Skyworks Solutions Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skyworks Solutions Bundle

Unlock the strategic blueprint behind Skyworks Solutions's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they innovate, build key partnerships, and deliver value in the semiconductor industry. Discover their customer relationships and revenue streams to gain actionable insights for your own business.

Partnerships

Skyworks Solutions cultivates essential partnerships with major global smartphone original equipment manufacturers (OEMs) such as Samsung, Google, Oppo, Xiaomi, and Asus. These collaborations are fundamental, as Skyworks supplies critical 5G content and other radio frequency (RF) solutions that power the premium and flagship devices produced by these industry giants.

The performance of new smartphone releases from these key partners directly influences Skyworks' mobile segment revenue. In fiscal year 2023, Skyworks reported that its mobile segment accounted for approximately 73% of its total revenue, underscoring the profound impact these OEM relationships have on the company's financial health.

Skyworks is actively growing its presence in the automotive industry by securing design wins with prominent Japanese and top European automotive original equipment manufacturers (OEMs).

These partnerships leverage Skyworks' expertise in providing critical cellular connectivity, efficient power management solutions, and components for advanced in-vehicle infotainment systems.

This strategic diversification into the automotive sector is a significant growth catalyst for Skyworks, fueled by the escalating demand for robust connectivity features in both electric vehicles (EVs) and conventional automobiles.

For instance, the automotive semiconductor market, a key area for Skyworks' expansion, was projected to reach approximately $70 billion in 2024, highlighting the substantial opportunity.

Skyworks Solutions actively partners with leading Wi-Fi ecosystem providers, including major players like Linksys, Charter, NETGEAR, CommScope, and TP-Link. These collaborations are vital for driving the adoption of Skyworks' advanced Wi-Fi 7 technology across a wide range of products.

These partnerships are instrumental in expanding Skyworks' reach in the Wi-Fi 7 market, ensuring their solutions are integrated into high-performance consumer routers, sophisticated home mesh networks, and robust enterprise-grade access points. This strategy helps solidify Skyworks' position in the evolving wireless connectivity landscape.

By working closely with these Wi-Fi product manufacturers, Skyworks' technology is positioned to enhance local wireless environments, complementing the capabilities of 5G networks. This synergy aims to deliver seamless, high-speed connectivity experiences for users.

IoT and Infrastructure Developers

Skyworks' strategic alliances extend to key players in the Internet of Things (IoT) and cellular infrastructure sectors. This includes collaborations with companies actively developing innovative products like AI routers that integrate voice-enabled healthcare services, showcasing the breadth of applications for Skyworks' technology.

These partnerships are crucial as Skyworks' advanced semiconductor components are fundamental to powering sophisticated features in a variety of cutting-edge devices. This encompasses edge IoT devices processing data locally, AI data centers handling massive computational loads, and the next generation of 5G wireless infrastructure, all demanding high-performance connectivity and processing capabilities.

By fostering these relationships, Skyworks is strategically positioning itself for sustained long-term growth and diversification. These collaborations are instrumental in expanding its market reach beyond the traditional mobile handset sector, tapping into rapidly evolving and high-potential new markets.

- IoT and Infrastructure Developers: Partnerships with companies building the physical and digital frameworks for connected devices and communication networks.

- AI Router Integration: Collaborations with developers creating advanced routers, such as those incorporating AI for voice-enabled healthcare services, demonstrating new market applications.

- Enabling Advanced Functionality: Skyworks' components are vital for enabling sophisticated features in edge IoT, AI data centers, and 5G infrastructure.

- Diversification Strategy: These alliances support Skyworks' goal of long-term growth and market diversification away from a sole reliance on mobile handsets.

Technology and Foundry Partners

Skyworks Solutions leverages critical partnerships with technology and foundry providers to access cutting-edge semiconductor manufacturing. These collaborations are vital for staying at the forefront of advanced packaging and heterogeneous integration techniques, ensuring Skyworks can deliver sophisticated wireless and mixed-signal products.

These alliances enable Skyworks to benefit from ongoing investments in essential semiconductor and filter technologies without bearing the full capital expenditure. For instance, the semiconductor industry saw significant global investment in 2024, with major foundries expanding capacity and investing in next-generation process nodes, which Skyworks can tap into through these relationships.

- Access to Advanced Manufacturing: Partnerships provide access to state-of-the-art fabrication facilities and processes.

- Technology Advancement: Essential for leveraging sustained investments in semiconductor and filter technologies.

- Innovation in Integration: Crucial for developing advanced packaging and heterogeneous integration solutions.

- Market Competitiveness: Ensures the delivery of leading-edge wireless and mixed-signal products to the market.

Skyworks Solutions' key partnerships are crucial for its market penetration and technological advancement across various sectors. These alliances span major smartphone OEMs, automotive manufacturers, Wi-Fi ecosystem providers, and IoT/infrastructure developers.

Collaborations with technology and foundry providers are essential for accessing advanced manufacturing capabilities and staying competitive in semiconductor innovation. These partnerships allow Skyworks to leverage external investments in cutting-edge fabrication processes and specialized technologies, ensuring the delivery of high-performance wireless and mixed-signal products.

The company's strategic alliances are designed to drive diversification and long-term growth by expanding its presence beyond the mobile sector into high-potential markets like automotive and IoT. These relationships are fundamental to integrating Skyworks' advanced components into a wide array of next-generation devices and infrastructure.

| Partner Category | Key Examples | Strategic Importance | 2024 Market Context |

|---|---|---|---|

| Smartphone OEMs | Samsung, Google, Oppo | Supplies critical RF solutions for premium devices; Mobile segment was 73% of FY23 revenue. | Continued demand for 5G and advanced mobile features. |

| Automotive OEMs | Top Japanese and European manufacturers | Provides cellular connectivity and infotainment components; Automotive semiconductor market projected at $70 billion in 2024. | Growing need for connectivity in EVs and connected car features. |

| Wi-Fi Ecosystem Providers | Linksys, NETGEAR, TP-Link | Drives adoption of Wi-Fi 7 technology in consumer and enterprise products. | Expansion of high-speed wireless networking solutions. |

| IoT & Infrastructure Developers | AI router developers, 5G infrastructure builders | Enables advanced features in edge IoT, AI data centers, and 5G networks. | Increasing demand for robust connectivity in diverse applications. |

| Technology & Foundry Providers | Leading semiconductor manufacturers | Access to advanced manufacturing and integration techniques; Leverages industry investments in new process nodes. | Global semiconductor industry investment in capacity and advanced nodes in 2024. |

What is included in the product

This Business Model Canvas provides a detailed blueprint of Skyworks Solutions' strategy, focusing on its key customer segments, diverse channels, and the unique value propositions it offers in the semiconductor market.

It reflects Skyworks' operational realities and strategic plans, making it ideal for presentations and funding discussions, organized into the 9 classic BMC blocks with insights and competitive advantage analysis.

Skyworks Solutions' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex semiconductor operations, simplifying understanding for stakeholders.

It efficiently distills Skyworks' strategy, allowing for rapid identification of key value propositions and customer segments, thus alleviating the pain of navigating intricate market dynamics.

Activities

Skyworks Solutions' core activities revolve around the intricate design and development of advanced analog and mixed-signal semiconductors. These chips, including essential power amplifiers and filters, are the backbone of modern wireless communication, powering everything from smartphones to sophisticated networking equipment.

In 2024, the company continued its significant investment in research and development, a crucial element for staying ahead in the rapidly evolving semiconductor industry. This ongoing commitment allows Skyworks to innovate and align with future technology roadmaps, ensuring their product offerings remain competitive and meet the demands of next-generation wireless standards like 5G Advanced and beyond.

Skyworks Solutions’ advanced manufacturing and fabrication activities are central to its business model, leveraging a global network to produce high-quality semiconductor products at scale. This global footprint is essential for meeting the demands of the wireless industry, ensuring reliable supply chains for their sophisticated components.

The company's expertise lies in fabricating advanced technologies such as TC-SAW and BAW filters, which are critical for next-generation mobile devices and connectivity solutions. Furthermore, their capabilities in heterogeneous integration allow for the combining of multiple semiconductor functions into a single package, enabling smaller, more powerful, and more efficient wireless chips.

In 2024, Skyworks continued to invest in its manufacturing capabilities to support the growing demand for 5G and Wi-Fi 6E/7 solutions. The company’s commitment to advanced fabrication ensures they remain at the forefront of wireless technology, delivering the essential components that power modern communication devices.

Skyworks Solutions actively manages its diverse product portfolio, a crucial activity that spans mobile, automotive, infrastructure, industrial, and medical sectors. This ensures they meet varied market needs.

Optimizing product lines is paramount, with a focus on strengthening product and market planning. This strategic approach aims to enhance profitability by expanding into new application areas.

In 2024, Skyworks reported a net revenue of $3.68 billion, reflecting the success of their diversified product strategy across these key segments.

Sales and Marketing

Skyworks Solutions focuses heavily on sales and marketing to secure design wins and build strong relationships with its wide array of customers. This involves both direct sales to major original equipment manufacturers (OEMs) and utilizing established distributor channels to reach a broader market.

These robust sales and marketing initiatives are crucial for Skyworks to achieve revenue growth and increase its market presence across numerous product applications. For instance, in fiscal year 2023, the company reported total revenue of $4.74 billion, underscoring the impact of its commercial strategies.

- Direct Sales: Engaging directly with large OEMs to integrate Skyworks' solutions into their flagship products.

- Distributor Networks: Partnering with distributors to expand reach and serve a wider customer base, particularly for smaller volume needs.

- Design Wins: The core objective of sales and marketing is to win designs, ensuring Skyworks' chips are selected for new product development.

- Market Expansion: Driving adoption of Skyworks' technology in emerging markets and new application areas to fuel growth.

Research and Development Investment

Skyworks Solutions' commitment to innovation is evident in its significant and ongoing investment in research and development. This is a core activity that fuels the company's future growth and competitiveness in the rapidly evolving semiconductor market.

In fiscal year 2024, Skyworks reported substantial R&D expenses, a figure that is expected to continue its upward trajectory. This increased spending underscores their dedication to staying at the forefront of technological advancements.

- Focus on Emerging Technologies: Skyworks is heavily investing in the development of next-generation technologies, including Wi-Fi 7, advanced 5G solutions, and AI-enabled products.

- Automotive Connectivity Expansion: A significant portion of R&D is allocated to enhancing automotive connectivity solutions, positioning Skyworks for growth in this key sector.

- Commitment to Innovation: The company's R&D strategy is designed to create differentiated products and maintain a competitive edge by anticipating and meeting future market demands.

Skyworks Solutions' key activities encompass the design, development, and manufacturing of advanced analog and mixed-signal semiconductors. This includes a strong focus on research and development to stay ahead in wireless technology, such as 5G and Wi-Fi 7. The company also actively manages its diverse product portfolio across various sectors and drives sales and marketing efforts to secure design wins and expand market presence.

In 2024, Skyworks continued to invest heavily in R&D, a critical driver for innovation in the fast-paced semiconductor industry, aligning with future technology roadmaps. Their manufacturing capabilities are essential for producing high-quality components at scale, supporting global demand for advanced wireless solutions.

The company's sales and marketing strategies are vital for securing design wins and fostering customer relationships, as demonstrated by their reported revenue figures. This multifaceted approach ensures Skyworks remains a key player in the connected economy.

| Key Activity | Description | 2024/2023 Data Point |

|---|---|---|

| Design & Development | Creating advanced analog and mixed-signal semiconductors. | Significant R&D investment in 2024. |

| Manufacturing & Fabrication | Producing high-quality semiconductor products globally. | Meeting demand for 5G and Wi-Fi 6E/7 solutions. |

| Product Portfolio Management | Managing diverse product lines across multiple sectors. | Net revenue of $3.68 billion in 2024. |

| Sales & Marketing | Securing design wins and building customer relationships. | Total revenue of $4.74 billion in fiscal year 2023. |

Delivered as Displayed

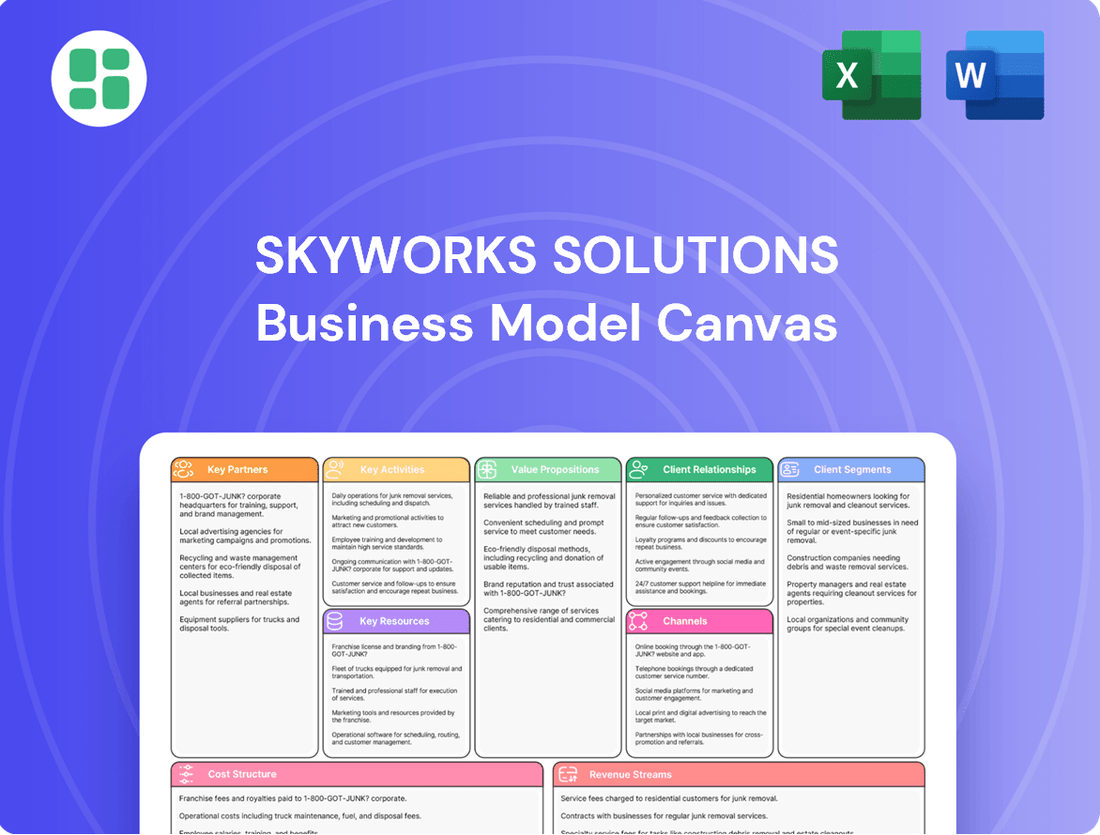

Business Model Canvas

The Skyworks Solutions Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of their strategic framework. This is not a sample or a mockup; it's a direct representation of the complete analysis that will be delivered to you. You can be confident that the detailed sections and insights presented here are precisely what you will gain full access to, ready for your own strategic planning or review.

Resources

Skyworks Solutions holds a robust intellectual property portfolio, boasting roughly 5,000 patents. These patents primarily focus on its advanced analog and mixed-signal semiconductor technologies, forming a substantial competitive advantage by safeguarding its unique designs.

This deep well of intellectual property is critical for maintaining Skyworks' leadership position in the rapidly evolving wireless connectivity market. The company's ongoing commitment to innovation and securing new patents ensures its technologies remain at the forefront of the industry.

Skyworks Solutions' proprietary and leading-edge semiconductor technologies are fundamental to its business model. These include advanced TC-SAW and BAW filters, MIMO modules, ultra-high band solutions, and digital power isolators. These core resources are critical for developing high-performance products.

These advanced technologies directly enable Skyworks to create essential components for next-generation mobile communication standards like 5G and Wi-Fi 7, along with other demanding applications. This technological edge is what allows them to stand out in a competitive market.

In 2024, Skyworks continued to emphasize investment in these critical technologies. This strategic focus underpins their product differentiation, ensuring they remain at the forefront of innovation in the mobile infrastructure and connectivity markets, a key driver for their revenue streams.

Skyworks Solutions leverages a global manufacturing footprint, encompassing engineering, operations, and support facilities strategically located across Asia, Europe, and North America. This extensive network is fundamental to their ability to produce high volumes of complex semiconductor products efficiently.

These facilities are crucial for managing a sophisticated supply chain, ensuring timely delivery of components and finished goods to a worldwide customer base. The geographic diversity also helps mitigate risks associated with regional disruptions.

In 2024, Skyworks continued to emphasize its advanced manufacturing capabilities, which are vital for meeting the escalating demand for its analog and mixed-signal semiconductors, particularly in the mobile, automotive, and infrastructure markets. Their operational scale allows them to remain competitive and responsive to market needs.

Skilled Workforce and R&D Talent

Skyworks Solutions' most critical resources include its highly skilled workforce, especially in engineering, design, and R&D. This talent pool is essential for driving innovation in complex semiconductor and radio frequency (RF) technologies.

As of September 2023, Skyworks employed approximately 10,100 individuals worldwide. The company's strategic focus on attracting and retaining top talent in these specialized fields directly fuels its product development and market competitiveness.

The expertise resident within Skyworks' employees is the bedrock of its ability to create cutting-edge solutions. This human capital is arguably the company's most significant asset, enabling its leadership in advanced wireless communication technologies.

- Highly Skilled Workforce: Skyworks' approximately 10,100 global employees are heavily concentrated in engineering, design, and R&D roles.

- Specialized Expertise: The company cultivates deep talent in semiconductor and RF technologies, crucial for its product innovation.

- Innovation Driver: Employee expertise directly translates into the development of advanced and high-performance wireless solutions.

- Talent as a Key Resource: The skilled workforce is fundamental to Skyworks' competitive advantage and its ability to meet evolving market demands.

Customer Relationships and Design Wins

Skyworks Solutions leverages its deeply entrenched relationships with major global Original Equipment Manufacturers (OEMs) as a cornerstone of its business model. These established partnerships, particularly with leading smartphone and automotive companies, are vital for securing a consistent flow of business. For instance, in fiscal year 2023, Skyworks reported that its top ten customers accounted for approximately 77% of its total revenue, underscoring the significance of these OEM relationships.

The company's robust pipeline of design wins represents another critical intangible resource. These wins signify that Skyworks' advanced semiconductor solutions have been selected for integration into future product generations by its OEM partners. This forward-looking engagement ensures sustained demand and provides visibility into future revenue streams.

- Established OEM Partnerships: Long-standing collaborations with key players in the mobile and automotive sectors provide a stable customer base.

- Design Win Pipeline: A strong pipeline of future product integrations ensures ongoing demand for Skyworks' components.

- Revenue Dependence: In fiscal year 2023, the top ten customers represented roughly 77% of total revenue, highlighting the importance of these relationships.

- Strategic Importance: Maintaining and expanding these customer engagements is paramount for Skyworks' continued revenue growth and market position.

Skyworks' key resources are its extensive intellectual property portfolio, proprietary semiconductor technologies, and a global manufacturing network. These are complemented by a highly skilled workforce, particularly in R&D, and deeply entrenched relationships with major OEMs, evidenced by its significant design win pipeline.

| Resource Category | Key Assets | Significance | 2024 Focus |

|---|---|---|---|

| Intellectual Property | ~5,000 Patents | Safeguards unique designs, competitive advantage | Continued patent acquisition for emerging technologies |

| Technology | Advanced Filters, MIMO, Ultra-high band solutions | Enables high-performance products for 5G, Wi-Fi 7 | Investment in next-gen connectivity solutions |

| Manufacturing | Global facilities (Asia, Europe, North America) | Efficient high-volume production, supply chain management | Enhancing advanced manufacturing capabilities |

| Human Capital | ~10,100 Employees (Sept 2023), R&D expertise | Drives innovation in complex semiconductor/RF tech | Attracting and retaining top engineering talent |

| Customer Relationships | Major Global OEMs, strong design win pipeline | Secures consistent business, revenue visibility | Strengthening OEM partnerships, securing future design wins |

Value Propositions

Skyworks Solutions delivers essential analog and mixed-signal semiconductors that are the backbone of advanced wireless connectivity in today's electronic devices. These components are crucial for ensuring high-performance communication in everything from the latest smartphones to sophisticated automotive systems and the emerging Wi-Fi 7 standard.

Their technology directly addresses the growing demand for seamless and efficient wireless data transfer, a fundamental requirement for modern digital experiences. For instance, Skyworks' solutions are integral to the 5G infrastructure and the proliferation of connected devices, supporting the massive increase in data traffic.

In 2024, the company's focus on these advanced connectivity solutions positions them to capitalize on the expanding Internet of Things (IoT) market and the ongoing upgrades in mobile and automotive wireless technologies. This commitment to enabling superior wireless performance is a key driver of their value proposition.

Skyworks Solutions excels by providing high-performance, customized semiconductor solutions designed for unique customer needs and demanding applications. Their specialized power amplifiers, filters, and front-end modules are engineered to deliver exceptional performance, even in challenging radio frequency environments. This focus on customization empowers clients to achieve peak system performance and gain a competitive edge in their respective markets.

Skyworks' solutions extend far beyond just mobile devices, reaching into critical sectors like automotive, infrastructure, industrial, and medical. This wide reach means their components are used in a diverse array of products, giving customers a broad base of applications.

This extensive market exposure, coupled with the established reliability of Skyworks' components, brings significant stability. It lessens the company's reliance on any single industry, acting as a buffer against sector-specific downturns.

For instance, in 2023, Skyworks reported that its non-mobile revenue streams, including automotive and infrastructure, continued to show robust growth, contributing a significant portion to their overall financial performance and demonstrating the success of their diversification strategy.

Technological Leadership and Innovation

Skyworks Solutions positions itself as a leader in analog and mixed-signal semiconductors, providing customers with technology that drives wireless innovation. Their commitment to research and development is substantial, with significant investments fueling the creation of solutions for next-generation standards.

This dedication to innovation ensures Skyworks' products are ready for emerging technologies. For instance, their portfolio actively supports the rollout of 5G networks and the development of Wi-Fi 7 capabilities, keeping their clients ahead of the curve. Furthermore, they are integrating AI capabilities into their offerings, anticipating future market demands.

- Cutting-Edge Technology: Skyworks provides advanced analog and mixed-signal semiconductor solutions enabling customers to lead in wireless innovation.

- Future-Proofing: Continuous R&D investment ensures support for emerging standards like 5G and Wi-Fi 7, along with AI integration.

- Market Leadership: Their technological advancements offer customers a competitive edge and future-ready products.

Optimized System Integration and Functionality

Skyworks’ components are engineered for effortless integration into sophisticated electronic systems, directly boosting their overall function and performance. This focus on seamless connectivity means customers can rely on Skyworks to deliver solutions that just work, reducing the headaches of compatibility and system design.

By offering integrated modules and pre-built sub-systems, Skyworks significantly simplifies the design process for their clients. Instead of piecing together numerous individual parts, customers can leverage Skyworks’ consolidated offerings, streamlining their development efforts.

This value proposition directly translates into tangible benefits for customers, enabling them to shorten design cycles and bring their innovative products to market much faster. For instance, in the competitive mobile device sector, a quicker time-to-market can be a critical differentiator. In 2024, the demand for faster product development cycles remained a key driver for semiconductor suppliers like Skyworks, as companies raced to incorporate the latest connectivity standards and features into their devices.

- Seamless Integration: Skyworks’ solutions are built to fit harmoniously within diverse and complex electronic architectures.

- Enhanced Functionality: Their components are designed to elevate the overall performance and capabilities of end products.

- Design Simplification: Customers benefit from integrated modules and sub-systems, reducing the complexity of their own engineering tasks.

- Accelerated Time-to-Market: The ease of integration and simplified design directly contribute to faster product development and launch for clients.

Skyworks Solutions provides critical semiconductor components that are fundamental to advanced wireless communication, enabling high-performance connectivity in a wide range of devices. Their expertise in analog and mixed-signal technology is essential for the seamless operation of smartphones, automotive systems, and emerging standards like Wi-Fi 7.

The company's value proposition centers on delivering customized, high-performance solutions that meet the specific needs of demanding applications, empowering clients to achieve superior system performance and a competitive edge. This focus on specialized engineering ensures their components excel even in challenging RF environments.

By offering solutions that simplify design and accelerate time-to-market, Skyworks enables its customers to bring innovative products to consumers faster. Their integrated modules and sub-systems reduce engineering complexity, a crucial advantage in fast-paced markets.

Skyworks' commitment to continuous research and development ensures their product portfolio remains at the forefront of technological advancement, supporting next-generation standards like 5G and integrating future technologies such as AI. This forward-looking approach positions their customers for sustained success.

| Value Proposition Area | Key Benefit | Supporting Evidence/Focus |

|---|---|---|

| Enabling Advanced Wireless Connectivity | High-performance communication for modern devices | Crucial for smartphones, automotive, IoT, Wi-Fi 7 |

| Customized High-Performance Solutions | Superior system performance and competitive advantage | Specialized power amplifiers, filters, front-end modules |

| Design Simplification & Faster Time-to-Market | Reduced engineering complexity and quicker product launches | Integrated modules, pre-built sub-systems |

| Commitment to Innovation & Future-Proofing | Access to cutting-edge technology and next-gen standards | R&D investment in 5G, Wi-Fi 7, AI integration |

Customer Relationships

Skyworks fosters robust partnerships with major Original Equipment Manufacturers (OEMs), especially within the mobile and automotive industries. These collaborations are built on joint product development, proactive design support, and enduring supply contracts, ensuring Skyworks is integrated into new product cycles from the outset.

In 2024, Skyworks continued to emphasize these strategic OEM relationships, which are crucial for securing design wins. For instance, the company’s advanced connectivity solutions are integral to the latest flagship smartphones and next-generation automotive platforms, reflecting the depth of these engagements.

Skyworks Solutions offers robust technical support and utilizes field application engineers to guide customers through the design, integration, and optimization of their semiconductor products. This direct assistance ensures customers can effectively implement Skyworks' components and overcome any technical hurdles they encounter.

This hands-on approach fosters deep trust and builds strong, lasting partnerships with their clientele. For instance, in fiscal year 2023, Skyworks highlighted the critical role of its engineering teams in supporting customer design wins, which are fundamental to future revenue streams.

Skyworks Solutions utilizes dedicated account management teams to foster strong relationships with its key clients. These teams provide personalized support, ensuring that customer needs are understood and addressed promptly. This direct engagement is crucial for building trust and loyalty.

By acting as the primary point of contact, these account managers streamline communication and collaboration. This focused approach allows Skyworks to better anticipate and respond to the dynamic requirements of its major customers, contributing to sustained satisfaction and repeat business.

Supply Chain Collaboration

Skyworks Solutions actively engages in collaborative supply chain planning with its customers. This partnership is vital for ensuring that components reach customers on time and for managing inventory efficiently. For instance, in the first half of fiscal year 2024, Skyworks emphasized its commitment to supply chain resilience, which directly benefits from such customer collaborations.

Given the critical role Skyworks' semiconductor solutions play in various industries, aligning production schedules with precise customer demand forecasts is paramount. This close coordination helps mitigate potential supply chain disruptions and optimizes inventory levels, creating a more stable and predictable flow for both Skyworks and its clients.

- Customer Collaboration: Joint planning with customers on supply chain activities.

- Demand Alignment: Synchronizing production with customer demand forecasts to ensure timely delivery.

- Inventory Optimization: Working together to minimize stockouts and excess inventory for mutual benefit.

- Resilience Focus: Enhancing supply chain stability through cooperative efforts, a key strategy in early FY24.

Diversified Customer Base Development

Skyworks Solutions is actively cultivating a more varied customer portfolio, moving beyond its established relationships with major players. The company is strategically targeting growth in what it terms "broad markets," which includes sectors like automotive, the Internet of Things (IoT), and critical infrastructure.

This strategic shift is designed to mitigate risks associated with over-reliance on a select few large clients. By expanding its reach into these diverse areas, Skyworks aims to build more robust and resilient revenue streams.

- Automotive Growth: Skyworks reported significant design wins in automotive applications, contributing to its broad market expansion.

- IoT Expansion: The company is seeing increased adoption of its connectivity solutions in various IoT devices, from smart home technology to industrial sensors.

- Infrastructure Development: Investments in 5G and other communication infrastructure projects are also driving new customer engagements for Skyworks.

Skyworks' customer relationships are characterized by deep technical collaboration, with field application engineers providing critical design support to ensure seamless integration of their semiconductor solutions. This hands-on approach, evident in their fiscal year 2023 support for customer design wins, fosters strong trust and loyalty. Dedicated account management teams further enhance these bonds by offering personalized service and prompt attention to client needs, streamlining communication and ensuring satisfaction.

The company also emphasizes collaborative supply chain planning, a strategy highlighted in early fiscal year 2024 for its role in enhancing resilience. This partnership ensures timely component delivery and efficient inventory management by aligning production schedules with precise customer demand forecasts. Skyworks is also broadening its customer base by targeting growth in diverse sectors like automotive and IoT, aiming to build more resilient revenue streams.

| Customer Relationship Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| OEM Partnerships | Joint product development and design support with major manufacturers. | Integral to new flagship smartphones and next-gen automotive platforms. |

| Technical Support | Field application engineers assist with design and integration. | Crucial for overcoming technical hurdles and ensuring effective component implementation. |

| Account Management | Dedicated teams provide personalized support and act as primary contacts. | Streamlines communication and fosters trust, leading to sustained satisfaction. |

| Supply Chain Collaboration | Joint planning for inventory optimization and demand alignment. | Key to supply chain resilience and mitigating disruptions, emphasized in H1 FY24. |

| Broad Market Expansion | Targeting growth in automotive, IoT, and infrastructure sectors. | Significant design wins reported in automotive; increased IoT adoption. |

Channels

Skyworks Solutions heavily relies on direct sales to its major Original Equipment Manufacturer (OEM) clients, particularly within the booming mobile and automotive sectors. This approach fosters deep partnerships, enabling collaborative product design and tailored supply chain solutions.

These direct relationships are crucial for Skyworks, with a substantial percentage of their revenue stemming from these key accounts. For instance, in fiscal year 2023, Skyworks reported net sales of $4.74 billion, a significant portion of which was driven by these direct OEM engagements.

Skyworks Solutions effectively utilizes a global network of authorized distributors to extend its market presence, especially reaching customers in the broad markets segment. This strategy is vital for accessing a diverse customer base that might not be directly served through direct sales channels.

These distributors are instrumental in managing inventory levels and offering localized customer support, which is particularly beneficial for small and medium-sized enterprises. Their involvement ensures that a wider array of clients receive timely assistance and product availability.

In fiscal year 2023, Skyworks reported that its broad markets segment accounted for approximately 30% of its total revenue, highlighting the significant contribution of this distribution strategy. This channel not only broadens market reach but also enhances overall sales efficiency by leveraging established distribution infrastructure.

Skyworks Solutions leverages its corporate website and a dedicated investor relations portal as crucial digital channels. These platforms are vital for sharing company news, financial reports, product details, and investor presentations, ensuring global stakeholders have transparent and easy access to information.

Industry Trade Shows and Conferences

Skyworks Solutions actively participates in key industry trade shows and technology conferences. These events are crucial for demonstrating new products, fostering business relationships, and identifying new sales opportunities. For instance, in 2024, Skyworks showcased its advanced connectivity solutions at events like CES and Mobile World Congress, reaching a broad audience of industry professionals.

These gatherings provide a vital platform for Skyworks to directly engage with current and prospective customers, as well as strategic partners. It’s an opportunity to highlight their latest innovations in areas such as 5G, Wi-Fi, and IoT technologies, reinforcing their market presence. Such direct interaction is invaluable for gathering feedback and understanding evolving market needs.

- Product Demonstration: Showcasing cutting-edge semiconductor solutions for mobile, automotive, and industrial markets.

- Networking: Connecting with key industry players, potential clients, and technology partners.

- Lead Generation: Identifying and nurturing new business opportunities through direct engagement.

- Market Visibility: Enhancing brand recognition and establishing thought leadership in the wireless semiconductor space.

Sales Representatives and Field Offices

Skyworks Solutions leverages a robust network of sales representatives and strategically positioned field offices across key global markets. This direct engagement model is crucial for fostering strong customer relationships and providing timely, localized support. In 2024, Skyworks continued to emphasize this direct outreach, recognizing its importance in navigating complex international sales cycles and understanding regional technology adoption trends.

These regional presences, spanning Asia, Europe, and North America, are instrumental in offering tailored sales support and essential technical assistance. By maintaining a local footprint, Skyworks can more effectively address the unique challenges and opportunities presented by diverse market demands, ensuring customers receive responsive service and expert guidance.

- Global Reach: Skyworks maintains field offices and sales representatives in Asia, Europe, and North America to serve a worldwide customer base.

- Localized Support: These regional teams provide direct sales, technical assistance, and customer service, enhancing the customer experience.

- Market Responsiveness: The direct regional presence allows Skyworks to better understand and adapt to the specific needs and evolving landscapes of different markets.

Skyworks Solutions utilizes a multi-channel approach to reach its diverse customer base, combining direct sales with a network of distributors. This strategy ensures both deep engagement with major clients and broad market penetration.

Direct sales are critical for large OEMs, fostering close collaboration and customized solutions. Complementing this, authorized distributors extend Skyworks' reach into broader markets, serving a wider array of customers and ensuring product accessibility.

Digital platforms and industry events also play a significant role, providing avenues for information dissemination, product showcasing, and direct customer interaction.

| Channel | Description | Key Benefits |

| Direct Sales (OEMs) | Direct engagement with major clients, fostering partnerships and tailored solutions. | Deep client relationships, collaborative design, supply chain optimization. |

| Authorized Distributors | Leveraging a global network to reach broad markets and smaller customers. | Extended market reach, inventory management, localized support for SMEs. |

| Digital Channels (Website, Investor Relations) | Online platforms for information sharing and stakeholder communication. | Transparent access to company news, financial reports, and product details. |

| Industry Events & Conferences | Participation in trade shows and technology conferences for product demonstration and networking. | Product showcasing, lead generation, market visibility, relationship building. |

| Sales Representatives & Field Offices | Direct regional presence for localized sales support and technical assistance. | Strong customer relationships, timely support, market responsiveness. |

Customer Segments

Mobile device manufacturers represent Skyworks Solutions' most significant customer base, including major players like Samsung, Google, Oppo, Xiaomi, and Asus. These companies rely on Skyworks for essential radio frequency (RF) front-end components and power amplifiers, critical for enabling advanced wireless features in their high-end smartphones.

This segment is the primary driver of Skyworks' revenue, underscoring the company's deep integration into the premium smartphone supply chain. For instance, in fiscal year 2023, Skyworks reported that its top two customers accounted for 37% of its total net sales, highlighting the substantial contribution of this segment, while also pointing to potential concentration risks.

The automotive sector is a significant and expanding strategic focus for Skyworks. Major car manufacturers, or OEMs, are increasingly demanding sophisticated wireless connectivity for their electric vehicles, advanced infotainment systems, and the development of autonomous driving capabilities.

Skyworks is well-positioned to meet these needs by supplying critical components such as 5G front-end modules, digital isolators, and cellular connectivity chips. These technologies are essential for enabling the seamless and reliable communication required in modern vehicles.

This segment is a vital area for Skyworks' future diversification and growth. For instance, the automotive semiconductor market is projected to reach over $100 billion by 2028, with wireless connectivity being a major driver of this expansion. Skyworks’ participation in this market, particularly with its 5G and connectivity solutions, highlights its strategic importance.

Skyworks Solutions serves providers of cellular infrastructure, including those building out 5G base stations, and manufacturers of networking equipment like Wi-Fi 7 routers and enterprise access points. These customers rely on Skyworks for critical components that ensure high-speed, reliable wireless communication within these essential networks.

The ongoing global rollout of 5G technology and the increasing adoption of advanced Wi-Fi standards are significant growth drivers for this customer segment. For instance, the global 5G infrastructure market was valued at approximately $45 billion in 2023 and is projected to grow substantially in the coming years, with component suppliers like Skyworks benefiting directly from this expansion.

Industrial and Medical Applications

Skyworks' industrial and medical applications segment serves critical sectors requiring reliable analog and mixed-signal semiconductors. For instance, in factory automation and motor control, their chips are integral to efficient operations. The medical field relies on Skyworks for components powering devices like clinical-grade hearing aids and various connected health solutions, demonstrating the company's reach into high-value markets.

These diverse applications contribute significantly to Skyworks' overall revenue streams. For fiscal year 2024, Skyworks reported total revenue of $4.0 billion, with their broad markets, which encompass these industrial and medical applications, playing a vital role in this performance.

- Industrial Automation: Skyworks' semiconductors are key enablers in modern factory automation systems.

- Medical Devices: The company's components are found in advanced medical equipment, including hearing aids and connected health devices.

- Revenue Contribution: These industrial and medical applications are a significant part of Skyworks' broad markets revenue.

- Market Diversification: Serving these sectors highlights Skyworks' strategy to diversify beyond traditional mobile markets.

Connected Home and Wearables

Skyworks Solutions serves manufacturers of smart home devices, consumer audio, tablets, and wearables. These companies rely on Skyworks for advanced wireless connectivity solutions that power seamless communication and enhanced functionality in their products. The growing demand for sophisticated features in these consumer electronics categories directly fuels the need for Skyworks' technology.

Key growth within this segment is significantly driven by the ongoing adoption of Wi-Fi 7. This next-generation wireless standard promises higher speeds and lower latency, crucial for the immersive experiences expected from connected home and wearable devices.

- Target Customers: Manufacturers of smart home devices (e.g., smart speakers, security cameras), consumer audio equipment (e.g., wireless headphones, soundbars), tablets, and wearable technology (e.g., smartwatches, fitness trackers).

- Value Proposition: Providing advanced wireless connectivity solutions that enable sophisticated features, reliable communication, and enhanced user experiences in consumer electronics.

- Key Trends: The increasing integration of AI and IoT in smart home devices, the demand for high-fidelity wireless audio, and the expanding capabilities of wearable technology are major drivers.

- Growth Catalysts: The widespread adoption of Wi-Fi 7 is a critical factor, offering substantial improvements in speed and efficiency for connected devices, further boosting demand for Skyworks' enabling technologies.

Skyworks' customer segments are diverse, spanning mobile device manufacturers, automotive OEMs, cellular infrastructure providers, and manufacturers of industrial, medical, and consumer electronics. These segments are united by their need for advanced wireless connectivity and analog semiconductor solutions.

The mobile segment, including giants like Samsung and Google, remains a primary revenue driver. In fiscal year 2023, Skyworks' top two customers represented 37% of net sales, underscoring this segment's importance and concentration. The automotive sector is a growing strategic area, with demand for 5G and connectivity chips in electric and autonomous vehicles. The global automotive semiconductor market is projected to exceed $100 billion by 2028.

Infrastructure and broad markets, including industrial, medical, and consumer electronics, further diversify Skyworks' customer base. The 5G infrastructure market was valued around $45 billion in 2023, a key growth area for component suppliers. Skyworks' total revenue for fiscal year 2024 was $4.0 billion, with these broad markets contributing significantly.

Cost Structure

Skyworks Solutions heavily invests in research and development, recognizing it as a cornerstone of its business model. This commitment fuels innovation, ensuring the company remains at the forefront of semiconductor technology for mobile, automotive, and infrastructure markets.

In fiscal year 2024, Skyworks reported R&D expenses of $724.5 million, a notable increase from the previous year. This substantial outlay directly supports the development of next-generation connectivity solutions and advanced analog and mixed-signal semiconductors.

Skyworks Solutions' Cost of Goods Sold (COGS) encompasses the direct expenses tied to producing their semiconductors. This includes critical inputs like silicon wafers and various chemicals, along with the labor involved in the manufacturing process and factory-related overhead costs.

In fiscal year 2023, Skyworks reported a COGS of $2.56 billion. This figure is directly influenced by the company's product mix and the sheer volume of units manufactured, both of which can significantly sway gross profit margins.

Maintaining highly efficient manufacturing operations is therefore paramount for Skyworks. By optimizing production, the company can effectively manage this substantial cost component, ensuring a healthier bottom line.

Selling, General, and Administrative (SG&A) expenses for Skyworks Solutions cover critical functions like sales, marketing, corporate overhead, and external professional services. Efficiently managing these costs is key to maintaining strong profitability.

For the fiscal year 2024, Skyworks reported SG&A expenses of $877.9 million. The company has demonstrated a focus on cost control, as evidenced by gains realized from property sales, which can offset operational SG&A burdens.

Capital Expenditures

Skyworks Solutions' capital expenditures are primarily directed towards maintaining and enhancing its manufacturing infrastructure. These investments are crucial for ensuring the company can meet the growing demand for its semiconductor products and stay at the forefront of technological advancements in the industry.

In fiscal year 2023, Skyworks reported capital expenditures of $248.6 million. This figure reflects ongoing investments in its facilities and equipment to support production capacity and innovation.

- Property, Plant, and Equipment: Significant portions of capital expenditures are allocated to acquiring, upgrading, and maintaining property, plant, and equipment. This includes investments in advanced manufacturing machinery and improvements to existing facilities.

- Capacity Expansion: The company invests in expanding its production capabilities to meet market demand. This ensures that Skyworks can efficiently produce its diverse range of advanced analog and mixed-signal semiconductors.

- Technological Advancement: Capital is also deployed to adopt new technologies and upgrade existing ones. This enables Skyworks to maintain its competitive edge by improving manufacturing processes and developing next-generation products.

Supply Chain and Logistics Costs

Skyworks Solutions incurs significant costs managing its intricate global supply chain. These expenses encompass the procurement of essential components, the complex logistics of moving goods worldwide, maintaining optimal inventory levels, and the final distribution to a diverse customer base and extensive network of distributors. For instance, in fiscal year 2023, Skyworks reported cost of goods sold totaling $2.77 billion, a substantial portion of which directly relates to supply chain operations.

The inherent complexity of operating on a global scale, coupled with the need for agile inventory adjustments to meet fluctuating market demands, directly impacts these costs. Skyworks' reliance on a geographically dispersed manufacturing and supplier base means that transportation, warehousing, and customs duties are ongoing significant expenditures. Furthermore, potential inventory write-downs or obsolescence, driven by rapid technological advancements in the semiconductor industry, can also add to the overall supply chain cost structure.

- Procurement Expenses: Costs associated with sourcing raw materials and components from various global suppliers.

- Logistics and Transportation: Expenses for shipping, freight, customs, and warehousing across international borders.

- Inventory Management: Costs related to holding, tracking, and insuring inventory, including potential obsolescence.

- Distribution Costs: Expenses incurred in delivering finished products to customers and distribution partners worldwide.

Skyworks Solutions' cost structure is dominated by its Cost of Goods Sold (COGS), which includes raw materials like silicon wafers, manufacturing labor, and factory overhead. Research and Development (R&D) is another significant expense, fueling innovation in advanced semiconductor technologies. Selling, General, and Administrative (SG&A) expenses cover sales, marketing, and corporate functions, while capital expenditures focus on maintaining and expanding manufacturing capabilities.

| Cost Category | Fiscal Year 2024 (Millions USD) | Fiscal Year 2023 (Millions USD) |

|---|---|---|

| Cost of Goods Sold (COGS) | Not Separately Disclosed | 2,560 |

| Research & Development (R&D) | 724.5 | Not Disclosed |

| Selling, General & Administrative (SG&A) | 877.9 | Not Disclosed |

| Capital Expenditures | Not Disclosed | 248.6 |

Revenue Streams

Skyworks Solutions' main income comes from selling its analog and mixed-signal semiconductors. These chips are crucial components for mobile devices, especially high-end Android smartphones. This part of the business is very sensitive to new product releases and seasonal demand, making up about two-thirds of their total earnings.

Skyworks Solutions generates revenue from selling its products to a broad range of customers across various industries. These include the automotive sector, infrastructure projects, industrial applications, medical devices, and the connected home market.

This diversified customer base is a key strength, helping to balance out any volatility experienced in the mobile phone market. For instance, in fiscal year 2023, Skyworks reported that its mobile segment represented 59% of its net revenue, highlighting the importance of these other growing markets.

The company is seeing significant growth in these non-mobile segments, fueled by major technological shifts. Trends like the increasing electrification of vehicles, the expansion of the Internet of Things (IoT) at the network edge, and the adoption of advanced Wi-Fi 7 systems are major drivers for this expansion.

Skyworks Solutions, with its deep portfolio of patented wireless technologies, likely generates revenue through licensing and royalties, even if not always a primary disclosed segment. This could involve agreements allowing other companies to utilize their advanced semiconductor designs.

Such arrangements might include cross-licensing, where Skyworks gains access to other firms' intellectual property, or royalty streams based on the sales of products incorporating Skyworks' chip technology. For instance, in the competitive mobile and connectivity space, licensing established and efficient designs can be a significant, albeit often embedded, revenue source.

Aftermarket and Service Revenue

Skyworks Solutions generates revenue from aftermarket sales of components and spare parts, crucial for maintaining the operational life of their existing products. This segment also includes technical services offered to their customer base, fostering recurring revenue streams and strengthening customer loyalty.

This aftermarket and service revenue, while a smaller contributor compared to new product sales, is vital for supporting the installed base of Skyworks’ advanced analog semiconductors. It ensures customers can continue to utilize their solutions effectively over the long term.

- Aftermarket Sales: Revenue from selling individual components and spare parts to existing clients.

- Technical Services: Income generated from providing support, maintenance, and troubleshooting to customers.

- Recurring Revenue: This stream contributes to predictable income by addressing ongoing customer needs.

- Customer Retention: Supporting the installed base through services enhances customer satisfaction and retention.

Strategic Design Wins and Content Expansion

Future revenue growth for Skyworks Solutions is intrinsically linked to securing new strategic design wins and increasing the content it provides within each device. This means getting its components designed into more products and also selling more of its components for each product that already uses them.

The increasing complexity of radio frequency (RF) systems, particularly in AI-enabled smartphones, directly fuels demand for Skyworks' advanced solutions. As these devices incorporate more sophisticated features requiring robust wireless connectivity, the need for Skyworks' specialized components rises, translating into higher sales volumes.

Furthermore, the widespread adoption of 5G and the emerging Wi-Fi 7 standard are significant drivers for expanded content. These next-generation wireless technologies necessitate more advanced and numerous RF components, creating substantial opportunities for Skyworks to increase its footprint in consumer electronics and other connected devices.

- Design Wins: Securing new design wins in next-generation smartphones and other connected devices.

- Content Expansion: Increasing the number and complexity of Skyworks components used within existing and new device designs.

- Market Trends: Capitalizing on the demand driven by AI integration in smartphones and the rollout of 5G and Wi-Fi 7 technologies.

- Revenue Impact: These factors collectively contribute to higher sales volumes and improved revenue streams for the company.

Skyworks Solutions' primary revenue stream originates from the sale of analog and mixed-signal semiconductors, particularly for mobile devices, which constituted approximately 59% of its net revenue in fiscal year 2023. Beyond mobile, the company is actively expanding its reach into automotive, infrastructure, industrial, and medical sectors, demonstrating a strategic diversification to mitigate reliance on a single market.

Growth in non-mobile segments is being propelled by significant technological advancements, including the increasing electrification of vehicles, the expansion of the Internet of Things (IoT), and the adoption of advanced Wi-Fi 7. These trends are creating new avenues for Skyworks' specialized semiconductor solutions.

The company also benefits from aftermarket sales and technical services, which support its existing customer base and contribute to recurring revenue. Furthermore, securing new design wins and increasing the content per device, especially with the proliferation of 5G and AI-enabled smartphones, are key strategies for future revenue expansion.

| Revenue Segment | FY2023 Contribution (Approx.) | Key Growth Drivers |

|---|---|---|

| Mobile Semiconductors | 59% of Net Revenue | High-end smartphone demand, AI integration, 5G deployment |

| Diversified Markets (Auto, Infra, Industrial, Medical) | 41% of Net Revenue | Vehicle electrification, IoT expansion, Wi-Fi 7 adoption |

| Aftermarket & Services | Smaller, but recurring | Customer retention, support for installed base |

Business Model Canvas Data Sources

The Skyworks Solutions Business Model Canvas is built upon a foundation of comprehensive market research, financial disclosures, and internal operational data. These sources provide the necessary insights into customer needs, competitive landscapes, and cost drivers to accurately define each element of the business model.