Swiss Prime Site Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

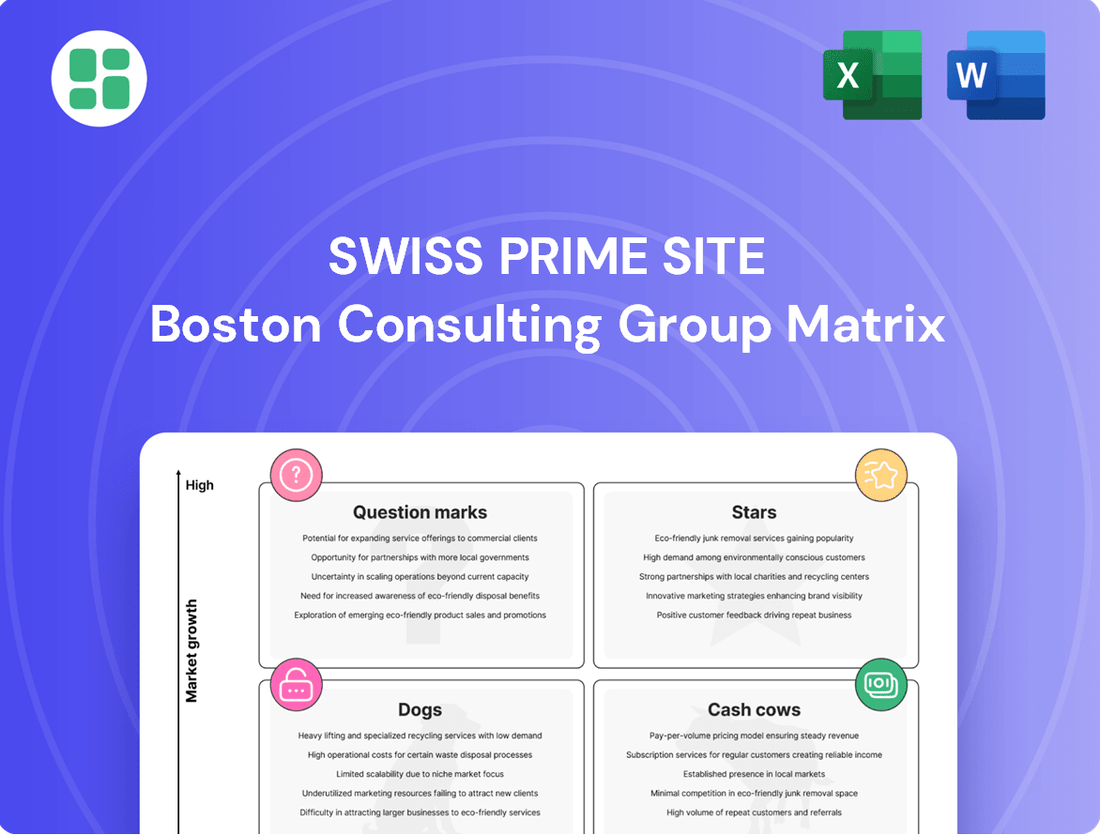

Curious about Swiss Prime Site's strategic positioning? Our BCG Matrix preview highlights key product categories, but the full report unlocks the complete picture of their Stars, Cash Cows, Dogs, and Question Marks.

Don't miss out on the detailed quadrant analysis and actionable insights that will empower your investment decisions. Purchase the full Swiss Prime Site BCG Matrix today for a comprehensive roadmap to maximizing their portfolio's potential.

Stars

Swiss Prime Site's prime sustainable commercial developments, like the Jelmoli building redevelopment and the YOND Campus, are significant growth drivers. These projects are strategically located in urban centers and cater to the robust demand for contemporary, eco-friendly office and mixed-use spaces.

The successful leasing of these new developments underscores Swiss Prime Site's strong market standing and substantial growth prospects. For instance, in 2023, the company reported a rental income of CHF 1.2 billion, with new developments contributing significantly to this figure, reflecting high occupancy rates and rental growth potential.

The growing real estate asset management segment of Swiss Prime Site is a clear Star in the BCG matrix. Its rapid expansion, notably fueled by the 2024 acquisition of Fundamenta Group, has propelled it into a high-growth, high-market-share position. By the close of 2024, assets under management reached an impressive CHF 13.3 billion, with projections indicating further growth to CHF 14 billion by the end of 2025.

Swiss Prime Site is seeing significant growth in its specialized logistics and infrastructure properties, positioning this segment as a Star. This strategic focus taps into the booming e-commerce sector and the increasing need for digital infrastructure, driving robust demand for these assets.

The company's investment in high-quality logistics and infrastructure properties is yielding strong returns, reflecting the market's appetite for efficient supply chain solutions. For instance, the Swiss logistics market has seen consistent growth, with e-commerce sales in Switzerland reaching approximately CHF 13.6 billion in 2023, a testament to the underlying demand drivers.

High-Growth Residential Investments via Asset Management

Swiss Prime Site Solutions' acquisition of Fundamenta significantly bolstered its residential real estate holdings, now representing roughly two-thirds of the acquired portfolio. This strategic move positions the company within a high-growth sector driven by Switzerland's robust and enduring demand for housing.

These managed residential assets are considered high-growth stars within the Swiss Prime Site BCG Matrix due to their strong market fundamentals. The company's expanded presence in this segment offers a pathway to capitalize on a resilient and appreciating asset class.

- Residential exposure increased to ~66% post-Fundamenta acquisition.

- Swiss residential market benefits from consistent, high demand.

- Strategic diversification into a resilient and appreciating asset class.

Urban Redevelopment Projects in Key Hubs

Major urban redevelopment projects, like the upcoming Grand Passage in Geneva, are pivotal for Swiss Prime Site. These initiatives are designed to transform prime urban locations, ensuring they meet the dynamic needs of the market.

These ambitious, large-scale projects demand significant capital outlay but are strategically focused on high-growth metropolitan areas. By breathing new life into existing properties, converting them into modern, versatile spaces, Swiss Prime Site is positioning itself for sustained market leadership and substantial future returns.

- Grand Passage Redevelopment: A flagship project in Geneva, aiming to create a modern, multi-functional hub.

- Targeted Investment: Focus on high-growth urban centers with strong potential for value creation.

- Market Position: Revitalizing sites to secure a leading position and drive future revenue growth.

- Financial Outlook: Projects are anticipated to generate significant returns, reflecting their strategic importance.

Swiss Prime Site's asset management segment, particularly following the 2024 acquisition of Fundamenta Group, has rapidly ascended to a Star position. This segment now manages CHF 13.3 billion in assets as of the close of 2024, with projections to reach CHF 14 billion by the end of 2025, indicating substantial market share and high growth. The strategic expansion into residential real estate, now comprising roughly two-thirds of the acquired portfolio, further solidifies its Star status due to consistent, high demand in the Swiss housing market.

| Segment | BCG Classification | Key Growth Drivers | 2024 AUM (CHF bn) | 2025 Proj. AUM (CHF bn) |

| Asset Management (incl. Residential) | Star | Fundamenta acquisition, strong residential demand | 13.3 | 14.0 |

| Logistics & Infrastructure | Star | E-commerce growth, digital infrastructure demand | N/A | N/A |

| Prime Commercial Developments | Star | Urban redevelopment, eco-friendly spaces | N/A | N/A |

What is included in the product

Highlights which Swiss Prime Site business units to invest in, hold, or divest based on market growth and share.

The Swiss Prime Site BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's position to alleviate strategic uncertainty.

Cash Cows

Swiss Prime Site's prime commercial office portfolio in Switzerland's key economic centers, such as Zurich and Geneva, functions as a classic Cash Cow. These properties consistently deliver substantial rental income, often boasting high occupancy rates, which translates into predictable and stable cash flows for the company.

As of the first half of 2024, Swiss Prime Site reported a rental income of CHF 235.6 million, with its office properties forming a significant portion of this revenue. The mature nature of these assets and their established tenant relationships mean that capital expenditure requirements are typically minimal, primarily focused on maintenance and minor upgrades rather than significant redevelopment.

Tertianum's established network of assisted living and healthcare facilities functions as a solid Cash Cow for Swiss Prime Site. This segment benefits from a stable, demographic-driven demand in a mature market, ensuring consistent revenue generation. In 2023, Tertianum reported a revenue of CHF 493 million, underscoring its significant contribution to the group's financial stability.

Long-term leased prime retail properties are indeed cash cows for Swiss Prime Site. These properties, situated in prime Swiss locations and leased to strong tenants, generate consistent and reliable rental income. For instance, as of the first half of 2024, Swiss Prime Site reported a rental income of CHF 225.4 million, with its retail portfolio playing a significant role in this stability.

These assets are less susceptible to the volatility often seen in the broader retail sector. Their appeal lies in their prime locations and the security provided by long-term contracts with reputable tenants, ensuring predictable cash flows with minimal need for additional marketing expenditure.

Core Property and Asset Management Services

Swiss Prime Site's core property and asset management services are the bedrock of its operations, acting as reliable cash cows. These established services, managing both the company's own extensive real estate portfolio and growing third-party mandates, consistently deliver stable, recurring fee-based income. This financial predictability stems from well-defined operational processes and a loyal, established client base.

These mature service lines are characterized by their operational efficiency, contributing a steady and dependable stream of revenue to Swiss Prime Site's overall financial performance. For instance, in 2024, the property management segment alone generated a significant portion of the company's fee and commission income, underscoring its role as a consistent profit generator.

- Stable Fee Income: The property and asset management divisions provide predictable, recurring revenue streams, crucial for financial stability.

- Operational Efficiency: Mature processes and a strong client base ensure these services operate with high efficiency, maximizing profitability.

- Portfolio Management: Managing both proprietary and third-party assets diversifies income sources within this core business.

- Contribution to Profitability: These segments consistently contribute a substantial portion to the company's overall earnings before interest, taxes, depreciation, and amortization (EBITDA).

Income-Generating Logistics and Storage Assets

Existing, well-utilized logistics and storage properties in established industrial zones function as Cash Cows for Swiss Prime Site. These assets generate reliable rental income through long-term leases with logistical and industrial tenants, benefiting from stable demand. Their consistent cash generation is further supported by relatively low ongoing capital expenditure requirements.

These properties, often situated in prime locations with established infrastructure, offer predictable revenue streams. For instance, Swiss Prime Site's portfolio typically includes a significant portion of logistics space that is consistently occupied, ensuring a steady flow of rental income. The maturity of these assets means they require less investment for growth compared to newer developments, thereby maximizing their cash-generating potential.

- Stable Income: These assets provide consistent rental income, often secured by long-term contracts with creditworthy tenants.

- Low Growth, High Share: While not experiencing rapid expansion, their established market position and consistent performance make them significant contributors to overall cash flow.

- Efficient Operations: Typically, these properties have lower operational costs and capital expenditure needs due to their established nature and high utilization rates.

- Portfolio Stability: They act as a foundational element of Swiss Prime Site's portfolio, offering a reliable base of earnings that can support investments in other business areas.

Swiss Prime Site's prime commercial office portfolio in key Swiss economic centers like Zurich and Geneva exemplifies a Cash Cow. These properties consistently generate substantial rental income, boasting high occupancy rates that translate into predictable and stable cash flows. As of the first half of 2024, Swiss Prime Site reported CHF 235.6 million in rental income, with its office segment being a significant contributor.

Tertianum's established assisted living and healthcare facilities also operate as a strong Cash Cow, benefiting from stable, demographic-driven demand in a mature market. In 2023, Tertianum generated CHF 493 million in revenue, underscoring its consistent contribution to the group's financial stability.

Long-term leased prime retail properties in prime Swiss locations, secured by strong tenants, are another key Cash Cow. These assets provide consistent and reliable rental income, with Swiss Prime Site reporting CHF 225.4 million in rental income for its retail portfolio in the first half of 2024, highlighting its stability.

The company's core property and asset management services act as reliable Cash Cows, delivering stable, recurring fee-based income from managing both proprietary and third-party mandates. This predictability arises from well-defined processes and an established client base, contributing significantly to the company's fee and commission income in 2024.

| Segment | Role in Portfolio | Key Characteristics | 2023/H1 2024 Data Point |

|---|---|---|---|

| Prime Office Portfolio | Cash Cow | High occupancy, stable rental income, minimal capex | H1 2024 Rental Income: CHF 235.6 million (significant portion from offices) |

| Tertianum (Healthcare) | Cash Cow | Stable demographic demand, consistent revenue | 2023 Revenue: CHF 493 million |

| Prime Retail Properties | Cash Cow | Long-term leases, prime locations, reliable income | H1 2024 Rental Income: CHF 225.4 million (significant portion from retail) |

| Property & Asset Management | Cash Cow | Recurring fee income, operational efficiency, loyal clients | Consistent contribution to fee and commission income in 2024 |

What You See Is What You Get

Swiss Prime Site BCG Matrix

The Swiss Prime Site BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no limitations – just the complete, professionally formatted strategic analysis ready for your immediate use. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the purchased file, enabling swift integration into your business planning and decision-making processes.

Dogs

Underperforming non-core portfolio properties are Swiss Prime Site's "Dogs" in the BCG Matrix. These are assets that are not central to the company's long-term strategy and are not performing well. For instance, in 2024, Swiss Prime Site actively streamlined and sold such properties, generating CHF 345 million in sales.

These "Dog" assets typically exhibit low market share and generate limited returns, often necessitating significant capital to maintain their viability. Their divestment is a strategic move to unlock capital that can be reinvested into more promising and core business areas.

Aging, energy-inefficient buildings within Swiss Prime Site's portfolio could be considered Dogs in a BCG Matrix analysis. These older properties often require substantial modernization to meet today's sustainability standards and tenant demands. For instance, a significant portion of older commercial real estate portfolios globally faces this challenge, with many buildings needing retrofits to improve energy performance and reduce operational costs.

These assets may find it difficult to attract high-paying tenants or achieve competitive rental rates, impacting their profitability. In 2024, the demand for energy-efficient and modern office spaces continued to rise, putting pressure on older, less sustainable buildings. This trend is likely to intensify as environmental regulations become stricter and tenant preferences shift towards ESG-compliant properties.

The high operating expenses associated with maintaining older, inefficient buildings, coupled with the considerable capital expenditure required for necessary upgrades, make them less attractive investments. This situation can lead to a cycle of declining value and increasing maintenance burdens for the owner, positioning them as potential Dogs in the portfolio.

Properties in stagnant secondary locations represent potential Dogs within the Swiss Prime Site BCG Matrix. These commercial assets, often found in areas with limited economic growth and persistent vacancy issues, struggle to attract and retain high-quality tenants. For instance, a portfolio segment showing a declining rental yield and occupancy rates below the sector average would signal a Dog.

Legacy Retail/Gastronomy Operations (Non-Real Estate)

Legacy retail and gastronomy operations, if not intrinsically linked to Swiss Prime Site's core real estate strategy, might represent 'Dogs' in a BCG matrix analysis. These ventures, such as former tenant operations or ancillary services not contributing to property value, could be resource drains.

For instance, while the Jelmoli building undergoes significant redevelopment, the original retail business associated with it may have exhibited low growth and a declining market share prior to its transformation. Such non-core activities can divert capital and management attention from more profitable, strategically aligned real estate projects.

- Low Growth & Market Share: Operations not contributing to prime property value or redevelopment efforts.

- Resource Drain: Divert capital and management focus from core real estate activities.

- Strategic Misalignment: Ventures outside the primary focus of real estate value enhancement.

- Potential Divestment: Consider divesting or restructuring to free up resources for core business.

Small, Fragmented Property Holdings

Small, fragmented property holdings within Swiss Prime Site's portfolio might be considered 'Dogs' in a BCG Matrix analysis. These assets often lack the scale to generate significant economies of scale in management or maintenance, leading to higher relative operating costs. For instance, a portfolio with numerous small retail units scattered across different towns might not benefit from centralized leasing or marketing efforts as effectively as a large, consolidated shopping center.

These holdings typically represent a low market share for Swiss Prime Site in their respective micro-locations and contribute minimally to the overall portfolio value. Their strategic leverage is also limited, meaning they do not significantly enhance the company's competitive position. During 2024, Swiss Prime Site continued its strategy of portfolio optimization, which often involves divesting non-core or underperforming assets to focus resources on higher-growth or more strategically important properties.

- Low Economies of Scale: Management and maintenance costs per square meter are often higher for smaller, dispersed properties.

- Limited Strategic Leverage: These assets typically do not provide significant bargaining power or market influence.

- Suboptimal Portfolio Contribution: Their individual value and income generation may not justify the management effort.

- Divestment Potential: Such properties are candidates for sale to streamline the portfolio and reinvest capital.

Swiss Prime Site's "Dogs" are properties that are not core to their strategy and underperform, like older, energy-inefficient buildings. These assets often have low rental yields and high maintenance costs, making them less attractive. In 2024, the company actively sold such properties, generating CHF 345 million to reinvest in more promising ventures.

These underperforming assets typically possess a low market share and yield minimal returns, often requiring substantial capital for upkeep. Divesting these "Dogs" allows Swiss Prime Site to free up capital for reinvestment in more strategic, high-growth areas of their portfolio.

Properties in stagnant secondary locations with persistent vacancy issues also fall into the "Dog" category. These assets struggle to attract quality tenants and maintain competitive rental rates, impacting their profitability. For example, a portfolio segment showing declining rental yields and below-average occupancy rates would be a clear indicator of a "Dog" asset.

Legacy retail or non-core operations, if not strategically linked to property value enhancement, can also be considered "Dogs." These ventures, such as ancillary services or former tenant operations, can drain resources and divert management attention from core real estate projects. The former retail business of Jelmoli, prior to its redevelopment, might be an example if it showed low growth and market share.

| Category | Characteristics | 2024 Impact/Strategy | Example |

| Underperforming Non-Core Properties | Low market share, low returns, high maintenance costs | Divestment to generate capital (CHF 345 million in sales) | Aging, energy-inefficient buildings |

| Stagnant Location Assets | Persistent vacancy, declining rental yields | Strategic optimization, potential divestment | Properties in secondary locations with limited economic growth |

| Non-Core Operations | Resource drain, strategic misalignment | Restructuring or divestment to focus on core real estate | Legacy retail or gastronomy ventures not linked to property value |

| Fragmented Holdings | Lack of economies of scale, higher operating costs | Portfolio streamlining, sale of non-core assets | Small, dispersed retail units |

Question Marks

Ambitious new urban development projects, like the 'YOND Campus' in Zurich, are prime examples of potential question marks in the Swiss Prime Site BCG Matrix. These ventures are situated in high-growth markets, promising substantial future impact, but they demand significant upfront capital before generating substantial revenue or market share.

The 'YOND Campus' project, for instance, involves a considerable investment to transform a former industrial site into a vibrant mixed-use district. Its success is contingent on attracting tenants and buyers in a competitive urban landscape, a process that typically takes several years to mature and prove profitability.

Swiss Prime Site's strategic exploration into emerging real estate niches, like specialized life sciences facilities or innovative mixed-use urban projects, positions these areas as potential Stars or Question Marks within a BCG framework. These sectors, while promising high growth, may currently represent a smaller market share for the company, demanding significant investment and specialized expertise to capture their full potential. For instance, the growing demand for flexible laboratory and research spaces, driven by advancements in biotechnology and pharmaceuticals, presents a clear opportunity.

Swiss Prime Site's commitment to advanced digitalization and PropTech integration, a key strategic focus, positions it in a dynamic but uncertain market segment. While the company is heavily investing in smart building technologies and digital services to enhance tenant experiences and operational efficiency, the long-term profitability and widespread market acceptance of these innovations remain to be fully proven. For instance, in 2023, Swiss Prime Site reported significant investments in digital transformation initiatives, aiming to future-proof its portfolio, but the direct impact on revenue growth from these specific advancements is still evolving.

New Investment Funds and Products in Asset Management

Swiss Prime Site Solutions is actively expanding its offerings by launching new, specialized investment funds and products. These new ventures are designed to tap into emerging, high-growth segments within the asset management landscape, with the goal of attracting diverse investor bases and exploring novel asset classes. For example, in 2024, the company might have introduced a fund focused on sustainable real estate technology, a sector projected for significant expansion.

These initiatives, while targeting promising growth areas, typically begin with a modest market share. The success of these new products hinges on robust marketing campaigns and substantial capital raising to build momentum and demonstrate strong investment returns. For instance, a new real estate debt fund launched in early 2024 might have initially raised CHF 50 million, aiming to prove its value proposition against established players.

- Targeted Growth: New funds focus on high-growth asset classes, aiming to capture emerging market opportunities.

- Initial Market Share: These products commence with a low market share, necessitating strategic market penetration efforts.

- Capital and Marketing Needs: Significant investment in marketing and capital raising is crucial for product traction and performance validation.

Circular Economy Initiatives in Construction

Swiss Prime Site is actively investing in circular economy principles for its construction and redevelopment projects. These initiatives focus on reducing carbon emissions and maximizing material reuse, reflecting a commitment to sustainability and anticipating future market demands. For instance, in 2024, the company continued its efforts to integrate recycled materials and design for deconstruction in its portfolio.

While these forward-thinking methods align with environmental goals, the complete financial advantages and broad market acceptance are still emerging. The implementation necessitates significant upfront capital and a shift in established construction processes, impacting immediate cost-benefit analyses.

- Significant Investment: Swiss Prime Site is channeling substantial capital into circular economy practices for new builds and renovations.

- Sustainability Goals: These initiatives directly support the company's commitment to reducing its environmental footprint and carbon emissions.

- Emerging Financial Benefits: The full economic advantages of these innovative methods are still being realized as the market matures.

- Process Adaptation: Widespread adoption requires overcoming initial investment hurdles and adapting existing construction workflows.

Question Marks in Swiss Prime Site's portfolio represent ventures with high growth potential but currently low market share. These require significant investment to develop and capture market position. Examples include ambitious urban developments like the 'YOND Campus' in Zurich and strategic entries into specialized real estate niches. The company's investment in digitalization and PropTech also falls into this category, with uncertain long-term profitability despite ongoing capital allocation.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | Key Challenge |

|---|---|---|---|---|

| 'YOND Campus' (Zurich) | High (Urban Development) | Low | Significant Upfront Capital | Tenant/Buyer Acquisition |

| Life Sciences Facilities | High (Biotech/Pharma Growth) | Low | Specialized Expertise & Capital | Market Penetration |

| Digitalization & PropTech | High (Industry Transformation) | Low to Moderate | Ongoing Capital Allocation | Proven Profitability & Adoption |

| New Specialized Funds (e.g., Sustainable Real Estate Tech) | High (Emerging Asset Classes) | Low | Marketing & Capital Raising | Demonstrating Returns |

| Circular Economy Practices | Moderate to High (Sustainability Trend) | Low | Process Adaptation & Capital | Economic Advantage Realization |

BCG Matrix Data Sources

Our Swiss Prime Site BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.