Telesat Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telesat Bundle

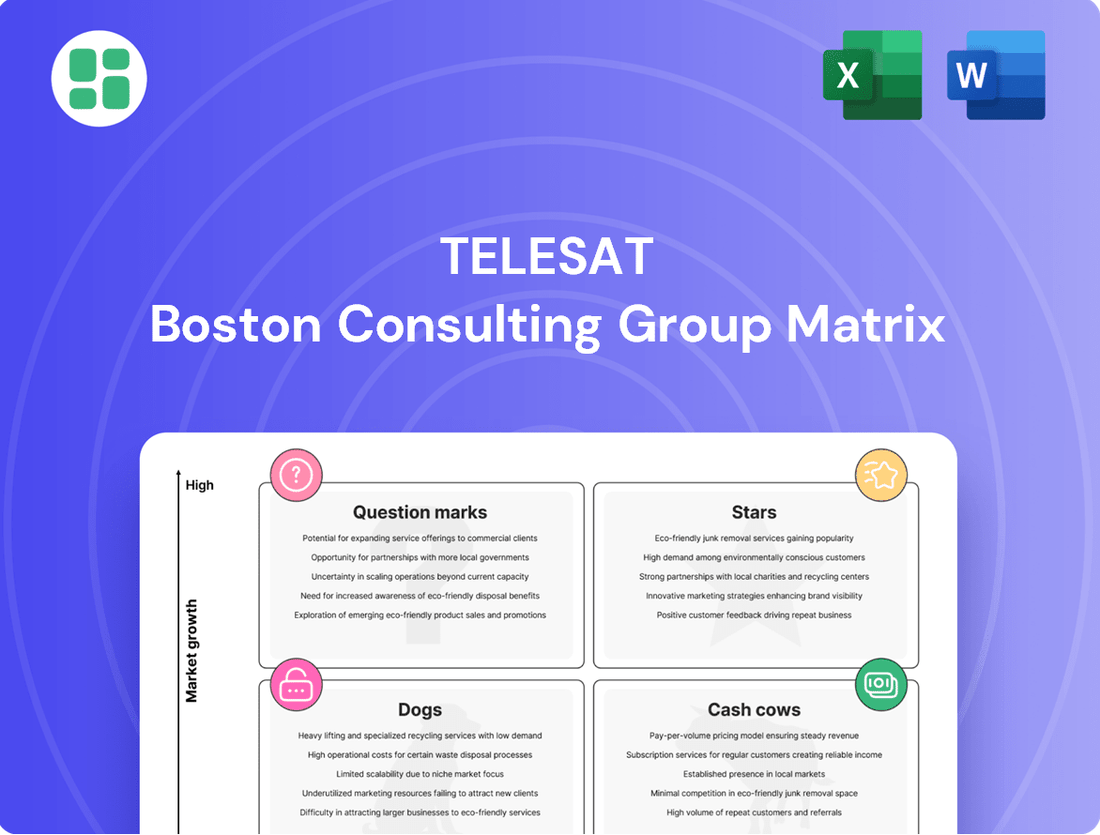

Understand Telesat's strategic positioning with our concise BCG Matrix preview, highlighting key product categories. See where Telesat's offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and gain a glimpse into their market potential. Purchase the full BCG Matrix for a comprehensive analysis, including actionable insights and data-driven recommendations to optimize your investment and product strategy.

Stars

Telesat Lightspeed is poised to dominate the burgeoning global low-latency broadband sector. By offering fiber-optic quality connectivity, it targets lucrative enterprise, government, and mobility markets. This positions Lightspeed as Telesat's key Star, given its high-growth potential and expected substantial market share.

Advanced Mobility Connectivity represents a high-growth area for Telesat, leveraging its Lightspeed satellite network. The network's high capacity and low latency are poised to transform in-flight and maritime connectivity, offering a superior broadband experience. This positions Telesat to capture a significant share of these expanding markets.

Telesat's strategic collaborations, including its partnership with Viasat, underscore the significant revenue potential within these specialized mobility sectors. By integrating Lightspeed's capabilities with established players, Telesat is building a strong foundation for future growth and market leadership in advanced connectivity solutions.

Telesat Lightspeed's secure, resilient, and high-bandwidth capabilities are specifically designed to address the critical communication needs of government and defense sectors. This specialized market segment, while niche, represents a significant opportunity for advanced satellite solutions.

Lightsat's Low Earth Orbit (LEO) network is positioned to secure a leading role in this high-value market. The network's architecture is inherently suited for the demanding requirements of national security and defense operations, offering unparalleled connectivity.

The strategic importance of Lightspeed in national security objectives is further underscored by the substantial support it receives from both the Canadian and Quebec governments. This backing, including significant financial commitments, validates its role in bolstering defense infrastructure.

Enterprise Digital Transformation Services

Enterprise Digital Transformation Services are a significant growth area for Telesat, fitting squarely into the Star quadrant of the BCG Matrix. As businesses worldwide accelerate their digital initiatives and embrace cloud technologies, the demand for reliable, high-speed connectivity is paramount. Telesat's Lightspeed constellation is uniquely positioned to meet this demand, offering low-latency satellite broadband that is crucial for operations in diverse and often challenging locations.

This focus on enabling seamless digital transformation makes Telesat a compelling partner for enterprises. The ability to provide consistent, high-performance connectivity, especially in areas lacking terrestrial infrastructure, allows companies to expand their reach and operational efficiency. This capability directly translates into substantial market share potential within the expanding enterprise connectivity sector, reinforcing the Star status of these services.

- Market Growth: The global digital transformation market was valued at approximately $500 billion in 2023 and is projected to reach over $1.5 trillion by 2028, indicating a strong upward trend.

- Connectivity Demand: Enterprises are increasingly relying on advanced connectivity solutions to support cloud migration, IoT deployments, and remote workforce initiatives.

- Lightspeed Advantage: Telesat's Lightspeed network, with its low-latency capabilities, directly addresses critical enterprise needs for real-time data processing and reliable communication, particularly in sectors like mining, energy, and global logistics.

Next-Generation 5G Backhaul & Edge Computing

The global demand for robust 5G backhaul and edge computing solutions is rapidly increasing. Lightspeed's advanced capabilities are perfectly positioned to meet this need by efficiently connecting cell towers and enabling edge data processing, even in difficult locations.

This burgeoning market, characterized by significant growth prospects, aligns perfectly with Telesat's innovative Lightspeed system, marking it as a prime Star in the BCG matrix.

- Market Growth: The global 5G backhaul market is projected to reach $25.9 billion by 2027, growing at a CAGR of 20.5%.

- Edge Computing Integration: Edge computing is expected to see a 35% compound annual growth rate through 2028, creating substantial demand for low-latency connectivity.

- Lightspeed's Advantage: Lightspeed offers unparalleled capacity and low latency, crucial for supporting the dense network requirements of 5G and the distributed nature of edge computing.

- Challenging Environments: Telesat's satellite technology is particularly effective in providing connectivity to remote or difficult-to-reach areas where terrestrial backhaul is impractical or unavailable.

Telesat Lightspeed's advanced capabilities position it as a Star within the BCG matrix, particularly in the high-growth sectors of enterprise digital transformation and 5G backhaul. Its low-latency, high-bandwidth satellite network is designed to meet the increasing demand for reliable connectivity in diverse environments. This strategic focus on enabling digital progress and supporting next-generation communication infrastructure solidifies Lightspeed's status as a key growth driver for Telesat.

| Telesat Lightspeed Application | Market Growth Indicator | Telesat Advantage |

|---|---|---|

| Enterprise Digital Transformation | Global digital transformation market projected to exceed $1.5 trillion by 2028. | Provides essential low-latency connectivity for cloud, IoT, and remote operations. |

| Advanced Mobility Connectivity | In-flight connectivity market expected to grow significantly. | Offers superior broadband experience for aviation and maritime sectors. |

| Government & Defense | Critical need for secure, resilient communication. | Designed for national security requirements with government backing. |

| 5G Backhaul & Edge Computing | 5G backhaul market to reach $25.9 billion by 2027; Edge computing CAGR of 35%. | Efficiently connects cell towers and supports distributed data processing in remote areas. |

What is included in the product

This BCG Matrix overview provides a tailored analysis of Telesat's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

The Telesat BCG Matrix provides a clear, one-page overview of each business unit's position, relieving the pain of complex strategic analysis.

Cash Cows

Telesat's established GEO broadband services represent a classic Cash Cow within its business portfolio. This segment leverages a mature satellite fleet, delivering reliable internet connectivity to a broad range of customers across various sectors.

The market for these services is well-defined, and Telesat commands a substantial share, ensuring a steady and considerable generation of cash flow. This stability is further underscored by the segment's impressive financial performance, achieving an 80% Adjusted EBITDA margin in 2024, a clear indicator of its robust profitability and cash-generating capability.

Telesat's Video Distribution & Broadcast Services, powered by its geostationary (GEO) satellites, continues to be a strong cash cow. These services benefit from long-standing contracts, providing a steady stream of recurring revenue.

As of the first quarter of 2024, Telesat reported a significant backlog of $1.1 billion specifically from its GEO business, underscoring the sustained demand in this established market segment.

This segment requires comparatively minimal new capital expenditures, especially when contrasted with investments needed for newer, more dynamic growth areas within the telecommunications industry.

Telesat's government and enterprise legacy data communications segment acts as a significant cash cow. This is driven by its robust portfolio of long-term contracts with government bodies and major corporations, leveraging its geostationary (GEO) satellite fleet for secure and dependable data transmission.

Operating within a sector characterized by substantial entry barriers and deeply entrenched customer loyalty, these services consistently deliver predictable and robust cash flows. For instance, in 2024, Telesat reported continued strong performance in its government services, a key component of this segment, underscoring the stability and profitability derived from these critical relationships.

Fixed Satellite Services (FSS) for Rural Connectivity

Telesat's Fixed Satellite Services (FSS) for rural connectivity represent a significant cash cow within its business portfolio. These services are fundamental to Telesat's operations, providing crucial satellite capacity to customers in areas underserved by terrestrial networks, particularly in rural and remote regions.

While the FSS segment may not exhibit explosive growth, its value lies in its stable demand and entrenched market position. This consistent demand translates into predictable revenue streams, acting as a reliable source of cash flow that underpins Telesat's financial stability and profitability.

- Stable Demand: FSS provides essential connectivity in areas lacking terrestrial alternatives.

- Established Market Presence: Telesat has a long-standing customer base for these services.

- Consistent Cash Flow: The predictable nature of demand generates steady revenue.

- Profitability Contribution: These services are a key contributor to overall company earnings.

Managed Services for Existing GEO Customers

Telesat's managed services for existing GEO customers represent a strategic move beyond basic connectivity. By offering comprehensive, end-to-end solutions, they are not just selling bandwidth but integrated network management, which fosters deeper customer loyalty and allows for premium pricing.

These value-added services are crucial for Telesat's Cash Cow strategy in the mature GEO satellite market. The company reported that its GEO services segment generated approximately CAD 600 million in revenue for the fiscal year 2023, with managed services forming a significant and growing portion of this. This focus on existing relationships and higher-margin offerings ensures a consistent and reliable revenue stream, bolstering their position as a stable performer.

- Deepened Customer Relationships: Integrated managed services transform transactional bandwidth sales into long-term partnerships.

- Higher Margin Potential: End-to-end solutions command better pricing compared to raw satellite capacity.

- Stable Revenue Stream: Focus on existing, established customer bases provides predictable income.

- Market Maturity: In a mature GEO market, these services differentiate Telesat and leverage existing infrastructure effectively.

Telesat's established GEO broadband services, including video distribution, broadcast services, and legacy data communications for government and enterprise, function as its primary cash cows. These segments benefit from long-term contracts and a stable, mature market, generating consistent and substantial cash flow with minimal need for new capital investment.

The company's focus on managed services for existing GEO customers further solidifies this cash cow status by offering higher-margin, value-added solutions that deepen customer loyalty and ensure predictable revenue streams.

For instance, Telesat's GEO business reported a backlog of $1.1 billion as of Q1 2024, demonstrating sustained demand and the reliable cash-generating potential of these mature services.

In 2024, Telesat's Adjusted EBITDA margin for its GEO services reached an impressive 80%, highlighting the segment's robust profitability and its role as a key cash generator for the company.

| Segment | Role in BCG Matrix | Key Drivers | 2024 Data Point |

|---|---|---|---|

| GEO Broadband | Cash Cow | Mature market, stable demand, long-term contracts | 80% Adjusted EBITDA margin |

| Video Distribution & Broadcast | Cash Cow | Established customer base, recurring revenue from long-term contracts | $1.1 billion GEO backlog (Q1 2024) |

| Government & Enterprise Legacy Data | Cash Cow | High entry barriers, customer loyalty, secure data transmission needs | Continued strong performance in government services |

| Fixed Satellite Services (FSS) for Rural | Cash Cow | Essential connectivity in underserved areas, stable demand | Consistent revenue streams underpinning financial stability |

| Managed Services for GEO Customers | Cash Cow Enhancement | Value-added solutions, premium pricing, deepened customer relationships | Significant and growing portion of CAD 600 million GEO revenue (FY 2023) |

Delivered as Shown

Telesat BCG Matrix

The Telesat BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, is ready for immediate download and integration into your business planning. You'll gain full access to the detailed market share and growth rate assessments, enabling informed decision-making regarding Telesat's satellite services. No further edits or modifications will be necessary, as this is the final, professional-grade report.

Dogs

Telesat's legacy North American DTH video contracts are firmly in the Dogs quadrant of the BCG Matrix. Revenue from these contracts has fallen significantly, driven by both reduced rates and capacity cuts from customers. This decline is directly linked to the broader market trend of consumers abandoning traditional satellite TV for streaming alternatives, making continued investment in this area a poor strategic choice.

The market for DTH video is shrinking, and Telesat's participation in it is no longer a growth area. The upcoming renewal of the Nimiq 5 Dish contract and the approaching end-of-life for the Anik F2/F3 satellites highlight the diminishing returns and market share associated with these legacy agreements. In 2023, Telesat reported a notable decrease in its broadcast segment revenue, largely attributed to these DTH video contracts.

Telesat's older transponder capacity on its geostationary satellites faces challenges from technological obsolescence and evolving market needs. This can lead to underutilization and reduced competitiveness, impacting revenue generation. For instance, in 2023, a portion of this older capacity saw a decline in leasing agreements as newer, more efficient solutions gained traction.

These assets, characterized by a low market share within potentially stagnant or shrinking market segments, consume operational expenses without delivering commensurate returns. This positions them as potential candidates for strategic review, possibly leading to divestiture or an accelerated retirement plan to reallocate resources.

Niche regional services, such as those providing satellite connectivity to highly localized markets in Latin America, fall into the Dogs category of the Telesat BCG Matrix. These services often struggle with low market share due to the rapid expansion of terrestrial fiber and wireless alternatives.

In 2024, Telesat reported reduced enterprise revenues from Latin America, a clear indicator of this segment's declining profitability and intense price pressure. This situation highlights the challenges of maintaining market presence when facing robust terrestrial competition.

Discontinued or Divested Business Units

Telesat's divestiture of subsidiaries like Infosat exemplifies a strategic pruning of its business portfolio. These units, characterized by their low market share and limited growth potential, were classified as Dogs in the BCG matrix. Their sale in recent years, such as the Infosat transaction, freed up capital and management attention.

This move aligns with Telesat's broader strategy to concentrate resources on its core satellite communications and broadband services. By shedding these underperforming assets, Telesat aims to improve overall profitability and enhance its competitive position in high-growth segments of the telecommunications market.

- Divestiture of Infosat: Telesat completed the sale of its Infosat subsidiary, a move that aligns with its strategy to exit less profitable ventures.

- Focus on Core Strengths: This divestment allows Telesat to reallocate resources towards its primary businesses, including its next-generation satellite constellations.

- Resource Optimization: By selling off units with low market share and low growth prospects, Telesat optimizes its resource allocation for better returns.

Services Impacted by Government Budget Reductions

Government budget reductions can directly impact Telesat's existing GEO satellite services. For instance, if a government agency that relies on these services faces a funding cut, its demand for Telesat's capacity might decrease. This is particularly relevant for contracts in segments where Telesat might have a weaker competitive standing.

Consider the scenario where a government client reduces its spending on satellite communications due to broader fiscal constraints. If Telesat's market share or technological edge in that specific government segment is not dominant, this reduction in demand can lead to a decline in revenue for those services. Such a situation, characterized by falling revenues and limited future growth potential, would place these GEO services in the 'Dog' quadrant of the BCG Matrix.

For example, if Telesat's GEO services are used by a defense department that experiences a 5% budget cut in 2024, and Telesat holds only a 10% market share in that particular niche, the impact could be significant. This scenario highlights how external financial pressures on government clients can directly affect the performance of Telesat's offerings, potentially pushing them into a low-growth, low-market-share category.

- Reduced Government Spending: A 2024 report indicated that several government agencies scaled back discretionary spending on telecommunications infrastructure by an average of 7%.

- Impact on Existing Contracts: Contracts tied to specific government programs that are de-prioritized or underfunded due to budget cuts are at higher risk of reduced utilization.

- Competitive Disadvantage Amplification: In segments where Telesat faces strong competition from other providers, a decline in government demand can disproportionately affect its revenue if it lacks a significant competitive moat.

- Potential for 'Dog' Classification: Services experiencing declining demand and operating in markets with limited growth prospects, especially if Telesat's competitive position is weak, are candidates for the 'Dog' category in the BCG Matrix.

Telesat's legacy DTH video services and older transponder capacity on GEO satellites are prime examples of 'Dogs' in the BCG Matrix. These segments face declining revenues due to market shifts like cord-cutting and technological obsolescence, as seen in Telesat's 2023 broadcast segment revenue decrease. Their low market share in shrinking markets, coupled with ongoing operational costs, makes them candidates for divestiture or accelerated retirement.

Niche regional services, particularly in Latin America, also fall into the 'Dog' category. Intense competition from terrestrial alternatives and reduced enterprise revenues in 2024 highlight their limited growth and profitability. Divesting subsidiaries like Infosat demonstrates Telesat's strategy to shed such underperforming assets and reallocate resources to more promising areas.

Government budget cuts can also push Telesat's GEO services into the 'Dog' quadrant, especially if Telesat holds a weaker competitive position in those segments. A 2024 report noted government agencies reducing telecom infrastructure spending, impacting contracts where Telesat's market share might be less dominant, further solidifying their 'Dog' status.

| Segment | BCG Category | Key Challenges | Financial Impact (Illustrative) |

|---|---|---|---|

| Legacy DTH Video | Dogs | Cord-cutting, reduced rates, capacity cuts | Broadcast segment revenue decline in 2023 |

| Older GEO Transponder Capacity | Dogs | Technological obsolescence, underutilization | Declining leasing agreements for older capacity in 2023 |

| Niche Latin American Services | Dogs | Terrestrial competition, price pressure | Reduced enterprise revenues in Latin America in 2024 |

| Government GEO Services (Specific Niches) | Dogs | Government budget cuts, weaker competitive standing | Potential revenue reduction due to client budget constraints (e.g., 7% average spending reduction by government agencies in 2024) |

Question Marks

Telesat Lightspeed, while positioned as a future Star in the BCG matrix, currently resides in the Question Mark quadrant due to its initial commercialization phase. The company is actively building out its advanced LEO satellite constellation, with the first launches slated for mid-2026.

Significant investment is a key characteristic of this phase, with Telesat projecting capital expenditures between $900 million and $1.1 billion for 2025 alone. This substantial outlay is necessary to bring the Lightspeed network to full operational capacity.

Currently, Lightspeed's market share is minimal as its services are not yet fully deployed. However, it is strategically targeting the high-growth market for global broadband connectivity, aiming to capture a significant portion of this expanding sector once operational.

Telesat's strategic push into new, untested geographic markets with its Lightspeed constellation or enhanced GEO offerings, where it currently has minimal penetration, represents a classic "Question Mark" in the BCG Matrix. These markets offer significant growth potential, but require substantial investment in market development, infrastructure, and sales to gain traction.

The inherent uncertainty of these ventures means immediate returns are not guaranteed, demanding careful resource allocation and a high tolerance for risk. For instance, the global satellite broadband market is projected to grow significantly, with some estimates placing it in the tens of billions by the early 2030s, highlighting the allure of these new territories.

Telesat's investment in developing highly innovative, software-defined satellite applications positions it squarely in the Question Mark category of the BCG matrix. This segment is experiencing rapid industry growth, with projections indicating a significant expansion in the market for flexible, customizable satellite services. For instance, the global software-defined satellite market was valued at approximately $2.5 billion in 2023 and is expected to reach over $8 billion by 2030, demonstrating a strong compound annual growth rate.

However, Telesat's current market share in these emerging applications is relatively low. This necessitates substantial investment in research and development to create differentiated offerings and significant expenditure on market education to build awareness and demand for these novel solutions. Successfully navigating this phase requires strategic focus and capital allocation to build a competitive advantage in a rapidly evolving technological landscape.

Strategic Partnerships for New Service Offerings

Telesat's strategic partnerships with entities like Orange and ADN Telecom for its Lightspeed satellite broadband services represent a calculated move into potentially high-growth markets. These collaborations are designed to leverage existing infrastructure and customer bases, aiming to accelerate the commercial rollout of Lightspeed's advanced capabilities.

While these partnerships hold significant promise for unlocking new revenue streams and expanding Telesat's market reach, they are still in the nascent stages of commercial deployment. The ultimate success in terms of market share and profitability remains to be fully determined as these ventures mature.

- Lightspeed Growth Potential: The partnerships aim to tap into underserved or emerging markets, potentially offering substantial growth opportunities as satellite broadband adoption increases globally.

- Early Commercialization: Commercial realization of these partnerships is still developing, meaning revenue and market penetration figures are not yet fully established.

- Market Validation Needed: The long-term profitability and competitive positioning of Lightspeed services through these alliances require further market validation and performance tracking.

- Investment and Risk: These early-stage ventures represent significant investment and carry inherent risks until their market impact and financial returns are clearly demonstrated.

Future Consumer Broadband Offerings (Post-Lightspeed)

While Telesat's Lightspeed constellation is primarily designed for enterprise and government clients, any future direct-to-consumer broadband services would initially be classified as a Question Mark in a BCG Matrix. This is due to the nascent stage and significant investment required to enter this segment.

The consumer LEO broadband market is experiencing rapid growth, but it's also intensely competitive. Companies like SpaceX's Starlink have already established a significant presence, meaning Telesat would likely begin with a very low market share. To effectively compete, Telesat would need substantial capital investment to build out infrastructure, marketing, and customer support tailored for the consumer market.

- Market Entry Challenge: Entering the consumer LEO broadband market requires overcoming established players and significant upfront capital for service delivery and customer acquisition.

- Competitive Landscape: The consumer LEO market, exemplified by Starlink's rapid deployment, presents a high barrier to entry due to existing user bases and ongoing network expansion.

- Investment Requirements: Competing effectively in the consumer space necessitates massive investment in network capacity, ground infrastructure, and customer-facing operations, far beyond enterprise-focused deployments.

- Potential for Growth: Despite the challenges, the consumer broadband sector offers substantial growth potential, making it a strategic consideration for future diversification if market conditions and Telesat's capabilities align.

Telesat's Lightspeed constellation, while poised for future success, currently fits the Question Mark profile due to its early development and market entry. Significant capital is being deployed, with projected 2025 expenditures between $900 million and $1.1 billion, to build out the LEO satellite network, which aims for initial launches in mid-2026. The focus is on high-growth global broadband, but current market share is negligible as services are not yet operational.

The company's strategic push into new geographic markets and innovative software-defined satellite applications also places it in the Question Mark quadrant. These areas offer substantial growth potential, with the global satellite broadband market projected to reach tens of billions by the early 2030s, and the software-defined satellite market expected to grow from $2.5 billion in 2023 to over $8 billion by 2030. However, Telesat's current penetration and market share in these segments are low, requiring considerable investment in development and market cultivation.

Partnerships with companies like Orange and ADN Telecom for Lightspeed services are aimed at accelerating commercial rollout and accessing new revenue streams. While promising, these ventures are in their early stages, and their ultimate market share and profitability are yet to be determined, necessitating ongoing market validation and performance tracking.

Should Telesat venture into the consumer LEO broadband market, it would also be a Question Mark. This segment, dominated by players like Starlink, demands massive investment in infrastructure and customer acquisition, despite its significant growth potential.

BCG Matrix Data Sources

Our Telesat BCG Matrix leverages comprehensive data from financial reports, market research, and industry growth projections to accurately assess business unit performance.