SK Telecom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SK Telecom Bundle

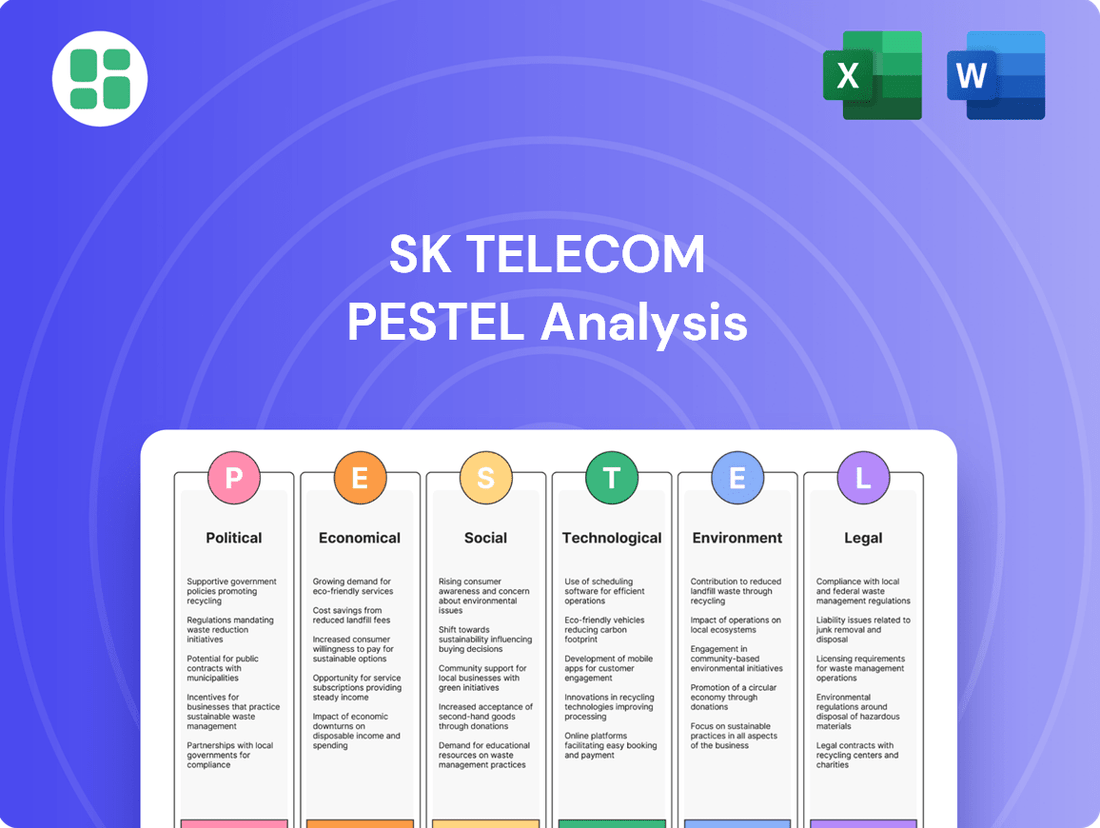

Navigate the dynamic landscape of South Korea's telecommunications sector with our comprehensive PESTLE analysis of SK Telecom. Understand how political, economic, social, technological, legal, and environmental factors are shaping their operations and future growth. Gain a competitive edge by leveraging these critical insights for your strategic planning. Download the full analysis now to unlock actionable intelligence.

Political factors

The South Korean government, via the Korea Communications Commission (KCC) and the Ministry of Science and ICT (MSIT), significantly shapes the telecom industry. For instance, the abolition of the Mobile Device Distribution Improvement (MDDI) Act in January 2024 aims to boost competition by permitting increased handset subsidies, a move that could alter SK Telecom's marketing and pricing approaches.

Furthermore, the KCC's 2025 Action Plan sets a course for digital and media policies, prioritizing a secure digital space and a dynamic ecosystem. This strategic direction will undoubtedly influence SK Telecom's operational framework and future development plans.

South Korea's government is aggressively pushing digital transformation, with a 'National AI Strategy' and 'Digital Strategy of Korea' aiming for global AI leadership. This involves bolstering infrastructure, research, and development, alongside easing regulations. These policies directly benefit SK Telecom, aligning with its focus on AI and network advancements.

The government's commitment to a nationwide 5G network by 2024 and pre-6G demonstrations by 2026 provides a robust foundation for SK Telecom's services. Furthermore, the June 2024 'Action Plan to Establish a New Digital Order' emphasizes AI safety and digital rights, shaping how SK Telecom develops and deploys its AI technologies.

Recent legal revisions, like the amended Personal Information Protection Act effective September 2023, have introduced significantly tougher sanctions for data breaches, with fines potentially reaching up to 3% of a company's total revenue. This heightened regulatory environment directly impacts SK Telecom's operational costs and strategic planning.

A major data breach affecting SK Telecom in April 2025, impacting 25 million subscribers, has led the privacy regulator to hint at substantial penalties. This event underscores the critical importance of robust cybersecurity and strict compliance with evolving data protection laws, potentially costing SK Telecom billions in fines and reputational damage.

In response, SK Telecom is investing KRW 700 billion over five years to build a world-class information protection system. The company has also reorganized its Chief Information Security Officer role to report directly to the CEO, signaling a top-down commitment to enhancing data privacy and cybersecurity measures.

Antitrust and Competition Regulations

The telecom landscape in South Korea saw a significant shift in early 2024 with the abolition of the Mobile Device Distribution Improvement Act (MDDI Act). This change is designed to foster greater competition by enabling companies like SK Telecom to offer more substantial subsidies on mobile devices. This, in turn, is expected to make it easier and more attractive for customers to switch between providers, potentially boosting SK Telecom's customer acquisition efforts.

Further government initiatives are actively promoting competition. The state is supporting budget mobile carriers by facilitating access to 5G networks and encouraging the introduction of more affordable 5G plans. This strategy aims to diversify the market and provide consumers with a wider range of choices, directly impacting the competitive dynamics SK Telecom operates within.

Looking ahead, proposed regulations could impose restrictions on large platform companies that hold substantial market power. These rules might prohibit anti-competitive behaviors, which could have implications beyond SK Telecom's core mobile services, potentially affecting its broader digital ecosystem and service offerings.

- MDDI Act Abolished: January 2024, allowing for increased device subsidies and customer mobility.

- Budget Operator Support: Government backing for cheaper 5G plans and network access to intensify competition.

- Platform Regulation: Potential rules targeting anti-competitive practices by dominant platform companies, impacting SK Telecom's diverse digital services.

Government Support for New Technologies

The South Korean government is actively fostering innovation, with significant backing for emerging technologies like 5G, 6G, AI, and IoT. This commitment translates into tangible support through various policies and substantial investments, creating a favorable environment for companies like SK Telecom.

A prime example is the Ministry of Science and ICT's spectrum plan for 2024-2027. This strategic initiative aims to enhance mobile network infrastructure and expedite 5G rollout. Such government efforts directly empower SK Telecom's ongoing network expansion and reinforce its position as a technological leader in the market.

- Government Investment: South Korea allocated approximately 3.5 trillion KRW (around $2.6 billion USD) in 2024 towards R&D for future technologies, including advanced telecommunications and AI.

- Spectrum Allocation: The Ministry of Science and ICT's 2024-2027 spectrum plan prioritizes efficient allocation for 5G and future 6G development, ensuring SK Telecom has access to crucial frequencies.

- Policy Initiatives: The government's digital new deal and related policies encourage private sector investment in digital infrastructure, directly benefiting telecom operators by driving demand for advanced services.

The South Korean government's commitment to digital transformation, including its National AI Strategy and Digital Strategy of Korea, directly supports SK Telecom's focus on AI and network advancements. The government's aggressive push for nationwide 5G by 2024 and pre-6G demonstrations by 2026 provides a strong foundation for SK Telecom's services.

The abolition of the Mobile Device Distribution Improvement Act in January 2024, allowing for increased handset subsidies, aims to boost competition and customer mobility, impacting SK Telecom's market strategies. In parallel, government support for budget mobile carriers and potential regulations on dominant platform companies are intensifying the competitive landscape.

Heightened data protection regulations, such as the amended Personal Information Protection Act effective September 2023, with fines up to 3% of total revenue, significantly influence SK Telecom's operational costs and cybersecurity investments. A major data breach in April 2025, affecting 25 million subscribers, has prompted SK Telecom to invest KRW 700 billion over five years in its information protection system.

| Government Initiative | Impact on SK Telecom | Key Data/Timeline |

| National AI Strategy & Digital Strategy of Korea | Supports AI and network advancement focus | Ongoing, with 2024-2025 focus on AI leadership |

| 5G Rollout & Pre-6G Demonstrations | Provides robust network infrastructure | Nationwide 5G by 2024; Pre-6G by 2026 |

| Abolition of MDDI Act | Increases competition via device subsidies | January 2024 |

| Amended Personal Information Protection Act | Increases data breach penalties | Effective September 2023; Fines up to 3% of revenue |

| SK Telecom Data Breach Response | Requires significant investment in cybersecurity | KRW 700 billion investment over 5 years |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing SK Telecom, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces create both challenges and strategic opportunities for SK Telecom's growth and market positioning.

SK Telecom's PESTLE analysis offers a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring all stakeholders grasp key external factors impacting the business.

Economic factors

South Korea's economic landscape, with its robust digitalization, fuels the telecom sector's expansion. The market, valued at USD 40.0 billion in 2024, is on track to reach USD 50.0 billion by 2033, a testament to the surging demand for data-heavy services and enterprise digital transformation initiatives.

This sustained growth, despite subscriber saturation, is further bolstered by advancements like private 5G networks and the monetization of advanced infrastructure. SK Telecom benefits directly from this environment, characterized by high internet penetration and a population adept at adopting new technologies, which supports its ongoing revenue generation.

The South Korean telecom landscape is a concentrated market, primarily shaped by SK Telecom, KT, and LG Uplus. SK Telecom has historically held a leading position in the mobile sector, but this dominance faces increasing challenges.

The anticipated repeal of the handset subsidy ban in July 2025 is a significant development. This move is widely expected to ignite a subsidy war among the major players, including SK Telecom. Carriers will likely employ aggressive pricing tactics and enhanced subsidies to attract new subscribers and defend their market share.

This intensified competition directly impacts profitability. The pressure to offer more attractive deals will likely lead to a decrease in Average Revenue Per User (ARPU) for SK Telecom and its rivals, as the cost of acquiring and retaining customers rises. For instance, in Q1 2024, SK Telecom reported a slight dip in ARPU, a trend that could be exacerbated by the upcoming regulatory changes.

SK Telecom's strategic focus on Artificial Intelligence and digital infrastructure is driving substantial economic activity. The company's commitment to building hyperscale AI data centers and offering GPU-as-a-Service (GPUaaS) positions it as a key player in the burgeoning AI sector, requiring significant capital allocation.

In 2024 alone, SK Telecom's capital expenditure reached KRW 2.39 trillion, underscoring the scale of investment in these advanced technologies. Furthermore, a planned KRW 700 billion investment over five years dedicated to information protection systems highlights the economic commitment to securing this digital foundation.

These considerable financial outlays are essential for SK Telecom's ambition to become a global AI powerhouse, directly impacting economic growth through job creation, technology development, and the expansion of digital services.

Revenue Diversification and Growth Areas

SK Telecom's financial performance in fiscal year 2024 demonstrated robust revenue streams, with consolidated revenue reaching KRW 17.94 trillion and operating income at KRW 1.82 trillion. The company experienced solid growth in its core fixed and mobile communications sectors, alongside a notable 4.0% expansion in its AI businesses.

Looking ahead to 2025, SK Telecom anticipates continued revenue and profit increases, projecting consolidated operating revenue of KRW 17.8 trillion. Key growth drivers for this projection include the burgeoning AI data center (AIDC) and AI transformation (AIX) segments.

- FY 2024 Consolidated Revenue: KRW 17.94 trillion

- FY 2024 Operating Income: KRW 1.82 trillion

- AI Business Revenue Growth (FY 2024): 4.0%

- AIDC Revenue Growth (Q1 2025): 11.1% year-over-year

Inflation and Cost Management

Inflationary pressures and rising interest rates can significantly affect SK Telecom's operating expenses. For instance, higher energy costs directly impact the operational budget for their extensive data centers and network infrastructure. Furthermore, increased borrowing costs can make financing new investments, such as 5G network expansion, more expensive.

SK Telecom is actively addressing these cost pressures through strategic initiatives. Their investment in AI-driven network optimization aims to enhance energy efficiency, thereby lowering utility bills. This focus on operational efficiency is crucial for maintaining profitability in a dynamic economic environment.

- Inflation Impact: Rising inflation in South Korea, with CPI reaching 3.6% year-on-year in May 2024, increases costs for energy and raw materials essential for network maintenance and upgrades.

- Interest Rate Sensitivity: The Bank of Korea's policy rate, which stood at 3.50% as of mid-2024, influences SK Telecom's cost of capital for its substantial infrastructure investments.

- Efficiency Gains: SK Telecom's AI-powered network management solutions are designed to reduce energy consumption per unit of data traffic, offering a direct hedge against rising energy prices.

South Korea's economy is a significant driver for SK Telecom, with a strong digital infrastructure and a population eager for new technologies. The market's projected growth from USD 40.0 billion in 2024 to USD 50.0 billion by 2033 highlights the demand for data-intensive services and digital transformation, directly benefiting SK Telecom.

However, economic factors like inflation and interest rates present challenges. Rising energy costs, with South Korea's CPI at 3.6% in May 2024, impact operational expenses, while the Bank of Korea's 3.50% policy rate affects borrowing costs for infrastructure projects.

SK Telecom is proactively managing these economic pressures through AI-driven operational efficiencies, aiming to reduce energy consumption and mitigate rising costs. The company's substantial investments, including KRW 2.39 trillion in capital expenditure in 2024, underscore its commitment to technological advancement and economic growth.

| Key Economic Indicators | Value/Rate | Source/Period |

| Telecom Market Value (2024) | USD 40.0 billion | Industry Projections |

| Telecom Market Projected Value (2033) | USD 50.0 billion | Industry Projections |

| South Korea CPI (May 2024) | 3.6% | Bank of Korea |

| Bank of Korea Policy Rate (Mid-2024) | 3.50% | Bank of Korea |

| SK Telecom CapEx (FY 2024) | KRW 2.39 trillion | SK Telecom Financials |

What You See Is What You Get

SK Telecom PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive SK Telecom PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting SK Telecom.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into SK Telecom's strategic landscape.

Sociological factors

South Korea boasts an impressive internet penetration rate, reaching 97.4% in 2023, which underscores a deep-seated societal reliance on digital access. This high penetration fuels a robust demand for seamless connectivity, a foundational element for modern life and business operations.

The widespread adoption of data-hungry services like high-definition streaming, competitive online gaming, and the burgeoning Internet of Things (IoT) ecosystem is significantly increasing data consumption. This escalating usage pattern necessitates continuous investment in network infrastructure to ensure reliable and high-speed service delivery.

These trends present a direct opportunity for SK Telecom, a leading player in the South Korean telecommunications market. The company's portfolio, encompassing mobile communication and broadband internet services, is well-positioned to capitalize on this growing demand, further strengthened by its ongoing development of advanced technologies like 5G and beyond.

South Korean consumers increasingly expect personalized experiences, fueled by rapid adoption of AI and digital technologies. This shift is evident in the robust mobile data usage, which represented 69.21% of data revenue in South Korea in 2024. This trend is largely driven by a mobile-first culture, the popularity of video content, livestream commerce, and dedicated fan engagement apps for K-pop.

SK Telecom's strategic focus on AI development and its rollout of AI-powered services directly addresses these evolving consumer demands. By integrating AI into its offerings, the company aims to cater to the growing desire for tailored digital interactions and services, solidifying its position in a market that values innovation and personalization.

South Korea's demographic landscape is undergoing significant transformation, marked by an ultra-low birth rate, with the total fertility rate falling to a record low of 0.72 in 2023. This shift, coupled with an aging population, is reshaping consumer behavior and market demand, influencing everything from product preferences to service utilization.

While the long-term implications of a shrinking population on subscriber numbers are a consideration, SK Telecom is actively navigating these changes. The company's strategic focus on enterprise digitalization and the development of innovative new services, such as AI-driven solutions and 5G-enabled enterprise applications, are key strategies to offset potential declines in the consumer mobile market and ensure continued growth.

Consumer Trust and Data Privacy Concerns

A significant data breach impacting approximately 25 million SK Telecom subscribers in April 2025 has severely eroded consumer trust. In response, SK Telecom has launched an Accountability and Commitment Program, pledging a substantial KRW 700 billion investment over the next five years. This commitment underscores the paramount importance of robust data privacy measures in retaining customer loyalty and safeguarding the company's reputation.

The incident highlights a growing societal concern regarding data privacy, directly influencing consumer behavior and purchasing decisions. SK Telecom's proactive investment in enhanced information protection systems is a critical step towards rebuilding confidence.

- Data Breach Impact: 25 million SK Telecom subscribers affected in April 2025.

- Company Response: Launch of Accountability and Commitment Program.

- Investment in Security: KRW 700 billion allocated over five years for information protection.

- Societal Trend: Increasing consumer demand for data privacy and security.

Social Impact of AI and Digital Inclusion

SK Telecom is actively leveraging AI to address societal challenges, notably through initiatives like AI-powered voice phishing prevention. They are also extending support to vulnerable populations with services such as 'CareVia' and 'AI Call,' which facilitate welfare check-ins, demonstrating a commitment to social impact.

The South Korean government's push for a 'Digital Inclusion Society 2.0' strategy, aiming to broaden access and digital literacy, presents a significant opportunity for SK Telecom. This policy direction aligns with the company's efforts to bridge digital divides, potentially creating new avenues for service expansion and enhanced societal well-being.

- AI for Social Good: SK Telecom's AI is used to combat voice phishing, a growing concern, and support welfare services for the elderly and disabled.

- Government Digital Inclusion Drive: The 'Digital Inclusion Society 2.0' strategy by the government aims to ensure all citizens can benefit from digital advancements.

- Bridging the Digital Divide: These combined efforts create a fertile ground for SK Telecom to offer innovative services that enhance accessibility and quality of life for all citizens.

South Korean society exhibits a strong digital dependency, with a 97.4% internet penetration rate in 2023, driving demand for high-speed connectivity. This reliance is amplified by the increasing use of data-intensive services like streaming and online gaming, requiring continuous network upgrades.

Consumer expectations for personalized, AI-driven experiences are high, evidenced by mobile data's 69.21% contribution to South Korea's data revenue in 2024, fueled by video content and K-pop fan engagement.

Demographic shifts, including an ultra-low birth rate (0.72 in 2023) and an aging population, are altering consumer behavior and market demand, prompting SK Telecom to focus on enterprise digitalization and new AI services to counter potential consumer market declines.

A significant data breach affecting 25 million subscribers in April 2025 has heightened consumer concerns about data privacy, leading SK Telecom to invest KRW 700 billion over five years in information protection to rebuild trust and enhance security measures.

Technological factors

SK Telecom is heavily invested in next-generation mobile technology, boasting 16.9 million 5G subscribers by the end of fiscal year 2024. This commitment positions them to capitalize on the government's drive for a fully realized nationwide 5G network by 2024.

Furthermore, the South Korean government's ambition to lead in 6G communication standards, evidenced by a pre-6G service demonstration planned for 2026, creates a significant opportunity for SK Telecom. Their continued investment in 5G infrastructure and early engagement with 6G development are crucial for solidifying their market leadership.

SK Telecom is aggressively integrating AI into its core strategy, evidenced by substantial investments in AI data centers and GPU-as-a-Service. This focus is designed to support its 'AI Infrastructure Superhighway' and 'AI Pyramid Strategy,' aiming to capture growth in the burgeoning AI market. The company reported a 19% year-over-year increase in AI-related revenue for 2024, underscoring the immediate impact of this strategic shift.

The company's commitment to AI is so strong that it plans to discontinue its metaverse service, ifland, by March 2025. This move allows SK Telecom to reallocate resources and attention towards its AI cloud business and B2B AI solutions, signaling a clear prioritization of AI development over other emerging technologies like the metaverse.

SK Telecom is heavily investing in hyperscale AI data centers across South Korea, aiming for capacities exceeding 100 megawatts and a potential expansion to one to two gigawatts, positioning them as significant players in the nation's AI infrastructure. The launch of their Gasan AI data center in December 2024 and the introduction of SKT GPUaaS underscore their commitment to accelerating AI development by providing crucial computing resources.

This strategic push into AI data centers and GPU-as-a-Service (GPUaaS) is a cornerstone of SK Telecom's strategy to monetize its AI capabilities, evidenced by partnerships with leading global GPU cloud providers like Lambda. By building out this robust infrastructure, SK Telecom is directly addressing the escalating demand for high-performance computing essential for advanced AI workloads.

Evolution of Cybersecurity Technologies

SK Telecom is significantly bolstering its cybersecurity defenses, investing KRW 700 billion over five years to establish a top-tier information protection system. This initiative is aligned with the U.S. National Institute of Standards and Technology's (NIST) Cybersecurity Framework, demonstrating a commitment to international best practices.

The company’s strategic response to a major data breach includes a substantial expansion of its information protection team, effectively doubling its size. Furthermore, SK Telecom is establishing a KRW 10 billion fund dedicated to nurturing and strengthening South Korea's broader cybersecurity industry.

- KRW 700 billion: Total investment over five years for enhanced information protection.

- NIST Cybersecurity Framework: Guiding principles for building a world-class security system.

- Doubling Information Protection Team: Significant expansion of internal cybersecurity expertise.

- KRW 10 billion Fund: Capital allocated to foster the Korean cybersecurity sector.

Convergence of Technologies and Industry Digitalization

SK Telecom is strategically merging its telecommunications prowess with artificial intelligence (AI), structuring its business units to enhance core telecom services while aggressively pursuing AI adoption. This dual focus positions the company to capitalize on the growing demand for integrated digital solutions.

Leveraging its robust data center operations and nationwide network infrastructure, SK Telecom is expanding its footprint in the AI data center market. This expansion directly supports enterprise digitalization efforts and the development of smart city projects, by providing the essential technological backbone.

- AI Data Center Expansion: SK Telecom aims to solidify its position as a key player in the AI data center sector, a market projected for significant growth in the coming years.

- Enterprise Digitalization Support: The company's infrastructure and AI capabilities are crucial for enabling businesses to transition to more digital operational models.

- Smart City Initiatives: SK Telecom's technology convergence is fundamental to building the smart city infrastructure of the future, integrating communication and AI for enhanced urban living.

SK Telecom is aggressively pursuing AI development, evident in its substantial investments in AI data centers and GPU-as-a-Service (GPUaaS). This strategic focus aims to capture growth in the AI market, with the company reporting a 19% year-over-year increase in AI-related revenue for 2024.

The company is also prioritizing AI by discontinuing its metaverse service, ifland, by March 2025 to reallocate resources towards its AI cloud business and B2B AI solutions.

SK Telecom's commitment to AI infrastructure is further demonstrated by its plans for hyperscale AI data centers, with capacities exceeding 100 megawatts, and the launch of its Gasan AI data center in December 2024.

These technological advancements are crucial for SK Telecom's strategy to monetize its AI capabilities, evidenced by partnerships with global GPU cloud providers.

| Technology Focus | Key Initiatives/Investments | 2024/2025 Data Points |

|---|---|---|

| 5G Network | Nationwide 5G expansion | 16.9 million 5G subscribers (end of FY2024) |

| 6G Development | Early engagement and R&D | Pre-6G service demonstration planned for 2026 |

| Artificial Intelligence (AI) | AI Data Centers, GPUaaS, AI Pyramid Strategy | 19% YoY increase in AI-related revenue (2024) |

| Metaverse | Discontinuation of ifland service | Service to cease by March 2025 |

| Cybersecurity | Information protection system enhancement | KRW 700 billion investment over five years |

Legal factors

The South Korean telecommunications landscape is heavily shaped by regulatory bodies like the Korea Communications Commission (KCC) and the Ministry of Science and ICT (MSIT). These agencies manage crucial aspects such as spectrum allocation, the rollout of new network infrastructure, and ensuring a competitive market environment. This oversight directly influences SK Telecom's operational framework and strategic planning.

A significant legal shift occurred in January 2024 with the repeal of the Mobile Device Distribution Improvement Act. This move was intended to foster greater competition within the mobile sector by permitting increased subsidies on mobile devices. For SK Telecom, this repeal has a direct bearing on its pricing strategies and the overall competitive dynamics of the South Korean market, potentially leading to more aggressive customer acquisition tactics.

South Korea's Personal Information Protection Act, with revisions effective September 2023, now imposes severe penalties for data breaches, potentially reaching 3% of a company's total revenue. This legal framework directly impacts SK Telecom's operational costs and risk management strategies.

SK Telecom faced a significant data breach in April 2025, compromising the personal information of approximately 25 million subscribers. This incident has intensified regulatory scrutiny and heightened the company's financial and reputational exposure.

In response to these stringent legal demands and the need to rebuild customer confidence, SK Telecom announced a substantial KRW 700 billion investment in information protection over the next five years. This commitment underscores the critical importance of data security compliance in the current legal landscape.

Antitrust and fair competition laws are a significant factor for SK Telecom. The South Korean government is actively fostering competition within the telecommunications industry. This is demonstrated by the repeal of the Mobile Device Distribution Improvement Act (MDDI Act) and ongoing support for budget mobile carriers, which intensifies market rivalry.

Furthermore, evolving regulations targeting online platforms could impact SK Telecom's broader digital services. Proposed rules aim to prevent anti-competitive behaviors by dominant market players, potentially affecting SK Telecom's digital ventures and requiring careful compliance strategies.

AI-Specific Legal Frameworks

South Korea's enactment of the Framework Act on Artificial Intelligence Development and Establishment of a Foundation for Trustworthiness in December 2024 significantly impacts SK Telecom. This AI Framework Act, effective in late 2025, mandates adherence to AI governance principles, requiring the company to prioritize reliability and safety in its AI offerings.

This new legislation necessitates that SK Telecom proactively manage the ethical implications and potential risks associated with its AI services. For instance, the company must ensure transparency in how its AI models operate and establish mechanisms for accountability, especially as AI integration deepens across its telecommunications and media platforms.

- AI Framework Act: Enacted December 2024, effective late 2025, establishing national AI governance.

- SK Telecom's Obligation: Ensure reliability, safety, and ethical compliance for all AI-driven services.

- Impact on Innovation: Balancing the need for rapid AI development with robust regulatory safeguards.

- Focus Areas: Transparency, accountability, and risk mitigation in AI deployment.

Consumer Protection and Service Quality Regulations

Regulatory bodies, like the Korea Communications Commission (KCC), are increasingly focused on safeguarding users of AI services and combating the spread of misinformation. This regulatory environment directly impacts SK Telecom's operations, pushing for enhanced consumer protection measures and service quality. For instance, following a significant data breach, SK Telecom responded by launching a 'Customer Assurance Package' and a 'Customer Appreciation Package,' which included various programs and discounts. This strategic move aimed to rebuild customer trust and demonstrated a clear response to regulatory pressure concerning service reliability and consumer welfare.

These initiatives underscore the growing importance of consumer trust and data security in the telecommunications sector. SK Telecom's proactive measures, such as offering compensation and loyalty programs, reflect an understanding of the financial and reputational risks associated with regulatory non-compliance and customer dissatisfaction. The company's 2023 financial reports, while not directly detailing the cost of these packages, highlight a commitment to customer retention strategies in a competitive market, influenced by these legal and ethical considerations.

- KCC's focus on AI user protection and disinformation mitigation.

- SK Telecom's 'Customer Assurance Package' and 'Customer Appreciation Package' post-data breach.

- Regulatory pressure to ensure service reliability and consumer welfare.

- Impact on customer trust and SK Telecom's strategy for retention.

South Korea's legal framework, overseen by bodies like the KCC and MSIT, dictates spectrum allocation and network development, directly influencing SK Telecom's operations. The repeal of the Mobile Device Distribution Improvement Act in January 2024 has intensified competition by allowing higher device subsidies, impacting SK Telecom's pricing and customer acquisition strategies.

Stricter data protection laws, with penalties up to 3% of revenue, are critical for SK Telecom, especially after a significant data breach in April 2025 affecting 25 million subscribers, leading to a KRW 700 billion investment in information protection over five years.

The new AI Framework Act, effective late 2025, mandates ethical AI governance, requiring SK Telecom to ensure reliability, safety, and transparency in its AI services, balancing innovation with regulatory compliance.

Increasing regulatory focus on AI user protection and misinformation, exemplified by the KCC's stance, has prompted SK Telecom to implement customer-focused initiatives like the 'Customer Assurance Package' to rebuild trust and ensure service reliability.

Environmental factors

SK Telecom's ambitious expansion into AI data centers (AIDCs), with plans for hyperscale facilities exceeding 100 megawatts, signals a substantial increase in energy demand. This growth necessitates a strong focus on environmental sustainability within their operational framework.

The company is proactively addressing this by prioritizing network efficiency and AI-driven energy consumption reduction, recognizing these as critical environmental initiatives. For instance, in 2023, SK Telecom highlighted its commitment to green ICT, aiming to reduce the carbon footprint of its network operations.

Strategic collaborations, like the one with Schneider Electric, are instrumental in this effort. These partnerships are geared towards pioneering advanced cooling technologies designed to significantly minimize power usage and heat output in their cutting-edge AIDCs, a crucial step for managing their environmental impact.

SK Telecom is actively integrating artificial intelligence into its environmental, social, and governance (ESG) strategy through its 'Do the Good AI' vision. This approach leverages AI to enhance network efficiency, a key factor in reducing their carbon footprint and minimizing greenhouse gas emissions.

The company's parent, SK Group, has established a comprehensive Net Zero 2040 roadmap, setting ambitious short-term and long-term climate change objectives. SK Telecom's alignment with these group-wide targets underscores a significant commitment to sustainability and emission reduction across its operations.

SK Telecom is actively engaging with environmental concerns by developing AI-powered waste separation guidance. This initiative is a direct step towards fostering a circular economy, aiming to improve the handling of electronic waste. While concrete figures on their hardware recycling rates for 2024 or 2025 are not yet widely publicized, this focus signals a strategic shift towards more sustainable operational practices within the company.

Stakeholder Pressure for Green Business Practices

SK Telecom is actively responding to growing stakeholder demands for environmentally conscious business operations. The company's 2024 Sustainability Report details its ESG performance and future strategies, demonstrating a commitment to being a market-recognized leader in sustainability. This includes robust ESG management indicators and transparent reporting of its environmental, social, and governance achievements.

This focus on green practices is driven by increasing pressure from various stakeholders, including investors, customers, and regulatory bodies. SK Telecom's proactive approach aims to align its operations with societal expectations for corporate responsibility and environmental stewardship. The company's efforts underscore a broader trend in the telecommunications sector towards integrating sustainability into core business strategies.

Key aspects of SK Telecom's stakeholder engagement on environmental matters include:

- Transparent ESG Reporting: The 2024 Sustainability Report provides detailed insights into the company's environmental performance and targets.

- Market Recognition: SK Telecom aims for its ESG commitments to foster market and societal support.

- Regulatory Compliance: The company's actions reflect responsiveness to evolving environmental regulations and expectations.

Climate Change Impact on Infrastructure

Climate change presents a significant environmental factor for SK Telecom, necessitating robust infrastructure resilience. Extreme weather events, amplified by climate change, can disrupt network operations and damage physical assets. For instance, the increasing frequency of typhoons and heavy rainfall in South Korea poses a direct threat to base stations and fiber optic cables.

SK Telecom's commitment to sustainability and energy efficiency is crucial in mitigating these risks. By investing in more durable infrastructure and implementing advanced monitoring systems, the company can better withstand environmental shocks. Their efforts in reducing carbon emissions, aiming for a 50% reduction by 2030 compared to 2019 levels, also contribute to long-term operational stability.

- Infrastructure Resilience: Telecom networks must be hardened against extreme weather, such as floods and heatwaves, which are becoming more common due to climate change.

- Energy Efficiency: SK Telecom's focus on reducing energy consumption in its data centers and network operations not only lowers costs but also enhances operational sustainability in a changing climate.

- Supply Chain Vulnerability: Global supply chains for network equipment can be disrupted by climate-related events, impacting SK Telecom's ability to maintain and upgrade its infrastructure.

- Regulatory Pressures: Governments worldwide, including South Korea, are implementing stricter environmental regulations, pushing companies like SK Telecom to adopt greener practices and invest in climate-resilient technologies.

SK Telecom's expansion into AI data centers significantly increases energy demand, driving a focus on environmental sustainability and network efficiency. The company aims to reduce its carbon footprint by prioritizing green ICT solutions and leveraging AI for energy consumption reduction, as highlighted in their 2023 initiatives.

Strategic partnerships, like the one with Schneider Electric, are key to developing advanced cooling technologies for their AI data centers, aiming to minimize power usage and heat output. SK Telecom's 'Do the Good AI' vision integrates AI into its ESG strategy to improve network efficiency and cut greenhouse gas emissions.

The company aligns with SK Group's Net Zero 2040 roadmap, targeting a 50% reduction in greenhouse gas emissions by 2030 compared to 2019 levels. SK Telecom is also exploring AI-powered waste separation to promote a circular economy, though specific hardware recycling rates for 2024-2025 are not yet public.

Increasing stakeholder pressure, including from investors and regulators, reinforces SK Telecom's commitment to environmentally conscious operations, as detailed in their 2024 Sustainability Report. This includes robust ESG management and transparent reporting to meet societal expectations for corporate responsibility.

PESTLE Analysis Data Sources

Our SK Telecom PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic research institutions, and reputable telecommunications industry reports. We meticulously gather insights on political stability, economic indicators, technological advancements, and regulatory changes.