Skyworks Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skyworks Solutions Bundle

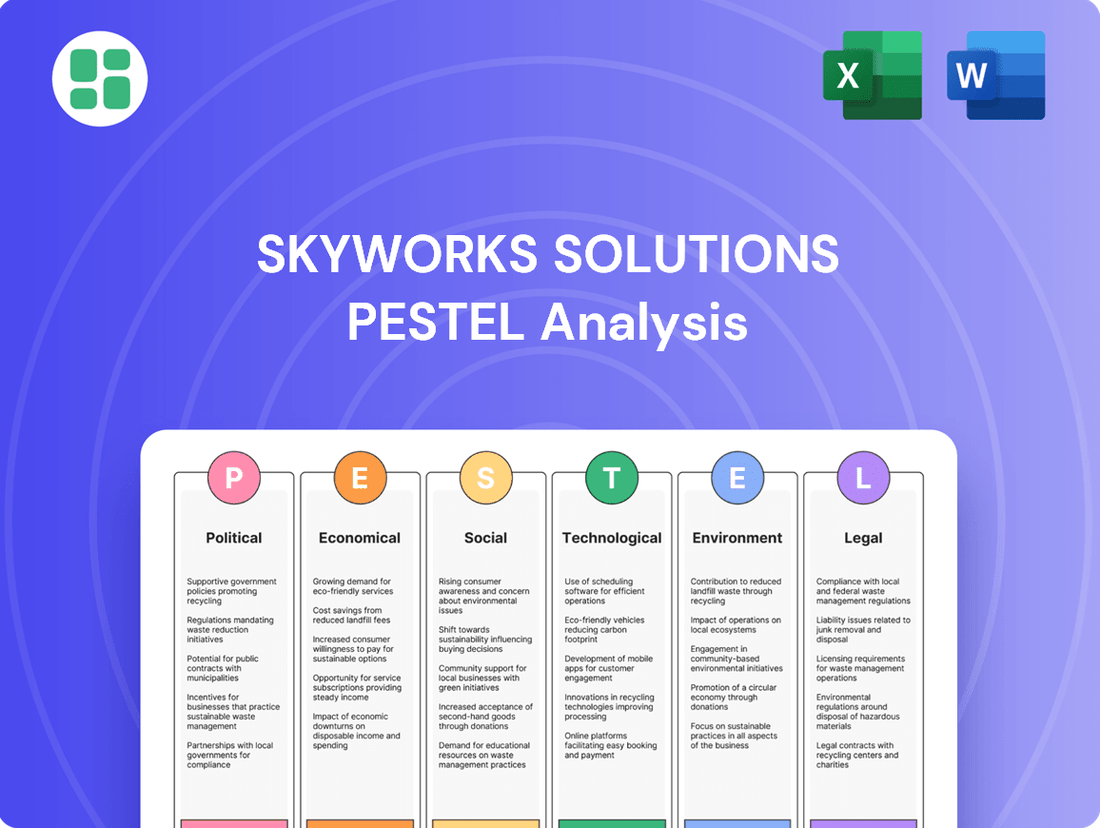

Navigate the complex external landscape impacting Skyworks Solutions with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are shaping the semiconductor industry and Skyworks's strategic direction. Gain actionable intelligence to inform your investment decisions and competitive strategy. Download the full PESTLE analysis now for an in-depth understanding.

Political factors

The 'Building Chips in America Act,' enacted in October 2024, offers a significant advantage to semiconductor manufacturers by exempting certain projects receiving CHIPS Act subsidies from environmental reviews. This aims to expedite domestic chip production, a move that directly benefits companies like Skyworks Solutions.

This policy could accelerate the establishment or expansion of Skyworks' manufacturing facilities within the United States, potentially streamlining the process and reducing the time to market for new products. The reduction in regulatory hurdles can lead to cost savings and improved operational efficiency.

Global trade tensions, especially between the U.S. and China, continue to present significant challenges for companies like Skyworks Solutions, impacting both their supply chains and access to key markets. These ongoing disputes can disrupt the flow of essential components and finished goods, potentially leading to increased costs and production delays.

Heightened import/export restrictions and controls, such as those seen in recent years, directly affect Skyworks' operational capabilities. For instance, the U.S. Department of Commerce's Entity List has previously impacted companies' ability to procure technology from certain Chinese firms, a factor that could influence Skyworks' sourcing of critical materials and its sales strategies in affected regions.

Geopolitical tensions are significantly reshaping global supply chains, particularly for critical components like semiconductors. The US, for instance, is aiming to triple its chipmaking capacity by 2032, fueled by over $500 billion in anticipated private sector investments. This global push for resilience directly influences companies like Skyworks Solutions by driving a strategic shift towards localized manufacturing and reducing reliance on single-source dependencies.

National Security and Critical Infrastructure

Semiconductors are now widely recognized as vital for national security, playing a crucial role in sectors like aerospace, defense, and telecommunications. This heightened awareness translates into increased government oversight and the potential for regulations designed to safeguard the supply of these essential components. For Skyworks Solutions, this could mean adjustments to strategic alliances and a shift in their primary market focus to align with national security priorities.

The US government, for instance, has been actively promoting domestic semiconductor manufacturing through initiatives like the CHIPS and Science Act, which allocated $52.7 billion in funding. This policy aims to reduce reliance on foreign supply chains, particularly in Asia, and bolster national security by ensuring a stable domestic source of advanced chips. Such government interventions directly influence the competitive landscape and strategic decisions for companies like Skyworks.

- Critical Infrastructure Reliance: The widespread use of semiconductors in power grids, communication networks, and transportation systems underscores their importance to national security.

- Government Incentives and Regulations: Policies like the CHIPS Act in the US aim to onshore semiconductor manufacturing, impacting supply chains and market access.

- Defense Sector Demand: Advanced semiconductor capabilities are essential for modern defense systems, driving demand and potentially influencing R&D priorities for suppliers.

- Supply Chain Security: Governments are increasingly focused on securing semiconductor supply chains against geopolitical risks, which can lead to preferential treatment for domestic producers or partnerships.

Executive Incentive Plans and Corporate Governance

Government and regulatory bodies play a significant role in shaping corporate governance, particularly concerning executive compensation. These influences often drive greater transparency and accountability in how top executives are rewarded.

Skyworks Solutions' approval of its Fiscal Year 2025 Executive Incentive Plan exemplifies this trend. The plan directly links executive awards to key corporate performance metrics, ensuring alignment between leadership compensation and the company's success.

This approach reflects a broader movement within corporate governance, emphasizing performance-based incentives and robust oversight. For instance, in 2024, the Securities and Exchange Commission (SEC) continued its focus on executive compensation disclosures and say-on-pay votes, reinforcing the importance of shareholder input and clear performance links.

- Executive Compensation Alignment: Skyworks' FY2025 plan links executive awards to corporate performance, a common practice influenced by regulatory trends.

- Increased Transparency: Such plans aim to provide clearer insight into how executive pay is determined, fostering greater accountability.

- Shareholder Focus: Regulatory bodies and institutional investors increasingly scrutinize executive pay packages, pushing for alignment with long-term shareholder value.

- Regulatory Environment: Ongoing SEC guidance and shareholder activism in 2024 underscore the political and regulatory pressure for responsible executive compensation structures.

Government policies like the CHIPS Act, which allocated $52.7 billion, are actively reshaping the semiconductor landscape by incentivizing domestic manufacturing. This push, aiming to triple US chipmaking capacity by 2032, directly impacts Skyworks by encouraging localized production and reducing foreign supply chain reliance.

Geopolitical tensions and trade disputes, particularly between the US and China, continue to create significant headwinds, affecting component sourcing and market access for companies like Skyworks. Heightened import/export restrictions, such as those previously impacting technology procurement, can disrupt operations.

Semiconductors are increasingly viewed through a national security lens, leading to greater government oversight and potential regulations to safeguard supply. This trend may influence Skyworks' strategic partnerships and market focus towards national security priorities.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Skyworks Solutions, examining their impact across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these dynamic global forces.

A concise PESTLE analysis for Skyworks Solutions, highlighting key external factors impacting the semiconductor industry, serves as a pain point reliever by offering clarity and focus for strategic decision-making.

This analysis provides a structured framework to understand and navigate the complex political, economic, social, technological, environmental, and legal landscape, thereby reducing uncertainty and enabling proactive strategy development.

Economic factors

Global economic conditions significantly influence consumer spending on electronic devices, a key market for Skyworks Solutions. A slowdown in global economic growth can directly translate to reduced demand for smartphones and other connected devices, impacting Skyworks' revenue streams.

The smartphone market, a substantial contributor to Skyworks' sales, experienced contractions in fiscal years 2023 and 2024. Projections suggest this trend of revenue decline is likely to persist through 2025 and into 2026, underscoring the sensitivity of Skyworks' performance to broader economic headwinds and consumer purchasing power.

Inflationary pressures directly impact Skyworks Solutions by increasing the cost of essential components, manufacturing processes, and global logistics. For instance, the Consumer Price Index (CPI) in the US saw a significant rise, with annual inflation reaching 3.4% in April 2024, a figure that can translate to higher input costs for Skyworks' semiconductor production.

Furthermore, the Federal Reserve's monetary policy, including interest rate adjustments, plays a crucial role. As of May 2024, the Federal Funds Rate target range remained elevated, impacting Skyworks' ability to secure capital for crucial research and development and significant capital expenditures. Higher borrowing costs can potentially squeeze profit margins and temper investment in next-generation technologies.

Currency fluctuations present a significant challenge for Skyworks Solutions, a global semiconductor manufacturer. As a company with substantial international operations, changes in exchange rates directly influence its reported financial results, affecting both revenues earned abroad and costs incurred in foreign currencies. For instance, a stronger US dollar can make Skyworks' products more expensive for international buyers, potentially impacting sales volume.

In 2024, the US dollar experienced volatility against major currencies like the Euro and Japanese Yen. This volatility can directly impact Skyworks' profitability. If Skyworks generates a significant portion of its revenue in Euros, a weaker Euro relative to the US dollar would translate to lower reported dollar-denominated revenue, even if unit sales remain consistent. Conversely, a stronger Euro would boost reported revenue.

These currency shifts also affect Skyworks' cost of goods sold and operating expenses. If the company sources components or manufactures in countries with weaker currencies, a strengthening US dollar could lower its reported costs. However, the net impact depends on the balance of foreign-denominated revenues and expenses, with significant swings potentially affecting earnings per share and overall financial performance in the 2024-2025 period.

Market Demand and Diversification

Skyworks Solutions is actively navigating market shifts by expanding its reach beyond the traditional mobile sector. The company is seeing significant traction in its Broad Markets segment, which encompasses areas like automotive electronics, the rapidly growing Edge Internet of Things (IoT), and the adoption of Wi-Fi 7 technology. This strategic diversification is key to counteracting the slowdown in smartphone demand.

This pivot is crucial for Skyworks' long-term financial health. For instance, in fiscal year 2023, the Broad Markets segment represented approximately 35% of Skyworks' total revenue, showcasing a growing reliance on these newer growth avenues. This trend is expected to continue, with projections indicating that Broad Markets could contribute even more significantly to the company's revenue stability and overall growth trajectory in the coming years, particularly as demand for connected devices in automotive and industrial applications accelerates.

Key growth drivers within the Broad Markets segment include:

- Automotive Electronics: Increasing demand for advanced driver-assistance systems (ADAS) and in-car infotainment systems.

- Edge IoT: Expansion of connected devices in industrial, medical, and smart home applications.

- Wi-Fi 7 Adoption: The rollout of next-generation Wi-Fi technology, offering higher speeds and lower latency.

- 5G Infrastructure: Continued investment in 5G networks globally, requiring robust connectivity solutions.

Supply Chain Costs and Efficiency

Skyworks Solutions, like many in the semiconductor industry, continues to navigate the complexities of global supply chain disruptions and elevated costs. These challenges, stemming from factors like the pandemic and geopolitical tensions, directly impact the company's ability to secure essential materials and components, influencing production schedules and overall operational efficiency.

To mitigate these headwinds, Skyworks employs a strategic hybrid manufacturing model. This approach allows the company to balance its reliance on external foundries with its own internal manufacturing capabilities. By optimizing this internal capacity, Skyworks aims to create a more resilient supply chain, better align production with market demand, and crucially, protect its gross margins amidst fluctuating input costs.

- Supply chain disruptions have led to increased lead times and component costs for semiconductor manufacturers.

- Skyworks' hybrid manufacturing model seeks to leverage both internal production and external foundry partners for flexibility.

- Gross margin management remains a key focus as the company works to offset rising supply chain expenses through operational efficiencies.

- In fiscal year 2023, Skyworks reported a gross margin of approximately 47.4%, reflecting ongoing efforts to manage costs in a challenging environment.

Global economic conditions continue to shape the demand for electronic devices, directly impacting Skyworks' revenue. Projections for 2025 indicate a continued, albeit potentially moderating, contraction in the smartphone market, a core segment for Skyworks.

Inflationary pressures, as evidenced by a US CPI of 3.4% in April 2024, increase input costs for Skyworks' semiconductor production. Elevated interest rates, with the Federal Funds Rate target range remaining high in May 2024, also affect capital access for R&D and expansion.

Currency fluctuations remain a significant factor, with the US dollar's volatility against currencies like the Euro impacting Skyworks' reported international revenues and expenses throughout 2024 and into 2025.

Preview the Actual Deliverable

Skyworks Solutions PESTLE Analysis

The Skyworks Solutions PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting Skyworks Solutions.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Consumer appetite for seamless, high-speed connectivity, exemplified by the growing adoption of 5G and the emerging Wi-Fi 7 standards, directly fuels the demand for Skyworks' sophisticated semiconductor solutions. This trend is further amplified by the increasing prevalence of Internet of Things (IoT) devices and the expansion of smart home ecosystems, creating a robust market for advanced radio frequency (RF) components.

The anticipated AI-driven upgrade cycle for smartphones is poised to significantly boost the need for increased RF complexity within these devices. Analysts project that the global smartphone market is expected to see shipments reach approximately 1.2 billion units in 2024, with a notable portion of these featuring enhanced AI capabilities, thereby requiring more advanced chipsets.

The semiconductor industry's demand for specialized skills means Skyworks Solutions must actively recruit and retain engineers and technicians. In 2023, the U.S. Bureau of Labor Statistics projected a 6% growth for software developers, a key talent pool, highlighting the competitive landscape for skilled professionals.

Skyworks' commitment to employee growth is evident in its investment in training programs. For instance, the company reported spending $108.5 million on research and development in Q1 2024, much of which supports the advanced skillsets of its workforce, crucial for staying ahead in chip design and manufacturing.

The growing dependence on digital services worldwide underscores the critical need for widespread, affordable wireless access. Skyworks' semiconductor solutions are instrumental in facilitating this ubiquitous connectivity, playing a key role in narrowing the digital divide.

By enabling reliable and cost-effective wireless communication, Skyworks' technology supports societal progress and expands market reach, particularly in developing economies. For instance, in 2024, over 5.3 billion people were projected to use smartphones globally, a figure expected to climb, directly benefiting companies like Skyworks that provide the underlying technology.

Ethical Consumerism and Responsible Sourcing

Consumers and stakeholders are increasingly demanding that companies operate ethically, with a particular focus on responsible sourcing and supply chain transparency. This trend directly impacts Skyworks Solutions, pushing it to align its operational standards with these evolving societal expectations.

Skyworks has responded to this by committing to a 100% audited and conformant 3TG (tin, tantalum, tungsten, and gold) supply chain. This initiative demonstrates their dedication to responsible mineral sourcing, a key area of concern for ethically minded consumers and investors.

- Growing Demand for Ethical Practices: Surveys consistently show a rise in consumers willing to pay more for products from companies with strong ethical and sustainability track records. For instance, a 2024 report indicated that over 60% of consumers consider a company's ethical practices when making purchasing decisions.

- Supply Chain Transparency as a Differentiator: Companies that can clearly demonstrate the ethical origins of their materials, particularly conflict minerals, gain a competitive advantage and build greater trust with their customer base.

- Investor Scrutiny: Institutional investors are also increasingly incorporating ESG (Environmental, Social, and Governance) factors into their investment decisions, with supply chain ethics being a significant component.

Impact of AI on Daily Life and Device Evolution

The increasing integration of Artificial Intelligence (AI) into everyday devices, from smart home assistants to advanced automotive systems, is fundamentally reshaping consumer expectations and product development cycles. This societal shift necessitates more powerful yet energy-efficient semiconductors to handle complex AI computations. Skyworks, as a provider of analog and mixed-signal semiconductors, is positioned to capitalize on this trend by innovating solutions that enable these sophisticated functionalities.

This evolution directly impacts Skyworks' product roadmap, demanding advancements in areas like:

- AI-powered personal assistants: Devices like smartphones and smart speakers are becoming more intelligent, requiring specialized chips for natural language processing and on-device AI.

- Autonomous driving systems: The automotive sector is a major driver of AI adoption, with vehicles increasingly relying on AI for perception, decision-making, and control, demanding high-performance, reliable semiconductor components.

- Smart infrastructure: AI is being embedded in everything from traffic management to energy grids, creating a demand for connected devices with embedded intelligence and efficient communication.

By 2025, it's projected that over 75% of enterprises will be using AI in some capacity, highlighting the pervasive nature of this technology and its direct influence on hardware requirements. This growing reliance on AI-driven devices fuels the demand for Skyworks' core competencies in delivering the essential analog and mixed-signal components that power these intelligent systems.

Societal shifts toward digital integration and the increasing reliance on connected devices directly benefit Skyworks. The global population's growing adoption of smartphones, projected to exceed 5.4 billion users by the end of 2025, creates a sustained demand for the advanced semiconductor solutions Skyworks provides to enable seamless wireless communication.

Furthermore, ethical consumerism and investor focus on ESG principles are shaping corporate behavior. Skyworks' commitment to supply chain transparency, including its adherence to responsible sourcing of 3TG minerals, aligns with these societal expectations, fostering trust and potentially enhancing brand loyalty among a growing segment of the market.

The pervasive integration of Artificial Intelligence (AI) across various sectors, from consumer electronics to automotive, is a significant sociological trend driving hardware innovation. By 2025, an estimated 75% of enterprises are expected to be utilizing AI, underscoring the need for sophisticated, energy-efficient semiconductors that Skyworks specializes in.

This societal embrace of AI necessitates more complex chipsets within devices, directly impacting Skyworks' product development. For instance, the demand for AI-powered personal assistants and autonomous driving systems requires advanced RF components that Skyworks is well-positioned to supply.

Technological factors

The continued rollout of 5G infrastructure globally, coupled with the nascent development of 6G, presents a substantial technological tailwind for Skyworks Solutions. This expansion necessitates increasingly sophisticated radio frequency (RF) components, a core area of Skyworks' expertise.

Skyworks has already secured crucial 5G design wins within the premium segment of the Android smartphone market. This positions them well to capitalize on the growing demand for enhanced connectivity and advanced mobile capabilities.

Looking ahead, the company anticipates a surge in demand for even more complex RF solutions. This is largely driven by the integration of artificial intelligence within smartphones, requiring greater processing power and, consequently, more advanced RF front-end architectures.

Skyworks is making significant strides in Wi-Fi 7 technology, securing design wins in enterprise access points, consumer routers, and home mesh networks. This push is crucial as demand for faster, more reliable wireless connections grows across all sectors. The company is also already looking ahead, initiating development for Wi-Fi 8 to solidify its position as a technology leader in the evolving wireless landscape.

Artificial Intelligence (AI) and Machine Learning (ML) are set to be major drivers for Skyworks Solutions. The integration of AI into smartphones is expected to spur a significant upgrade cycle, directly boosting demand for the radio frequency (RF) components Skyworks specializes in. For instance, advanced AI capabilities, like on-device processing for natural language understanding and enhanced camera features, require sophisticated RF front-end modules to ensure seamless connectivity.

Furthermore, AI is revolutionizing chip design itself. Companies are increasingly leveraging ML algorithms to optimize circuit layouts, predict performance, and accelerate the overall design process. This could lead to faster development cycles for Skyworks' products. However, this advancement also introduces complexities around intellectual property, particularly concerning the ownership of designs created with AI assistance, a factor Skyworks will need to navigate.

Miniaturization and Power Efficiency

The relentless pursuit of smaller, more potent, and power-conscious electronic gadgets is a major catalyst for advancements in semiconductor engineering and production. This trend directly impacts companies like Skyworks Solutions, which must continuously innovate to meet these evolving market demands.

Skyworks Solutions strategically invests in creating chips that excel in both performance and energy conservation. These high-efficiency semiconductors are critical for ensuring robust and dependable wireless communication across their wide array of products, from mobile devices to automotive systems.

For instance, the company's focus on miniaturization and power efficiency is evident in its solutions for 5G infrastructure and advanced mobile platforms. In fiscal year 2023, Skyworks reported a significant portion of its revenue derived from mobile solutions, underscoring the importance of these technological factors.

- Demand for Compact Devices: Consumer preference for sleeker smartphones, wearables, and IoT devices necessitates smaller, integrated semiconductor components.

- Power Consumption: Extended battery life is a key selling point, driving the need for highly power-efficient chipsets that minimize energy drain.

- 5G and Beyond: Next-generation wireless technologies require sophisticated chips capable of handling higher frequencies and data rates with improved power management.

- Market Trends: The global semiconductor market, valued at over $600 billion in 2024, is heavily influenced by these miniaturization and efficiency trends.

Advanced Packaging and Heterogeneous Integration

Skyworks' commitment to advanced packaging and heterogeneous integration is vital for its competitive edge in wireless technology. These advancements allow for the integration of diverse semiconductor components into a single package, boosting performance and reducing size. This is essential for meeting the demands of next-generation mobile devices, the expanding Internet of Things (IoT) ecosystem, and the increasingly connected automotive sector.

The company's investments in these areas directly impact its ability to offer cutting-edge solutions. For instance, heterogeneous integration enables the creation of smaller, more powerful chipsets that are critical for 5G and future wireless standards. This technological push is supported by industry trends; the global advanced packaging market was valued at approximately $45 billion in 2023 and is projected to grow significantly, with many analysts forecasting a compound annual growth rate (CAGR) of around 7-8% through 2028. This growth underscores the market's demand for the very capabilities Skyworks is investing in.

Key benefits for Skyworks include:

- Enhanced Performance: Integrating different chip functions leads to faster processing and improved signal integrity.

- Miniaturization: Smaller form factors are crucial for portable electronics and space-constrained applications like wearables and automotive sensors.

- Cost Efficiency: Advanced packaging can sometimes offer a more cost-effective way to achieve higher functionality compared to traditional monolithic integration.

- Accelerated Innovation: It allows for quicker development cycles by enabling the combination of best-in-class components from various sources.

The ongoing global rollout of 5G, with 6G development on the horizon, significantly benefits Skyworks by increasing demand for sophisticated radio frequency (RF) components, their core expertise. Skyworks' design wins in premium Android smartphones for 5G connectivity position them to capture this growth, anticipating further demand for complex RF solutions driven by AI integration in mobile devices.

Skyworks is also advancing in Wi-Fi 7, securing design wins across enterprise, consumer, and home networking sectors, and is already developing for Wi-Fi 8 to maintain its leadership. AI and ML are becoming crucial, not only driving upgrades for RF components due to enhanced smartphone capabilities but also revolutionizing chip design through optimized layouts and accelerated development cycles.

| Technology Trend | Impact on Skyworks | Market Data/Examples |

|---|---|---|

| 5G/6G Rollout | Increased demand for advanced RF components | Global 5G subscriptions projected to exceed 5 billion by 2025. |

| AI/ML Integration | Drives demand for sophisticated RF front-ends; impacts chip design | AI features in smartphones require more complex RF architectures. |

| Wi-Fi Advancements (7/8) | Opportunities in enterprise, consumer, and home networking | Wi-Fi 7 adoption is growing in high-performance routers. |

| Miniaturization & Power Efficiency | Necessity for smaller, energy-conscious semiconductor solutions | Skyworks' fiscal year 2023 revenue heavily influenced by mobile solutions. |

| Advanced Packaging/Heterogeneous Integration | Enhances performance, miniaturization, and cost-efficiency | Global advanced packaging market valued around $45 billion in 2023, with strong growth forecasts. |

Legal factors

Intellectual property is the bedrock of the semiconductor industry, safeguarding substantial research and development expenditures. Skyworks Solutions must remain vigilant against potential patent disputes, a common threat in this sector.

These disputes can arise from various sources, including non-practicing entities (NPEs) that leverage older patents to assert claims. Navigating this complex IP landscape, especially with emerging technologies like AI-generated inventions, requires constant adaptation and legal strategy.

Skyworks Solutions must diligently adhere to international export control regulations, a critical legal factor impacting its global operations. These regulations, often targeting specific nations or advanced technologies, pose a significant challenge in maintaining seamless global supply chains and market access. For instance, the Export Administration Regulations (EAR) in the United States govern the export and re-export of many items, including semiconductors and related technologies, which are central to Skyworks' business. Failure to comply can result in severe penalties, including fines and restrictions on future trade.

Navigating these complex trade rules is essential for Skyworks to avoid disruptions. The company's reliance on a global manufacturing and distribution network means that changes in export policies, such as those implemented in response to geopolitical events or national security concerns, can directly affect its ability to source components and deliver products. For example, the US Department of Commerce's Entity List, which restricts exports to certain companies, can have a direct impact on Skyworks' suppliers and customers. Staying abreast of these evolving legal landscapes is paramount for sustained business continuity.

As a major player in the semiconductor industry, Skyworks Solutions faces significant antitrust and competition law scrutiny. These regulations are in place to prevent monopolistic behavior and ensure a fair playing field for all market participants. The company's position in the highly competitive mobile chipset market, where giants like Qualcomm and Broadcom also operate, means strict adherence to these laws is crucial to avoid potential investigations or penalties.

Data Privacy and Security Regulations

Data privacy and security regulations are increasingly critical for hardware providers like Skyworks Solutions, especially with the explosion of connected devices and data. Frameworks such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States directly impact how data is handled, processed, and protected throughout the device lifecycle. Skyworks, by providing the underlying connectivity and communication technology, plays a vital role in enabling its customers to meet these stringent legal requirements. Failure to support compliance could lead to significant penalties and reputational damage.

As an enabler of the Internet of Things (IoT) and other connected ecosystems, Skyworks must ensure its semiconductor solutions are designed with privacy and security in mind. This means offering features that help customers secure data transmission, manage device identities, and comply with data localization mandates where applicable. For instance, ongoing developments in secure element integration and encrypted communication protocols are key areas of focus for the industry. The global data privacy software market, for example, was projected to reach over $2.5 billion in 2024, highlighting the significant investment and attention being paid to this area by businesses worldwide.

- GDPR and CCPA Compliance: Skyworks' components must facilitate customer adherence to global data protection laws, impacting data handling within connected devices.

- Security by Design: Integrating robust security features into hardware is essential for protecting sensitive data transmitted through Skyworks' solutions.

- Evolving Regulatory Landscape: Staying ahead of new and updated data privacy laws worldwide is a continuous challenge and necessity for Skyworks.

- Market Demand for Secure Solutions: Customers increasingly demand hardware that inherently supports strong data security and privacy measures, influencing product development priorities.

Labor Laws and Global Workforce Regulations

Skyworks Solutions operates across numerous countries, necessitating strict adherence to a patchwork of labor laws. These regulations cover everything from minimum wage requirements and working hours to employee benefits and termination procedures. For instance, in 2024, many European nations continued to strengthen worker protections, impacting hiring and management practices.

Navigating these global labor landscapes requires meticulous attention to detail. Key areas of compliance include ensuring fair wages, safe working conditions, and upholding non-discrimination policies in line with local statutes and international labor standards. Skyworks' commitment to ethical employment practices is crucial for maintaining its global reputation and operational integrity.

The evolving nature of labor legislation presents ongoing challenges. For example, in 2025, discussions around artificial intelligence in the workplace and its impact on employment rights are gaining traction in several key markets where Skyworks has a presence. Companies must remain agile in adapting their policies to these emerging legal frameworks.

- Global Compliance Burden: Skyworks must manage varying labor laws in regions like Asia, Europe, and North America, each with distinct employee rights and regulations.

- Wage and Hour Laws: Adherence to minimum wage, overtime pay, and maximum working hours is critical in all operating jurisdictions, with significant differences between countries.

- Non-Discrimination and Equal Opportunity: Skyworks is obligated to ensure fair treatment and prevent discrimination based on factors like gender, race, and age, as mandated by local laws.

- Employee Benefits and Protections: Compliance extends to statutory benefits such as health insurance, retirement plans, and parental leave, which differ considerably worldwide.

Skyworks Solutions must navigate a complex web of global regulations concerning intellectual property, ensuring its innovations are protected while respecting existing patents. The semiconductor industry, particularly in 2024 and 2025, is seeing increased patent litigation, including from non-practicing entities, demanding robust IP defense strategies.

Environmental factors

Skyworks Solutions is actively working to reduce its environmental impact, particularly concerning greenhouse gas emissions. The company successfully met an enhanced long-term emissions reduction target for Scope 1 and 2 CO2e emissions ahead of schedule in 2024, demonstrating a commitment to operational efficiency and sustainability.

Despite these achievements, Skyworks faces increasing scrutiny from investors and stakeholders regarding the disclosure of Scope 3 emissions, which represent indirect emissions in the value chain. Failing to provide comprehensive Scope 3 data could expose the company to significant competitive disadvantages and reputational damage, as transparency in climate-related disclosures becomes a critical factor for investment decisions in 2024 and beyond.

Environmental regulations, such as the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, are increasingly impacting semiconductor manufacturers like Skyworks. These rules mandate that companies consider the recyclability and responsible disposal of their products, influencing design choices and overall product lifecycle management to minimize environmental impact.

Skyworks Solutions, like all semiconductor manufacturers, must navigate complex environmental regulations such as RoHS and REACH. These directives restrict the use of hazardous materials in electronic products, forcing companies to reformulate their components and materials, which can involve significant R&D investment and rigorous testing to ensure compliance. For instance, the ongoing evaluation of substances under REACH could lead to further restrictions impacting supply chains.

The industry is also facing increasing pressure regarding per- and polyfluoroalkyl substances (PFAS), often referred to as 'forever chemicals'. With some PFAS slated for phase-out by 2025, Skyworks must actively seek and implement safer alternatives in its manufacturing processes. Failure to adapt could result in supply chain disruptions and potential market access issues, especially as governmental bodies and consumers alike demand greater environmental responsibility.

Water Management and Conservation

Water management is a significant environmental factor for semiconductor manufacturers like Skyworks Solutions, as the fabrication process is highly water-intensive. Conserving water resources is crucial, especially in regions facing water scarcity. Skyworks' commitment to this is evident in its strategic investments, aiming to reduce its environmental footprint and ensure sustainable operations.

A key initiative is the new municipal wastewater treatment plant at Skyworks' Mexicali facility, which became operational in October 2024. This facility is designed to purify millions of gallons of wastewater annually. By treating and reusing this water, Skyworks significantly reduces its reliance on fresh water sources, a critical step in responsible resource management.

- Wastewater Treatment: The Mexicali plant aims to process millions of gallons of wastewater, turning it into a reusable resource.

- Freshwater Reduction: This initiative directly contributes to lowering Skyworks' overall freshwater withdrawal by a substantial margin.

- Operational Efficiency: Investing in advanced treatment technologies enhances operational sustainability and addresses environmental concerns proactively.

Renewable Energy Sourcing and Energy Efficiency

Skyworks Solutions is actively pursuing renewable energy sourcing, notably through the acquisition of renewable energy credits. This initiative is coupled with significant investments in energy efficiency upgrades across its facilities, including widespread adoption of LED lighting. These actions align with a clear industry-wide push to lower energy consumption and reduce manufacturing carbon footprints, influenced by both evolving regulations and increasing customer demand for sustainable operations.

The company's commitment to sustainability is further evidenced by its progress in this area. For instance, in fiscal year 2023, Skyworks reported a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, largely attributable to these energy initiatives. This focus not only addresses environmental concerns but also positions Skyworks favorably within a market increasingly prioritizing ESG (Environmental, Social, and Governance) performance.

- Renewable Energy Credits: Skyworks is increasing its procurement of renewable energy credits to offset its electricity consumption.

- Energy Efficiency Improvements: The company is implementing measures like LED lighting upgrades to reduce overall energy usage.

- Industry Trend Alignment: These efforts reflect a broader industry movement towards decarbonization and reduced environmental impact in manufacturing.

- Customer and Regulatory Drivers: The push for sustainability is fueled by both regulatory mandates and growing customer expectations for environmentally responsible products and supply chains.

Skyworks is actively addressing environmental concerns, notably reducing greenhouse gas emissions. The company achieved its enhanced Scope 1 and 2 CO2e emissions reduction target ahead of schedule in 2024, showcasing operational efficiency and sustainability efforts.

However, Skyworks faces scrutiny for Scope 3 emissions disclosure, a critical factor for investors in 2024-2025. Transparency in climate reporting is becoming paramount, and a lack of comprehensive Scope 3 data could create competitive disadvantages and reputational risks.

Navigating stringent regulations like the EU's WEEE Directive and RoHS/REACH is crucial for Skyworks. These rules mandate responsible product disposal and restrict hazardous materials, necessitating significant R&D investment and rigorous testing for compliance, especially with ongoing substance evaluations under REACH.

The company is also tackling the challenge of per- and polyfluoroalkyl substances (PFAS), with some slated for phase-out by 2025. Skyworks must proactively seek and implement safer alternatives to avoid supply chain disruptions and potential market access issues, driven by increasing demand for environmental responsibility.

Water management is a key environmental focus for Skyworks, given the water-intensive nature of semiconductor fabrication. The new wastewater treatment plant in Mexicali, operational since October 2024, treats millions of gallons of wastewater annually, significantly reducing reliance on fresh water sources and enhancing sustainable operations.

| Environmental Factor | Skyworks' Action/Impact | Key Data/Timeline |

|---|---|---|

| Greenhouse Gas Emissions | Reduced Scope 1 & 2 CO2e emissions | Target met ahead of schedule in 2024; 15% reduction in FY23 vs. 2020 baseline |

| Scope 3 Emissions | Increasing stakeholder scrutiny on disclosure | Critical for investor decisions in 2024-2025 |

| Hazardous Materials Regulations | Compliance with RoHS, REACH, PFAS phase-outs | Ongoing substance evaluations under REACH; PFAS phase-outs by 2025 |

| Water Management | Wastewater treatment and reuse | Mexicali facility plant operational since October 2024; processes millions of gallons annually |

PESTLE Analysis Data Sources

Our Skyworks Solutions PESTLE Analysis draws from a robust dataset including semiconductor industry market research reports, global economic indicators from institutions like the IMF and World Bank, and regulatory updates from key operating regions.