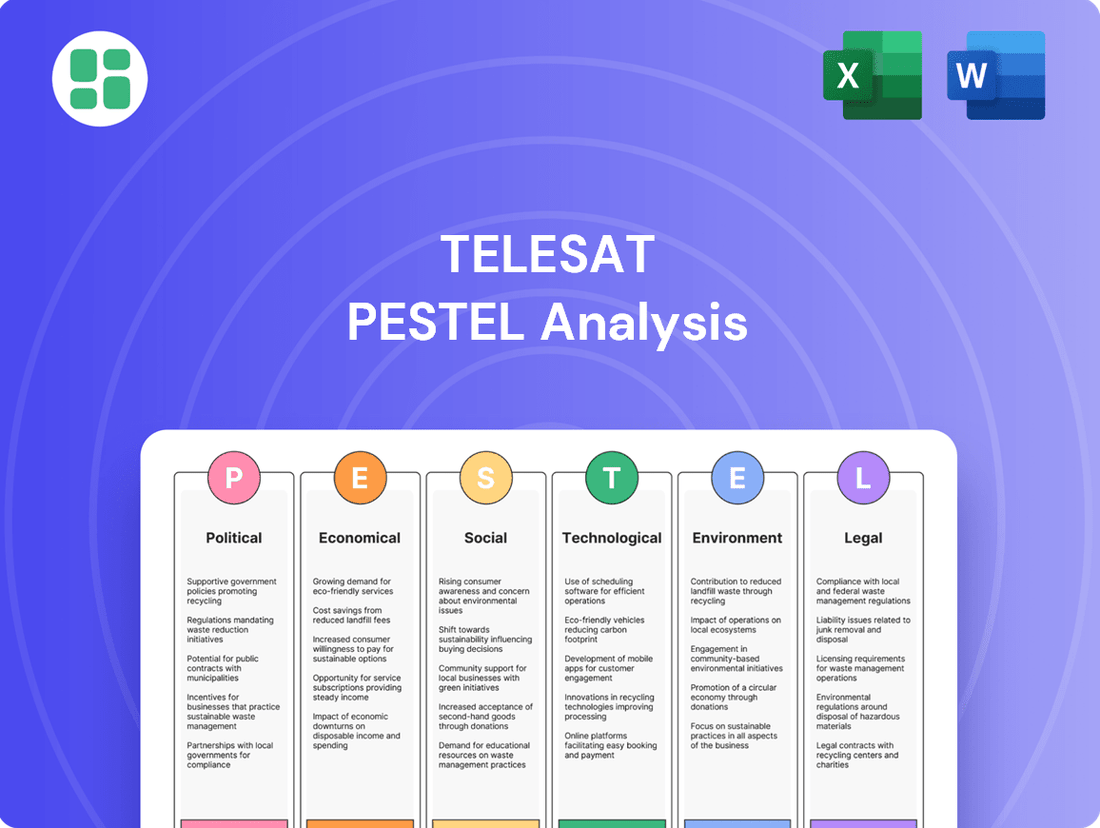

Telesat PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telesat Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Telesat's future. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence for strategic planning. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Government funding and support are critical for Telesat's strategic initiatives, particularly for the Lightspeed satellite constellation. The Canadian federal government and the Quebec provincial government have committed substantial loan financing, amounting to $2.54 billion, to support the development and deployment of this advanced low-Earth orbit (LEO) network.

This significant financial backing underscores the political recognition of Lightspeed's role in achieving national objectives. These include narrowing the digital divide by expanding broadband access, fostering job creation within the Canadian technology sector, and enhancing Canada's competitive edge in the global space industry.

The political endorsement and financial assistance from these governments not only reduce the financial risks associated with such a large-scale infrastructure project but also serve to accelerate its overall timeline, enabling Telesat to bring its innovative satellite services to market more efficiently.

Telesat's Lightspeed network is poised to significantly enhance national security and defense communications for governments, including Canada. This initiative directly supports modernization efforts within organizations like NATO and NORAD, offering secure and resilient satellite connectivity. The demand from government and military sectors is a crucial driver for the burgeoning Low Earth Orbit (LEO) satellite market, with projections indicating substantial growth in this segment through 2025 and beyond.

Global space policy, particularly international agreements on spectrum allocation and orbital slot coordination, is crucial for Telesat. For instance, the International Telecommunication Union (ITU) plays a significant role in managing these resources. In 2024, the ITU continued its work on spectrum harmonization, which directly affects satellite communication services like those offered by Telesat.

The evolving international space law and initiatives such as the Zero Debris Charter are reshaping how satellite constellations are deployed and managed. By 2025, adherence to these guidelines will be increasingly important for ensuring the long-term sustainability of space operations, impacting Telesat's constellation planning and operational strategies.

The dynamic interplay of cooperation and competition among nations in space presents both opportunities and challenges for Telesat. For example, increased government investment in space programs in 2024, such as the US Space Force's expansion, can lead to new commercial partnerships, but also intensified competition for orbital resources and market share.

Regulatory Environment and Licensing

Changes in national and international regulatory frameworks for space activities, including licensing and spectrum management, significantly impact satellite operators like Telesat. For instance, the European Union's ongoing development of its new space law, expected to be fully implemented by 2025, aims to create a more harmonized regulatory environment across member states, potentially streamlining operations for companies with a European presence.

Updates to export control regulations, particularly in key markets like the United States, can also affect market access and compliance for Telesat. In 2024, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to review and update export control classifications for emerging technologies, including those relevant to satellite communications, requiring constant vigilance from operators to ensure adherence.

- EU Space Law: Anticipated full implementation by 2025, aiming for regulatory harmonization.

- U.S. Export Regulations: Ongoing reviews by BIS in 2024 impacting technology exports.

- Spectrum Management: International Telecommunication Union (ITU) continues to manage global spectrum allocation, crucial for satellite operations.

Digital Divide Initiatives

Government efforts to close the digital divide, including funding and programs to bring internet to areas lacking service, are a significant boon for satellite broadband companies like Telesat. These political priorities directly translate into a robust market for their offerings.

Telesat's Lightspeed network is specifically engineered to deliver cost-effective, high-speed internet to remote and rural regions, aligning perfectly with these government objectives. This strategic alignment strengthens the demand for Telesat's advanced satellite solutions.

- Government Investment: In 2024, the Canadian government committed an additional $1.2 billion to the Universal Broadband Fund, aiming to connect 98% of Canadians to high-speed internet by 2026.

- Market Opportunity: This creates a substantial opportunity for satellite providers to serve the remaining unserved and underserved populations, a key focus for Telesat's Lightspeed.

- Policy Alignment: The increasing political emphasis on digital inclusion and equitable access to broadband ensures a supportive regulatory environment for companies like Telesat.

Government support is a cornerstone for Telesat's Lightspeed initiative, with Canada and Quebec providing $2.54 billion in financing. This political backing acknowledges Lightspeed's role in bridging the digital divide and boosting Canada's space sector competitiveness.

The demand from government and defense sectors for secure, resilient satellite communications is a key market driver for LEO constellations through 2025. Telesat's Lightspeed network directly addresses these needs for entities like NATO and NORAD.

International agreements on spectrum and orbital slots, managed by bodies like the ITU, are vital for Telesat's operations. The ITU's ongoing work in 2024 on spectrum harmonization directly impacts satellite communication services.

Evolving space law, including initiatives like the Zero Debris Charter by 2025, will shape constellation deployment and management, influencing Telesat's long-term strategies.

| Political Factor | Description | Impact on Telesat | Relevant Data/Timelines |

| Government Funding & Support | Financial assistance and policy backing from national and regional governments. | Reduces financial risk, accelerates project timelines, and validates strategic direction. | Canada & Quebec: $2.54 billion financing for Lightspeed. |

| National Security & Defense | Government demand for secure and resilient communication networks. | Creates a strong market segment for LEO satellite services like Lightspeed. | Growing demand from NATO, NORAD; LEO market growth projected through 2025. |

| International Space Policy | Global regulations on spectrum allocation and orbital slot coordination. | Affects operational efficiency and market access; requires adherence to international standards. | ITU's ongoing spectrum harmonization efforts (2024); Zero Debris Charter (by 2025). |

| Digital Divide Initiatives | Government programs aimed at expanding broadband access to underserved areas. | Directly fuels market demand for satellite broadband solutions. | Canadian Universal Broadband Fund: $1.2 billion committed in 2024 to reach 98% connectivity by 2026. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Telesat, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise summary of Telesat's PESTLE analysis, highlighting key external factors, alleviates the pain of sifting through extensive data, enabling faster strategic decision-making.

Economic factors

Telesat's Lightspeed project is a significant capital undertaking. For 2025, the company anticipates capital expenditures between $900 million and $1.1 billion, with nearly all of this dedicated to Lightspeed's development and deployment.

While Telesat has secured substantial government financing, the sheer scale of the Lightspeed program means the company also faces elevated operating expenditures. This dual pressure on finances necessitates astute financial planning and management to navigate the project's impact on the company's overall financial health.

The demand for low-latency broadband is a significant economic driver, with the global satellite internet market projected to hit $11.35 billion by 2029. This growth is fueled by the need for faster, more responsive internet, particularly in underserved regions. Telesat's Lightspeed constellation is strategically designed to capitalize on this trend, offering a solution for various sectors requiring high-performance connectivity.

The Low Earth Orbit (LEO) satellite market is heating up, with giants like SpaceX's Starlink, Amazon's Project Kuiper, and Eutelsat's OneWeb aggressively expanding their constellations. This crowded field naturally creates pricing pressure, which could significantly impact Telesat's revenue streams, especially from its established Geostationary (GEO) satellite services. For instance, Starlink's residential service pricing has seen adjustments as its user base grows, indicating the dynamic nature of LEO pricing.

Telesat is banking on its Lightspeed constellation to stand out by focusing on enterprise and government clients, offering a more tailored and potentially premium service. This strategic differentiation is crucial to navigate the intense competition and avoid being drawn into a pure price war, which could erode margins for all players in the burgeoning LEO market.

Revenue Diversification and Decline in GEO Segment

Telesat experienced a consolidated revenue decline in 2024, projecting further decreases into 2025. This downturn is largely attributed to reduced rates and capacity from traditional North American direct-to-home satellite video clients, alongside competitive pressures affecting enterprise revenue streams.

To counter these revenue challenges, Telesat is actively developing and commercializing its Lightspeed initiative. The goal is to pivot towards a more robust and diversified revenue model centered on Low Earth Orbit (LEO) satellite services.

- Revenue Shift: Telesat's strategy prioritizes the LEO Lightspeed network to offset declines in its GEO segment.

- Market Pressures: Declining demand and competitive pricing in traditional satellite video and enterprise services are impacting current revenues.

- 2024/2025 Outlook: The company anticipates continued revenue reduction in these legacy segments in the near term.

- Diversification Goal: Lightspeed aims to introduce new revenue streams and reduce reliance on older, less profitable services.

Global Economic Conditions and Investment Trends

Broader global economic conditions, such as persistent inflation and rising interest rates, directly impact Telesat's operational expenses and the cost of capital for its ambitious Lightspeed project. For instance, the Bank of Canada's benchmark interest rate hovered around 5% in early 2024, a significant increase from previous years, potentially increasing Telesat's financing costs.

Investment trends in the burgeoning space economy present a generally positive outlook for satellite operators like Telesat. Projections suggest the global space economy could reach $1 trillion by 2040, driven by satellite broadband, Earth observation, and in-space manufacturing. This growth signals substantial market opportunities.

However, this dynamic environment also necessitates continuous innovation and the formation of strategic partnerships. Telesat's commitment to its Lightspeed constellation, a low-latency satellite network, exemplifies this need for forward-thinking development to capture market share and maintain a competitive edge.

- Inflationary Pressures: Global inflation rates, which saw significant spikes in 2022-2023, can increase the cost of raw materials and labor for satellite manufacturing and deployment.

- Interest Rate Sensitivity: Higher interest rates, as seen in major economies throughout 2023-2024, increase the cost of borrowing for capital-intensive projects like Lightspeed.

- Space Economy Growth: The space economy is projected to expand significantly, with Morgan Stanley forecasting a potential market value of $1 trillion by 2040, offering substantial growth avenues for satellite service providers.

- Investment in Connectivity: There's a growing global demand for reliable, high-speed internet, particularly in underserved regions, which directly benefits satellite broadband providers like Telesat.

Telesat faces economic headwinds with projected revenue declines in 2024 and 2025, primarily due to competitive pressures and reduced demand in legacy satellite video and enterprise services. The company is heavily investing in its Lightspeed Low Earth Orbit (LEO) constellation, with 2025 capital expenditures estimated between $900 million and $1.1 billion, almost entirely for Lightspeed. This significant investment, coupled with potential increases in operating expenses and financing costs due to global inflation and higher interest rates, necessitates careful financial management.

| Economic Factor | Impact on Telesat | Data/Projection |

| Revenue Outlook | Declining legacy revenues | Projected decrease in 2024 and 2025 |

| Capital Expenditures | Heavy investment in Lightspeed | $900M - $1.1B in 2025 for Lightspeed |

| Financing Costs | Increased by interest rates | Benchmark rates around 5% in early 2024 (e.g., Bank of Canada) |

| Market Opportunity | Growth in satellite broadband demand | Global satellite internet market to reach $11.35B by 2029 |

Full Version Awaits

Telesat PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Telesat PESTLE analysis covers all key external factors impacting the company, providing valuable strategic insights.

Sociological factors

The global push for digital inclusion is intensifying, highlighting the critical need for reliable internet access in areas previously left behind. As of early 2024, an estimated 2.6 billion people still lack regular internet access, a gap that satellite technology is poised to fill. Telesat's Lightspeed constellation is designed to directly address this, offering a pathway to connect these underserved populations, thereby fostering opportunities in education and healthcare.

Modern society's increasing reliance on seamless, high-speed, and low-latency internet for daily life, work, and entertainment is a significant driver for advanced connectivity solutions. This demand extends to sectors like aviation and maritime, where on-the-go connectivity is no longer a luxury but a standard expectation. By 2024, the global mobile data traffic was projected to reach 200 exabytes per month, highlighting this insatiable need.

Telesat's Lightspeed constellation is specifically engineered to address these evolving user expectations on a global scale. The system aims to provide reliable, high-performance satellite internet, catering to the growing number of users who require constant and robust connectivity, regardless of their location. This positions Telesat to capitalize on the expanding market for ubiquitous internet access.

The development of Telesat's Lightspeed constellation is a significant driver for workforce development, projected to create and sustain thousands of high-quality jobs across Canada. This initiative directly supports government objectives focused on economic growth and building a skilled domestic workforce, particularly within the burgeoning space sector.

By fostering innovation and requiring specialized expertise, Lightspeed is expected to stimulate demand for a range of roles, from engineering and manufacturing to data analysis and network operations. This focus on high-value employment aligns with national strategies aimed at enhancing Canada's technological capabilities and global competitiveness.

Public Perception and Acceptance of Space Technology

Public perception of satellite technology, particularly concerning space debris and the visual impact of large satellite constellations like Starlink, can significantly sway regulatory bodies and public backing. For instance, a 2023 survey indicated that while 65% of respondents saw the internet access benefits of LEO constellations, 40% expressed concern about light pollution affecting astronomical observations.

To foster long-term acceptance, positive public engagement and clear communication about the advantages and sustainability initiatives of these LEO constellations are crucial. Telesat's efforts to highlight its advanced deorbiting capabilities for its Lightspeed constellation, aiming to remove satellites within 25 months of mission end, are designed to address these very concerns and build trust.

- Public Concern: Growing awareness of space debris and light pollution from large constellations.

- Regulatory Impact: Public sentiment can influence government policies and spectrum allocation.

- Telesat's Strategy: Emphasis on sustainable satellite design and end-of-life management for Lightspeed.

- Engagement Need: Transparent communication is key to building public confidence in space technology advancements.

Impact on Remote Communities

The availability of high-capacity, low-latency satellite broadband, like that offered by Telesat's Lightspeed constellation, can be a game-changer for remote communities. It unlocks access to vital services such as online education, allowing students in isolated areas to compete on a more even playing field. Telemedicine also becomes a reality, providing crucial healthcare consultations without the need for long-distance travel. This societal impact highlights Telesat's role in bridging the digital divide.

Economically, this enhanced connectivity fosters new opportunities. Remote communities can tap into the global digital economy, enabling e-commerce, remote work, and the development of new service-based industries. For instance, by 2025, it's projected that over 50% of the global workforce could be engaged in some form of remote work, a trend that satellite broadband can significantly support in underserved regions.

- Digital Inclusion: Satellite broadband can connect the remaining 7% of the global population still lacking internet access, with a significant portion residing in rural and remote areas.

- Economic Empowerment: By 2024, the digital economy's contribution to global GDP is expected to reach 25%, a figure that could be significantly boosted in remote areas with improved connectivity.

- Healthcare Access: Telemedicine adoption is projected to grow by over 20% annually through 2025, offering critical health services to populations far from urban centers.

- Educational Advancement: Online learning platforms are becoming increasingly essential, with over 100 million students worldwide expected to enroll in online courses by 2025.

Societal shifts towards greater digital inclusion are paramount, with satellite technology like Telesat's Lightspeed playing a crucial role in connecting the 7% of the global population still without internet access as of early 2024. This connectivity is vital for education and healthcare, especially in remote areas. The increasing societal reliance on seamless, high-speed internet, projected to drive global mobile data traffic to 200 exabytes per month by 2024, underscores the demand for advanced solutions.

Public perception of satellite constellations, influenced by concerns over space debris and light pollution, can impact regulatory support. Telesat's commitment to deorbiting Lightspeed satellites within 25 months of mission end aims to mitigate these concerns, fostering public trust. The development of Lightspeed is also a significant driver for workforce development, creating thousands of high-quality jobs in Canada's space sector, aligning with national economic growth strategies.

| Sociological Factor | Description | Impact on Telesat | Relevant Data (2024/2025) |

| Digital Inclusion Demand | Growing societal need for internet access in underserved regions. | Telesat's Lightspeed directly addresses this gap, expanding market reach. | 2.6 billion people lacked internet access in early 2024; 7% of global population still unconnected. |

| Reliance on Connectivity | Increasing dependence on high-speed, low-latency internet for daily life and work. | Creates a strong market for Telesat's advanced satellite broadband services. | Global mobile data traffic projected to reach 200 exabytes/month by 2024. |

| Public Perception & Sustainability | Concerns about space debris and light pollution from satellite constellations. | Requires Telesat to emphasize sustainable practices and transparent communication. | 40% of respondents in a 2023 survey concerned about light pollution; Telesat's deorbiting plan within 25 months. |

| Workforce Development | Government focus on creating skilled jobs, particularly in the space sector. | Lightspeed project supports these objectives, boosting domestic capabilities and employment. | Projected to create and sustain thousands of high-quality jobs across Canada. |

Technological factors

Telesat's strategic pivot from its established geostationary (GEO) satellites to the cutting-edge Low Earth Orbit (LEO) Lightspeed constellation represents a significant technological evolution. This transition is driven by the demand for improved connectivity, with LEO offering substantially reduced latency and increased capacity.

The Lightspeed constellation is designed to deliver fiber-like speeds, a critical advancement for demanding broadband services. This capability is essential for applications like real-time gaming, advanced telecommunications, and robust enterprise solutions, positioning Telesat to compete more effectively in the evolving satellite internet market.

Innovations in satellite miniaturization and manufacturing processes are significantly lowering the cost and time to deploy large-scale LEO satellite networks. This trend is crucial for companies like Telesat, which aims to expand its global reach.

Reusable launch technologies, exemplified by SpaceX's success, are dramatically reducing the cost per kilogram to orbit. Telesat's strategic reliance on SpaceX for launches, as seen in their launch agreements, directly benefits from these cost efficiencies, enabling more frequent and affordable satellite deployments.

The success of Telesat's Lightspeed LEO constellation is intrinsically linked to the robust development of its global ground segment infrastructure. This includes a worldwide network of landing stations and points of presence, crucial for receiving and distributing data from space-based assets. By 2024, Telesat has been actively expanding its terrestrial network, with investments focused on creating a seamless, high-capacity backbone to handle the anticipated data volumes.

Advancements in ground infrastructure are paramount for supporting scalable LEO data traffic and ensuring uninterrupted connectivity. As Lightspeed aims to deliver enterprise-grade broadband services, the ground segment must be capable of processing and routing vast amounts of data efficiently. This involves leveraging cutting-edge technologies in fiber optics and network management to guarantee low latency and high throughput, essential for mission-critical applications.

Cybersecurity and Network Resilience

As satellite networks become more crucial for essential communications, safeguarding them against cyber threats and ensuring their ability to withstand disruptions is incredibly important. Telesat’s Lightspeed network is built with robust cybersecurity measures, adhering to strict government standards. This focus on resilience is vital for maintaining uninterrupted service, particularly for government and defense clients who rely on secure connectivity.

Telesat Lightspeed incorporates a Zero-Trust Network Access (ZTNA) architecture. This means that every access request is rigorously verified, regardless of whether it originates from inside or outside the network. This approach significantly enhances security by minimizing the potential impact of a breach. For defense users, this level of security is non-negotiable, ensuring the integrity and confidentiality of their communications.

The increasing reliance on satellite technology for critical infrastructure, from national security to essential services, places a premium on network resilience. Telesat’s commitment to government cybersecurity standards and ZTNA for Lightspeed directly addresses these concerns. This proactive stance is crucial in the evolving threat landscape of 2024 and beyond, where sophisticated cyberattacks are a constant risk.

Key aspects of Telesat's approach include:

- Adherence to stringent government cybersecurity standards, ensuring a high baseline of protection.

- Implementation of Zero-Trust Network Access (ZTNA) for granular security control and verification.

- Design for resilience to maintain service continuity even in the face of cyber threats or network disruptions.

- Focus on secure and resilient communications, particularly for high-stakes sectors like defense.

Integration with Emerging Technologies (e.g., 5G, AI)

The satellite sector is increasingly incorporating advanced technologies such as 5G and artificial intelligence. AI is particularly crucial for tasks like preventing satellite collisions and optimizing the management of satellite fleets.

Telesat's Lightspeed constellation is specifically designed to align with telecom Carrier Ethernet standards. This ensures seamless integration and interoperability, which is vital for achieving network automation objectives.

- 5G Integration: Telesat Lightspeed's design facilitates integration with 5G networks, enabling new low-latency, high-bandwidth services.

- AI for Operations: The company is leveraging AI for enhanced satellite fleet management and critical functions like collision avoidance.

- Interoperability: Adherence to Carrier Ethernet standards promotes easier connection with terrestrial networks, a key benefit for telecom partners.

Technological advancements are reshaping Telesat's operational landscape, particularly with its Lightspeed constellation. The move to Low Earth Orbit (LEO) addresses the growing demand for high-speed, low-latency connectivity, aiming to deliver fiber-like services. This strategic shift is supported by innovations in satellite miniaturization and the decreasing costs of space launches, with Telesat leveraging partnerships for deployment.

The robustness of the ground segment infrastructure is paramount, with Telesat actively expanding its terrestrial network to handle the massive data volumes expected from Lightspeed. This includes investments in fiber optics and advanced network management to ensure seamless, high-throughput data delivery. Furthermore, the integration of 5G capabilities and the application of artificial intelligence for fleet management and collision avoidance are key technological drivers.

Cybersecurity and network resilience are critical considerations for Telesat's Lightspeed constellation, especially for government and defense clients. The implementation of Zero-Trust Network Access (ZTNA) and adherence to stringent government cybersecurity standards are central to ensuring secure and uninterrupted communications in an increasingly complex threat environment.

Telesat's commitment to interoperability, evidenced by its adherence to Carrier Ethernet standards, facilitates smoother integration with existing terrestrial networks. This interoperability is crucial for realizing network automation goals and expanding service offerings in the telecommunications sector.

Legal factors

Spectrum allocation and management are absolutely crucial for Telesat's satellite operations, especially with its Lightspeed LEO constellation. Access to and effective management of radio frequency spectrum directly impacts the ability to deliver reliable, interference-free services. This is a core operational requirement.

International and national regulations play a massive role here. For instance, the International Telecommunication Union (ITU) sets global standards for spectrum use. Telesat needs to navigate these complex regulatory landscapes to secure the necessary spectrum licenses for its LEO satellites, ensuring compatibility and avoiding interference with other satellite and terrestrial services. Failure to do so can severely hinder service deployment and efficiency.

Telesat's global operations are significantly shaped by international space law, including treaties like the Outer Space Treaty of 1967 and the Registration Convention. These agreements dictate responsibilities for space object registration and liability for damages caused by satellites, impacting Telesat's satellite deployment and operational strategies.

Compliance with these international legal frameworks is not just a formality but a necessity for Telesat to conduct its business responsibly and maintain its license to operate in the global space arena. For instance, the Liability Convention establishes international rules and procedures for the prompt payment of compensation for space object damage, a crucial consideration for any satellite operator.

Telesat must adhere to the specific national licensing and regulatory compliance frameworks in every country it operates or offers services. This includes understanding and meeting the requirements set by various national regulatory bodies. For example, as of early 2024, many nations are actively developing or refining their space laws, introducing new regulations that could impact satellite operations and spectrum allocation.

Navigating this complex and evolving legal landscape is paramount for Telesat's market access and ensuring its operations remain fully compliant. Failure to comply with these diverse national legal requirements, including emerging space legislation, could lead to significant operational disruptions or penalties. The global nature of satellite communications necessitates a thorough understanding of each jurisdiction's unique legal obligations.

Data Privacy and Security Regulations

Data privacy and security are paramount as satellite communications handle vast amounts of sensitive information. Telesat must navigate an evolving landscape of regulations like the EU's General Data Protection Regulation (GDPR) and similar national laws globally. Failure to comply can result in significant fines and reputational damage, impacting customer trust and business operations.

Key considerations for Telesat include:

- Compliance with diverse data protection laws: Adhering to GDPR, CCPA, and other regional privacy mandates is crucial for international operations.

- Secure data transmission and storage: Implementing robust encryption and access controls for customer data is non-negotiable.

- Incident response planning: Having clear protocols for data breaches and security incidents is essential to mitigate harm and maintain regulatory compliance.

Export Control Regulations

Changes in export control regulations, especially from key technology providers like the United States, directly affect Telesat's access to crucial components for its Lightspeed satellite constellation. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List and Commerce Control List, which can restrict the export of advanced technologies essential for satellite manufacturing and launch services. Failure to adapt to these evolving rules could disrupt Telesat's supply chain and project timelines.

Telesat must diligently monitor and comply with these complex, often shifting, export control frameworks. This includes understanding licensing requirements and potential restrictions on technology transfer. For example, in 2024, ongoing geopolitical tensions continue to influence export control policies, potentially impacting the availability and cost of specialized satellite components. Proactive compliance strategies are therefore paramount for maintaining operational continuity and market access.

- U.S. Export Administration Regulations (EAR): These govern the export and re-export of dual-use items, including many advanced technologies used in satellite construction, and are subject to frequent updates based on national security and foreign policy considerations.

- International Traffic in Arms Regulations (ITAR): Managed by the U.S. State Department, ITAR imposes strict controls on defense articles and services, which can encompass certain satellite technologies and related software, requiring specific licenses for export.

- Impact on Supply Chain: Companies like Telesat rely on a global supply chain for specialized components; changes in export controls can lead to delays, increased costs, or the need to find alternative suppliers, potentially affecting the Lightspeed constellation's deployment schedule.

- Compliance Costs: Maintaining compliance involves significant investment in legal counsel, internal expertise, and robust tracking systems to navigate the intricate web of international export regulations.

Telesat's operations are heavily influenced by evolving spectrum allocation and international telecommunications regulations, particularly concerning its Lightspeed LEO constellation. The ITU's framework and national licensing bodies are critical for securing and maintaining access to essential radio frequencies, directly impacting service delivery and preventing interference. As of 2024, regulatory bodies globally are refining policies for non-terrestrial networks, which could present both opportunities and challenges for Telesat's spectrum needs.

Environmental factors

The increasing number of satellites, especially in Low Earth Orbit (LEO) constellations, presents a growing challenge with space debris. This proliferation necessitates stricter operational guidelines for companies like Telesat.

Regulatory bodies are actively addressing this. For instance, the FCC now mandates that satellites must be deorbited within five years of their mission ending. Similarly, the European Space Agency (ESA) has adopted a Zero Debris approach, which influences satellite design and end-of-life planning.

These regulations directly impact Telesat's satellite design, mission planning, and overall operational costs, requiring proactive mitigation strategies to ensure long-term sustainability in space operations.

The increasing concern over the long-term sustainability of Earth's orbital environment is prompting regulatory bodies worldwide to impose stricter regulations on satellite operators. This growing awareness of space debris and the need for responsible orbital management directly impacts companies like Telesat.

Telesat's commitment to sustainable space utilization is crucial for the viability of its planned Lightspeed LEO constellation. By aligning its operational practices with global efforts to mitigate space debris, Telesat can ensure continued access to and use of valuable orbital resources, which is essential for its future revenue streams and market position.

Rocket launches, while essential for deploying satellites, carry a significant carbon footprint. The combustion of rocket fuels releases greenhouse gases and other pollutants into the atmosphere. For instance, the European Space Agency's Ariane 5 rocket, a workhorse for many satellite deployments, emits approximately 300 tonnes of CO2 per launch. Telesat, as a satellite operator relying on these launches, is directly linked to this environmental impact.

Beyond launches, the ongoing operation of satellite ground stations also contributes to energy consumption and, consequently, carbon emissions. These facilities require substantial power for tracking, communication, and data processing. As the demand for satellite services grows, so does the energy needed to maintain this infrastructure, putting pressure on companies like Telesat to seek more sustainable energy solutions for their terrestrial operations.

The increasing global focus on climate change and corporate sustainability means Telesat will likely face mounting pressure from regulators, investors, and customers to mitigate its environmental impact. This could translate into a strategic imperative to partner with launch providers utilizing cleaner propellants or investing in renewable energy sources for its ground station network. For example, the industry is exploring options like liquid hydrogen-powered rockets, which produce water vapor as a byproduct instead of CO2.

Light Pollution and Astronomical Interference

The proliferation of large Low Earth Orbit (LEO) satellite constellations, such as those being deployed by competitors, has sparked significant concerns within the astronomical community regarding increased light pollution and radio frequency interference. These constellations can obscure faint celestial objects and disrupt sensitive ground-based and space-based observatories. While Telesat, as a satellite operator, is not directly regulated by these environmental factors, the growing societal awareness and potential for future policy changes could influence operational parameters or necessitate the adoption of industry-wide mitigation strategies.

The impact on astronomical observation is a tangible concern. For instance, the International Astronomical Union (IAU) has actively engaged with satellite operators to discuss the visual and radio interference issues. While specific financial data on Telesat's direct response to this is not publicly detailed, the broader industry is exploring solutions like:

- Satellite design modifications to reduce reflectivity and brightness.

- Orbital adjustments to minimize overlap with critical observation times.

- Development of advanced algorithms to filter out satellite trails from astronomical data.

Climate Change Impact on Infrastructure

Climate change presents tangible risks to Telesat's ground infrastructure, including earth stations and data centers. Increased frequency and intensity of extreme weather events, such as hurricanes and wildfires, can disrupt operations and impact the reliability of satellite services. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, highlighting the growing threat to critical infrastructure.

Telesat must proactively integrate climate resilience into the design and deployment of its terrestrial network. This involves considering factors like elevated infrastructure to mitigate flood risks and robust power backup systems to withstand prolonged outages. Investing in resilient infrastructure is crucial for maintaining service continuity and protecting assets against the escalating impacts of a changing climate.

- Increased Extreme Weather Events: NOAA data shows a rising trend in billion-dollar weather and climate disasters, directly impacting ground infrastructure.

- Infrastructure Vulnerability: Earth stations and data centers are susceptible to damage from floods, high winds, and other climate-related phenomena.

- Service Reliability: Disruptions to ground infrastructure can lead to outages and reduced reliability of satellite communication services.

- Resilience Investment: Implementing climate-resilient design and deployment strategies is essential for long-term operational stability.

The increasing number of satellites, particularly in Low Earth Orbit (LEO) constellations, poses a significant challenge due to space debris, necessitating stricter operational guidelines for companies like Telesat. Regulatory bodies are responding; for example, the FCC now mandates deorbiting satellites within five years of mission end, and the European Space Agency (ESA) promotes a Zero Debris approach, impacting satellite design and end-of-life planning.

Rocket launches, essential for satellite deployment, contribute to carbon emissions, with rockets like Ariane 5 emitting around 300 tonnes of CO2 per launch. Telesat's reliance on these launches links it to this environmental impact. Furthermore, ground stations require substantial energy, contributing to carbon emissions as demand for satellite services grows, pushing Telesat towards sustainable energy solutions.

Climate change presents tangible risks to Telesat's ground infrastructure, with an increasing frequency of extreme weather events like hurricanes and wildfires potentially disrupting operations. NOAA reported 28 billion-dollar weather and climate disasters in the U.S. in 2023 alone, underscoring the threat to critical infrastructure and service reliability.

The growing concern over space debris and orbital sustainability directly affects satellite operators like Telesat, requiring proactive mitigation strategies for long-term viability. Telesat's commitment to sustainable space utilization is crucial for its Lightspeed LEO constellation, ensuring continued access to orbital resources and protecting future revenue streams.

| Environmental Factor | Impact on Telesat | Mitigation/Response |

| Space Debris & Orbital Sustainability | Necessitates stricter operational guidelines and end-of-life planning for satellites. | Adherence to regulations (e.g., FCC 5-year deorbit rule), adoption of Zero Debris approaches. |

| Carbon Footprint of Launches | Directly linked to emissions from rocket launches used for satellite deployment. | Exploring partnerships with providers using cleaner propellants (e.g., liquid hydrogen). |

| Energy Consumption of Ground Stations | Contributes to carbon emissions from powering terrestrial infrastructure. | Investing in renewable energy sources for ground station networks. |

| Climate Change & Extreme Weather | Threatens ground infrastructure (earth stations, data centers) with disruptions. | Integrating climate resilience into infrastructure design, e.g., elevated structures, robust power backups. |

| Light Pollution & Radio Frequency Interference | Potential societal concern impacting astronomical observation, may lead to future policy changes. | Industry exploring satellite design modifications for reduced reflectivity and orbital adjustments. |

PESTLE Analysis Data Sources

Our Telesat PESTLE Analysis is built on a comprehensive review of data from international telecommunications bodies, national regulatory agencies, and leading market research firms. This ensures all insights into political, economic, social, technological, legal, and environmental factors are grounded in current and authoritative information.