Skyworks Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skyworks Solutions Bundle

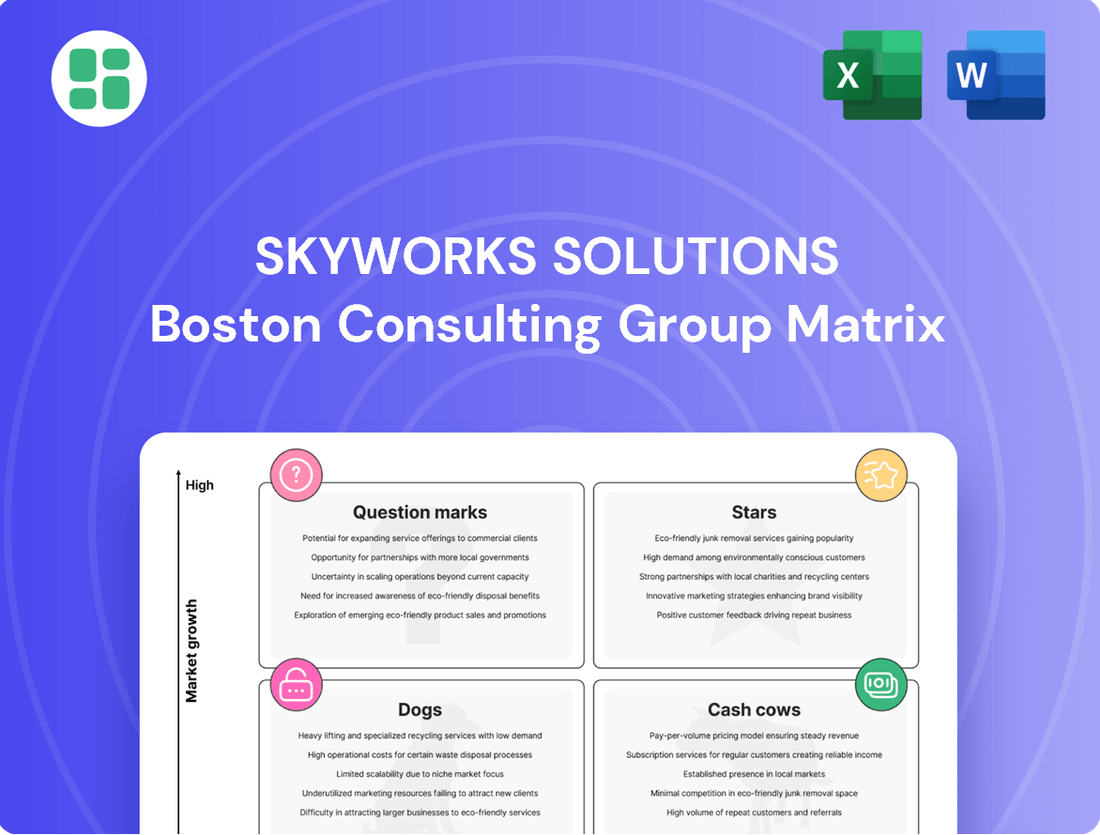

Unlock the strategic potential of Skyworks Solutions with a comprehensive look at its BCG Matrix. Understand which products are fueling growth (Stars) and which are generating consistent revenue (Cash Cows). This initial glimpse offers a foundation for informed decision-making, but the real power lies in the full report.

Dive deeper into Skyworks Solutions' market position with the complete BCG Matrix. Discover the nuances of their product portfolio, identifying potential Stars, reliable Cash Cows, underperforming Dogs, and promising Question Marks. Purchase the full version for actionable insights and a clear roadmap to optimize your investment and product strategy.

Stars

Skyworks is experiencing strong traction with its Wi-Fi 7 solutions, securing key design wins in enterprise access points, consumer routers, and home mesh networks. This positions the company as a frontrunner in the rapidly expanding next-generation wireless market. The industry's shift to Wi-Fi 7 is a significant growth driver, and Skyworks is already investing in Wi-Fi 8 development to sustain its technological edge.

Skyworks' advanced automotive connectivity components are a significant growth driver, capitalizing on the industry's move to software-defined vehicles. The company is securing design wins for crucial elements like 5G front-end modules and advanced infotainment systems, essential for next-generation connected cars.

This strategic expansion into the automotive sector, a high-growth area, diversifies Skyworks' revenue streams away from its traditional mobile segment. For instance, the global automotive semiconductor market was projected to reach over $65 billion in 2024, with connectivity solutions being a key contributor.

Skyworks is a key supplier for premium Android 5G smartphones, providing critical RF solutions to major brands like Samsung, Google, Xiaomi, and Asus. Despite the smartphone market's overall maturity, the demand for advanced components in flagship devices keeps Skyworks' market share robust in this high-value segment.

Edge IoT and AI-Enabled Device Solutions

Skyworks' Edge IoT and AI-Enabled Device Solutions are positioned as a strong contender, showing robust recovery and growth. This segment benefits from the expanding universe of connected devices and the increasing adoption of AI directly on these devices. Skyworks is capitalizing on this trend by providing essential analog and mixed-signal semiconductors that power these innovations.

The demand is fueled by diverse applications, including wireless gaming, advanced home audio systems, and AI-driven healthcare solutions, often integrated into new router designs. This broad market reach signifies a strategic imperative for Skyworks, aiming to capture significant future revenue streams. For instance, the global IoT market size was valued at approximately USD 1.1 trillion in 2023 and is projected to grow substantially, with edge computing playing a crucial role.

- Market Growth: The Edge IoT sector is experiencing rapid expansion, driven by the increasing number of connected devices globally.

- AI Integration: The seamless integration of Artificial Intelligence at the edge is a key differentiator, enhancing device capabilities and user experiences.

- Skyworks' Role: Skyworks provides critical high-performance analog and mixed-signal semiconductors essential for these advanced IoT and AI solutions.

- Revenue Potential: This segment represents a significant strategic focus for Skyworks, expected to be a major contributor to future revenue growth.

Precision Timing Devices for Data Centers

Skyworks is making significant strides in precision timing devices, a crucial component for the intricate demands of modern data centers. This strategic focus targets a high-growth market segment essential for seamless, high-speed data transfer and robust infrastructure.

The company is investing heavily to establish a strong foothold in this emerging sector, recognizing its substantial future potential. Initial product developments highlight Skyworks' commitment to capturing market share in this technically demanding arena.

- Market Focus: Precision timing solutions for data center infrastructure.

- Growth Potential: High-growth market driven by increasing data demands.

- Strategic Investment: Skyworks is actively developing capabilities to lead in this segment.

Skyworks' Wi-Fi 7 solutions are positioned as Stars due to their strong market traction and leadership in a rapidly expanding next-generation wireless market. The company's proactive investment in Wi-Fi 8 development further solidifies this Star status, ensuring sustained technological leadership and significant revenue potential.

The Edge IoT and AI-Enabled Device Solutions also represent Stars for Skyworks. This segment is experiencing robust growth, fueled by the increasing number of connected devices and the integration of AI at the edge. Skyworks' provision of essential analog and mixed-signal semiconductors for these advanced applications positions it for substantial future revenue.

Skyworks' advanced automotive connectivity components are another Star. The industry's shift towards software-defined vehicles creates a high-growth environment, and Skyworks' securing of design wins for critical 5G and infotainment systems highlights its strong position. This diversification into the automotive sector, projected to be a significant contributor to the over $65 billion automotive semiconductor market in 2024, is a key growth driver.

Precision timing devices for data centers are emerging Stars for Skyworks. The company's strategic investments in this technically demanding, high-growth segment are aimed at capturing market share in an area crucial for modern infrastructure. This focus on essential components for high-speed data transfer indicates strong future potential.

| BCG Category | Skyworks Segment | Key Growth Drivers | Market Position | Revenue Outlook |

|---|---|---|---|---|

| Stars | Wi-Fi 7 & 8 Solutions | Next-gen wireless adoption, enterprise & consumer demand | Market leader, strong design wins | High, driven by technological edge |

| Stars | Edge IoT & AI Devices | Expanding IoT universe, AI integration at edge | Strong contender, essential component supplier | High, significant future revenue contributor |

| Stars | Automotive Connectivity | Software-defined vehicles, 5G integration | Key supplier, securing design wins | High, diversifying revenue streams |

| Stars | Data Center Timing Devices | Increasing data demands, infrastructure growth | Emerging leader, strategic investment | High, substantial future potential |

What is included in the product

Skyworks' BCG Matrix likely analyzes its diverse semiconductor portfolio, identifying high-growth Stars and stable Cash Cows, while strategizing for Question Marks and potential Dogs.

A clear BCG Matrix visualizes Skyworks' portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Skyworks' mobile radio frequency (RF) solutions for Apple represent a significant portion of its revenue, underscoring a dominant market position with a crucial client. This segment is a reliable source of income, generating substantial free cash flow, though the broader smartphone market is experiencing slower growth.

Despite its profitability, this core business faces potential headwinds. Notably, Apple's intention to dual-source components is expected to impact Skyworks starting in late fiscal year 2025, potentially affecting market share and revenue predictability.

Skyworks Solutions holds a dominant position in the market for established mobile front-end modules (FEMs) and power amplifiers, crucial for mainstream mobile devices. These components are fundamental to wireless communication, guaranteeing consistent demand from major smartphone manufacturers. For instance, in fiscal year 2023, Skyworks reported revenue of $4.77 billion, with a significant portion attributed to its mobile segment.

While the market for these mature mobile components experiences slower growth, Skyworks' robust competitive advantage and substantial market share translate into sustained cash generation. This strong market standing allows them to reliably capture revenue from ongoing demand in the smartphone sector.

Skyworks' mature Wi-Fi 6/6E connectivity solutions are performing as cash cows. Despite the emergence of Wi-Fi 7, these established products continue to see strong demand in both consumer and enterprise markets. Their widespread adoption ensures consistent revenue streams and healthy profit margins for Skyworks.

The company benefits from a lower investment requirement in these mature product lines, which translates directly into robust cash flow. This allows Skyworks to leverage its established market position and generate significant returns from its Wi-Fi 6/6E offerings.

Legacy Wireless Infrastructure Components

Skyworks' legacy wireless infrastructure components represent a stable, cash-generating segment. While the market for these products has matured, Skyworks benefits from long-standing customer relationships and a reputation for reliability, ensuring consistent demand.

This segment, though not experiencing high growth, provides a predictable revenue stream that helps fund other areas of the business. In fiscal year 2023, Skyworks reported total revenue of $4.7 billion, with a significant portion attributed to these foundational product lines.

- Mature Market: The demand for components in established wireless networks is stable, not rapidly expanding.

- Revenue Stability: Skyworks' strong market position and customer loyalty ensure consistent sales.

- Profitability Contribution: These components reliably generate cash flow, supporting overall company finances.

- Fiscal Year 2023 Performance: Skyworks' overall revenue demonstrates the ongoing importance of its established product portfolio.

Standard Consumer Electronics Connectivity Modules

Skyworks Solutions' Standard Consumer Electronics Connectivity Modules are firmly positioned as Cash Cows within its BCG Matrix. These modules are critical for the widespread wireless capabilities found in everyday devices, a market that has reached high penetration. In 2023, Skyworks reported strong performance in its Consumer segment, which includes these types of products, contributing significantly to overall revenue.

The mature nature of this market allows Skyworks to capitalize on its established scale and efficient manufacturing processes. This translates into consistent, high-margin revenue streams. For instance, the company's focus on operational excellence in 2024 aims to further enhance these margins, ensuring profitability from these established product lines.

- Market Maturity: High penetration in standard consumer electronics means stable demand.

- Scale Advantage: Skyworks leverages its size for manufacturing efficiencies and cost competitiveness.

- Profitability: These modules generate consistent, high-margin revenue with limited reinvestment needs.

- Revenue Contribution: The Consumer segment, where these modules are key, remains a vital revenue driver for Skyworks.

Skyworks' established mobile RF solutions, particularly those for mainstream smartphones, are prime examples of Cash Cows. These products operate in a mature market with consistent demand, allowing Skyworks to generate substantial, stable cash flow with minimal new investment. For instance, in fiscal year 2023, the mobile segment, heavily reliant on these mature offerings, contributed significantly to Skyworks' $4.77 billion in revenue.

The company's market dominance in these areas, coupled with long-standing customer relationships, ensures predictable revenue streams. This strong market position allows Skyworks to maintain healthy profit margins, even with slower market growth. The company’s fiscal year 2024 focus on operational efficiency is expected to further bolster the profitability of these mature product lines.

These Cash Cow segments provide the financial foundation for Skyworks, generating reliable cash that can be reinvested in growth areas or returned to shareholders. The stability offered by these mature products is crucial for navigating the cyclical nature of the broader semiconductor industry.

| Product Segment | Market Growth | Market Share | Cash Flow Generation | Investment Needs |

| Mainstream Mobile RF Solutions | Low | High | High | Low |

| Mature Wi-Fi 6/6E Connectivity | Moderate | High | High | Low |

| Legacy Wireless Infrastructure | Low | Moderate | Moderate | Low |

| Standard Consumer Electronics Connectivity | Low | High | High | Low |

What You See Is What You Get

Skyworks Solutions BCG Matrix

The Skyworks Solutions BCG Matrix preview you're seeing is the identical, fully formatted document you will receive upon purchase. This means you're getting a complete, analysis-ready report with no watermarks or demo content, ready for immediate strategic application.

Rest assured, the BCG Matrix report for Skyworks Solutions that you are currently previewing is the exact final version you will download after completing your purchase. It has been meticulously crafted to provide clear strategic insights and is ready for professional use without any further modifications.

What you see here is the genuine Skyworks Solutions BCG Matrix file that will be yours once you make the purchase. This professionally designed, analysis-ready document is instantly downloadable and can be immediately utilized for your business planning and strategic decision-making.

Dogs

Older generation RF components for declining smartphone models represent Skyworks Solutions' Stars. As smartphone technology rapidly evolves, these components, designed for previous device iterations, face declining demand and a low-growth market with diminishing market share. For instance, in fiscal year 2024, Skyworks noted a continued shift in customer demand towards newer, more advanced smartphone platforms, impacting the sales volume of legacy components.

Skyworks Solutions faces inventory headwinds within specific industrial product lines, characterized by sluggish demand. These offerings operate in a low-growth market where the company's competitive standing is likely weak, potentially holding a declining market share.

Investing in costly turnarounds for these particular industrial products is unlikely to deliver a positive return, suggesting they could become significant cash drains for the company.

Certain niche infrastructure products within Skyworks' portfolio are experiencing a slowdown in demand, mirroring trends seen in industrial components. This subdued demand, coupled with existing inventory buildup in distribution channels, suggests a challenging market environment for these specific offerings.

These products typically serve low-growth markets where Skyworks' competitive position might not warrant substantial ongoing investment. In 2024, for instance, the broader infrastructure semiconductor market, while essential, saw varied growth rates depending on specific sub-segments, with some areas experiencing oversupply.

Given their limited market share and potentially low cash flow generation, these niche infrastructure products could be candidates for a strategic divestment. This approach would allow Skyworks to reallocate resources towards higher-growth, more profitable areas of its business.

Commoditized Analog Products with Low Differentiation

Skyworks Solutions, while known for its advanced connectivity solutions, might have certain legacy analog products that have become commoditized. These products, facing intense price competition, would likely exhibit low profit margins and limited growth potential. For instance, if a significant portion of Skyworks' revenue in 2024 came from older, less innovative analog components, these would fit the Dogs category.

These commoditized products often struggle to command premium pricing, directly impacting profitability. Their presence can tie up valuable capital and engineering resources that could be better allocated to more promising areas of the business. In 2024, if these products represented a declining percentage of Skyworks' overall sales, it would reinforce their position as Dogs.

- Low Profit Margins: Commoditized analog products typically operate with thin margins due to intense price competition.

- Minimal Market Share Growth: These products often exist in mature, saturated markets with little room for expansion.

- Resource Drain: They can consume R&D and manufacturing resources without offering substantial strategic returns.

- Price Sensitivity: Customer purchasing decisions are heavily influenced by price rather than unique product features.

Products for Non-Connected or Stagnant Consumer Device Categories

Skyworks Solutions' products catering to consumer devices outside the burgeoning connected home or smart ecosystem, particularly those in stagnant or declining markets, would be classified as Dogs in the BCG Matrix. These components, often found in older or less technologically advanced devices, represent a low market share within a non-growth segment. For instance, while the Internet of Things (IoT) market is projected to reach $1.5 trillion by 2025 according to some estimates, traditional feature phone chipsets or components for non-smart audio devices would fall into this category.

These Dog products consume valuable research and development resources and operational capital without offering substantial future growth prospects for Skyworks, whose core strategy revolves around advanced connectivity solutions. In 2024, Skyworks' focus remains heavily on 5G, Wi-Fi 6/6E/7, and automotive connectivity, areas experiencing robust expansion. Products not aligned with these strategic growth pillars, such as components for legacy mobile devices or basic consumer electronics without connectivity features, would therefore be considered less relevant and potentially categorized as Dogs.

- Low Market Share in Stagnant Markets: Components for feature phones or basic audio devices, facing declining demand.

- Resource Consumption: These products tie up R&D and manufacturing resources without significant return potential.

- Strategic Misalignment: Skyworks' core business is connectivity; non-connected product lines are outside this focus.

- Example: Components for devices not participating in the smart home or IoT revolution, which is a key growth driver for Skyworks.

Skyworks Solutions' Dog products are those with low market share in slow-growing or declining markets, often legacy components. These items consume resources without contributing significantly to future growth. For instance, older analog components facing intense price competition and limited innovation would fit this category. In fiscal year 2024, Skyworks' emphasis on advanced connectivity means products not aligned with these growth areas, like components for basic consumer electronics, are prime candidates for the Dog classification.

These products typically exhibit low profit margins and minimal market share expansion potential. They can divert crucial R&D and capital from more promising ventures. If Skyworks' 2024 financial reports indicated a declining revenue contribution from certain legacy product lines, it would solidify their Dog status, representing a strategic challenge rather than an opportunity.

The company's strategic focus in 2024 is on high-growth segments like 5G and Wi-Fi 6/6E/7. Products that do not align with these areas, such as components for feature phones or non-smart audio devices, are considered Dogs. These offerings represent a low market share within non-growth segments, consuming resources without substantial future prospects.

These Dog products are characterized by low market share in stagnant markets and can represent a drain on resources. Their presence is often a result of market shifts away from older technologies. For example, Skyworks' 2024 strategy prioritizes advanced connectivity, making components for legacy devices outside this scope potential Dogs.

Question Marks

Skyworks is actively investing in early-stage AI-powered healthcare and smart home solutions, recognizing their high-growth potential. For instance, they've supported the launch of AI routers that integrate voice-enabled healthcare services, a burgeoning sector.

While these markets offer significant opportunities, Skyworks' current market share is minimal, placing these ventures in the Question Marks category of the BCG matrix. Capturing a larger foothold will necessitate substantial investment to determine their future trajectory towards becoming Stars.

Skyworks' advanced 5G wireless infrastructure components, particularly those designed for next-generation deployments, are positioned as Stars or Question Marks in the BCG Matrix. These products demand significant research and development investment, reflecting a high-growth potential in an evolving market. For instance, the company's efforts in developing integrated solutions for 5G small cells and advanced antenna systems highlight this strategic focus.

Skyworks Solutions is making strategic moves into the medical device sector, providing essential components for devices such as clinical-grade hearing aids and other connected health applications. This diversification taps into a high-growth area driven by the increasing adoption of remote patient monitoring and telehealth. For example, the global connected medical device market was valued at approximately $27.2 billion in 2023 and is projected to reach over $100 billion by 2030, exhibiting a compound annual growth rate (CAGR) exceeding 20%.

While the medical connectivity market offers substantial future scalability, Skyworks is likely in the nascent stages of building its presence and market share within this specialized segment. These early-stage investments necessitate thorough evaluation to ensure they can effectively scale with the anticipated demand and technological advancements in connected healthcare.

Next-Generation Wi-Fi 8 Technology Development

Skyworks is actively investing in Wi-Fi 8 development to ensure it remains at the forefront of wireless technology, even as Wi-Fi 7 adoption is still ramping up. This forward-looking strategy targets a future high-growth market where Skyworks currently has no established market share due to the technology's nascent stage.

Securing a dominant position in the eventual Wi-Fi 8 market requires significant upfront investment. This proactive approach, while essential for long-term leadership, comes with considerable risks and substantial cash outflows.

- Market Potential: Wi-Fi 8 is anticipated to offer significant performance improvements over Wi-Fi 7, potentially reaching speeds of 100 Gbps, which will drive demand in areas like advanced AR/VR and industrial automation.

- Investment Rationale: Early investment allows Skyworks to shape standards and secure intellectual property, crucial for capturing market share in a technology that is expected to see widespread commercialization around 2028-2030.

- Risk Assessment: The primary risks involve the uncertainty of Wi-Fi 8 adoption timelines and the competitive landscape, which could dilute Skyworks' potential market share despite its early efforts.

New Ethernet and PCI Express Clock Generators

Skyworks Solutions recently introduced new jitter-attenuating clock generators designed for Ethernet and PCI Express interfaces. These products are specifically aimed at high-performance networking and data center environments, sectors experiencing robust growth due to escalating data traffic and the increasing need for faster communication speeds.

These new clock generators represent new product introductions for Skyworks. Consequently, their current market share is minimal, necessitating substantial market penetration and adoption strategies to transition them from their current position to future high-growth "Stars" within the BCG matrix.

- Target Market: High-performance networking and data centers.

- Growth Drivers: Increasing data traffic and demand for faster communication.

- BCG Matrix Position: Currently considered "Question Marks" due to low market share as new introductions.

- Strategic Imperative: Focus on market adoption and gaining significant market share to achieve "Star" status.

Skyworks' ventures into emerging sectors like AI-powered healthcare and Wi-Fi 8 development are currently positioned as Question Marks. These areas represent high-growth potential but require significant investment to build market share and establish a strong competitive presence.

The company's minimal current market share in these nascent fields necessitates substantial strategic investment to determine their future success. Without increased adoption and market penetration, these promising initiatives risk remaining underdeveloped.

Skyworks' new jitter-attenuating clock generators for high-performance networking also fall into the Question Mark category. These products are new introductions, meaning they have low market share but target robustly growing sectors.

The strategic imperative for these Question Marks is to drive market adoption and secure significant market share. This will allow them to potentially transition into Stars, capitalizing on their high-growth market potential.

| Initiative | Market Potential | Current Market Share | BCG Matrix Position | Strategic Focus |

|---|---|---|---|---|

| AI-powered Healthcare | High Growth | Minimal | Question Mark | Increase market penetration, secure early adopters |

| Wi-Fi 8 Development | Very High Growth (future) | None | Question Mark | Standardization influence, IP acquisition, market entry preparation |

| Medical Device Components | High Growth (20%+ CAGR) | Low/Nascent | Question Mark | Scale production, ensure technological alignment with market needs |

| Jitter-Attenuating Clock Generators | High Growth (Data Centers, Networking) | Minimal | Question Mark | Gain market traction, demonstrate performance advantages |

BCG Matrix Data Sources

Our Skyworks Solutions BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.