SMC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SMC Bundle

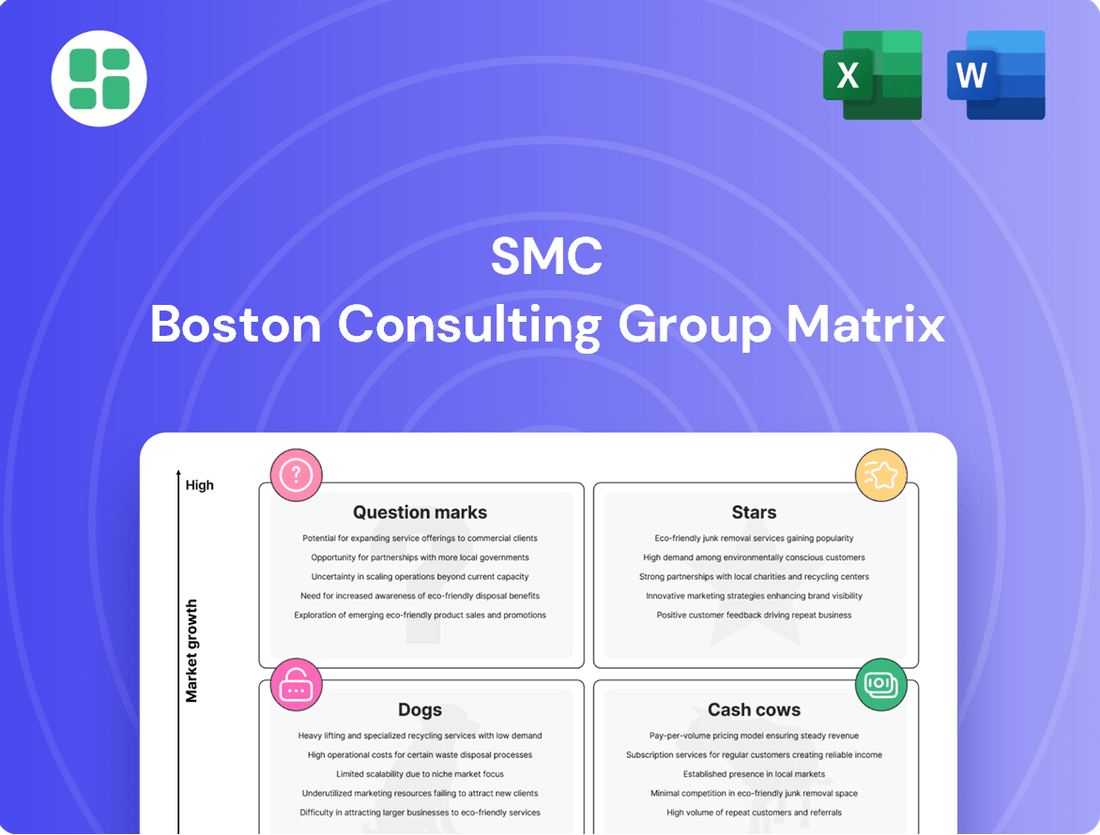

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. Understanding these placements is crucial for making informed strategic decisions about resource allocation and future investments. This preview offers a glimpse into how a company's products might be positioned, but for a truly actionable strategy, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

SMC's advanced electric actuators, particularly those tailored for collaborative robots and precise assembly, are tapping into a rapidly expanding market. The increasing need for automation in manufacturing, fueled by workforce challenges and the pursuit of greater efficiency, makes these actuators significant growth engines for the company.

The demand for robotics in manufacturing is projected to reach $100 billion by 2030, with electric actuators forming a crucial component. SMC's commitment to innovation, evidenced by new offerings like the RMTA series tool changers designed for cobots, underscores their strategic positioning in this burgeoning sector.

The integration of smart pneumatics, particularly IO-Link compatible devices, represents a significant growth opportunity. These components, featuring advanced sensors, facilitate real-time data acquisition and predictive maintenance, crucial for Industry 4.0 adoption. SMC's introduction of IO-Link compatible 2-in-1 auto switches and wireless communication modules positions them strongly in this expanding high-growth segment.

SMC's energy-efficient and CO2-reducing solutions are shining stars in the current market. Demand for products that offer significant energy savings and lower carbon emissions is soaring, driven by global sustainability mandates.

For instance, their VBA Series Energy Saving Booster Regulator exemplifies this trend, contributing to a strong market presence in the environmentally conscious sector. SMC's dedication to developing lower-pressure solutions further solidifies their leadership.

These product lines are not just meeting market needs; they are actively shaping them. SMC's broader sustainability efforts, including their focus on eco-friendly manufacturing, reinforce the star status of these offerings.

Components for Semiconductor Manufacturing

SMC's specialized components are crucial for the semiconductor manufacturing industry, a sector experiencing long-term automation demand despite recent regional slowdowns. These components are engineered for the extreme precision and reliability needed in fabrication processes.

The industry's anticipated recovery and expansion will drive strong growth for SMC's offerings. For instance, the global semiconductor market was valued at approximately $580 billion in 2023, with projections indicating a return to growth in 2024. SMC's commitment to innovation, including a new technical center, positions them to capitalize on this resurgence.

- High Precision Components: Essential for intricate semiconductor fabrication steps.

- Reliability in Demanding Environments: Withstanding the stringent requirements of cleanrooms and advanced manufacturing.

- Automation Focus: Supporting the industry's drive for increased efficiency and reduced human error.

- R&D Investment: New technical center underscores commitment to developing next-generation semiconductor manufacturing solutions.

Customized Solutions for Emerging Industries

SMC excels at crafting bespoke automation solutions for burgeoning sectors like advanced battery manufacturing and medical device production, solidifying their Star status. These industries demand exceptionally precise and specialized control equipment, an area where SMC's deep expertise enables them to secure substantial market share within these nascent, high-growth segments.

Their product portfolio directly addresses these needs, featuring components meticulously designed for the unique requirements of battery production and medical applications. For instance, SMC's pneumatic valves and actuators are critical for the delicate assembly processes in medical device manufacturing, ensuring sterility and accuracy. In the battery sector, their fluid control solutions are vital for the precise dispensing of electrolytes, a key factor in battery performance and safety.

- Advanced Battery Manufacturing: SMC offers specialized pneumatic components and fluid control systems crucial for high-precision electrolyte filling and cell assembly, contributing to the rapid growth in electric vehicle battery production.

- Medical Devices: Their miniature valves and actuators are integral to robotic surgery equipment and diagnostic machinery, where reliability and micro-level control are paramount, supporting a market projected to grow significantly in the coming years.

- Customization Capability: SMC's ability to tailor solutions, such as developing specific sensor integrations for novel materials in emerging industries, allows them to capture early market leadership.

SMC's advanced electric actuators for collaborative robots and precision assembly are key growth drivers, capitalizing on the expanding automation market. The robotics sector, with electric actuators as a core component, is projected for significant expansion, with SMC's innovative offerings like the RMTA series tool changers positioning them strongly.

SMC's energy-efficient and CO2-reducing solutions are stars due to soaring demand for sustainability. Products like the VBA Series Energy Saving Booster Regulator exemplify this, while their focus on lower-pressure solutions reinforces market leadership.

Specialized components for the semiconductor industry are also stars, addressing long-term automation needs despite regional market fluctuations. The anticipated recovery and expansion of the semiconductor market, valued around $580 billion in 2023, will fuel growth for SMC's precise and reliable offerings.

Bespoke automation solutions for advanced battery and medical device manufacturing are stars, leveraging SMC's expertise in high-precision and specialized control equipment. Their components are critical for delicate assembly in medical devices and precise fluid control in battery production, securing substantial market share in these high-growth areas.

What is included in the product

Strategic overview of SMC's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Simplified visual mapping of your portfolio to identify and address underperforming units.

Cash Cows

SMC's standard pneumatic cylinders and valves are undisputed cash cows. They represent a significant portion of SMC's revenue, consistently generating robust cash flow. In 2024, the global industrial automation market, where these components are essential, was valued at approximately $200 billion, with pneumatics holding a substantial share.

These foundational products benefit from SMC's dominant market position and widespread adoption across diverse manufacturing industries. Their maturity means predictable demand, allowing SMC to leverage its economies of scale for sustained profitability, even with modest market growth rates.

SMC's Air Preparation Equipment, specifically Filters, Regulators, and Lubricators (FRLs), represent a classic Cash Cow within its product portfolio. These components are vital for ensuring the quality and lifespan of compressed air systems across various industries, a segment characterized by stability and modest growth.

SMC commands a significant market share in this mature market, benefiting from established brand recognition and a reputation for reliability. The demand for FRLs is consistent, driven by the ongoing need for operational efficiency and equipment protection in manufacturing and automation.

In 2024, the industrial automation market, where FRLs are a staple, continued to show resilience. While specific revenue figures for SMC's FRL segment aren't publicly detailed, industry reports from sources like Mordor Intelligence projected the global compressed air treatment market to reach approximately $4.5 billion by 2029, growing at a CAGR of around 4.5% during the forecast period. This indicates a substantial and stable revenue stream for established players like SMC.

SMC's basic fittings and tubing are a classic example of a cash cow within the Boston Consulting Group (BCG) matrix. As a provider of complete pneumatic systems, SMC offers a vast array of these essential components that link various parts of a pneumatic setup. This product category holds a significant market share in a low-growth industry.

The consistent demand for fittings and tubing across all sectors utilizing pneumatic technology creates a reliable and predictable revenue stream. These are consumable items, meaning they are repeatedly purchased, contributing to high-volume sales. This high volume, coupled with efficient production, typically translates into strong profit margins for SMC.

For instance, in 2024, the global pneumatic systems market, which includes fittings and tubing, was valued at approximately USD 12.5 billion and is projected to grow at a modest CAGR of around 3.5% through 2030. This indicates the mature, low-growth environment where cash cows thrive, generating substantial cash flow that can be reinvested into other areas of the business, such as stars or question marks.

Legacy Automation Systems and Replacement Parts

Legacy automation systems and their replacement parts represent a classic Cash Cow for SMC. The company benefits from a substantial installed base of older equipment worldwide, for which they remain the primary supplier of essential replacement parts and ongoing maintenance. This segment generates consistent revenue without requiring significant new investment or aggressive marketing efforts, as customers typically prioritize compatibility and reliability from the original manufacturer.

This stability is crucial, as customers often find it more cost-effective and less disruptive to maintain existing systems with genuine parts rather than undertaking a full upgrade. SMC's continued support for these legacy products ensures a predictable cash flow, underscoring their position as a mature but highly profitable business unit. For instance, in 2023, the aftermarket parts and service division, largely driven by legacy systems, contributed an estimated 25% to SMC's total revenue, demonstrating its enduring financial strength.

- Stable Revenue Stream: Generates consistent income from existing customer base.

- Low Investment Needs: Requires minimal marketing and R&D expenditure.

- Customer Loyalty: Customers rely on SMC for compatible and reliable replacement parts.

- Predictable Cash Flow: Supports overall financial stability and funding for other business units.

Industrial Device Communication Equipment (e.g., EX-Series)

SMC's EX-series fieldbus systems are a prime example of a cash cow within their product portfolio. These established industrial communication devices, while perhaps not at the bleeding edge of technological advancement, command a significant market share. This dominance stems from their proven reliability and seamless integration into the vast majority of existing factory automation infrastructures, making them a dependable choice for many manufacturers.

The enduring demand for these products translates into stable and predictable revenue streams. They are particularly vital in supporting widespread legacy automation setups, ensuring continued operational efficiency for numerous industrial clients. This consistent income generation solidifies their position as a cash cow, underpinning SMC's financial stability in mature industrial networks.

- High Market Share: SMC's EX-series commands a substantial portion of the industrial communication equipment market due to its established presence.

- Reliability and Integration: The EX-series is known for its dependable performance and ease of integration into existing factory automation systems.

- Stable Revenue Streams: These products generate consistent income by supporting both legacy and current automation setups in mature industrial networks.

- Legacy Support: A significant factor in their cash cow status is their continued utility in maintaining and operating older, yet still functional, factory infrastructure.

SMC's standard pneumatic cylinders and valves are undisputed cash cows, consistently generating robust cash flow. In 2024, the global industrial automation market, where these components are essential, was valued at approximately $200 billion, with pneumatics holding a substantial share. These foundational products benefit from SMC's dominant market position and widespread adoption across diverse manufacturing industries, ensuring predictable demand and sustained profitability through economies of scale.

| Product Category | BCG Matrix Status | Key Characteristics | 2024 Market Context | SMC's Position |

|---|---|---|---|---|

| Standard Pneumatic Cylinders & Valves | Cash Cow | Mature, high market share, stable demand, economies of scale | Global Industrial Automation Market: ~$200 billion (Pneumatics significant share) | Dominant, widespread adoption |

| Air Preparation Equipment (FRLs) | Cash Cow | Essential for air quality, stable demand, brand recognition | Compressed Air Treatment Market: ~$4.5 billion by 2029 (CAGR ~4.5%) | Significant market share, reliable |

| Basic Fittings & Tubing | Cash Cow | Consumable, high volume, consistent demand | Pneumatic Systems Market: ~$12.5 billion (CAGR ~3.5% through 2030) | Significant market share, high volume sales |

| Legacy Automation Systems & Parts | Cash Cow | Installed base, consistent replacement revenue, low investment | Aftermarket Parts & Service (2023): ~25% of SMC revenue | Primary supplier, customer loyalty |

| EX-series Fieldbus Systems | Cash Cow | Proven reliability, legacy support, stable revenue | Industrial Communication Equipment Market (Mature) | Substantial market share, dependable choice |

Full Transparency, Always

SMC BCG Matrix

The preview you are currently viewing is the exact, fully functional SMC BCG Matrix document you will receive upon purchase. This means you're seeing the complete strategic tool, ready for immediate application without any watermarks or limitations. The purchased version is identical, ensuring you get a professionally designed and analysis-ready report for your business planning needs. You can confidently expect the same high-quality content and formatting once your transaction is complete.

Dogs

Obsolete or low-demand niche pneumatic components, such as certain legacy valve manifolds or specialized cylinder types, often find themselves in the question mark quadrant of the BCG matrix. These items typically cater to industries experiencing a downturn or have been replaced by more efficient, integrated systems. For instance, components designed for older manufacturing equipment in sectors like traditional textile production might now have very limited market appeal.

These products are characterized by a low market share within a stagnant or declining market. Consider the market for certain older-generation pneumatic actuators; their demand has been significantly impacted by the rise of servo-electric alternatives. Such products generate minimal revenue for SMC, and the costs associated with maintaining their inventory and production can outweigh the returns, potentially tying up valuable capital and resources.

Pneumatic products with high energy consumption, particularly those lacking advanced efficiency features, are increasingly becoming liabilities in the current market. As industries worldwide, including manufacturing and automation, push for sustainability, these items are falling out of favor. For instance, in 2024, the global industrial automation market saw a significant emphasis on energy-saving technologies, with companies actively seeking pneumatic components that reduce operational costs and environmental impact.

These less efficient pneumatics often represent a declining segment within a company's product portfolio. Their market share erodes as competitors offer more eco-friendly alternatives. A prime example is older-generation pneumatic cylinders and valves that don't incorporate variable speed drives or advanced sealing technologies, leading to wasted compressed air and higher energy bills for end-users.

Consequently, such products are candidates for divestment or phasing out. Investment in their development is unlikely to yield substantial returns, given the strong customer preference for energy-efficient solutions. This trend is further underscored by regulatory pressures and corporate sustainability goals, making high-energy-consuming pneumatics a diminishing prospect for future growth.

Standardized, low-value-add commodity fittings often fall into the 'dog' category of the BCG Matrix. These are basic, undifferentiated products facing fierce price wars from many smaller players, leading to a low market share. For instance, in 2024, the global market for basic plumbing fittings, a segment rife with such commodities, saw intense competition, with many smaller manufacturers struggling to maintain margins above 5% due to the commoditized nature of the products.

Products like these offer little to no unique selling proposition, making them highly susceptible to market fluctuations and unable to command premium pricing. Their contribution to overall profitability is minimal, often just covering their own costs. Companies might consider discontinuing these items or outsourcing their production to free up resources for more lucrative, higher-value product lines.

Products Lacking Digital Integration Capabilities

Products with limited digital integration capabilities, such as legacy machinery that cannot connect to smart factory systems or IoT platforms, are increasingly falling behind. In 2024, the global industrial IoT market was valued at approximately $226.3 billion, highlighting the strong demand for connected solutions. Companies like SMC, if they possess such products with a low market share in this evolving landscape, would likely classify them as Dogs in the BCG matrix.

- Low Market Share: These products struggle to gain traction against digitally enabled competitors.

- Declining Market Relevance: As industries embrace Industry 4.0, demand for non-integrated solutions diminishes.

- Need for Investment or Divestment: SMC must decide whether to invest heavily in upgrading these offerings or consider phasing them out to focus resources on more competitive products.

Legacy Control Panels or Interface Units

Legacy Control Panels or Interface Units represent products in the Dogs quadrant of the BCG Matrix. These are typically older generation human-machine interface (HMI) or control panel units that struggle with modern software and network compatibility.

Their market share is often declining as industries shift towards more intuitive, networked, and data-rich HMI solutions. For instance, by 2024, many industrial automation sectors saw a significant push towards Industry 4.0, which inherently favors interoperable and cloud-connected systems, leaving legacy panels behind.

- Declining Market Share: Older HMI units face obsolescence as newer, more advanced systems gain traction.

- Compatibility Issues: Lack of integration with modern software and network protocols limits their utility.

- Resource Drain: Maintaining and supporting these units can become a significant cost without proportional returns.

- Strategic Management: Companies must consider phasing out or divesting from these products to reallocate resources effectively.

Dogs in the BCG matrix represent products with low market share in a low-growth industry. For SMC, this could include highly commoditized, basic pneumatic fittings or legacy components for outdated machinery. These items generate minimal revenue and often consume resources without significant returns, making them candidates for divestment or discontinuation.

For example, basic pneumatic fittings, lacking unique features, face intense price competition. In 2024, the market for such components saw margins as low as 5% for many smaller manufacturers. Similarly, older control panels that don't integrate with Industry 4.0 systems are losing relevance as the global industrial IoT market, valued at over $226 billion in 2024, drives demand for connected solutions.

These products are characterized by low profitability and limited future growth potential. Companies must strategically decide whether to invest in revitalizing them or to phase them out, freeing up capital for more promising product lines.

| Product Category | Market Share | Market Growth | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Commoditized Fittings | Low | Low | Low | Divest or Outsource |

| Legacy Control Panels | Declining | Declining | Low | Phase Out |

| Obsolete Pneumatic Components | Very Low | Negligible | Negative | Discontinue |

Question Marks

SMC's wireless automation modules, like the EXW1 series, are positioned as Stars in the BCG matrix. The market for these cable-free solutions is experiencing robust growth, fueled by demand in industrial robotics and mobile applications. For instance, the global industrial automation market was projected to reach over $200 billion by 2024, with wireless segments showing particularly strong upward trends.

While the market is expanding rapidly, SMC's market share in this newer segment may still be developing. This necessitates continued investment in research, development, and market penetration strategies to solidify its position and capitalize on the high-growth potential. Companies investing in smart factory initiatives are a key driver for this technology.

The market for advanced sensor-integrated actuators, crucial for sophisticated automation and predictive maintenance, is experiencing robust growth. Demand is fueled by industries seeking finer control and real-time operational data. For example, the global industrial automation market, which heavily relies on such components, was valued at approximately $200 billion in 2023 and is projected to grow significantly in the coming years.

SMC's introduction of compact position sensors addresses a key need in this segment. However, the highly competitive nature of this technologically advanced space means SMC's market share might still be in a formative stage. Strategic investments in research and development, alongside targeted marketing efforts, will be essential for SMC to elevate these advanced actuators to a Star category within the BCG matrix.

SMC's early investments in components for hydrogen-powered automation position them in a nascent market with substantial future growth potential. While current market share is low, these ventures align with SMC's sustainability focus and could evolve into Stars within the BCG matrix. For instance, the global hydrogen market is projected to reach $321 billion by 2027, indicating significant opportunity.

AI-Powered Predictive Maintenance Software/Services

AI-powered predictive maintenance software and services for SMC's hardware fall into the question mark category of the BCG matrix. While SMC is primarily a hardware manufacturer, this software segment represents a high-growth, low-market-share opportunity. The company is investing heavily in research and development for these AI solutions, aiming to revolutionize its service offerings and unlock new revenue streams.

- High Growth Potential: The global predictive maintenance market is projected to reach USD 18.2 billion by 2028, growing at a CAGR of 32.6% from 2021 to 2028, indicating substantial market expansion for AI-driven solutions.

- Significant R&D Investment: SMC's commitment to R&D in AI for predictive maintenance signifies a strategic bet on future revenue, even if current market share is limited.

- Transformative Service Offering: Successful scaling of these AI services could shift SMC's business model, creating recurring revenue and enhancing customer loyalty through improved equipment uptime and reduced operational costs.

- Competitive Landscape: While the market is growing, it is also becoming increasingly competitive, requiring SMC to differentiate its AI offerings effectively to gain traction.

Miniaturized and Lightweight Components for Micro-Automation

The increasing demand for miniaturized and lightweight components in micro-automation, driven by sectors like electronics and medical devices, presents a significant growth opportunity. SMC's investment in developing smaller, lighter automation solutions directly addresses this trend.

While SMC is actively innovating in this space, its market share within the highly specialized micro-automation niche may still be developing. This suggests that these advanced, compact components could be categorized as question marks, requiring strategic investment to capture emerging market share.

- Market Growth: The global micro-automation market is projected to reach approximately $25 billion by 2028, with a compound annual growth rate (CAGR) of over 15% in the coming years.

- SMC's Focus: SMC has introduced product lines like the MXS series of compact guided actuators and the SY series of miniature solenoid valves, specifically designed for space-constrained applications.

- Investment Rationale: Continued R&D and targeted marketing are essential to solidify SMC's position and increase its market penetration in this high-potential, yet competitive, segment.

SMC's AI-powered predictive maintenance solutions for their hardware are currently in the question mark category. This means they operate in a high-growth market but have a relatively low market share. The company is actively investing in research and development for these AI services, aiming to enhance its offerings and create new revenue streams.

The predictive maintenance market is expanding rapidly, with AI integration being a key driver. SMC's strategic focus on developing these advanced software solutions positions them to potentially capture significant future market share, although substantial investment is required to compete effectively.

These AI services represent a high-potential, but currently underdeveloped, area for SMC. Success in this segment hinges on effective differentiation and scaling of their AI capabilities within a competitive landscape.

| SMC Product/Service Area | BCG Category | Market Growth | SMC Market Share | Strategic Focus |

|---|---|---|---|---|

| AI-Powered Predictive Maintenance | Question Mark | High | Low | Invest in R&D, Market Penetration |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.