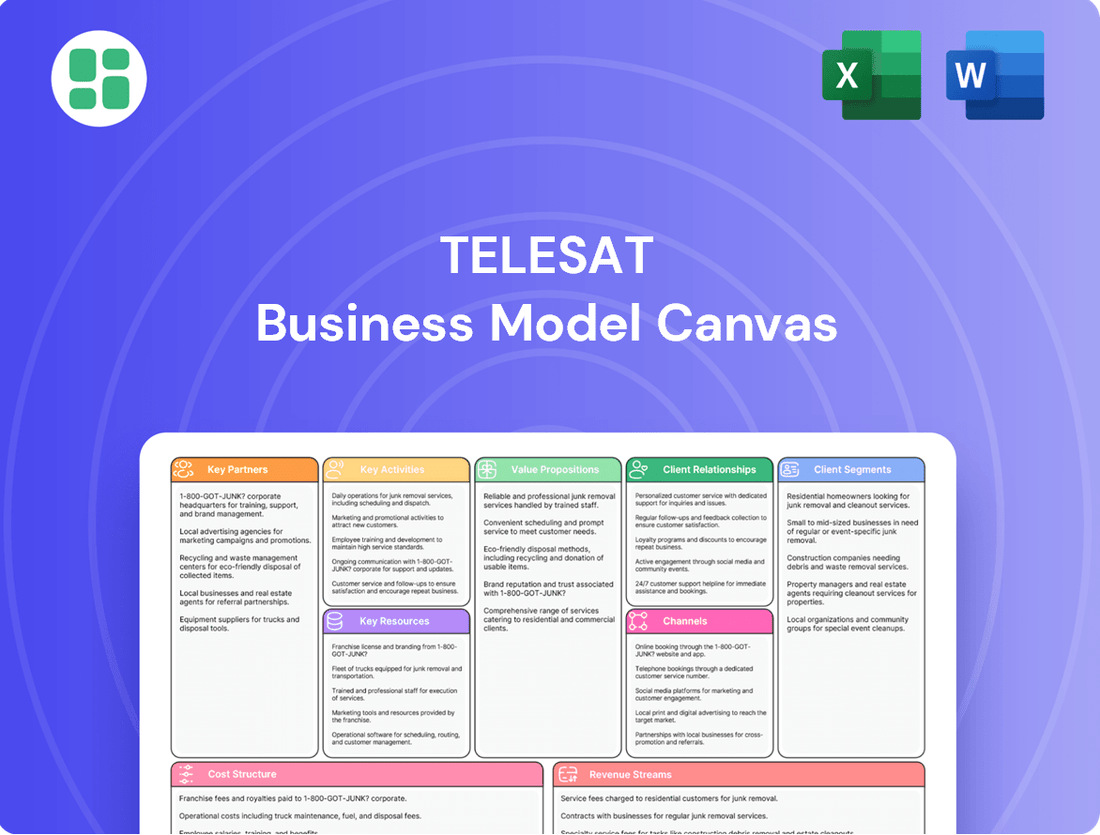

Telesat Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telesat Bundle

Discover the intricate workings of Telesat's innovative business model. This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone looking to understand how Telesat navigates the complex satellite communications industry.

Partnerships

Telesat actively collaborates with government entities, notably the governments of Canada and Quebec. These partnerships are instrumental in securing substantial financing and strategic backing for its ambitious Lightspeed satellite constellation project. For instance, the Canadian government committed C$89.6 million in 2021 to support Lightspeed development, underscoring the critical role of public funding in advancing such large-scale infrastructure.

These collaborations are vital for funding the immense capital requirements of next-generation satellite networks. They also serve to align Telesat's objectives with national connectivity strategies, aiming to bridge the digital divide and improve internet access in underserved and remote areas across Canada.

Telesat’s success hinges on strong alliances with satellite manufacturers and launch providers. Partnerships with firms like MDA Space are critical for the intricate design and production of their advanced satellite constellations, such as the Lightspeed LEO fleet. These collaborations are fundamental to ensuring the robust technical execution and timely deployment of Telesat's cutting-edge satellite technology.

Telesat forms strategic alliances with major global telecom operators, including companies like Orange. These partnerships are crucial for integrating Telesat's satellite capacity into existing terrestrial networks, thereby broadening its market reach and enhancing its service offerings.

These telecommunication partners function as vital distributors for Telesat. By leveraging Telesat's satellite capabilities, they can provide more robust and comprehensive connectivity solutions to their own end-customers, expanding the utility and accessibility of satellite-based communication.

For instance, in 2024, Telesat continued to strengthen its relationships with key players in the telecommunications sector, aiming to capitalize on the growing demand for advanced connectivity. These collaborations are instrumental in ensuring Telesat's services are seamlessly integrated into the global communication infrastructure.

Technology and Ground Infrastructure Providers

Telesat actively collaborates with technology and ground infrastructure providers to build out the terrestrial network essential for its satellite services. These partnerships are crucial for integrating satellite capacity with terrestrial networks, ensuring reliable connectivity for customers. For instance, collaborations with companies like Vocus in Australia and Calian are key to developing and deploying critical components such as landing stations, sophisticated network management systems, and strategically located points of presence. These elements are fundamental to delivering seamless and high-quality service to end-users.

These alliances enable Telesat to offer end-to-end solutions, bridging the gap between its advanced satellite technology and the ground-based infrastructure required for data transmission and management. The development of these terrestrial components is a significant undertaking, requiring specialized expertise and investment. By leveraging the strengths of its partners, Telesat can accelerate the deployment of its network and enhance the overall value proposition for its clients.

- Technology Collaborations: Partnerships with technology firms are essential for integrating advanced networking solutions and satellite communication technologies.

- Ground Infrastructure Development: Working with providers like Vocus and Calian ensures the deployment of vital terrestrial components, including landing stations and network operations centers.

- Seamless Service Delivery: These partnerships are fundamental to creating a robust and integrated network that provides reliable and high-speed connectivity.

- Network Management Systems: Collaborations focus on developing and implementing sophisticated systems for monitoring and managing the complex satellite and terrestrial network infrastructure.

Enterprise and Mobility Solution Providers

Telesat's strategic alliances with enterprise and mobility solution providers are crucial for expanding its market presence. These partnerships, such as the one with Viasat, enable Telesat to offer tailored connectivity solutions for demanding sectors like commercial aviation, maritime operations, and government agencies. This focus allows Telesat to tap into high-value, mission-critical markets where reliable and advanced satellite communication is essential.

These collaborations are vital for extending Telesat's service capabilities and reach. By integrating their satellite technology with the specialized platforms and distribution networks of these partners, Telesat can effectively serve niche markets. For instance, by working with mobility solution providers, Telesat can ensure seamless connectivity for moving assets, a key requirement in industries like global shipping and air travel.

The benefits of these key partnerships are evident in their ability to unlock new revenue streams and strengthen Telesat's competitive position. These relationships allow Telesat to:

- Access specialized market segments: Partnerships provide direct entry into sectors with unique connectivity needs, such as defense and transportation.

- Enhance service offerings: Collaborations enable the bundling of Telesat's satellite capacity with partner-provided hardware, software, and managed services for a comprehensive solution.

- Drive innovation: Working with solution providers fosters joint development of new applications and services tailored to evolving market demands.

- Expand geographic reach: Partners often have established global networks and customer bases, accelerating Telesat's international market penetration.

Telesat's key partnerships are crucial for its operational success and market expansion. These include collaborations with government entities for funding and strategic alignment, satellite manufacturers for constellation development, and telecom operators for service distribution. Additionally, alliances with technology and ground infrastructure providers are vital for seamless service delivery, while partnerships with enterprise and mobility solution providers unlock access to specialized, high-value markets.

| Partner Type | Key Partners Example | Purpose of Partnership | Impact/Benefit |

|---|---|---|---|

| Government | Government of Canada, Government of Quebec | Financing, strategic backing, national connectivity alignment | Secured C$89.6 million from Canadian government for Lightspeed (2021); enables bridging digital divide |

| Satellite Manufacturing | MDA Space | Design and production of satellite constellations (e.g., Lightspeed LEO fleet) | Ensures robust technical execution and timely deployment of advanced satellite technology |

| Telecom Operators | Orange | Integration of satellite capacity into terrestrial networks, market reach expansion | Enhances service offerings and broadens market access for both partners |

| Ground Infrastructure | Vocus, Calian | Deployment of landing stations, network management systems, points of presence | Enables end-to-end solutions and reliable connectivity for customers |

| Enterprise/Mobility | Viasat | Tailored connectivity for aviation, maritime, government sectors | Access to high-value markets, expansion into niche segments |

What is included in the product

A comprehensive, pre-written business model tailored to Telesat's strategy, detailing customer segments, channels, and value propositions for global satellite communications.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting Telesat's real-world operations and plans for satellite-based connectivity solutions.

Provides a clear, visual roadmap for addressing complex satellite communication challenges.

Simplifies the intricate aspects of global connectivity solutions for easier understanding and strategic planning.

Activities

Telesat's key activities revolve around the continuous development, manufacturing, and deployment of its satellite constellations. This encompasses both its established geostationary (GEO) fleet and the ambitious new Low Earth Orbit (LEO) network, Telesat Lightspeed.

Managing the intricate engineering processes and coordinating with global manufacturers and launch service providers are critical to bringing new satellites online. This ensures the operational readiness and expansion of Telesat's service capabilities.

By mid-2024, Telesat had secured significant funding and partnership agreements for Lightspeed, underscoring the substantial investment and progress in this constellation development. The company continues to work with key suppliers for satellite production and launch services.

Telesat's key activities center on the robust operation and ongoing maintenance of its extensive global satellite fleet and its critical ground infrastructure. This includes managing gateways, network control centers, and strategically located points of presence, all vital for uninterrupted service delivery.

These operational efforts are crucial for ensuring the reliable and continuous provision of satellite-based communication services to a diverse customer base. For instance, Telesat's investment in its network infrastructure supports its advanced capabilities, such as those offered by its new Phase 1 Lightspeed network, which aims to provide low-latency broadband connectivity.

Telesat's key activities revolve around the aggressive marketing and sales of its satellite-based broadband, video, and data communication services. This includes securing new contracts and managing ongoing client relationships across diverse global customer segments.

Expanding the customer base for both its established geostationary (GEO) and upcoming low Earth orbit (LEO) satellite services is a critical focus. For instance, in 2024, Telesat continued to advance its Project Kuiper collaboration, a significant step in broadening its LEO service offerings and attracting new enterprise clients.

Research and Development (R&D)

Telesat's commitment to Research and Development is vital for staying ahead in the competitive satellite communications industry. This includes significant investment in the Telesat Lightspeed project, a cutting-edge Low Earth Orbit (LEO) satellite constellation. The development of proprietary technologies like the Constellation Network Operating System (CNOS) is a direct result of this R&D focus, enabling advanced network management and service delivery.

This continuous innovation fuels advancements not only in satellite hardware but also in the complex software and operational systems required to manage a global LEO network. For instance, Telesat reported capital expenditures of approximately $1.2 billion in 2023, a substantial portion of which is allocated to the Lightspeed program and its underlying R&D efforts. This investment underpins their strategy to offer unparalleled connectivity solutions.

- Innovation Driver: R&D is the engine for developing and refining Telesat Lightspeed and associated technologies like CNOS.

- Technological Advancement: Focus on satellite technology, network orchestration, and new service capabilities.

- Capital Allocation: Significant portions of capital expenditures, like the $1.2 billion in 2023, are directed towards R&D for Lightspeed.

- Competitive Edge: R&D ensures Telesat maintains a leading position in providing advanced satellite broadband services.

Regulatory Compliance and Spectrum Management

Telesat actively engages with global regulatory bodies, including the FCC in the United States, to ensure ongoing compliance and secure necessary spectrum licenses. This proactive approach is critical for the successful deployment and operation of its satellite constellations, particularly the advanced Lightspeed network.

Managing spectrum licenses involves optimizing the use of valuable orbital resources, a complex task given the evolving satellite landscape. Telesat must adapt to new regulations and technical standards, especially those concerning Low Earth Orbit (LEO) constellations and specific orbital altitudes, to maintain operational integrity and service continuity.

Key activities in this area include:

- Regulatory Engagement: Participating in rule-making processes and consultations with authorities like the FCC, ISED Canada, and ITU.

- Spectrum Licensing: Acquiring, maintaining, and managing licenses for the necessary frequency bands for LEO and geostationary (GEO) satellite services.

- Compliance Monitoring: Ensuring all operations adhere to national and international regulations, including those related to orbital debris mitigation and spectrum usage.

- Adaptation to LEO Regulations: Staying ahead of evolving regulatory frameworks specifically designed for large LEO constellations, including coordination and interference management.

Telesat's key activities are centered on the design, manufacturing, and deployment of its satellite constellations, including the new Telesat Lightspeed LEO network. This involves managing complex engineering processes and coordinating with global partners for satellite production and launch services, with significant progress noted in 2024 through secured funding and partnerships for Lightspeed.

Operational management and maintenance of its existing GEO fleet and ground infrastructure are paramount for reliable service delivery. This includes managing gateways and network control centers to support advanced capabilities like low-latency broadband from the Lightspeed network.

The company actively markets and sells its satellite communication services, focusing on expanding its customer base for both GEO and LEO offerings. Collaborations, such as the one with Project Kuiper in 2024, are key to broadening its LEO service portfolio and attracting new clients.

Telesat's commitment to Research and Development is crucial for innovation, particularly for the Lightspeed project and proprietary technologies like the Constellation Network Operating System (CNOS). Significant capital expenditures, like the approximately $1.2 billion in 2023, are allocated to these R&D efforts to maintain a competitive edge.

Engaging with global regulatory bodies and managing spectrum licenses are vital activities to ensure compliance and operational integrity. This includes adapting to evolving regulations for LEO constellations and securing necessary frequency bands for uninterrupted service.

| Key Activity | Description | 2024/Recent Data Point |

|---|---|---|

| Satellite Development & Deployment | Designing, manufacturing, and launching satellite constellations (GEO & LEO). | Secured significant funding and partnerships for Telesat Lightspeed in 2024. |

| Operations & Maintenance | Managing and maintaining the satellite fleet and ground infrastructure. | Ensuring reliable service delivery for existing GEO services and the new Lightspeed network. |

| Sales & Marketing | Promoting and selling satellite-based communication services to diverse customers. | Advancing collaborations like Project Kuiper to expand LEO service offerings. |

| Research & Development | Innovating satellite technology, network systems, and service capabilities. | Substantial investment in Lightspeed and proprietary technologies like CNOS. |

| Regulatory & Spectrum Management | Ensuring compliance and managing spectrum licenses with global bodies. | Active engagement with regulatory bodies like the FCC for spectrum and operational approvals. |

Delivered as Displayed

Business Model Canvas

The Telesat Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this same comprehensive Business Model Canvas, allowing you to immediately begin leveraging its insights.

Resources

Telesat operates a substantial fleet of geostationary satellites, a core asset underpinning its traditional broadband, video distribution, and data communications offerings. This established satellite infrastructure provides a reliable foundation for ongoing revenue streams and market presence.

As of early 2024, Telesat’s GEO fleet includes approximately 15 satellites, a significant portion of its overall capacity. These satellites generated revenue of CAD 692 million in 2023 from its traditional satellite services, highlighting their continued economic importance.

Telesat Lightspeed is Telesat's advanced Low Earth Orbit (LEO) satellite constellation, a cornerstone of their future business model. It's engineered to provide high-capacity, low-latency broadband internet services worldwide. This innovative network is designed to be a key enabler for Telesat's future revenue streams and competitive advantage in the global connectivity market.

The Lightspeed constellation is crucial for Telesat's strategy to capture new markets and enhance existing services. It aims to offer performance comparable to terrestrial fiber, opening up significant opportunities in enterprise, government, and mobility sectors. Telesat has secured substantial funding commitments, with over $2 billion in financing arranged by the end of 2023, underscoring the project's viability and market confidence.

Telesat's global ground infrastructure is the backbone of its satellite services, comprising a robust network of gateways, landing stations, and data centers. This terrestrial network is crucial for seamlessly connecting its advanced satellite constellations, like Lightspeed, to the global internet. In 2024, Telesat continued to invest in expanding and upgrading this vital infrastructure to support increasing data demands and ensure reliable service delivery.

This comprehensive ground segment enables efficient data routing and low-latency connectivity for end-users worldwide. The network operations centers (NOCs) play a key role in monitoring and managing the satellite and terrestrial assets, ensuring optimal performance and rapid response to any issues. The strategic placement of these facilities is designed to minimize transit times and maximize the reach of Telesat's high-speed satellite internet services.

Spectrum Licenses and Orbital Rights

Spectrum licenses and orbital rights are the bedrock of Telesat's operations, granting the essential authority to transmit and receive signals. These regulatory assets are crucial for both geostationary (GEO) and low Earth orbit (LEO) satellite constellations, ensuring interference-free communication. In 2024, Telesat continued to leverage its extensive portfolio of spectrum licenses across various frequency bands, vital for its global connectivity services.

These rights are not merely permissions; they are valuable, scarce resources that define the operational boundaries and capabilities of satellite networks. Telesat's strategic acquisition and management of these licenses are key to its competitive advantage in the rapidly evolving satellite communications market.

- Spectrum Licenses: Telesat holds licenses in key frequency bands like C-band and Ku-band, enabling a wide range of services from broadcasting to broadband internet.

- Orbital Rights: The company has secured and maintains rights to geostationary orbital slots, providing stable, long-term coverage for its traditional satellite fleet.

- LEO Constellation: For its Lightspeed LEO constellation, Telesat is actively securing the necessary spectrum and orbital assignments to support its advanced global network.

Skilled Workforce and Intellectual Property

Telesat's competitive edge is deeply rooted in its highly specialized workforce. This includes a cadre of engineers, technicians, and satellite communication experts who possess the intricate knowledge required to design, build, and operate advanced satellite systems. Their collective expertise is crucial for maintaining Telesat's technological leadership and operational excellence.

Proprietary technology and intellectual property form another critical pillar. Telesat has invested heavily in developing unique assets, such as the innovative Lightspeed network architecture. This, combined with advanced software platforms like CNOS (Connectivity Network Operations System), provides significant advantages in network management and service delivery.

- Skilled Workforce: Telesat employs a global team of over 1,000 highly skilled professionals, a significant portion of whom are engineers and technical specialists.

- Intellectual Property: The company holds numerous patents related to satellite technology, network design, and operational software, underpinning its unique service offerings.

- Lightspeed Network: This next-generation LEO satellite constellation represents a substantial investment in proprietary technology, designed for low latency and high throughput connectivity.

- CNOS Software: Telesat's proprietary CNOS platform is a key enabler for managing its complex satellite networks, offering advanced capabilities for dynamic resource allocation and service assurance.

Telesat's key resources also include its robust intellectual property and proprietary technology, notably the Lightspeed network architecture and its advanced CNOS software. These elements are critical for maintaining a competitive edge in network management and service delivery.

The company's skilled workforce, comprising over 1,000 professionals with significant engineering and technical expertise, is another vital resource. This human capital is essential for the design, operation, and ongoing innovation of Telesat's complex satellite systems.

Furthermore, Telesat's extensive portfolio of spectrum licenses and orbital rights are fundamental, providing the necessary regulatory foundation for its GEO and LEO operations. These scarce resources are actively managed to ensure interference-free communication and market access.

| Resource Category | Specific Assets | 2023/2024 Relevance |

|---|---|---|

| Satellite Fleet | GEO Satellites | Generated CAD 692 million in revenue in 2023; approximately 15 satellites in operation. |

| Next-Gen Constellation | Lightspeed LEO Constellation | Secured over $2 billion in financing by end of 2023; designed for low-latency, high-capacity broadband. |

| Infrastructure | Global Ground Network | Continued investment in gateways, landing stations, and NOCs in 2024 to support Lightspeed. |

| Regulatory Assets | Spectrum Licenses & Orbital Rights | Holding key licenses (C-band, Ku-band) and orbital slots; actively securing LEO assignments. |

| Human Capital & IP | Skilled Workforce & Proprietary Tech | Over 1,000 employees; patents in satellite tech and network design; CNOS software. |

Value Propositions

Telesat's commitment to ubiquitous and reliable global connectivity ensures that even the most remote and underserved regions gain access to essential broadband internet, video distribution, and data communications. This is crucial in areas where traditional ground-based infrastructure simply isn't feasible.

For instance, in 2024, Telesat continued to expand its reach, supporting critical operations in sectors like disaster relief and remote resource exploration where consistent connectivity is non-negotiable. Their satellite network effectively bridges these digital divides.

This capability directly addresses a significant market need, enabling businesses and governments to operate efficiently and connect populations that would otherwise remain isolated. Telesat's solutions are vital for global digital inclusion.

Telesat's Lightspeed initiative is set to redefine broadband by offering fiber-optic-like speeds and dramatically lower latency, a critical upgrade for businesses and government entities. This advanced connectivity is designed to meet the escalating global need for high-performance internet access, enabling new applications and services.

Telesat Lightspeed offers secure and resilient communications, crucial for sectors like defense and critical infrastructure. Its design incorporates stringent government cybersecurity standards and a Zero-Trust Network Access architecture, ensuring assured connectivity even in challenging environments.

This commitment to security is vital for government clients who require dependable and protected communication channels. For example, in 2024, global cybersecurity spending was projected to reach $266.4 billion, highlighting the increasing demand for such robust solutions.

Tailored Solutions for Specific Sectors

Telesat crafts bespoke satellite solutions, meticulously engineered to address the demanding operational needs of diverse industries. This includes specialized offerings for telecommunications providers, government agencies, and the maritime and aeronautical sectors.

By focusing on sector-specific requirements, Telesat ensures its services are not just functional but are optimized for unique industry challenges. For instance, in 2024, the company continued to emphasize its role in providing resilient connectivity for critical government operations and supporting the growing data demands of the aviation industry.

- Telecommunications: Delivering high-capacity, low-latency broadband to underserved regions.

- Government: Providing secure and reliable communication networks for defense and public safety.

- Maritime: Offering continuous connectivity for vessels, enhancing operational efficiency and crew welfare.

- Aeronautical: Supplying inflight Wi-Fi and connectivity solutions for passengers and flight operations.

Integration with Terrestrial Networks (MEF 3.0)

Telesat's Lightspeed network is engineered for MEF 3.0 certification, ensuring robust Layer 2 Carrier Ethernet compatibility. This means it can connect effortlessly with current terrestrial networks, making it a natural extension for service providers.

This integration capability is crucial for telecom operators looking to enhance their offerings. By leveraging Lightspeed, they can readily add satellite capacity to their existing service portfolios, creating more comprehensive solutions for their customers.

Furthermore, the MEF 3.0 compliance of Lightspeed directly supports the development of hybrid 5G infrastructures. This allows for more resilient and widespread 5G coverage, bridging gaps where terrestrial networks alone may fall short.

- Seamless Terrestrial Integration: MEF 3.0 certification ensures Lightspeed connects smoothly with existing fiber and wireless networks.

- Enhanced Service Portfolios: Telecoms can easily incorporate Lightspeed's satellite capacity to offer expanded connectivity options.

- Hybrid 5G Enablement: Facilitates the creation of robust, hybrid 5G networks by complementing terrestrial infrastructure.

- Future-Proof Connectivity: Aligns with industry standards, ensuring long-term compatibility and service innovation.

Telesat's value proposition centers on delivering ubiquitous, reliable, and high-performance connectivity, particularly to underserved regions. Their Lightspeed initiative promises fiber-optic-like speeds and low latency, crucial for businesses and governments. This advanced network also prioritizes secure and resilient communications, meeting stringent government cybersecurity standards.

Customer Relationships

Telesat cultivates enduring partnerships with its primary enterprise, government, and telecom clients via dedicated account management. This approach fosters a profound comprehension of client requirements, enabling highly customized service provision.

Telesat offers robust technical support, backed by Service Level Agreements (SLAs) that guarantee performance and uptime, especially for critical services. This focus on reliability is key to building and keeping customer trust.

For example, in 2024, Telesat's commitment to its SLAs meant consistently meeting or exceeding targets for network availability, which is vital for clients relying on uninterrupted connectivity for their operations.

Telesat actively partners with clients, especially for significant undertakings like government programs or specific business needs, fostering a co-creation environment for tailored connectivity solutions. This approach ensures that the final product precisely meets intricate operational demands, as seen in their work with global defense organizations requiring highly secure and resilient satellite networks.

Partnership-Oriented Approach

Telesat moves beyond basic customer interactions, cultivating deep, partnership-oriented relationships with major entities in the telecommunications and technology industries. This approach is central to their strategy for mutual advancement and wider market reach.

These collaborations are designed for more than just service delivery; they focus on shared growth objectives and expanding market presence. For instance, Telesat's 2024 initiatives include co-development projects with satellite technology providers to enhance next-generation connectivity solutions.

- Strategic Alliances: Telesat actively forms alliances with leading telecom operators and technology firms to integrate satellite capabilities into broader communication networks.

- Joint Ventures: The company engages in joint ventures to explore new markets and develop innovative services, leveraging the strengths of its partners.

- Co-creation of Solutions: Telesat collaborates with partners to co-create tailored solutions that address specific industry needs, such as enhanced broadband for remote areas.

- Market Expansion: These partnerships are instrumental in Telesat's efforts to expand its global footprint and introduce its advanced satellite services to new customer segments.

Long-term Contractual Agreements

Telesat's customer relationships are significantly strengthened by long-term contractual agreements, often spanning multiple years. These contracts provide a predictable and stable revenue base, which is crucial for long-term planning and investment.

This contractual backbone is clearly reflected in Telesat's substantial backlog for both its geostationary (GEO) and low Earth orbit (LEO) satellite services. As of early 2024, Telesat reported a significant backlog, demonstrating the enduring commitment of its customers.

- Stable Revenue: Multi-year contracts secure consistent income, reducing financial volatility.

- Predictability: Long-term agreements offer visibility into future revenue streams, aiding strategic decisions.

- Customer Commitment: A large backlog indicates strong customer loyalty and reliance on Telesat's services.

Telesat prioritizes deep, partnership-based relationships, particularly with enterprise, government, and telecom clients, focusing on co-creation and long-term contracts. This strategy ensures tailored solutions, like secure satellite networks for defense in 2024, and provides a stable revenue foundation, evident in their significant service backlog.

| Relationship Type | Key Features | 2024 Impact/Example |

|---|---|---|

| Dedicated Account Management | Profound client understanding, customized service | Meeting diverse needs of enterprise clients |

| Robust Technical Support & SLAs | Guaranteed performance, uptime, reliability | Exceeding network availability targets for critical services |

| Strategic Alliances & Co-creation | Joint development, integrated solutions | Co-development with tech firms for next-gen connectivity |

| Long-Term Contracts | Revenue stability, predictability, customer commitment | Significant backlog across GEO and LEO services |

Channels

Telesat employs a dedicated direct sales force to cultivate relationships with key clients, including large enterprises, government bodies, and major telecom providers. This approach facilitates tailored solutions and intricate contract negotiations.

This direct engagement model is crucial for addressing the complex needs of these significant customers, allowing Telesat to offer customized satellite communication solutions. For instance, in 2024, Telesat secured a significant multi-year agreement with a major North American airline for in-flight connectivity services, a deal likely facilitated by their direct sales expertise.

Telesat leverages a robust network of channel partners and resellers, like ADN Telecom, to significantly expand its market presence. This strategy is crucial for reaching diverse geographic regions and catering to a wider customer base, especially for their regional broadband and data offerings.

In 2024, the satellite communications industry saw continued growth, with companies like Telesat actively seeking to enhance their terrestrial reach through these partnerships. For instance, collaborations with local providers allow for more effective last-mile delivery of broadband services, a key focus for the company.

Telesat engages with complex government procurement processes, particularly for defense and public sector clients, ensuring its satellite communication solutions meet stringent national security and operational requirements. This involves meticulous responses to tenders and adherence to established frameworks. For instance, in 2023, the Canadian government continued to invest in advanced communication technologies, with Telesat a key player in providing secure satellite services.

Industry Conferences and Trade Shows

Telesat leverages industry conferences and trade shows as crucial channels to highlight its advancements in satellite technology and connectivity solutions. These events are vital for engaging with potential customers and partners across the telecom and broader technology sectors. For instance, in 2024, Telesat actively participated in key events like Satellite 2024, showcasing its next-generation capabilities, including its global LEO constellation, Lightspeed.

These gatherings provide a platform for direct interaction, enabling Telesat to demonstrate its value proposition and foster business relationships. Such participation is instrumental in securing new contracts and solidifying its market position. The company's presence at these shows directly supports lead generation and brand visibility within the competitive satellite communications landscape.

- Showcasing Innovation: Demonstrating new technologies like the Lightspeed constellation to a global audience.

- Networking Opportunities: Connecting with potential clients, partners, and industry influencers.

- Strategic Announcements: Announcing partnerships and business developments to key stakeholders.

- Market Intelligence: Gathering insights into industry trends and competitor activities.

Online Presence and Investor Relations

Telesat leverages its official website and dedicated investor relations portals as key channels for corporate communication and stakeholder engagement. These platforms are crucial for disseminating information about the company's diverse satellite services, its financial performance, and significant strategic initiatives, such as the ongoing Lightspeed global satellite constellation development.

These digital touchpoints are vital for maintaining transparency and fostering relationships with investors, analysts, and other interested parties. They provide access to timely updates, financial reports, and strategic insights, ensuring stakeholders are well-informed about Telesat's trajectory.

- Website & Investor Portal: Telesat's primary online presence serves as a central hub for all corporate information.

- Lightspeed Information: Specific sections are dedicated to detailing the progress and strategic importance of the Lightspeed initiative.

- Financial Transparency: Regular updates on financial performance, including earnings reports and investor presentations, are readily available.

- Stakeholder Engagement: These channels facilitate two-way communication, allowing for feedback and inquiry from the investment community.

Telesat utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for large enterprise and government clients, a network of channel partners and resellers for broader market penetration, and active participation in industry events for showcasing innovation and networking. Digital channels like its website and investor relations portals are crucial for corporate communication and stakeholder engagement.

Customer Segments

Telecommunication companies and Internet Service Providers (ISPs) represent a crucial customer segment for Telesat. These entities utilize Telesat's satellite capacity for essential functions like backhaul, extending their network reach, and delivering broadband services. This is particularly vital for connecting customers in remote or underserved regions where terrestrial infrastructure is limited or non-existent.

In 2024, the global satellite broadband market is projected for significant growth, with an estimated value of $10.5 billion, indicating a strong demand for the services Telesat provides to these telecommunication partners. Telesat's capacity enables these providers to offer reliable internet access, bridging the digital divide and expanding their service offerings to a wider customer base.

Governments and defense organizations rely on Telesat for mission-critical communication solutions, essential for national security and disaster response. These entities require secure and reliable satellite networks to maintain command and control, disseminate critical information, and support intelligence gathering operations.

In 2024, the global defense market is projected to reach over $2.2 trillion, highlighting the significant investment in security infrastructure where advanced communication plays a vital role. Telesat's offerings directly address the need for resilient connectivity in challenging environments, supporting everything from troop movements to emergency management.

Telesat's maritime and aviation segments are crucial components of its mobility market strategy, providing essential connectivity solutions. For ships, this means enabling broadband internet access for passengers and crew, facilitating operational communications, and offering entertainment services. Similarly, in aviation, Telesat delivers robust internet and communication capabilities to aircraft, enhancing the passenger experience and supporting airline operations. The demand for reliable, high-speed connectivity in these sectors is growing rapidly, with the global aviation connectivity market projected to reach $13.9 billion by 2027, according to a 2023 report.

Enterprise Businesses

Enterprise businesses, particularly those operating in sectors like energy, mining, and finance, depend heavily on Telesat for robust data communication and secure corporate network connectivity. These industries often have extensive operations in remote or challenging geographical locations where terrestrial infrastructure is limited or nonexistent, making satellite solutions essential for maintaining business continuity and efficiency. For instance, many resource extraction companies leverage Telesat's services to connect their operational sites, enabling real-time data transfer for monitoring, control, and personnel safety.

Telesat's enterprise customer base is diverse, reflecting the broad applicability of its advanced satellite services. Key segments include:

- Energy Sector: Oil and gas exploration and production companies utilize Telesat for remote site connectivity, pipeline monitoring, and operational command and control.

- Mining Operations: Mining companies rely on satellite links for communication between mine sites, processing plants, and corporate offices, facilitating logistics and data management.

- Financial Institutions: Banks and financial services firms with global or remote operations use Telesat for secure data transmission and backup connectivity.

- Other Industries: This includes transportation, government agencies, and disaster relief organizations that require reliable communication in areas lacking terrestrial networks.

Media and Broadcast Companies (Direct-to-Home)

Media and broadcast companies, particularly those offering direct-to-home (DTH) television services, represent a historically significant customer segment for Telesat. These companies rely on satellite capacity for the efficient distribution of video content to a broad subscriber base.

While the DTH market has seen some shifts, it continues to be a vital part of Telesat's revenue. In 2023, Telesat reported that its Broadcast segment, which includes DTH services, generated approximately CAD 490 million in revenue, demonstrating its continued relevance.

- DTH Video Distribution: Core service provided to broadcasters for content delivery.

- Historical Significance: A foundational customer base for Telesat's growth.

- Market Evolution: Adapting to changing media consumption patterns while retaining a core audience.

- Revenue Contribution: Broadcast segment remains a key revenue driver for the company.

Telesat serves a diverse range of customer segments, each with unique connectivity needs. These include telecommunication companies and ISPs looking to extend their networks, governments and defense organizations requiring secure, mission-critical communications, and mobility providers in the maritime and aviation sectors. Additionally, enterprise businesses in sectors like energy and mining, along with media and broadcast companies, rely on Telesat for robust data and video distribution, particularly in remote locations.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Telcos & ISPs | Network extension, backhaul, broadband delivery to underserved areas | Global satellite broadband market projected at $10.5 billion in 2024 |

| Governments & Defense | Secure, reliable, mission-critical communications, national security, disaster response | Global defense market exceeds $2.2 trillion, emphasizing communication infrastructure investment |

| Maritime & Aviation | Passenger and crew connectivity, operational communications, enhanced experience | Global aviation connectivity market projected to reach $13.9 billion by 2027 |

| Enterprise (Energy, Mining, Finance) | Remote site connectivity, secure data transmission, business continuity | Critical for operations in geographically challenging locations |

| Media & Broadcast | DTH video distribution, content delivery to subscribers | Telesat's Broadcast segment generated ~CAD 490 million in 2023 |

Cost Structure

The design, manufacturing, and launch of new satellites, especially for the ambitious Telesat Lightspeed constellation, represent a substantial cost. This requires significant upfront capital for the spacecraft themselves and the crucial launch services to get them into orbit.

For context, the Telesat Lightspeed constellation, a key part of Telesat's future, involves a multi-billion dollar investment. The manufacturing of each advanced satellite in this constellation incurs considerable expense, and securing reliable launch vehicles adds another layer of significant cost. For example, in 2024, launch costs for dedicated heavy-lift rockets can range from $60 million to over $100 million per launch, depending on the provider and mission specifics.

Telesat's cost structure heavily involves the development and ongoing upkeep of its ground infrastructure. This includes the significant capital expenditure required to build and enhance its global network of ground stations, teleports, and the terrestrial fiber optic links that connect them. These facilities are crucial for managing satellite operations, processing data, and ensuring reliable service delivery to customers worldwide.

In 2024, investments in upgrading and expanding this ground network remain a substantial cost. For instance, the deployment of new teleport facilities and the integration of advanced technologies like 5G-enabled gateways contribute to these expenses. Maintaining the existing infrastructure, including power, cooling, and security for these critical sites, also represents a continuous operational cost.

Telesat's cost structure is heavily influenced by substantial investment in Research and Development (R&D). This is particularly evident in their ambitious Lightspeed program, a next-generation satellite constellation. These R&D expenses encompass a wide range of activities, including cutting-edge engineering, ongoing technology development, and continuous innovation aimed at enhancing satellite and network capabilities.

For instance, the capital expenditure for the Lightspeed program alone is projected to be in the billions of dollars, with a significant portion allocated to R&D. This investment drives the development of advanced technologies necessary for a low-latency, high-speed satellite broadband network. These costs are critical for maintaining a competitive edge in the rapidly evolving telecommunications sector.

Operational Expenses (Staff, Power, Spectrum Fees)

Telesat's operational expenses are a significant component of its business model, primarily driven by its need for a highly skilled workforce, substantial power consumption, and ongoing spectrum license fees. These are not one-time costs but recurring necessities for maintaining its satellite network and ground infrastructure.

The company's specialized workforce, encompassing engineers, technicians, and operational staff, represents a major salary expense. Furthermore, the power required to operate its ground stations and maintain satellite connectivity is a considerable ongoing cost. Spectrum fees, essential for utilizing radio frequencies for communication, also contribute significantly to these operational expenditures. For instance, in 2024, telecommunications companies globally continued to invest heavily in spectrum, with auctions for new bands often reaching billions of dollars, underscoring the importance of these fees for satellite operators like Telesat.

- Staffing Costs: Salaries and benefits for highly skilled personnel in satellite operations, engineering, and network management are a primary driver.

- Power Consumption: Significant electricity costs are incurred to operate ground stations, data centers, and other essential infrastructure.

- Spectrum Licensing: Fees paid to regulatory bodies for the right to use specific radio frequency bands are a recurring and often substantial expense.

Sales, Marketing, and Administrative Overheads

Telesat’s cost structure includes significant investments in sales, marketing, and administrative overheads. These expenses are crucial for acquiring and retaining customers, as well as ensuring smooth corporate operations.

These overheads encompass the costs of a dedicated sales force, including their compensation and incentives, alongside expenditures on broad marketing campaigns designed to reach target audiences. Customer support functions, vital for client satisfaction and retention, also fall under this umbrella.

Furthermore, general administrative functions, which include everything from executive management to legal and HR, are managed within these overheads. For instance, in 2024, companies in the telecommunications sector often allocate a substantial portion of their budget to these areas to maintain a competitive edge and ensure compliance.

- Sales Force Compensation: Salaries, commissions, and benefits for sales teams responsible for client acquisition and relationship management.

- Marketing Campaigns: Costs associated with advertising, public relations, digital marketing, and promotional activities to build brand awareness and generate leads.

- Customer Support: Expenses for call centers, technical assistance, and client service teams dedicated to resolving issues and enhancing customer experience.

- General Administration: Costs related to executive leadership, finance, legal, human resources, and other corporate functions essential for governance and operational efficiency.

Telesat's cost structure is dominated by the capital-intensive nature of satellite development and deployment, particularly for its Lightspeed constellation, alongside significant investments in ground infrastructure and ongoing operational expenses like power and spectrum licensing.

The company also incurs substantial costs related to research and development to maintain technological leadership, and significant overheads for sales, marketing, and general administration to support its global operations and customer base.

| Cost Category | Description | 2024 Context/Example |

|---|---|---|

| Satellite Development & Launch | Manufacturing and launching advanced satellites, including the Lightspeed constellation. | Launch costs for heavy-lift rockets in 2024: $60M - $100M+ per launch. |

| Ground Infrastructure | Building and maintaining global ground stations, teleports, and fiber optic networks. | Investments in 5G-enabled gateways and new teleport facilities are ongoing. |

| Research & Development (R&D) | Engineering and technology development for next-generation satellite and network capabilities. | Lightspeed program R&D is a multi-billion dollar component of its overall capital expenditure. |

| Operational Expenses | Skilled workforce, power consumption for infrastructure, and spectrum license fees. | Global spectrum auctions in 2024 saw billions invested by telecom companies. |

| Sales, Marketing & Admin | Customer acquisition, brand building, client support, and corporate functions. | Telecom sector budgets in 2024 often allocate significant portions to these areas. |

Revenue Streams

Telesat's satellite capacity leasing, often termed wholesale, is a cornerstone revenue generator. They lease transponder capacity to a diverse clientele including telecom firms, broadcasters, and major corporations. This model is built on long-term agreements, ensuring a predictable and stable income flow.

For instance, in 2023, Telesat reported that its Lightspeed network, a next-generation satellite constellation, is expected to significantly bolster its capacity leasing revenue, projecting substantial growth in this segment as the network becomes operational.

Telesat's broadband internet services represent a significant and expanding revenue source, focusing on connecting remote and underserved regions. This segment also caters to enterprise needs and mobility applications, leveraging both existing geostationary (GEO) satellites and the upcoming Low Earth Orbit (LEO) constellation.

For instance, Telesat's Lightspeed LEO network is designed to offer high-speed, low-latency broadband to a global customer base, including governments, telecommunications companies, and businesses. This advanced network aims to capture a substantial share of the growing demand for reliable connectivity in areas previously lacking adequate service. The company projects significant market penetration for these services as Lightspeed deployment progresses through 2024 and beyond.

Telesat generates revenue by offering satellite capacity specifically for video distribution, a key service supporting direct-to-home (DTH) television. This segment, while experiencing some competition, continues to be a contributing element to the company's overall income streams.

In 2024, the broadcast and content distribution sector, which includes video delivery, remained a significant area for satellite operators. While specific figures for Telesat's video distribution revenue aren't publicly broken out in detail, the broader satellite industry saw continued demand for capacity, particularly for live events and high-definition content delivery.

Government and Defense Contracts

Telesat generates significant revenue by securing long-term contracts with government and defense entities worldwide. These agreements are crucial, providing stable, high-value income streams for its secure and critical communication services.

These contracts often involve specialized satellite capabilities tailored to national security and public service needs. For instance, Telesat Canada's government business is a key segment, with a substantial portion of its revenue historically derived from these partnerships.

- Government and Defense Contracts: Telesat's multi-year agreements with national governments and defense organizations are a cornerstone of its revenue.

- Secure Communications: These contracts leverage Telesat's satellite network to provide secure and reliable communication solutions vital for national security and public safety.

- High-Value and Stability: Such contracts typically represent substantial, recurring revenue, offering a predictable financial foundation.

- Global Reach: Telesat serves various government clients across different regions, demonstrating the broad applicability of its services in this sector.

Managed Services and Custom Solutions

Telesat generates revenue through managed services and custom solutions, offering clients comprehensive support from network design and installation to ongoing maintenance. This segment leverages Telesat's deep technical expertise and integrated capabilities to deliver tailored connectivity. For instance, in 2023, Telesat's focus on these higher-value services contributed to its overall revenue diversification, moving beyond traditional satellite capacity sales.

These offerings are crucial for clients requiring specialized network configurations or facing unique operational challenges. Telesat's ability to develop custom connectivity solutions allows them to address niche market demands, thereby creating additional revenue streams. This strategic approach ensures that Telesat remains a vital partner for businesses seeking robust and adaptable communication infrastructure.

- Managed Network Services: Includes design, deployment, and operational support for complex networks.

- Custom Connectivity Solutions: Tailored solutions addressing specific client requirements, often involving integration of multiple technologies.

- Revenue Diversification: These services provide a stable and growing revenue base beyond traditional satellite transponder leases.

- Leveraging Expertise: Utilizes Telesat's extensive experience in satellite and terrestrial network integration.

Telesat's revenue streams are diverse, encompassing wholesale satellite capacity leasing, broadband internet services, video distribution, government and defense contracts, and managed/custom solutions. The company's strategy, particularly with the Lightspeed LEO constellation, aims to capture growing demand in underserved markets and enterprise mobility.

In 2023, Telesat's strategic focus on these higher-value services contributed to revenue diversification. The Lightspeed network is projected to significantly boost capacity leasing revenue as it becomes operational, with substantial growth anticipated in 2024 and beyond.

The company's commitment to government and defense contracts provides stable, high-value income, leveraging specialized satellite capabilities. Managed services and custom solutions further enhance revenue by offering tailored connectivity, utilizing Telesat's technical expertise.

| Revenue Stream | Description | Key Drivers | 2024 Outlook |

|---|---|---|---|

| Capacity Leasing | Wholesale leasing of transponder capacity | Long-term contracts, growing demand for connectivity | Significant growth expected with Lightspeed |

| Broadband Internet | Connecting remote/underserved regions, enterprise, mobility | Lightspeed LEO network deployment, demand for high-speed internet | Substantial market penetration projected |

| Video Distribution | Satellite capacity for direct-to-home (DTH) TV | Continued demand for HD content and live events | Stable contribution amidst competition |

| Govt. & Defense Contracts | Secure, critical communication services for governments | National security needs, public service requirements | Stable, high-value recurring revenue |

| Managed & Custom Solutions | Network design, installation, maintenance, tailored connectivity | Client needs for specialized networks, niche market demands | Revenue diversification, leveraging technical expertise |

Business Model Canvas Data Sources

The Telesat Business Model Canvas is informed by a robust combination of market intelligence, competitive analysis, and internal operational data. These sources provide a comprehensive understanding of customer needs, market opportunities, and the company's capabilities.