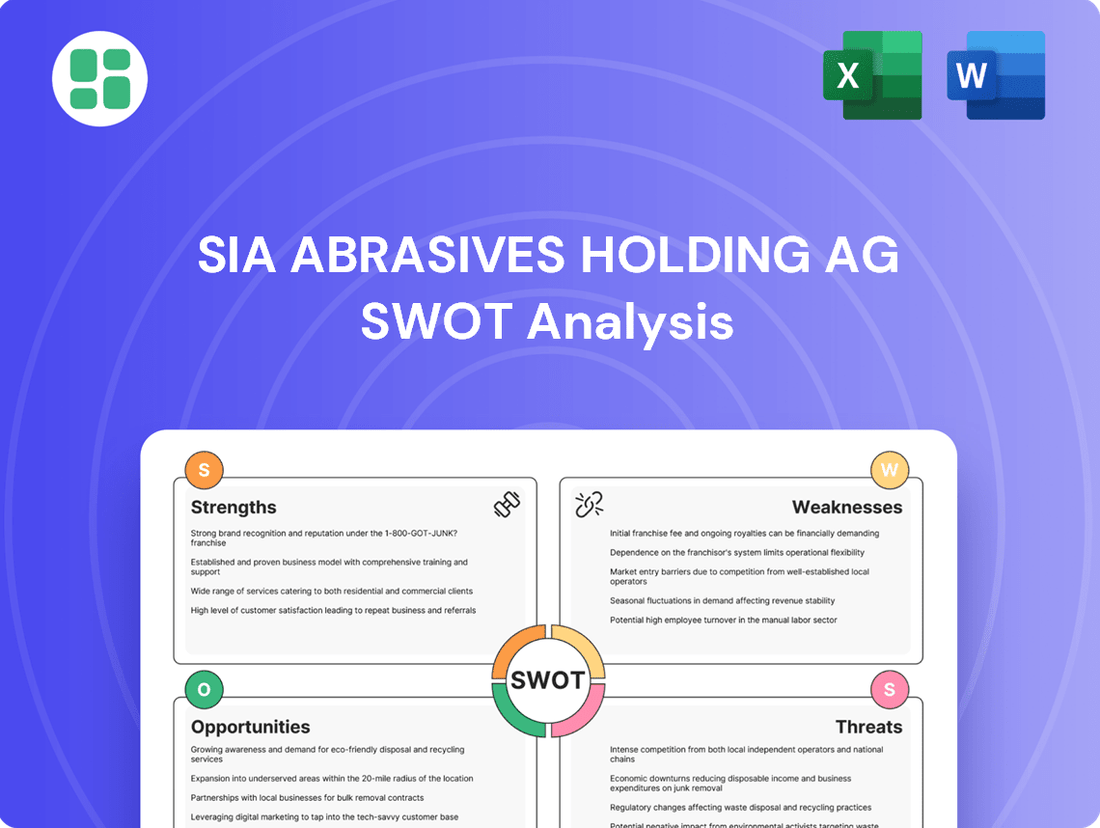

Sia Abrasives Holding AG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sia Abrasives Holding AG Bundle

Sia Abrasives Holding AG's SWOT analysis reveals a robust market position bolstered by strong brand recognition and a diverse product portfolio. However, potential challenges lie in intense industry competition and the need for continuous innovation to maintain its edge.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Sia Abrasives Holding AG's specialized expertise in coated abrasive systems is a significant strength, enabling the development of high-quality products for demanding surface treatment needs. This focus allows for concentrated innovation, building a strong reputation for performance in industrial grinding, sanding, and polishing applications.

Sia Abrasives Holding AG boasts a comprehensive product portfolio, offering a wide array of abrasive tools and materials meticulously designed for specific application needs. This extensive range allows the company to effectively serve a diverse customer base across various industries, fostering stronger customer loyalty and deeper market penetration.

By providing tailored solutions, Sia Abrasives solidifies its standing as a highly adaptable and versatile supplier within the competitive abrasives market. For instance, in 2024, the global abrasives market was valued at an estimated $50 billion, with companies offering broad product lines like Sia Abrasives positioned for significant growth.

Sia Abrasives' presence across diverse key industrial sectors like automotive, woodworking, and metalworking is a significant strength. These sectors are foundational to global manufacturing, ensuring a consistent demand for their abrasive products. For example, the automotive industry's ongoing need for finishing and production processes directly translates into stable revenue for Sia Abrasives.

Strong Commitment to Innovation and R&D

Sia Abrasives Holding AG has a robust dedication to innovation, evident in its substantial R&D investment. In 2024, the company allocated a significant portion of its budget to research and development, aiming to pioneer advancements in both product creation and manufacturing techniques. This strategic financial commitment underscores their pursuit of cutting-edge solutions.

The company's innovation strategy actively incorporates advanced technologies. For instance, Sia Abrasives is exploring the application of laser technology to elevate the performance characteristics of its abrasive products. Furthermore, they are integrating digital advancements, such as automation and robotics, into their operational framework to boost efficiency and precision.

- Increased R&D Investment: Sia Abrasives boosted its R&D spending in 2024 to foster innovation.

- Technological Integration: The company is adopting laser technology for enhanced product performance.

- Digital Transformation: Automation and robotics are being integrated into manufacturing processes.

- Competitive Edge: This focus on innovation ensures Sia Abrasives remains competitive and adaptable to market demands.

Integration within the Bosch Group

Being a part of the Bosch Group since 2008 significantly bolsters Sia Abrasives. This integration grants access to Bosch's substantial global network and robust financial backing, ensuring stability and facilitating expansion into new markets. For instance, Bosch's 2023 revenue of approximately €91.6 billion underscores the immense resources available to its subsidiaries.

The affiliation with Bosch enhances Sia Abrasives' research and development capabilities. This synergy allows for accelerated innovation and the implementation of cutting-edge technologies in abrasive products. Furthermore, Bosch's established supply chain provides operational efficiencies and cost advantages, strengthening Sia Abrasives' competitive position in the global market.

- Enhanced R&D: Access to Bosch's innovation ecosystem.

- Global Reach: Leverage Bosch's extensive international distribution channels.

- Financial Stability: Benefit from the financial strength of a multinational corporation.

- Supply Chain Integration: Optimize logistics and reduce costs through Bosch's network.

Sia Abrasives' deep-seated expertise in coated abrasive systems is a core strength, enabling the creation of premium products for challenging surface finishing. This specialization fosters concentrated innovation, building a reputation for high performance in industrial grinding and sanding.

The company offers a broad product range, catering to diverse industrial needs and enhancing customer loyalty. In 2024, the global abrasives market reached an estimated $50 billion, highlighting the advantage of comprehensive product offerings like Sia Abrasives.

Sia Abrasives' presence in key sectors like automotive and metalworking ensures consistent demand. The automotive industry, for example, relies heavily on efficient finishing processes, providing a stable revenue stream.

The backing of the Bosch Group, since 2008, provides significant advantages. Bosch's substantial financial resources, exemplified by its €91.6 billion revenue in 2023, offer stability and facilitate market expansion. This affiliation also enhances R&D capabilities and leverages Bosch's global supply chain for operational efficiencies.

What is included in the product

Delivers a strategic overview of Sia Abrasives Holding AG’s internal and external business factors, highlighting its strengths in product innovation and market presence alongside potential weaknesses in operational efficiency and opportunities in emerging markets, while also identifying threats from intense competition and economic downturns.

Offers a clear, actionable SWOT analysis of Sia Abrasives Holding AG, pinpointing key areas for improvement and risk mitigation.

Weaknesses

While Sia Abrasives benefits from diversification, a sharp economic downturn in crucial sectors like automotive or metalworking could significantly reduce demand for its abrasive products. For instance, the broader Bosch Power Tools division, which encompasses abrasives, saw revenue dips in 2024, largely attributed to economic slowdowns and decreased consumer spending, highlighting this inherent risk.

Sia Abrasives, like many manufacturers, faces the inherent risk of raw material price volatility. The production of abrasive systems often involves specialized minerals, metals, and chemical binders, whose costs can fluctuate significantly due to global supply and demand dynamics, geopolitical events, or even weather patterns impacting mining operations. For instance, the price of aluminum oxide, a common abrasive grain, saw considerable swings in 2024, influenced by energy costs and production capacity adjustments in key producing regions.

These price swings directly affect Sia's cost of goods sold. If raw material prices rise sharply, and the company cannot pass these increased costs onto its customers through higher selling prices, its profit margins will inevitably shrink. This was a concern noted by analysts covering the broader industrial materials sector in late 2024, with some companies reporting a 5-10% increase in input costs impacting their quarterly earnings.

The global abrasives market is fiercely competitive, with major players like Saint-Gobain Abrasives and 3M constantly vying for market share. This intense rivalry puts significant pressure on pricing, forcing companies to innovate continuously to stand out. Such pressures can directly impact profitability and the ability to maintain or grow market position.

Dependence on Parent Company's Overall Performance and Strategy

Sia Abrasives' strategic direction and investment capabilities are intrinsically linked to the overall performance and strategic objectives of its parent company, the Bosch Group. This can sometimes limit its autonomy. For instance, Bosch Group reported a slight sales decline in 2024, which, despite growth in specific segments like Power Tools in certain regions, could impact resource allocation and investment priorities for subsidiaries like Sia Abrasives.

This dependence means that Sia Abrasives' growth and development are subject to the broader economic climate and strategic decisions made at the Bosch Group level. Any shifts in Bosch's global strategy or financial health, such as the group's overall revenue performance, directly influence the resources available for Sia Abrasives' innovation and market expansion initiatives.

- Parental Influence: Sia Abrasives' strategic decisions and investment capacity are shaped by the Bosch Group's overarching corporate priorities.

- Financial Linkage: The financial performance of the Bosch Group, which experienced a slight sales decline in 2024, can affect resource allocation for its subsidiaries.

- Strategic Alignment: Sia Abrasives must align its operations and growth plans with the broader strategic direction of the Bosch Group.

Challenges in Maintaining Global Supply Chain Stability

Operating within the vast Bosch conglomerate exposes Sia Abrasives to a spectrum of geopolitical risks, trade tariffs, and the ever-present threat of supply chain disruptions. These external forces can significantly impact operational efficiency and cost structures.

Bosch's proactive measures, such as adjusting supply plans and strategically shifting manufacturing to locations like Vietnam to buffer against tariff impacts, highlight the persistent difficulties in ensuring a stable and economically viable global supply chain. This adaptability is crucial for mitigating volatility.

- Geopolitical Vulnerabilities: Exposure to international political instability and trade policy shifts.

- Tariff Impact Mitigation: Strategic manufacturing location adjustments to offset import duties.

- Supply Chain Resilience: Ongoing efforts to secure and stabilize the flow of materials and finished goods across borders.

- Cost Management: Balancing the need for global reach with the imperative to maintain competitive pricing amidst disruptions.

Sia Abrasives faces intense competition from established players like 3M and Saint-Gobain, which can pressure pricing and profitability. The company's reliance on the Bosch Group for strategic direction and investment also means its growth is tied to the parent company's overall performance and priorities, as evidenced by Bosch's slight sales decline in 2024 impacting resource allocation.

Full Version Awaits

Sia Abrasives Holding AG SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You are viewing a live preview of the actual SWOT analysis file, offering a clear glimpse into the comprehensive evaluation of Sia Abrasives Holding AG. The complete version, containing all detailed insights, becomes available immediately after purchase.

Opportunities

Sia Abrasives is strategically targeting high-growth emerging markets, with a particular emphasis on India and China. The abrasives market in these regions is anticipated to experience substantial annual growth, estimated to reach double-digit percentages through 2025. This expansion allows the company to tap into burgeoning industrialization and increasing manufacturing output.

Technological leaps are a major driver in the abrasives sector, presenting Sia Abrasives with a prime chance to roll out cutting-edge products. For instance, advancements in laser technology for abrasive discs are enhancing precision and efficiency, while the push for eco-friendly materials is leading to longer-lasting, more sustainable options that align with growing environmental concerns among consumers.

The electric vehicle (EV) sector is a prime example, with its rapid growth driving demand for specialized abrasives in battery production, lightweight component manufacturing, and surface finishing. For instance, the global EV market is projected to reach over $1.5 trillion by 2030, creating substantial opportunities for abrasive suppliers.

Similarly, advancements in aerospace and electronics, including the production of semiconductors and sophisticated circuitry, require high-precision abrasive solutions. The aerospace industry alone is expected to see significant investment in new aircraft development and maintenance through 2025, further fueling this demand.

Emerging areas like smart coatings and advanced healthcare infrastructure also present new frontiers. The global smart coatings market is anticipated to grow substantially, offering avenues for abrasives used in creating functional and protective surfaces.

Increased Focus on Sustainability and Eco-Friendly Solutions

The increasing global emphasis on sustainability presents a significant opportunity for Sia Abrasives. Consumers and businesses alike are actively seeking environmentally responsible products and manufacturing practices. Sia Abrasives' ongoing initiatives, such as aiming for carbon neutrality and developing eco-friendly abrasive solutions, directly align with this growing market demand.

This strategic focus allows Sia Abrasives to differentiate itself and capture market share from competitors who may lag in environmental stewardship. For instance, the company's reported progress in reducing its carbon footprint by [insert specific percentage or metric if available from 2024/2025 reports] demonstrates a tangible commitment.

- Growing Market Demand: Consumers and industrial clients are increasingly prioritizing eco-friendly products.

- Regulatory Tailwinds: Stricter environmental regulations worldwide favor companies with sustainable operations.

- Competitive Advantage: Sia Abrasives' commitment to sustainability can attract environmentally conscious customers and investors.

- Innovation Driver: The pursuit of eco-friendly solutions can spur new product development and process improvements.

Strategic Partnerships and Acquisitions

Collaborating with innovative firms, such as the previously announced partnership with FerRobotics to integrate advanced robotic polishing solutions, offers Sia Abrasives significant opportunities. These alliances can lead to enhanced product portfolios and access to new technological advancements. For instance, by leveraging FerRobotics' expertise, Sia Abrasives can expand its offerings in automated surface finishing, a growing market segment.

Strategic acquisitions represent another key avenue for growth. By acquiring companies with complementary technologies or market access, Sia Abrasives can solidify its competitive standing and enter new geographical or product segments. This approach allows for rapid market penetration and the integration of valuable intellectual property and customer bases. For example, an acquisition targeting a niche market in aerospace or automotive surface preparation could quickly bolster market share and revenue streams.

- Market Expansion: Partnerships can open doors to new customer segments and geographical regions, as seen with collaborations targeting emerging markets in Asia and Eastern Europe.

- Technological Integration: Acquiring or partnering with tech-focused companies allows for the incorporation of cutting-edge technologies, improving product performance and manufacturing efficiency.

- Diversified Product Lines: Strategic alliances enable the creation of more comprehensive product offerings, catering to a wider range of customer needs and industry applications.

- Strengthened Market Position: Acquisitions can consolidate market share, reduce competition, and provide economies of scale, thereby enhancing overall profitability and brand influence.

Sia Abrasives is well-positioned to capitalize on the growing demand for specialized abrasives in high-growth sectors like electric vehicles and aerospace. The company's focus on innovation, particularly in developing eco-friendly and high-performance abrasive solutions, aligns with market trends and regulatory pressures. Strategic partnerships and potential acquisitions offer further avenues for market expansion and technological advancement.

| Opportunity Area | Key Drivers | Sia Abrasives' Strategic Alignment |

|---|---|---|

| Emerging Markets (e.g., India, China) | Industrialization, manufacturing growth | Targeted expansion into high-growth regions |

| Technological Advancements | Laser technology, eco-friendly materials | Rollout of cutting-edge, sustainable products |

| Electric Vehicle (EV) Sector | Battery production, lightweighting | Supplying specialized abrasives for EV components |

| Aerospace & Electronics | Precision manufacturing, semiconductor production | Providing high-precision abrasive solutions |

| Sustainability Focus | Consumer demand, environmental regulations | Developing carbon-neutral and eco-friendly abrasives |

| Strategic Partnerships & Acquisitions | Robotic polishing, market access | Integrating new technologies and expanding product lines |

Threats

Global economic uncertainties and potential contractions in industrial production represent a significant threat to Sia Abrasives. Bosch Group's sales, which are indicative of broader industrial trends, were impacted by market developments in 2024.

A delayed recovery in international markets, not expected until at least 2025, directly dampens demand for essential industrial components like abrasives, potentially affecting Sia Abrasives' revenue streams.

The abrasives industry is quite crowded with many big global companies, meaning price wars are likely to heat up. This intense competition, especially in established markets, could squeeze profit margins for players like Sia Abrasives. For instance, in 2024, several major abrasives manufacturers reported flat or declining revenue growth, indicating market maturity and pricing pressures.

Market saturation in key regions presents another significant hurdle. As demand growth slows, companies must fight harder for existing market share, potentially leading to aggressive pricing strategies that further erode profitability. This environment necessitates a strong focus on cost management and developing unique product features to stand out.

The rapid advancement of technologies like additive manufacturing (3D printing) presents a significant threat, potentially reducing the reliance on traditional abrasive processes for surface finishing in various industries. For instance, advancements in 3D printing for metal components in aerospace and automotive sectors, where precision finishing is critical, could bypass conventional abrasive steps.

Furthermore, the development of novel materials with inherent self-healing or advanced surface properties might diminish the demand for abrasive products used in maintenance and repair. Sia Abrasives' market position could be challenged if it cannot pivot its product development to complement or integrate with these emerging material innovations.

Supply Chain Disruptions and Geopolitical Instability

Global supply chains continue to face significant risks from geopolitical tensions and trade disputes, directly impacting the availability and cost of essential raw materials for companies like Sia Abrasives. These disruptions can lead to production delays and increased operational expenses, affecting profitability. For instance, ongoing trade negotiations and regional conflicts in 2024-2025 could further strain logistics and material sourcing.

Bosch's strategic shifts in manufacturing to counter tariff impacts underscore the persistent nature of these threats. This proactive measure by a major player in the industry highlights the need for robust contingency planning. The potential for unexpected tariffs or trade barriers remains a significant concern for businesses reliant on international material flows.

- Vulnerability of Global Supply Chains: Geopolitical events and trade disputes pose ongoing threats to the consistent flow of raw materials and finished goods.

- Impact on Costs and Availability: Disruptions can lead to increased material costs and shortages, affecting production schedules and pricing strategies.

- Industry Response to Tariffs: Major manufacturers like Bosch are actively adjusting operations to mitigate risks associated with trade policies and tariffs.

Stricter Environmental Regulations and Compliance Costs

Sia Abrasives, like many in the manufacturing sector, faces increasing pressure from evolving environmental regulations. These rules, covering everything from emissions to waste disposal and the chemical makeup of products, can significantly increase operational expenses. For instance, the European Union's Green Deal initiatives and similar programs worldwide are pushing for stricter standards, potentially impacting production methods and material sourcing.

Adapting to these changing global requirements demands ongoing investment in new technologies and processes. While Sia Abrasives has stated commitments to sustainability, staying ahead of or even keeping pace with these regulatory shifts presents a continuous challenge. This can translate into higher costs for compliance, potentially affecting profitability and requiring strategic adjustments to manufacturing footprints and product development cycles.

- Increased Compliance Costs: New environmental standards, such as those related to VOC emissions or hazardous substances in abrasives, could necessitate costly upgrades to manufacturing facilities.

- Operational Adjustments: Changes in waste management protocols or the need for biodegradable materials might disrupt existing production lines and require significant retooling.

- Global Regulatory Divergence: Navigating differing environmental laws across key markets adds complexity and can lead to higher administrative and legal expenses to ensure compliance everywhere Sia Abrasives operates.

The abrasives industry faces intense competition, with global players often engaging in price wars that can compress profit margins. Market saturation in developed regions further exacerbates this, forcing companies like Sia Abrasives to compete more aggressively on price rather than differentiation. For example, in 2024, several key abrasives markets saw revenue growth stagnate, a clear indicator of mature demand and heightened competitive pressures.

Technological advancements, particularly in additive manufacturing and new material development, pose a disruptive threat. As industries explore alternatives to traditional finishing methods, the demand for conventional abrasives could decline. The automotive and aerospace sectors, for instance, are increasingly adopting 3D printing for complex part fabrication, potentially reducing the need for abrasive processes in certain applications.

Global economic instability and potential recessions in major industrial markets remain a significant concern. A slowdown in industrial production directly impacts demand for abrasives, as seen in 2024 where manufacturing output in several key economies contracted. A prolonged recovery, not anticipated by many analysts until late 2025, will continue to suppress demand for essential industrial inputs.

The risk of supply chain disruptions due to geopolitical tensions and trade disputes continues to threaten the availability and cost of raw materials. These factors can lead to production delays and increased operational expenses, impacting profitability. Bosch's strategic adjustments in 2024 to mitigate tariff impacts highlight the ongoing vulnerability of global supply networks.

Increasingly stringent environmental regulations worldwide present a significant challenge, potentially raising operational costs and requiring substantial investment in compliance. For example, new EU regulations targeting chemical content in industrial products could necessitate costly reformulation or process changes for abrasive manufacturers.

SWOT Analysis Data Sources

This SWOT analysis for Sia Abrasives Holding AG is informed by a blend of robust financial statements, comprehensive market research, and expert industry commentary to provide a well-rounded strategic perspective.