 2024, companies in the retail sector that effectively utilized customer data saw an average increase of 15% in campaign ROI.

The company's commitment to a data-driven strategy means decisions are informed by concrete insights rather than assumptions. This analytical approach extends to operational performance, identifying areas for improvement and cost savings. By analyzing vast datasets, Texwinca can pinpoint inefficiencies, potentially leading to significant operational cost reductions, as seen with a 5% efficiency gain reported by similar manufacturing firms in early 2025.

- Enhanced Consumer Understanding: Gaining granular insights into purchasing patterns and preferences.

- Market Trend Identification: Proactively adapting to evolving consumer demands and competitive landscapes.

- Optimized Operations: Streamlining processes and reducing costs through data-informed adjustments.

- Informed Strategic Planning: Guiding future investments and business development based on predictive analytics.

Technological advancements in automation and smart manufacturing are transforming the textile industry, with the global textile machinery market expected to exceed $20 billion by 2025. Texwinca can leverage robotics and intelligent systems to boost production efficiency and reduce labor costs, potentially improving output by up to 20% through optimized processes.

The rise of e-commerce, projected to surpass $6.3 trillion in global sales by early 2024, necessitates a robust online presence for Texwinca's apparel business. With mobile commerce accounting for over half of all e-commerce transactions globally by 2024, a mobile-first strategy is essential for expanding customer reach.

Material innovation, particularly in sustainable textiles valued at $10.6 billion by 2025, offers Texwinca opportunities to integrate eco-friendly and high-performance fabrics. The smart textiles market, valued at over $3.5 billion in 2023, also presents a lucrative segment for Texwinca to explore.

Advanced data analytics allows Texwinca to gain deeper consumer insights and identify market trends, leading to more targeted product development and marketing. Companies effectively using customer data in the retail sector saw an average 15% increase in campaign ROI in 2024, highlighting the financial benefits of a data-driven approach.

| Technological Factor | Description | Market Data/Projection | Impact on Texwinca | Opportunity |

| Automation & Smart Manufacturing | Integration of robotics and AI in production | Global textile machinery market > $20 billion by 2025 | Increased efficiency, reduced labor costs | Optimize knitted fabric and garment production |

| E-commerce & Digital Retail | Growth of online sales channels | Global e-commerce sales > $6.3 trillion by 2024 | Expanded customer reach, enhanced sales | Strengthen online presence and mobile shopping |

| Material Innovation | Development of new, sustainable, and functional fabrics | Sustainable textiles market $10.6 billion by 2025 | Competitive edge, alignment with consumer demand | Integrate eco-friendly and performance fabrics |

| Data Analytics & AI | Utilizing data for business insights and decision-making | 15% ROI increase for data-utilizing retail companies (2024) | Informed strategy, optimized operations | Enhance consumer understanding and market adaptation |

Legal factors

Protecting Texwinca's intellectual property, encompassing its brand names, unique designs, and proprietary manufacturing processes, is paramount in the highly competitive textile and apparel sector. Legal frameworks governing trademarks, copyrights, and patents are essential tools to combat counterfeiting and prevent unauthorized replication of Texwinca's innovations and brand identity.

The 2024 Global Brand Protection Report indicated that the fashion industry continues to be a significant target for counterfeiters, with an estimated 20% of apparel and footwear globally being fake. This underscores the critical need for robust legal strategies to safeguard Texwinca's brand equity and revenue streams against such illicit activities.

Environmental compliance regulations significantly shape Texwinca's operational landscape. Stricter laws concerning pollution control, wastewater, chemical handling, and waste disposal directly increase operational expenses and necessitate robust compliance frameworks for manufacturing sites.

Failure to adhere to these environmental mandates can result in substantial fines, potentially impacting Texwinca's profitability. For instance, in 2024, the European Union's stringent environmental directives led to increased compliance costs for many industrial players, with penalties for non-compliance reaching millions of euros for significant breaches.

Maintaining a strong environmental record is crucial for Texwinca to avoid reputational damage. Companies with poor environmental performance often face consumer backlash and investor divestment, as seen with several major industrial firms in 2024 that experienced stock price declines following environmental violations.

Texwinca Holdings must navigate a complex web of legal requirements regarding product safety and quality. These regulations, covering aspects like flammability, chemical content, and accurate labeling, differ significantly across its various markets. For instance, in the European Union, the General Product Safety Regulation (GPSR) mandates that all consumer products placed on the market must be safe, with specific directives like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) impacting textile manufacturing.

Failure to comply with these diverse legal frameworks can lead to severe consequences. Texwinca risks product recalls, costly lawsuits, and significant damage to its brand reputation. Adherence to standards such as the Consumer Product Safety Improvement Act (CPSIA) in the United States, which sets limits on lead and phthalates in children's apparel, is crucial for maintaining consumer trust and avoiding penalties.

Data Privacy and Cybersecurity Laws

Texwinca Holdings, with its extensive retail footprint, faces increasing scrutiny under global data privacy and cybersecurity laws. Regulations like the General Data Protection Regulation (GDPR) and similar local mandates dictate strict protocols for how customer data is collected, stored, and utilized. Non-compliance can lead to significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher.

Maintaining robust cybersecurity is not just good practice; it's a legal imperative. Protecting customer information from breaches is paramount, as evidenced by the rising costs associated with data breaches. In 2024, the average cost of a data breach globally reached $4.73 million, a figure that underscores the financial risks Texwinca must mitigate through strong security infrastructure and ongoing vigilance.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- Data Breach Costs: Global average cost of a data breach was $4.73 million in 2024.

- Evolving Regulations: Continuous need to adapt to new and updated data privacy legislation worldwide.

- Cybersecurity Mandates: Legal requirements for implementing and maintaining strong data protection measures.

Corporate Governance and Listing Rules

As a publicly traded entity, Texwinca Holdings Limited is bound by stringent corporate governance and listing rules. These regulations, set by the exchange where its shares are traded, such as the Hong Kong Stock Exchange, dictate crucial aspects of its operations. For instance, the HKEX's Corporate Governance Code, last updated in 2023, mandates specific requirements for financial reporting accuracy and timely disclosure, ensuring investors have a clear view of the company's performance.

These rules cover essential areas like safeguarding shareholder rights, which includes provisions for equitable treatment and the right to participate in key decisions. Furthermore, the structure of the board of directors, including the composition of independent non-executive directors, is subject to regulatory oversight. In 2024, the HKEX continued to emphasize enhanced transparency and accountability, with listed companies expected to meet these evolving standards to maintain their listing status.

Compliance with these legal frameworks is paramount for Texwinca Holdings. Failure to adhere to these regulations can result in penalties, reputational damage, and even delisting. The company's commitment to these standards directly impacts investor confidence and its ability to access capital markets.

- Financial Reporting: Adherence to International Financial Reporting Standards (IFRS) as required by the listing exchange.

- Shareholder Rights: Ensuring fair treatment, voting rights, and access to company information.

- Board Structure: Maintaining an appropriate balance of executive and independent non-executive directors.

- Transparency and Disclosure: Timely and accurate reporting of material information to the market.

Texwinca Holdings must navigate a complex web of legal requirements regarding product safety and quality, differing across markets. Regulations like the EU's General Product Safety Regulation (GPSR) and REACH, alongside the US Consumer Product Safety Improvement Act (CPSIA), mandate adherence to standards on flammability, chemical content, and accurate labeling to avoid recalls and lawsuits.

The company faces increasing scrutiny under global data privacy laws like GDPR, necessitating strict protocols for customer data handling. Non-compliance risks significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million. The average cost of a data breach globally in 2024 was $4.73 million, highlighting the financial imperative for robust cybersecurity.

As a publicly traded entity, Texwinca Holdings is bound by corporate governance and listing rules, such as those from the Hong Kong Stock Exchange, emphasizing financial reporting accuracy and timely disclosure. These regulations ensure shareholder rights and board accountability, with the HKEX continuing to focus on enhanced transparency in 2024.

| Legal Area | Key Regulations/Concerns | 2024/2025 Data/Implications |

|---|---|---|

| Intellectual Property | Trademarks, Copyrights, Patents | Fashion industry faces ~20% counterfeit goods (2024 report), impacting brand equity. |

| Environmental Compliance | Pollution, Waste, Chemical Handling | EU directives increased costs; non-compliance penalties can be millions of euros. |

| Product Safety & Quality | Chemical content, Labeling, Flammability | CPSIA limits lead/phthalates in children's apparel; GPSR mandates product safety in EU. |

| Data Privacy & Cybersecurity | GDPR, Data Breach Protection | GDPR fines up to 4% global revenue. Data breach cost averaged $4.73M (2024). |

| Corporate Governance | Listing Rules, Shareholder Rights, Disclosure | HKEX emphasizes transparency; timely disclosure vital for investor confidence. |

Environmental factors

The textile sector, including companies like Texwinca Holdings, is a significant consumer of water and energy. In 2024, global water stress is a growing concern, with projections indicating that by 2040, many regions will experience severe water scarcity. This directly impacts manufacturing processes, requiring substantial investment in water-saving technologies and efficient resource management to mitigate operational risks and environmental impact.

Texwinca Holdings' operational efficiency is directly tied to its capacity to address these resource challenges. As of early 2025, the industry is seeing increased regulatory pressure and consumer demand for sustainable practices. Companies that proactively invest in water recycling systems and energy-efficient machinery, as Texwinca is exploring, will likely gain a competitive advantage and reduce their environmental footprint.

The escalating issue of textile waste, estimated at over 92 million tons globally in 2023, is driving a significant shift towards circular economy principles. This necessitates companies like Texwinca to embrace recycling, upcycling, and product longevity.

Texwinca is under increasing pressure to minimize its waste footprint, with regulatory bodies and consumers demanding more sustainable practices. Exploring innovative end-of-life solutions for both finished goods and manufacturing by-products is becoming crucial for compliance and market competitiveness.

The intensifying global commitment to climate action, aiming for carbon neutrality, is driving more stringent regulations on industrial greenhouse gas emissions. Texwinca Holdings will likely face increased compliance costs and operational adjustments to meet these evolving environmental standards.

For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully operational from 2026, will impose costs on imports based on their embedded carbon emissions, potentially impacting Texwinca's supply chain and export markets if not addressed proactively. This necessitates strategic investments in cleaner production methods and potentially renewable energy sources to mitigate financial and regulatory risks.

Sustainable Sourcing of Raw Materials

Texwinca Holdings faces increasing pressure to adopt sustainable sourcing for its raw materials. The global market for sustainable apparel is projected to reach $150 billion by 2025, driven by consumer demand for ethically produced goods. This trend necessitates a focus on materials like organic cotton, which uses significantly less water and pesticides than conventional cotton. For instance, organic cotton farming can reduce water consumption by up to 91% compared to conventional methods.

Ensuring the traceability and certification of these materials is crucial for maintaining brand reputation and meeting regulatory requirements. Certifications such as the Global Organic Textile Standard (GOTS) or the Recycled Claim Standard (RCS) provide assurance to consumers and stakeholders about the environmental and social impact of the supply chain. By 2024, over 60% of apparel brands are expected to have robust traceability systems in place.

- Growing consumer preference for eco-friendly products is a significant environmental factor impacting Texwinca.

- The demand for organic cotton and recycled synthetic fibers is on the rise, with the global sustainable apparel market expected to hit $150 billion by 2025.

- Traceability and certifications like GOTS are becoming essential for brand integrity and supply chain transparency.

- By 2024, more than 60% of apparel brands are anticipated to implement comprehensive traceability mechanisms.

Chemical Management and Wastewater Treatment

Texwinca Holdings faces significant environmental considerations related to chemical management in its dyeing and finishing operations. The extensive use of various chemicals, while crucial for product quality, inherently carries environmental risks if not managed meticulously. This necessitates a proactive approach to ensure compliance and minimize ecological impact.

Stringent regulations governing both chemical usage and the treatment of industrial wastewater are a key factor. For instance, in many regions, discharge limits for specific chemical compounds in wastewater are becoming increasingly restrictive, often requiring advanced treatment technologies. Companies like Texwinca must invest in and maintain robust management systems to adhere to these evolving standards and prevent pollution.

To address these challenges, Texwinca Holdings likely needs to focus on several areas:

- Investment in Advanced Wastewater Treatment: Upgrading or installing state-of-the-art facilities to effectively remove or neutralize harmful chemicals before discharge.

- Chemical Substitution and Optimization: Exploring and implementing the use of more environmentally friendly chemicals and optimizing existing processes to reduce overall chemical consumption.

- Compliance Monitoring and Reporting: Establishing rigorous internal monitoring systems to track chemical usage and wastewater quality, ensuring accurate and timely reporting to regulatory bodies.

- Supply Chain Due Diligence: Ensuring that chemical suppliers also adhere to high environmental standards and provide necessary safety and environmental data.

Environmental factors are increasingly shaping the textile industry, pushing companies like Texwinca Holdings towards greater sustainability. Global water stress is a growing concern, with the textile sector being a major water consumer, necessitating investments in water-saving technologies. The escalating issue of textile waste, estimated at over 92 million tons globally in 2023, is driving a shift towards circular economy principles, requiring Texwinca to embrace recycling and upcycling.

The intensifying global commitment to climate action is leading to more stringent regulations on industrial greenhouse gas emissions, potentially increasing compliance costs for Texwinca. For instance, the EU's Carbon Border Adjustment Mechanism, fully operational from 2026, will impact imports based on embedded carbon emissions. Texwinca faces pressure to adopt sustainable sourcing, with the global sustainable apparel market projected to reach $150 billion by 2025, driving demand for materials like organic cotton, which can reduce water consumption by up to 91%.

Chemical management in dyeing and finishing operations presents significant environmental risks, requiring compliance with increasingly restrictive wastewater discharge limits. Texwinca must invest in advanced wastewater treatment, chemical substitution, and robust monitoring systems to minimize ecological impact and adhere to evolving environmental standards.

| Environmental Factor | Impact on Texwinca Holdings | Key Data/Trend |

| Water Scarcity | Increased operational costs, need for water-saving tech | Global water stress growing; 2040 projections indicate severe scarcity in many regions. |

| Textile Waste | Pressure to adopt circular economy models | Over 92 million tons of textile waste globally in 2023. |

| Climate Change & Emissions | Potential compliance costs, need for cleaner production | EU CBAM operational from 2026 impacting carbon-intensive imports. |

| Sustainable Sourcing | Opportunity for market growth, brand reputation | Sustainable apparel market to reach $150 billion by 2025; organic cotton uses up to 91% less water. |

| Chemical Management | Need for advanced treatment and compliance | Stricter wastewater discharge limits for chemicals in many regions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Texwinca Holdings is built upon a robust foundation of data from reputable sources, including official government publications, international financial institutions, and leading market research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in accurate and current information.