Swedencare SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

Swedencare's robust brand reputation and strong product portfolio represent significant strengths, but understanding potential market saturation and evolving regulatory landscapes is crucial. Our full SWOT analysis dives deep into these dynamics, offering actionable insights for strategic planning.

Want the full story behind Swedencare's competitive advantages and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment or strategic decisions.

Strengths

Swedencare's strength lies in its dedicated focus on preventive animal healthcare products, particularly for dental, joint, and skin health. This specialization cultivates deep expertise and strong brand loyalty in crucial market segments. The company's emphasis on prevention resonates with the increasing pet humanization trend, where owners are more inclined to invest in their pets' long-term well-being, a factor contributing to Swedencare's robust market position.

Swedencare's established global distribution network is a significant strength, allowing it to access markets across the world through a robust system of partners and distributors. This extensive reach is crucial for tapping into the expanding global pet healthcare market, which saw significant growth in recent years, with projections indicating continued upward trends through 2025 and beyond.

This broad network not only facilitates market penetration but also diversifies revenue streams, mitigating risks associated with over-reliance on any single geographical region. For instance, Swedencare's presence in key European markets, alongside growing penetration in North America and Asia, demonstrates its ability to navigate varied economic conditions and capitalize on diverse consumer demands.

Swedencare boasts a robust brand portfolio encompassing recognized names like ProDen PlaqueOff®, NaturVet®, Innovet, Pet MD®, Rx Vitamins®, and nutravet®. This diverse range allows them to cater to a wide array of consumer needs within the pet health sector, solidifying their market presence.

ProDen PlaqueOff® stands out as their fastest-growing brand on a global scale, demonstrating significant consumer adoption and market traction. This brand's success highlights Swedencare's ability to develop and market high-performing products that resonate with pet owners worldwide.

Consistent Growth and Profitability

Swedencare has a proven track record of consistent growth and robust profitability, a significant strength that underpins its market position. This financial resilience is evident in its performance metrics, showcasing the company's ability to expand its revenue streams while managing costs effectively.

For example, in the first quarter of 2025, Swedencare reported a 7% increase in net revenue compared to the same period in 2024. Furthermore, the company achieved a healthy 5% organic growth during Q1 2025, demonstrating the inherent strength of its core business operations and product appeal. This sustained financial performance highlights successful strategic execution and strong market acceptance.

- Consistent Revenue Growth: Swedencare's net revenue saw a 7% uplift in Q1 2025 year-over-year.

- Strong Organic Expansion: The company recorded 5% organic growth in Q1 2025.

- Sustained Profitability: A history of high profitability accompanies this growth, indicating efficient operations.

- Market Acceptance: The financial results reflect positive market reception of Swedencare's product portfolio.

Strategic Acquisitions and Product Innovation

Swedencare's strategic acquisitions are a key strength, exemplified by the Q2 2025 purchase of Summit Veterinary Pharmaceuticals Limited. This move significantly broadens their market reach and diversifies their product portfolio, enhancing their competitive standing.

Furthermore, the company's dedication to product innovation is evident in their pipeline, which includes a novel cat product slated for a late 2025 release and the development of soft chews featuring new active ingredients. These advancements are crucial for maintaining market relevance and driving future growth.

- Strategic Acquisitions: Summit Veterinary Pharmaceuticals Limited acquisition in Q2 2025.

- Market Expansion: Broadens geographical presence and customer base.

- Product Innovation: Planned launch of new cat product in late 2025.

- R&D Focus: Development of soft chews with new active ingredients.

Swedencare's strength lies in its specialized focus on preventive animal healthcare, particularly for dental, joint, and skin health, fostering deep expertise and brand loyalty. This aligns perfectly with the growing trend of pet humanization, where owners increasingly invest in their pets' long-term well-being, bolstering Swedencare's market standing.

The company's global distribution network is a significant asset, enabling access to diverse markets and mitigating region-specific risks. This expansive reach, covering key European markets and expanding into North America and Asia, allows Swedencare to capitalize on varied consumer demands and economic conditions, contributing to its robust financial performance.

Swedencare's diverse brand portfolio, including ProDen PlaqueOff®, NaturVet®, and Pet MD®, caters to a wide range of pet owner needs, solidifying its market presence. ProDen PlaqueOff® has emerged as their fastest-growing global brand, underscoring successful product development and marketing strategies that resonate with pet owners worldwide.

The company demonstrates consistent financial growth and profitability, a testament to effective strategic execution and strong market acceptance. For instance, Q1 2025 saw a 7% year-over-year increase in net revenue and 5% organic growth, highlighting the inherent strength of its core business operations.

| Key Strength | Supporting Data/Fact | Impact |

| Specialized Focus | Dental, joint, skin health products | Deep expertise, brand loyalty |

| Global Distribution | Presence in Europe, North America, Asia | Market access, revenue diversification |

| Brand Portfolio | ProDen PlaqueOff®, NaturVet®, Pet MD® | Caters to diverse needs, market penetration |

| Financial Performance | 7% revenue growth (Q1 2025 YoY), 5% organic growth (Q1 2025) | Financial resilience, market acceptance |

What is included in the product

Delivers a strategic overview of Swedencare’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing Swedencare's strategic challenges, simplifying complex market dynamics.

Weaknesses

Swedencare's reliance on third-party distributors, while enabling a broad global reach, presents a significant weakness. This dependence can dilute direct control over crucial aspects like sales execution, pricing strategies, and brand messaging. For instance, if a key distributor shifts focus or faces financial difficulties, Swedencare's market penetration in that region could be severely impacted.

Swedencare's organic growth, excluding currency fluctuations, came in at 5% for the first quarter of 2025. This figure fell short of the company's ambitious target for double-digit organic expansion. This suggests that the company's existing business lines and product portfolio are not yet generating growth at the desired pace, potentially necessitating a greater reliance on acquisitions to meet expansion goals.

While the CEO expressed confidence in achieving double-digit organic growth by the end of 2025, the Q1 2025 performance highlights an immediate challenge. Overcoming this requires a focused effort to boost sales from current operations and potentially introduce new products or strategies to invigorate existing markets.

Swedencare's profitability margin has experienced a dip. The operational EBITDA margin decreased to 19.4% in the first quarter of 2025, down from 23.2% in the same period of 2024. This trend is also reflected in the profit after tax, which has seen a decline.

While Swedencare still demonstrates strong profitability, this margin contraction warrants attention. It could indicate rising operational expenses, more aggressive pricing strategies from competitors, or the financial impact of integrating recent acquisitions.

Geographic Concentration in North America

Swedencare's significant reliance on the North American market, despite its global reach, presents a notable weakness. This concentration, bolstered by its NaturVet subsidiary, means the company is particularly susceptible to regional economic fluctuations or shifts in regulatory landscapes within North America. For example, a downturn in the US pet care market, which represented a substantial portion of global spending in 2023, could disproportionately impact Swedencare's overall performance.

While Swedencare is actively pursuing expansion into new territories, such as Asia, its current geographic concentration in North America remains a key vulnerability. This focus could limit its resilience against unforeseen regional challenges. The company's strategic efforts to diversify its revenue streams into emerging markets are crucial for mitigating this risk.

Key points regarding geographic concentration:

- North American Dominance: Historically, North America has been a primary market for pet healthcare products, and Swedencare's strong presence there, including its NaturVet operations, reflects this trend.

- Vulnerability to Regional Shocks: A high concentration in one geographical area exposes the company to heightened risks from regional economic downturns or specific regulatory changes.

- Expansion Strategy: Swedencare is actively working to broaden its footprint, with a particular focus on expanding into new and growing markets like Asia to reduce its reliance on North America.

Potential Impact of Supply Chain Disruptions

Swedencare's reliance on global supply chains presents a significant weakness. Disruptions, whether from geopolitical events, natural disasters, or logistical bottlenecks, can directly impact their ability to source raw materials and deliver finished products. For instance, the semiconductor shortage experienced globally in 2021-2022, while not directly tied to Swedencare's specific products, illustrates the potential for widespread industrial impact.

While Swedencare's production division demonstrated resilience, scheduled production halts, even for maintenance, coupled with the inherent uncertainties in global trade, pose a risk. These factors can lead to delays in manufacturing and delivery. Such disruptions could ultimately affect sales performance and overall profitability, especially if they lead to stockouts or increased operational costs.

The company's global footprint, while offering market diversification, also amplifies its exposure to varied regulatory environments and potential trade barriers. This complexity can introduce unforeseen challenges and costs.

- Global Sourcing Risks: Dependence on international suppliers for key ingredients or packaging materials increases vulnerability to disruptions.

- Logistical Challenges: Shipping delays, port congestion, and rising freight costs can impact delivery times and margins.

- Production Interruption Impact: Scheduled or unscheduled halts in manufacturing can lead to lost sales opportunities and unmet customer demand.

Swedencare's organic growth in Q1 2025 was 5%, falling short of its double-digit target, indicating current operations may not be expanding at the desired pace. This necessitates a stronger focus on boosting sales from existing business lines or potentially acquiring companies to achieve growth objectives.

Profitability has seen a decline, with operational EBITDA margin dropping to 19.4% in Q1 2025 from 23.2% in Q1 2024. This margin contraction suggests potential increases in operational costs or intensified competitive pricing pressures.

The company's significant reliance on the North American market, particularly through its NaturVet subsidiary, exposes it to regional economic downturns and regulatory shifts. While expansion into Asia is underway, this geographic concentration remains a key vulnerability.

Swedencare's dependence on third-party distributors can limit direct control over sales, pricing, and brand messaging, potentially impacting market penetration if a key distributor falters.

Preview Before You Purchase

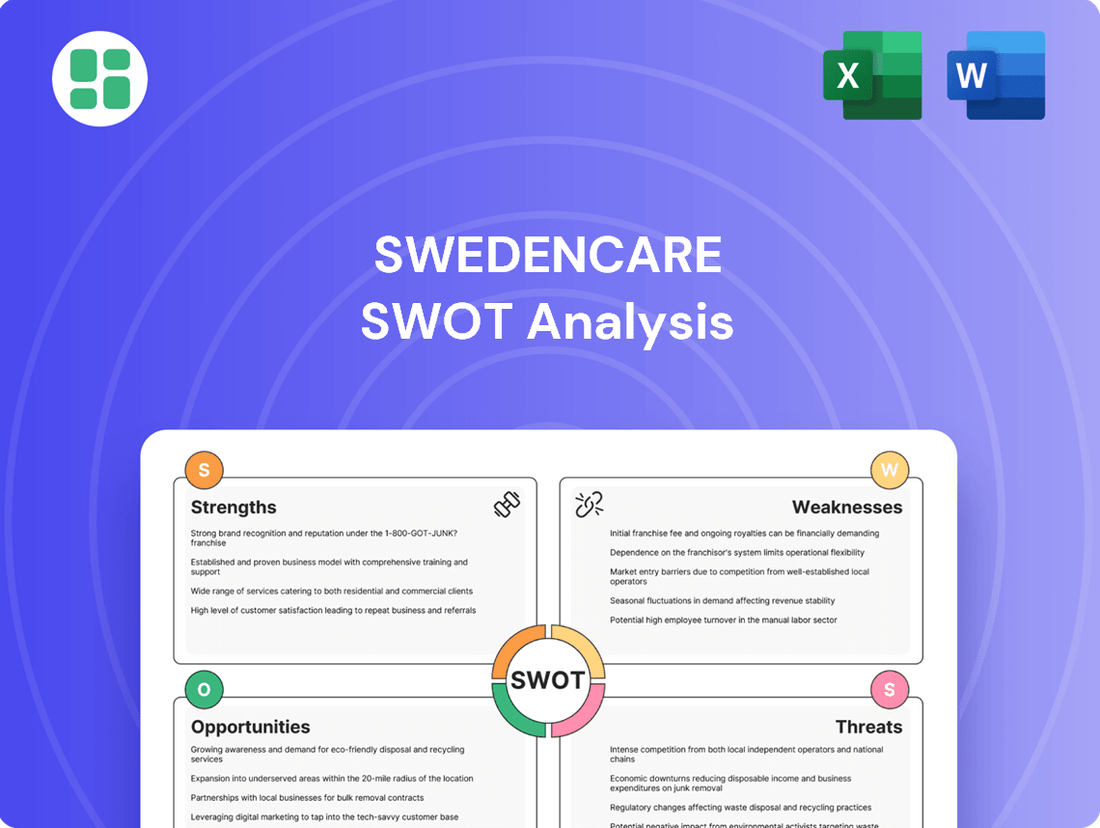

Swedencare SWOT Analysis

You’re viewing a live preview of the actual Swedencare SWOT analysis. The complete version, offering a comprehensive breakdown of Swedencare's Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a clear insight into the detailed analysis of Swedencare's strategic position.

The file shown below is not a sample—it’s the real Swedencare SWOT analysis you'll download post-purchase, in full detail. This ensures you get exactly what you need to understand their market standing.

Opportunities

The global pet healthcare market is booming, offering a significant opportunity for Swedencare. This market is anticipated to grow from $253.75 billion in 2024 to $269.63 billion in 2025, and is projected to reach $385.45 billion by 2029. This expansion, fueled by increasing pet humanization and greater investment in pet wellness, creates a strong tailwind for Swedencare's specialized preventive care offerings.

The rising emphasis on proactive and tailored pet wellness, including preventive measures, custom diets, and sophisticated health tracking, mirrors evolving human healthcare expectations. Swedencare's established expertise in preventive solutions, such as their dental, joint, and skin/coat health products, positions them to capitalize on this growing consumer demand. For instance, the global pet care market was valued at approximately $261 billion in 2023, with a significant portion attributed to health and wellness products, indicating a strong market for Swedencare's offerings.

Swedencare has explicitly stated its ambition to grow into new international territories, with Asia, especially China and India, pinpointed as particularly promising regions for substantial future expansion. This strategic push into markets with burgeoning pet populations and increasing pet ownership rates presents a significant avenue for revenue diversification and capturing new customer bases, moving beyond their established presence in North America.

Leveraging E-commerce and Digital Health Solutions

The escalating adoption of e-commerce and digital health solutions offers Swedencare significant avenues for growth. By strengthening its presence on online retail platforms and integrating with digital health tools like telemedicine and remote monitoring devices, Swedencare can directly connect with a wider pet owner base. This digital shift is already evident, with global online pet product sales projected to reach over $150 billion by 2027, indicating a substantial market ready for digital engagement.

These digital channels not only expand Swedencare's distribution but also facilitate more personalized customer interactions and data collection. The increasing trend of pet owners utilizing technology for their pets' well-being, such as smart feeders and activity trackers, creates an ecosystem where Swedencare can offer complementary health products and services. For instance, the global pet tech market was valued at approximately $20 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030.

- Expanded Reach: E-commerce platforms allow Swedencare to transcend geographical limitations, reaching more pet owners globally.

- Direct Customer Engagement: Digital health tools enable direct communication, feedback, and personalized product recommendations for pet health.

- Streamlined Access: Online sales and digital services simplify the purchasing process for pet health products, improving customer convenience.

- Data-Driven Insights: Increased digital interaction provides valuable data on customer behavior and pet health trends, informing product development and marketing strategies.

Product Line Extension and Innovation in New Therapeutic Areas

Swedencare has a significant opportunity to broaden its product offerings by venturing into new therapeutic areas, leveraging its expertise in pet health. This could involve developing innovative products for cats, a segment where penetration might be less saturated than dogs, or introducing novel delivery formats such as advanced soft chews. The company's recent acquisitions of ingredients and technologies provide a strong foundation for this expansion, allowing for the creation of science-backed nutritional supplements and specialized treatments.

By focusing on continuous innovation, Swedencare can tap into emerging market needs and solidify its competitive position. For instance, the pet health market, valued at over $100 billion globally in 2023 and projected to grow, presents ample room for specialized products addressing specific conditions or life stages. This strategic move allows Swedencare to capture new customer segments and enhance its overall market share.

- Expand into feline-specific health solutions, targeting unmet needs in a growing market segment.

- Develop innovative soft chew formats, enhancing palatability and ease of administration for pets.

- Integrate newly acquired ingredients to create science-backed nutritional supplements for specialized pet health challenges.

- Explore adjacent therapeutic areas such as dental care or joint health, building on existing brand trust.

Swedencare can capitalize on the expanding global pet healthcare market, which is projected to reach $385.45 billion by 2029, by focusing on its preventive care solutions. The growing trend of pet humanization and increased spending on pet wellness, particularly in preventive measures and tailored health solutions, aligns perfectly with Swedencare's established product portfolio. This market growth, evidenced by the global pet care market's valuation of approximately $261 billion in 2023, presents a substantial opportunity for the company.

Leveraging e-commerce and digital health platforms offers Swedencare a significant avenue for expansion, with global online pet product sales expected to exceed $150 billion by 2027. This digital shift allows for broader reach, direct customer engagement, and data-driven insights, enhancing customer convenience and informing future product development. The burgeoning pet tech market, valued around $20 billion in 2023, further supports this digital integration.

Swedencare has a clear opportunity to expand its product lines into new therapeutic areas, potentially focusing on the less saturated feline market or developing innovative delivery formats like advanced soft chews. The company's recent acquisitions of key ingredients and technologies provide a solid foundation for creating science-backed nutritional supplements and specialized treatments, tapping into a market that valued pet health at over $100 billion globally in 2023.

| Market Segment | 2024 Projection | 2029 Projection | Growth Driver |

|---|---|---|---|

| Global Pet Healthcare | $253.75 Billion | $385.45 Billion | Pet Humanization, Wellness Focus |

| Global Online Pet Products | N/A | >$150 Billion (by 2027) | E-commerce Adoption |

| Global Pet Tech | N/A | N/A (CAGR >15% through 2030) | Digital Integration |

Threats

The animal health sector is highly competitive, featuring large global corporations and nimble new entrants. This intense rivalry, with major companies actively broadening their product ranges and pursuing acquisitions, directly challenges Swedencare's existing market position and its ability to set prices effectively.

Economic uncertainties and rising inflation in 2024 and 2025 pose a significant threat to Swedencare. These factors can directly impact consumer discretionary spending, particularly on premium pet products like preventive care. As household budgets tighten, owners might delay or reduce purchases of higher-priced items.

While the trend of pet humanization continues to support spending, a severe economic downturn could force pet owners to seek more budget-friendly alternatives to Swedencare's offerings. For instance, in 2024, consumer confidence indices in key European markets showed volatility, indicating potential shifts in spending habits away from non-essential pet care.

Swedencare operates within the animal health sector, which is heavily influenced by evolving and stringent regulations concerning product approval, manufacturing processes, and product labeling across various global markets. These regulatory landscapes can shift, requiring constant adaptation and investment in compliance measures.

The increasing demands for compliance, alongside the potential for product development and launch timelines to be delayed, present a significant hurdle. Furthermore, the rising costs associated with meeting these regulatory requirements could impact Swedencare's profitability and operational efficiency, especially as companies like Zoetis, a major player, navigate similar complexities with significant R&D budgets.

Supply Chain Disruptions and Raw Material Costs

Global trade uncertainties and potential disruptions in supply chains present a significant threat to Swedencare. These issues can directly impact the availability and cost of essential raw materials and finished products, affecting overall operational efficiency and product delivery.

Swedencare's reliance on stable supply chains means any major interruption could lead to increased operational costs. For instance, during 2024, many companies experienced rising logistics expenses due to geopolitical tensions and shipping route challenges, a trend that could continue to affect companies like Swedencare.

- Increased Raw Material Prices: Volatility in global commodity markets, exacerbated by supply chain bottlenecks, can drive up the cost of key ingredients used in Swedencare's products.

- Production Delays: Shortages or delayed shipments of necessary components can halt or slow down manufacturing processes, impacting inventory levels and sales.

- Higher Transportation Costs: Rising fuel prices and limited shipping capacity, as seen throughout much of 2023 and into early 2024, directly increase the cost of moving goods globally.

- Reduced Product Availability: Significant disruptions might lead to stockouts, frustrating customers and potentially causing a loss of market share to competitors with more resilient supply networks.

Emergence of New Technologies and Competitors

The veterinary sector is experiencing rapid technological evolution. Advancements in biotechnology, like gene editing and advanced diagnostics, alongside digital health tools such as AI-powered analysis of pet health data, present a significant threat. These innovations could lead to disruptive new products or companies entering the market, potentially outpacing Swedencare if it doesn't adapt quickly.

For instance, the global veterinary diagnostics market was valued at approximately USD 4.7 billion in 2023 and is projected to grow substantially. Companies leveraging AI for faster, more accurate diagnoses or offering personalized treatment plans based on genetic profiles could gain a significant competitive edge. Swedencare must prioritize its own innovation pipeline to remain competitive against these agile, tech-forward entrants.

- Technological Disruption: New AI-driven diagnostic tools and personalized medicine approaches in veterinary care pose a threat.

- Market Entry: Agile competitors leveraging these new technologies could quickly gain market share.

- Innovation Imperative: Swedencare must invest in R&D to keep pace with or lead technological advancements.

The intensifying competition in the animal health sector, marked by aggressive product expansion and acquisitions by larger players, directly challenges Swedencare's market standing and pricing power. Economic volatility and inflation in 2024-2025 could curb consumer spending on premium pet products, pushing owners towards more budget-friendly alternatives.

Evolving and stringent global regulations in animal health necessitate continuous adaptation and investment in compliance, potentially delaying product launches and increasing operational costs. Supply chain disruptions and rising logistics expenses, a trend observed through 2024, also pose a threat to Swedencare's operational efficiency and product availability.

Rapid technological advancements in veterinary diagnostics and digital health tools present a disruptive force, with agile competitors leveraging AI and personalized medicine potentially gaining a significant edge. Swedencare faces the imperative to invest heavily in its own innovation to remain competitive in this evolving landscape.

| Threat Category | Specific Risk | Impact on Swedencare | 2024/2025 Data Point |

| Competition | Aggressive market expansion by large corporations | Reduced market share, pricing pressure | Global animal health market expected to grow, increasing competitive intensity. |

| Economic Factors | Inflation and reduced consumer discretionary spending | Lower demand for premium products, shift to alternatives | Consumer confidence in key European markets showed volatility in 2024. |

| Regulatory Environment | Increasingly stringent and evolving regulations | Higher compliance costs, potential product launch delays | Companies like Zoetis invest billions in R&D and regulatory affairs. |

| Supply Chain | Disruptions and rising logistics costs | Increased operational costs, potential stockouts | Logistics expenses rose significantly in 2024 due to geopolitical factors. |

| Technological Advancements | Disruptive innovations in veterinary diagnostics and digital health | Risk of being outpaced by tech-forward competitors | Veterinary diagnostics market valued at ~$4.7 billion in 2023, with AI integration growing. |

SWOT Analysis Data Sources

This Swedencare SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research reports, and expert industry insights. These sources ensure a data-driven and accurate assessment of the company's current standing and future potential.