Skyworks Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skyworks Solutions Bundle

Skyworks Solutions, a leader in analog semiconductors, boasts strong market positions and innovative product pipelines, but faces intense competition and evolving technological landscapes. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Skyworks' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Skyworks Solutions boasts a robust and diversified product portfolio, encompassing high-performance analog and mixed-signal semiconductors. This includes essential components like power amplifiers, filters, and advanced connectivity solutions, crucial for modern electronic devices.

This broad product offering significantly reduces the company's dependence on any single product line, creating a more resilient business model. For instance, in fiscal year 2023, Skyworks reported revenue diversification across key segments, with mobile communications still being a significant contributor but with growing contributions from other sectors like automotive and infrastructure.

The strategic diversification of Skyworks' products across mobile, automotive, infrastructure, industrial, and medical markets provides a stable financial foundation. This broad market penetration helps to mitigate risks associated with economic downturns or shifts in demand within any single industry sector, as seen in their Q4 2023 results where non-mobile revenue showed steady growth.

Skyworks Solutions' components are critical enablers of wireless connectivity and advanced features in a wide array of electronic devices. This makes them an indispensable supplier in today's fast-paced digital world, where dependable connectivity is a must-have. Their products are fundamental to the smooth operation of contemporary gadgets, securing consistent demand across multiple sectors.

Skyworks Solutions exhibits remarkable financial resilience, consistently generating substantial operating and free cash flow. For instance, in fiscal year 2023, the company reported over $1.3 billion in free cash flow, showcasing its ability to convert earnings into readily available cash. This strong cash generation is further bolstered by a healthy balance of cash and marketable securities, exceeding $1.5 billion as of late 2023.

This robust financial position empowers Skyworks to pursue strategic growth initiatives, including significant investments in research and development to fuel innovation in its product lines. Furthermore, its financial strength provides the flexibility for strategic acquisitions that could expand its market reach or technological capabilities. The company also prioritizes returning value to its shareholders, actively engaging in dividend payments and share repurchase programs, demonstrating a commitment to enhancing shareholder returns.

Innovation in Key Growth Markets

Skyworks is making significant strides in innovation, particularly by securing design wins for cutting-edge technologies. This includes next-generation 5G components, the emerging Wi-Fi 7 standard, and advanced solutions for AI-enabled smartphones. Their focus extends to automotive connectivity, a rapidly expanding market.

These strategic investments are designed to position Skyworks at the forefront of high-growth sectors. By capitalizing on long-term trends in these demanding areas, the company aims to drive future revenue growth and solidify its market leadership. For instance, the demand for 5G infrastructure and devices continues to surge, with global 5G subscriptions projected to exceed 5 billion by 2028, according to recent market analyses.

- 5G Expansion: Skyworks is a key supplier for 5G infrastructure and devices, benefiting from the ongoing global rollout.

- Wi-Fi 7 Adoption: The company is developing solutions for Wi-Fi 7, which promises significantly faster speeds and lower latency, critical for next-gen applications.

- Automotive Connectivity: Skyworks is increasing its presence in the automotive sector, providing connectivity solutions for increasingly sophisticated connected vehicles.

- AI-Enabled Devices: Their components are crucial for the advanced processing and connectivity required by AI-powered smartphones and other smart devices.

Global Manufacturing and Operations Footprint

Skyworks Solutions boasts a robust global manufacturing and operations footprint, with facilities strategically positioned across Asia, Europe, and North America. This expansive network includes engineering, marketing, operations, sales, and support centers, enabling a truly international reach. This global presence is crucial for maintaining proximity to key customers and critical supply chains, facilitating efficient service delivery to a diverse worldwide clientele.

This widespread operational infrastructure allows Skyworks to adapt to regional market demands and navigate complex global logistics. For instance, their significant presence in Asia, a hub for semiconductor manufacturing and a key market for mobile devices, underscores their commitment to efficient production and market access. As of their fiscal year 2023, Skyworks reported revenue from international operations constituting a substantial portion of their total sales, highlighting the importance of this global network.

- Global Reach: Engineering, marketing, operations, sales, and support facilities across Asia, Europe, and North America.

- Supply Chain Integration: Proximity to key suppliers and manufacturing partners worldwide.

- Customer Proximity: Enhanced ability to serve and support a diverse global customer base efficiently.

- Operational Resilience: Diversified locations contribute to a more robust and adaptable operational framework.

Skyworks' diversified product portfolio, encompassing essential analog and mixed-signal semiconductors, reduces reliance on single markets. Their components are critical for wireless connectivity across mobile, automotive, and infrastructure sectors, ensuring consistent demand.

The company demonstrates strong financial health, evidenced by over $1.3 billion in free cash flow in fiscal year 2023 and more than $1.5 billion in cash and marketable securities as of late 2023. This financial stability enables strategic investments in R&D and potential acquisitions, alongside shareholder returns via dividends and buybacks.

Skyworks is actively innovating, securing design wins for next-generation 5G, Wi-Fi 7, and AI-enabled devices, along with expanding its automotive connectivity solutions. These advancements position them to capitalize on high-growth trends, with global 5G subscriptions projected to surpass 5 billion by 2028.

Their extensive global manufacturing and operations network, with facilities in Asia, Europe, and North America, ensures proximity to customers and supply chains. This footprint allows for adaptation to regional demands and enhances operational resilience, with international operations forming a substantial part of their fiscal year 2023 sales.

| Key Strength | Description | Supporting Data (FY23/Late 2023) |

| Product Diversification | Broad portfolio reduces market dependency. | Revenue diversified across mobile, automotive, infrastructure. |

| Financial Resilience | Strong cash generation and liquidity. | >$1.3B Free Cash Flow; >$1.5B Cash & Marketable Securities. |

| Innovation Leadership | Focus on next-gen technologies. | Design wins in 5G, Wi-Fi 7, AI devices, automotive connectivity. |

| Global Operations | Worldwide manufacturing and support network. | Facilities across Asia, Europe, North America; substantial international sales. |

What is included in the product

Analyzes Skyworks Solutions’s competitive position through key internal and external factors, highlighting its strong market presence and the opportunities presented by emerging technologies, while also acknowledging potential threats from market volatility and competition.

Identifies potential market shifts and competitive threats, enabling proactive risk mitigation for Skyworks Solutions.

Weaknesses

Skyworks Solutions faces significant customer concentration risk, with a substantial portion of its revenue historically derived from a single major client. For instance, in fiscal year 2023, Apple represented approximately 58.7% of Skyworks' net sales, highlighting a pronounced dependency. This reliance makes the company vulnerable to fluctuations in that customer's purchasing behavior, such as reduced orders or a shift to alternative suppliers.

While Skyworks Solutions has expanded into diverse markets, its significant reliance on the mobile sector leaves it vulnerable to the inherent cyclicality and seasonality of smartphone demand. This exposure means that any slowdown in smartphone sales or extensions in consumer upgrade cycles can directly affect Skyworks' financial performance. For instance, in the fiscal year 2023, Skyworks reported a revenue decline, partly attributed to softer demand in the mobile market.

Skyworks Solutions has grappled with significant inventory challenges, especially within its industrial and infrastructure sectors. This has directly contributed to weaker financial performance and suggests that anticipated demand may not materialize as quickly as expected. For instance, in fiscal year 2023, the company reported a notable increase in inventory levels, impacting its ability to respond nimbly to market shifts.

Effective inventory control is paramount in the fast-paced semiconductor market. Skyworks' difficulties in this area can directly affect its profitability by pressuring gross margins and hindering overall operational agility. The semiconductor industry's cyclical nature means that mismanaging inventory can lead to substantial financial setbacks, as seen in the broader industry trends throughout 2024.

Intensified Competitive Pressures

Skyworks Solutions contends with significant competitive pressures within the dynamic semiconductor sector. The RF connectivity market, in particular, is characterized by intense rivalry, not only from direct competitors but also from a broad spectrum of analog and mixed-signal providers. This competitive landscape can directly impact pricing, potentially forcing Skyworks to offer more aggressive terms to secure business.

The need for customers to mitigate supply chain risks often leads to dual-sourcing strategies, meaning Skyworks must continually prove its value proposition against alternative suppliers. This can create hurdles in maintaining its existing market share and, crucially, in its ability to expand profit margins, as price becomes a more significant factor in purchasing decisions.

- Intensified Competition: Skyworks faces fierce competition in the RF and analog semiconductor markets.

- Pricing Pressure: Intense rivalry can lead to downward pressure on Skyworks' product pricing.

- Dual-Sourcing: Customers often source components from multiple suppliers, impacting Skyworks' market share.

- Margin Challenges: Maintaining and growing profit margins becomes more difficult amidst strong competition.

Declining Revenue and Profitability Projections

Skyworks Solutions is facing a challenging financial outlook, with recent reports indicating a downturn. For fiscal year 2023, the company reported net revenue of $4.75 billion, a decrease from $5.06 billion in fiscal year 2022. This trend is expected to continue, with analysts projecting further declines in revenue and profitability through 2025 and 2026.

This persistent decline in key financial indicators, such as net revenue and adjusted earnings per share (EPS), raises concerns about the company's operational performance and its ability to navigate the current market landscape. For instance, adjusted diluted EPS for fiscal year 2023 was $7.07, down from $9.00 in fiscal year 2022.

- Projected Revenue Decline: Analysts forecast continued revenue contraction into fiscal years 2025 and 2026, signaling ongoing market headwinds.

- Profitability Concerns: Declining earnings per share, with fiscal year 2023 adjusted diluted EPS at $7.07 compared to $9.00 in fiscal year 2022, highlight potential margin pressures.

- Investor Confidence Impact: The sustained negative financial trend could potentially dampen investor sentiment and affect the company's valuation.

Skyworks Solutions is grappling with a challenging financial performance, marked by declining revenues and profitability. For fiscal year 2023, net revenue stood at $4.75 billion, down from $5.06 billion in fiscal year 2022. This downward trend is projected to persist, with analyst forecasts indicating continued revenue contraction through fiscal years 2025 and 2026, reflecting ongoing market headwinds and potential margin pressures.

The company's profitability has also been impacted, as evidenced by a decrease in adjusted diluted earnings per share (EPS) from $9.00 in fiscal year 2022 to $7.07 in fiscal year 2023. This decline in EPS, coupled with revenue contraction, raises concerns about Skyworks' operational efficiency and its ability to adapt to the current market environment, potentially affecting investor confidence.

| Financial Metric | FY 2022 | FY 2023 | Projected Trend (2025-2026) |

| Net Revenue | $5.06 billion | $4.75 billion | Continued Decline |

| Adjusted Diluted EPS | $9.00 | $7.07 | Pressure on Profitability |

What You See Is What You Get

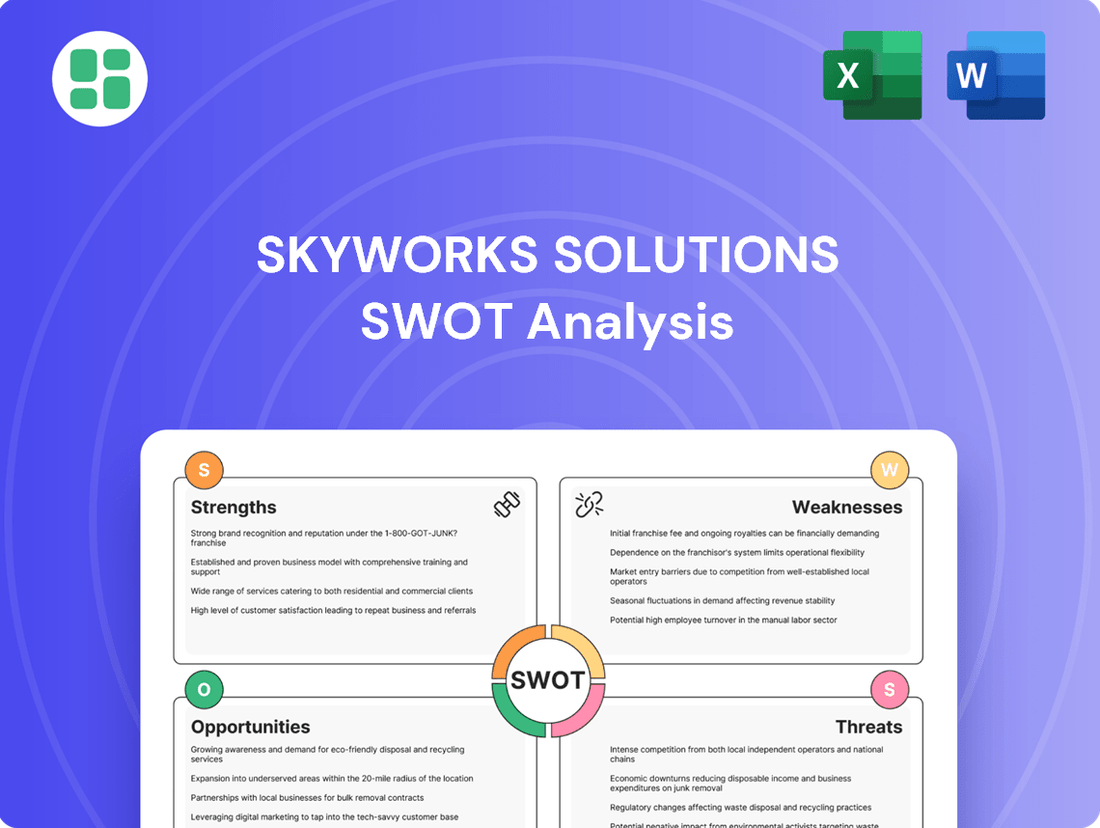

Skyworks Solutions SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, offering a clear glimpse into the comprehensive insights available. The complete version becomes available after checkout, ensuring you get the full, detailed analysis.

Opportunities

The increasing shift of artificial intelligence processing to edge devices, alongside the robust growth of the Internet of Things (IoT), creates a substantial market opening. Skyworks' core strengths in connectivity and advanced analog semiconductors are vital for powering the sophisticated features needed in smart homes, industrial IoT, and wearable technology.

This trend is particularly evident as IoT device shipments are projected to reach 29 billion by 2030, according to Statista, with edge AI capabilities becoming a key differentiator. Skyworks' analog and mixed-signal chips are instrumental in facilitating the low-power, high-performance communication essential for these connected, intelligent devices.

The automotive sector's increasing demand for connectivity, particularly in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), presents a significant growth opportunity for Skyworks. These sophisticated systems require robust power management and reliable cellular connectivity, areas where Skyworks excels. For instance, the global automotive semiconductor market, which includes connectivity components, was projected to reach over $70 billion in 2024, with EVs being a major driver.

Furthermore, the rebound and expansion within industrial and infrastructure markets offer Skyworks a chance to diversify its revenue streams. As these sectors upgrade their systems with more connected and intelligent solutions, Skyworks' power management and wireless communication technologies can find broader application, contributing to overall market diversification and growth.

The global 5G network rollout is accelerating, with 2024 seeing continued expansion in mid-band and millimeter-wave deployments. This surge directly fuels demand for advanced RF components like those Skyworks provides. For instance, the increasing density of 5G base stations and the growing number of 5G-enabled devices in 2024 are key drivers.

Wi-Fi 7 adoption is also gaining momentum, with consumer and enterprise device manufacturers integrating the standard throughout 2024 and into 2025. This new standard's higher speeds and lower latency necessitate more sophisticated RF front-end solutions, a core strength for Skyworks. The increasing prevalence of Wi-Fi 7 in routers and client devices presents a significant opportunity for increased content per device.

Strategic Acquisitions and Partnerships

Skyworks Solutions can pursue strategic acquisitions to broaden its product offerings and gain entry into emerging markets. For instance, acquiring companies with expertise in advanced power management or specialized RF components could bolster its competitive edge. In fiscal year 2023, Skyworks reported $4.76 billion in revenue, indicating a strong base from which to fund strategic growth initiatives.

Collaborations with other industry giants present another avenue for accelerated innovation and market penetration. By partnering with leading semiconductor designers or system manufacturers, Skyworks can co-develop next-generation solutions, leveraging shared R&D resources and market access. These alliances are crucial in the rapidly evolving connectivity landscape, where interoperability and integrated solutions are increasingly valued by customers.

- Diversification: Acquisitions can move Skyworks beyond its traditional mobile connectivity focus into areas like automotive, industrial IoT, and aerospace.

- Technology Enhancement: Targeting companies with cutting-edge IP in areas like AI-enabled RF or advanced packaging can provide a significant technological leap.

- Market Expansion: Partnerships can open doors to new geographical regions or customer segments that might be difficult to penetrate independently.

Shareholder Value Creation through Capital Allocation

Skyworks Solutions is well-positioned to boost shareholder value through strategic capital allocation. With a robust balance sheet and strong free cash flow generation, the company has the capacity to continue its practice of returning capital to shareholders via dividends and share buybacks. This disciplined approach is a key opportunity to bolster investor confidence and potentially support the stock's valuation, even when the broader market experiences volatility.

For instance, in fiscal year 2023, Skyworks repurchased approximately $1.0 billion of its stock and paid out $535 million in dividends. This commitment to returning capital demonstrates a clear strategy to enhance earnings per share and reward its investors.

- Continued Share Repurchases: The company can leverage its strong cash position to further reduce the number of outstanding shares, thereby increasing earnings per share and potentially the stock price.

- Dividend Growth: Maintaining or increasing dividend payments provides a steady income stream for shareholders and signals financial health.

- Strategic Acquisitions: While focusing on returns, Skyworks can also explore targeted acquisitions that align with its growth strategy, creating long-term value.

The increasing integration of AI into edge devices and the expanding Internet of Things (IoT) ecosystem present a significant opportunity for Skyworks. Its expertise in connectivity and analog semiconductors is crucial for the high-performance, low-power communication required by smart devices. IoT device shipments are projected to reach substantial figures, underscoring the demand for Skyworks' solutions.

The automotive sector, particularly the growth in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), offers a robust expansion avenue. These applications rely heavily on reliable connectivity and efficient power management, areas where Skyworks' offerings are well-suited. The automotive semiconductor market is expected to see considerable growth, driven by these technological advancements.

The ongoing global 5G network deployment, including mid-band and millimeter-wave expansions, directly benefits Skyworks by increasing demand for its advanced radio frequency (RF) components. Furthermore, the adoption of Wi-Fi 7, with its enhanced speed and reduced latency, necessitates more sophisticated RF front-end solutions, a core competency for Skyworks, creating opportunities for increased content per device.

Strategic acquisitions and partnerships offer Skyworks avenues to broaden its product portfolio, access new technologies, and enter emerging markets. These moves can bolster its competitive position and drive innovation in rapidly evolving sectors like automotive and industrial IoT. The company's strong financial standing provides a solid foundation for such strategic growth initiatives.

| Opportunity Area | Key Drivers | Skyworks' Role |

|---|---|---|

| Edge AI & IoT | Growing IoT device shipments, AI processing on devices | Providing low-power, high-performance connectivity chips |

| Automotive Connectivity | EV adoption, ADAS growth | Supplying power management and cellular connectivity solutions |

| 5G & Wi-Fi 7 Expansion | Global 5G network rollout, Wi-Fi 7 adoption | Delivering advanced RF front-end components |

| Strategic Growth | Market diversification, technology enhancement | Pursuing acquisitions and industry partnerships |

Threats

The semiconductor landscape is fiercely competitive, with both long-standing giants and emerging innovators constantly pushing for dominance. Skyworks is particularly vulnerable to losing crucial design wins or market share, especially with its key clients who are increasingly adopting dual-sourcing strategies to mitigate risk or are being courted by rivals with more compelling product portfolios.

A global economic slowdown, particularly impacting consumer discretionary spending, poses a significant threat to Skyworks Solutions. For instance, a projected slowdown in global GDP growth for 2024-2025 could directly translate to decreased consumer demand for the advanced smartphones and other electronic devices that utilize Skyworks' chipsets. This macroeconomic sensitivity can lead to reduced order volumes, impacting Skyworks' revenue and potentially its profit margins as factory utilization rates decline.

The semiconductor industry, including companies like Skyworks, faces significant threats from supply chain disruptions. These can stem from shortages of critical raw materials, limited manufacturing capacity, or geopolitical tensions that disrupt global trade and logistics. For instance, the global semiconductor shortage that began in late 2020 and extended through 2022 highlighted these vulnerabilities, leading to production delays and increased costs across the sector.

These disruptions directly impact Skyworks' ability to fulfill customer orders, potentially resulting in lost sales and revenue. The company's reliance on a complex global supply chain means that events in one region can have cascading effects. For example, trade restrictions or natural disasters affecting key manufacturing hubs could significantly hinder Skyworks' production schedules and its competitive position.

Rapid Technological Obsolescence and R&D Investment Needs

The semiconductor industry moves at lightning speed, meaning Skyworks' current offerings could become outdated quickly. To stay ahead, the company needs to pour substantial resources into research and development for new technologies. This constant innovation is crucial for introducing next-generation products, but it demands significant capital and carries the inherent risk that new developments might not succeed in the market.

For instance, Skyworks' commitment to R&D is evident in its financial statements. In fiscal year 2023, the company reported research and development expenses of approximately $566 million. This investment is vital for developing advanced solutions in areas like 5G, Wi-Fi 7, and automotive connectivity, technologies that are rapidly evolving.

- Rapid Innovation: The pace of technological change in wireless communication and semiconductors necessitates continuous product updates.

- High R&D Costs: Significant capital is required for research and development to maintain a competitive edge, impacting profitability.

- Development Risk: Investments in new technologies carry the risk of failure, potentially leading to wasted resources and missed market opportunities.

- Obsolescence Threat: Failure to innovate quickly enough can render existing product lines obsolete, eroding market share.

Regulatory and ESG Pressures

Skyworks Solutions faces growing regulatory headwinds, especially concerning environmental, social, and governance (ESG) mandates. The increasing focus on Scope 3 emissions, for instance, could require significant investment in supply chain transparency and reduction efforts. Failure to adapt to these evolving disclosure standards and demonstrate tangible sustainability progress could harm Skyworks' reputation and competitive standing.

These pressures can translate into direct financial risks. Companies that fall behind on ESG reporting or performance may face penalties, increased borrowing costs, and investor divestment. For Skyworks, this could mean higher operational expenses to meet new compliance requirements and a potential loss of market share if competitors are perceived as more sustainable.

- Increased Compliance Costs: Meeting new ESG disclosure requirements, such as those related to Scope 3 emissions, can necessitate substantial investments in data collection, reporting systems, and potentially process overhauls.

- Reputational Risk: A perceived lack of commitment to sustainability or failure to meet evolving ESG standards can damage brand image, leading to reduced customer loyalty and investor confidence.

- Competitive Disadvantage: Competitors who proactively address ESG concerns and demonstrate strong sustainability performance may gain a competitive edge, attracting environmentally conscious customers and investors.

- Potential Fines and Penalties: Non-compliance with emerging environmental regulations or disclosure mandates could result in significant financial penalties and legal challenges.

The intense competition within the semiconductor industry, coupled with the risk of losing key design wins to rivals, presents a significant threat. Skyworks must navigate the increasing trend of dual-sourcing by its major clients, a strategy aimed at mitigating supply chain risks and leveraging competitive pricing. This dynamic requires Skyworks to consistently offer superior technology and value to retain its market position.

A global economic downturn, impacting consumer spending, directly threatens Skyworks' revenue. For example, a projected slowdown in global GDP for 2024-2025 could curb demand for smartphones and other electronics, leading to reduced orders. This sensitivity to macroeconomic shifts can depress sales volumes and profitability, especially if factory utilization rates fall.

Supply chain vulnerabilities remain a critical threat, as evidenced by the extended global semiconductor shortage that impacted the industry through 2022. Disruptions from raw material scarcity, limited manufacturing capacity, or geopolitical events can hinder Skyworks' ability to meet customer demand, resulting in lost sales and increased costs.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of reliable data, including Skyworks Solutions' official financial filings, comprehensive market research reports, and expert industry analyses to provide a robust strategic overview.