Swiss Prime Site Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

Curious about the engine driving Swiss Prime Site's success? Our comprehensive Business Model Canvas breaks down their customer relationships, key resources, and revenue streams in meticulous detail. Understand the strategic framework that underpins their market dominance and unlock transferable insights for your own ventures.

Partnerships

Swiss Prime Site actively cultivates relationships with institutional investors, pension funds, and diverse capital providers to secure funding for its real estate initiatives. This strategic alignment is fundamental to bolstering capital for its investment vehicles and real estate funds.

These collaborations are instrumental in driving substantial capital injections, thereby facilitating the growth of assets under management. A prime example of this dynamic is the acquisition of Fundamenta, which was significantly bolstered by such partnerships.

Securing capital through these key partnerships is vital for financing both new development projects and strategic acquisitions, allowing Swiss Prime Site to expand its portfolio beyond properties held directly on its balance sheet.

Swiss Prime Site, through its subsidiary Tertianum, actively collaborates with municipalities and public sector entities in public-private partnerships. These collaborations focus on the management and development of assisted living and care facilities. For instance, in 2024, Tertianum continued its role in supporting local governments by providing specialized operational expertise for senior living communities.

These partnerships are mutually beneficial, offering a solution for public sector entities facing financial pressures while ensuring the continued availability of high-quality, specialized care services for their residents. Tertianum's comprehensive service offering includes property acquisition, efficient operational management, and strategic succession planning for these vital community assets.

Swiss Prime Site actively engages with a diverse range of development and construction partners. These collaborations are crucial for executing its new build, conversion, and modernization initiatives across its extensive commercial property holdings. For instance, the JED Campus and Stücki Park projects highlight the necessity of these alliances.

These partnerships provide the specialized expertise and vital resources needed for intricate construction undertakings. They ensure the delivery of high-quality, sustainable real estate developments that align with Swiss Prime Site's strategic objectives.

Service Providers and Facility Management

Swiss Prime Site collaborates with a broad spectrum of service providers to ensure the seamless operation and upkeep of its vast real estate holdings. These partnerships are crucial for maintaining high standards in facility management, security, and cleaning services, directly impacting tenant experience and property value. For instance, in 2023, Swiss Prime Site's operational expenses related to property management and services were significant, reflecting the scale of its portfolio and the necessity of these external collaborations.

Even after the divestment of Wincasa, Swiss Prime Site continues to leverage external expertise for specialized property management tasks. This strategic approach allows the company to focus on its core competencies while ensuring that its properties are managed efficiently and effectively. The company's commitment to quality is underscored by its selection of partners who can deliver reliable and high-standard services, a key factor in tenant retention and overall portfolio performance.

- Key Service Providers: Partners include specialized firms for HVAC maintenance, landscaping, waste management, and technical building services.

- Facility Management Focus: Emphasis on ensuring operational efficiency, sustainability, and occupant comfort across all properties.

- Tenant Satisfaction: Service provider performance directly influences tenant satisfaction, a critical metric for Swiss Prime Site.

- Strategic Outsourcing: Continued reliance on external partners for specialized services to maintain agility and cost-effectiveness.

Technology and Innovation Partners

Swiss Prime Site is actively forging alliances with technology and innovation companies to elevate its real estate offerings. This includes integrating smart building systems for enhanced operational efficiency and digital services for tenants.

By collaborating with tech partners, the company aims to boost property performance and sustainability. For instance, in 2024, Swiss Prime Site continued its investment in digital transformation initiatives, targeting a significant improvement in energy management across its portfolio.

- Smart Building Integration: Partnerships focus on implementing IoT solutions for real-time building monitoring and control.

- Energy Efficiency Solutions: Collaborations aim to deploy advanced technologies reducing energy consumption, contributing to sustainability goals.

- Digital Tenant Experience: Innovation partners help develop platforms for seamless tenant services and engagement.

Swiss Prime Site's key partnerships are diverse, encompassing capital providers, public sector entities, development and construction firms, service providers, and technology innovators. These alliances are crucial for securing funding, managing specialized facilities, executing construction projects, maintaining properties, and enhancing its real estate offerings with smart technologies.

| Partner Type | Focus Area | Example/Impact |

| Capital Providers | Funding for Real Estate Initiatives | Securing capital for investment vehicles and funds, facilitating growth in assets under management. |

| Municipalities/Public Sector | Assisted Living & Care Facilities | Public-private partnerships for managing senior living communities, providing operational expertise (e.g., Tertianum's 2024 activities). |

| Development & Construction Partners | New Builds, Conversions, Modernization | Providing expertise for projects like JED Campus and Stücki Park, ensuring quality and sustainability. |

| Service Providers | Property Operations & Maintenance | Ensuring high standards in facility management, security, and cleaning, impacting tenant satisfaction. |

| Technology & Innovation Companies | Smart Building Systems & Digital Services | Integrating IoT for efficiency and developing platforms for tenant engagement, enhancing property performance and sustainability. |

What is included in the product

A robust business model detailing Swiss Prime Site's focus on prime real estate, encompassing tenant relationships, property management, and investment strategies.

This model highlights key customer segments like institutional investors and long-term tenants, supported by strong property development and management capabilities.

Swiss Prime Site's Business Model Canvas offers a clear, actionable framework to navigate complex real estate strategies, alleviating the pain of fragmented planning and execution.

It provides a singular, digestible overview of their entire operation, simplifying strategic alignment and reducing the burden of information overload.

Activities

Swiss Prime Site's key activity of property acquisition and portfolio management centers on strategically securing and actively overseeing premium commercial real estate throughout Switzerland. This includes identifying prime locations and ensuring these assets are of high quality.

The company actively refines its property holdings. In 2023, for instance, Swiss Prime Site completed acquisitions totaling CHF 226.6 million and disposed of assets valued at CHF 114.9 million, demonstrating a clear strategy of portfolio optimization.

This ongoing process aims to cultivate a valuable and diverse property portfolio. A core objective is to ensure the portfolio remains aligned with evolving market dynamics and increasingly important sustainability objectives, as evidenced by their focus on modern, eco-friendly properties.

Swiss Prime Site actively engages in developing new properties, converting existing ones, and modernizing its portfolio. This focus is on creating adaptable and eco-friendly spaces, especially for commercial and life sciences sectors.

In 2024, Swiss Prime Site continued its strategic development activities, aiming to enhance its rental income and overall portfolio value. For instance, the company reported significant progress on its major development projects, contributing to its long-term growth strategy.

Swiss Prime Site Solutions actively manages real estate assets for institutional investors through various investment products, including funds and mandates. This core activity encompasses comprehensive portfolio management, hands-on asset management, and expert advisory services for directly held real estate portfolios.

The strategic acquisition of Fundamenta in 2023 was a pivotal moment, significantly bolstering this segment and positioning Swiss Prime Site as a leading independent asset manager in the Swiss market. By the end of 2023, Swiss Prime Site Solutions managed assets totaling CHF 17.7 billion, demonstrating substantial growth and market presence.

Property and Tenant Management

Property and tenant management forms the operational core for Swiss Prime Site, focusing on the daily upkeep and strategic leasing of its extensive portfolio. This involves actively managing relationships with approximately 2,000 tenants, ensuring their needs are met and fostering long-term tenancies.

Key to this activity is maintaining high occupancy rates, which directly translates to stable and predictable rental income for the company. Swiss Prime Site's proactive approach includes negotiating lease renewals and new agreements, aiming to minimize vacancies and maximize asset value.

- Leasing and Rent Negotiation: Swiss Prime Site actively engages in leasing activities, negotiating terms with new and existing tenants to secure stable rental income streams.

- Tenant Relationship Management: The company prioritizes building and maintaining strong relationships with its approximately 2,000 tenants, addressing their needs and ensuring satisfaction.

- Occupancy Rate Optimization: A primary focus is on achieving and sustaining high occupancy rates across the portfolio, which is crucial for consistent revenue generation.

- Property Maintenance and Operations: This includes the day-to-day management of properties, ensuring they are well-maintained and operational, contributing to tenant retention and overall asset value.

Sustainable Development and ESG Integration

Swiss Prime Site actively integrates Environmental, Social, and Governance (ESG) principles across its operations, viewing sustainability as fundamental to its long-term value creation. The company has set an ambitious goal of achieving climate neutrality by 2040, a target that guides its strategic decisions and property management practices.

To achieve climate neutrality, Swiss Prime Site is focused on concrete actions such as developing clear CO2 reduction pathways for its portfolio. This includes investing in energy efficiency upgrades and exploring renewable energy sources for its buildings. By 2024, a significant portion of their portfolio is expected to meet stringent green building standards, reflecting their commitment to environmental responsibility.

- Climate Neutrality by 2040: A core strategic objective driving property development and management.

- CO2 Reduction Pathways: Implementing measurable steps to lower carbon emissions across the portfolio.

- Green Building Certifications: Aiming for high environmental standards in new constructions and renovations.

- Green Leases: Offering lease agreements that incentivize sustainable practices for tenants.

Swiss Prime Site's key activities encompass strategic property acquisition and active portfolio management, focusing on premium commercial real estate in Switzerland. This involves identifying prime locations and ensuring high-quality assets, as demonstrated by CHF 226.6 million in acquisitions and CHF 114.9 million in disposals during 2023, optimizing their portfolio for evolving market dynamics and sustainability goals.

The company actively develops new properties and modernizes its existing portfolio, creating adaptable and eco-friendly spaces, particularly for commercial and life sciences sectors. Significant progress on major development projects in 2024 continued to enhance rental income and portfolio value, aligning with their long-term growth strategy.

Swiss Prime Site Solutions manages real estate assets for institutional investors, offering comprehensive portfolio and asset management, alongside advisory services. The acquisition of Fundamenta bolstered this segment, with CHF 17.7 billion in assets under management by the end of 2023, solidifying their position as a leading independent asset manager.

Operational core activities include property and tenant management for their extensive portfolio, which serves approximately 2,000 tenants. Maintaining high occupancy rates through proactive leasing and tenant relationship management is crucial for consistent revenue generation and asset value maximization.

A significant commitment to ESG principles drives operations, with a target of climate neutrality by 2040. This involves implementing clear CO2 reduction pathways, investing in energy efficiency, and exploring renewable energy sources, with a substantial portion of the portfolio expected to meet stringent green building standards by 2024.

| Key Activity | Description | 2023/2024 Data Highlight |

|---|---|---|

| Property Acquisition & Portfolio Management | Strategic acquisition and active oversight of premium Swiss commercial real estate. | CHF 226.6M acquisitions, CHF 114.9M disposals in 2023. |

| Property Development & Modernization | Creating adaptable, eco-friendly spaces for commercial and life sciences. | Continued progress on major development projects in 2024. |

| Asset Management (Solutions) | Managing real estate assets for institutional investors via funds and mandates. | CHF 17.7B assets under management by end of 2023. |

| Property & Tenant Management | Day-to-day upkeep and strategic leasing for the property portfolio. | Servicing approximately 2,000 tenants. |

| Sustainability (ESG) | Integrating ESG principles with a goal of climate neutrality by 2040. | Focus on CO2 reduction pathways and green building standards. |

What You See Is What You Get

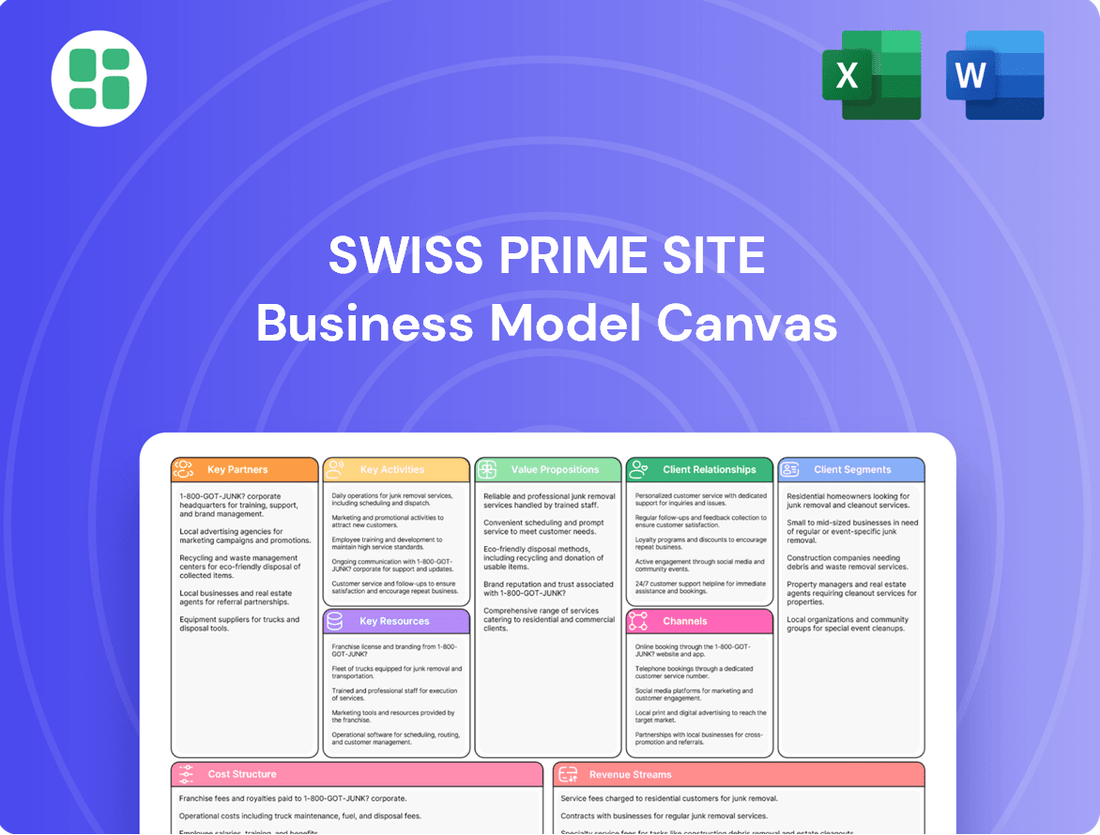

Business Model Canvas

The Swiss Prime Site Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means you can confidently assess the structure, content, and professional formatting before committing. Once your order is complete, you'll gain full access to this identical, ready-to-use Business Model Canvas.

Resources

Swiss Prime Site's core strength lies in its substantial portfolio of prime commercial real estate, valued at CHF 13.1 billion by the end of 2024. This collection of assets is strategically situated in Switzerland's most dynamic economic centers, forming the bedrock of its business operations.

The portfolio encompasses a broad spectrum of property types, including offices, retail spaces, logistics facilities, and residential units. This diversification across sectors and geographies enhances resilience and provides multiple revenue streams.

The exceptional quality and prime locations of these properties are fundamental to Swiss Prime Site's ability to generate consistent rental income and maintain a leading position in the Swiss real estate market.

Swiss Prime Site boasts robust financial capital, leveraging equity, debt financing, and substantial capital raising capabilities from institutional investors for its asset management offerings. This financial strength is crucial for funding strategic acquisitions and development projects.

In 2024, Swiss Prime Site's conservative capital structure and strong credit profile were key enablers for accessing necessary funds. For instance, their ability to secure favorable financing terms directly supports their ongoing investment in high-quality real estate assets.

Swiss Prime Site's expertise in real estate development and management is a cornerstone of its business model. This internal capability encompasses a highly skilled team adept at acquisition, project development, construction management, and ongoing property management.

This deep well of experience enables Swiss Prime Site to successfully undertake and deliver complex real estate projects. It also allows for the optimization of their extensive portfolio, ensuring strong performance across all assets.

As of the first half of 2024, Swiss Prime Site reported a portfolio value of CHF 14.5 billion, demonstrating the scale at which their development and management expertise is applied. Their focus on prime locations and long-term value creation is directly supported by this core competency.

Brand Reputation and Market Leadership

Swiss Prime Site's brand reputation, honed over 25 years as a leading Swiss real estate entity, is a cornerstone of its business model. This reputation is built on a foundation of quality, reliability, and a commitment to sustainability, attracting top-tier tenants and significant institutional investor interest.

This market leadership translates directly into tangible business advantages. For instance, in 2024, Swiss Prime Site reported a robust portfolio valuation, reflecting the premium associated with its well-regarded properties and strong tenant relationships. The company's consistent performance and positive market perception foster a high degree of trust, which is crucial for securing favorable lease agreements and facilitating ongoing business expansion.

- 25 Years of Market Leadership: Swiss Prime Site has consistently been at the forefront of the Swiss real estate market.

- Attracts High-Quality Tenants: A strong brand reputation draws premium commercial tenants, ensuring stable rental income.

- Appeals to Institutional Investors: Market leadership and reliability make the company an attractive investment for institutional capital.

- Fosters Trust and Growth: The established reputation builds confidence, enabling easier access to financing and strategic partnerships.

Technology and Data Infrastructure

Swiss Prime Site significantly invests in advanced technology and robust data infrastructure. This commitment is crucial for optimizing every facet of their operations, from managing properties and enhancing tenant services to making smarter investment choices.

Their technology stack includes sophisticated tools for in-depth portfolio analysis and real-time property performance monitoring. For instance, in 2024, the company continued to leverage data analytics to identify trends and opportunities across its diverse real estate holdings.

- Data-Driven Portfolio Optimization: Utilizing advanced analytics for strategic asset allocation and performance tracking.

- Smart Building Solutions: Implementing technologies to improve operational efficiency and tenant satisfaction in their properties.

- Tenant Experience Enhancement: Deploying digital platforms to streamline communication and service delivery for tenants.

- Investment Decision Support: Leveraging data for informed acquisition, development, and divestment strategies.

Swiss Prime Site's key resources are anchored by its extensive portfolio of prime Swiss real estate, valued at CHF 13.1 billion by the end of 2024. This collection is complemented by significant financial capital, enabling strategic acquisitions and development, and deep expertise in real estate development and management. Furthermore, its strong brand reputation, built over 25 years, attracts high-quality tenants and investors, while advanced technology and data infrastructure drive operational efficiency and informed decision-making.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Real Estate Portfolio | Substantial holdings in prime commercial and residential properties across Switzerland. | Valued at CHF 13.1 billion (end of 2024); CHF 14.5 billion (H1 2024). |

| Financial Capital | Access to equity, debt financing, and institutional investor capital. | Conservative capital structure and strong credit profile facilitated funding in 2024. |

| Expertise | In-house capabilities in acquisition, development, construction, and property management. | Enables successful complex projects and portfolio optimization. |

| Brand Reputation | 25 years of market leadership, synonymous with quality, reliability, and sustainability. | Attracts premium tenants and institutional investors, fostering trust and growth. |

| Technology & Data | Investment in advanced analytics, smart building solutions, and digital platforms. | Supports portfolio optimization, tenant experience enhancement, and informed investment decisions. |

Value Propositions

Swiss Prime Site's prime location properties offer unparalleled access to Switzerland's most dynamic economic hubs. These modern, high-quality commercial spaces are strategically positioned to provide businesses with significant advantages, including excellent transport links and robust infrastructure. This focus on prime locations ensures sustained value for both tenants and investors.

Swiss Prime Site offers sustainable properties designed to meet stringent environmental standards and future needs, including a commitment to climate neutrality and green building certifications.

This focus attracts tenants prioritizing eco-friendly workspaces and investors keen on Environmental, Social, and Governance (ESG) performance, thereby enhancing long-term value and mitigating operational risks.

For instance, in 2023, Swiss Prime Site reported a 4.2% increase in rental income, partly driven by demand for its high-quality, sustainable portfolio.

Swiss Prime Site provides clients and investors with a complete suite of services spanning the entire real estate lifecycle. This includes everything from identifying and acquiring prime properties, through to their development, ongoing asset and property management, and eventual sale.

This integrated model ensures a streamlined and efficient experience for all stakeholders involved in real estate investment and management. For instance, in 2024, Swiss Prime Site successfully managed a portfolio valued at over CHF 13 billion, demonstrating the scale and breadth of their operational capabilities.

Stable and Attractive Investment Opportunities

For investors, Swiss Prime Site presents a compelling case for stable and attractive investment opportunities within the resilient Swiss real estate sector. The company's portfolio is geared towards generating consistent rental income, a key factor in its appeal, alongside the potential for long-term capital appreciation. This stability is further enhanced by its diversified product offerings, such as investment funds and foundations, which are designed to meet the needs of a broad spectrum of investors looking for dependable returns.

Swiss Prime Site's commitment to quality and strategic location of its properties underpins its value proposition. For instance, as of the first half of 2024, the company reported a rental income of CHF 174.1 million, demonstrating the steady revenue stream generated from its assets. The occupancy rate across its portfolio remained robust, averaging 97.1% in the same period, highlighting the strong demand for its properties and the effectiveness of its asset management.

- Consistent Rental Income: Swiss Prime Site's portfolio generates predictable rental income, a cornerstone of its investment attractiveness.

- Capital Appreciation Potential: Properties are strategically located, offering the prospect of capital growth over time.

- Diversified Investment Products: Funds and investment foundations cater to a wide range of investor risk appetites and return expectations.

- High Occupancy Rates: An average occupancy rate of 97.1% in H1 2024 underscores the demand for Swiss Prime Site's well-managed real estate assets.

Specialized Assisted Living and Healthcare Solutions

Swiss Prime Site, through its subsidiary Tertianum, offers specialized assisted living and healthcare solutions designed for seniors. These facilities provide a high standard of care, catering to the diverse needs of the elderly with tailored services and professional management.

This value proposition directly addresses the increasing demand for quality eldercare, ensuring residents receive comprehensive support in comfortable and secure living environments. In 2024, the Swiss population aged 65 and over represented approximately 19.4% of the total population, highlighting a significant and growing market for these services.

- High-Quality Assisted Living: Tertianum facilities focus on providing premium living spaces and personalized care plans.

- Comprehensive Healthcare: Integrated healthcare services ensure residents' well-being is managed professionally.

- Societal Need Fulfillment: Addresses the growing demographic trend of an aging population in Switzerland.

- Peace of Mind for Families: Offers reliable and professional support for seniors, easing concerns for their loved ones.

Swiss Prime Site's core value proposition centers on offering prime, high-quality commercial properties in Switzerland's key economic centers. These locations provide tenants with superior accessibility and infrastructure, fostering business growth. The company's commitment to sustainability, evidenced by its focus on green building certifications and climate neutrality, appeals to environmentally conscious businesses and ESG-focused investors.

The company also provides a comprehensive, end-to-end real estate service, managing properties throughout their lifecycle. This integrated approach ensures efficiency and value for clients and investors alike. Swiss Prime Site's portfolio delivers stable rental income and capital appreciation potential, making it an attractive investment in the resilient Swiss real estate market. For instance, in the first half of 2024, Swiss Prime Site reported a rental income of CHF 174.1 million with a portfolio occupancy rate of 97.1%.

Furthermore, through its subsidiary Tertianum, Swiss Prime Site offers specialized assisted living and healthcare services for seniors. This addresses the growing demographic trend of an aging population in Switzerland, with individuals aged 65 and over representing approximately 19.4% of the population in 2024. These services provide high-quality care and secure living environments, offering peace of mind to residents and their families.

| Value Proposition | Key Features | Supporting Data (H1 2024 / 2024) |

|---|---|---|

| Prime Location Properties | Access to dynamic economic hubs, excellent transport links, robust infrastructure | Portfolio value over CHF 13 billion (2024) |

| Sustainable Properties | Climate neutrality commitment, green building certifications | 4.2% increase in rental income (2023) driven by sustainable portfolio |

| Integrated Real Estate Services | Acquisition, development, asset and property management, sales | Rental income of CHF 174.1 million (H1 2024) |

| Attractive Investment Opportunities | Consistent rental income, capital appreciation potential, diversified products | 97.1% average occupancy rate (H1 2024) |

| Specialized Eldercare Solutions (Tertianum) | Assisted living, healthcare, tailored services, professional management | 19.4% of Swiss population aged 65+ (2024) |

Customer Relationships

Swiss Prime Site cultivates enduring connections with its varied clientele, encompassing commercial tenants, institutional investors, and individuals residing in their assisted living communities. Dedicated relationship management teams ensure consistent dialogue, tailored assistance, and proactive interaction to anticipate and address changing requirements.

Swiss Prime Site prioritizes a service-oriented approach, ensuring responsive support to its tenants. This commitment is crucial for maintaining high tenant satisfaction and streamlining property operations, a key aspect of their business model.

The company actively addresses tenant needs, from prompt maintenance requests to facilitating lease renewals. By offering tailored services, they aim to enhance the overall tenant experience within their diverse portfolio of properties.

In 2023, Swiss Prime Site reported a strong occupancy rate of 96.1% across its portfolio, underscoring the effectiveness of its tenant relationship management and service offerings.

Swiss Prime Site's asset management division offers bespoke investment advisory to institutional clients. This includes crafting strategic portfolios, delivering in-depth market analysis, and developing unique investment solutions designed to meet specific real estate goals. For example, in 2024, the company continued to leverage its deep understanding of the Swiss real estate market to guide institutional investors through evolving economic conditions.

Community Engagement and Resident Care

In the assisted living sector, specifically for Tertianum, customer relationships are deeply rooted in providing empathetic care and cultivating a strong sense of community. This approach ensures residents feel valued and connected, enhancing their overall well-being and quality of life.

Building these relationships involves a multi-faceted strategy. Personalized care plans are central, addressing each resident's unique needs and preferences. Furthermore, a diverse array of activities is offered to promote engagement and social interaction, fostering a vibrant community atmosphere. Continuous, open communication with both residents and their families is paramount, ensuring transparency and trust.

- Personalized Care Plans: Tailored support addressing individual health and lifestyle needs.

- Community Building: Fostering social connections through diverse activities and shared spaces.

- Family Communication: Maintaining regular contact and involvement with residents' families.

- Resident Well-being: Focused efforts on enhancing physical, mental, and social health.

Digital Platforms and Communication Tools

Swiss Prime Site actively leverages digital platforms to streamline tenant and investor interactions. Online portals offer efficient property management, access to crucial reports, and timely investor updates, fostering transparency.

This digital approach enhances accessibility and operational efficiency across its portfolio. For instance, in 2024, the company continued to invest in its digital infrastructure to support its diverse tenant base and global investor community.

- Tenant Portals: Providing a centralized hub for lease management, maintenance requests, and communication, improving the tenant experience.

- Investor Relations Platforms: Offering secure access to financial reports, company news, and performance data, ensuring clear and consistent communication with stakeholders.

- Digital Reporting: Streamlining the delivery of property performance and financial updates, enhancing data accessibility and analysis for investors.

- Communication Tools: Utilizing digital channels for targeted outreach, feedback collection, and relationship building with both tenants and investors.

Swiss Prime Site focuses on building strong, long-term relationships through personalized service and consistent communication. This is evident in their high occupancy rates and tailored offerings for both commercial tenants and residents in their assisted living facilities.

| Relationship Type | Key Engagement Strategy | 2023 Data Highlight | 2024 Focus Area |

|---|---|---|---|

| Commercial Tenants | Responsive property management, proactive communication, lease renewal support | 96.1% portfolio occupancy | Enhancing digital tenant portals |

| Institutional Investors | Bespoke advisory, market analysis, tailored investment solutions | Continued asset growth | Navigating evolving economic conditions |

| Assisted Living Residents (Tertianum) | Empathetic care, community building, family communication | High resident satisfaction | Personalized care plan development |

Channels

Swiss Prime Site leverages its dedicated internal sales and leasing teams to directly engage with potential commercial tenants. This direct approach fosters personalized relationships, enabling the team to effectively highlight property advantages and negotiate lease terms.

In 2024, Swiss Prime Site's direct sales and leasing efforts were crucial in securing key tenants for its prime office and retail spaces across Switzerland. The company reported a strong occupancy rate, partly attributed to the proactive management of these direct channels.

Swiss Prime Site actively partners with external real estate agents and brokers. This collaboration is crucial for expanding their market reach, tapping into a broader network of potential tenants and buyers for their diverse property portfolio.

These partnerships are strategic alliances that leverage the specialized local market knowledge of these external professionals. This allows Swiss Prime Site to more effectively identify and engage with suitable parties, optimizing property leasing and sales processes.

For instance, in 2024, Swiss Prime Site continued to utilize these channels to manage its extensive portfolio, which includes prime office spaces and retail locations across Switzerland. The effective engagement of these agents directly contributes to maintaining high occupancy rates and achieving favorable rental agreements.

Swiss Prime Site actively engages its investor base through a dedicated investor relations team, ensuring transparent communication via official reports and presentations. This proactive approach, including participation in capital market events, aims to attract and retain investors by clearly articulating the company's financial performance and strategic vision, fostering confidence in its long-term growth prospects.

Digital Platforms and Company Websites

The official Swiss Prime Site website, along with dedicated sites for its subsidiaries like Swiss Prime Site Solutions and Tertianum, acts as a central hub for sharing information. These platforms are essential for showcasing their extensive property portfolio and connecting with a wide range of stakeholders, from potential tenants to investors and the general public.

These digital channels are vital for maintaining market visibility and ensuring broad accessibility to their offerings. In 2024, Swiss Prime Site continued to invest in its online presence, recognizing its role in driving engagement and facilitating business transactions. The company reported that a significant portion of its new leasing inquiries originate through its digital platforms, underscoring their importance in the customer acquisition process.

- Website as primary information source: Swiss Prime Site's official website and subsidiary sites provide detailed property information, company news, and investor relations updates.

- Digital engagement: Online platforms facilitate direct interaction with customers, partners, and the investment community.

- Market visibility and accessibility: A strong digital presence ensures that Swiss Prime Site's properties and services are easily discoverable and accessible to a global audience.

- Lead generation: In 2024, digital channels were a key driver for new leasing inquiries, highlighting their effectiveness in attracting potential tenants.

Industry Events and Conferences

Swiss Prime Site actively participates in major real estate industry events and conferences. This engagement is crucial for building relationships with potential tenants, investors, and strategic partners. For instance, in 2024, the company likely had a significant presence at events like EXPO REAL in Munich, a premier European real estate trade fair, to demonstrate its diverse portfolio and industry knowledge.

These platforms offer Swiss Prime Site a valuable opportunity to showcase its properties and highlight its expertise in property development and management. By presenting its offerings, the company aims to attract new business and reinforce its market position. The ability to connect face-to-face at these events is invaluable for fostering trust and securing future collaborations.

Furthermore, attending these gatherings keeps Swiss Prime Site informed about the latest market trends, technological advancements, and regulatory changes. This intelligence is vital for adapting its business strategies and maintaining a competitive edge. For example, discussions around sustainability and digital transformation in real estate are key themes at many 2024 conferences, directly impacting how Swiss Prime Site operates.

- Networking: Connecting with potential tenants, investors, and partners at industry events.

- Portfolio Showcase: Presenting properties and expertise to a broad audience.

- Market Intelligence: Gathering insights on trends and innovations to inform strategy.

- Brand Visibility: Enhancing brand recognition and reputation within the real estate sector.

Swiss Prime Site utilizes both direct internal sales and leasing teams, as well as external real estate agents and brokers, to connect with potential tenants and buyers. The company also actively engages its investor base through a dedicated investor relations team and leverages its official website and subsidiary sites as primary information hubs. Participation in industry events further enhances market visibility and networking opportunities.

In 2024, these channels were instrumental in maintaining high occupancy rates and securing favorable lease agreements across Swiss Prime Site's portfolio. Digital platforms, in particular, proved to be a significant source of new leasing inquiries, demonstrating their growing importance in customer acquisition. The company's presence at key industry events like EXPO REAL in Munich provided valuable market intelligence and networking opportunities.

The effectiveness of these channels is reflected in Swiss Prime Site's continued strong performance. For instance, the company reported a robust occupancy rate for its prime office and retail spaces throughout 2024, a testament to the success of its multi-channel approach in reaching and engaging its target markets.

The company's strategic use of these diverse channels ensures broad market reach and accessibility, crucial for a real estate portfolio of its scale and quality.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Internal Sales & Leasing | Direct engagement with tenants, relationship building, negotiation. | Secured key tenants, maintained high occupancy. |

| External Agents & Brokers | Leveraging local market knowledge, expanding reach. | Optimized leasing and sales processes. |

| Investor Relations | Transparent communication, capital market events. | Fostered investor confidence and attracted capital. |

| Digital Platforms (Website, etc.) | Showcasing portfolio, connecting stakeholders, lead generation. | Key driver for new leasing inquiries, enhanced market visibility. |

| Industry Events & Conferences | Networking, portfolio showcase, market intelligence gathering. | Strengthened relationships, gained insights on trends like sustainability. |

Customer Segments

Commercial tenants, including those in office, retail, and logistics sectors, represent the bedrock of Swiss Prime Site's business model. This segment encompasses a broad spectrum of businesses, from established multinational corporations to dynamic small and medium-sized enterprises, all in pursuit of premium commercial real estate in Switzerland's most desirable locations.

These tenants prioritize attributes like operational flexibility, cutting-edge infrastructure, and strategic accessibility, which are crucial for optimizing their business functions and market reach. For instance, in 2024, Swiss Prime Site reported a high occupancy rate across its portfolio, underscoring the consistent demand for its well-situated and modern properties from these core customer groups.

Institutional investors like pension funds and insurance companies represent a crucial customer segment for Swiss Prime Site Solutions. These entities are characterized by their substantial capital and a primary objective of generating stable, long-term returns from their real estate holdings. For instance, in 2024, global pension fund assets under management were projected to exceed $50 trillion, highlighting the immense scale of this market.

These sophisticated investors typically seek diversified portfolios that offer predictable income streams and capital appreciation. They value professional asset management services that can navigate complex market dynamics and ensure their investments align with stringent risk-return profiles. Furthermore, environmental, social, and governance (ESG) mandates are increasingly important, with many institutional investors prioritizing real estate that demonstrates strong sustainability credentials.

Private investors, such as high-net-worth individuals and family offices, represent a crucial customer segment for Swiss Prime Site. These sophisticated investors are actively seeking direct or indirect investment opportunities within the Swiss real estate market, valuing stability and long-term growth potential. Their interest often extends to customized investment solutions and participation in specialized real estate funds, aiming for diversification and capital preservation.

Elderly Individuals and Families (Assisted Living)

Swiss Prime Site, through its Tertianum subsidiary, serves elderly individuals and their families who require assisted living, nursing care, or specialized dementia care. This segment prioritizes high-quality, comprehensive care and comfortable living environments, valuing personalized services and a strong sense of community.

In 2024, Tertianum operated a significant portfolio of senior living facilities, demonstrating its commitment to this demographic. For instance, Tertianum's facilities are designed to foster social interaction and well-being, crucial for residents' quality of life.

- Targeting Seniors: Focus on individuals needing assisted living, nursing, and dementia care.

- Family Needs: Address families seeking reliable, high-quality care solutions.

- Value Proposition: Emphasize personalized services and supportive community living.

- Market Presence: Swiss Prime Site's Tertianum division actively manages a substantial number of senior living units.

Development and Project Partners

Swiss Prime Site actively collaborates with landowners and municipalities, recognizing their crucial role in unlocking the potential of prime real estate. These partnerships are vital for developing large-scale projects, often in urban regeneration zones.

For instance, in 2024, Swiss Prime Site continued its strategic partnerships in key Swiss cities, leveraging municipal zoning approvals and landowner agreements to advance its development pipeline. These collaborations are built on shared vision and a commitment to sustainable urban development.

These partners seek a developer with a proven track record, robust financial stability, and the technical expertise to manage intricate construction and planning processes. They value Swiss Prime Site's ability to deliver complex projects on time and within budget, ensuring long-term value creation.

- Landowners: Seeking capital appreciation and expertise to develop their assets.

- Municipalities: Aiming for urban revitalization, job creation, and enhanced public amenities.

- Other Developers: Looking for joint venture opportunities to share risk and leverage complementary strengths.

- Financial Institutions: Providing debt financing for projects where Swiss Prime Site acts as the primary developer.

Swiss Prime Site's customer segments are diverse, reflecting its multifaceted real estate operations. These include commercial tenants in office, retail, and logistics, who seek premium locations and modern infrastructure. Institutional investors, such as pension funds and insurance companies, are drawn to stable, long-term returns and professional asset management. Private investors, including high-net-worth individuals and family offices, look for diversification and capital preservation in the Swiss real estate market.

Furthermore, Swiss Prime Site, through its Tertianum subsidiary, caters to seniors requiring assisted living and care services, emphasizing quality and community. The company also collaborates with landowners and municipalities to develop large-scale projects, valuing expertise and financial stability in these partnerships.

| Customer Segment | Key Needs | Swiss Prime Site's Offering |

|---|---|---|

| Commercial Tenants | Prime locations, modern infrastructure, operational flexibility | High-quality office, retail, and logistics spaces |

| Institutional Investors | Stable, long-term returns, capital appreciation, professional management | Diversified real estate portfolios, ESG-compliant assets |

| Private Investors | Diversification, capital preservation, customized solutions | Direct/indirect investment opportunities, specialized funds |

| Seniors (via Tertianum) | Assisted living, nursing care, dementia care, community | Comprehensive care services, comfortable living environments |

| Landowners/Municipalities | Capital appreciation, urban revitalization, development expertise | Project development, financial stability, technical expertise |

Cost Structure

Swiss Prime Site's cost structure is significantly shaped by substantial investments in property acquisition and development. These capital expenditures are crucial for expanding and upgrading their real estate portfolio, encompassing the purchase of new land and existing properties, alongside the intricate processes of planning, construction, and renovation of their diverse projects.

In 2024, the company continued to focus on strategic acquisitions and development. For instance, their ongoing development projects, such as the "Immo-Invest" initiative, represent a considerable outlay. The financial reports for the first half of 2024 indicated that capital expenditures for property development and acquisitions were a primary driver of their cost base, reflecting a commitment to long-term portfolio enhancement.

Financing and interest expenses are a significant cost for Swiss Prime Site, a real estate company that leverages debt to fund its substantial property portfolio. In 2023, the company reported financing costs of CHF 191.9 million, reflecting the considerable interest paid on its loans and outstanding bonds.

Managing these costs is paramount, especially given the dynamic interest rate landscape. Swiss Prime Site's commitment to maintaining a conservative loan-to-value (LTV) ratio, which stood at 37.9% as of year-end 2023, demonstrates a strategic approach to mitigating the impact of interest rate fluctuations and ensuring financial stability.

Property management and operating expenses are a significant part of Swiss Prime Site's cost structure, encompassing utilities, maintenance, repairs, property taxes, and insurance for their vast portfolio. In 2024, the company continued to focus on efficient operational management and sustainability to keep these recurring costs in check.

Personnel Costs

Personnel costs are a major component of Swiss Prime Site's expenses, reflecting its substantial workforce across diverse operations. This includes salaries and benefits for employees involved in real estate management, development, asset management, and the assisted living sector through Tertianum.

The company employs specialized teams for crucial functions such as property management, asset management, and facility management, ensuring the smooth operation and maintenance of its extensive real estate portfolio. Additionally, the assisted living segment, Tertianum, requires dedicated care staff to provide high-quality services to residents.

- Salaries and benefits for a large workforce across real estate and assisted living operations.

- Costs include specialized teams for property, asset, and facility management.

- Significant expenditure on care staff for the Tertianum segment.

Marketing, Sales, and Administrative Overheads

Swiss Prime Site incurs significant costs in marketing its properties and attracting both tenants and investors. These expenditures are crucial for maintaining market visibility and driving occupancy rates.

Administrative functions, encompassing IT infrastructure, legal services, and corporate governance, represent another substantial cost category. These overheads are essential for the smooth and compliant operation of the company.

- Marketing & Sales: Costs associated with advertising, property promotion, and sales commissions to secure tenants and buyers.

- Administrative Overheads: Expenses for IT, legal counsel, human resources, and corporate compliance activities.

- Property Management Support: Costs related to the teams that manage tenant relations and property upkeep, indirectly supporting sales and marketing efforts.

- Investor Relations: Expenditure on communicating with and attracting investors to fund development and acquisitions.

Swiss Prime Site's cost structure is dominated by property acquisition and development, a key driver of their portfolio expansion. Financing and interest expenses are also substantial, reflecting their use of debt to fund operations, with CHF 191.9 million reported in 2023. Personnel costs, particularly for specialized teams and care staff in the Tertianum segment, represent another significant outlay, alongside operational expenses like maintenance and utilities.

| Cost Category | 2023 (CHF millions) | Key Components |

| Property Acquisition & Development | Significant Capital Expenditure | Land purchase, construction, renovation |

| Financing & Interest Expenses | 191.9 | Interest on loans and bonds |

| Personnel Costs | Substantial | Salaries, benefits, care staff (Tertianum) |

| Property Management & Operations | Ongoing | Utilities, maintenance, taxes, insurance |

| Marketing & Administration | Essential Overheads | IT, legal, HR, marketing, investor relations |

Revenue Streams

Swiss Prime Site's main engine for revenue is the rent collected from its vast array of commercial properties. This includes everything from office spaces and retail locations to logistics hubs and specialized facilities, all leased out to a wide range of businesses.

This rental income is the bedrock of their earnings, providing a steady and predictable flow of cash. For instance, in 2023, Swiss Prime Site reported rental income of CHF 714.5 million, highlighting its significance.

Swiss Prime Site Solutions generates significant income by managing real estate portfolios for institutional investors. These asset management fees are a cornerstone of their revenue, typically calculated as a percentage of the total assets they oversee.

For instance, in 2023, Swiss Prime Site reported that its asset management segment, which includes these fees, contributed substantially to its overall financial performance, demonstrating the recurring and reliable nature of this income stream.

Swiss Prime Site generates revenue through the profitable sale of properties, a key component of its portfolio optimization efforts. This includes divesting assets that no longer align with strategic goals, thereby freeing up capital for reinvestment. For instance, in 2023, the company reported proceeds from property sales, contributing to its overall financial performance and enabling further development activities.

Service Fees from Assisted Living and Healthcare

Tertianum, a key part of Swiss Prime Site, generates significant revenue through its assisted living and healthcare services. These services encompass accommodation, specialized nursing care, and a wide array of medical and support functions tailored to resident needs. This revenue stream is bolstered by the increasing demand for quality senior living and healthcare solutions.

In 2024, the Swiss healthcare and senior living market continued its upward trajectory, driven by an aging population. Tertianum's robust service offering, including residential care, outpatient services, and rehabilitation, positions it well to capture this growing market share. The company's focus on integrated care models ensures a consistent revenue flow from a diverse resident base.

- Accommodation Fees: Monthly charges for private rooms and apartments.

- Care and Nursing Services: Fees for personalized medical, therapeutic, and daily living assistance.

- Ancillary Services: Revenue from additional offerings like physiotherapy, meal plans, and wellness programs.

- Healthcare Services: Income from specialized medical treatments and consultations provided within facilities.

Advisory and Project Management Fees

Swiss Prime Site Solutions generates revenue through advisory and project management fees. These services encompass comprehensive real estate consulting, guiding clients on their property strategies, conducting profitability assessments, and managing transactions. This segment leverages the company's expertise to offer tailored solutions.

In 2024, Swiss Prime Site Solutions continued to build on its advisory capabilities. The company's project management services are crucial for the successful execution of development and renovation projects, ensuring they meet timelines and budget requirements. These fees are a direct reflection of the value and specialized knowledge provided to clients.

- Advisory Services: Offering strategic guidance on real estate portfolios.

- Project Management: Overseeing development and renovation projects from inception to completion.

- Profitability Analyses: Evaluating the financial viability of real estate investments.

- Transaction Management: Facilitating property acquisitions and disposals.

Beyond core rental income, Swiss Prime Site Solutions also generates revenue by managing real estate portfolios for institutional investors. These asset management fees, typically a percentage of assets under management, represent a stable and recurring income stream.

In 2024, the company's focus on its Solutions segment continued, with asset management fees playing a vital role in diversifying revenue. This segment leverages Swiss Prime Site's expertise to provide valuable services to external clients.

The sale of properties is another significant revenue contributor, allowing Swiss Prime Site to optimize its portfolio and reinvest in new developments. This strategic divestment activity is crucial for capital allocation and future growth.

Tertianum, its senior living division, generates revenue through accommodation, care services, and ancillary offerings. The growing demand for quality senior care in Switzerland underpins this segment's consistent performance.

| Revenue Stream | Description | 2023 Contribution (CHF million) |

|---|---|---|

| Rental Income | Rent from commercial properties | 714.5 |

| Asset Management Fees | Fees from managing institutional investor portfolios | Substantial contribution (specific figure not separately itemized in 2023 report) |

| Property Sales | Proceeds from selling properties | Contributed to overall financial performance (specific figure not separately itemized in 2023 report) |

| Tertianum Services | Accommodation, care, and ancillary services | Significant revenue from senior living operations (specific figure not separately itemized in 2023 report) |

Business Model Canvas Data Sources

The Swiss Prime Site Business Model Canvas is informed by a combination of internal financial reports, market research on the Swiss real estate sector, and strategic analyses of competitor activities. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and market position.