Swedencare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swedencare Bundle

Curious about Swedencare's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up in terms of market share and growth potential, highlighting their potential Stars and Cash Cows.

To truly unlock strategic advantages and make informed decisions about resource allocation and future investments, you need the full picture. Purchase the complete Swedencare BCG Matrix for a detailed quadrant breakdown, actionable insights, and a clear roadmap to optimizing their product strategy for sustained success.

Stars

ProDen PlaqueOff® stands out as Swedencare's star performer, consistently showing robust global expansion. Its dental product line, encompassing powders, dental bones, and soft chews, has cemented its position as a market leader in pet oral health.

The brand's impressive trajectory is underscored by a remarkable 54% surge in dental sales during Q4 2024, highlighting its rapid ascent. This growth is further validated by its VOHC Seal approval, a testament to its efficacy in combating plaque and tartar, and signaling significant future potential.

NaturVet® is a cornerstone of Swedencare's nutraceuticals segment, representing the largest product category and contributing significantly to the group's financial performance. In 2023, nutraceuticals generated 49% of Swedencare's net revenue, underscoring NaturVet's crucial role.

NaturVet has demonstrated robust growth, highlighted by the successful introduction of Scoopables in 2023. The brand's strategic move to manage its Amazon sales directly starting in 2024 and continuing through 2025 signals a strong focus on capturing a larger share of the growing online market, suggesting high growth potential.

Innovet, based in Italy, is a significant contributor to Swedencare's portfolio, boasting science-based and patented veterinary products. Its strong standing in the Italian market, alongside its international reach, solidifies its role in Swedencare's expansion strategy.

The Italian market experienced a rebound in Q2 2025, with growth returning to single digits. This recovery, coupled with Innovet's established presence and innovative product pipeline, reinforces its position as a star within Swedencare's strategic framework.

Recently Acquired High-Growth Brands (e.g., Summit Veterinary Pharmaceuticals)

Swedencare's acquisition of Summit Veterinary Pharmaceuticals Limited in March 2025 positions Summit as a Star within Swedencare's portfolio. This strategic move significantly expands Swedencare's footprint in the burgeoning Animal Health Specials sector, particularly in the UK and Hong Kong markets.

Summit Veterinary Pharmaceuticals is recognized for its high profitability and possesses clear avenues for enhanced growth and profitability under Swedencare's stewardship. This makes it a prime candidate for continued investment and development.

- Market Expansion: Summit's acquisition strengthens Swedencare's position in the UK and Hong Kong, key growth regions for animal health.

- Profitability and Growth: Summit is a highly profitable entity with identified opportunities for further expansion and increased earnings.

- Strategic Fit: The acquisition aligns with Swedencare's strategy to bolster its presence in high-growth specialty animal health segments.

New Product Launches & Innovations in Soft Chews

Swedencare is actively expanding its soft chew offerings, a strategic move to capture growing market segments. Brands like Nutraquin, Nutracalm, and Nutracoat are seeing new formulations designed for ease of use and targeted health benefits.

These innovative soft chews are demonstrating strong market acceptance, contributing to Swedencare's projected double-digit organic growth for 2025. This product development strategy positions the company favorably within emerging pet health and wellness categories.

- Product Innovation Focus: Swedencare's emphasis on soft chew formats across its portfolio, including Nutraquin, Nutracalm, and Nutracoat.

- Market Traction: New launches are gaining significant market traction, indicating strong consumer demand.

- Growth Contribution: These products are expected to drive double-digit organic growth for Swedencare in 2025.

- Strategic Positioning: The soft chew segment represents an emerging area where Swedencare is strengthening its competitive edge.

ProDen PlaqueOff®, NaturVet®, Innovet, and Summit Veterinary Pharmaceuticals are key stars in Swedencare's portfolio, exhibiting strong growth and market leadership. These brands, across dental health, nutraceuticals, and specialized veterinary products, are driving significant revenue and expansion. Their consistent performance and strategic importance solidify their star status within Swedencare's growth strategy.

| Brand | Category | Key Performance Indicators | 2024/2025 Outlook |

|---|---|---|---|

| ProDen PlaqueOff® | Pet Oral Health | 54% surge in dental sales (Q4 2024), VOHC Seal approval | Continued global expansion, market leadership |

| NaturVet® | Nutraceuticals | 49% of Swedencare's net revenue (2023), successful Scoopables launch (2023) | Direct Amazon sales management, capturing online market share |

| Innovet | Veterinary Products | Strong Italian market presence, international reach | Single-digit growth rebound in Italy (Q2 2025), innovative pipeline |

| Summit Veterinary Pharmaceuticals | Animal Health Specials | Acquired March 2025, high profitability | Expansion in UK/Hong Kong, enhanced growth and profitability |

What is included in the product

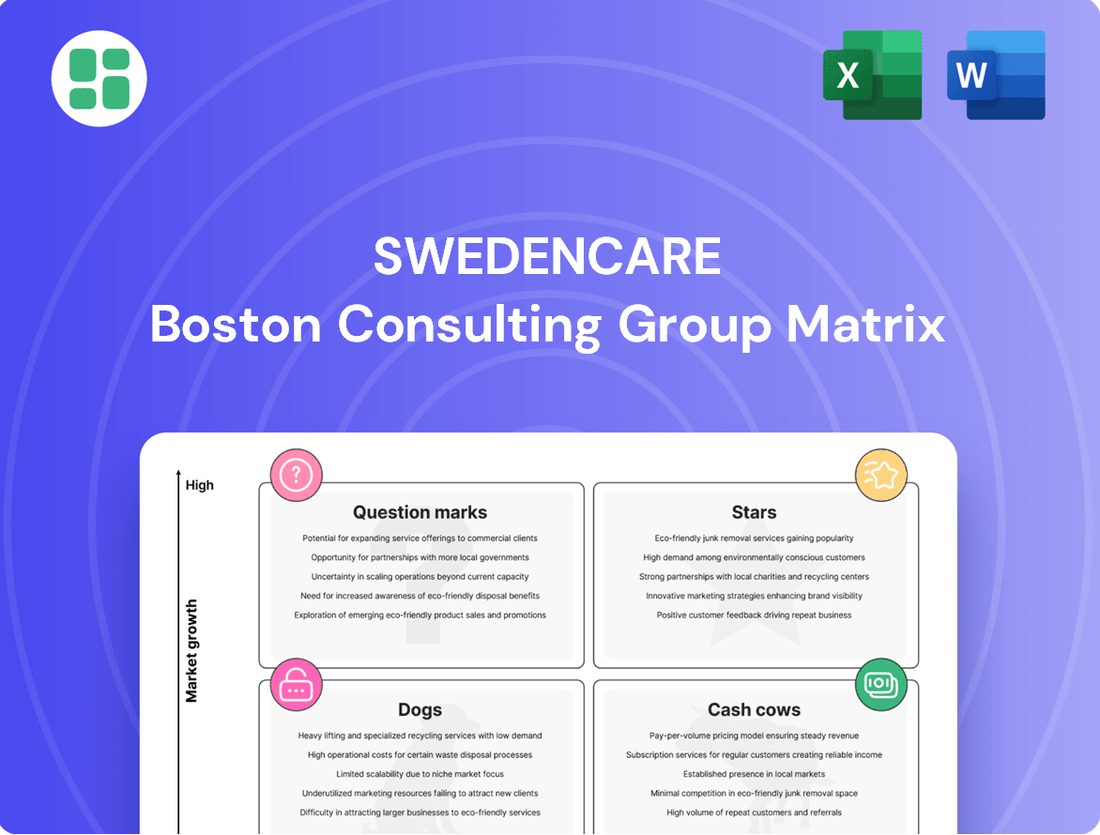

The Swedencare BCG Matrix categorizes products by market growth and share, guiding strategic decisions.

It helps identify which products to invest in, hold, or divest for optimal portfolio performance.

Generate clear, actionable insights from Swedencare's BCG matrix for strategic resource allocation.

Cash Cows

Swedencare's established nutraceuticals portfolio, a significant driver of its business, accounts for nearly half of its total revenue. This category encompasses a diverse array of well-recognized supplement brands, including Nutravet and FAV, in addition to the NaturVet line. These products are recognized for their strong market presence and consistent profitability.

While the overall nutraceuticals category saw a modest 1% growth in Q4 2024 compared to the prior year, these established products continue to hold substantial market share. Their maturity in the market translates to predictable revenue streams and robust cash flow generation, solidifying their position as Cash Cows within Swedencare's portfolio.

The ProDen PlaqueOff Powder has been a foundational success for Swedencare, consistently driving a substantial portion of the company's revenue. This established product benefits from strong brand loyalty and a stable demand within the pet dental care sector, a market that is already well-developed.

Its status as a cash cow is reinforced by its ability to generate consistent profits with minimal need for aggressive marketing spend. For instance, in 2024, Swedencare reported continued robust sales for their core dental products, with ProDen PlaqueOff Powder remaining a significant contributor to their overall financial performance, underscoring its reliable cash-generating capacity.

Pet MD® Online Sales represents a significant Cash Cow for Swedencare. This segment leverages a robust online distribution, particularly through Amazon, which has proven to be a consistent revenue generator. The focus on self-managed sales channels within this digital space ensures strong cash flow in a mature market.

The online sales of Pet MD®, encompassing supplements, vitamins, and external solutions, benefit from a high-volume, lower-growth digital environment. This maturity means less need for aggressive promotional spending, allowing the business to harvest profits efficiently. For instance, in 2024, Swedencare reported that its online segment continued to be a primary contributor to overall revenue, demonstrating the stability of this Cash Cow.

Rx Vitamins® for Pets

Rx Vitamins® for Pets is Swedencare's established cash cow, offering specialized nutraceuticals for the veterinary market. These products, designed to work alongside conventional treatments, have built a strong reputation among veterinarians. This loyalty, combined with the recurring nature of pet healthcare, suggests a consistent and profitable revenue stream.

The brand benefits from high margins due to its professional positioning and the trust veterinarians place in established, effective formulations. In 2024, Swedencare reported strong performance in its companion animal segment, where Rx Vitamins® for Pets is a significant contributor. This segment saw continued growth, driven by increased pet ownership and a greater willingness among owners to invest in their pets' health and well-being.

- Market Position: Rx Vitamins® for Pets holds a stable, leading position within the veterinary nutraceutical market.

- Financial Performance: The brand consistently generates high profit margins, contributing significantly to Swedencare's overall profitability in 2024.

- Customer Loyalty: Veterinarian trust and repeat prescriptions from pet owners ensure a predictable and robust demand.

- Growth Potential: While mature, the brand benefits from overall market growth in pet healthcare and the introduction of complementary products.

Strategic Distribution Network

Swedencare's strategic distribution network is a significant asset, extending its reach to around 70 countries. This vast network, bolstered by nine subsidiaries and a broad international retail presence, facilitates efficient product delivery and substantial cost savings.

The maturity and optimization of this distribution system directly contribute to Swedencare's strong profit margins and reliable cash flow from its established product lines. In 2023, Swedencare reported net sales of SEK 1,400 million, demonstrating the commercial success enabled by this extensive reach.

- Global Reach: Operations in approximately 70 countries with 9 subsidiaries.

- Efficiency Gains: Streamlined network leads to significant cost-efficiency.

- Profitability Driver: Contributes to high profit margins and consistent cash flow.

- Market Penetration: Supports established product lines effectively.

Swedencare's established nutraceuticals, including brands like Nutravet and FAV, represent its core Cash Cows. These mature products, which contributed nearly half of Swedencare's total revenue, benefit from strong market presence and predictable profitability.

The ProDen PlaqueOff Powder and Pet MD® Online Sales are prime examples of these Cash Cows, generating consistent profits with minimal marketing investment. In 2024, these segments continued to be significant revenue drivers, showcasing their reliable cash-generating capacity.

Rx Vitamins® for Pets also stands as a key Cash Cow, commanding high margins within the veterinary market due to veterinarian trust and recurring demand. This segment's strong performance in 2024 highlights its role in Swedencare's overall financial health.

These Cash Cows are supported by Swedencare's efficient global distribution network, reaching approximately 70 countries. This optimized infrastructure, with nine subsidiaries, ensures cost-efficiency and sustains the high profit margins of these established product lines, as demonstrated by their SEK 1,400 million in net sales in 2023.

| Product/Segment | BCG Category | Key Characteristics | 2024 Contribution Insight | Strategic Value |

|---|---|---|---|---|

| Nutravet & FAV | Cash Cow | Established brands, strong market presence, consistent profitability | Significant revenue drivers, stable demand | Foundation of revenue and cash flow |

| ProDen PlaqueOff Powder | Cash Cow | Market leader in pet dental care, high brand loyalty | Continued robust sales, substantial revenue contributor | Reliable profit generation, minimal marketing needs |

| Pet MD® Online Sales | Cash Cow | High-volume digital sales, particularly via Amazon | Primary revenue contributor, stable cash flow | Efficient profit harvesting in a mature market |

| Rx Vitamins® for Pets | Cash Cow | Specialized veterinary nutraceuticals, high veterinarian trust | Strong performance in companion animal segment | High margins, recurring revenue, professional positioning |

What You See Is What You Get

Swedencare BCG Matrix

The Swedencare BCG Matrix you are currently previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered to you without any watermarks or demo content, ready for immediate professional application.

Dogs

Swedencare's private label operations are currently positioned as a Dog in its BCG Matrix. This segment faced significant headwinds in Q4 2024, with sales declining due to a combination of lower order volumes and price adjustments that occurred at the transition from 2023 to 2024.

This underperformance indicates a business area with limited growth prospects and potentially a weak competitive position. Such segments often require substantial investment to maintain, yet yield minimal returns, draining resources that could be better allocated to more promising ventures.

While Swedencare as a whole demonstrates a positive growth trajectory, certain regional markets exhibit sluggish expansion. For example, the UK veterinary sector, a key market for Swedencare, has experienced weak growth. Despite this, there are positive signals for a potential turnaround in 2025, driven by improved market dynamics and the introduction of new products.

Regions consistently displaying low or negative growth, coupled with challenges in increasing market share, are prime candidates for classification as 'Dogs' within the BCG matrix. These segments necessitate a thorough assessment to determine the viability of continued investment, as they may not offer sufficient returns to justify resource allocation.

Within Swedencare's acquired brands, some older products might be in sub-segments with declining demand. These could represent low-market-share items that are no longer strategically important or profitable. For instance, a specific line of older pet supplements, acquired from a smaller company, might have seen its market shrink as newer, more specialized products emerged.

Products Heavily Reliant on Outdated Distribution Channels

Products within Swedencare that still depend significantly on older, less efficient distribution methods could be flagged as Dogs. Think about items primarily sold through brick-and-mortar stores that haven't embraced e-commerce or direct-to-consumer models effectively. This reliance can mean higher operational expenses and a narrower customer base compared to digitally savvy competitors.

For instance, if a particular pet supplement line in Swedencare is still heavily distributed through independent veterinary clinics with limited online presence, it might fall into this category. Such channels often struggle to compete with the broad reach and convenience offered by online retailers or larger pet specialty chains. This can directly impact market share and overall profitability.

- Limited Online Sales Presence: Products with less than 20% of their sales originating from e-commerce platforms.

- Declining Traditional Retail Footprint: Brands experiencing a year-over-year decrease of more than 5% in sales through traditional brick-and-mortar channels.

- High Distribution Costs: Products where distribution expenses represent over 15% of their net sales.

- Low Market Penetration in Digital Channels: A market share below 10% in online pet health product sales.

Segments Impacted by Intense Local Competition with Low Differentiation

Swedencare's product lines facing intense local competition with minimal differentiation often find themselves in a challenging position. These segments, operating in markets where rivals offer very similar products, can lead to price wars and difficulty in standing out. This scenario typically results in slower growth and reduced profitability.

When a company's offerings are not unique, customers often base purchasing decisions primarily on price. This dynamic can erode margins and make it hard to build brand loyalty. For Swedencare, this means segments where their products are easily substitutable by local competitors may require a strategic rethink.

In 2024, several European pet care markets, for instance, saw increased activity from smaller, localized brands focusing on specific niche needs or offering lower-cost alternatives. This intensified competition within these less differentiated segments can pressure Swedencare's market share, especially if they cannot highlight unique product benefits or superior quality.

- Struggling Market Share: Products in highly competitive, undifferentiated local markets may experience declining market share as consumers opt for cheaper alternatives.

- Price Sensitivity: Low differentiation leads to price-sensitive customers, forcing companies to compete on cost, which can squeeze profit margins.

- Limited Growth Potential: These segments often exhibit low overall market growth, making it difficult to expand revenue streams without gaining share from competitors.

- Strategic Re-evaluation: Swedencare may need to consider exiting or significantly revamping product offerings in these areas to avoid sustained losses and reallocate resources to more promising segments.

Swedencare's private label operations, characterized by declining sales in late 2024 due to lower order volumes and price adjustments, represent a Dog in the BCG matrix. This segment struggles with limited growth prospects and a potentially weak competitive position, demanding resources without significant returns.

Specific regional markets, such as the UK veterinary sector, exhibit sluggish expansion, contributing to the Dog classification. While Swedencare aims for overall growth, these underperforming areas, including older acquired product lines with shrinking demand, require careful evaluation for continued investment viability.

Products with a limited online sales presence (under 20% e-commerce) and declining traditional retail footprints (over 5% year-over-year decrease) are prime examples of Dogs. High distribution costs exceeding 15% of net sales further solidify this classification, indicating a need for strategic reassessment.

| Segment | BCG Classification | Key Challenges | 2024 Performance Indicator |

| Private Label Operations | Dog | Low order volumes, price adjustments, weak market position | Sales decline in Q4 2024 |

| Certain Regional Markets (e.g., UK Vet) | Dog | Sluggish expansion, intense local competition | Weak growth in key markets |

| Older Acquired Product Lines | Dog | Declining demand, low market share, lack of differentiation | Potential shrinking market for specific lines |

| Products with Inefficient Distribution | Dog | Reliance on traditional retail, high operational expenses | Limited reach compared to digital channels |

Question Marks

Riley's Organics, acquired by Swedencare in January 2024, fits into the Question Marks category of the BCG Matrix. This is due to its entry into the high-growth North American organic pet treat market, a sector experiencing significant expansion. For example, the global pet care market, which includes treats, was valued at over $260 billion in 2023 and is projected to grow substantially in the coming years.

Despite the promising market, Riley's Organics itself is a relatively small player. With an estimated net revenue of $3.2 million in 2023, its current market share within Swedencare's portfolio is low. This positions it as a Question Mark because substantial investment is required to increase its market presence and capitalize on the sector's growth potential.

Summit Veterinary Pharmaceuticals Limited, acquired by Swedencare in March 2025, is positioned as a Question Mark within Swedencare's BCG Matrix. Operating in the burgeoning Animal Health Specials market across the UK and Hong Kong, the company demonstrates strong profitability.

Despite its financial success, Summit Veterinary Pharmaceuticals holds a developing market share relative to Swedencare's overall portfolio, classifying it as a Question Mark. This segment exhibits high growth potential, necessitating strategic capital allocation for successful integration and future expansion.

Swedencare's acquisition of MedVant Inc. in July 2024 positions MedVant as a Question Mark within Swedencare's BCG Matrix. This strategic move grants Swedencare a significant foothold in the Canadian veterinary market, a region where Swedencare's current market share remains relatively low.

The acquisition allows Swedencare to leverage MedVant's established distribution network and premium supplement portfolio, including RX Vitamins, which Swedencare has already been distributing since 2020. This direct entry into Canada signifies a concentrated effort to grow within this high-potential market, necessitating investment and strategic nurturing to transform MedVant into a Star.

New Geographic Market Expansions (e.g., Asia, China, India)

Swedencare is strategically prioritizing expansion into new geographic markets, with a clear focus on Asia, particularly China and India. These regions represent significant growth opportunities where the company currently holds a low market share.

This strategic shift in mergers and acquisitions (M&A) signals a commitment to substantial investment and dedicated effort to establish a stronger presence in these high-potential markets. The company views these new ventures as crucial for future growth and market penetration.

- Asia's Growing Pet Market: The Asian pet care market is experiencing rapid expansion, with China's pet food market alone projected to reach approximately $10.5 billion by 2025, according to industry reports.

- India's Untapped Potential: India's pet food market, while smaller, is also showing robust growth, with an estimated compound annual growth rate (CAGR) of over 15% in recent years, indicating significant room for Swedencare to capture market share.

- Strategic M&A Focus: Swedencare's explicit mention of shifting its M&A strategy to target these new geographies underscores the importance of these markets in its long-term growth plan.

Emerging Technologies/Product Categories (e.g., Kynosil®)

Swedencare's strategic move into emerging product categories, exemplified by Kynosil®, highlights a forward-looking approach to market expansion. This unique silicium supplement, developed through partnerships with Vetio and APR Pharma, represents a significant investment in a potentially high-growth area.

- Kynosil®'s patented nature and scientific backing position it as an innovative offering.

- Its current market penetration and revenue contribution are still in the early stages, characteristic of a Question Mark.

- The company's investment in such novel products signals a commitment to future revenue streams.

Question Marks in Swedencare's portfolio represent new ventures or acquisitions in high-growth markets where the company currently holds a low market share. These entities require significant investment to build market presence and capitalize on future potential. For instance, the global pet care market exceeded $260 billion in 2023, highlighting the attractive growth trajectory for businesses like Riley's Organics. The strategic acquisitions of Summit Veterinary Pharmaceuticals and MedVant Inc. in 2025 and 2024 respectively, also fall into this category, targeting burgeoning animal health and Canadian veterinary markets with substantial growth prospects.

BCG Matrix Data Sources

This Swedencare BCG Matrix is built upon a robust foundation of market data, incorporating financial reports, veterinary industry analysis, and consumer trend insights.