Telesat SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telesat Bundle

Telesat's innovative LEO satellite constellation presents a significant strength, poised to disrupt the global connectivity market. However, understanding the full scope of their competitive landscape and potential regulatory hurdles requires a deeper dive.

Want the full story behind Telesat's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Telesat boasts a significant strength with its established global presence, underpinned by a robust fleet of geostationary (GEO) satellites. This extensive infrastructure allows the company to deliver essential connectivity services to a wide array of clients, encompassing businesses, government entities, and various communities across the globe.

This operational capability translates into a stable and reliable revenue stream, solidifying Telesat's position as a key player in the satellite communications industry. The company's commitment to maintaining this advanced fleet provides a strong foundation for its market operations and future growth initiatives.

Further demonstrating the value of this established asset, Telesat reported a substantial GEO backlog amounting to approximately $1.0 billion as of March 31, 2025. This figure highlights the ongoing demand for its services and the company's ability to secure long-term contracts, underscoring the strategic importance of its GEO fleet.

Telesat is significantly advancing its Lightspeed constellation, a cutting-edge Low Earth Orbit (LEO) satellite network. This initiative is geared towards providing robust, low-latency broadband, placing Telesat as a key player in the expanding satellite communications market and meeting the growing worldwide need for faster internet access.

The Lightspeed project is demonstrating considerable momentum, evidenced by the successful completion of its Preliminary Design Review in December 2024. This milestone indicates substantial progress in developing a next-generation network designed for high-capacity, low-latency connectivity.

Telesat's Lightspeed project has secured a significant financial boost with $2.54 billion in loan financing from the Canadian and Quebec governments, fully covering the network's funding needs. This substantial government backing underscores the strategic national importance of Lightspeed, particularly for enhancing digital connectivity and supporting 5G infrastructure.

This considerable financial commitment from the government not only de-risks the Lightspeed project but also signals strong confidence in its potential to bridge the digital divide and bolster national security objectives.

Strategic Partnerships and Commercial Backlog for Lightspeed

Telesat's Lightspeed initiative is bolstered by significant strategic partnerships and a substantial commercial backlog, showcasing strong market traction. Key multi-year agreements have been secured with prominent entities such as Viasat, Orange, and ADN Telecom, validating the demand for Lightspeed services even in the pre-deployment phase.

This commercial validation translates into a robust financial outlook. As of May 5, 2025, Telesat reported a contracted backlog for its Lightspeed low Earth orbit (LEO) services amounting to approximately $1.1 billion. This figure represents a clear indicator of future revenue streams and the commercial viability of Telesat's LEO constellation.

The strategic partnerships and contracted backlog highlight several key strengths:

- Market Validation: Agreements with major industry players like Viasat and Orange demonstrate strong market acceptance and confidence in Lightspeed's capabilities.

- Revenue Visibility: The $1.1 billion contracted LEO backlog as of May 2025 provides significant visibility into future revenue, de-risking the project's financial prospects.

- Commercial Momentum: Securing these agreements before full Lightspeed deployment suggests a powerful commercial strategy and a competitive advantage in the LEO market.

Focus on Enterprise-Grade Services and Security

Telesat's Lightspeed network is specifically engineered for demanding enterprise clients in sectors like telecommunications, government, and aviation, providing guaranteed Service Level Agreements (SLAs) that many consumer-oriented LEO providers do not offer. This focus on enterprise-grade services ensures reliability and performance crucial for critical operations.

Security is a cornerstone of the Lightspeed design, incorporating over 400 cybersecurity controls. This robust security posture is critical for attracting and serving defense and government clients who require high security classifications for their sensitive data and communications.

- Enterprise-Grade Focus: Lightspeed targets telecom, government, and aeronautical sectors with guaranteed SLAs, differentiating from consumer LEO services.

- Robust Cybersecurity: The network integrates over 400 cybersecurity controls to achieve high security classifications, appealing to defense and government clients.

Telesat's established global network of geostationary satellites represents a significant strength, providing reliable connectivity to a diverse clientele. This robust infrastructure underpins a stable revenue stream, further solidified by a GEO backlog of approximately $1.0 billion as of March 31, 2025, indicating sustained demand and long-term contracts.

The company's forward-looking Lightspeed LEO constellation is a key strategic asset, designed to deliver high-performance broadband. The project has achieved critical milestones, including its Preliminary Design Review in December 2024, and secured $2.54 billion in government financing, highlighting national strategic importance and de-risking its development.

Lightspeed benefits from strong market validation, evidenced by a $1.1 billion contracted backlog for LEO services as of May 5, 2025, and strategic partnerships with major players like Viasat and Orange. This demonstrates significant commercial momentum and future revenue visibility.

Telesat's focus on enterprise-grade services for sectors like telecommunications and government, coupled with over 400 cybersecurity controls in Lightspeed, positions it to meet the stringent demands of critical applications and sensitive data handling.

| Asset | Status/Value | Key Feature |

|---|---|---|

| GEO Fleet | $1.0 billion backlog (as of March 31, 2025) | Established global presence, stable revenue |

| Lightspeed LEO | $1.1 billion contracted backlog (as of May 5, 2025) | Low-latency broadband, enterprise-grade focus |

| Lightspeed Funding | $2.54 billion government financing | National strategic importance, project de-risking |

| Lightspeed Security | Over 400 cybersecurity controls | High security classifications for government/defense |

What is included in the product

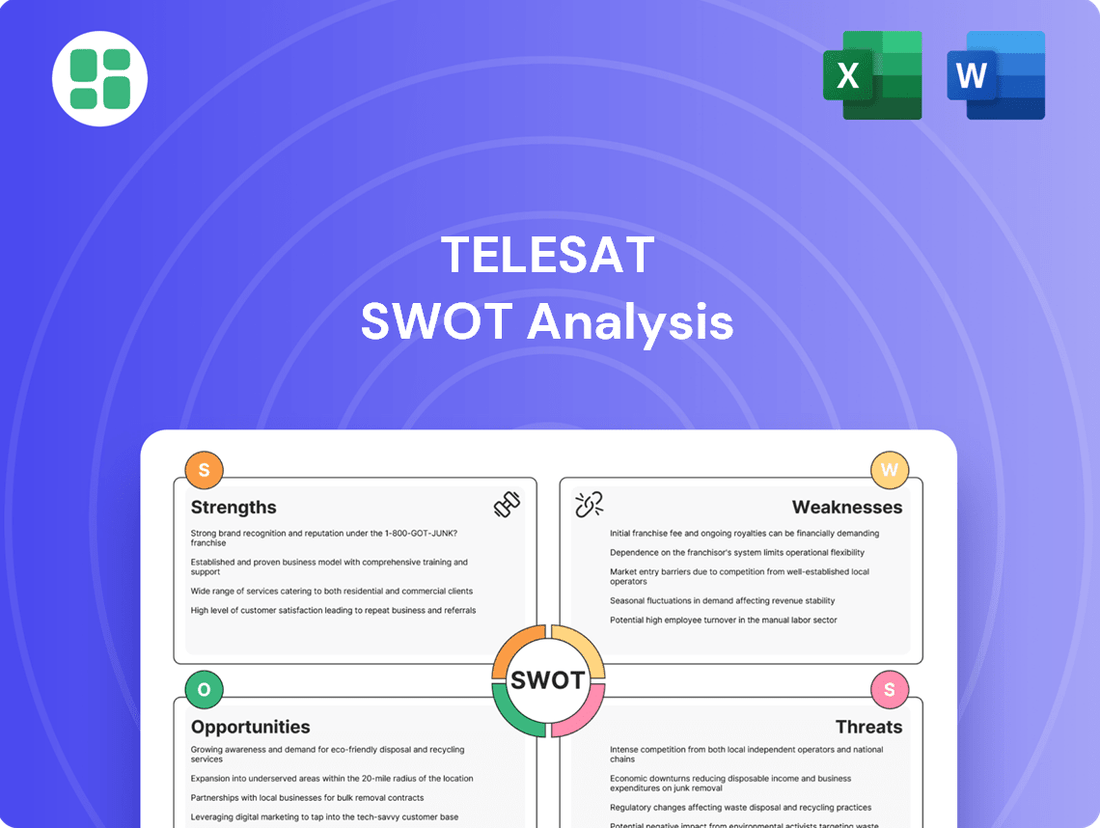

Analyzes Telesat’s competitive position through key internal and external factors, highlighting its strengths in established satellite networks and opportunities in emerging markets, while acknowledging weaknesses in technological adoption and threats from new entrants.

Uncovers critical competitive advantages and potential threats to proactively address market challenges.

Weaknesses

Telesat's traditional geostationary (GEO) satellite business is facing a significant revenue decline. This downturn is largely attributed to the shrinking market for direct-to-home (DTH) satellite video contracts and reduced enterprise revenues. This segment's performance is a key weakness for the company.

The financial impact of this weakness is evident in the company's recent performance. For the full year 2024, Telesat's consolidated revenue saw a substantial decrease of 19% when compared to the previous year. This trend continued into the first quarter of 2025, with revenue declining a further 23% compared to the first quarter of 2024.

The development of Telesat Lightspeed demands significant financial commitment. For 2025, capital expenditures are estimated between $900 million and $1.1 billion, with almost all of this directed towards the Lightspeed project. This substantial upfront investment is a key weakness.

Beyond the initial build, Lightspeed will also incur considerable ongoing costs. Operating expenses for the Low Earth Orbit (LEO) constellation are forecast to rise sharply in 2025, which will put pressure on the company's Adjusted EBITDA. These escalating operating expenses present a continuous financial challenge.

Telesat's significant debt burden presents a notable weakness, with a US$1.9 billion senior secured term loan and US$500 million in senior secured notes maturing in December 2026. This substantial upcoming repayment looms large, especially given the continued softness in its traditional Geostationary (GEO) satellite business.

The company faces considerable refinancing risk, as there is uncertainty about its capacity to secure new financing at favorable terms before its Lightspeed constellation begins generating substantial revenue. This cash flow is not anticipated to materialize until 2027, creating a potential funding gap.

Project Delays and Execution Risks for Lightspeed

Lightspeed, Telesat's ambitious low-Earth orbit (LEO) satellite constellation, has encountered significant hurdles. The service debut has been postponed to at least 2026, a stark indicator of the project's current challenges. These delays are primarily attributed to manufacturing issues and ongoing supply chain disruptions, which have proven more persistent than initially anticipated.

Despite securing necessary funding and completing preliminary design reviews, the inherent complexity of deploying a large-scale LEO constellation presents substantial execution risks. These risks include the potential for unforeseen technical failures during satellite production or launch, or further supply chain bottlenecks that could push the timeline back even further.

- Project Delays: Lightspeed service debut pushed to at least 2026.

- Root Causes: Manufacturing issues and supply chain challenges are the primary drivers of delays.

- Execution Risks: Complex LEO constellation deployment carries inherent technical and logistical risks.

- Financial Impact: While funding is secured, further delays could increase project costs and impact revenue generation timelines.

Increased Operating Expenses in LEO Segment

The ongoing development and deployment of Telesat's Lightspeed program are significantly driving up operating expenses within its Low Earth Orbit (LEO) segment. This includes substantial investments in personnel, leading to higher wages and benefits costs, alongside increased spending on professional services and external expertise.

These escalating expenditures are a primary factor contributing to a projected notable decline in consolidated Adjusted EBITDA for 2025 when compared to the 2024 figures. Analysts anticipate this trend will impact profitability in the near term.

- Increased LEO Operating Expenditures: The ramp-up of the Lightspeed program is directly causing higher operating costs in the LEO segment.

- Personnel Cost Growth: A significant portion of this increase stems from elevated wages and benefits for the growing team involved in Lightspeed.

- Professional Fees: Additional expenses are being incurred due to increased reliance on professional fees for project support and specialized services.

- Projected EBITDA Decline: These rising costs are expected to lead to a substantial decrease in consolidated Adjusted EBITDA for 2025 compared to 2024.

Telesat's traditional GEO business is experiencing a significant revenue decline, with consolidated revenue down 19% in 2024 and a further 23% in Q1 2025, largely due to shrinking demand for DTH video contracts and enterprise services.

The company faces substantial refinancing risk with US$1.9 billion in senior secured term loans and US$500 million in senior secured notes due in December 2026, creating a potential funding gap until Lightspeed revenue materializes in 2027.

The Lightspeed LEO constellation's service debut has been delayed to at least 2026 due to manufacturing and supply chain issues, introducing significant execution risks for this complex project.

Escalating operating expenses for Lightspeed, driven by personnel and professional services, are expected to cause a notable decline in consolidated Adjusted EBITDA for 2025 compared to 2024.

| Financial Metric | 2024 (Full Year) | Q1 2025 | Notes |

|---|---|---|---|

| Consolidated Revenue Change | -19% | -23% (vs Q1 2024) | Reflects GEO business decline |

| Lightspeed CapEx (2025 Est.) | $900M - $1.1B | N/A | Primarily for Lightspeed |

| Debt Maturities | N/A | US$1.9B Term Loan, US$500M Notes (Dec 2026) | Significant refinancing risk |

Same Document Delivered

Telesat SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global appetite for robust internet access is surging, especially in areas lacking reliable broadband. This demand extends to critical sectors such as 5G network expansion, the Internet of Things (IoT), and ensuring seamless, high-speed connections for flights and ships. The market is ripe for solutions that can deliver on both capacity and speed.

Telesat's Lightspeed network is strategically positioned to capitalize on this trend. Its low-latency, high-capacity LEO satellite constellation is purpose-built to meet these escalating connectivity requirements. This offers a significant opportunity for Telesat to capture market share by providing essential infrastructure.

By 2025, the global broadband market is projected to reach hundreds of billions of dollars, with a significant portion driven by enterprise and specialized applications. Telesat’s LEO network directly addresses the need for advanced connectivity that traditional terrestrial networks struggle to provide in many regions.

Telesat's Lightspeed constellation presents a significant opportunity to tap into new markets beyond its established geostationary (GEO) services. By offering fiber-like speeds and guaranteed performance, Lightspeed enables Telesat to target lucrative segments like commercial aviation, maritime operations, enterprise networks, and defense applications.

This expansion is already gaining traction, with Telesat announcing agreements with key players such as Viasat, Orange, and ADN Telecom. These partnerships are crucial for demonstrating Lightspeed's capabilities and securing early adoption, paving the way for broader market penetration and revenue diversification in the coming years.

Telesat's Lightspeed constellation is strategically positioned to support government and defense modernization initiatives, particularly within Canada and allied nations. This alignment with national security priorities, including contributions to NATO and NORAD modernization efforts, opens doors for substantial, long-term government contracts. For instance, Canada's defense budget for 2024-2025 includes significant investments in advanced communication and surveillance technologies, areas where Lightspeed can provide critical capabilities.

Leveraging AI and Advanced Network Orchestration

Telesat's Lightspeed network is set to integrate a sophisticated Constellation Network Operating System (CNOS), powered by machine learning and artificial intelligence. This AI-driven system is designed to intelligently manage customer traffic and enable autonomous satellite operations, promising a significant leap in efficiency and service quality.

This advanced technological backbone offers a distinct competitive advantage. By leveraging AI, Telesat can achieve highly optimized service delivery, ensuring seamless connectivity and rapid response times for its clients. Furthermore, the AI capabilities are expected to bolster network security, a critical factor in the satellite communications industry.

- AI-Powered Network Optimization: Lightspeed's CNOS will utilize machine learning for dynamic traffic routing, enhancing bandwidth utilization and reducing latency.

- Autonomous Satellite Operations: AI will enable self-management of satellite functions, improving reliability and reducing the need for constant human intervention.

- Enhanced Security Features: Machine learning algorithms can proactively identify and neutralize cyber threats, safeguarding network integrity.

- Market Differentiation: These advanced capabilities position Telesat to offer superior performance and security, setting it apart from competitors in the global satellite market.

Strategic Partnerships and Integration with Existing Networks

Telesat's strategic approach to partnering with existing service providers and integrating its Lightspeed network into their portfolios is a key opportunity for swift market penetration. This strategy is exemplified by collaborations that allow for multi-orbit solutions, such as those with companies like Viasat, which can leverage Telesat's capabilities alongside their own offerings. This integration facilitates a more comprehensive service for end-users and accelerates Lightspeed's adoption by tapping into established customer bases.

The network's adherence to MEF 3.0 Layer 2 Carrier Ethernet standards is another significant advantage. This standardization simplifies the process of merging Lightspeed with existing terrestrial networks, paving the way for seamless hybrid 5G infrastructures. Such interoperability is crucial for building robust and flexible connectivity solutions that support both fixed and mobile services, enhancing the overall value proposition for telecommunications providers.

This focus on integration and standardization directly addresses the growing demand for advanced connectivity. For instance, the global 5G services market was valued at approximately $56.07 billion in 2023 and is projected to grow substantially. By making Lightspeed easily compatible with existing infrastructure, Telesat positions itself to capture a significant share of this expanding market, offering providers a clear path to upgrade their networks.

- Facilitates rapid market adoption by leveraging established service provider networks.

- Streamlines integration with terrestrial networks through MEF 3.0 standards.

- Enables hybrid 5G infrastructures for fixed and mobile services.

- Positions Telesat to capitalize on the growing global 5G market.

Telesat's Lightspeed network is poised to capitalize on the increasing demand for high-speed, low-latency connectivity across various sectors. The company is well-positioned to serve growing markets such as 5G expansion, IoT, and advanced mobility solutions for aviation and maritime industries. By 2025, the global broadband market is expected to see significant growth, with enterprise and specialized applications driving a substantial portion of this expansion, creating a prime opportunity for Telesat's advanced satellite capabilities.

The strategic partnerships Telesat is forging, including those with Viasat and Orange, are crucial for accelerating Lightspeed's market penetration. These collaborations not only validate the network's performance but also provide access to established customer bases, facilitating early adoption and revenue generation. This approach allows Telesat to offer integrated, multi-orbit solutions, enhancing its value proposition to telecommunications providers.

Furthermore, Telesat's commitment to adhering to MEF 3.0 standards is a key enabler for seamless integration with existing terrestrial networks. This interoperability is vital for building robust hybrid 5G infrastructures, a critical requirement for the evolving telecommunications landscape. The global 5G services market, valued at approximately $56.07 billion in 2023, presents a substantial opportunity for Telesat to capture market share by offering compatible and advanced connectivity solutions.

Telesat's Lightspeed constellation offers a unique opportunity to support government and defense modernization efforts, particularly in Canada and allied nations. Aligning with national security priorities, such as contributions to NATO and NORAD modernization, can lead to substantial long-term government contracts. Canada's defense budget for 2024-2025, with its focus on advanced communication technologies, underscores the potential for Telesat's capabilities in this strategic sector.

Threats

The low Earth orbit (LEO) satellite market is incredibly crowded. Companies like SpaceX with its Starlink constellation and OneWeb have a significant head start, already operating with substantial capacity. This existing scale gives them a distinct advantage in terms of market penetration and potential pricing strategies.

This fierce competition poses a direct threat to Telesat's Lightspeed project. It could limit Lightspeed's ability to capture a significant market share, potentially forcing them to lower prices to remain competitive. This, in turn, could negatively impact Telesat's profitability and its overall return on investment for the Lightspeed initiative.

By the end of 2024, Starlink alone had launched over 6,000 satellites, far surpassing any other LEO constellation. This massive deployment provides Starlink with a considerable advantage in terms of coverage and service availability, making it a formidable competitor for Telesat Lightspeed as it aims to enter the market.

The satellite industry is moving at lightning speed. Telesat's existing geostationary (GEO) satellites could become less competitive as newer technologies emerge, potentially impacting its market position. This rapid pace of innovation means even its planned Lightspeed LEO constellation might face challenges from even more advanced systems or alternative connectivity solutions down the line.

For instance, the development of more efficient propulsion systems and miniaturized satellite components are constantly pushing the boundaries of what's possible. Companies are investing billions in next-generation satellite technology, with projections suggesting the global satellite communication market could reach over $400 billion by 2030, highlighting the intense competitive landscape Telesat operates within.

Telesat faces significant threats from evolving international regulations and the ongoing competition for vital orbital spectrum. Navigating the patchwork of national and international rules governing satellite operations is a constant challenge, with any shifts potentially impacting service delivery and future growth. For instance, the International Telecommunication Union (ITU) plays a crucial role in spectrum allocation, and changes in their policies or the outcomes of frequency coordination meetings could directly affect Telesat's ability to launch and operate its satellites.

Economic Downturns and Customer Spending Reductions

Global economic downturns pose a significant threat, potentially reducing customer spending on satellite services. This was evident in recent periods where Telesat experienced a dip in certain enterprise and direct-to-home (DTH) revenues, reflecting broader market pressures.

A prolonged economic slowdown could further strain Telesat's revenue streams. This economic climate might also slow down the adoption rate of new, crucial services like the Lightspeed constellation, impacting future growth projections.

- Economic Headwinds: Global economic slowdowns can lead to reduced discretionary spending by businesses and consumers.

- Revenue Pressure: A decline in customer spending directly impacts revenue from existing satellite services.

- Adoption Rate Impact: Economic uncertainty can delay or reduce investment in new technologies like Lightspeed.

- Industry Sensitivity: The satellite industry, particularly enterprise and DTH segments, can be sensitive to economic cycles.

Launch Risks and In-Orbit Failures

Telesat faces significant launch risks for its Lightspeed LEO constellation. Historically, the space launch industry experiences failure rates, with some estimates suggesting around 5% of launches experience anomalies. A launch failure for a critical component of the Lightspeed constellation could result in substantial financial losses, estimated in the hundreds of millions of dollars per launch, and push back deployment timelines significantly.

Beyond launch, in-orbit failures or degraded satellite performance pose a threat. While satellite reliability has improved, component failures or environmental factors like space debris can impact operational status. For a constellation like Lightspeed, where interconnectedness is key, even a few underperforming satellites could disrupt network performance and impact service delivery, potentially leading to customer churn and revenue shortfalls.

- Launch Failure Cost: A single launch failure for a constellation of Lightspeed's scale could cost upwards of $100 million, including the satellite itself and associated launch services.

- In-Orbit Reliability: While specific data for LEO constellations is still emerging, general satellite mission success rates for complex systems can range from 90-95%, indicating potential for in-orbit issues.

- Deployment Delays: Each launch failure or significant in-orbit issue could delay the full operational capability of Lightspeed by 6-12 months, impacting revenue generation and competitive positioning.

The intense competition in the Low Earth Orbit (LEO) satellite market, particularly from SpaceX's Starlink and OneWeb, presents a significant challenge. Starlink's substantial satellite deployment, exceeding 6,000 by late 2024, gives it a considerable advantage in coverage and service availability, potentially limiting Telesat Lightspeed's market share and profitability.

Rapid technological advancements in the satellite industry threaten the competitiveness of Telesat's existing geostationary (GEO) satellites and could even challenge its future LEO constellation. The global satellite communication market is projected to exceed $400 billion by 2030, indicating aggressive investment and innovation from competitors.

Navigating complex and evolving international regulations, including spectrum allocation by bodies like the ITU, poses an ongoing threat to Telesat's operations and growth. Furthermore, global economic downturns can reduce customer spending, impacting revenues from existing services and potentially slowing the adoption of new initiatives like Lightspeed.

Telesat faces considerable risks associated with satellite launches, including potential failures that could cost hundreds of millions of dollars per launch and cause significant deployment delays. In-orbit failures or performance degradation of Lightspeed satellites could also disrupt network performance, leading to customer dissatisfaction and revenue loss.

SWOT Analysis Data Sources

This Telesat SWOT analysis is built on a foundation of verified financial disclosures, comprehensive market intelligence, and expert industry evaluations. These sources ensure a data-driven and accurate assessment of the company's strategic position.