SK Telecom SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SK Telecom Bundle

SK Telecom, a titan in the telecommunications industry, boasts significant strengths in its advanced 5G network and a vast customer base. However, it faces intense competition and the ever-present threat of technological disruption. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

SK Telecom commands a significant lead in the South Korean mobile sector, serving over 31.8 million subscribers, with 16.9 million of those on its 5G network as of the close of 2024. This dominant market position is built upon a foundation of expansive 4G and 5G network coverage and cutting-edge infrastructure, ensuring a reliable service for its vast customer base.

The company’s infrastructure is a key strength, enabling it to maintain its leadership. This robust network allows for consistent revenue generation from both fixed and mobile services, reinforcing SK Telecom’s strong standing within the domestic telecommunications industry.

SK Telecom is strategically repositioning itself as a global AI leader through its AI Pyramid Strategy, which encompasses AI Infrastructure, AI Transformation (AIX), and AI Services. This ambitious pivot is backed by substantial investments in critical areas like AI data centers (AIDC) and GPU-as-a-Service (GPUaaS), along with forging partnerships with prominent global AI entities.

The company's commitment to AI is yielding tangible results, with AI-related revenue experiencing a robust 19% year-over-year increase in 2024. Notably, the AIX business segment has demonstrated significant growth, underscoring the early success of SK Telecom's diversification initiatives into cutting-edge technological domains.

SK Telecom's strength lies in its diversified business portfolio, extending beyond traditional mobile and fixed-line services into dynamic sectors like media and enterprise solutions. This strategic expansion significantly de-risks its revenue streams.

The company's enterprise solutions, particularly its AI Contact Center (AICC) and Vision AI offerings, are demonstrating strong growth. For instance, in the first quarter of 2024, SK Telecom's enterprise business saw a notable increase in revenue, driven by these advanced AI services, contributing substantially to overall financial performance.

This broad business scope not only cushions the impact of potential slowdowns in its core telecom operations but also strategically positions SK Telecom as a key player in the burgeoning digital infrastructure and AI services market for the coming years.

Strong Financial Performance

SK Telecom demonstrated robust financial health in fiscal year 2024, achieving consolidated revenue of KRW 17.94 trillion and an operating income of KRW 1.82 trillion. This strong performance underscores the company's effective management and strategic execution. The substantial growth in net income further highlights successful business portfolio adjustments and improved asset utilization.

These healthy financial results are crucial, as they directly fuel SK Telecom's capacity for ongoing investment in cutting-edge technologies and strategic expansion efforts. This financial strength positions the company to capitalize on emerging market opportunities and maintain its competitive edge.

- KRW 17.94 trillion consolidated revenue for FY2024.

- KRW 1.82 trillion operating income for FY2024.

- Substantial increase in net income due to restructuring and efficiency.

- Financial strength enables continued investment in innovation and growth.

Commitment to Innovation and Global Partnerships

SK Telecom is aggressively pursuing innovation to lead the AI era, aiming to enhance its corporate value. The company is actively building its AI Infrastructure Superhighway by investing in global GPU cloud firms and AI data center solution providers. This strategic approach, bolstered by ongoing research and development, ensures SK Telecom remains a leader in technological progress and broadens its AI reach worldwide.

SK Telecom's dominant market share in South Korea, with over 31.8 million subscribers and 16.9 million on its 5G network by the end of 2024, is a significant strength. This leadership is underpinned by its extensive and advanced 4G and 5G network infrastructure, ensuring reliable service delivery.

The company’s strategic focus on becoming a global AI leader, driven by its AI Pyramid Strategy, is a key differentiator. Investments in AI infrastructure, including AI data centers and GPU-as-a-Service, along with strategic partnerships, are bolstering its capabilities. This AI push saw AI-related revenue grow by 19% year-over-year in 2024.

SK Telecom's diversified business model, encompassing media and enterprise solutions alongside its core telecom services, reduces revenue risk. Its enterprise offerings, such as AICC and Vision AI, are experiencing robust growth, contributing significantly to overall financial performance, as evidenced by strong Q1 2024 enterprise revenue increases.

Financially, SK Telecom demonstrated resilience in fiscal year 2024, reporting KRW 17.94 trillion in consolidated revenue and KRW 1.82 trillion in operating income. This financial strength provides the capital necessary for continued investment in technological innovation and strategic growth initiatives.

| Metric | FY2024 Value | Significance |

|---|---|---|

| Consolidated Revenue | KRW 17.94 trillion | Demonstrates market presence and service demand. |

| Operating Income | KRW 1.82 trillion | Indicates operational efficiency and profitability. |

| 5G Subscribers | 16.9 million | Highlights leadership in next-generation mobile technology. |

| AI-Related Revenue Growth | 19% YoY | Shows success in diversifying into AI services. |

What is included in the product

Offers a full breakdown of SK Telecom’s strategic business environment, detailing its internal capabilities and external market forces.

SK Telecom's SWOT analysis offers a clear, actionable framework to identify and address competitive weaknesses and external threats, thereby alleviating the pain of navigating a dynamic market.

Weaknesses

SK Telecom's significant reliance on the South Korean market, despite diversification attempts, remains a key weakness. In 2023, the domestic market accounted for the vast majority of its revenue, leaving it vulnerable to local market saturation and economic fluctuations.

This concentration limits SK Telecom's ability to tap into diverse international growth opportunities, unlike competitors with more robust global operations. The mature South Korean telecom landscape, while advanced, presents inherent growth ceiling challenges.

SK Telecom operates in a fiercely competitive South Korean market, primarily contending with KT and LG Uplus. This intense rivalry often triggers price wars and escalates marketing expenditures, which can put a strain on profit margins.

For instance, the telecommunications sector saw significant churn in subscriber numbers in early 2024 as operators aggressively competed on pricing and device subsidies. The past decade has shown a consistent trend of aggressive promotional activities, with average revenue per user (ARPU) often pressured by these competitive dynamics.

Further complicating matters, regulatory shifts, like the earlier dismantling of the Mobile Device Distribution Improvement Act, have historically amplified pricing pressures, making it challenging for any single player to gain a substantial, sustained market share advantage without significant investment or differentiation.

SK Telecom faces significant financial hurdles due to the substantial capital expenditure required for cutting-edge technologies. Investments in 5G network expansion, artificial intelligence infrastructure, and advanced data centers are crucial for staying competitive, but these ventures demand considerable upfront investment. For instance, the ongoing rollout and densification of 5G networks, along with the development of AI capabilities, represent multi-billion dollar commitments that can impact the company's near-term financial flexibility and profitability.

Challenges in Monetizing New Ventures

SK Telecom faces hurdles in turning its significant investments in AI, IoT, and metaverse platforms into substantial revenue streams. While these forward-looking areas are crucial for future growth, the path to profitability and widespread user engagement isn't always clear. This is underscored by the company's decision to discontinue its 'ifland' metaverse platform in March 2025, a move signaling the tough reality of user adoption and monetization in nascent technology sectors.

The challenges in monetizing new ventures are evident:

- Monetization Difficulty: Converting investments in AI, IoT, and metaverse into scalable revenue remains a significant challenge for SK Telecom.

- Metaverse Setback: The planned closure of 'ifland' by March 2025 highlights the struggles in achieving critical mass and financial viability in the metaverse space.

- Market Uncertainty: These difficulties reflect the inherent risks and unpredictability associated with pioneering new technology markets.

Regulatory and Cybersecurity Risks

SK Telecom operates in a highly regulated industry where changes in government policies concerning data privacy, network neutrality, and spectrum allocation can significantly affect its business model and profitability. For instance, new regulations introduced in late 2024 mandated increased investment in network infrastructure, impacting capital expenditure plans.

A significant cybersecurity breach in April 2025 resulted in a notable loss of subscribers, estimated at 150,000, and necessitated a substantial customer appreciation package totaling KRW 50 billion. This incident not only dented the company's near-term financial performance but also raised concerns about its data security protocols, potentially affecting future subscriber growth and brand reputation.

- Evolving Regulations: Telecommunications sector is subject to dynamic government oversight impacting pricing and operations.

- Cybersecurity Incident (April 2025): A data breach led to subscriber attrition and significant customer compensation costs.

- Financial Impact: The April 2025 incident resulted in an estimated KRW 50 billion in customer appreciation packages.

- Reputational Damage: Cybersecurity failures can erode customer trust and negatively impact market perception.

SK Telecom's heavy reliance on the South Korean market, despite some diversification, is a notable weakness. In 2023, domestic operations generated the lion's share of revenue, making the company susceptible to local economic downturns and market saturation. This concentration limits its ability to capitalize on global growth opportunities, especially when compared to competitors with more extensive international footprints.

Full Version Awaits

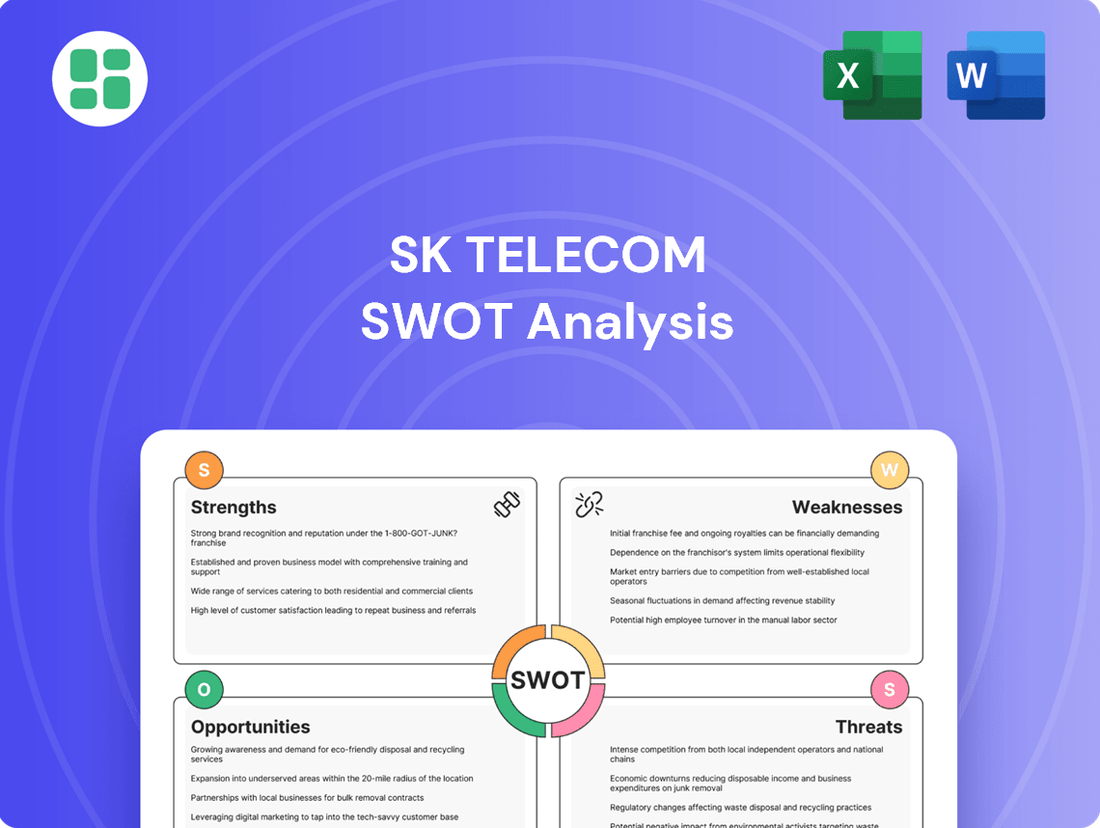

SK Telecom SWOT Analysis

This is the actual SK Telecom SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the detailed breakdown of Strengths, Weaknesses, Opportunities, and Threats that will be yours to use.

The preview below is taken directly from the full SK Telecom SWOT report you'll get. Purchase unlocks the entire in-depth version, offering comprehensive insights into the company's strategic position.

This preview reflects the real SK Telecom SWOT analysis document—professional, structured, and ready to use. You're getting a genuine look at the full content before you commit.

Opportunities

SK Telecom is well-positioned to capitalize on the burgeoning global demand for AI and enterprise solutions. The company's established strength in AI data centers (AIDC) and AI cloud services provides a robust foundation for international expansion. By offering its AI B2B solutions to a wider market, SK Telecom can tap into new revenue streams and solidify its global presence.

The planned beta launch of its global personal AI agent, Aster, in the U.S. during the first half of 2025 is a key strategic move. This launch demonstrates SK Telecom's commitment to entering major international markets and directly engaging with global consumers and businesses. This move is expected to drive significant user adoption and provide valuable feedback for future development.

Strategic partnerships with leading global LLM companies, such as Anthropic and Perplexity, are crucial for accelerating this global expansion. These collaborations will enable SK Telecom to integrate cutting-edge AI technologies and broaden the capabilities of its offerings, making them more competitive on the international stage. For instance, Perplexity AI secured $73.6 million in Series B funding in early 2024, highlighting the significant investment and growth potential in the AI search and information retrieval sector.

SK Telecom is well-positioned to benefit from the surging demand for AI infrastructure and services. The company's strategic investment in its 'AI Infrastructure Superhighway,' which includes AI data centers and GPU-as-a-Service, directly addresses this growing market need.

This focus is expected to drive significant revenue growth, with SK Telecom projecting double-digit increases in its AI data center (AIDC) business. By providing the foundational capabilities for AI development and deployment, SK Telecom aims to capture a substantial share of the expanding AI ecosystem.

SK Telecom is well-positioned to capitalize on the ongoing digital transformation trend by offering integrated enterprise solutions. These solutions can combine essential services like cloud connectivity, robust security measures, and advanced AI analytics, providing a one-stop shop for businesses. The company's demonstrated success in AI B2B offerings, such as its AI Contact Center (AICC) and Vision AI, highlights a substantial and growing market demand for these specialized services.

Convergence of Services and Smart City Initiatives

The growing trend of service convergence, where mobile, fixed-line, and digital content are bundled together, presents a significant opportunity for SK Telecom. This bundling strategy can boost customer loyalty and increase the average revenue per user (ARPU). For instance, in 2023, SK Telecom saw its ARPU reach approximately 31,000 KRW, a figure that could see further growth with enhanced service packages.

South Korea's commitment to smart city development creates a fertile ground for SK Telecom's expertise. As more smart cities are constructed, the demand for connected infrastructure, including IoT devices for smart homes, cities, and industries, will surge. SK Telecom's robust IoT capabilities are well-positioned to capitalize on this expansion, potentially powering smart grids and intelligent transportation systems.

- Service Convergence: Bundling mobile, fixed-line, and digital content to enhance customer loyalty and ARPU.

- Smart City Expansion: Leveraging IoT capabilities to support South Korea's growing smart city initiatives.

- IoT Market Growth: Capitalizing on the increasing need for connected devices in smart homes, cities, and industries.

Regulatory Changes Favoring Competition and Innovation

Recent regulatory shifts, like the repeal of the Mobile Device Distribution Improvement (MDDI) Act in South Korea, are designed to foster a more competitive market. This move, effective from late 2021, allows for increased handset subsidies and greater pricing flexibility, potentially benefiting consumers and encouraging new market entrants.

SK Telecom can leverage these changes to its advantage. By developing more innovative and competitive pricing plans and promotional offers, the company can aim to capture a larger market share and enhance subscriber loyalty in a more dynamic environment. This presents a clear opportunity to differentiate its service offerings.

Furthermore, the government's stated intention to support budget operators and facilitate cheaper network access creates an opening for SK Telecom to explore new service models. This could involve partnerships or the development of distinct service tiers that cater to price-sensitive segments of the market, potentially expanding its overall reach.

- Increased Subsidy Potential: The abolition of the MDDI Act allows for higher subsidies, potentially reaching up to 500,000 KRW (approximately $370 USD as of early 2024) per device, which SK Telecom can utilize in its marketing strategies.

- Pricing Flexibility: Greater freedom in setting prices enables SK Telecom to introduce more varied and attractive plans, potentially targeting specific customer segments more effectively.

- Budget Operator Growth: Government support for budget carriers may spur innovation in low-cost service models, which SK Telecom could either compete with or incorporate into its own portfolio through strategic alliances.

SK Telecom's expansion into global AI markets, particularly with its personal AI agent Aster set for a U.S. beta launch in early 2025, presents a significant growth avenue. Partnerships with AI leaders like Anthropic and Perplexity, which saw Perplexity secure $73.6 million in Series B funding in early 2024, bolster its competitive edge. The company's investment in its AI infrastructure, including AIDC and GPU-as-a-Service, is strategically aligned with the booming demand for AI capabilities, projecting double-digit growth for its AIDC business.

The company is also poised to benefit from the trend of service convergence, bundling mobile, fixed-line, and digital content to enhance customer loyalty and ARPU, which stood at approximately 31,000 KRW in 2023. Furthermore, SK Telecom's robust IoT capabilities are well-suited to capitalize on South Korea's smart city development initiatives, driving demand for connected infrastructure.

Regulatory changes in South Korea, such as the repeal of the MDDI Act in late 2021, allow for increased handset subsidies, potentially up to 500,000 KRW per device, and greater pricing flexibility. This regulatory environment creates opportunities for SK Telecom to introduce more competitive and varied service plans, potentially attracting new subscribers and strengthening its market position.

Threats

SK Telecom faces a fiercely competitive South Korean telecom landscape, battling established rivals like KT and LG Uplus, with the potential for new budget carriers to emerge, possibly encouraged by regulators. The recent repeal of the handset subsidy law is a significant concern, as it could ignite a price war. This means carriers might offer deeper discounts, potentially driving down average revenue per user (ARPU) across the board, impacting SK Telecom's profitability.

The relentless pace of technological change, especially in areas like artificial intelligence and digital services, presents a significant threat. Existing technologies and SK Telecom's current business models could become outdated very quickly. For instance, the global AI market was valued at approximately USD 150.2 billion in 2023 and is projected to grow substantially, meaning any lag in adoption or development could be detrimental.

While SK Telecom is actively investing in AI, there's always a risk that rivals or entirely new players might emerge with even better or more affordable AI solutions. This competitive pressure demands constant innovation and agility to stay ahead in the rapidly evolving landscape.

The company's strategic shift, such as moving away from its metaverse focus towards AI, underscores the critical need to adapt swiftly to shifting market preferences and emerging technological trends. Failure to anticipate and respond to these changes could impact SK Telecom's market position.

SK Telecom's vast digital footprint and the sheer volume of customer data it handles expose it to considerable cybersecurity threats. The company must navigate an increasingly complex landscape of data privacy regulations, which are constantly being updated. This necessitates continuous investment in advanced security measures to protect sensitive information.

A significant cybersecurity incident in April 2025 highlighted the tangible consequences of such vulnerabilities. The breach led to a measurable decline in SK Telecom's subscriber base and required the company to offer a substantial customer appreciation package, underscoring the direct financial and reputational costs associated with security failures. This event serves as a stark reminder of the critical importance of maintaining a vigilant and robust cybersecurity posture.

Regulatory Scrutiny and Consumer Protection Measures

The Korea Communications Commission (KCC) is actively revising regulations to promote affordable mobile plans and enhance oversight of platform businesses. These changes, expected to be fully implemented by late 2024, aim to prevent discriminatory practices and safeguard consumers from unfair treatment. This could limit SK Telecom's pricing strategies and service innovation, impacting its competitive edge.

SK Telecom faces increased compliance burdens due to stricter rules on platform operators and enhanced penalties for illegal spamming activities. For instance, the KCC's proposed amendments in early 2024 include significant fines for data misuse, potentially impacting revenue streams if not managed proactively. The company must invest more in compliance infrastructure to avoid these penalties.

- Regulatory Amendments: KCC's focus on affordable mobile plans and platform oversight by late 2024.

- Consumer Protection: Measures to prevent discrimination and protect users from unfair practices.

- Compliance Burden: Increased penalties for illegal spam and data misuse, requiring greater investment in compliance.

Economic Downturn and Market Saturation

South Korea's mobile market is notably mature, with penetration rates exceeding 100% in recent years, suggesting limited room for organic subscriber growth in traditional services. This saturation presents a significant challenge for SK Telecom, as the primary avenues for expansion shift towards enterprise solutions and new technology adoption rather than acquiring new individual users.

An economic downturn, particularly in late 2024 or 2025, could further constrain SK Telecom's revenue streams. Consumer discretionary spending on premium mobile plans, 5G upgrades, and emerging technologies like AI-powered services might decrease, impacting average revenue per user (ARPU) in core segments. For instance, a projected slowdown in global GDP growth for 2025 could translate directly into reduced consumer confidence and spending in the South Korean market.

The combination of a saturated core market and potential economic headwinds creates a threat of dampened revenue growth for SK Telecom. While enterprise digitalization offers a growth vector, its pace might not fully offset potential declines in consumer spending on high-value mobile offerings, especially if economic conditions worsen.

Key considerations include:

- Subscriber Saturation: South Korea's mobile penetration rate consistently hovers above 100%, indicating that most individuals already possess at least one mobile subscription.

- Economic Sensitivity: A potential economic slowdown in 2025 could lead to reduced consumer spending on premium services and new technology adoption.

- ARPU Pressure: Market saturation and economic pressures may limit the ability to increase average revenue per user (ARPU) from the existing subscriber base.

- Growth Diversification Reliance: SK Telecom's reliance on enterprise digitalization and new technologies to offset core market saturation becomes critical during economic downturns.

SK Telecom faces significant regulatory pressure from the Korea Communications Commission (KCC), which is pushing for more affordable mobile plans and increased oversight of platform businesses, potentially limiting pricing flexibility. Stricter rules on platform operators and enhanced penalties for data misuse and spamming, with fines potentially impacting revenue, necessitate greater investment in compliance infrastructure.

SWOT Analysis Data Sources

This SK Telecom SWOT analysis is built upon a foundation of reliable data, including their official financial reports, comprehensive market research from industry analysts, and insights from telecommunications sector experts.