Swiss Prime Site Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

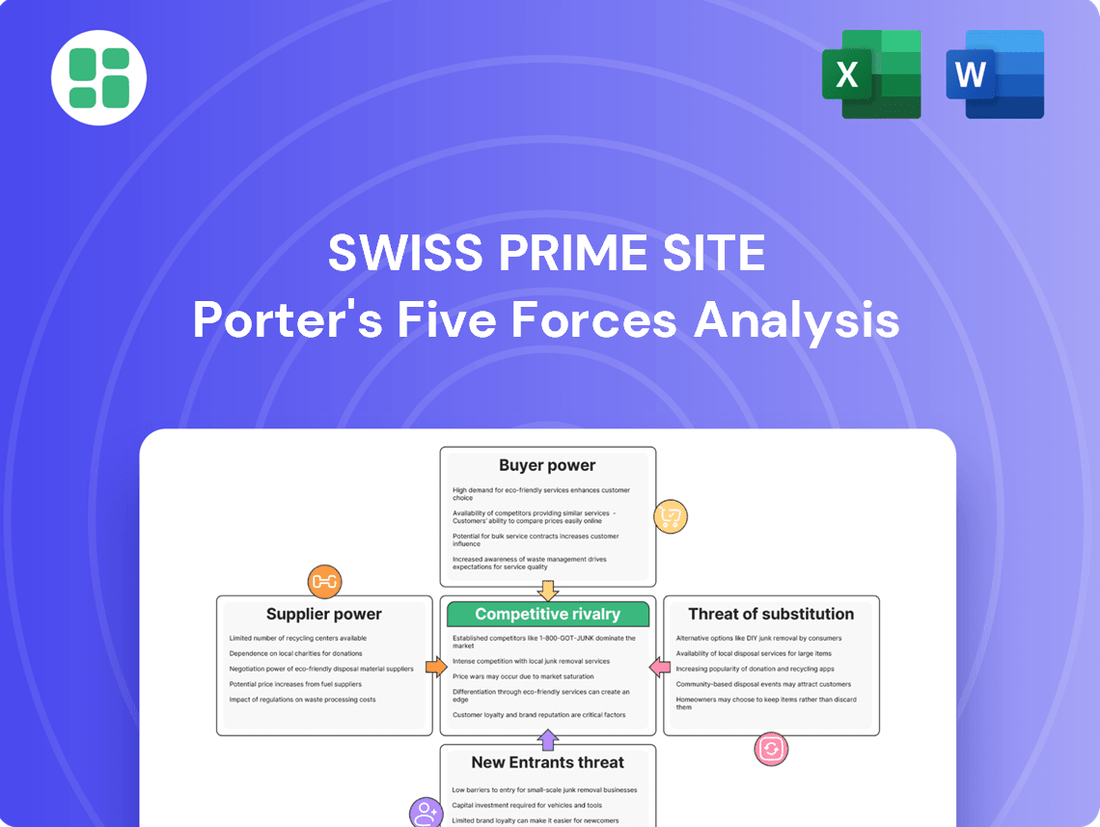

Swiss Prime Site navigates a competitive real estate landscape where buyer power and the threat of new entrants significantly influence market dynamics. Understanding these forces is crucial for strategic planning and investment decisions.

The complete report reveals the real forces shaping Swiss Prime Site’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of crucial construction materials such as steel, cement, and unique building components can wield moderate bargaining power, particularly for substantial development projects. Swiss Prime Site's commitment to premium, sustainable construction often necessitates specialized materials, which can narrow the pool of available suppliers.

While this specialization might enhance supplier leverage, the broader Swiss market for conventional construction materials generally remains competitive, thereby tempering the overall bargaining power of these suppliers.

The availability of highly skilled labor and specialized contractors for complex commercial and sustainable building projects significantly impacts supplier power for Swiss Prime Site. A scarcity of such expertise within the Swiss market, particularly for advanced construction techniques and green building certifications, can drive up labor costs and lead to less favorable contract terms for Swiss Prime Site.

With demand for new construction projected to rise in 2025, the labor market for specialized contractors is expected to tighten further. This increased demand, coupled with a potentially limited supply of qualified professionals, could empower suppliers by giving them greater leverage in negotiations over wages and project timelines.

Land is absolutely essential for Swiss Prime Site, especially since they concentrate on prime spots across Switzerland. The limited availability of attractive land in key business hubs and popular residential zones grants landowners considerable sway.

This scarcity translates directly into elevated acquisition expenses for Swiss Prime Site, potentially squeezing their profit margins on new developments. For instance, in 2023, Swiss Prime Site reported that its property portfolio was valued at CHF 13.9 billion, with a significant portion tied to these prime urban locations.

Financial Service Providers

Financial service providers, particularly banks, hold significant bargaining power over Swiss Prime Site. Access to crucial financing for real estate development and operations means that lenders can dictate terms. While interest rates in 2024 have been relatively low, a trend anticipated to continue into 2025, the landscape of lending is shifting.

The consolidation within the Swiss capital market, notably the merger of UBS and Credit Suisse, has reduced the number of major financial institutions. This concentration of power among fewer key lenders can amplify their influence, potentially allowing them to negotiate more favorable terms with companies like Swiss Prime Site. For instance, a reduced competitive environment among lenders might lead to stricter loan covenants or less favorable interest rate spreads than might be seen in a more fragmented market.

- Reduced Lender Competition: The UBS-Credit Suisse merger has consolidated the Swiss banking sector, potentially increasing the bargaining power of remaining major lenders.

- Financing Dependency: As a real estate company, Swiss Prime Site relies heavily on access to capital for its projects, making it susceptible to the terms set by financial institutions.

- Interest Rate Environment: While interest rates have been favorable in 2024 and are expected to remain so in 2025, the structural changes in the banking sector could offset some of this advantage for borrowers.

Technology and Software Providers for Property Management

Suppliers of advanced property management software, smart building technologies, and data analytics tools are crucial for Swiss Prime Site's operational efficiency and sustainability goals. The increasing reliance on these specialized digital solutions means that providers of proprietary or complex integration technologies can hold significant bargaining power. For instance, the global proptech market was valued at approximately $26.7 billion in 2023 and is projected to grow substantially, indicating a dynamic supplier landscape.

Swiss Prime Site's strategic focus on digitalization and innovation inherently creates a dependency on these technology providers. If specific software or hardware is essential for maintaining competitive advantages or meeting regulatory requirements, suppliers of these unique offerings may leverage that position. The need for seamless integration and ongoing support for these advanced systems further solidifies the potential leverage of key technology partners.

- Proprietary Technology: Suppliers offering unique or patented software and hardware solutions can command higher prices or dictate terms due to limited alternatives.

- Integration Complexity: Providers whose technologies require specialized knowledge or significant integration efforts may wield more influence, as switching costs can be high.

- Industry Consolidation: In segments of the proptech market where a few dominant players exist, their bargaining power is amplified.

- Data Analytics Dependence: Suppliers of advanced data analytics platforms, critical for optimizing building performance and tenant experience, can exert power if their insights are indispensable.

Suppliers of specialized construction materials and skilled labor can exert moderate to significant bargaining power, especially for premium and sustainable projects. Landowners in prime Swiss locations also hold considerable leverage due to scarcity, impacting acquisition costs for Swiss Prime Site. Furthermore, a consolidated banking sector, following the UBS-Credit Suisse merger, may increase the influence of financial institutions on financing terms.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power |

|---|---|---|

| Specialized Construction Materials | Moderate to High | Premium quality, sustainability requirements, limited supplier pool for unique components. |

| Skilled Labor & Contractors | Moderate to High | Scarcity of expertise for advanced/green building, increasing demand in 2025. |

| Land in Prime Locations | High | Limited availability in key business hubs and popular residential zones, driving up acquisition costs. |

| Financial Service Providers (Banks) | Moderate to High | Consolidated banking sector (UBS-Credit Suisse merger), dependency on financing, although interest rates remain favorable in 2024-2025. |

| Proptech & Data Analytics Suppliers | Moderate to High | Proprietary technology, integration complexity, reliance on advanced digital solutions for efficiency and innovation. |

What is included in the product

This analysis delves into the competitive forces impacting Swiss Prime Site, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector.

Instantly identify and mitigate competitive threats with a clear, actionable overview of Swiss Prime Site's market landscape.

Customers Bargaining Power

Swiss Prime Site’s customer base is quite varied, encompassing commercial tenants needing office and retail spaces, institutional investors utilizing their asset management expertise, and individuals residing in their senior living facilities. This broad spectrum of clients inherently dilutes the concentrated power any single customer group might wield.

For instance, in 2023, Swiss Prime Site reported a rental income of CHF 1.17 billion, with its real estate portfolio valued at CHF 13.8 billion. While commercial tenants represent a significant portion of this income, the sheer number and diversity of these tenants, spread across various sectors and locations, limit their collective ability to dictate terms.

The bargaining power also differs across segments. Institutional investors, due to the scale of their investments and their own sophisticated financial analysis, may possess more leverage when engaging with asset management services. Conversely, individual residents in assisted living facilities typically have less bargaining power, as their needs are more specialized and often less price-sensitive.

For commercial tenants, especially large corporations looking for premium office or retail spaces, their bargaining power can range from moderate to high. This is particularly true in markets experiencing rising vacancy rates or the introduction of new properties. In 2024, certain Swiss cities might see increased tenant leverage due to new developments, but Swiss Prime Site's strategy of concentrating on top-tier locations in Switzerland, which remain highly desirable, effectively counters this tenant influence.

Institutional investors, like pension funds and major asset managers, wield considerable influence in the asset management sector. Their substantial capital deployment and the availability of diverse investment options mean they can negotiate favorable terms. For Swiss Prime Site's Asset Management, this translates to a need for competitive returns, clear reporting, and customized investment solutions to secure and maintain these crucial relationships.

Assisted Living Residents (Tertianum)

The bargaining power of customers within Tertianum's assisted living sector is moderately high. Residents and their families are keenly aware of the quality of care, the range of services offered, and the associated costs. This awareness, coupled with the presence of alternative care providers, grants them a degree of leverage.

While factors like specialized care needs and preferred locations can anchor some customers, the broader availability of other assisted living facilities means that price and service quality are significant competitive drivers. For instance, in 2024, the Swiss healthcare market continues to see a steady demand for senior living solutions, with providers actively competing on value propositions.

- Customer Sensitivity: High sensitivity to quality of care, services, and pricing.

- Switching Costs: Moderate, influenced by personal needs and location preferences.

- Availability of Alternatives: Presence of other assisted living providers offers leverage.

- Key Differentiators: Reputation and the quality of delivered services are critical for customer retention and attraction.

Market Demand and Supply Dynamics

The bargaining power of customers is heavily shaped by market demand and supply dynamics in Switzerland's property sector. While residential demand consistently outstrips supply, keeping rental housing tight through 2025, certain urban areas are experiencing rising office vacancies. This imbalance can shift leverage towards commercial tenants.

This dynamic means that while residential renters have limited power, commercial entities in specific locations might find themselves in a stronger negotiating position. For instance, if office vacancy rates continue to climb in Zurich or Geneva, businesses leasing space there could negotiate more favorable lease terms.

- Residential demand in Switzerland is projected to remain high through 2025, with limited supply.

- Increasing office vacancies in select Swiss cities are observed, potentially enhancing commercial tenant bargaining power.

- The overall market balance between property supply and demand directly impacts customer leverage.

Swiss Prime Site's customer base, ranging from commercial tenants to institutional investors and senior living residents, exhibits varied bargaining power. While the sheer diversity of tenants dilutes collective power, specific segments like institutional investors and commercial lessees in markets with rising vacancies can exert more influence.

In 2024, while overall residential demand in Switzerland remains robust, increasing office vacancies in key cities like Zurich could empower commercial tenants to negotiate better lease terms. Conversely, the specialized nature of senior living services means residents and their families have moderate leverage, primarily driven by service quality and pricing.

| Customer Segment | Bargaining Power Drivers | Swiss Prime Site Response |

|---|---|---|

| Commercial Tenants (Prime Locations) | Market vacancy rates, lease duration, company size | Focus on premium, high-demand locations to maintain occupancy and pricing power. |

| Institutional Investors (Asset Management) | Capital deployed, alternative investment options, performance expectations | Offer competitive returns, transparent reporting, and tailored investment strategies. |

| Senior Living Residents (Tertium) | Quality of care, service offerings, pricing, availability of alternatives | Emphasize service excellence, specialized care, and community to foster loyalty. |

Full Version Awaits

Swiss Prime Site Porter's Five Forces Analysis

You're previewing the final version of the Swiss Prime Site Porter's Five Forces Analysis, precisely the same document that will be available to you instantly after buying. This comprehensive analysis delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector. Understanding these forces is crucial for strategic decision-making and identifying opportunities for Swiss Prime Site to maintain its market position.

Rivalry Among Competitors

The Swiss real estate market features a blend of significant institutional investors, such as Swiss Prime Site, alongside a multitude of smaller private developers and diverse real estate funds. This structure ensures a dynamic competitive landscape.

While Swiss Prime Site holds a prominent position, it does not exert complete market dominance, fostering robust competition across various property segments. For instance, in 2023, the total transaction volume in the Swiss real estate market reached approximately CHF 200 billion, illustrating the breadth of activity and the presence of numerous participants.

Swiss Prime Site's commitment to prime locations and high-quality commercial properties naturally limits its direct competition to other entities with similar strategic focuses. This concentration intensifies rivalry among those players vying for the same premium assets and tenant base.

For instance, in 2024, the demand for well-situated, modern office spaces in major Swiss cities like Zurich and Geneva remained robust, driving up rental prices and making it more challenging for companies to acquire or develop comparable properties. This focus on quality and location means Swiss Prime Site competes fiercely with other established real estate investors and developers who also prioritize these attributes.

Furthermore, Swiss Prime Site's emphasis on sustainability, a growing factor in tenant and investor preferences, creates a distinct competitive advantage. Companies increasingly seek environmentally certified buildings, and those that can offer this, like Swiss Prime Site, attract a premium and differentiate themselves from less sustainable competitors.

The asset management sector is intensely competitive, with numerous real estate investment managers and financial institutions vying for institutional investor capital. These competitors offer a wide array of real estate-backed investment products, making differentiation crucial. For instance, in 2024, the global real estate investment market saw significant activity, with institutional investors actively seeking diversified portfolios, putting pressure on managers to attract and retain these inflows through strong performance metrics.

Impact of Interest Rate Environment

The interest rate environment is a key driver of competition in the real estate sector. Lower interest rates generally stimulate demand for property investments by making financing cheaper and increasing the attractiveness of real estate relative to other asset classes. This can lead to more capital flowing into the market, potentially drawing in new competitors or encouraging existing players to expand their portfolios.

For Swiss Prime Site, the anticipated trend of lower interest rates in 2025 is likely to amplify competitive pressures, particularly for high-quality, prime real estate assets. As borrowing costs decrease, more investors will be able to participate in the market, driving up demand and potentially increasing acquisition prices for desirable properties.

- Lower borrowing costs incentivize more real estate investment.

- Anticipated lower rates in 2025 could intensify competition for prime Swiss assets.

- Increased competition may lead to higher property valuations and acquisition costs.

- This environment demands strategic differentiation and efficient capital deployment.

Regulatory and Sustainability Pressures

Increasing regulatory requirements and a heightened focus on sustainability, particularly Environmental, Social, and Governance (ESG) criteria, are reshaping the competitive landscape. Companies that proactively adapt and offer green, compliant properties are gaining a distinct advantage.

Swiss Prime Site's strategic commitment to its 2040 climate targets and robust ESG reporting positions it favorably against competitors who may be less prepared for these evolving trends. This proactive stance can translate into stronger investor appeal and a more resilient business model.

- Regulatory Compliance: Adherence to evolving building codes and environmental regulations is becoming a critical differentiator.

- ESG Integration: Companies demonstrating strong ESG performance, such as Swiss Prime Site with its clear climate targets, attract investors and tenants prioritizing sustainability.

- Competitive Advantage: Those who can effectively integrate and communicate their sustainability efforts are better positioned to capture market share and command premium valuations.

- Market Trends: The demand for sustainable real estate is a growing trend, influencing investment decisions and tenant preferences, thereby impacting competitive dynamics.

The competitive rivalry within the Swiss real estate market is substantial, driven by a mix of large institutional players and numerous smaller developers. Swiss Prime Site competes directly with other firms focused on prime commercial properties, where demand in 2024 for modern, well-located spaces in cities like Zurich remained strong, pushing rental prices higher.

This intense competition is further fueled by the asset management sector, where many firms vie for institutional capital by offering diverse real estate investment products. The anticipated trend of lower interest rates in 2025 is expected to escalate this rivalry, particularly for high-quality assets, as reduced borrowing costs attract more investors.

Companies prioritizing sustainability and ESG compliance, like Swiss Prime Site with its 2040 climate targets, gain a significant edge. This focus on green credentials is becoming a critical differentiator in attracting both tenants and investors, intensifying competition among those who can meet these evolving market demands.

| Competitor Type | Key Focus Areas | Competitive Pressure Drivers | 2024 Market Trend Example | Impact on Swiss Prime Site |

|---|---|---|---|---|

| Large Institutional Investors | Prime commercial properties, high-quality assets | Demand for premium locations, rental price appreciation | Robust demand for modern office spaces in Zurich | Intensified competition for prime assets and tenants |

| Real Estate Investment Managers | Diversified real estate portfolios, capital attraction | Investor capital inflows, performance metrics | Global search for diversified real estate investments | Need for strong performance and differentiation |

| Sustainability-Focused Developers | ESG compliance, green certifications | Tenant and investor preference for sustainability | Growing demand for environmentally certified buildings | Advantage for proactive ESG integration |

SSubstitutes Threaten

The increasing prevalence of remote and hybrid work models acts as a potent substitute threat to traditional office spaces. This shift directly impacts the demand for commercial real estate, potentially leading to higher vacancy rates and subdued rental growth for companies like Swiss Prime Site. For instance, in 2024, many businesses continued to evaluate their office footprint, with some downsizing or opting for flexible co-working solutions instead of long-term leases for conventional office buildings.

Co-working spaces present a significant substitute threat to traditional office leases, especially for agile startups and flexible workforces. These spaces allow businesses to avoid the commitment and overhead of long-term leases, offering pay-as-you-go or shorter-term arrangements.

The growth in co-working, with the global market projected to reach $20.7 billion by 2025, highlights its appeal. For instance, in 2024, companies are increasingly prioritizing flexibility, making co-working an attractive alternative to the substantial capital and time investment required for traditional office acquisition or leasing, thereby impacting demand for Swiss Prime Site's core offerings.

The strong demand for residential properties in Switzerland, especially in desirable urban areas, presents a potential threat of substitution for commercial spaces. With land scarcity being a persistent issue, developers might find it economically attractive to convert existing commercial buildings into residential units, particularly if rental yields for commercial properties decline relative to residential ones.

This trend could directly impact Swiss Prime Site by reducing the overall availability of commercial real estate in key markets. For instance, if the cost of converting a commercial property to residential becomes significantly lower than the potential return from commercial leasing, it could lead to a shrinking pool of suitable assets for Swiss Prime Site to acquire or develop.

In 2023, the Swiss residential property market continued to see robust demand, with average rents for apartments increasing by approximately 1.5% nationwide. This sustained demand, coupled with limited new construction, creates an environment where residential conversion of commercial spaces becomes a more viable option for property owners, potentially impacting the supply dynamics for commercial real estate.

Alternative Investment Vehicles for Investors

Investors have a wide array of choices beyond direct real estate. For instance, as of early 2024, global bond yields have shown a notable increase, making them a more compelling alternative for risk-averse investors. Equities, particularly in growth sectors, also present opportunities for higher returns, albeit with increased volatility.

Alternative investments, such as private equity and venture capital, are also vying for investor capital. In 2023, the private equity market saw significant deal activity, indicating investor confidence in these less liquid, but potentially more rewarding, avenues. If these alternatives consistently offer superior risk-adjusted returns compared to real estate, capital flows may shift, impacting demand for properties managed by entities like Swiss Prime Site.

- Bonds: Increased yields in 2024 make them a stronger competitor for capital.

- Equities: Growth sectors offer potential for higher returns, attracting investors seeking capital appreciation.

- Alternative Investments: Robust private equity activity in 2023 signals strong investor interest in these asset classes.

- Risk-Adjusted Returns: The primary driver for capital allocation, influencing investor decisions between real estate and other investment vehicles.

Digitalization and Virtualization

The increasing adoption of advanced communication and virtualization technologies presents a subtle threat of substitution for traditional commercial real estate. Tools like high-definition video conferencing and immersive virtual meeting platforms can reduce the necessity for physical business travel and, consequently, the demand for certain types of office space, such as meeting rooms or even entire floors in corporate headquarters. This ongoing digital transformation, accelerated by trends observed throughout 2024, means that some functions traditionally fulfilled by physical locations can now be achieved through digital means.

This shift impacts demand for specific real estate segments. For instance, the ongoing hybrid work models, a strong trend in 2024, have led to a reassessment of office space needs, with companies potentially reducing their physical footprint. This can be seen as a substitution for traditional, fully occupied office environments. The continued development and accessibility of these virtual collaboration tools mean that the need for extensive physical office infrastructure may diminish over time, acting as an indirect substitute for certain real estate functions.

- Digitalization Threat: Virtual collaboration tools can substitute for physical meeting spaces, reducing demand for certain office functionalities.

- Hybrid Work Impact: The prevalence of hybrid work models in 2024 has already led to companies downsizing office space, a direct substitution effect.

- Long-Term Trend: Continued advancements in communication technology may gradually decrease the overall need for extensive physical commercial real estate.

The threat of substitutes for Swiss Prime Site's offerings is multifaceted, encompassing alternative work arrangements, investment vehicles, and technological advancements. The rise of co-working spaces and the continued adoption of hybrid work models directly challenge the demand for traditional office leases. Furthermore, attractive yields from bonds and robust activity in private equity markets in 2023 and early 2024 present compelling alternatives for investor capital that might otherwise flow into real estate.

Technological innovations in virtual collaboration also serve as a substitute, potentially reducing the need for physical office space. As businesses increasingly leverage these tools, the demand for traditional office functionalities may diminish, impacting the core business of companies like Swiss Prime Site.

| Substitute Type | Key Characteristics | Impact on Swiss Prime Site | 2024 Relevance |

| Remote/Hybrid Work | Increased flexibility, reduced office footprint | Lower demand for traditional office space, potential vacancy | Continued evaluation of office needs by businesses |

| Co-working Spaces | Flexible terms, lower overhead | Direct competition for tenants seeking agility | Growing market, attractive to startups and flexible workforces |

| Alternative Investments (Bonds, Equities, PE) | Varying risk/return profiles, liquidity | Capital diversion from real estate if returns are superior | Rising bond yields, strong PE activity in 2023 |

| Virtual Collaboration Tech | Reduced need for physical meetings/travel | Substitution for certain office functionalities | Accelerated adoption of digital tools |

Entrants Threaten

The real estate sector, particularly for premium commercial properties in sought-after urban centers, demands immense upfront capital. This high financial threshold serves as a formidable barrier, deterring many aspiring competitors from entering the market. For instance, Swiss Prime Site's significant investment in prime Swiss locations, such as its portfolio valued at CHF 13.6 billion as of the end of 2023, underscores the substantial capital needed to establish and maintain a competitive presence.

Switzerland's stringent zoning laws and intricate building regulations present a significant hurdle for potential new entrants in the real estate market. These complex rules, coupled with lengthy approval processes for new developments, demand substantial expertise and considerable time investment, effectively acting as a strong deterrent for newcomers.

Swiss Prime Site’s established reputation and deep market knowledge act as a significant barrier. New entrants would find it incredibly difficult to replicate the trust and extensive network the company has cultivated over years with tenants, investors, and key stakeholders in the Swiss real estate sector.

Scarcity of Prime Locations

Swiss Prime Site's strategic focus on prime, high-demand urban locations presents a significant barrier to entry for newcomers. The most attractive and valuable development sites in Switzerland's key cities are already secured by established entities, including Swiss Prime Site itself.

This scarcity of prime, undeveloped land means that new entrants face considerable challenges in acquiring comparable high-quality portfolios. For instance, as of late 2023 and early 2024, major Swiss cities continue to see limited availability of large, centrally located development plots, driving up acquisition costs significantly.

- Limited Availability of Prime Development Land: Major Swiss urban centers have seen a substantial portion of their prime real estate already developed, leaving few opportunities for new large-scale projects.

- High Acquisition Costs for New Entrants: The scarcity drives up the price of available land, making it prohibitively expensive for new companies to establish a competitive portfolio.

- Established Player Advantage: Existing owners of prime locations benefit from long-term leases and established tenant relationships, further cementing their market position.

Access to Expertise and Talent

New companies entering the Swiss real estate market, particularly those aiming to develop and manage specialized portfolios like assisted living facilities, face significant hurdles in acquiring the necessary expertise. This includes deep knowledge in property acquisition, development, hands-on management, sales, and crucial financial and sustainability competencies. For instance, the average salary for a real estate development manager in Switzerland can exceed CHF 120,000 annually, reflecting the specialized skill set required.

Attracting and retaining top-tier talent in these diverse fields presents a substantial challenge for new entrants. Established players like Swiss Prime Site have built robust teams over years, possessing a collective knowledge base that is difficult for newcomers to replicate quickly. The competitive landscape for skilled professionals in areas like sustainable building practices and elderly care facility management is intense, often favoring companies with established reputations and attractive compensation packages.

- High Demand for Specialized Skills: Expertise in areas such as elderly care facility operations, adaptive reuse of properties, and ESG (Environmental, Social, and Governance) compliance is increasingly sought after.

- Talent Acquisition Costs: Recruiting experienced professionals in the Swiss market can be costly, with recruitment fees potentially reaching 20-30% of an employee's first-year salary.

- Retention Challenges: New entrants must offer more than just competitive salaries to retain talent; they need to provide compelling career growth opportunities and a strong company culture, which takes time to cultivate.

The threat of new entrants for Swiss Prime Site is generally low due to substantial capital requirements, with the company's portfolio valued at CHF 13.6 billion as of the end of 2023. Stringent Swiss zoning and building regulations also create significant barriers, demanding extensive expertise and time. Furthermore, Swiss Prime Site's established reputation and deep market knowledge, built over years, are difficult for newcomers to replicate.

The scarcity of prime development land in major Swiss cities, a trend continuing into 2024, drives up acquisition costs significantly, making it challenging for new players to secure comparable portfolios. This limited availability, coupled with high acquisition costs, favors established entities like Swiss Prime Site that already possess prime locations and long-term tenant relationships.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment needed for property acquisition and development. | Deters smaller or less capitalized firms. |

| Regulatory Hurdles | Complex zoning laws and lengthy approval processes in Switzerland. | Requires specialized knowledge and significant time commitment. |

| Brand Reputation & Networks | Established trust and relationships with tenants and stakeholders. | Difficult for new entrants to build comparable credibility quickly. |

| Scarcity of Prime Land | Limited availability of high-quality development sites in key urban areas. | Increases acquisition costs and limits competitive portfolio building. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Swiss Prime Site leverages data from company annual reports, investor presentations, and real estate industry publications. We also incorporate market research reports and economic indicators to provide a comprehensive view of the competitive landscape.