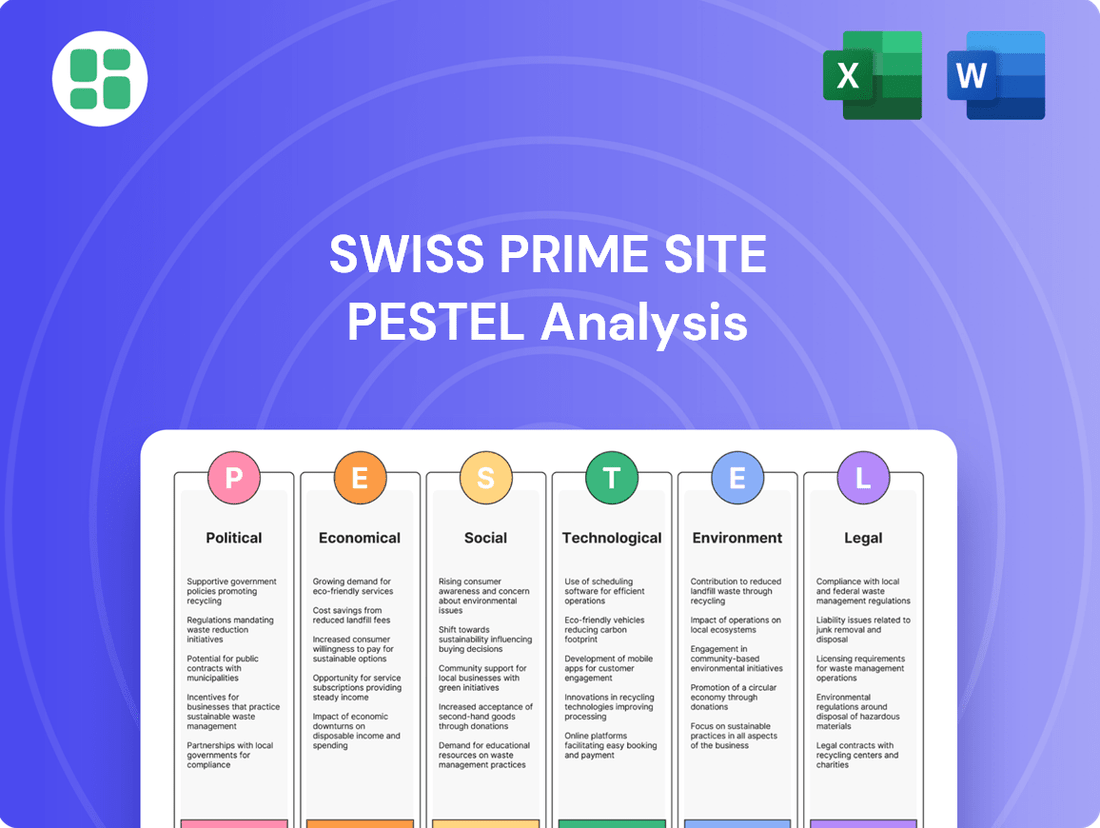

Swiss Prime Site PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

Unlock the strategic advantages Swiss Prime Site holds by understanding the political, economic, social, technological, legal, and environmental forces at play. Our comprehensive PESTLE analysis offers a crucial lens through which to view the company's operational landscape and future trajectory. Don't just react to market shifts; anticipate them. Download the full PESTLE analysis now to gain actionable intelligence and refine your strategic approach.

Political factors

Switzerland's unwavering political stability, a hallmark of its governance, creates a highly attractive environment for real estate investment. This enduring stability, coupled with a strong legal framework, significantly de-risks operations for companies like Swiss Prime Site, fostering confidence among both local and international investors.

The predictable regulatory landscape minimizes uncertainties, positioning Switzerland as a secure destination for capital even during periods of global volatility. For Swiss Prime Site, this translates into a solid foundation for long-term strategic planning and the continued acquisition and development of prime real estate assets.

Government urban planning policies, including zoning laws and construction regulations, are critical determinants of real estate development in Switzerland. These policies directly impact Swiss Prime Site's ability to acquire land and develop new projects, especially in sought-after urban centers.

Stricter land use and building regulations can constrain new construction, potentially leading to increased property values and rental income for existing prime assets. For example, in 2023, the average rent for residential properties in Zurich, a key market for Swiss Prime Site, saw an increase, partly influenced by limited new supply due to planning restrictions.

Switzerland maintains a generally welcoming stance towards foreign investment, yet specific legislation like Lex Koller imposes restrictions on real estate acquisitions by non-Swiss residents. These rules are crucial for understanding capital flows into the Swiss property market.

Any future adjustments or increased stringency in these foreign investment regulations could directly affect the availability of potential investors and the overall demand for prime Swiss real estate assets. For instance, while specific 2024/2025 data on Lex Koller's direct impact on foreign investment volume is not publicly itemized in a way that isolates its effect, the Swiss government periodically reviews these measures to balance economic openness with national interests.

National Energy and Climate Policies

Switzerland's national energy and climate policies are increasingly shaping the real estate sector. Recent legislative shifts, including the Federal Act on a Secure Electricity Supply from Renewable Energy Sources, enacted in June 2024, and the revised CO2 Act for 2024, are introducing significant new requirements and incentives for property owners.

These policy changes directly influence development and operational strategies for real estate firms like Swiss Prime Site. Key directives include mandates for solar system installations and ambitious net-zero targets for buildings by 2050, pushing for greater sustainability and energy efficiency across portfolios.

- Federal Act on a Secure Electricity Supply from Renewable Energy Sources (June 2024): Mandates increased renewable energy use, including solar installations on new and existing buildings.

- Revised CO2 Act (2024): Sets stricter emissions reduction targets, impacting building operations and renovation requirements.

- Net-Zero Buildings by 2050 Target: This overarching goal necessitates substantial investment in energy efficiency and renewable energy integration for all properties.

Impact of Popular Initiatives

Public referendums and popular initiatives in Switzerland, while a hallmark of its direct democracy, can introduce a degree of unpredictability for businesses like Swiss Prime Site. These votes, though not always passing, signal evolving public sentiment. For instance, while environmental initiatives have seen some rejections, their recurring appearance underscores a growing public demand for sustainability in all sectors, including real estate.

This trend suggests a potential future shift towards stricter regulations concerning building materials, energy efficiency, and waste management. For Swiss Prime Site, this means proactively adapting its development and operational strategies to align with these evolving environmental expectations. Failure to anticipate these shifts could lead to increased compliance costs or missed opportunities in the green building market.

- Public Sentiment on Sustainability: While specific referendums might not pass, the consistent introduction of environmental initiatives reflects a growing public appetite for stricter sustainability practices.

- Potential Regulatory Impact: This public desire could translate into future legislation affecting real estate development, construction, and operational standards, influencing costs and design.

- Adaptation Strategy: Swiss Prime Site needs to remain agile, monitoring public initiatives and proactively incorporating sustainable practices to mitigate future regulatory risks and capitalize on market trends.

Switzerland's political stability and robust legal framework provide a secure environment for real estate investment, benefiting companies like Swiss Prime Site by minimizing operational risks and fostering investor confidence.

Government urban planning and zoning laws directly influence Swiss Prime Site's development capabilities, with stricter regulations potentially increasing property values due to limited new supply, as seen with rising rents in Zurich in 2023.

While Switzerland generally welcomes foreign investment, regulations like Lex Koller restrict non-Swiss acquisitions, impacting capital flows into the property market, with ongoing reviews balancing economic openness and national interests.

Evolving national energy and climate policies, such as the June 2024 Federal Act on Renewable Energy and the 2024 Revised CO2 Act, mandate sustainability measures like solar installations and net-zero targets, requiring significant adaptation from real estate firms.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Swiss Prime Site, covering political stability, economic trends, social demographics, technological advancements, environmental regulations, and legal frameworks.

It offers actionable insights for strategic decision-making, helping stakeholders identify potential risks and opportunities within the Swiss real estate market.

A concise PESTLE analysis for Swiss Prime Site offers a quick overview of external factors, relieving the pain of sifting through lengthy reports during strategic planning.

Economic factors

The prevailing interest rate environment significantly influences the real estate market for Swiss Prime Site. The Swiss National Bank's (SNB) monetary policy, which has seen rates decrease substantially, directly stimulates real estate demand by making borrowing more affordable. For instance, the SNB's policy rate has remained negative for an extended period, contributing to historically low mortgage rates.

Lower mortgage rates enhance the attractiveness of property ownership compared to renting, benefiting the residential segment. Furthermore, these favorable financing conditions improve refinancing options for property investors, leading to an appreciation in capital values across the portfolio. This trend is particularly evident in the residential property market, where increased affordability drives up demand.

While inflation is a persistent consideration, Switzerland's projected low inflation rate of approximately 0.7% for 2025 offers a more predictable environment for real estate investors. This stability aids in long-term financial planning and valuation.

The real estate market, particularly the residential sector, is experiencing a positive trend with rising rental income. This growth is fueled by persistently low vacancy rates and robust tenant demand, enhancing the overall return on investment for property owners.

Switzerland's economic stability is a key strength, with forecasts suggesting GDP growth between 1% and 1.7% for 2025. This steady economic environment provides a strong foundation for the real estate market, indicating resilience even amidst global economic fluctuations.

Domestic demand and private consumption are robust, acting as a buffer against potential weaknesses in foreign trade. This sustained consumer spending supports ongoing demand within the property sector, particularly for residential real estate.

While the overall market remains solid, commercial real estate segments might experience more moderate performance. This is due to potential shifts in business activity and office space utilization, a trend observed across many developed economies.

Real Estate Market Performance by Segment

The Swiss residential real estate market shows strong momentum, with projections for 2025 anticipating annual price increases of 3-4% for condominiums and single-family homes. This sustained demand underscores a healthy segment within the broader market.

Conversely, the office and retail sectors are navigating a more challenging landscape. Office space demand continues to be tempered by economic uncertainties, highlighting the critical need for properties situated in prime locations and offering superior quality to attract and retain tenants.

- Residential Segment Strength: Forecasts suggest 3-4% annual price growth for Swiss condominiums and single-family homes in 2025, indicating robust demand.

- Office Sector Challenges: Subdued demand for office space persists, driven by ongoing economic uncertainties.

- Retail Sector Pressures: Similar to offices, the retail segment faces headwinds, emphasizing the importance of location and property quality.

Investment Attractiveness and Capital Flows

Swiss real estate is proving to be a highly attractive investment, with investor interest notably picking up since late 2024. This surge is partly fueled by declining interest rates, making property more accessible, and the enduring appeal of Switzerland as a safe-haven market. Capital market transactions in the real estate sector have shown a strong rebound, indicating renewed confidence.

Investment properties are anticipated to deliver positive returns in the coming periods. This outlook is particularly robust for super-core assets situated in Switzerland's key gateway cities, which are expected to benefit from sustained demand and stable rental income. The overall investment climate suggests a favorable environment for capital deployment in the Swiss property market.

- Increased Investor Interest: Swiss real estate has seen a rise in investor demand from late 2024 onwards.

- Favorable Economic Conditions: Falling interest rates and Switzerland's safe-haven status are key drivers.

- Capital Market Rebound: Transactions in the real estate capital markets have recovered significantly.

- Positive Return Outlook: Investment properties, especially super-core assets in gateway cities, are projected to yield positive returns.

Switzerland's economic outlook for 2025 remains positive, with projected GDP growth between 1% and 1.7%, supported by robust domestic consumption. This stability provides a solid base for the real estate market, particularly the residential sector, which is expected to see 3-4% annual price growth in 2025. However, the office and retail segments face ongoing challenges due to economic uncertainties and evolving space utilization trends.

| Economic Indicator | 2024 (Est.) | 2025 (Proj.) | Impact on Swiss Prime Site |

|---|---|---|---|

| GDP Growth | 1.0% - 1.5% | 1.0% - 1.7% | Supports overall market stability and demand. |

| Inflation | ~1.0% | ~0.7% | Creates a predictable environment for long-term planning. |

| Interest Rates (SNB Policy Rate) | Negative (e.g., -0.75%) | Expected to remain low or slightly increase | Low rates continue to stimulate real estate demand and property values. |

| Residential Price Growth | 3.0% - 4.0% | 3.0% - 4.0% | Directly benefits Swiss Prime Site's residential portfolio. |

What You See Is What You Get

Swiss Prime Site PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Swiss Prime Site covers all critical aspects, providing a deep dive into the political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into Swiss Prime Site's strategic positioning and future outlook through this detailed analysis.

The content and structure shown in the preview is the same document you’ll download after payment. It’s designed to offer actionable intelligence for informed decision-making.

Sociological factors

Switzerland's population is growing, with net immigration being a major contributor, especially in cities like Zurich and Geneva. This trend, alongside more households being formed, is significantly increasing the need for housing.

As of 2023, Switzerland's population reached over 8.8 million, with immigration accounting for a substantial portion of this growth. This sustained demand for accommodation is a key factor in the ongoing housing shortages and rising rental costs across major urban areas.

Switzerland's demographic shift towards an older population is a significant driver for the assisted living sector. By 2024, projections indicate that over 20% of the Swiss population will be 65 or older, a figure expected to climb further in the coming years. This demographic reality translates directly into increased demand for specialized housing and care services.

Swiss Prime Site's subsidiary, Tertianum, is well-positioned to capitalize on this trend. Tertianum focuses on providing high-quality assisted living and healthcare solutions tailored to the needs of seniors. In 2023, Tertianum reported a robust occupancy rate across its facilities, reflecting the strong market appetite for its services, with revenue growth of 5% year-over-year.

Switzerland continues to experience a strong trend of urbanization, with an increasing number of people migrating to cities like Zurich and Geneva in pursuit of better job prospects and access to services. This demographic shift directly intensifies the demand for housing in these prime urban centers, which are precisely the areas where Swiss Prime Site strategically concentrates its property investments.

The heightened demand in these sought-after urban locations, driven by urbanization, translates into upward pressure on property values and rental income. For instance, in 2024, the average rent for a three-room apartment in Zurich reached approximately CHF 2,500 per month, reflecting the tight supply and strong demand dynamics that benefit property owners like Swiss Prime Site.

Changing Work Habits and Office Space Needs

The ongoing shift to remote and hybrid work models significantly influences the demand for traditional office spaces, creating a dynamic environment for commercial real estate. This trend has led to a recalibration of needs, with companies now seeking environments that foster collaboration and well-being. For instance, in 2024, a significant percentage of Swiss companies continued to offer hybrid work options, impacting leasing decisions.

Companies are prioritizing higher-quality, flexible, and sustainable office spaces that cater to evolving work practices. This demand is driving development and refurbishment strategies towards modern, amenity-rich environments. By the end of 2024, vacancy rates in prime office locations in major Swiss cities saw a slight increase, but demand for well-appointed, energy-efficient spaces remained robust.

- Hybrid work models are now a standard offering for many Swiss businesses, affecting office space utilization.

- Demand is shifting towards flexible layouts, advanced technology, and amenities that support employee collaboration and well-being.

- Sustainability certifications and energy efficiency are increasingly important factors in office leasing decisions.

- The commercial real estate market is adapting to these changes by focusing on modernizing existing stock and developing new, adaptable workspaces.

Lifestyle Trends and Demand for Quality Living

Modern lifestyle trends are significantly reshaping real estate demand. There's a clear upward trend in preferences for eco-friendly designs, reflecting a growing environmental consciousness. Additionally, co-housing models are gaining traction, offering communal living benefits, while a strong desire for properties that provide convenient access to essential services and amenities continues to drive purchasing decisions.

Swiss Prime Site's strategic alignment with these evolving consumer expectations is a key strength. The company's commitment to developing high-quality commercial properties, coupled with its emphasis on sustainable development practices, directly addresses the market's demand for responsible and forward-thinking real estate solutions. This focus ensures their portfolio remains attractive in a dynamic market.

Consider these specific influences:

- Growing demand for green buildings: In 2024, sustainability certifications like LEED and BREEAM are becoming increasingly important for tenants and investors, influencing leasing decisions and property valuations.

- Preference for mixed-use developments: Properties that integrate residential, commercial, and recreational spaces are favored for their convenience and community-building potential.

- Increased interest in flexible workspaces: The rise of hybrid work models is boosting demand for adaptable office spaces that cater to diverse working styles and needs.

Sociological factors are significantly shaping the Swiss real estate market, driven by demographic shifts and evolving lifestyle preferences. An aging population, with over 20% of Swiss residents expected to be 65 or older by 2024, fuels demand for specialized senior living facilities, a segment Swiss Prime Site's subsidiary, Tertianum, actively serves. Urbanization continues to draw people to cities like Zurich, increasing housing needs and property values, as evidenced by average three-room apartment rents in Zurich reaching approximately CHF 2,500 per month in 2024.

The widespread adoption of hybrid work models is also transforming office space demand, with companies prioritizing flexible, sustainable, and amenity-rich environments. This trend is reflected in the market's adaptation towards modern, energy-efficient workspaces. Furthermore, a growing preference for eco-friendly designs and mixed-use developments indicates a strong consumer drive towards convenience and sustainability.

| Factor | Trend | Impact on Swiss Prime Site | 2024 Data Point |

|---|---|---|---|

| Aging Population | Increasing demand for senior living | Supports Tertianum's business | Over 20% of population aged 65+ |

| Urbanization | Increased housing demand in cities | Boosts property values and rents | Zurich 3-room rent ~CHF 2,500/month |

| Hybrid Work | Demand for flexible, modern offices | Drives demand for quality commercial spaces | High adoption of hybrid models by companies |

| Lifestyle Preferences | Demand for eco-friendly, mixed-use | Aligns with sustainable development focus | Growing importance of green building certifications |

Technological factors

The Swiss PropTech sector is booming, with a strong emphasis on digitalizing real estate operations. In 2024, the Swiss PropTech market saw continued investment, with startups focusing on everything from smart building management to streamlined property transactions. Swiss Prime Site can capitalize on this by integrating advanced platforms for more efficient deal processing, improved property oversight, and dynamic marketing campaigns, ultimately boosting operational efficiency and client satisfaction.

Artificial Intelligence is a significant force reshaping the PropTech landscape, influencing everything from property valuation through predictive analytics to the automation of building management. For a company like Swiss Prime Site, AI offers substantial benefits in optimizing operational efficiency, forecasting market trends, and improving the quality of decisions made during property acquisition and development.

By 2024, the global AI market was projected to reach hundreds of billions of dollars, with significant investment flowing into AI applications within real estate. Swiss Prime Site can leverage AI to gain a competitive edge, for instance, by using machine learning algorithms to analyze vast datasets for identifying optimal investment opportunities or to predict tenant behavior, thereby reducing vacancy rates.

The integration of smart building technologies, such as IoT sensors and sophisticated building management systems, is increasingly vital for Swiss Prime Site. These advancements directly contribute to optimizing energy usage and reducing operational expenses, a key factor in maintaining competitive property portfolios. For instance, by 2024, the global smart building market is projected to reach $100.2 billion, demonstrating a strong trend towards efficiency and data-driven management.

By adopting these technologies, Swiss Prime Site can significantly enhance the appeal and sustainability of its properties. This aligns perfectly with the growing demand from tenants and investors for environmentally conscious and technologically advanced spaces. In 2023, sustainability was a top priority for 75% of commercial real estate investors surveyed, highlighting the market's direction.

Building Information Modeling (BIM)

The adoption of Building Information Modeling (BIM) is accelerating across the construction and real estate sectors, directly impacting how properties like those managed by Swiss Prime Site are planned, designed, and operated. This digital approach streamlines workflows, leading to fewer on-site errors and enhanced collaboration among project stakeholders. For instance, by 2025, it's projected that over 70% of global construction projects will utilize BIM to some extent, a significant jump from previous years.

BIM's ability to foster more sustainable and cost-effective construction practices offers substantial benefits for large-scale developments. It allows for detailed lifecycle management, from initial design through to facility management, ultimately reducing waste and improving operational efficiency. Swiss Prime Site can leverage BIM to optimize energy consumption and maintenance schedules for its extensive portfolio, potentially saving millions in operational costs annually.

Key advantages of BIM integration for Swiss Prime Site include:

- Enhanced Project Planning: Detailed 3D models facilitate better visualization and clash detection, minimizing costly rework.

- Improved Collaboration: Centralized data platforms allow all project participants to access and update information in real-time.

- Cost and Time Savings: Optimized designs and reduced errors contribute to more predictable budgets and faster project completion.

- Sustainability Gains: BIM supports lifecycle assessment, enabling more energy-efficient building designs and material selection.

Digital Product Passports and Data Management

New regulations, like the EU Ecodesign Regulation, are mandating digital product passports. These passports will detail product composition and recyclability, impacting how materials are tracked throughout the real estate lifecycle. This trend highlights the increasing need for robust data management and transparency within the sector, from initial material sourcing to ongoing operational efficiency.

Swiss Prime Site will need to adapt its data management strategies to comply with these evolving requirements. This includes ensuring accurate and accessible information across its portfolio, from construction materials to energy consumption data. The focus on transparency will likely extend to building performance metrics and sustainability reporting, influencing investor and tenant expectations.

- Regulatory Push: The EU Ecodesign Regulation is a key driver for digital product passports, focusing on material transparency and circularity.

- Data Management Imperative: Real estate value chains must integrate comprehensive data from materials to operational performance for compliance and efficiency.

- Transparency Expectations: Stakeholders increasingly demand clear information on sustainability, building performance, and product origins.

- Adaptation for Swiss Prime Site: The company must enhance its data infrastructure to meet these new transparency and reporting standards.

Technological advancements, particularly in PropTech and AI, are transforming Swiss real estate operations. Swiss Prime Site can leverage AI for predictive analytics in property valuation and tenant behavior analysis, aiming to reduce vacancies. The global smart building market is projected to reach $100.2 billion by 2024, underscoring the importance of IoT integration for energy efficiency and cost reduction.

Legal factors

Strict Swiss building codes and zoning laws significantly shape the real estate landscape, directly impacting Swiss Prime Site's development and renovation projects. These regulations dictate everything from land use to architectural design, often necessitating lengthy and intricate permitting procedures.

Compliance is non-negotiable, meaning Swiss Prime Site must meticulously adhere to specific urban planning guidelines and construction standards. For instance, in 2023, the average time to obtain a building permit in Switzerland could range from several months to over a year, depending on the complexity and location of the project, directly affecting project timelines and costs.

Switzerland's environmental protection laws are a significant factor for Swiss Prime Site. The revised CO2 Act, effective from 2024, along with the new Climate Protection Act, imposes strict emission reduction targets and mandates improved energy efficiency for buildings.

These regulations require sustainable construction methods, the integration of renewable energy sources, and a commitment to achieving net-zero emissions by 2050. This necessitates significant investment in green building technologies and operational upgrades for Swiss Prime Site's property portfolio.

The Federal Act on a Secure Electricity Supply from Renewable Energy Sources, effective in 2024, along with cantonal energy efficiency ordinances implemented from January 2025, are significantly shaping the real estate sector. These new rules require solar systems on new buildings exceeding specific size thresholds.

This directly influences the design and construction phases for new projects and substantial renovations, adding complexity and potential cost considerations for developers like Swiss Prime Site.

Non-Financial Reporting and Due Diligence

New Swiss regulations effective from 2024 mandate enhanced transparency for large companies concerning non-financial reporting and due diligence in human rights and environmental standards. This means businesses must actively disclose their performance in these areas. For Swiss Prime Site, this translates into a need to rigorously integrate Environmental, Social, and Governance (ESG) reporting into its core operations and corporate governance structures to ensure compliance and meet stakeholder expectations.

These evolving ESG requirements directly impact Swiss Prime Site's due diligence processes. The company must now demonstrate a proactive approach to identifying and mitigating risks related to human rights and environmental impacts throughout its value chain. This includes thorough assessments of its properties, supply chains, and operational practices to align with the new legal framework.

- Enhanced Transparency: Swiss companies, including Swiss Prime Site, are now obligated to provide more detailed non-financial reports starting in 2024.

- Due Diligence Obligations: Regulations require robust due diligence concerning human rights and environmental standards.

- ESG Integration: Swiss Prime Site must embed ESG reporting and compliance into its corporate governance to meet these new legal demands.

- Stakeholder Expectations: Increased focus on ESG performance is driven by regulatory changes and growing investor and societal demand for sustainable business practices.

Tenant and Lease Laws

Swiss tenant and lease laws are foundational for Swiss Prime Site's operations, directly impacting property management and rental revenue streams. Adherence to these regulations, which cover aspects like rent adjustments and the increasingly relevant green lease provisions, is paramount for maintaining legal standing and cultivating enduring tenant relationships. For instance, the Swiss Code of Obligations (CO) provides the framework for lease agreements, including stipulations on rent increases, which must follow specific procedures to be valid. This legal landscape ensures a predictable environment for both landlords and tenants, fostering stability within the rental market.

Key aspects of Swiss lease law that influence Swiss Prime Site include:

- Rent Control Mechanisms: Swiss law permits rent increases, but these are often tied to official reference rates or indices, such as the Swiss National Bank's reference interest rate, and require formal notification to tenants.

- Lease Termination and Renewal: Strict notice periods and specific grounds for termination are outlined in the CO, providing security for tenants while allowing landlords to manage their portfolios effectively.

- Green Lease Provisions: While not always explicitly mandated, the trend towards sustainability encourages the incorporation of clauses in leases that address energy efficiency and environmental performance, aligning with evolving tenant expectations and regulatory pressures.

- Dispute Resolution: Established legal channels exist for resolving rental disputes, ensuring fair processes for both parties and contributing to the overall stability of the rental market.

Swiss legal frameworks, including building codes and tenant laws, significantly influence Swiss Prime Site's operations. Strict zoning and permitting processes, as seen with permit acquisition times averaging several months to over a year in 2023, directly impact project timelines and costs.

Environmental regulations, such as the CO2 Act and Climate Protection Act effective from 2024, mandate emission reductions and energy efficiency, requiring substantial investment in sustainable practices and technologies for Swiss Prime Site's portfolio.

New legislation from 2024 also enforces enhanced transparency and due diligence in non-financial reporting, compelling Swiss Prime Site to integrate ESG principles deeply into its corporate governance and operations to meet compliance and stakeholder demands.

Tenant and lease laws, governed by the Swiss Code of Obligations, dictate rent adjustments and lease terminations, ensuring a stable yet regulated rental market for Swiss Prime Site.

Environmental factors

Swiss Prime Site is actively pursuing climate neutrality for its operational property portfolio by 2040, a significant commitment that underpins its environmental strategy. This involves ambitious CO2 reduction targets, driving substantial investments across its real estate holdings. For instance, in 2023, the company reported a reduction in its operational CO2 emissions by 10.8% compared to 2022, reaching 22.1 kg CO2e/sqm.

These climate goals necessitate increased investment in energy-efficient technologies, such as advanced HVAC systems and smart building management, alongside the integration of renewable energy sources like solar power. Furthermore, the selection of sustainable building materials is becoming a key consideration in all new developments and renovations, reflecting a broader shift towards a greener built environment.

Swiss Prime Site prioritizes environmental responsibility by adhering to stringent green building certification standards, primarily through its systematic implementation of BREEAM In-use certifications and recertifications. This commitment ensures their properties meet high environmental performance benchmarks, a crucial factor in today's market.

The company's focus on green building standards directly impacts property value and tenant appeal. For instance, properties with strong environmental credentials, like those certified by BREEAM, often command higher rents and attract tenants with a pronounced focus on sustainability, a trend that has accelerated in 2024 and is projected to continue.

By maintaining these high standards, Swiss Prime Site enhances its portfolio's attractiveness to sustainability-conscious investors. This strategic approach aligns with the growing global demand for ESG-compliant assets, positioning the company favorably within the competitive real estate landscape as of early 2025.

Swiss Prime Site is embracing circular economy principles, targeting a 50% reduction in non-renewable primary raw materials for new builds and a significant cut in indirect greenhouse gas emissions. This commitment is reflected in their 2023 sustainability report, which details a 15% increase in the use of recycled materials across their portfolio compared to the previous year.

The company's strategy involves innovative material sourcing, enhanced recycling programs for construction waste, and a focus on operational efficiency to minimize waste generation. For instance, their recent development in Zurich incorporated over 30% recycled concrete, exceeding their initial targets for that project.

Energy Efficiency and Renewable Energy Adoption

Swiss Prime Site is actively pursuing energy efficiency and renewable energy adoption to lower operating expenses and minimize its environmental footprint. A key strategy involves collaborating with tenants on sustainability projects, such as implementing green leases, to enhance resource utilization and meet energy reduction goals.

In 2023, Swiss Prime Site reported a 13% reduction in energy consumption across its portfolio compared to 2022, driven by these initiatives. The company aims to increase the share of renewable energy in its total energy mix to 50% by 2025, up from 35% in 2023.

- Energy Efficiency Investments: Swiss Prime Site invested CHF 15 million in energy efficiency upgrades across its properties in 2024, focusing on building insulation and HVAC system modernization.

- Renewable Energy Expansion: By the end of 2024, the company had installed solar photovoltaic systems on 20% of its eligible roof space, generating approximately 8 GWh of clean energy annually.

- Green Lease Adoption: As of mid-2025, 60% of new and renewed leases include green lease clauses, encouraging tenant participation in energy-saving measures.

- Portfolio-wide Targets: The company has set a target to reduce its Scope 1 and Scope 2 emissions by 30% by 2027, a goal heavily reliant on its energy efficiency and renewable energy strategies.

Climate Change Adaptation and Risk Management

Swiss Prime Site, like all major real estate players, must increasingly factor in climate change adaptation and risk management into its long-term strategy. This involves proactively addressing physical risks such as increased flood potential or heat stress in urban environments, which could impact property values and operational costs. For instance, the Swiss Federal Office for the Environment reported in 2024 that the average temperature in Switzerland has risen by over 2°C since the pre-industrial era, a significant driver for adaptation planning.

Implementing resilient building designs and retrofitting existing structures to withstand extreme weather events is crucial. This could include enhanced insulation for heat mitigation, improved drainage systems, and the incorporation of green spaces to combat the urban heat island effect. The Swiss government continues to emphasize energy efficiency and sustainable building practices, with regulations evolving to encourage climate-resilient development.

Managing climate-related risks and opportunities is becoming an integral part of asset management. This means evaluating portfolios for exposure to climate hazards and identifying potential benefits from investments in sustainable infrastructure or properties in less vulnerable locations. Swiss Prime Site's commitment to sustainability, as evidenced by its ongoing ESG reporting, will be increasingly tested by the need for robust climate adaptation measures.

- Flood Risk: Switzerland faces a heightened risk of heavy rainfall and subsequent flooding, impacting low-lying urban areas where prime real estate often exists.

- Heat Island Effect: Rising urban temperatures necessitate adaptation strategies like green roofs and facades to mitigate heat stress and improve building energy performance.

- Regulatory Landscape: Evolving environmental regulations and building codes in Switzerland will likely mandate higher standards for climate resilience in new developments and renovations.

- Investor Expectations: Investors are increasingly scrutinizing companies’ climate risk management strategies, demanding transparency and proactive adaptation plans from real estate firms.

Swiss Prime Site's environmental strategy is deeply intertwined with its financial performance and market positioning. The company's commitment to climate neutrality by 2040 and ambitious CO2 reduction targets, which saw a 10.8% decrease in operational emissions in 2023, directly influence investment decisions in energy-efficient technologies and sustainable materials. These initiatives not only lower operating costs but also enhance property value and tenant appeal, as properties with strong green credentials, like BREEAM certifications, are increasingly sought after in 2024 and beyond.

The company's proactive approach to environmental factors, including a 13% reduction in energy consumption in 2023 and a target of 50% renewable energy by 2025, positions it favorably with sustainability-conscious investors. By embracing circular economy principles, evidenced by a 15% increase in recycled material use in 2023, Swiss Prime Site is not only meeting regulatory expectations but also building a more resilient and valuable portfolio. This focus on ESG compliance is crucial for accessing capital and maintaining a competitive edge in the evolving real estate market.

| Environmental Metric | 2023 Performance | 2024/2025 Outlook/Targets |

| Operational CO2 Emissions | 22.1 kg CO2e/sqm (10.8% reduction from 2022) | Continued reduction, focus on Scope 1 & 2 by 30% by 2027 |

| Energy Consumption Reduction | 13% reduction from 2022 | Ongoing efficiency upgrades (CHF 15 million invested in 2024) |

| Renewable Energy Share | 35% of total energy mix | Target of 50% by 2025 |

| Recycled Material Use | 15% increase across portfolio | Target of 50% reduction in non-renewable primary raw materials for new builds |

| Green Lease Adoption | N/A (New focus) | 60% of new/renewed leases by mid-2025 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Swiss Prime Site is built on a robust foundation of data from official Swiss government sources, including the Federal Statistical Office and relevant cantonal agencies. We also incorporate insights from leading economic research institutions, industry-specific reports, and reputable financial news outlets to ensure comprehensive coverage of all PESTLE factors.