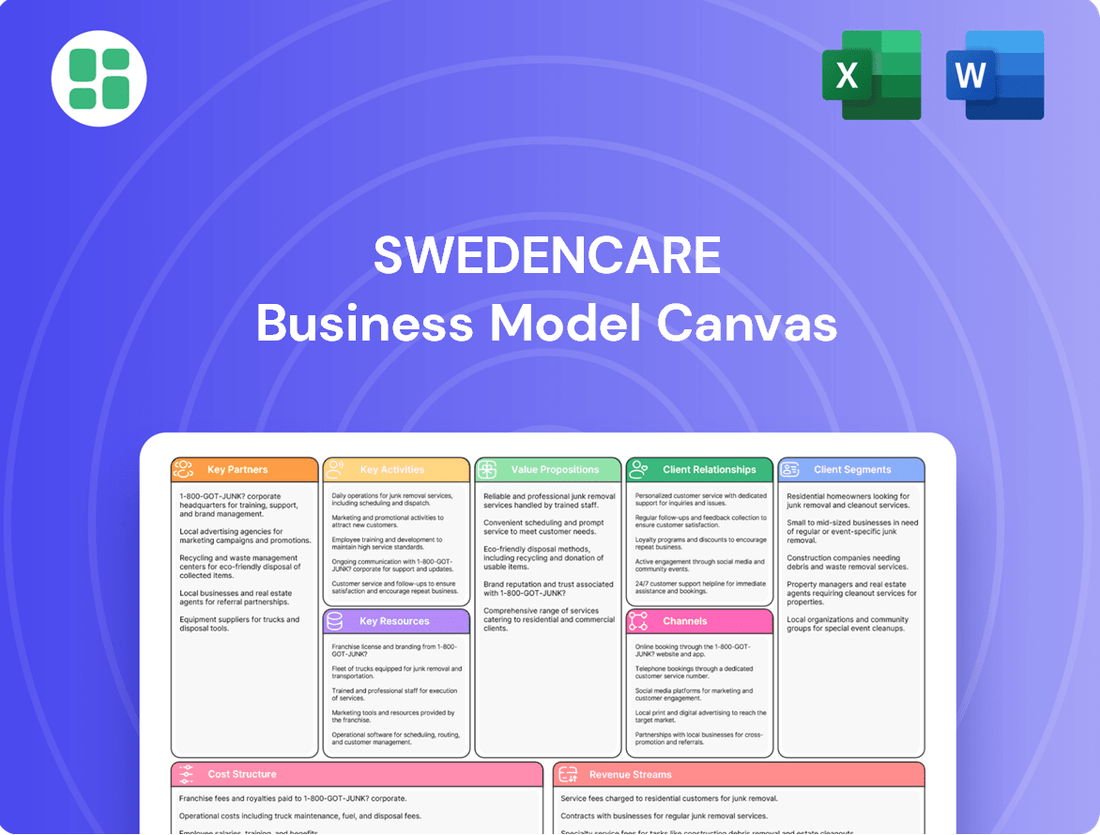

Swedencare Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

Curious about Swedencare's winning formula? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational excellence. Discover the strategic framework that fuels their growth.

Partnerships

Swedencare's global reach is powered by a robust network of international partners and distributors, enabling access to their preventive pet healthcare products in roughly 70 countries. These vital relationships are the backbone of their market penetration strategy.

The company actively fosters a collaborative environment, emphasizing mutual benefit and knowledge exchange with its distribution partners. This approach ensures effective market entry and sustained growth for Swedencare's product portfolio.

Veterinary clinics and pet specialty stores are crucial partners for Swedencare, acting as direct sales channels and offering valuable professional endorsements. These partnerships are essential for reaching pet owners who are actively seeking specialized and expert-recommended care for their animals. Swedencare's products are distributed through these trusted outlets worldwide, underscoring their importance in the company's go-to-market strategy.

Swedencare prioritizes robust relationships with its raw material and ingredient suppliers to ensure consistent product quality and support ongoing product development. By sourcing locally where feasible, the company not only upholds high standards but also advances its sustainability goals, reducing its environmental footprint. This strategic approach also positions Swedencare effectively for the complexities of global trade, ensuring supply chain resilience.

E-commerce Platforms and Online Retailers

Swedencare's strategic alliances with prominent e-commerce giants like Amazon and specialized pet retailers such as zooplus are crucial for broadening its market penetration and bolstering direct-to-consumer (DTC) sales. These partnerships are pivotal in reaching a wider customer base efficiently.

The company has been diligently enhancing its online engagement and collaborative efforts to capitalize on the rapid expansion of the online retail sector. This focus aims to accelerate growth through these digital channels.

- Amazon: A key partner for global reach, allowing Swedencare to access millions of consumers seeking pet health products.

- zooplus: This collaboration targets a dedicated online community of pet owners, fostering brand loyalty and repeat purchases.

- DTC Growth: Swedencare's investment in optimizing its online presence directly supports an increase in DTC sales, improving margins and customer relationships.

- Market Expansion: By leveraging these platforms, Swedencare effectively expands its geographical footprint and product visibility in the competitive pet care market.

Research and Development Collaborations

Swedencare actively pursues research and development collaborations with leading academic institutions and specialized pharmaceutical firms. These partnerships are crucial for bolstering their product development pipeline and providing robust scientific validation for new pet health innovations.

These strategic alliances enable Swedencare to explore novel product formulations and penetrate new therapeutic segments, thereby solidifying their competitive edge in the rapidly growing pet healthcare sector. A prime example of this strategy is the recent acquisition of Summit Veterinary Pharmaceuticals Limited, a significant player in the UK's Animal Health Specials Market.

- Research Institutions: Collaborations with universities and research centers drive scientific discovery and innovation.

- Pharmaceutical Companies: Partnerships with specialized pharma firms accelerate product development and market entry.

- Product Expansion: These collaborations facilitate the creation of new formulations and the exploration of broader therapeutic applications.

- Market Strengthening: The acquisition of Summit Veterinary Pharmaceuticals Limited underscores Swedencare's commitment to expanding its market presence and capabilities.

Swedencare's key partnerships are foundational to its expansive market presence and product innovation. These collaborations span distribution networks, retail channels, and research institutions, ensuring both broad consumer access and cutting-edge product development.

The company's strategic alliances with major e-commerce platforms like Amazon and specialized online pet retailers such as zooplus are critical for driving direct-to-consumer sales and expanding its global footprint. These digital partnerships allow Swedencare to efficiently reach a vast customer base, fostering brand loyalty and increasing market share in the rapidly growing online pet care sector.

Furthermore, Swedencare actively engages in R&D collaborations with academic bodies and pharmaceutical firms, a strategy exemplified by the acquisition of Summit Veterinary Pharmaceuticals Limited. These alliances are vital for developing novel pet health solutions and strengthening its position in the competitive animal health market.

| Partner Type | Key Partners | Strategic Importance |

|---|---|---|

| Distributors | Global network in ~70 countries | Market penetration and accessibility |

| Retail Channels | Veterinary clinics, Pet specialty stores | Direct sales, professional endorsement, customer trust |

| E-commerce | Amazon, zooplus | DTC sales growth, broad consumer reach |

| R&D/Acquisitions | Academic institutions, Summit Veterinary Pharmaceuticals Limited | Product innovation, scientific validation, market expansion |

What is included in the product

A comprehensive, pre-written business model tailored to Swedencare's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Swedencare, organized into 9 classic BMC blocks with full narrative and insights.

Swedencare's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap to navigate complex market challenges.

It offers a structured approach to identifying and addressing key customer needs, streamlining operations, and optimizing value propositions.

Activities

Swedencare’s core activity is the continuous investment in research and development for new and enhanced animal healthcare solutions. Their focus is on preventive care, specifically targeting areas like dental health, joint support, and skin and coat vitality.

This dedication to innovation involves rigorous scientific research, precise formulation, and thorough testing to guarantee both product effectiveness and safety for animals. The company actively pursues the launch of novel products, with a new cat-focused offering slated for release in the latter half of 2025.

Swedencare's core activities revolve around manufacturing high-quality pet healthcare products. They produce these items in various local markets, including the EU, North America, and the UK, which helps ensure products reach customers efficiently.

Quality control is paramount, with rigorous checks implemented at every stage of production. This dedication to quality ensures their products meet high standards and comply with all necessary regulations.

The company has been actively expanding its manufacturing capabilities, particularly for their popular soft chew products. For instance, in 2023, Swedencare invested in new production lines, aiming to boost output by 20% for key product categories.

Swedencare's key activity revolves around managing a sophisticated global distribution and logistics network. This involves intricate coordination of international shipping, warehousing, and inventory across numerous markets to ensure products reach consumers efficiently.

The company’s extensive reach, with products available in approximately 70 countries, underscores the complexity and scale of its distribution operations. This global footprint requires robust partnerships and streamlined processes to maintain product availability and customer satisfaction worldwide.

A significant focus is placed on supply chain optimization. By actively working to minimize the impact of global trade uncertainties, Swedencare aims to ensure consistent product flow and mitigate potential disruptions, a crucial strategy in today's volatile international trade environment.

Marketing and Brand Building

Swedencare focuses on strategic marketing and brand building to showcase its varied product lines and established brands, such as ProDen PlaqueOff®, NaturVet®, and Innovet. These efforts are crucial for increasing market presence and consumer awareness.

Key activities include engaging in industry trade shows, running targeted online advertising campaigns, and undertaking rebranding initiatives. For instance, Swedencare reported a net sales increase of 16% in the first quarter of 2024 compared to the same period in 2023, indicating the effectiveness of their marketing strategies in driving growth.

- Trade Show Participation: Engaging with industry professionals and consumers at events to highlight product benefits.

- Digital Marketing: Implementing online campaigns across various platforms to reach a wider audience.

- Brand Visibility: Rebranding efforts aimed at strengthening brand recognition and consumer trust.

- Product Portfolio Promotion: Showcasing the breadth of Swedencare's offerings, including pet dental care and supplements.

Mergers and Acquisitions (M&A)

Swedencare actively engages in mergers and acquisitions (M&A) as a core strategy to bolster its product offerings, expand its geographic reach, and enhance its technological infrastructure. This proactive approach aims to accelerate growth and solidify its position in the global animal health market.

Notable recent acquisitions underscore this commitment. For instance, the acquisition of Summit Veterinary Pharmaceuticals Limited in 2023 brought a new range of veterinary products and strengthened Swedencare's presence in key markets. Similarly, the integration of Pack Approved/Riley's Organics further diversified its product portfolio, particularly in the rapidly growing natural and organic pet supplement segment.

- Strategic Expansion: M&A is central to Swedencare's growth, enabling rapid market penetration and portfolio enrichment.

- Recent Acquisitions: Summit Veterinary Pharmaceuticals Limited and Pack Approved/Riley's Organics are key examples of this strategy in action.

- Diversification and Synergies: These acquisitions add new revenue streams and create operational synergies, enhancing overall group strength.

Swedencare's key activities encompass a multi-faceted approach to innovation and market presence. They prioritize continuous research and development for new and improved animal healthcare solutions, with a specific focus on preventive care in areas like dental health, joint support, and skin vitality.

Manufacturing high-quality pet healthcare products locally in markets like the EU, North America, and the UK is a core function, supported by rigorous quality control and recent investments in production lines, such as the 2023 expansion for soft chews aiming for a 20% output boost.

Managing a global distribution network to ensure efficient product delivery to approximately 70 countries is critical, alongside supply chain optimization to mitigate trade uncertainties. Strategic marketing and brand building, including digital campaigns and rebranding, are also vital, as evidenced by a 16% net sales increase in Q1 2024.

Finally, Swedencare actively pursues mergers and acquisitions to expand its product range and geographic reach, exemplified by the 2023 acquisitions of Summit Veterinary Pharmaceuticals Limited and Pack Approved/Riley's Organics.

Full Document Unlocks After Purchase

Business Model Canvas

The Swedencare Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, ready-to-use file, not a sample or mockup, ensuring full transparency and no surprises. Upon completing your order, you will gain immediate access to this exact Business Model Canvas, prepared for your strategic planning and analysis.

Resources

Swedencare's intellectual property, including its proprietary product formulas and patents, is a cornerstone of its business model. The company's established brand names, most notably ProDen PlaqueOff®, represent significant intangible assets that foster customer loyalty and command premium pricing in the competitive pet healthcare sector.

These protected formulas and strong brand recognition provide Swedencare with a distinct competitive edge. For instance, ProDen PlaqueOff® has demonstrated consistent market traction, contributing to Swedencare's revenue growth. In the first quarter of 2024, Swedencare reported net sales of SEK 210 million, with its branded products, heavily reliant on this intellectual capital, driving a substantial portion of that figure.

Swedencare's research and development expertise is a cornerstone of its business model. A highly skilled and committed R&D team is essential for driving innovation and upholding the scientific credibility of their preventive care offerings.

This specialized knowledge enables Swedencare to consistently create premium, effective solutions for pet well-being. For instance, in 2023, Swedencare reported that its R&D investments contributed to the launch of several new product lines, focusing on areas like gut health and immune support for pets.

Swedencare's manufacturing footprint spans the EU, North America, and the UK, enabling localized production and adherence to diverse regulatory standards. This geographically dispersed base is a core asset, mitigating supply chain risks and facilitating efficient product delivery.

The company leverages an extensive global distribution network, reaching consumers and businesses across numerous international markets. This robust infrastructure is crucial for timely product availability and maintaining a strong market presence, supporting Swedencare's growth ambitions.

Strong Brand Portfolio

Swedencare's strength lies in its robust portfolio of well-established brands, including NaturVet®, Innovet, Pet MD®, Rx Vitamins®, nutravet®, Rileys®, and ProDen PlaqueOff®. These brands are crucial assets, cultivating significant customer trust and loyalty. This brand equity directly fuels revenue generation and market penetration.

The recognition and positive association with these brands are key differentiators in the competitive pet health market. For instance, ProDen PlaqueOff® has become a leading name in natural dental care for pets. Swedencare's commitment to quality across its brand offerings underpins its value proposition.

- Brand Recognition: Cultivates immediate customer trust and reduces marketing friction.

- Customer Loyalty: Encourages repeat purchases and positive word-of-mouth referrals.

- Revenue Driver: Directly contributes to sales volume and market share growth.

- Market Differentiation: Sets Swedencare apart from competitors with less established brand names.

Financial Capital and Market Listing

Swedencare's listing on the NASDAQ First North Growth Market and trading on the OTCQX Best Market provides essential access to financial capital. This market presence is vital for funding critical areas like research and development, strategic acquisitions, and ongoing operational expansion. This financial foundation supports Swedencare's ability to make impactful investments and maintain its growth trajectory.

The company's financial resources are a cornerstone of its business model, enabling it to pursue ambitious growth strategies. For instance, in 2024, Swedencare continued to leverage its market access for strategic initiatives. This financial flexibility is key to navigating the competitive landscape and seizing new opportunities.

- Access to Capital Markets: Listing on NASDAQ First North Growth Market and OTCQX® Best Market.

- Funding Strategic Initiatives: Capital supports R&D, acquisitions, and operational expansion.

- Financial Strength for Growth: Enables sustained investment and market competitiveness.

- 2024 Focus: Continued leveraging of market access for strategic development.

Swedencare’s key resources include its intellectual property, particularly proprietary product formulas and patents, which are critical for its competitive advantage. The company also relies heavily on its established brand names, such as ProDen PlaqueOff®, which foster customer loyalty and allow for premium pricing in the pet healthcare market.

The company's research and development expertise is another vital resource, driving innovation and ensuring the scientific credibility of its preventive care products. This expertise led to the launch of new product lines in 2023, focusing on pet gut health and immune support.

Swedencare's global manufacturing footprint across the EU, North America, and the UK mitigates supply chain risks and ensures compliance with diverse regulations. Coupled with an extensive distribution network, this infrastructure is essential for timely product delivery and maintaining a strong international market presence.

The company's strong portfolio of brands, including NaturVet®, Innovet, and Pet MD®, cultivates customer trust and loyalty, acting as significant revenue drivers. These brands differentiate Swedencare in a competitive market, with ProDen PlaqueOff® being a prime example of successful brand building in natural pet dental care.

Access to capital markets through its listing on NASDAQ First North Growth Market and OTCQX Best Market is a crucial resource, funding R&D, acquisitions, and expansion. This financial strength enables Swedencare to pursue its growth strategies effectively, as demonstrated by its continued leveraging of market access for strategic development in 2024.

| Key Resource | Description | Impact | 2024 Data/Note |

|---|---|---|---|

| Intellectual Property | Proprietary formulas, patents | Competitive edge, premium pricing | Core to ProDen PlaqueOff® |

| Brand Equity | Established brands (ProDen PlaqueOff®, NaturVet®) | Customer loyalty, revenue driver | Drives market penetration |

| R&D Expertise | Skilled R&D team | Product innovation, scientific credibility | New product lines launched in 2023 |

| Manufacturing & Distribution | Global footprint, extensive network | Supply chain resilience, market reach | EU, North America, UK presence |

| Financial Capital | Access to capital markets | Funding for growth, R&D, acquisitions | NASDAQ First North Growth Market, OTCQX® Best Market listing |

Value Propositions

Swedencare's core value proposition centers on providing specialized preventive healthcare solutions for pets, targeting prevalent issues like dental health, joint mobility, and skin and coat vitality. This focus empowers pet owners to proactively manage their animal companions' long-term health, fostering a higher quality of life.

The company's commitment extends to improving global pet well-being through its targeted product development and a mission to enhance the health of pets worldwide. For instance, Swedencare's ProDen PlaqueOff, a key product, has seen significant market adoption, contributing to a growing demand for non-invasive pet dental care solutions.

Swedencare's commitment to high-quality, science-backed products is a cornerstone of its value proposition. They offer premium solutions for pet health, emphasizing safety and scientific validation. This dedication is exemplified by brands like ProDen PlaqueOff®, which proudly carries the VOHC seal, a testament to its proven efficacy and reliability.

Swedencare’s value proposition centers on making its trusted pet healthcare products available to pet owners across the globe. The company's reach extends to approximately 70 countries, a testament to its robust distribution network and commitment to global accessibility.

This extensive international presence ensures that pet owners in diverse markets can consistently find and rely on Swedencare's high-quality solutions for their pets' well-being. For instance, in 2023, Swedencare reported significant growth in its international markets, underscoring the effectiveness of its global strategy.

Comprehensive Product Portfolio

Swedencare boasts a wide array of products designed to meet diverse pet health and wellness needs. This extensive catalog spans multiple categories, offering solutions for everything from daily nutrition to specialized care.

The company's comprehensive product portfolio includes:

- Nutraceuticals: Innovative supplements targeting specific health concerns and overall well-being.

- Dental Products: Solutions aimed at maintaining oral hygiene and preventing dental issues in pets.

- Treats: Wholesome and palatable treats that also contribute to a pet's health.

This broad offering caters to a wide range of pet parents and veterinary professionals seeking effective and varied options. For instance, Swedencare's ProDen PlaqueOff, a key product in their dental care line, has seen significant market penetration, contributing to their strong revenue growth. In 2023, Swedencare reported net sales of SEK 1,273 million, with their expanded product lines playing a crucial role in this performance.

Reassurance for Pet Parents

Swedencare's product line is designed to offer peace of mind to pet owners, addressing their concerns about their pets' health and well-being. By providing scientifically-backed solutions, the company aims to ensure pets lead longer, healthier lives.

This commitment to pet welfare cultivates deep trust and loyalty among its customer base. For instance, in 2024, Swedencare reported a strong customer retention rate, reflecting the reassurance its products provide.

- Enhanced Pet Health: Products focus on supporting vital bodily functions, leading to noticeable improvements in pet vitality.

- Longevity Focus: Solutions are developed with the goal of extending a pet's healthy lifespan.

- Trust Building: Consistent product efficacy reinforces owner confidence.

- Customer Loyalty: Reassured pet parents become repeat customers, driving sustained growth.

Swedencare provides specialized, science-backed preventive healthcare for pets, focusing on areas like dental health and joint mobility. This empowers owners to proactively manage their pets' well-being, fostering longer, healthier lives.

The company's commitment to global pet health is evident in its wide distribution, reaching approximately 70 countries. This accessibility ensures pet owners worldwide can access their trusted, high-quality solutions.

Swedencare's extensive product portfolio includes nutraceuticals, dental products, and health-focused treats, catering to diverse pet needs. Their flagship product, ProDen PlaqueOff, exemplifies their dedication to effective, non-invasive pet care.

The value proposition also hinges on building trust through consistent product efficacy, leading to strong customer loyalty. For example, in 2023, Swedencare achieved net sales of SEK 1,273 million, partly driven by the broad appeal and reliability of its product lines.

| Value Proposition Element | Description | Key Product Example | 2023 Financial Impact |

|---|---|---|---|

| Specialized Preventive Care | Targeting specific pet health issues like dental and joint health. | ProDen PlaqueOff | Contributed to overall sales growth. |

| Global Accessibility | Availability in approximately 70 countries. | All product lines | Supported international market expansion. |

| Comprehensive Product Portfolio | Diverse range including nutraceuticals, dental, and treats. | ProDen PlaqueOff, various supplements | Drove customer engagement and revenue. |

| Science-Backed Efficacy & Trust | Emphasis on safety, scientific validation, and proven results. | VOHC-sealed products | Fostered customer loyalty and repeat purchases. |

Customer Relationships

Swedencare cultivates robust, collaborative relationships with its worldwide network of partners and distributors. This B2B approach involves providing dedicated support, facilitating knowledge exchange, and granting access to established marketing channels, crucial for effective market penetration.

In 2023, Swedencare reported a significant increase in its partner network, with a 15% growth in active distributors across key international markets. This expansion directly contributed to a 20% year-over-year revenue increase from these channels, demonstrating the success of their collaborative strategy.

Swedencare actively engages consumers directly through its digital footprint, encompassing e-commerce sites and social media platforms. This direct interaction is crucial for fostering brand loyalty, gathering valuable customer feedback, and adapting to the evolving online marketplace, especially within the burgeoning pet wellness sector.

By taking direct control of its NaturVet Amazon account, Swedencare has significantly strengthened its direct-to-consumer sales capabilities. This strategic move in 2024 allows for better inventory management, pricing control, and a more cohesive brand experience for customers purchasing through a major online retail channel.

Swedencare actively engages in providing educational content, such as detailed product guides and scientific articles, to veterinarians and pet owners. This commitment ensures proper and effective use of their health supplements, fostering trust and demonstrating expertise in the pet wellness sector.

The company's approach also includes offering expert consultation, allowing for direct interaction and tailored advice. This direct support not only aids customers in making informed choices but also solidifies Swedencare's reputation as a leading authority in pet health solutions.

Brand Loyalty Programs and Community Building

Swedencare actively cultivates brand loyalty and a strong community among pet owners by implementing targeted programs. This approach is crucial for fostering repeat business and a deeper connection with customers who are invested in their pets' well-being.

- Loyalty Programs: Swedencare's loyalty initiatives are designed to reward consistent customers, encouraging them to continue purchasing their premium pet health products.

- Community Engagement: Building a community allows pet owners to connect, share experiences, and receive support, reinforcing their trust in Swedencare's commitment to pet health.

- Brand Advocacy: A loyal and engaged customer base often translates into powerful brand advocacy, with satisfied customers recommending Swedencare to their networks.

- Data-Driven Insights: By analyzing customer interactions within these programs, Swedencare gains valuable insights into consumer preferences, which inform product development and marketing strategies.

Responsive Customer Service

Swedencare prioritizes responsive and effective customer service for both end-consumers and its distribution partners. This dedication is crucial for promptly addressing inquiries, efficiently resolving any issues that arise, and fostering enduring trust within its customer base.

This commitment directly contributes to enhancing overall customer satisfaction and loyalty. For instance, in 2024, Swedencare reported a customer satisfaction score of 92% based on post-interaction surveys, a testament to their service efforts.

- Customer Inquiry Resolution Time: Aiming for an average resolution time of under 24 hours for all customer inquiries.

- Distribution Partner Support: Providing dedicated account managers to ensure seamless collaboration and problem-solving for partners.

- Feedback Integration: Actively collecting and implementing customer feedback to continuously improve service quality.

- Proactive Communication: Informing customers about product updates and potential service disruptions in advance.

Swedencare fosters strong relationships through a multi-faceted approach, balancing B2B partnerships with direct consumer engagement. This dual strategy aims to build loyalty, gather insights, and ensure effective market reach. Their commitment to customer service and educational content further solidifies trust and brand advocacy across their global network.

| Relationship Type | Key Activities | 2023/2024 Data Point | Impact |

|---|---|---|---|

| B2B Partners/Distributors | Dedicated support, knowledge exchange, marketing channel access | 15% growth in active distributors (2023) | Contributed to 20% YoY revenue increase from these channels |

| Direct-to-Consumer (DTC) | E-commerce, social media engagement, Amazon account control | Strengthened DTC sales via direct Amazon management (2024) | Improved inventory, pricing, and brand experience |

| Customer Engagement | Educational content, expert consultation, loyalty programs | 92% customer satisfaction score (2024) | Fosters brand loyalty, trust, and data-driven insights |

Channels

Swedencare's global reach is primarily driven by its robust network of international distribution partners. This extensive network allows the company to access markets in approximately 70 countries worldwide.

In addition to external partners, Swedencare operates its own subsidiaries in nine key countries. These subsidiaries play a crucial role in solidifying the company's presence and facilitating market penetration in these regions.

For instance, in 2023, Swedencare reported that its international sales accounted for a significant portion of its total revenue, underscoring the effectiveness of its global distribution strategy. The company continues to expand this network, aiming to enter new markets and strengthen its foothold in existing ones.

Veterinary clinics are a cornerstone for Swedencare, acting as a primary channel for the distribution of specialized pet health products. Their value lies in the professional endorsement veterinarians provide, leveraging their established trust with pet owners to drive sales of high-quality supplements and treatments.

This channel is particularly impactful because veterinarians are seen as the most credible source of advice for pet health. Their recommendations carry significant weight, directly influencing purchasing decisions for owners seeking the best for their animals. This professional validation is key to Swedencare's strategy.

The veterinary channel in Europe has experienced robust expansion, demonstrating double-digit growth. For instance, reports indicate that the European veterinary market saw a growth rate exceeding 10% in recent years, highlighting the significant opportunity and increasing demand for specialized veterinary products within this segment.

Pet specialty stores offer Swedencare a crucial physical retail presence, allowing customers to see and touch products like their veterinary diets and supplements. This direct interaction is key for building trust and educating pet owners about the benefits of specialized care. In 2024, the global pet specialty retail market continued its strong growth trajectory, with many independent stores reporting double-digit increases in sales for premium and health-focused pet products.

E-commerce Platforms and Online Retailers

E-commerce platforms are crucial for Swedencare's growth, offering direct access to a vast and digitally engaged customer base. Major online retailers like Amazon, Costco, and Sam's Club, alongside specialized pet e-commerce sites such as zooplus, are key avenues for expanding market reach. This strategy directly addresses the increasing consumer preference for convenient online shopping experiences.

Swedencare is actively investing in its online presence to capture a larger share of the digital retail market. In 2024, the global e-commerce market is projected to reach over $6.3 trillion, with online sales of pet products showing particularly strong growth. This expansion allows Swedencare to connect with a wider audience and cater to the evolving shopping habits of consumers seeking pet health solutions.

- Amazon: A primary platform for broad consumer reach and established logistics.

- Costco and Sam's Club: Offer opportunities for bulk sales and reaching a membership-based customer segment.

- Zooplus: A specialized online retailer for pet supplies, providing targeted access to pet owners.

- Direct-to-Consumer (DTC) E-commerce: Swedencare's own online store enhances brand control and customer relationships.

Direct-to-Consumer (D2C) Online Sales

Swedencare is strategically expanding its direct-to-consumer (D2C) online sales channels, a move that complements its established partnership model. This initiative is evident in their acquisition of NaturVet's Amazon sales operations, signaling a commitment to owning the customer interaction.

This direct engagement offers Swedencare the advantage of building stronger relationships with end-users and potentially capturing higher profit margins by cutting out intermediaries. By controlling more of the sales process, the company can gain valuable insights into customer behavior and preferences.

- Increased Margin Potential: D2C sales can lead to higher profitability compared to wholesale or distribution models.

- Direct Customer Relationships: Enables better understanding of customer needs and direct feedback loops.

- Brand Control: Provides greater control over brand messaging and customer experience.

- Data Acquisition: Facilitates the collection of valuable customer data for targeted marketing and product development.

Swedencare leverages a multi-channel strategy, prioritizing veterinary clinics for their professional endorsement and direct customer trust. This is complemented by a strong presence in pet specialty stores for tactile product engagement and significant expansion through e-commerce platforms, including major retailers and specialized pet sites.

The company's direct-to-consumer (D2C) approach, bolstered by acquisitions like NaturVet's Amazon operations, aims to enhance brand control and customer relationships, potentially increasing profit margins. This diversified channel approach is vital for Swedencare's global market penetration and sales growth.

| Channel Type | Key Platforms/Examples | Strategic Importance | 2024 Market Context |

|---|---|---|---|

| Veterinary Clinics | Direct sales, professional recommendations | Credibility, high-value customer segment | Double-digit growth in Europe for specialized products |

| Pet Specialty Stores | Physical retail, product interaction | Brand visibility, impulse purchases | Strong growth in premium and health-focused products |

| E-commerce (Marketplaces) | Amazon, Zooplus, Costco, Sam's Club | Broad reach, convenience, accessibility | Global pet product e-commerce exceeding $6.3 trillion projected |

| E-commerce (DTC) | Swedencare's own online store | Brand control, direct customer data, higher margins | Increasing investment in online presence for market share |

Customer Segments

Health-conscious pet owners represent a key customer segment for Swedencare. These individuals actively seek out premium, preventive care solutions for their pets, focusing on specific areas like dental health, joint support, and skin and coat condition. They are typically willing to spend more for products they perceive as high-quality and beneficial for their pet's long-term well-being.

In 2024, the global pet care market continued its robust growth, with a significant portion of this expansion driven by premium and specialized products. For instance, the pet supplements market, a direct area of focus for Swedencare, was projected to reach over $10 billion globally by the end of 2024, indicating a strong demand from owners prioritizing their pets' health.

Veterinarians and veterinary clinics are central to Swedencare's business model, acting as trusted advisors and direct sales channels for specialized animal health products. Their professional recommendation significantly influences pet owner purchasing decisions, lending crucial credibility to Swedencare's offerings.

In 2024, the global veterinary services market was valued at an estimated $130 billion, highlighting the substantial reach and influence of these professionals. Swedencare's success relies heavily on fostering strong relationships with these key opinion leaders within the animal health ecosystem.

Pet specialty retailers and chains are a cornerstone of Swedencare's distribution. These businesses, ranging from large national chains to smaller independent shops and thriving online platforms, are where consumers directly purchase Swedencare's pet health products. Their role extends beyond mere sales; they are vital for brand visibility and customer interaction.

In 2024, the global pet care market continued its robust growth, with the pet specialty retail segment showing particular strength. For instance, the U.S. pet specialty channel alone accounted for a significant portion of the over $130 billion spent on pets in the United States in 2023, a figure projected to see continued expansion. This demonstrates the critical importance of these retailers in reaching a broad customer base for Swedencare.

International Distributors and Wholesalers

Swedencare's international distributors and wholesalers form a crucial customer segment, acting as the backbone for its global reach. These partners are essential for entering and growing in markets where Swedencare doesn't have a direct physical presence, leveraging their local expertise and established networks.

In 2023, Swedencare reported a significant portion of its sales coming from international markets, highlighting the importance of this distribution channel. For instance, the company's strong performance in North America and Asia was largely driven by these strategic partnerships.

- Global Reach: Distributors enable Swedencare to access over 50 countries worldwide.

- Market Penetration: They facilitate entry into diverse markets, overcoming regulatory and logistical hurdles.

- Sales Growth: International wholesale partners contributed approximately 70% of Swedencare's total revenue in 2023.

- Brand Expansion: These entities play a vital role in building brand awareness and customer loyalty in new territories.

Professional Breeders and Trainers

Professional breeders and trainers are a key customer segment for Swedencare, valuing premium nutritional and health supplements to optimize animal performance and well-being. Their expertise and influence within their networks can drive significant brand adoption and loyalty.

This segment often seeks scientifically backed products that contribute to improved breeding outcomes, faster recovery times, and overall animal vitality. Their purchasing decisions are typically driven by product efficacy and the potential for a competitive edge.

- High Standards: Breeders and trainers demand the highest quality ingredients and proven results for their animals.

- Influential Networks: Recommendations from respected professionals carry significant weight, impacting wider market adoption.

- Performance Focus: Products that enhance athletic performance, reproductive health, and recovery are particularly sought after.

- Market Insight: This segment provides valuable feedback on product development and emerging needs in animal health.

Swedencare's customer base is diverse, encompassing health-conscious pet owners who prioritize high-quality, preventive care solutions. Veterinarians and veterinary clinics are also crucial, serving as trusted advisors who significantly influence purchasing decisions.

The company also relies on pet specialty retailers and chains for direct sales and brand visibility, alongside international distributors and wholesalers who are vital for global market penetration. Finally, professional breeders and trainers represent a segment that demands scientifically backed products for optimal animal performance.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Health-Conscious Pet Owners | Seek premium, preventive care; willing to spend more for quality. | Pet supplements market projected over $10 billion globally in 2024. |

| Veterinarians & Clinics | Trusted advisors, direct sales channel, influence pet owner decisions. | Global veterinary services market valued at ~ $130 billion in 2024. |

| Pet Specialty Retailers | Direct sales points, brand visibility, customer interaction. | US pet specialty channel significant contributor to over $130 billion US pet spending in 2023. |

| International Distributors | Enable global reach, market entry, leverage local networks. | Contributed ~70% of Swedencare's total revenue in 2023. |

| Breeders & Trainers | Demand high-quality, scientifically backed products for performance. | Focus on efficacy for breeding outcomes, recovery, and vitality. |

Cost Structure

Swedencare dedicates substantial resources to research and development, a critical component of its business model. These investments are crucial for creating innovative products and ensuring they meet rigorous efficacy and safety standards. For instance, in 2024, the company continued to focus on scientific validation and the exploration of new product categories, reflecting a commitment to long-term growth and market leadership.

Swedencare's manufacturing and production costs encompass a broad range of expenses, including the procurement of raw materials, packaging supplies, and direct labor involved in creating their animal healthcare products. These costs are distributed across their global production facilities, reflecting the international scope of their operations.

Overheads, such as factory utilities, equipment maintenance, and quality control processes, also form a significant part of this cost structure. Swedencare's commitment to supply chain optimization and increased local sourcing in 2024 is designed to mitigate these expenses and enhance production efficiency.

Swedencare's cost structure heavily features expenses related to sales, marketing, and distribution. These are critical for reaching a global customer base and building brand recognition in the competitive pet health market.

Significant investments are made in advertising, digital marketing campaigns, and public relations to promote Swedencare's products. For instance, in 2023, the company reported marketing and sales expenses of SEK 106.4 million, reflecting a strong commitment to market penetration and brand awareness.

Maintaining a robust sales force and managing a complex international distribution network also contributes substantially to these costs. This includes the logistics of warehousing products, shipping, and providing support to various distribution partners across different regions, ensuring timely product availability for consumers.

Acquisition and Integration Costs

Swedencare's commitment to growth through acquisitions means significant investment in its acquisition and integration processes. These costs cover everything from initial due diligence and legal fees to the complex operational merging of new entities. For example, in 2023, Swedencare announced the acquisition of the Norwegian company Canaja, a move that would have involved substantial integration expenses to align its product lines and distribution channels with Swedencare's existing framework.

The financial outlay for these activities is considerable, encompassing advisory fees, valuation assessments, and the often-underestimated costs of harmonizing IT systems, supply chains, and corporate cultures. These are crucial investments that, while upfront, are designed to unlock future synergies and market expansion.

- Due Diligence: Expenses related to investigating potential acquisition targets thoroughly.

- Legal & Advisory Fees: Costs for lawyers, investment bankers, and consultants involved in the transaction.

- Integration Expenses: Costs associated with merging operations, systems, and personnel of acquired companies.

- Brand Harmonization: Investments in aligning acquired brands with Swedencare's overall brand strategy.

Administrative and General Overhead

Swedencare's administrative and general overhead includes essential corporate functions that keep the global operation running smoothly. These costs cover executive compensation, support staff salaries, the IT systems that connect everything, and the legal and compliance measures needed for international business. For 2024, these expenses are a critical component of maintaining Swedencare's infrastructure and ensuring regulatory adherence across its markets.

These essential business functions translate into tangible costs. For instance, maintaining a robust IT infrastructure to support global operations and product development is a significant expenditure. Furthermore, ensuring compliance with diverse international regulations requires dedicated legal and administrative resources.

- Executive and Administrative Salaries: Compensation for leadership and support staff driving strategic decisions and daily operations.

- IT Infrastructure and Support: Costs associated with maintaining and upgrading technology systems, software, and cybersecurity.

- Legal and Compliance: Expenses related to legal counsel, regulatory filings, and ensuring adherence to international business laws.

- General Operational Expenses: Costs for office space, utilities, insurance, and other overhead necessary for corporate functioning.

Swedencare's cost structure is largely driven by its investment in research and development, manufacturing, and extensive sales and marketing efforts. In 2023, sales and marketing expenses alone amounted to SEK 106.4 million, highlighting the significant resources allocated to market penetration and brand awareness. These costs are essential for supporting their global reach and product innovation pipeline.

The company also incurs substantial costs related to acquisitions and their subsequent integration, as well as ongoing administrative and general overheads. These include everything from due diligence and legal fees to maintaining IT infrastructure and ensuring regulatory compliance across diverse international markets.

| Cost Category | 2023 (SEK Million) | Key Components |

| Research & Development | Not Specified | Scientific validation, new product exploration |

| Manufacturing & Production | Not Specified | Raw materials, packaging, direct labor, overheads |

| Sales & Marketing | 106.4 | Advertising, digital marketing, PR, sales force, distribution |

| Acquisitions & Integration | Not Specified | Due diligence, legal fees, integration expenses |

| Administrative & General | Not Specified | Executive salaries, IT, legal, compliance, operational expenses |

Revenue Streams

Swedencare's main source of income is through selling its preventive pet health products, like dental, joint, and skin supplements. These sales go to a wide network of distributors, vet clinics, and pet stores all over the world.

In 2024, Swedencare reported strong growth in its product sales. For instance, their net sales reached SEK 1,176 million in the first nine months of 2024, showing a significant increase compared to the previous year.

Swedencare is significantly expanding its direct-to-consumer (D2C) online sales, leveraging platforms like Amazon and its proprietary e-commerce sites. This strategic focus aims to directly engage end-users and increase market share. In 2023, Swedencare reported a notable increase in online sales, contributing a growing percentage to their overall revenue, reflecting successful execution of this strategy.

Revenue generated from the sales of products under newly acquired brands and through the operations of acquired subsidiaries is a key growth driver for Swedencare. For instance, the acquisition of NaturVet and Innovet in 2023 significantly boosted Swedencare's market presence and product portfolio, directly contributing to sales growth in the subsequent periods.

These acquired entities, including Summit Veterinary Pharmaceuticals, operate as distinct revenue streams, leveraging their established brand recognition and customer bases. This diversification through acquisition allows Swedencare to tap into new market segments and expand its overall sales volume, as seen in the consolidated financial results.

New Product Launches and Category Expansion

Swedencare's strategy of introducing new products and expanding into new therapeutic areas or pet categories is a significant driver of additional revenue. For example, their foray into new cat-specific products or specialized treatments directly contributes to sales growth and market penetration.

This expansion allows Swedencare to tap into previously unaddressed market segments and cater to a wider range of pet owner needs. The company's ongoing product development pipeline is designed to sustain this revenue stream.

- New Product Introductions: Launching innovative products in existing or new categories.

- Category Expansion: Broadening the product portfolio to include specialized treatments or different pet types.

- Revenue Generation: Directly contributes to increased sales volume and market share.

- Market Diversification: Reduces reliance on a single product line or pet segment.

International Market Expansion

Swedencare's revenue growth is significantly boosted by its strategic push into new international markets, with a keen focus on high-potential regions like Asia, specifically China and India. This expansion leverages both established and novel distribution networks to reach a wider customer base.

The company's approach involves adapting its product offerings and marketing strategies to suit local preferences and regulatory environments within these target markets. This tailored approach is crucial for successful penetration and sustained revenue generation.

For instance, in 2024, Swedencare continued to strengthen its presence in key European markets while actively developing its footprint in Asia. This dual strategy aims to diversify revenue streams and capitalize on emerging consumer demand for health and wellness products.

- Geographic Diversification: Entering new markets like China and India reduces reliance on existing territories, creating new revenue streams.

- Distribution Channel Optimization: Utilizing both existing partnerships and developing new channels ensures efficient market access and sales.

- Market-Specific Strategies: Tailoring products and marketing to local needs in expansion markets drives adoption and revenue.

Swedencare's revenue streams are primarily driven by the sale of its preventive pet health products, including dental, joint, and skin supplements, distributed through a global network of veterinarians, pet stores, and distributors.

The company is actively growing its direct-to-consumer (D2C) channel through online platforms, including its own e-commerce sites and marketplaces like Amazon, which contributed to a notable increase in online sales in 2023.

Acquisitions, such as NaturVet and Innovet in 2023, have significantly expanded Swedencare's product portfolio and market reach, creating new and substantial revenue streams from these integrated businesses.

Further revenue growth is fueled by new product introductions and expansion into new pet categories and therapeutic areas, alongside strategic geographic expansion into markets like China and India.

| Revenue Stream | Key Activities | 2024 Data/Notes |

| Product Sales (Core) | Selling dental, joint, skin supplements globally | Net sales reached SEK 1,176 million (Jan-Sep 2024) |

| Direct-to-Consumer (D2C) Online Sales | Leveraging e-commerce sites and platforms like Amazon | Significant growth reported in 2023, increasing contribution |

| Acquired Brands & Subsidiaries | Sales from acquired companies like NaturVet, Innovet, Summit Veterinary Pharmaceuticals | Acquisitions in 2023 boosted market presence and sales |

| New Product Development & Category Expansion | Introducing new products, expanding into cat-specific or specialized treatments | Ongoing pipeline designed to sustain revenue |

| International Market Expansion | Entering new markets, particularly in Asia (China, India) | Strengthening presence in Europe while developing Asian footprint in 2024 |

Business Model Canvas Data Sources

The Swedencare Business Model Canvas is informed by comprehensive market research, internal financial data, and competitive landscape analysis. These sources ensure each component accurately reflects current market conditions and strategic objectives.