SK Telecom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SK Telecom Bundle

Curious about SK Telecom's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't settle for a partial view; purchase the full BCG Matrix to unlock actionable insights and a clear roadmap for optimizing their product portfolio and future investments.

Stars

SK Telecom's AI-powered enterprise solutions, such as their AI Contact Center (AICC) and Vision AI, are demonstrating robust expansion. The AIX business, a core component of this strategy, achieved an impressive 32.0% year-over-year growth in 2024.

Looking ahead, SK Telecom has set an ambitious target of 30% growth in its B2B AI revenue for 2025. This strong performance and forward-looking objective position these AI solutions within a high-growth market segment.

SK Telecom is actively solidifying its market presence by leveraging its advanced AI technologies and making strategic investments in this rapidly evolving sector.

SK Telecom's AI Data Center (AIDC) business is a significant growth engine, exemplified by its strategic investments and expansion. The launch of the Gasan AI data center and the introduction of 'SKT GPUaaS' underscore the company's commitment to this high-demand sector.

The AIDC segment demonstrated robust performance, with revenue climbing 13.1% year-over-year in 2024. This growth is directly attributable to the increased operational utilization of its newly established data centers, signaling strong market adoption and demand for AI infrastructure services.

Driven by the escalating need for advanced AI computing power and infrastructure, the AIDC sector represents a key area of opportunity for SK Telecom. The company is positioning itself as a pivotal provider in this rapidly expanding market, capitalizing on the transformative potential of artificial intelligence.

SK Telecom is a strong contender in the 5G mobile services sector, a key component of its BCG Matrix. By the close of 2024, the company boasted an impressive 16.9 million 5G subscribers, a figure that signifies over 70% of its entire customer base. This dominance highlights SK Telecom's successful penetration into the advanced mobile technology market.

Despite a maturing overall mobile market, the adoption of 5G continues its upward trajectory. This growth fuels increased data usage among consumers, a trend that directly benefits SK Telecom by reinforcing its leading market position in this high-value segment. The company's strategic focus on 5G has clearly paid off, solidifying its competitive advantage.

Global Personal AI Agent (GPAA) - 'Aster'

SK Telecom's 'Aster,' their Global Personal AI Agent (GPAA), is positioned as a Star in the BCG matrix, reflecting its high growth potential and strong market ambition.

The company showcased Aster at CES 2025, signaling its readiness for international expansion. A U.S. beta launch is slated for the first half of 2025, targeting a segment expected to see substantial global growth.

This strategic move aims to capture a significant share of the burgeoning global AI agent market.

- High Growth Potential: The GPAA market is anticipated to expand rapidly, with projections suggesting a market size of over $100 billion by 2028.

- Global Ambition: SK Telecom's focus on the U.S. market first indicates a clear strategy to establish a strong foothold in key international territories.

- Competitive Landscape: While specific market share data for Aster is not yet available, the sector includes major players like Google Assistant, Amazon Alexa, and Apple's Siri, highlighting the competitive environment.

- Strategic Investment: SK Telecom's investment in AI, including the development of Aster, aligns with broader industry trends where AI integration is becoming crucial for service differentiation.

AI Cloud Business

SK Telecom's AI Cloud business is a significant growth driver, demonstrating impressive momentum. In 2024, this segment experienced a remarkable expansion of over 20% year-over-year. It now represents a substantial portion of the company's AIX revenue, making up roughly two-thirds of the total.

The company's strategic push into AI cloud is yielding tangible results, evidenced by securing its inaugural AI cloud order from domestic internet service providers during the second quarter of 2024. This achievement signals a strong market entry and a clear intention to scale operations considerably.

- Rapid Growth: The AI Cloud business saw over 20% year-over-year growth in 2024.

- Revenue Contribution: It accounts for approximately two-thirds of SK Telecom's AIX revenue.

- Market Traction: Secured its first AI cloud order from domestic ISPs in Q2 2024.

- Scalability Plans: SK Telecom intends to significantly expand this business segment.

SK Telecom's AI Cloud business is a significant growth driver, demonstrating impressive momentum. In 2024, this segment experienced a remarkable expansion of over 20% year-over-year. It now represents a substantial portion of the company's AIX revenue, making up roughly two-thirds of the total.

The company's strategic push into AI cloud is yielding tangible results, evidenced by securing its inaugural AI cloud order from domestic internet service providers during the second quarter of 2024. This achievement signals a strong market entry and a clear intention to scale operations considerably.

The AI Cloud business saw over 20% year-over-year growth in 2024, accounting for approximately two-thirds of SK Telecom's AIX revenue. Securing its first AI cloud order from domestic ISPs in Q2 2024 demonstrates market traction, with plans to significantly expand this segment.

| Business Segment | 2024 Revenue Growth (YoY) | Contribution to AIX Revenue | Key Developments |

| AI Cloud | > 20% | Approx. 2/3 | First ISP order (Q2 2024), expansion plans |

| AIX (Overall) | 32.0% | N/A | Targeting 30% B2B AI revenue growth in 2025 |

| AIDC | 13.1% | N/A | Gasan AI data center launch, SKT GPUaaS introduction |

What is included in the product

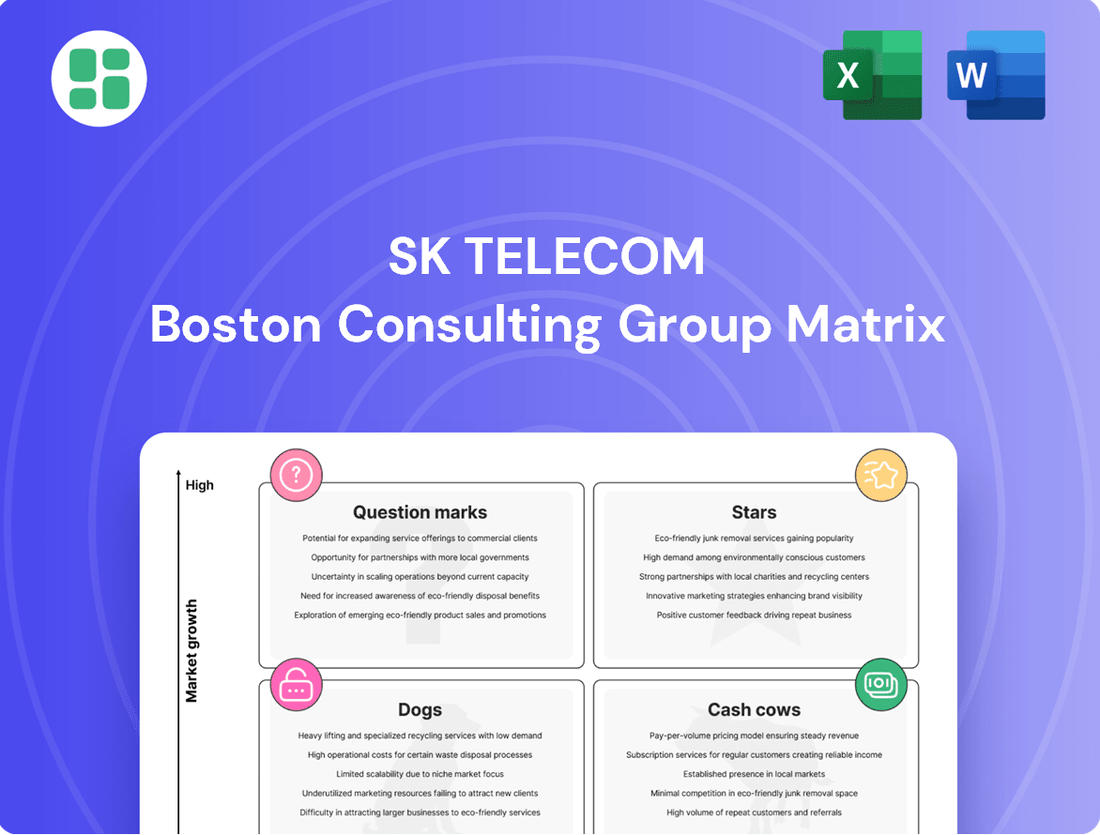

SK Telecom's BCG Matrix offers a strategic overview of its diverse business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting areas for growth, sustained profit, further investigation, and potential divestment.

The SK Telecom BCG Matrix offers a clear, one-page overview to identify underperforming business units, alleviating the pain of resource misallocation.

Cash Cows

SK Telecom commands a dominant position in South Korea's mature mobile market, serving 31.8 million customers by the close of 2024. This extensive subscriber base, coupled with high market penetration, ensures a consistent and significant generation of cash flow for the company.

Despite the overall market maturity, the mobile communication segment acts as a robust cash cow. SK Telecom's ongoing efforts in operational efficiency and cost management are key to sustaining the profitability of this established business, even as it navigates growth opportunities like 5G deployment.

SK Broadband, a key affiliate, demonstrated robust performance in 2024, with revenue climbing 3.1% and operating income surging 13.7% year-over-year. This growth was primarily fueled by a steady increase in its broadband subscriber base.

By the second quarter of 2024, SK Broadband had secured 7.05 million broadband subscribers. This substantial number signifies a high market share within the fixed-line broadband sector, a market characterized by maturity yet remarkable stability.

The fixed-line broadband services thus operate as a Cash Cow for SK Telecom, consistently generating reliable cash flow. This stability in a mature market allows for significant capital generation, supporting other ventures within the SK Telecom portfolio.

SK Telecom's pay TV services, operated under SK Broadband, represent a significant Cash Cow in its portfolio. By the second quarter of 2024, this segment boasted 9.6 million subscribers.

Despite operating in a mature market, SK Telecom's pay TV services consistently deliver stable revenue and operating income. This reliability stems from its strong market position, ensuring consistent cash generation even with limited growth potential.

Traditional Fixed Voice Services

Traditional fixed voice services for SK Telecom, while a mature market with declining revenues, continue to be a stable cash cow. This segment, despite its contraction, still generates consistent cash flow with minimal need for further investment, leveraging SK Telecom's existing infrastructure and a loyal customer base.

In 2023, the fixed-line telephone market in South Korea saw a continued decline, with the number of fixed-line subscriptions falling. However, for major providers like SK Telecom, these services remain a predictable source of revenue.

- Declining Market Share: Fixed voice services are experiencing a downward trend in subscriber numbers and revenue across South Korea.

- Stable Cash Generation: Despite the decline, the installed base and customer inertia ensure a steady, albeit low, cash inflow for SK Telecom.

- Low Investment Requirement: Existing network infrastructure means minimal capital expenditure is needed to maintain these services, maximizing profitability.

- Contribution to Overall Revenue: While not a growth engine, fixed voice still contributes a predictable portion to SK Telecom's total revenue.

Basic Data Services (4G/LTE)

SK Telecom's Basic Data Services, primarily 4G/LTE, represent a stable cash cow within its business portfolio. Despite the ongoing push towards 5G, the company maintained a substantial 6.26 million LTE subscribers as of Q3 2024. This large, established user base generates consistent and predictable revenue streams.

These services are characterized by lower capital expenditure requirements compared to the development and expansion of 5G networks. This allows SK Telecom to harvest profits from its existing infrastructure without significant reinvestment, a hallmark of a cash cow.

- Established Subscriber Base: 6.26 million LTE subscribers by Q3 2024.

- Consistent Revenue Generation: Provides predictable income due to a mature service offering.

- Lower Investment Needs: Requires less capital expenditure than emerging technologies like 5G.

- Profit Harvesting: Allows for the extraction of profits without substantial further investment.

SK Telecom's mobile communication segment, serving 31.8 million customers by the end of 2024, acts as a primary cash cow. This mature market, despite its growth limitations, generates consistent and substantial cash flow.

SK Broadband's broadband services, with 7.05 million subscribers by Q2 2024, also function as a cash cow. The 3.1% revenue growth and 13.7% operating income surge in 2024 highlight its stable profitability.

The pay TV segment, boasting 9.6 million subscribers by Q2 2024, is another key cash cow. Its consistent revenue and operating income, despite market maturity, underscore its reliable cash generation.

Even declining fixed voice services, while shrinking, remain a predictable cash cow due to existing infrastructure and customer loyalty, contributing a stable revenue portion.

| Business Segment | Customer Base (Approx.) | Market Maturity | Cash Cow Status |

| Mobile Communication | 31.8 million (End of 2024) | Mature | High |

| Broadband Services (SK Broadband) | 7.05 million (Q2 2024) | Mature | High |

| Pay TV Services (SK Broadband) | 9.6 million (Q2 2024) | Mature | High |

| Fixed Voice Services | Declining | Mature | Stable |

Preview = Final Product

SK Telecom BCG Matrix

The SK Telecom BCG Matrix preview you're examining is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, detailing SK Telecom's portfolio across Stars, Cash Cows, Question Marks, and Dogs, is ready for your strategic planning and decision-making. You're not seeing a sample; you're viewing the final, professionally formatted report designed for immediate use and insightful interpretation of SK Telecom's market position.

Dogs

Legacy Fixed-Line Telephony (Circuit-Switched) represents SK Telecom's traditional voice services, a segment facing significant headwinds. In 2024, the demand for these services continued to wane as consumers increasingly adopted Voice over Internet Protocol (VoIP) and mobile communication solutions, leading to a contraction in subscriber numbers and revenue for this business line.

This segment is characterized by its low market share and minimal growth prospects within the South Korean telecommunications landscape. Given the ongoing shift towards more advanced and cost-effective communication technologies, SK Telecom's circuit-switched fixed-line services are positioned as a declining asset, warranting a strategy of reduced investment or potential divestment to reallocate resources to higher-growth areas.

Outdated Value-Added Services (VAS) represent a classic example of a company's portfolio needing constant evaluation. Think of services that were once cutting-edge, like basic ringtone downloads or early mobile game subscriptions, which are now largely obsolete. These are the digital equivalent of a fax machine in today's world.

In SK Telecom's context, these might be legacy services that offered features now seamlessly integrated into modern smartphones or have been replaced by more sophisticated over-the-top (OTT) applications. For instance, simple SMS-based alerts or content services that don't leverage the full capabilities of current devices would fit here.

These outdated VAS typically show very low user engagement metrics and a consistent decline in revenue. SK Telecom, like any forward-thinking telecom, would allocate minimal resources to maintaining them, focusing instead on services with higher growth potential. The strategic decision is often to phase them out gracefully to free up resources and simplify the service offering.

Underperforming niche B2C services within SK Telecom's portfolio, particularly those launched in slow-growth segments, would likely be classified as Dogs. These ventures, characterized by low customer adoption and minimal market share, contribute little to the company's overall revenue or strategic objectives. For instance, a hypothetical niche streaming service that failed to attract a substantial subscriber base despite marketing efforts would fit this category, especially if the broader streaming market is experiencing modest growth.

Non-Core, Divested Assets

Non-core, divested assets within SK Telecom's BCG Matrix represent business units or holdings that the company has strategically chosen to exit. These are often characterized by low profitability and a lack of alignment with SK Telecom's core strategic direction, thus tying up valuable capital and resources. For instance, if SK Telecom were to divest a legacy infrastructure division that no longer fits its 5G-centric strategy, this would be categorized here.

These divested assets typically exhibit low market share and low growth potential. Their disposal frees up capital that can be reinvested into more promising areas, such as advanced AI services or next-generation network technologies. For example, in 2023, SK Telecom continued to refine its portfolio, focusing on high-growth digital services.

- Portfolio Optimization: SK Telecom actively manages its portfolio to shed underperforming or non-strategic assets.

- Capital Reallocation: Divesting these assets allows for capital to be redirected towards innovation and core business growth areas.

- Strategic Focus: The move aligns with SK Telecom's strategy to concentrate on future-oriented technologies and services.

- Financial Prudence: Disposing of low-profitability units improves overall financial health and efficiency.

Certain Declining IoT Verticals

While SK Telecom's overall IoT business shows promise, certain niche verticals might be struggling. These could include specific industrial IoT applications where adoption has been slower than anticipated or consumer IoT segments that are highly saturated, leading to low market share for SK Telecom's offerings.

These "dog" categories within IoT are characterized by limited growth potential and a weak competitive position. For instance, if SK Telecom invested heavily in a particular smart home device that hasn't gained traction against established players, it would likely fall into this quadrant. The company needs to carefully assess these underperforming areas.

By mid-2024, the global IoT market was projected to reach over $1.1 trillion, demonstrating strong overall growth. However, this masks the performance of individual segments. For example, while connected cars and smart cities are booming, some specialized industrial IoT solutions might be facing headwinds due to high implementation costs or a lack of clear return on investment for businesses.

- Saturated Consumer IoT: Verticals like basic smart home sensors or connected pet trackers may face intense competition, leading to low market share for SK Telecom's offerings.

- Niche Industrial IoT: Specific industrial automation or monitoring solutions that haven't achieved widespread adoption due to complex integration or high upfront costs.

- Underperforming Smart City Components: Certain smart city initiatives, like specific types of environmental sensors, might not have met initial adoption targets or demonstrated significant value.

SK Telecom's "Dogs" represent business segments with low market share and low growth potential. These are often legacy services or niche offerings that have not gained significant traction. For instance, outdated Value-Added Services (VAS) that are now obsolete due to technological advancements fall into this category. These segments require minimal investment and may be candidates for divestment or phasing out to reallocate resources to more promising areas.

Question Marks

SK Telecom's substantial investment in Urban Air Mobility (UAM), exemplified by its $100 million stake in Joby Aviation, positions it within a sector poised for significant growth, with commercial operations anticipated around 2025.

This initiative places SK Telecom in a classic 'question mark' scenario within the BCG matrix; the market is nascent with high growth potential, but SK Telecom's current market share is minimal, reflecting the early stage of development and the substantial investments required to capture future leadership.

SK Telecom's metaverse platforms, such as ifland, are positioned in the "question mark" category of the BCG matrix. While the metaverse sector is experiencing significant growth, with global metaverse market size projected to reach $567.4 billion by 2028, ifland itself is still building its user base and revenue streams. This means it has high growth potential but currently holds a relatively low market share.

SK Telecom's investment in quantum cryptography communication positions it in a high-potential, early-stage market. This frontier technology, crucial for future secure communications, currently boasts a minimal market share due to its nascent development. However, the global quantum cryptography market is projected for substantial growth, with forecasts indicating it could reach billions of dollars by the late 2020s, driven by increasing cybersecurity needs.

AI-Powered Personal Agent 'A.' (Domestic)

SK Telecom's domestic personal AI agent, 'A.', experienced significant user growth, reaching over 8 million users by the close of 2024. This represents a substantial 160% increase compared to the previous year, highlighting its expanding reach.

The company's strategic move to introduce a subscription-based paid service in 2025 indicates a focus on monetization. However, the challenge lies in converting this impressive user base into consistent revenue and establishing a dominant market position amidst fierce competition in the personal AI assistant sector.

- User Base Growth: Exceeded 8 million users by end-2024, a 160% year-over-year increase.

- Monetization Strategy: Plans to launch a subscription-based paid service in 2025.

- Market Position: Faces the challenge of revenue conversion and solidifying market share in a competitive landscape.

Health Tech and Digital Healthcare Ventures

SK Telecom is actively pursuing health tech and digital healthcare as key growth avenues, reflecting a strategic push into high-potential markets. These ventures are in their nascent stages, with SK Telecom investing to establish a foothold and capture future market share.

The digital health market is experiencing significant expansion. For instance, the global digital health market was valued at approximately $211 billion in 2023 and is projected to reach over $600 billion by 2030, growing at a compound annual growth rate (CAGR) of around 16%. This robust growth trajectory indicates substantial opportunity for companies like SK Telecom.

- High Growth Potential: Digital health is a rapidly expanding sector, offering substantial revenue opportunities.

- Market Penetration: SK Telecom is likely in the early stages of market penetration, aiming to build brand recognition and customer base.

- Investment Focus: The company is channeling resources into these areas to develop innovative solutions and services.

- Strategic Importance: Health tech aligns with broader trends in personalized medicine and preventative care, positioning SK Telecom for long-term relevance.

SK Telecom's ventures into areas like Urban Air Mobility (UAM), metaverse platforms, quantum cryptography, and digital healthcare all represent classic 'question mark' positions in the BCG matrix.

These sectors are characterized by high growth potential but currently low market share for SK Telecom, necessitating significant investment to capture future leadership.

The company's personal AI agent, 'A.', also falls into this category, showing strong user growth but facing the challenge of converting that into dominant market share and revenue.

SK Telecom's strategic investments in these emerging technologies and markets highlight its ambition to diversify and lead in future growth sectors, despite the inherent risks of early-stage ventures.

| Business Area | Market Growth Potential | SK Telecom's Current Market Share | Strategic Implication (BCG Matrix) | Key Developments/Data |

| Urban Air Mobility (UAM) | High | Low | Question Mark | $100M investment in Joby Aviation; commercial ops by 2025 |

| Metaverse (ifland) | High | Low | Question Mark | Global market projected $567.4B by 2028 |

| Quantum Cryptography | High | Low | Question Mark | Growing cybersecurity needs; market to reach billions by late 2020s |

| Personal AI Agent (A.) | High | Developing | Question Mark | 8M+ users end-2024 (160% YoY growth); paid service planned 2025 |

| Health Tech/Digital Healthcare | High | Low | Question Mark | Global market $211B in 2023, projected $600B+ by 2030 (16% CAGR) |

BCG Matrix Data Sources

Our SK Telecom BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.