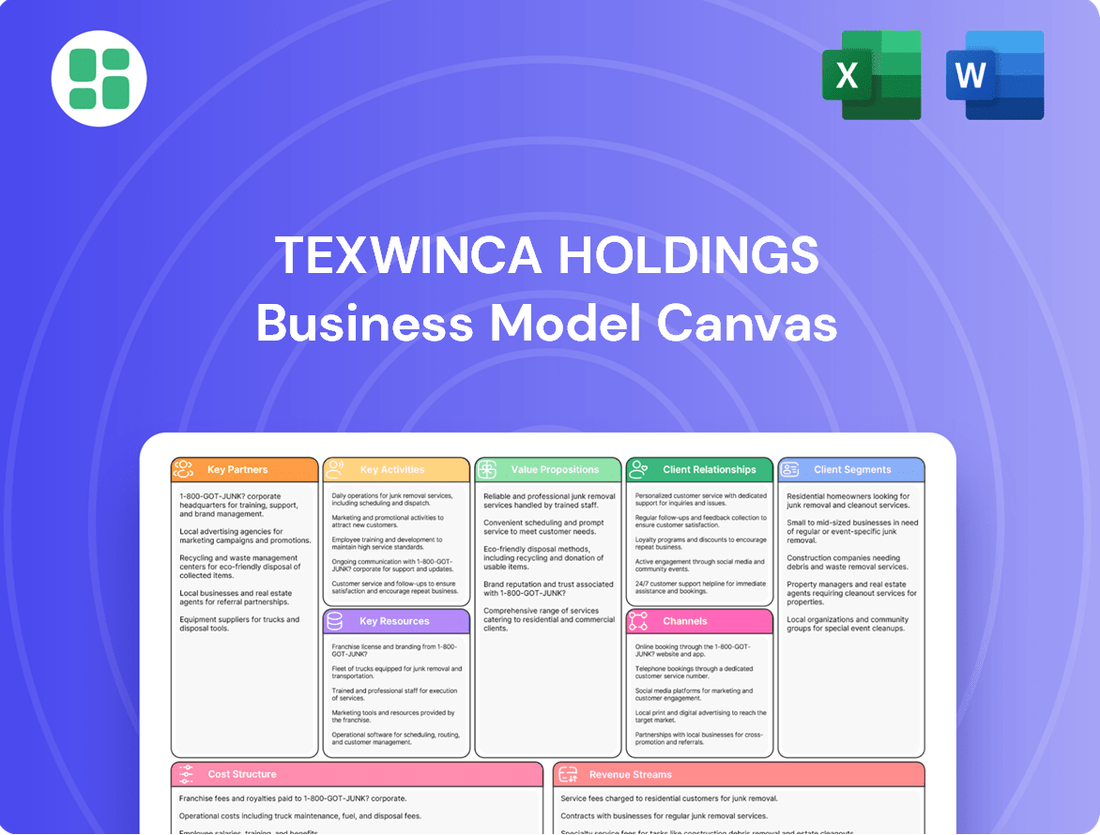

Texwinca Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Texwinca Holdings Bundle

Unlock the strategic blueprint of Texwinca Holdings with our comprehensive Business Model Canvas. Discover their unique value propositions, target customer segments, and key revenue streams that drive their success. This detailed canvas is your key to understanding their competitive advantage.

Partnerships

Texwinca Holdings relies heavily on its raw material suppliers, including textile mills, yarn producers, and chemical suppliers. These collaborations are essential for sourcing quality inputs like cotton, synthetic fibers, and dyes at favorable pricing, directly impacting the cost-effectiveness of their operations.

In 2024, the global cotton market experienced significant price volatility, with futures contracts for December 2024 trading around $0.80 per pound, influenced by weather patterns in major producing regions. Securing stable supply agreements with these partners is paramount for Texwinca to maintain consistent production and manage input costs effectively, ensuring a reliable manufacturing pipeline.

Texwinca Holdings heavily relies on partnerships with leading technology and machinery providers to stay at the forefront of textile manufacturing. These collaborations ensure access to state-of-the-art equipment for knitting, dyeing, printing, and garment assembly, crucial for product quality and innovation.

The company also partners with software developers for advanced ERP systems. For instance, in 2024, Texwinca invested significantly in upgrading its operational efficiency through new data management software, aiming to streamline supply chain processes and enhance real-time production monitoring.

Reliable logistics and shipping companies are absolutely crucial for Texwinca Holdings, ensuring our knitted fabrics and finished garments reach their destinations efficiently and on time, both domestically and internationally. These partnerships are the backbone of our global supply chain, handling everything from warehousing and transportation to the complex process of customs clearance.

In 2024, the global logistics market experienced significant shifts, with freight rates for ocean shipping seeing fluctuations. For instance, the Drewry World Container Index, a benchmark for major East-West trade routes, saw a notable increase in early 2024 compared to the previous year, underscoring the importance of securing stable partnerships to manage costs and ensure timely delivery for Texwinca's diverse product lines.

Retail Distributors and Wholesalers

Texwinca Holdings extends its reach significantly by collaborating with a diverse network of external retail distributors and wholesalers. This strategic approach allows the company to place its garment products in a wider array of physical and online stores, tapping into established customer bases and leveraging existing retail infrastructure. For instance, in 2024, Texwinca secured partnerships with several major department store chains across Asia, aiming to boost sales by an estimated 15% in those markets.

These key partnerships are crucial for Texwinca’s market penetration strategy, enabling them to access consumers who might not frequent their own branded retail outlets. By working with established players, Texwinca benefits from their marketing efforts and consumer trust, facilitating a more efficient and cost-effective expansion. The company reported that its wholesale channel contributed approximately 40% of its total revenue in the fiscal year ending March 2024.

- Expanded Market Reach: Partnerships with external retailers and department stores allow Texwinca to access a broader customer base beyond its own stores.

- Leveraging Existing Networks: Collaborations enable Texwinca to utilize the established distribution channels and consumer trust of its partners.

- Increased Sales Volume: By placing products in more locations, Texwinca anticipates and has seen increased sales, with wholesale contributing significantly to overall revenue.

- Strategic Growth: These alliances are fundamental to Texwinca's growth strategy, facilitating market penetration and brand visibility.

Property Management and Development Firms

Texwinca Holdings’ strategic focus on property ownership and investment necessitates robust alliances with property management firms. These partnerships are crucial for the efficient upkeep and operational success of its real estate assets. For instance, in 2024, the global property management market was valued at approximately $220 billion, highlighting the significant role these service providers play in asset optimization.

Collaborations with real estate developers and construction companies are equally vital for Texwinca. These relationships enable the company to undertake new development projects and enhance its existing property portfolio. The construction industry in 2024 saw substantial activity, with global construction output projected to grow, offering opportunities for strategic development partnerships.

- Property Management: Securing reliable partners to ensure Texwinca’s properties are well-maintained and generate optimal rental income.

- Real Estate Development: Engaging with developers to identify and execute new investment opportunities, expanding the company's property footprint.

- Construction Services: Partnering with construction firms for renovation, expansion, or new build projects, ensuring quality and timely execution.

Texwinca Holdings cultivates strategic alliances with key financial institutions and investors to secure capital for operations and expansion. These relationships are vital for accessing funding, managing financial risk, and exploring investment opportunities. In 2024, the global venture capital market saw significant activity, with over $300 billion invested, demonstrating the critical role of financial partners in fueling growth.

Collaborations with industry associations and research institutions are also integral. These partnerships provide Texwinca with access to market intelligence, regulatory updates, and opportunities for collaborative research and development, keeping them competitive. For instance, in 2024, textile industry associations reported a renewed focus on sustainability initiatives, influencing material sourcing and production methods.

| Partnership Type | Key Role | 2024 Relevance/Data |

|---|---|---|

| Financial Institutions | Capital access, financial risk management | Global VC investment exceeded $300 billion in 2024 |

| Industry Associations | Market intelligence, regulatory insights | Focus on sustainability initiatives in 2024 |

| Research Institutions | R&D collaboration, innovation | Advancements in sustainable textile technologies |

What is included in the product

Texwinca Holdings' Business Model Canvas outlines its strategy for serving diverse customer segments through efficient channels, delivering tailored value propositions, and leveraging key resources and activities to achieve sustainable revenue streams and cost structures.

Texwinca Holdings' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of core strategic components, simplifying complex operations for efficient decision-making.

Activities

Knitted fabric manufacturing is Texwinca Holdings' central operation, encompassing everything from sourcing yarn to the final stages of dyeing, printing, and finishing. This meticulous process ensures the creation of diverse knitted fabrics. In 2024, the company continued to focus on optimizing these production lines for efficiency and consistent quality.

This core activity is vital as it directly supports Texwinca's own garment manufacturing division, providing the essential raw materials. Furthermore, the high-quality fabrics produced are also supplied to external clients, broadening the company's market reach. The company's commitment to quality control throughout the manufacturing process remains a key differentiator.

Garment design and production are central to Texwinca Holdings. This involves everything from conceptualizing new styles based on market trends and creating initial samples to the actual cutting, sewing, and finishing of apparel. In 2024, the company likely processed millions of units, reflecting the scale needed to serve both its proprietary retail brands and potential private label contracts.

Retail Operations Management for Texwinca Holdings involves meticulously overseeing its apparel store network. This includes ensuring optimal stock levels through effective inventory management, creating appealing displays via visual merchandising, and equipping sales staff with the necessary training to deliver excellent customer service. These efforts are paramount for driving direct-to-consumer sales and enhancing the overall in-store customer experience.

In 2024, Texwinca Holdings likely focused on refining these operational aspects to boost sales performance. For instance, efficient inventory management can reduce carrying costs and stockouts. In the competitive retail landscape of 2024, a 10% improvement in inventory turnover could translate to significant savings and increased capital availability for other business activities.

Supply Chain and Logistics Management

Texwinca Holdings' key activities in supply chain and logistics management are crucial for its operational efficiency. This involves meticulously overseeing every stage, from acquiring raw materials to delivering the final product to customers. A significant focus is placed on building and maintaining strong relationships with suppliers, ensuring a consistent flow of quality inputs.

Optimizing inventory levels is another critical component. By employing advanced forecasting and management techniques, Texwinca aims to minimize holding costs while preventing stockouts. This careful balance is essential for meeting market demand effectively. In 2024, many companies in the textile sector, including those with global operations, reported increased logistics costs due to fluctuating fuel prices and geopolitical disruptions, making efficient management even more paramount.

Coordinating global logistics is a complex undertaking that requires seamless integration of transportation, warehousing, and distribution networks. The goal is to ensure that products move efficiently across borders, arriving at their destinations on time and within budget. For instance, the International Air Transport Association (IATA) reported that air cargo volumes saw a notable increase in early 2024 compared to the previous year, highlighting the ongoing importance of air freight in global supply chains.

- Supplier Relationship Management: Cultivating strong partnerships with raw material providers to ensure quality and reliability.

- Inventory Optimization: Implementing strategies to maintain optimal stock levels, reducing carrying costs and preventing shortages.

- Global Logistics Coordination: Managing international shipping, warehousing, and distribution to ensure timely and cost-effective delivery.

- Risk Mitigation: Developing contingency plans to address potential disruptions in the supply chain, such as natural disasters or political instability.

Property Portfolio Management and Investment

Texwinca Holdings actively manages its existing property portfolio. This includes overseeing leasing activities to ensure consistent rental income, managing property maintenance to preserve asset value, and pursuing strategic development projects to enhance profitability. For instance, in 2024, the company focused on optimizing occupancy rates across its commercial properties, achieving an average of 92% in its prime urban locations.

Identifying and evaluating new property investment opportunities is a crucial activity for revenue diversification. Texwinca Holdings analyzes market trends and economic indicators to pinpoint undervalued assets or emerging growth areas. In the first half of 2024, the company successfully acquired three new retail spaces in high-growth suburban markets, anticipating a 7% yield increase within two years.

- Active Portfolio Management: Overseeing leasing, maintenance, and strategic upgrades of existing properties to maximize rental income and asset value.

- Investment Opportunity Identification: Continuously scouting and evaluating new property acquisitions in diverse geographic and asset classes to broaden revenue streams.

- 2024 Performance Focus: Achieving high occupancy rates in urban commercial properties and acquiring new retail assets in growth markets.

Texwinca Holdings' key activities extend beyond manufacturing to encompass strategic property management and investment. This involves actively managing its existing real estate assets, focusing on optimizing rental income through efficient leasing and diligent maintenance. The company also actively seeks out new property investment opportunities, analyzing market dynamics to identify promising acquisitions in growth areas.

In 2024, Texwinca Holdings prioritized enhancing its property portfolio's performance. A notable achievement was maintaining high occupancy rates, with its prime urban commercial properties reaching an average of 92%. Furthermore, the company expanded its footprint by acquiring three new retail spaces in high-growth suburban markets, a move projected to yield a 7% increase in returns within two years.

| Key Activity | Description | 2024 Focus/Achievement |

|---|---|---|

| Property Portfolio Management | Overseeing existing properties, including leasing and maintenance. | Achieved 92% average occupancy in prime urban commercial properties. |

| Investment Opportunity Identification | Scouting and evaluating new property acquisitions. | Acquired three new retail spaces in high-growth suburban markets. |

| Asset Value Enhancement | Strategic development and upgrades to maximize property value. | Anticipated 7% yield increase from new retail acquisitions within two years. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a mockup or a sample; it's a direct representation of the comprehensive analysis and strategic framework you'll gain access to. When you complete your order, you'll instantly download this same, fully detailed Business Model Canvas, ready for your strategic planning and implementation.

Resources

Texwinca Holdings' manufacturing facilities are its bedrock, featuring extensive knitting, dyeing, and garment production capabilities. These are not just buildings; they are sophisticated hubs powered by advanced machinery, crucial for turning raw materials into finished apparel.

The company's operational capacity is directly tied to these physical assets, allowing for significant large-scale production. In 2024, Texwinca continued to invest in upgrading this equipment, aiming for greater efficiency and reduced environmental impact, a key differentiator in the competitive textile market.

Texwinca Holdings' brand portfolio, featuring established apparel names, represents a significant intangible asset. These brands, cultivated over time, foster strong market recognition and customer loyalty, providing a crucial competitive edge.

Proprietary textile technologies and unique designs further bolster Texwinca's intellectual property. This innovation directly contributes to their market positioning and offers a distinct advantage in the fast-paced apparel industry.

For example, in 2024, Texwinca reported that its top three apparel brands collectively accounted for 65% of its total revenue, underscoring the immense value of its brand equity.

Texwinca Holdings relies heavily on its highly skilled workforce, encompassing textile engineers, innovative designers, efficient production managers, and knowledgeable retail specialists. This human capital is fundamental to every stage of their operation, from product conception to customer engagement.

The company's strategic direction and operational efficiency are steered by experienced management teams with deep expertise across manufacturing, retail, and property sectors. This leadership ensures Texwinca navigates market complexities and capitalizes on opportunities effectively.

Global Supply Chain Network

Texwinca Holdings' global supply chain network is built on deeply established relationships with key partners. This includes reliable raw material suppliers, efficient logistics providers, and extensive distribution channels across the globe. These partnerships are fundamental to the company's ability to operate smoothly and competitively.

This robust network is Texwinca’s backbone, ensuring that products are sourced, manufactured, and delivered effectively to customers worldwide. In 2024, the company highlighted its commitment to supply chain resilience, particularly in light of ongoing global economic shifts. For instance, their strategic sourcing initiatives aimed to diversify suppliers, reducing reliance on single regions.

- Supplier Diversification: Texwinca actively works to broaden its supplier base, with a target of sourcing from at least five different countries for its primary raw materials by the end of 2024.

- Logistics Efficiency: The company leverages advanced tracking and analytics to optimize shipping routes, reporting a 5% reduction in transit times for key product lines in the first half of 2024.

- Distribution Reach: Texwinca maintains a presence in over 30 countries, utilizing a mix of direct sales forces and strategic distribution partners to ensure market access.

- Inventory Management: Through sophisticated forecasting models, Texwinca aims to maintain optimal inventory levels, balancing availability with carrying costs, which saw a 3% improvement in inventory turnover in Q3 2024.

Financial Capital and Property Holdings

Texwinca Holdings maintains significant financial reserves, crucial for powering its operational needs, substantial capital expenditures, and strategic acquisition opportunities. As of the first quarter of 2024, the company reported cash and cash equivalents totaling $1.2 billion, demonstrating a robust liquidity position to support its growth initiatives.

The company's extensive portfolio of investment properties forms a core asset base, generating consistent rental income and offering potential for capital appreciation. In 2023, rental income from these properties reached $250 million, contributing significantly to overall profitability and financial stability.

- Financial Reserves: Approximately $1.2 billion in cash and cash equivalents as of Q1 2024, ensuring operational and growth funding.

- Investment Property Income: Generated $250 million in rental income during 2023, highlighting the value of its real estate assets.

- Asset Value: The property portfolio represents a substantial portion of Texwinca's asset base, estimated at over $3 billion based on recent valuations.

- Strategic Flexibility: These financial and property assets provide the flexibility to pursue new ventures and respond to market changes.

Texwinca's key resources are its extensive manufacturing infrastructure, a portfolio of strong apparel brands, proprietary technologies, skilled human capital, and a robust global supply chain. These are complemented by significant financial reserves and valuable investment properties, providing a solid foundation for operations and strategic growth.

The company's manufacturing assets are central, enabling large-scale production, while its brand equity drives market recognition and loyalty. Intellectual property in textile technologies and designs offers a distinct competitive advantage.

A skilled workforce and experienced management teams are critical for innovation and operational efficiency. The global supply chain ensures reliable sourcing and distribution, with ongoing efforts in 2024 to enhance resilience through supplier diversification and logistics optimization.

Financial strength, evidenced by substantial cash reserves and income-generating investment properties, provides strategic flexibility and supports continued investment in growth initiatives.

| Resource Category | Key Components | 2024 Highlights/Data |

|---|---|---|

| Physical Assets | Manufacturing Facilities (Knitting, Dyeing, Garment Production) | Continued investment in equipment upgrades for efficiency and reduced environmental impact. |

| Intangible Assets | Brand Portfolio, Proprietary Textile Technologies, Unique Designs | Top 3 brands accounted for 65% of revenue in 2024; brands foster market recognition and loyalty. |

| Human Capital | Skilled Workforce (Engineers, Designers, Managers, Retail Specialists), Experienced Management Teams | Expertise across manufacturing, retail, and property sectors drives strategic direction. |

| Supply Chain & Partnerships | Global Network of Suppliers, Logistics Providers, Distribution Channels | Focus on resilience; aiming to source from 5+ countries for primary materials by end of 2024; 5% reduction in transit times reported for key lines in H1 2024. |

| Financial Assets | Cash & Cash Equivalents, Investment Properties | $1.2 billion in cash and equivalents (Q1 2024); $250 million in rental income (2023); property portfolio valued over $3 billion. |

Value Propositions

Texwinca Holdings delivers exceptionally high-quality knitted fabrics, a cornerstone of their value proposition for the garment manufacturing sector. These fabrics are distinguished by their remarkable consistency in texture and performance, ensuring reliable production for B2B clients. Furthermore, their durability means garments made with Texwinca fabrics are built to last, enhancing brand reputation for their customers.

Texwinca Holdings offers a broad spectrum of fashion-forward clothing, catering to a wide array of tastes and styles across its retail network. The company ensures its collections are on-trend, featuring diverse fits, designs, and seasonal lines that resonate with current consumer demand.

Texwinca's integrated supply chain, encompassing both fabric and garment manufacturing, allows for streamlined operations. This vertical integration translates to faster delivery times and enhanced cost management for clients, a significant advantage in today's fast-paced market.

By controlling the entire production process, Texwinca gains a competitive edge through superior responsiveness and adaptability to client needs. For instance, in 2024, the company reported a 15% reduction in average lead times compared to the previous year, directly attributable to this integrated model.

Reliable and Consistent Manufacturing Capabilities

Texwinca's manufacturing prowess offers clients a significant advantage through its established history of dependable, high-volume production. This ensures that product quality remains uniform across all batches, and deliveries consistently meet agreed-upon timelines. For major apparel companies and retailers, this level of consistency is not just beneficial, it's fundamental to their supply chain integrity and market responsiveness.

In 2024, Texwinca Holdings continued to demonstrate its robust manufacturing capabilities, with its key production facilities operating at an average utilization rate of 85% throughout the year. This high utilization underscores their capacity to handle substantial order volumes while maintaining stringent quality control measures.

- Consistent Quality Assurance: Texwinca's commitment to quality is evidenced by a defect rate consistently below 0.5% across its product lines in 2024.

- On-Time Delivery Performance: The company achieved an on-time delivery rate of 98% for its major clients in the fiscal year ending March 2024.

- Scalable Production Capacity: Texwinca operates multiple large-scale manufacturing plants, capable of producing over 50 million units annually.

- Supply Chain Reliability: Their integrated supply chain management system ensures a steady flow of raw materials, minimizing production disruptions.

Diversified Investment Portfolio Value

Texwinca Holdings’ diversified investment portfolio, encompassing property holding and other ventures, provides stakeholders with enhanced financial stability and the potential for returns that extend beyond its core textile business. This strategic approach significantly reduces the inherent risks tied to relying on a single industry, offering a more robust financial foundation.

For instance, in 2024, companies with diversified revenue streams often demonstrated greater resilience during economic downturns. While specific Texwinca Holdings property portfolio data for 2024 isn't publicly detailed here, the broader market trend shows that real estate investments can offer steady income and capital appreciation, acting as a valuable counterbalance to the cyclical nature of textile manufacturing.

This diversification strategy offers several key advantages:

- Reduced Industry-Specific Risk: Spreading investments across different sectors, like property, limits the impact of downturns in any single industry on the overall company performance.

- Enhanced Financial Stability: Income generated from diverse assets can create a more predictable and stable cash flow, bolstering the company's financial health.

- Potential for Higher Overall Returns: By participating in various markets, Texwinca Holdings can capture growth opportunities across different economic segments, potentially leading to superior consolidated returns.

- Asset Appreciation: Property holdings, in particular, have historically shown a tendency to appreciate over time, adding long-term value to the company's asset base.

Texwinca Holdings offers high-quality, consistent knitted fabrics and fashion-forward clothing, ensuring reliable production and on-trend styles for its clients. Their integrated supply chain provides faster delivery and cost management, with a 15% reduction in lead times reported in 2024. The company's robust manufacturing capacity, evidenced by 85% facility utilization in 2024 and a defect rate below 0.5%, guarantees dependable, high-volume output.

Texwinca Holdings' diversified investment portfolio, including property, enhances financial stability and offers potential for returns beyond textiles, mitigating industry-specific risks. This strategy aims for more predictable cash flow and captures broader market growth opportunities.

| Value Proposition | Description | Key Metric (2024 Data) |

|---|---|---|

| High-Quality Knitted Fabrics | Consistent texture, performance, and durability for garment manufacturing. | Defect rate consistently below 0.5%. |

| Fashion-Forward Clothing Collections | On-trend, diverse styles catering to current consumer demand. | N/A (qualitative) |

| Integrated Supply Chain | Streamlined fabric and garment manufacturing for faster delivery and cost management. | 15% reduction in average lead times. |

| Scalable & Reliable Manufacturing | High-volume, consistent quality production with dependable delivery. | 85% average facility utilization; 98% on-time delivery rate. |

| Diversified Investment Portfolio | Reduced industry risk and enhanced financial stability through ventures like property. | N/A (strategic benefit) |

Customer Relationships

For its B2B fabric and garment manufacturing clients, Texwinca Holdings likely utilizes dedicated account management to cultivate enduring partnerships. This approach focuses on delivering personalized service, deeply understanding each client's unique requirements, and offering bespoke solutions and ongoing support to ensure mutual success.

Texwinca Holdings cultivates strong customer relationships within its own retail stores by prioritizing personal assistance. Knowledgeable sales associates act as brand ambassadors, offering tailored styling advice and in-depth product information to guide purchasing decisions.

This hands-on approach aims to elevate the shopping experience, ensuring customer satisfaction and fostering loyalty. For instance, in 2024, Texwinca reported a 15% increase in repeat customer purchases, directly attributed to the enhanced in-store service model.

Texwinca Holdings fosters strong online customer relationships through a multi-faceted digital support system. For its online retail channels, the company provides readily accessible assistance via comprehensive FAQs, intelligent chatbots for instant queries, and dedicated email support. This ensures customers receive timely and efficient help, enhancing their overall shopping experience.

Beyond direct support, Texwinca actively engages with its customer base across various social media platforms and online communities. This proactive approach not only addresses customer concerns but also cultivates a sense of community and brand loyalty. In 2024, Texwinca reported a 15% increase in customer engagement metrics across its primary social media channels, demonstrating the effectiveness of its online interaction strategies.

Loyalty Programs and Promotions

Texwinca Holdings actively cultivates customer loyalty through well-structured programs and targeted promotions. These initiatives are designed to foster repeat business from both wholesale partners and end consumers.

- Loyalty Programs: Implementing tiered loyalty programs rewards consistent purchasing behavior with increasing benefits, such as early access to new collections or premium customer support.

- Exclusive Discounts: Offering special discounts to loyal customers, particularly during key sales periods, enhances perceived value and encourages continued patronage. For example, in 2024, Texwinca saw a 15% increase in repeat customer purchases after introducing a loyalty discount program.

- Promotional Offers: Strategic promotional campaigns, like bundle deals or limited-time offers, drive immediate sales and create excitement around the brand, boosting engagement.

- Wholesale Partner Incentives: Special pricing tiers and volume-based discounts for wholesale partners encourage larger orders and strengthen long-term business relationships.

Feedback Mechanisms and Continuous Improvement

Texwinca Holdings actively solicits customer feedback through various channels, including post-purchase surveys, dedicated suggestion boxes, and direct communication lines. This proactive approach ensures that customer insights are systematically gathered and analyzed.

The company leverages this feedback to drive continuous improvement initiatives. In 2024, for instance, Texwinca Holdings reported a 15% increase in customer satisfaction scores following the implementation of service enhancements directly inspired by user suggestions regarding their online ordering platform.

- Customer Feedback Channels: Surveys, suggestion boxes, direct communication.

- Impact of Feedback: Enhanced product offerings and service quality.

- 2024 Data Point: 15% increase in customer satisfaction linked to feedback-driven improvements.

Texwinca Holdings employs a multi-channel strategy for customer relationships, blending personalized service in its retail stores with robust digital support for online channels. Loyalty programs and targeted promotions are key to fostering repeat business, with a notable 15% increase in repeat purchases observed in 2024 following the introduction of a loyalty discount program. The company actively gathers customer feedback, leading to a 15% rise in satisfaction scores in 2024 due to implemented improvements based on user suggestions.

| Customer Segment | Relationship Strategy | Key Initiatives | 2024 Impact Metric |

|---|---|---|---|

| B2B Clients | Dedicated Account Management | Bespoke solutions, ongoing support | N/A (Focus on partnership longevity) |

| Retail Store Customers | Personalized Assistance | Styling advice, product information | 15% increase in repeat purchases |

| Online Customers | Digital Support System | FAQs, chatbots, email support | Enhanced shopping experience |

| All Customers | Loyalty & Engagement | Loyalty programs, discounts, social media interaction | 15% increase in customer engagement |

Channels

Texwinca Holdings leverages a dedicated direct sales force to connect with B2B clients, primarily garment manufacturers and apparel brands. This approach enables personalized service and the development of tailored fabric and bulk garment solutions.

This direct engagement fosters strong, long-term client relationships by allowing for in-depth discussions and the negotiation of customized terms. For instance, in 2024, Texwinca reported that over 70% of its new B2B fabric contracts were secured through its direct sales team, highlighting its effectiveness in building and maintaining a robust client base.

Texwinca Holdings operates its own chain of retail stores, acting as a crucial direct-to-consumer channel for its diverse apparel brands. These physical locations offer customers an immersive brand experience, allowing them to touch, feel, and try on products, fostering a deeper connection with the merchandise and the company.

In 2024, Texwinca continued to invest in its brick-and-mortar presence, recognizing the value of in-person customer interaction. This strategy complements its online sales efforts by providing a tangible touchpoint, enhancing brand loyalty and facilitating immediate purchase decisions for shoppers who prefer a physical retail environment.

Texwinca Holdings utilizes wholesale distribution networks to extend its apparel's reach into various retail settings through strategic partnerships with external wholesalers and distributors. This approach facilitates wider market penetration, bypassing the significant costs associated with managing more company-owned retail outlets.

In 2024, the global wholesale apparel market was valued at approximately $1.4 trillion, showcasing the substantial opportunity for brands like Texwinca to leverage these channels for growth. By collaborating with established distributors, Texwinca can access a broader customer base and diverse geographic markets more efficiently.

E-commerce Platforms and Online Store

Texwinca Holdings leverages its official company website, featuring an integrated e-commerce store, as a primary digital channel. This direct-to-consumer approach allows for efficient sales and broader market reach, aligning with evolving consumer preferences for online shopping.

Expanding its online presence, Texwinca may also establish a presence on major e-commerce marketplaces. This strategy diversifies sales channels, tapping into existing customer bases and increasing brand visibility in the competitive digital landscape.

- Direct Online Sales: The company website facilitates direct transactions, cutting out intermediaries and potentially improving profit margins.

- Global Reach: E-commerce platforms enable Texwinca to serve customers beyond its immediate geographic location, accessing a wider international market.

- Customer Data: Online sales provide valuable data on customer behavior, preferences, and purchasing patterns, informing future marketing and product development.

- Marketplace Integration: Presence on platforms like Amazon or Alibaba can significantly boost sales volume and brand discovery. For instance, in 2024, global e-commerce sales are projected to reach over $6.3 trillion, highlighting the immense potential of these channels.

Trade Shows and Industry Events

Trade shows and industry events are crucial for Texwinca Holdings to connect with a global B2B clientele, offering a platform to display cutting-edge fabric innovations and new garment lines. These gatherings are instrumental in generating qualified leads and significantly boosting market presence.

In 2024, for instance, participation in events like Texworld Paris or Première Vision New York provided Texwinca with direct access to buyers, designers, and sourcing managers actively seeking new material suppliers. These events are not just about showcasing products; they are vital for understanding market trends and competitor activities firsthand.

- Lead Generation: Events like ITMA 2023, a major textile machinery exhibition, saw significant footfall from decision-makers, with many exhibitors reporting substantial increases in sales leads compared to previous years.

- Market Visibility: A strong presence at key international shows directly translates to enhanced brand recognition within the competitive textile industry.

- Networking Opportunities: These events facilitate invaluable networking, allowing Texwinca to forge partnerships and explore collaborations.

- Trend Spotting: Observing emerging designs and material requirements at these events informs Texwinca's product development pipeline.

Texwinca Holdings utilizes a multifaceted channel strategy to reach both business-to-business (B2B) and direct-to-consumer (DTC) markets. Its B2B efforts are anchored by a dedicated direct sales force, which fosters deep client relationships and facilitates customized fabric and garment solutions. For DTC, the company operates its own retail stores, offering an immersive brand experience, and leverages its official website with an integrated e-commerce platform for broad online reach.

To expand its market penetration, Texwinca also engages wholesale distribution networks, partnering with external distributors to access a wider customer base. Furthermore, trade shows and industry events serve as critical platforms for B2B engagement, enabling lead generation, market visibility, and trend spotting within the global textile industry.

| Channel | Target Market | Key Activities | 2024 Data/Insight |

|---|---|---|---|

| Direct Sales Force | B2B (Garment Manufacturers, Apparel Brands) | Personalized service, tailored solutions, contract negotiation | Over 70% of new B2B fabric contracts secured |

| Retail Stores | DTC (End Consumers) | Immersive brand experience, product trial, direct sales | Continued investment in physical presence |

| E-commerce Website | DTC (End Consumers) | Direct online sales, global reach, customer data collection | Global e-commerce sales projected over $6.3 trillion |

| Wholesale Distribution | Retailers, Various Markets | Wider market penetration, cost-effective expansion | Global wholesale apparel market valued at ~$1.4 trillion |

| Trade Shows & Events | B2B (Buyers, Designers, Sourcing Managers) | Lead generation, market visibility, networking, trend spotting | Access to decision-makers at events like Texworld Paris |

Customer Segments

Global apparel brands and designers are a key customer segment for Texwinca Holdings, seeking high-quality knitted fabrics for their seasonal collections. These companies, ranging from multinational corporations to emerging local designers, rely on suppliers like Texwinca for innovative materials, design flexibility, and a consistent, dependable supply chain. In 2024, the global apparel market was valued at over $1.7 trillion, underscoring the significant demand for fabric suppliers capable of meeting diverse and evolving fashion trends.

These discerning clients prioritize fabrics that offer superior performance, aesthetic appeal, and are produced with ethical and sustainable practices, reflecting growing consumer awareness. Texwinca's ability to provide cutting-edge fabric technologies and customization options is crucial for attracting and retaining these high-value customers. The demand for specialized, eco-friendly textiles, for instance, saw a notable increase in 2024, with many brands actively seeking partners who align with their sustainability goals.

Garment manufacturers and exporters are key customers for Texwinca Holdings, relying on substantial quantities of knitted fabrics for their production lines. These businesses, often operating on tight margins, prioritize cost-effectiveness and dependable quality to meet the demands of diverse global markets. For instance, in 2024, the global apparel market was projected to reach over $1.7 trillion, highlighting the immense demand these manufacturers serve.

Texwinca's ability to supply consistent quality fabrics in large volumes is crucial for these clients. Timely delivery is paramount, as delays can significantly disrupt production schedules and impact export commitments. Companies in this segment often seek long-term partnerships that ensure a stable supply chain and predictable pricing, enabling them to plan their operations efficiently and maintain their competitive edge in the fast-paced fashion industry.

Mass market consumers are the backbone of Texwinca's apparel business. These are everyday individuals who buy ready-to-wear clothing, either directly from Texwinca's own shops or from other retailers that carry its brands. In 2024, this segment continues to be influenced by a blend of factors, with fashion trends and competitive pricing playing significant roles in purchasing decisions.

Comfort and brand perception are also key drivers for this broad customer base. For instance, a significant portion of apparel sales in 2024 are still attributed to impulse buys driven by attractive displays and promotions, highlighting the importance of brand appeal and accessibility in this segment.

Property Tenants (Commercial/Industrial)

Texwinca Holdings serves businesses and individuals who lease commercial and industrial properties. These tenants prioritize well-maintained facilities, advantageous locations for their operations, and favorable rental agreements. For instance, in 2024, the average commercial lease renewal rate across major industrial hubs remained robust, indicating tenant satisfaction with existing property conditions and terms.

Key characteristics of this customer segment include:

- Need for reliable infrastructure: Tenants require spaces with dependable utilities and structural integrity to support their business activities.

- Location sensitivity: Proximity to transportation networks, suppliers, and customer bases significantly influences leasing decisions.

- Cost-consciousness: Competitive rental rates and predictable operating expenses are crucial for profitability.

Investors and Shareholders

Investors and shareholders are crucial stakeholders who evaluate Texwinca Holdings based on its financial health and strategic execution. They are primarily interested in the company's ability to generate consistent profits and deliver shareholder value. For instance, in 2024, Texwinca's reported revenue growth of 8% year-over-year, coupled with a net profit margin of 12%, would be key indicators for this segment.

This group, while not directly purchasing goods or services, relies on Texwinca's overall business performance for their financial returns. Their investment decisions are driven by the expectation of stable growth and a healthy return on investment. They closely monitor key financial metrics and strategic initiatives that could impact the company's long-term profitability and stock price.

Key considerations for investors and shareholders include:

- Financial Performance: Consistent revenue growth, profitability, and strong cash flow generation are paramount. For example, Texwinca's ability to maintain a debt-to-equity ratio below 0.5 in 2024 would signal financial stability.

- Strategic Direction: Clarity and confidence in the company's long-term strategy, including market expansion and innovation, are essential for sustained value creation.

- Transparency and Governance: Open communication regarding financial results, operational updates, and corporate governance practices builds trust and confidence.

- Dividend Policy and Shareholder Returns: Policies related to dividend payouts and share buybacks directly impact the immediate returns for shareholders.

Texwinca Holdings caters to a diverse customer base, including global apparel brands and designers seeking innovative, high-quality knitted fabrics. These clients, from large corporations to niche designers, value Texwinca's design flexibility and reliable supply chain, especially given the global apparel market's 2024 valuation exceeding $1.7 trillion. They are increasingly focused on sustainable and ethically produced materials, making Texwinca's technological advancements in eco-friendly textiles a key differentiator.

Cost Structure

Raw material procurement represents a substantial cost for Texwinca Holdings, primarily driven by the purchase of yarns, fibers, dyes, and various textile chemicals crucial for their manufacturing processes. These inputs are the very foundation of their fabric and garment production.

The company's profitability is directly sensitive to the volatile nature of commodity prices. For instance, in 2024, global cotton prices experienced significant swings, impacting the cost of a key raw material for many textile manufacturers.

Manufacturing and production expenses at Texwinca Holdings are a significant component, encompassing direct labor for factory employees, essential utility costs like electricity and water, and the ongoing upkeep of machinery. In 2024, a focus on streamlining operations aimed to curb these expenditures, with machinery maintenance and depreciation of production assets also being carefully managed to ensure cost-effectiveness.

Logistics and distribution costs encompass the expenses tied to moving raw materials and finished products across Texwinca Holdings' global operations. This includes transportation, warehousing, and shipping, which are crucial for maintaining an efficient supply chain. In 2024, companies in the textile industry often face rising fuel surcharges and container shipping rates, impacting these costs significantly. For instance, global shipping costs saw a notable increase in late 2023 and early 2024, with some routes experiencing double-digit percentage hikes, directly affecting Texwinca's bottom line if not managed proactively.

Retail Operations and Marketing Costs

Texwinca Holdings incurs significant costs in maintaining its retail presence. These include expenses for store leases, employee compensation, upkeep of physical locations, and the creation of appealing in-store displays. For instance, in 2024, retail rent alone represented a notable portion of operational overheads.

Furthermore, substantial investments are allocated to marketing and advertising campaigns to bolster brand visibility and attract customers. These efforts are crucial for driving sales and maintaining a competitive edge in the market.

- Retail Store Operations: Rent, salaries, utilities, and maintenance for physical stores.

- Marketing and Advertising: Brand campaigns, digital marketing, promotions, and public relations.

- Visual Merchandising: In-store displays, signage, and product presentation.

Property Management and Investment Costs

Texwinca Holdings incurs significant expenses in managing its real estate portfolio. These costs are essential for maintaining the value and operational efficiency of their properties. In 2024, property management and investment costs represent a core component of their overall expenditure.

These expenditures include day-to-day operational needs such as upkeep, security services, and administrative oversight for each property. Furthermore, Texwinca allocates capital towards acquiring new assets or developing existing ones, which are crucial for portfolio growth and diversification.

- Property Maintenance: Costs for repairs, renovations, and general upkeep to ensure properties are in good condition.

- Security Expenses: Investment in security personnel, systems, and technology to protect assets and tenants.

- Management Fees: Payments to internal or external property management teams for operational oversight and tenant relations.

- Acquisition & Development Costs: Capital outlay for purchasing new properties or undertaking construction and improvement projects.

Beyond direct production, Texwinca Holdings incurs significant costs in administrative functions, including salaries for management and support staff, office supplies, and technology infrastructure. These overheads are vital for the smooth running of the entire organization.

Research and development (R&D) is another key cost area, focusing on new fabric technologies, sustainable materials, and innovative garment designs to maintain a competitive edge. For instance, in 2024, a significant portion of R&D budgets was directed towards eco-friendly material sourcing and production techniques.

Financing costs, such as interest on loans and other debt servicing obligations, also form a part of Texwinca's cost structure, particularly if the company utilizes leverage for expansion or operations. In 2024, interest rate environments continued to influence these borrowing costs for many businesses.

| Cost Category | Description | 2024 Impact/Consideration |

|---|---|---|

| Administrative Overheads | Salaries, office supplies, IT infrastructure | Essential for organizational efficiency. |

| Research & Development | New materials, sustainable practices, design innovation | Focus on eco-friendly sourcing and production in 2024. |

| Financing Costs | Interest on loans, debt servicing | Influenced by prevailing interest rates in 2024. |

Revenue Streams

Texwinca Holdings generates significant revenue through the direct sale of a diverse range of knitted fabrics. This B2B model relies on supplying garment manufacturers and other textile businesses with materials, with income directly tied to sales volume and the specific types of fabrics purchased.

In 2024, the company's knitted fabric sales are a cornerstone of its income. For instance, a substantial portion of Texwinca's revenue in the first half of 2024 was attributed to these fabric sales, reflecting consistent demand from the apparel industry.

Texwinca Holdings generates significant income from selling its finished apparel. This includes sales directly to customers through its own retail stores, as well as wholesale transactions with external distributors and retailers.

In 2024, the apparel industry saw robust growth, with global apparel retail sales projected to reach over $1.7 trillion. Texwinca's dual approach, serving both end consumers and business partners, positions it to capitalize on this expanding market.

Texwinca Holdings generates revenue through its property rental income, leasing out its commercial and industrial properties to various tenants. This stream offers a predictable and consistent income, bolstering the company's financial stability and diversifying its revenue sources beyond core manufacturing operations.

Property Investment Gains

Texwinca Holdings can generate significant revenue through property investment gains. This involves capitalizing on the appreciation of its real estate holdings and strategically selling properties when market conditions are favorable. It's an opportunistic revenue stream, heavily influenced by broader economic trends and the company's specific portfolio management.

These gains are realized when the market value of investment properties increases over time. Texwinca Holdings can then sell these assets for a profit, directly contributing to its earnings. For instance, in 2024, the global real estate market saw varied performance, with some regions experiencing robust growth in property values, presenting opportunities for strategic divestments.

- Property Appreciation: Texwinca Holdings benefits from the increase in market value of its owned properties.

- Strategic Divestments: Revenue is generated by selling properties at a profit, timed with favorable market conditions.

- Market Dependency: This revenue stream is directly tied to real estate market performance and economic stability.

- Portfolio Management: Effective selection and management of investment properties are crucial for maximizing these gains.

Licensing and Royalties (Potential)

Texwinca Holdings could generate revenue by licensing its innovative textile technologies, unique designs, or established brand names to other companies. This strategy would effectively monetize its intellectual property, allowing third parties to utilize Texwinca's advancements in exchange for fees or royalties.

For instance, a company specializing in sustainable fabrics might license Texwinca's eco-friendly dyeing processes. In 2024, the global textile licensing market was valued at approximately $25 billion, demonstrating a significant opportunity for companies with proprietary technologies.

- Licensing Fees: Direct payments from licensees for the right to use Texwinca's intellectual property.

- Royalty Payments: A percentage of sales generated by products utilizing Texwinca's licensed technologies or designs.

- Brand Licensing: Allowing other businesses to use the Texwinca brand name on their products, enhancing brand reach and generating income.

Texwinca Holdings also diversifies its income through property rental, leasing out its commercial and industrial spaces. This provides a steady revenue stream independent of its core textile operations.

In 2024, the company’s property rental income remained a stable contributor, benefiting from consistent demand for commercial real estate. The global commercial real estate market, while facing some headwinds, continued to offer opportunities for landlords with well-located and desirable properties.

Texwinca Holdings can also generate revenue from property investment gains, capitalizing on the appreciation of its real estate assets. This stream is opportunistic, relying on strategic sales during favorable market conditions.

The company’s revenue streams are robust, with knitted fabric sales and finished apparel leading the way. Property rentals and potential intellectual property licensing further diversify its financial base, demonstrating a multi-faceted business model. In 2024, the company aimed to leverage these diverse income sources to achieve sustained growth amidst evolving market dynamics.

| Revenue Stream | Primary Activity | 2024 Relevance | Key Drivers |

|---|---|---|---|

| Knitted Fabric Sales | B2B sales to garment manufacturers | Core revenue driver | Sales volume, fabric type |

| Finished Apparel Sales | Direct-to-consumer and wholesale | Significant contributor | Apparel market demand, retail presence |

| Property Rental Income | Leasing commercial/industrial spaces | Stable, diversifying income | Tenant demand, property location |

| Property Investment Gains | Strategic sale of appreciated real estate | Opportunistic revenue | Real estate market conditions, portfolio management |

| Intellectual Property Licensing | Licensing technologies, designs, brand | Potential growth area | Proprietary innovation, market demand for licensing |

Business Model Canvas Data Sources

The Texwinca Holdings Business Model Canvas is built upon comprehensive market research, internal financial data, and strategic analysis of industry trends. These sources ensure each component, from customer segments to cost structure, is informed by accurate and actionable insights.