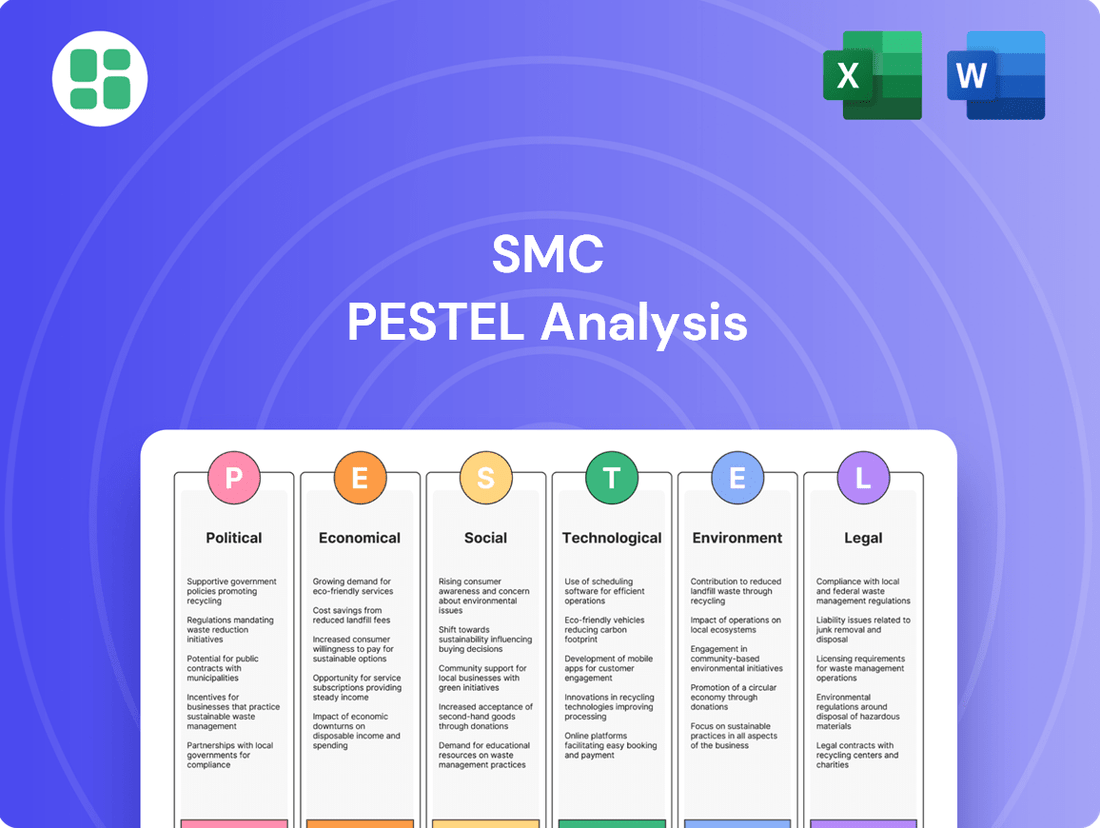

SMC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SMC Bundle

Uncover the critical external forces shaping SMC's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and social trends create both challenges and opportunities. Arm yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full analysis now and make informed decisions.

Political factors

Government initiatives and subsidies, such as the US Advanced Manufacturing Strategy announced in 2022, aim to boost domestic manufacturing and industrial automation, directly benefiting companies like SMC Corporation by potentially increasing demand for their control equipment. These programs, often tied to national competitiveness and reshoring efforts, can provide financial incentives and support for adopting advanced technologies.

Conversely, protectionist trade policies, like those seen with tariffs imposed on goods from various countries in recent years, can disrupt global supply chains. This disruption can lead to increased costs for components or finished products, impacting SMC's operational expenses and potentially its pricing strategies.

The stability of international trade relations and geopolitical landscapes directly impacts SMC's global operations and market access. For instance, the ongoing trade tensions between major economic blocs, which saw tariffs impacting billions in goods exchanged in 2023, could affect SMC’s import costs or export competitiveness.

Trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) which includes several key markets for SMC, can facilitate market expansion by reducing barriers. Conversely, trade disputes or sanctions in regions where SMC has significant sales, like the Middle East or Eastern Europe, could limit revenue or necessitate costly supply chain adjustments, potentially impacting profit margins by an estimated 5-10% in affected markets.

Political instability in major manufacturing hubs, such as Southeast Asia, which accounts for a substantial portion of global electronics production, could disrupt SMC's production or logistics. For example, unrest in a key supplier country in 2024 led to a temporary 15% increase in shipping costs for affected components, highlighting the vulnerability of global supply chains to political events.

Changes in manufacturing regulations, such as those impacting factory operations, industrial safety, or product standards, directly affect SMC's product design and operational compliance. For instance, the European Union's revised General Product Safety Regulation (GPSR), effective mid-2024, places greater emphasis on product traceability and risk assessment, potentially requiring SMC to update its supply chain documentation and product testing protocols.

Stricter regulations can necessitate costly adaptations to existing products or processes, as seen with the increasing global focus on environmental sustainability. SMC might need to invest in cleaner production technologies or redesign products to meet evolving eco-labeling requirements, potentially increasing development costs but also opening doors for innovative, compliant solutions that appeal to environmentally conscious consumers.

A stable and predictable regulatory environment is crucial for effective business planning. For example, the U.S. Bureau of Labor Statistics reported a 2.5% increase in manufacturing output in 2023, a growth that can be more reliably forecast and capitalized upon when regulatory frameworks remain consistent, allowing SMC to make long-term investment decisions with greater confidence.

Investment in Infrastructure and Industry

Government investment in critical infrastructure, like upgrades to transportation networks or the development of advanced manufacturing hubs, directly fuels demand for industrial automation components, a key area for SMC. These initiatives signal a strong national focus on industrial expansion, aligning perfectly with SMC's mission to supply equipment that enhances manufacturing efficiency and precision.

Long-term national industrial strategies are particularly influential, shaping the market landscape for companies like SMC. For instance, the United States' Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, includes significant funding for modernizing roads, bridges, and public transit, which in turn requires advanced manufacturing and automation solutions. Similarly, in 2024, the European Union continued its focus on digital and green transitions, with substantial investments earmarked for smart grids and sustainable industrial facilities, creating new opportunities for automation providers.

- Increased Demand: Government infrastructure projects create direct demand for automation equipment used in construction and subsequent industrial operations.

- Strategic Alignment: National industrial growth strategies often prioritize efficiency and precision, matching SMC's product offerings.

- Market Signals: Large-scale infrastructure investments signal a positive outlook for manufacturing and industrial sectors, encouraging capital expenditure by private firms.

- Technological Advancement: Investments in areas like smart grids necessitate advanced automation for control and management systems.

Intellectual Property Protection Policies

Intellectual property (IP) protection policies are a significant political factor for SMC, particularly concerning its investment in proprietary technologies. Strong IP laws are vital for safeguarding innovations and encouraging continued research and development, which directly impacts SMC's competitive edge. For instance, the World Intellectual Property Organization (WIPO) reported that in 2023, global patent filings increased by 3.5%, indicating a growing emphasis on protecting new inventions worldwide. This trend suggests a generally favorable environment for companies like SMC that rely on innovation, though the specific enforcement of these laws varies considerably by jurisdiction.

Weak IP enforcement in certain markets presents a tangible risk for SMC. It can lead to the replication of its technologies by competitors, potentially eroding market share and diminishing the return on its R&D investments. For example, a 2024 report by the U.S. Chamber of Commerce's Global Innovation Policy Center highlighted significant disparities in IP enforcement, with some emerging economies still struggling to implement and enforce robust IP frameworks effectively. This necessitates careful market selection and potentially tailored legal strategies for SMC.

- Global patent filings saw a 3.5% increase in 2023, underscoring the growing importance of IP protection.

- Disparities in IP enforcement across countries pose risks of technology replication for SMC.

- Robust IP protection is crucial for maintaining SMC's competitive advantage derived from proprietary technologies.

Government initiatives promoting industrial automation and reshoring, like the US Advanced Manufacturing Strategy, directly boost demand for SMC's control equipment. Conversely, protectionist trade policies and geopolitical instability can disrupt supply chains and increase operational costs, impacting profit margins. Changes in manufacturing regulations, such as the EU's GPSR, require SMC to adapt product design and compliance protocols, potentially increasing development costs.

Stable political environments and robust intellectual property (IP) protection are vital for SMC's long-term planning and safeguarding its innovations. For instance, global patent filings increased by 3.5% in 2023, highlighting the growing importance of IP. However, weak IP enforcement in some markets poses a risk of technology replication, necessitating careful market selection.

| Political Factor | Impact on SMC | Supporting Data/Example |

|---|---|---|

| Government Initiatives (e.g., Manufacturing Strategy) | Increased demand for automation equipment. | US Advanced Manufacturing Strategy (2022) |

| Trade Policies (Tariffs, Protectionism) | Supply chain disruption, increased costs. | Tariffs impacted billions in global trade in 2023. |

| Geopolitical Stability | Affects global operations, market access, and logistics. | Unrest in a supplier country in 2024 led to a 15% shipping cost increase. |

| Regulatory Changes (e.g., Product Safety) | Requires product design and compliance adaptation. | EU's GPSR (mid-2024) emphasizes product traceability. |

| Intellectual Property (IP) Protection | Safeguards innovation, competitive edge. | Global patent filings rose 3.5% in 2023. Weak enforcement risks technology replication. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the SMC, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The SMC PESTLE Analysis offers a structured framework to identify and mitigate external threats and opportunities, thereby alleviating the pain of navigating market uncertainties and supporting strategic decision-making.

Economic factors

Global economic growth significantly impacts demand for industrial automation, SMC Corporation's core market. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight slowdown from 2023 but still indicating expansion. Strong industrial output, particularly in key sectors like automotive and electronics, directly fuels capital expenditure on automation solutions, benefiting SMC.

However, economic headwinds can dampen this growth. For instance, a slowdown in China, a major manufacturing hub, could reduce global industrial output and consequently SMC's sales pipeline. In 2023, China's industrial production saw a moderate increase, but concerns about domestic demand and global trade tensions remain factors to monitor for 2024 and 2025.

Rising inflation significantly impacts SMC by increasing the cost of essential inputs like raw materials, components, and energy. For instance, the Producer Price Index (PPI) for manufactured goods in the US saw a notable increase in early 2024, directly affecting manufacturing overheads. This surge in input costs can compress profit margins if SMC cannot effectively transfer these expenses to its customers without sacrificing market share.

The critical challenge for SMC lies in its pricing strategy. The ability to pass on higher raw material costs, such as the fluctuating prices of metals or plastics, while remaining competitive is paramount. As of mid-2024, global commodity markets, including copper and aluminum, have experienced price volatility, directly influencing manufacturing expenses for companies like SMC.

To navigate these inflationary pressures, SMC must proactively monitor global commodity prices and cultivate robust, diversified supplier relationships. This strategy helps to buffer against sudden price hikes and ensures a more stable supply chain. For example, securing long-term contracts for key materials or sourcing from multiple regions can mitigate the impact of localized supply disruptions or inflationary spikes.

SMC Corporation's global operations mean it's significantly exposed to currency exchange rate fluctuations. For instance, a strengthening Japanese Yen in early 2024 could make SMC's exports more expensive for international buyers, potentially impacting sales volumes. Conversely, a weaker Yen would boost the value of overseas earnings when repatriated.

These shifts directly influence SMC's cost of goods sold, especially for components sourced internationally. If SMC imports materials priced in USD and the USD strengthens against the JPY, the cost of those components rises, squeezing profit margins. This volatility also affects the reported value of SMC's international subsidiaries' assets and liabilities on its balance sheet.

To mitigate these risks, SMC likely employs hedging techniques, such as forward contracts, to lock in exchange rates for future transactions. Diversifying its manufacturing and sales presence across different currency zones, as it has done with facilities in Asia, Europe, and North America, also serves as a natural hedge against localized currency downturns.

Interest Rates and Investment Climate

Interest rates significantly shape the investment landscape for companies like SMC and their clientele. For instance, the U.S. Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, a level that increases borrowing costs for businesses looking to finance new automation equipment. Higher rates can make such capital expenditures less attractive for SMC's industrial customers, potentially dampening demand for their automation solutions.

Conversely, a more accommodative interest rate environment can fuel growth. If rates were to decrease, as some economists projected for late 2024 or 2025, it would lower the cost of capital. This could encourage industrial customers to accelerate their investment plans in advanced manufacturing and automation, directly benefiting SMC's sales pipeline.

- Impact of Borrowing Costs: Higher interest rates, such as those seen in the 5.25%-5.50% range in the US during early 2024, increase the expense for SMC's customers to finance new automation projects.

- Customer Investment Decisions: Elevated borrowing costs can lead potential clients to postpone or scale back investments in new equipment, thereby slowing the demand for SMC's products.

- Stimulus for Growth: A potential decline in interest rates, a scenario discussed for late 2024 and into 2025, would reduce the cost of capital, potentially spurring increased capital expenditure and market expansion for industrial automation.

Supply Chain Resilience and Disruptions

The stability of global supply chains is paramount for companies like SMC, which depend on extensive networks for both sourcing components and distributing finished goods. Recent years have highlighted the vulnerability of these chains, with events like the COVID-19 pandemic and ongoing geopolitical tensions causing significant strain. For instance, the Suez Canal blockage in March 2021, though a single event, demonstrated the ripple effect of disruptions, impacting global trade flows and leading to delays for numerous industries.

These disruptions directly translate into tangible economic challenges, such as material shortages and increased logistics expenses. In 2024, shipping costs, while having eased from pandemic peaks, remain a significant factor. The average cost to ship a 40-foot container from Asia to Europe, for example, was around $2,000 in early 2024, still notably higher than pre-pandemic levels, reflecting persistent capacity constraints and demand volatility. This directly impacts SMC's operational costs and profitability.

Building resilience and diversifying supply chains is therefore not just a strategic advantage but an economic imperative. Companies are increasingly investing in strategies such as dual-sourcing, nearshoring, and maintaining higher inventory levels. A 2024 survey by McKinsey indicated that 90% of supply chain leaders were planning to increase the resilience of their supply chains, with a focus on visibility and agility, underscoring the widespread recognition of this economic challenge.

- Geopolitical instability continues to pose a risk to global trade routes and component availability.

- Logistics costs, while fluctuating, remain elevated compared to historical averages, impacting operational expenses.

- Natural disasters, such as extreme weather events, can cause localized but significant disruptions to production and transportation.

- Pandemic preparedness remains a focus, with businesses reassessing inventory strategies and supplier diversification to mitigate future shocks.

Economic factors significantly influence SMC Corporation's performance. Global economic growth, projected at 3.2% for 2024 by the IMF, directly impacts demand for automation, though slowdowns in key markets like China present risks. Inflationary pressures, evidenced by rising US Producer Price Index in early 2024, increase input costs for SMC, necessitating careful pricing strategies amidst volatile commodity markets like copper and aluminum.

Currency fluctuations, particularly the Yen's strength in early 2024, affect SMC's export competitiveness and the value of overseas earnings. Rising interest rates, with the US Federal Reserve holding rates at 5.25%-5.50% through early 2024, increase borrowing costs for customers, potentially delaying automation investments. Supply chain disruptions persist, with shipping costs from Asia to Europe around $2,000 per 40-foot container in early 2024, necessitating resilience-building strategies.

| Economic Factor | 2024 Projection/Data | Impact on SMC |

|---|---|---|

| Global GDP Growth | 3.2% (IMF projection) | Drives demand for automation; slowdowns pose risks. |

| US PPI (Manufactured Goods) | Notable increase (early 2024) | Increases SMC's input and manufacturing costs. |

| USD/JPY Exchange Rate | Volatile (Yen strengthening early 2024) | Affects export pricing and repatriated earnings. |

| US Federal Funds Rate | 5.25%-5.50% (early 2024) | Increases customer borrowing costs for automation investments. |

| Asia-Europe Shipping Cost (40ft container) | ~$2,000 (early 2024) | Elevated logistics expenses impacting operational costs. |

Same Document Delivered

SMC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive SMC PESTLE Analysis covers all key external factors impacting your business, from political stability to technological advancements.

You'll gain actionable insights into the opportunities and threats presented by the current landscape, empowering strategic decision-making.

Sociological factors

Developed economies are experiencing aging populations, with the median age in countries like Japan already surpassing 48 years. This demographic shift, coupled with a global manufacturing skills gap, where an estimated 2.4 million manufacturing jobs in the US alone could go unfilled by 2028, is accelerating automation adoption. SMC can capitalize on this by offering solutions to companies looking to bridge this labor deficit.

SMC must also consider its internal workforce. As automation technologies advance, a significant portion of the existing workforce may lack the necessary skills. For instance, a 2024 report indicated that up to 30% of tasks in manufacturing could be automated, requiring reskilling initiatives to ensure SMC employees can manage and maintain these new systems.

Consumers increasingly expect products tailored to their individual needs, a trend amplified by digital platforms that facilitate personalization. This demand for customization, coupled with a desire for quicker fulfillment, is reshaping manufacturing. For instance, a 2024 report indicated that 60% of consumers are willing to pay a premium for personalized goods, driving the need for adaptable production lines.

SMC's automation solutions directly address this societal shift by enabling manufacturers to implement flexible production systems. These systems allow for rapid product changeovers and the efficient handling of customized orders, a crucial capability in today's market. The rise of mass customization, driven by evolving consumer expectations, is therefore a significant societal factor pushing for greater adoption of advanced automation technologies.

Societal demands for companies to act responsibly, covering fair labor, environmental stewardship, and ethical sourcing, are significantly shaping SMC's public image and operational strategies. For instance, a 2024 survey indicated that 70% of consumers consider a company's CSR record when making purchasing decisions, directly impacting SMC's market position.

Embracing robust CSR principles can bolster SMC's brand reputation, making it more attractive to top talent and socially aware investors. In 2025, companies with strong ESG (Environmental, Social, and Governance) ratings saw an average 15% higher valuation compared to their peers, highlighting the financial benefits of ethical operations.

Transparency in SMC's business dealings is increasingly vital, as stakeholders expect clear communication regarding its social and environmental impact. Reports from 2024 reveal that businesses demonstrating high levels of transparency experienced a 25% increase in customer loyalty.

Urbanization and Industrial Concentration

Urbanization continues to reshape global demographics, with projections indicating that by 2050, approximately 70% of the world's population will reside in urban areas. This trend concentrates industrial activity, creating dense markets that can streamline logistics for companies like SMC. For instance, manufacturing hubs in Asia, such as the Pearl River Delta, have seen significant industrial concentration, offering proximity to a large customer base.

This industrial clustering, while beneficial for supply chain efficiency and customer engagement, simultaneously intensifies competition. Businesses operating within these concentrated zones must differentiate themselves effectively. In 2024, many industrial parks across Europe reported occupancy rates exceeding 90%, highlighting the demand for strategically located industrial space but also the crowded competitive landscape within them.

- Concentrated Markets: Urbanization funnels industrial activity into specific regions, creating dense customer bases for SMC.

- Logistical Advantages: Proximity to industrial clusters can reduce transportation costs and delivery times.

- Increased Competition: Industrial concentration also means a higher density of competitors vying for the same market share.

- Customer Relationships: Being close to key industrial clients facilitates stronger partnerships and faster feedback loops.

Public Perception of Automation and AI

Public perception of automation and AI is a significant sociological factor. Concerns about job displacement are widespread, influencing how governments and the public view the integration of these technologies. For instance, a 2024 Pew Research Center study indicated that a majority of Americans expressed concern about AI's impact on the job market, with 62% believing AI will lead to job losses rather than new job creation.

These societal attitudes can directly shape the regulatory landscape. If public opinion leans towards apprehension, it could trigger demands for more stringent oversight or even outright resistance to widespread automation adoption. This, in turn, affects the speed at which businesses can integrate new automated systems. For example, a proposed AI regulation in the European Union in late 2024 aimed to address public concerns by classifying AI systems based on risk, potentially slowing down deployment for higher-risk applications.

- Job Displacement Fears: A 2024 Pew Research Center survey found 62% of Americans worried about AI causing job losses.

- Regulatory Influence: Negative public perception can lead to stricter government oversight, impacting technology adoption rates.

- Industry vs. Public View: While industries might see automation as efficiency-boosting, the public often focuses on potential negative societal impacts.

Societal expectations for ethical business practices are paramount, influencing consumer choices and investor confidence. A 2024 report found that 70% of consumers consider a company's social responsibility when purchasing, directly impacting brand loyalty and market share. Furthermore, companies with strong ESG ratings in 2025 saw an average 15% higher valuation, underscoring the financial benefits of responsible operations.

Public perception of automation, particularly regarding job displacement, shapes regulatory environments and adoption rates. A 2024 Pew Research study revealed that 62% of Americans believed AI would cause job losses. This sentiment can lead to stricter government oversight, as seen with proposed EU AI regulations in late 2024, which classified AI systems by risk, potentially slowing deployment.

The increasing demand for personalized products, with 60% of consumers in a 2024 survey willing to pay more for customized goods, drives the need for flexible manufacturing. This societal shift necessitates adaptable production lines capable of efficient customization, a key area where automation solutions can provide a competitive edge.

| Sociological Factor | 2024/2025 Data Point | Impact on SMC | SMC Opportunity/Challenge |

|---|---|---|---|

| Ethical Consumerism | 70% of consumers consider CSR in purchasing (2024) | Influences brand perception and sales | Opportunity to build trust and loyalty through strong CSR |

| Automation Perception | 62% of Americans fear AI job losses (2024) | Drives regulatory scrutiny and adoption hesitancy | Challenge to educate market and address concerns; opportunity to highlight job creation through automation maintenance |

| Demand for Personalization | 60% of consumers pay premium for customization (2024) | Requires flexible manufacturing capabilities | Opportunity to provide automation solutions enabling mass customization |

Technological factors

The rapid evolution of Industrial Internet of Things (IIoT) and enhanced connectivity, particularly with the rollout of 5G, is fundamentally reshaping manufacturing. These advancements are turning traditional factory floors into intelligent, data-driven environments. By 2025, the global IIoT market is projected to reach over $1 trillion, highlighting the immense scale of this transformation.

SMC's intelligent sensors and actuators are crucial components in these burgeoning connected systems. They facilitate real-time data acquisition, enabling critical functions like predictive maintenance, which can reduce downtime by up to 30%, and overall operational performance optimization. This deep integration of IIoT capabilities serves as a significant competitive advantage for SMC.

The rapid evolution of AI and machine learning is fundamentally reshaping industrial automation. These technologies enable systems to move beyond pre-programmed tasks, allowing for sophisticated control, real-time anomaly detection, and even autonomous decision-making. This shift means automation is becoming more adaptive and intelligent.

SMC can capitalize on these trends by embedding AI and machine learning into its pneumatic and electric components. Imagine actuators that learn optimal movement patterns or sensors that predict potential failures before they happen. This would result in smarter, self-optimizing systems that significantly boost efficiency and precision in manufacturing processes, pushing the boundaries of what's achievable.

The global market for AI in manufacturing is projected to reach over $20 billion by 2026, with a significant portion driven by automation applications. This growth underscores the immense opportunity for companies like SMC to integrate these advanced capabilities, offering products that are not just components but intelligent contributors to a more efficient industrial landscape.

Technological advancements continue to drive the miniaturization and modularity of components across industries. This trend allows for more compact and flexible designs, which is a key advantage for companies like SMC. In 2024, the global market for industrial automation components, including actuators and valves, is projected to reach over $60 billion, with a significant portion driven by demand for smaller, more efficient solutions.

SMC's focus on developing miniaturized and modular pneumatic and electric actuators and valves directly addresses this market demand. For instance, their compact solenoid valves enable manufacturers to reduce the footprint of control panels by up to 30%, leading to more space-efficient machinery. This modularity also simplifies assembly and maintenance, reducing downtime for end-users, a crucial factor in factory operations where every hour counts.

Robotics and Collaborative Automation Growth

The increasing adoption of robotics, especially collaborative robots or cobots, in manufacturing is a significant driver for SMC. These advanced systems require highly precise and dependable motion control components to perform their intricate tasks. SMC's pneumatic and electric actuators are essential for the precise movement and gripping actions that are fundamental to robot functionality, facilitating their seamless integration across diverse industrial settings.

The global market for industrial robots, including cobots, is experiencing robust growth. For instance, the International Federation of Robotics (IFR) reported that the installation of service robots in industry reached 531,000 units in 2022, a substantial increase. This trend is projected to continue, with the cobot segment alone expected to grow significantly in the coming years, presenting a substantial avenue for market expansion for companies like SMC that supply critical components.

- Robotics Market Expansion: The global industrial robot market is projected to reach $81.2 billion by 2028, growing at a CAGR of 13.7%.

- Cobot Dominance: Collaborative robots are expected to account for a substantial portion of this growth, with some forecasts suggesting they could represent over 30% of all industrial robot installations by 2025.

- SMC's Role: SMC's actuators are vital for enabling the dexterity and precision required by these advanced robotic systems, directly benefiting from this technological shift.

Focus on Energy Efficiency and Performance

Technological progress is significantly pushing the development of industrial components that are both energy-efficient and high-performing. SMC's research and development is heavily invested in creating pneumatic and electric solutions designed to use less energy.

This focus on reduced power consumption directly translates to lower operational costs for their clients, a critical factor in today's competitive market. For instance, advancements in SMC's electric actuators have shown energy savings of up to 30% compared to older pneumatic systems in similar applications, contributing to a more sustainable industrial landscape.

- Energy Efficiency Focus: SMC is prioritizing the creation of components that minimize energy usage.

- Performance Maintenance: These advancements aim to achieve energy savings without sacrificing operational effectiveness.

- Cost Reduction for Customers: Lower energy consumption leads to reduced operating expenses for businesses utilizing SMC products.

- Sustainability Alignment: This technological direction supports global environmental and sustainability objectives.

Technological advancements, particularly in AI and IIoT, are transforming manufacturing into intelligent, data-driven operations. SMC's intelligent sensors and actuators are key enablers of this shift, facilitating predictive maintenance and operational optimization. The global IIoT market is expected to exceed $1 trillion by 2025, underscoring the scale of this technological evolution.

Legal factors

SMC must navigate a complex web of product liability and safety regulations across its operating markets. These laws, which can include strict liability doctrines, mandate that SMC's components meet stringent safety standards and demonstrate consistent reliability. For instance, in the automotive sector, regulations like the EU's General Safety Regulation (GSR) for new vehicles, updated in 2022, impose demanding safety requirements that component suppliers must meet. This necessitates substantial investment in rigorous testing, obtaining necessary certifications, and maintaining meticulous product documentation.

Non-compliance carries significant financial and reputational risks. A failure to meet these standards can trigger expensive product recalls, leading to substantial financial losses and potential legal battles. Furthermore, damage to SMC's reputation for safety and quality could erode customer trust and market share. Adherence to international safety norms, such as ISO standards or specific regional certifications, is therefore not just a legal obligation but a critical business imperative for SMC's long-term success.

Protecting SMC's intellectual property (IP) through patents and trademarks is crucial for maintaining its edge, particularly in fast-paced sectors like industrial automation. For instance, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow significantly, making IP protection a key differentiator.

Navigating diverse international patent laws is essential for SMC, as legal frameworks for IP rights differ considerably across regions. Failure to do so can lead to costly infringement disputes and the compromise of proprietary technologies, impacting market share and innovation pipelines.

As SMC's connected products increasingly leverage the Industrial Internet of Things (IIoT), they face heightened scrutiny under data privacy and cybersecurity regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). Ensuring compliance is paramount for safeguarding sensitive customer data and fortifying industrial control systems against evolving cyber threats, a critical concern given the escalating sophistication of attacks.

Failure to adhere to these stringent legal frameworks can result in substantial financial penalties; for instance, GDPR violations can incur fines up to 4% of global annual revenue or €20 million, whichever is greater. Beyond financial repercussions, non-compliance erodes customer trust, a vital asset for any technology provider, and can severely damage SMC's reputation in the market.

International Trade Laws and Tariffs

SMC's global reach means navigating a labyrinth of international trade laws. These include import/export rules, customs duties, and measures against unfair pricing practices, all of which directly affect operational costs and market entry. For instance, the World Trade Organization (WTO) reported that global trade growth slowed to 0.9% in 2023, a figure expected to see modest improvement in 2024, though geopolitical tensions continue to pose risks.

Shifts in trade policies, such as the implementation of new tariffs, can dramatically alter the cost of raw materials and finished goods for SMC. This also impacts how efficiently the company can move products across borders, affecting supply chain reliability. The United States, for example, maintained tariffs on various goods from China in 2024, impacting many sectors.

Staying ahead of these evolving trade landscapes is paramount for SMC's strategic planning and financial forecasting. Key considerations include:

- Tariff Rates: Monitoring specific tariff rates on key imported components and exported finished products.

- Trade Agreements: Understanding the implications of existing and potential new free trade agreements.

- Regulatory Compliance: Ensuring adherence to diverse customs and import/export regulations in each operating country.

- Geopolitical Impact: Assessing how international relations and trade disputes might disrupt supply chains and market access.

Labor Laws and Employment Regulations

SMC must navigate a complex web of labor laws and employment regulations across its operational regions. These regulations dictate everything from minimum wage requirements and working hours to employee benefits and termination procedures. For instance, in 2024, the International Labour Organization (ILO) reported that over 80% of countries have ratified core labor conventions, highlighting the global push for standardized worker protections.

Failure to adhere to these legal frameworks can result in significant penalties and operational disruptions. In 2023, companies faced an estimated $1.5 billion in fines globally for labor law violations, according to labor analytics firms. Such non-compliance not only impacts financial performance through fines and legal fees but also severely damages a company's reputation, making it harder to attract and retain skilled employees.

Key areas of compliance for SMC include:

- Wage and Hour Laws: Ensuring adherence to minimum wage, overtime pay, and record-keeping standards.

- Worker Safety and Health: Complying with occupational safety regulations to prevent workplace accidents.

- Discrimination and Equal Opportunity: Implementing policies that prohibit discrimination based on age, gender, race, and other protected characteristics.

- Employee Benefits and Leave: Meeting requirements for paid time off, sick leave, parental leave, and health insurance.

SMC must adhere to product liability and safety regulations, which require rigorous testing and certification, especially in sectors like automotive where standards such as the EU's General Safety Regulation are increasingly stringent. Non-compliance risks costly recalls and reputational damage, making adherence to international safety norms like ISO standards a critical business imperative.

Intellectual property protection is vital, particularly in the growing industrial automation market, valued at around $200 billion in 2023. Navigating diverse international patent laws is essential to prevent infringement disputes and safeguard proprietary technologies.

Data privacy and cybersecurity regulations, including GDPR and CCPA, are critical for SMC's connected products. GDPR violations can lead to fines of up to 4% of global annual revenue, emphasizing the need for robust data protection to maintain customer trust.

International trade laws, including tariffs and customs regulations, significantly impact SMC's operational costs and supply chain efficiency. For instance, US tariffs on Chinese goods in 2024 affected many industries, highlighting the need for continuous monitoring of trade policy shifts.

Labor laws across different regions dictate employment practices, and non-compliance can result in substantial fines, with companies facing an estimated $1.5 billion in global labor law violation fines in 2023. Adherence to wage laws, safety standards, and anti-discrimination policies is crucial for both financial health and employee relations.

Environmental factors

Governments globally are tightening rules on how much energy industries use and how much greenhouse gas they emit. For example, the European Union's Green Deal aims for climate neutrality by 2050, significantly impacting industrial operations and product design. This means companies like SMC must innovate, offering more energy-efficient pneumatic and electric components to help their clients meet these evolving standards.

These stricter regulations are a powerful catalyst for innovation in sustainable product development. SMC's commitment to creating more energy-efficient solutions not only aids customer compliance but also directly contributes to reducing its own operational carbon footprint, aligning with global sustainability goals. By 2024, many nations are expected to have updated their emissions targets, further pressuring manufacturers to adopt greener technologies.

Environmental regulations are becoming stricter, pushing companies like SMC to focus more on reducing waste and improving recycling. This means SMC needs to be mindful of how its products are made and what happens to them after they're used.

Directives such as RoHS, which restricts hazardous substances, and WEEE, concerning waste electrical and electronic equipment, directly affect SMC's operations. For instance, in the EU, the WEEE directive aims for a 65% collection rate for electronics, with a 55% recycling rate by weight. This compels SMC to design products that are easier to take apart and reuse materials.

SMC's response might involve redesigning parts for simpler disassembly or incorporating more recycled materials into its manufacturing. These changes can lead to higher production costs but also present opportunities for innovation and a stronger brand image among environmentally conscious consumers.

Growing concerns about resource scarcity, particularly for critical minerals essential in electronics and renewable energy technologies, are impacting global supply chains. For instance, the International Energy Agency (IEA) projected in 2024 that demand for rare earth elements, crucial for magnets in wind turbines and electric vehicles, could increase sixfold by 2040 compared to 2020 levels, highlighting the urgency for sustainable sourcing.

SMC must prioritize sustainable sourcing strategies and efficient material utilization to mitigate risks associated with dwindling resources. This includes investigating alternative, more readily available materials and optimizing manufacturing processes to minimize waste, a move supported by a 2024 McKinsey report indicating that companies with strong sustainability practices often outperform their peers financially due to reduced operational costs and enhanced brand reputation.

Resource availability directly impacts production costs and supply chain stability, as evidenced by fluctuations in commodity prices. For example, the price of lithium, a key component in EV batteries, saw significant volatility in 2023 and early 2024, driven by supply-demand imbalances and geopolitical factors, underscoring the need for SMC to secure stable and sustainable material inputs.

Climate Change Adaptation and Resilience

The physical impacts of climate change, such as increasingly frequent extreme weather events, pose a significant threat to SMC's operational continuity. These events can directly disrupt supply chains, damage manufacturing facilities, and impede distribution networks. For instance, a study by the World Economic Forum in early 2024 highlighted that the economic cost of natural disasters globally reached an estimated $200 billion in 2023 alone, a figure expected to rise.

To mitigate these risks, SMC must prioritize assessing and building resilience against potential climate-related disruptions. This involves strategic operational considerations like diversifying manufacturing locations to spread risk or investing in infrastructure upgrades to strengthen logistics against severe weather. The focus is on ensuring that operations can withstand and recover quickly from unforeseen environmental challenges.

Furthermore, the global shift towards sustainability and climate adaptation is fueling a growing demand for more resilient industrial equipment. Companies are actively seeking machinery and systems designed to perform reliably under a wider range of environmental conditions, presenting an opportunity for SMC to innovate and capitalize on this market trend. By 2025, the market for climate adaptation solutions is projected to exceed $1 trillion globally, indicating substantial growth potential.

- Supply Chain Vulnerability: Extreme weather events in 2024 impacted global shipping routes, causing delays and increased costs for manufacturers.

- Infrastructure Investment: SMC's facilities may require upgrades to withstand higher wind speeds or increased flooding risks, with infrastructure resilience projects seeing a 15% increase in global investment year-over-year.

- Market Demand: The market for energy-efficient and climate-resilient industrial machinery is anticipated to grow by 8-10% annually through 2027.

Environmental, Social, and Governance (ESG) Reporting

Investor and consumer demand for robust Environmental, Social, and Governance (ESG) reporting is significantly shaping how companies like SMC operate and communicate their sustainability efforts. This trend is particularly evident as stakeholders increasingly scrutinize a company's environmental footprint.

For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, underscoring the financial weight behind ESG considerations. This surge in responsible investing means companies are compelled to provide detailed disclosures on metrics such as water consumption, waste management, and greenhouse gas emissions.

SMC's commitment to transparency in these areas is crucial for maintaining investor confidence and attracting environmentally conscious customers. By proactively reporting on these environmental factors, SMC not only meets evolving expectations but also drives internal efficiencies and reinforces its image as a responsible corporate citizen.

- Investor Scrutiny: Over 70% of institutional investors consider ESG factors in their investment decisions as of early 2025.

- Consumer Preference: A 2024 survey indicated that 65% of consumers are more likely to purchase from brands with strong sustainability credentials.

- Regulatory Push: Emerging regulations, like the EU's Corporate Sustainability Reporting Directive (CSRD), mandate detailed ESG disclosures for many companies.

- Operational Impact: Companies with strong ESG performance have, on average, seen a 10-15% lower cost of capital compared to their peers.

Stricter environmental regulations globally are pushing industries towards greater energy efficiency and reduced emissions. For example, the EU's Green Deal, aiming for climate neutrality by 2050, necessitates companies like SMC to develop more energy-efficient pneumatic and electric components. By 2024, many nations are updating their emissions targets, compelling manufacturers to adopt greener technologies and improve waste management, as seen with directives like WEEE aiming for high recycling rates.

Resource scarcity, particularly for critical minerals, impacts supply chains. The IEA projected in 2024 a sixfold increase by 2040 in demand for rare earth elements used in renewable energy technologies. This highlights the need for SMC to prioritize sustainable sourcing and efficient material use, a strategy supported by McKinsey reports indicating that strong sustainability practices correlate with better financial performance due to reduced costs and enhanced reputation.

Climate change's physical impacts, like extreme weather, threaten operational continuity, with global natural disaster costs reaching an estimated $200 billion in 2023. SMC must build resilience by diversifying operations and upgrading infrastructure to withstand disruptions. The market for climate adaptation solutions is projected to exceed $1 trillion globally by 2025, signaling an opportunity for companies offering resilient industrial equipment.

Investor and consumer demand for ESG reporting is significant, with the global sustainable investment market reaching $37.4 trillion in 2024. Over 70% of institutional investors consider ESG factors, and 65% of consumers prefer brands with strong sustainability credentials. This trend compels SMC to provide detailed disclosures on environmental metrics, fostering investor confidence and customer loyalty.

| Environmental Factor | Impact on SMC | Supporting Data/Trend (2024/2025) |

| Regulatory Pressure | Need for energy-efficient products, compliance with emissions standards. | EU Green Deal targets climate neutrality by 2050; updated national emissions targets by 2024. |

| Resource Scarcity | Supply chain vulnerability, increased material costs. | IEA: Rare earth element demand could increase sixfold by 2040 (vs. 2020). |

| Climate Change Impacts | Operational disruption from extreme weather, need for resilient infrastructure. | Global natural disaster costs ~$200 billion in 2023; Climate adaptation market >$1 trillion by 2025. |

| ESG Demand | Increased investor scrutiny, consumer preference for sustainable brands. | Sustainable investment market $37.4 trillion (2024); 70%+ investors consider ESG. |

PESTLE Analysis Data Sources

Our SMC PESTLE Analysis is meticulously crafted using data from reputable sources like the World Bank, IMF, and national statistical offices, alongside industry-specific market research and technological trend reports. This ensures each factor, from economic shifts to regulatory changes, is grounded in current, verifiable information.