Swedencare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

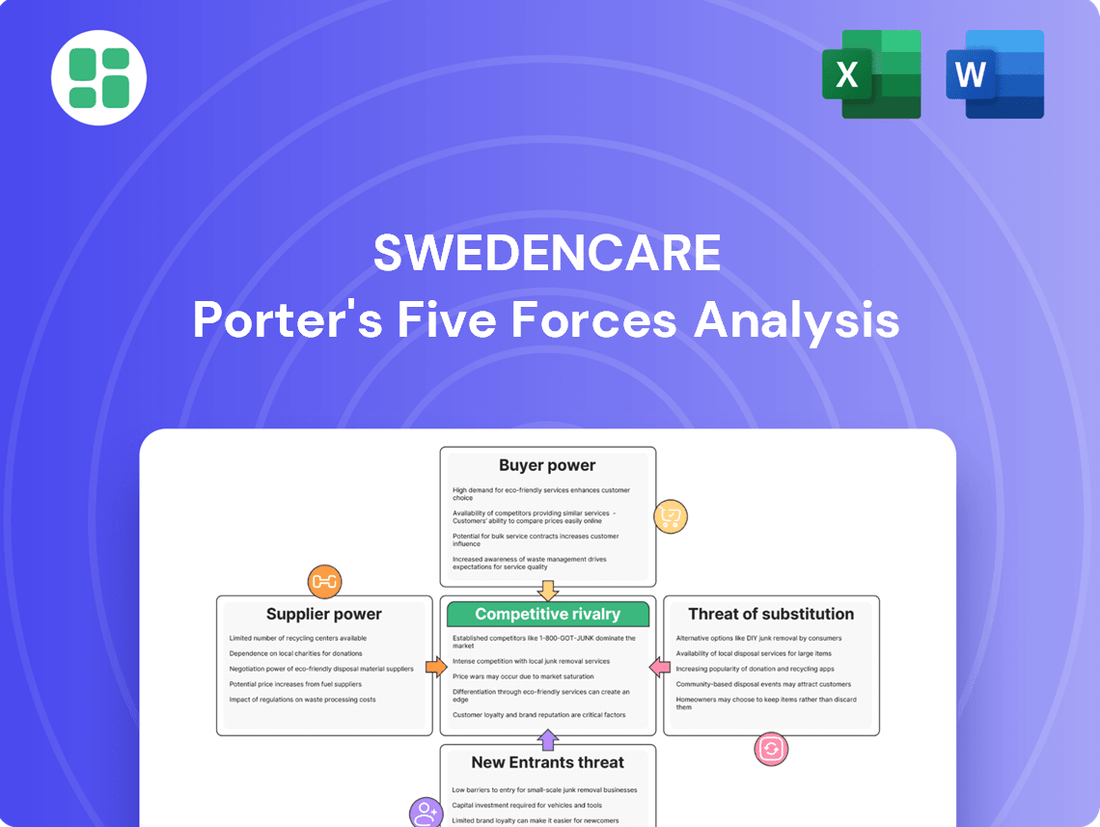

Swedencare navigates a competitive landscape shaped by the bargaining power of its suppliers and the intensity of rivalry within the pet health market. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Swedencare’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Swedencare AB can be considered moderate to high. This is especially true when the company relies on a small number of providers for specialized ingredients or unique formulations essential for its preventive care products, such as those for dental health, joints, and skin or coat condition.

For instance, if key components in their popular ProDen PlaqueOff line are sourced from a limited supplier base, those suppliers gain significant leverage. This concentration means Swedencare might have fewer alternatives, potentially leading to higher input costs or less favorable contract terms.

Swedencare's reliance on specialized ingredients for its pet health products can lead to significant switching costs for its suppliers. If the company has invested heavily in unique formulations or production lines that are specific to a particular supplier's raw materials or advanced technologies, the expense and effort to transition to an alternative supplier could be substantial. This could involve re-validating product efficacy, securing new regulatory approvals, and potentially disrupting ongoing manufacturing operations.

The availability of substitutes for Swedencare's animal health product inputs significantly influences supplier bargaining power. If a wide array of generic or easily replaceable raw materials and ingredients exist, suppliers' ability to dictate terms and prices diminishes. For instance, if Swedencare relies on common vitamins or minerals with multiple sourcing options, the power held by any single supplier is reduced.

Conversely, when Swedencare requires highly specialized or patented components, the suppliers of these unique inputs wield considerable power. This is because there are few, if any, readily available alternatives. In 2024, the market for novel, science-backed ingredients in pet supplements, a key area for Swedencare, saw continued growth, with a few key innovators holding patents on particularly effective compounds, thereby granting them higher bargaining leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers in the animal healthcare sector, while generally low for raw material providers, could become a significant concern if a supplier possesses unique capabilities or market leverage. Should a key supplier decide to enter the animal healthcare product market directly, they could become a formidable competitor to Swedencare AB. This is particularly relevant if the supplier has established brand recognition or robust downstream distribution networks, allowing them to bypass Swedencare and reach end consumers directly.

For Swedencare AB, this threat is mitigated by the specialized nature of many of its ingredients and the complexity of navigating regulatory approvals in the animal health industry. However, a supplier with significant R&D investment or a strong existing brand in a related consumer sector might find the prospect of forward integration more appealing. For instance, a major pet food manufacturer that also supplies specialized nutritional ingredients could potentially leverage its brand and distribution to launch its own line of supplements.

- Potential for Competition: Suppliers entering Swedencare's market directly poses a competitive threat.

- Supplier Capabilities: Brand recognition and distribution networks increase the likelihood and impact of forward integration.

- Industry Barriers: Regulatory hurdles and R&D intensity in animal health can deter less capable suppliers.

Importance of Swedencare to Suppliers

The bargaining power of suppliers for Swedencare AB is influenced by how crucial Swedencare is to their business. If Swedencare represents a substantial portion of a supplier's total sales, that supplier will likely have less leverage. They would be keen to preserve this significant revenue stream, potentially leading to more favorable terms for Swedencare. For instance, if a key ingredient supplier derives 20% of its revenue from Swedencare, they might be less inclined to push for price increases.

Conversely, if Swedencare is a minor client for a particular supplier, the supplier's bargaining power increases. In such scenarios, the supplier has numerous other customers and is less dependent on Swedencare’s business, giving them more room to dictate terms or raise prices. Imagine a specialized packaging supplier that serves hundreds of companies; Swedencare’s order might only represent 1% of their output, significantly reducing Swedencare's ability to negotiate.

- Supplier Dependence: A supplier heavily reliant on Swedencare for revenue has reduced bargaining power.

- Customer Size: Swedencare's status as a small customer to a large supplier diminishes its negotiating strength.

- Market Concentration: The number of alternative suppliers available to Swedencare and the number of customers available to suppliers are key factors.

The bargaining power of suppliers for Swedencare AB is generally moderate, but can escalate to high when specialized, patented ingredients are involved. In 2024, the demand for novel, science-backed ingredients in the pet health sector, a core area for Swedencare, saw key innovators with proprietary compounds command higher prices and more favorable terms due to limited alternatives. This concentration of supply for critical components significantly amplifies supplier leverage.

Swedencare's ability to negotiate is further impacted by the supplier's dependence on its business. If Swedencare constitutes a substantial portion of a supplier's revenue, the supplier is incentivized to maintain favorable terms. Conversely, if Swedencare is a minor client to a supplier, that supplier's bargaining power increases due to their reduced reliance on Swedencare's orders.

The threat of forward integration by suppliers, while not prevalent for raw material providers, could become a concern if a supplier possesses strong brand recognition or established distribution networks in the animal health market, allowing them to compete directly. However, the specialized nature of many Swedencare ingredients and the industry's regulatory complexities can act as deterrents to such integration.

| Factor | Impact on Swedencare | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | Moderate to High | Patented ingredients for pet joint health had few suppliers, increasing their power. |

| Switching Costs | Moderate | Re-validating efficacy of specialized ingredients can be costly and time-consuming. |

| Availability of Substitutes | Low for specialized, High for common | Common vitamins had many suppliers; novel compounds had few. |

| Supplier Dependence on Swedencare | Lowers supplier power | If Swedencare is a major client, supplier is less likely to dictate terms. |

| Swedencare's Dependence on Supplier | Increases supplier power | If Swedencare needs unique ingredients, it's more reliant on that supplier. |

What is included in the product

This analysis unpacks the competitive forces impacting Swedencare, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the potential of substitute products within the pet health industry.

Effortlessly identify and address competitive pressures with Swedencare's Porter's Five Forces Analysis, providing a clear roadmap to navigate market dynamics and alleviate strategic pain points.

Customers Bargaining Power

Swedencare's global reach relies on a diverse network of distributors, including veterinarians, pet stores, and online retailers. If a significant portion of Swedencare's sales are concentrated with a few large distributors, such as major pet store chains or prominent online marketplaces like Amazon or Chewy, these entities gain considerable leverage. Their substantial order volumes and their ability to influence consumer purchasing decisions through prominent placement or pricing strategies empower them to negotiate more favorable terms and prices with Swedencare.

Pet owners are increasingly prioritizing their pets' health, viewing them as family members. This trend often translates into a greater willingness to spend on premium, preventive care products, suggesting a lower price sensitivity for high-quality offerings. For instance, the global pet care market was valued at approximately $261 billion in 2022 and is projected to reach $350 billion by 2027, indicating sustained consumer investment in pet well-being.

Despite this elevated focus on pet wellness, broader economic conditions, including inflation and potential recessionary pressures, can still influence consumer spending. This means that while quality is paramount, price remains a consideration, particularly for products perceived as discretionary. This economic sensitivity can indirectly affect companies like Swedencare by influencing the purchasing decisions of distributors and retailers further down the supply chain.

Customers, encompassing both distributors and end-consumers, face a broad array of pet healthcare options. They can readily access products from multiple brands addressing needs like dental care, joint health, and skin condition, significantly impacting Swedencare's pricing leverage.

The availability of numerous alternatives means customers can easily switch to competing products if Swedencare's offerings become less attractive in terms of price or features. This ease of substitution directly amplifies their bargaining power.

For instance, in 2024, the global pet care market, valued at over $200 billion, saw continued growth with numerous new entrants and established players offering a wide range of supplements and treatments, intensifying competition and customer choice.

Customer Information and Product Differentiation

Customers today are highly informed, especially concerning pet nutrition and supplements, thanks to readily available online information. This heightened awareness allows them to easily compare ingredients and product effectiveness, potentially increasing their bargaining power.

Swedencare leverages strong brand recognition, particularly with its ProDen PlaqueOff line, to create product differentiation. This differentiation helps to mitigate the direct impact of customer power by offering unique value propositions.

- Informed Consumers: A significant portion of pet owners actively research pet health products online, comparing ingredients and efficacy.

- Brand Loyalty: Swedencare's established brands, like ProDen PlaqueOff, foster customer loyalty, reducing price sensitivity and bargaining power.

- Product Specialization: Focus on niche areas like dental health for pets allows Swedencare to command a premium and lessen direct comparison with broader pet care products.

Threat of Backward Integration by Customers

The bargaining power of customers, specifically the threat of backward integration, poses a significant consideration for Swedencare AB. Large distributors or retailers, particularly those with substantial market share and resources, could choose to develop their own private-label pet healthcare products. This strategy would allow them to bypass external suppliers like Swedencare, potentially leading to reduced demand for Swedencare's offerings.

This threat is amplified in product segments that are characterized by high volume and relatively low differentiation. In such markets, the cost savings and margin control gained from in-house production can be particularly attractive to powerful buyers. For instance, if a major pet supply retailer sees strong consumer demand for a particular type of joint supplement, they might explore manufacturing their own version to capture more of the value chain.

While specific data on the likelihood of backward integration by Swedencare's key distributors is not publicly detailed, the general trend in the consumer goods sector indicates this is a persistent concern. Companies like Swedencare must continually innovate and differentiate their products to maintain their value proposition and deter such moves by their customers.

The potential for backward integration by customers directly impacts Swedencare's market position and pricing power. If key distributors were to launch private-label alternatives, it could lead to increased price competition and a need for Swedencare to invest further in brand building and unique product formulations.

The bargaining power of customers for Swedencare is moderate, influenced by informed consumers and the availability of alternatives, yet somewhat mitigated by brand loyalty and product specialization. While pet owners are increasingly health-conscious, economic pressures can still lead to price sensitivity, particularly for non-essential items.

The threat of backward integration by large distributors or retailers exists, especially for less differentiated products, potentially impacting Swedencare's pricing power and market position. However, Swedencare's strong brand recognition, notably with ProDen PlaqueOff, helps to differentiate its offerings and reduce customer leverage.

| Factor | Impact on Swedencare | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Customer Information & Alternatives | Moderate to High Bargaining Power | Global pet care market valued over $200 billion in 2024, with numerous brands offering similar pet health solutions, increasing consumer choice. |

| Brand Loyalty & Differentiation | Lowers Bargaining Power | Swedencare's ProDen PlaqueOff line has strong brand recognition, fostering loyalty and reducing price sensitivity. |

| Economic Sensitivity | Increases Bargaining Power (Indirectly) | Inflationary pressures in 2024 can make consumers more price-aware, potentially influencing distributor purchasing decisions. |

| Backward Integration Threat | Potential for Increased Bargaining Power | While specific instances are not detailed, the trend in consumer goods for private labels remains a concern for suppliers. |

Preview Before You Purchase

Swedencare Porter's Five Forces Analysis

This preview showcases the complete Swedencare Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the pet healthcare industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The global pet healthcare market is indeed a crowded space, featuring a mix of established giants and agile newcomers. Swedencare AB navigates this landscape alongside major multinational corporations that offer a broad spectrum of pet health products, as well as specialized niche players focusing on areas like pet supplements and preventative care, creating a dynamic competitive environment.

The global pet healthcare market is on a strong upward trajectory, with projections indicating significant expansion in the coming years. This robust growth is fueled by several key trends, including the increasing humanization of pets, a rise in pet adoption rates, and a growing emphasis on preventive care for animal companions. For instance, the global pet care market was valued at an estimated $261 billion in 2023 and is expected to reach $350 billion by 2027, demonstrating a compound annual growth rate (CAGR) of approximately 7.7%.

This high market growth rate plays a crucial role in moderating competitive rivalry. When an industry is expanding rapidly, companies have the opportunity to grow their revenues and market presence by capitalizing on the increasing demand, rather than solely by taking market share away from existing competitors. This dynamic can lead to a less aggressive competitive environment, as the focus shifts towards market expansion and innovation to meet the growing needs of pet owners.

Swedencare AB leverages strong brand names like ProDen PlaqueOff, NaturVet, and Rx Vitamins to set its products apart. This premium positioning and brand recognition create a significant degree of product differentiation within the pet health market.

This differentiation strategy allows Swedencare to move away from intense price-based competition, fostering loyalty among both pet owners and veterinary professionals who trust the quality and efficacy of their offerings.

Switching Costs for Customers

Switching costs for pet owners looking to change supplement brands are typically low. While brand loyalty can play a role in the pet care sector, many supplements offer comparable functional benefits, making it easy for consumers to switch. For instance, a 2024 market analysis indicated that over 60% of pet owners surveyed had tried multiple brands of pet supplements in the past two years due to readily available alternatives and comparable pricing.

However, certain factors can introduce minor switching barriers. Veterinarian recommendations carry significant weight, and once a pet owner follows a vet's advice for a specific supplement, they may be less inclined to switch without professional guidance. Established routines are also a factor; a pet owner accustomed to a particular feeding schedule with a specific supplement might find it inconvenient to change, even if other options exist.

- Low Switching Costs: Most pet supplements offer similar functional benefits, allowing for easy brand changes.

- Brand Loyalty Impact: While present, brand loyalty is often outweighed by the availability of comparable products.

- Veterinarian Influence: Recommendations from veterinarians can create stickiness, discouraging switching without professional advice.

- Routine Inertia: Established feeding routines can act as a minor deterrent to switching supplement brands.

Strategic Objectives of Competitors

Competitors in the pet healthcare sector often pursue diverse strategic goals. Some focus on gaining market share through competitive pricing, introducing novel products, or expanding their global reach. For instance, Nestlé Purina, a major player, has consistently invested in R&D and marketing to bolster its market position, reporting sales of CHF 17.0 billion in 2023.

Other competitors might prioritize niche market penetration or building strong brand loyalty through specialized offerings. The market is dynamic, with companies like Mars Petcare, which reported revenues exceeding $20 billion in 2022, employing a multi-brand strategy to capture various consumer segments and needs.

Swedencare’s strategic objectives are centered on achieving organic growth, effectively integrating acquired businesses, and expanding its presence in new territories, with a particular emphasis on Asian markets. This approach aims to leverage existing strengths while capitalizing on emerging opportunities.

- Market Share Expansion: Competitors may aim to increase their share through aggressive pricing or innovative product launches.

- Product Innovation: Developing new and improved pet health products is a key differentiator for many players.

- Geographical Expansion: Entering new international markets offers significant growth potential.

- Swedencare's Focus: Organic growth, acquisition integration, and expansion into markets like Asia are central to Swedencare's strategy.

The competitive rivalry within the pet healthcare sector is intense, driven by a large number of players ranging from global conglomerates to specialized firms. This dynamic is further amplified by the market's rapid growth, which attracts new entrants and encourages existing companies to innovate and expand. For example, the global pet care market's projected growth to $350 billion by 2027, with a 7.7% CAGR, signals a fertile ground for competition.

Swedencare differentiates itself through strong brand recognition, such as ProDen PlaqueOff, which fosters customer loyalty and reduces direct price competition. While switching costs for many pet supplements are low, veterinarian recommendations and established routines can create minor barriers for consumers considering alternatives.

Major competitors like Nestlé Purina and Mars Petcare actively pursue market share through substantial investments in research and development, marketing, and strategic acquisitions. Nestlé Purina reported CHF 17.0 billion in sales for 2023, while Mars Petcare's revenues exceeded $20 billion in 2022, illustrating the scale of investment in this space.

| Company | 2023/2022 Revenue (Approx.) | Key Strategy |

|---|---|---|

| Nestlé Purina | CHF 17.0 billion (2023) | R&D, Marketing, Market Position |

| Mars Petcare | >$20 billion (2022) | Multi-brand Strategy, Consumer Segments |

| Swedencare AB | €139.4 million (2023) | Organic Growth, Acquisitions, Asian Expansion |

SSubstitutes Threaten

The threat of substitutes for Swedencare's products, particularly in pet dental and joint/skin health, is significant. For dental care, consumers can opt for professional veterinary cleanings, specialized prescription diets, or even non-Swedencare dental chews and toys. These alternatives offer varying degrees of effectiveness and price points, directly competing with Swedencare's offerings.

In the realm of joint support and skin/coat health, the substitute landscape is even broader. Owners might turn to conventional veterinary treatments, prescription medications, or even implement lifestyle changes such as diet and exercise. Furthermore, readily available generic supplements from a wide array of manufacturers present a cost-effective alternative, potentially drawing customers away from Swedencare's specialized formulations.

The attractiveness of substitutes for Swedencare's products, primarily pet supplements, hinges on their price-performance trade-off. Consumers will weigh the cost of an alternative against its ability to deliver desired health outcomes for their pets.

Cheaper, less effective alternatives might appeal to highly price-sensitive consumers, potentially impacting Swedencare's market share if these substitutes meet a basic need at a lower cost. For instance, while Swedencare offers specialized joint support supplements, a basic vitamin mix from a discount retailer could be seen as a substitute by some.

Conversely, more expensive veterinary procedures or prescription medications might be considered substitutes for managing severe pet health issues, offering a different, often more intensive, level of care. This highlights that the perceived value and efficacy of the substitute play a crucial role in consumer choice, especially when dealing with serious health concerns.

Pet owners are increasingly treating their pets like family, driving demand for premium and specialized products. This trend, evident in the growing global pet care market which reached an estimated USD 261 billion in 2023, means owners are less likely to switch to cheaper, less effective alternatives for their pets' health and well-being. For instance, the premium pet food segment alone saw significant growth in 2024, indicating a strong preference for quality.

Evolution of Veterinary Practices

The threat of substitutes for Swedencare's veterinary dietary supplements is influenced by the evolving landscape of pet healthcare. Advances in veterinary medicine, including new pharmaceuticals and therapeutic interventions, can offer alternative solutions for managing pet health issues. For instance, the development of advanced diagnostic tools and specialized treatments may reduce the perceived necessity of dietary supplements for certain conditions.

Furthermore, the increasing availability and sophistication of veterinary services present substitutes. Pet owners now have access to a wider array of specialized veterinary clinics and treatments, from advanced surgical procedures to cutting-edge rehabilitation therapies. This broader spectrum of care can address health concerns that might previously have been managed or supplemented through dietary means.

Consider the growing market for prescription veterinary diets, which are formulated to address specific medical conditions and are often recommended by veterinarians. These prescription foods can act as direct substitutes for over-the-counter supplements, especially when a diagnosed medical need exists. In 2024, the global pet food market, which includes therapeutic diets, was projected to continue its robust growth, indicating a strong demand for specialized pet nutrition solutions.

- Technological Advancements: New diagnostic and treatment technologies in veterinary medicine can reduce reliance on supplements.

- Specialized Veterinary Care: The rise of specialized clinics and advanced therapies offers alternative health management options.

- Prescription Diets: Medically formulated prescription diets serve as direct substitutes for supplements in treating specific conditions.

- Market Trends: The expanding veterinary market, including therapeutic diets, highlights the availability of alternative nutritional solutions.

Emergence of DIY or Home Remedies

The rise of do-it-yourself (DIY) pet care and home remedies presents a significant threat of substitutes for Swedencare. Some pet owners, particularly those seeking cost savings or exploring natural approaches, may opt for homemade solutions for common ailments such as skin irritations or digestive issues, bypassing specialized pet health products.

This trend is amplified by readily available online information and ingredient sourcing. For instance, a 2024 survey indicated that over 30% of pet owners had experimented with at-home remedies for minor pet health concerns, driven by a desire for natural ingredients and reduced veterinary costs. This directly impacts the market for Swedencare’s preventive and supportive care products.

The threat is particularly pronounced in segments focused on:

- Oral hygiene: Homemade dental solutions or natural chews can substitute for specialized dental care products.

- Skin and coat care: Natural oils or simple rinses are often used as alternatives to medicated shampoos or supplements.

- Digestive support: Probiotic-rich foods or simple dietary changes are sometimes favored over specialized digestive aids.

The threat of substitutes for Swedencare's products remains a dynamic factor, influenced by evolving pet owner preferences and advancements in veterinary care. While the premiumization trend in pet ownership in 2023, with the global pet care market reaching an estimated USD 261 billion, suggests a reduced willingness to compromise on quality, the availability of diverse alternatives cannot be ignored.

Prescription veterinary diets, a growing segment within the broader pet food market projected for robust growth in 2024, directly compete with supplements by offering targeted nutritional solutions for specific health conditions. Furthermore, the increasing accessibility of DIY pet care and home remedies, with over 30% of pet owners experimenting with such solutions in 2024, presents a cost-sensitive substitute, particularly for preventive and supportive care items.

Technological advancements in veterinary medicine also contribute to the substitute landscape by offering more sophisticated diagnostic and treatment options that may reduce the perceived need for supplements.

| Substitute Category | Examples for Swedencare | Key Influencing Factor | Market Trend Relevance (2023-2024) |

|---|---|---|---|

| Veterinary Procedures/Services | Professional dental cleanings, specialized vet consultations | Perceived efficacy and severity of pet's condition | Growing demand for specialized vet care |

| Prescription Diets | Therapeutic foods for joint, skin, or digestive issues | Veterinarian recommendation and diagnosed medical needs | Robust growth in the therapeutic pet food segment |

| Over-the-Counter (OTC) Generic Supplements | Basic vitamins, joint support from mass retailers | Price sensitivity and perceived basic need fulfillment | Continued presence of value-oriented consumers |

| DIY/Home Remedies | Homemade dental chews, natural skin rinses | Cost savings, natural ingredient preference, online information availability | Increasing experimentation with at-home pet care |

Entrants Threaten

The animal healthcare sector, particularly for specialized preventive products like Swedencare's, demands substantial upfront capital. Companies need to invest heavily in R&D to innovate, build state-of-the-art manufacturing facilities, and create robust marketing and distribution channels. Swedencare's focus on developing and producing its own product lines highlights this capital intensity, making it a significant barrier to entry for new players.

The pet health and supplement industry is subject to increasingly complex and evolving regulations. These rules govern everything from product ingredients and manufacturing processes to marketing claims and labeling, creating a significant compliance burden.

For new companies, understanding and adhering to these diverse regulatory frameworks, especially when aiming for international markets like Swedencare's presence in approximately 70 countries, represents a substantial barrier to entry. This complexity requires significant investment in legal and compliance expertise.

Swedencare AB benefits from strong, established brands such as ProDen PlaqueOff, NaturVet, and Innovet. This brand loyalty significantly raises the barrier to entry for new competitors. For instance, in 2023, Swedencare reported a net sales increase of 14% to SEK 1,147 million, demonstrating the continued strength of its brand portfolio.

Developing comparable brand recognition and fostering trust within the veterinary and pet owner communities demands considerable marketing investment and a significant time commitment. This makes it exceptionally difficult for new entrants to effectively challenge Swedencare's market position and capture market share, especially given the established customer relationships and perceived product efficacy.

Access to Distribution Channels

Swedencare benefits from an extensive global distribution network. This includes subsidiaries in nine countries and a broad international reach through retailers, veterinarians, pet stores, and online platforms.

For new entrants, securing similar access to these diverse and established distribution channels presents a substantial hurdle. The established relationships and infrastructure Swedencare has cultivated are difficult and costly to replicate.

- Established Network: Swedencare's global presence across nine countries provides immediate market access.

- Channel Diversity: The company leverages multiple channels including retail, veterinary, and online, creating a comprehensive market penetration.

- Barrier to Entry: New competitors face significant challenges in building comparable distribution relationships and infrastructure.

Proprietary Technology and Expertise

Swedencare's significant barrier to entry stems from its proprietary technology and deep expertise in developing unique oral hygiene solutions. Products like ProDen PlaqueOff, which utilize patented formulations, require new competitors to invest heavily in research and development to create comparable or better offerings.

The company's continuous innovation pipeline and in-house manufacturing capabilities further solidify this advantage.

- Patented Formulations: Swedencare holds patents on its key ingredients and product designs, making direct replication by new entrants extremely difficult and costly.

- R&D Investment: The company consistently invests in research and development, ensuring a pipeline of innovative products that maintain its competitive edge.

- Manufacturing Control: In-house manufacturing allows Swedencare to maintain strict quality control and protect its unique production processes, adding another layer of defense against new entrants.

The threat of new entrants for Swedencare is relatively low due to significant barriers. High capital requirements for R&D and manufacturing, coupled with complex regulatory compliance across approximately 70 countries, deter new players. Furthermore, Swedencare's established brand loyalty, as evidenced by its 14% net sales increase to SEK 1,147 million in 2023, and its extensive global distribution network present formidable challenges for any newcomer seeking to gain market traction.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for R&D, manufacturing, and marketing. | High barrier, requiring substantial financial resources. |

| Regulatory Compliance | Complex rules for ingredients, manufacturing, and marketing across multiple markets. | Demands significant legal and compliance expertise and investment. |

| Brand Loyalty | Strong recognition for brands like ProDen PlaqueOff. | Makes it difficult to capture market share from established customer relationships. |

| Distribution Network | Extensive global reach through various channels. | Challenging and costly for new entrants to replicate access and relationships. |

| Proprietary Technology | Patented formulations and in-house manufacturing expertise. | Requires costly R&D for new entrants to develop comparable products. |

Porter's Five Forces Analysis Data Sources

Our Swedencare Porter's Five Forces analysis is built upon a foundation of robust data, including Swedencare's annual reports, investor presentations, and industry-specific market research from reputable firms. We also incorporate data from relevant regulatory bodies and broader economic indicators to provide a comprehensive understanding of the competitive landscape.