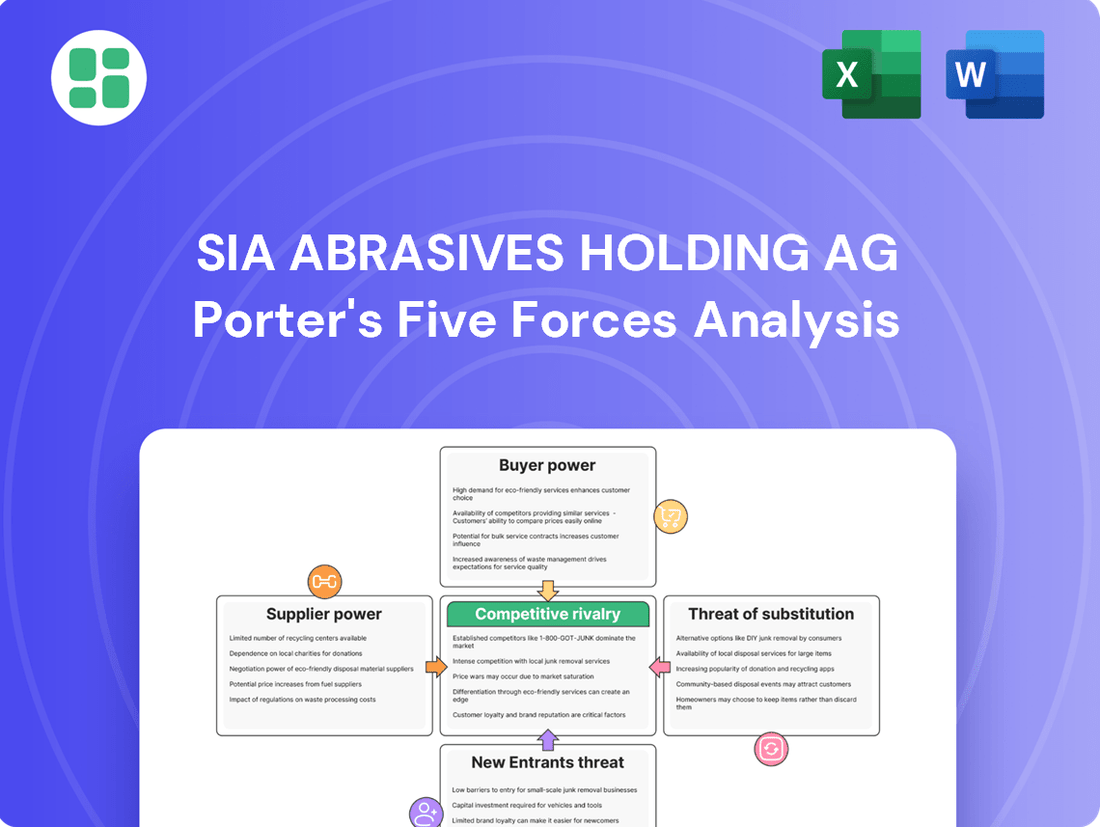

Sia Abrasives Holding AG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sia Abrasives Holding AG Bundle

Sia Abrasives Holding AG faces moderate bargaining power from buyers due to product differentiation, but intense rivalry from established competitors. The threat of substitutes is also a significant factor, impacting pricing strategies and market share.

The complete report reveals the real forces shaping Sia Abrasives Holding AG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The abrasives industry, including companies like Sia Abrasives, depends heavily on specific raw materials such as abrasive grains like aluminum oxide and silicon carbide, backing materials like paper and cloth, and resins. While some natural abrasives are plentiful, the supply of specialized synthetic grains or superabrasives can be more concentrated among fewer producers.

This concentration means that if a few key suppliers of these specialized materials experience disruptions or decide to increase prices, it can significantly affect Sia Abrasives' production costs. For instance, fluctuations in global commodity prices, energy costs, and shipping expenses directly impact the price of these essential inputs, creating potential cost volatility for manufacturers.

Switching core raw material suppliers for Sia Abrasives Holding AG presents moderate to high switching costs. These expenses encompass re-engineering product formulations, conducting rigorous testing for performance and quality assurance, and recalibrating manufacturing processes. Such transitions can lead to production disruptions and demand substantial time and financial investment.

Suppliers providing highly specialized or unique abrasive grains, such as advanced ceramic abrasives or superabrasives like diamond and cubic boron nitride (CBN), possess significant bargaining power. These differentiated inputs are vital for Sia Abrasives to manufacture high-performance products for precision applications across various demanding industries.

Innovations in material science by these specialized suppliers directly impact the quality and capabilities of Sia's final offerings. For instance, a breakthrough in CBN grit technology could enable Sia to produce grinding wheels for significantly harder materials, commanding premium pricing and solidifying its market position.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while not a documented concern for Sia Abrasives' specific raw material providers, represents a potential strategic maneuver. If a key supplier were to acquire the necessary manufacturing capabilities and capital, they could transition into producing finished coated abrasives, directly competing with Sia Abrasives.

This scenario becomes more plausible if the supplier's existing operations share technological similarities with abrasives manufacturing. For instance, a producer of specialized backing materials or abrasive grains might possess the foundational knowledge to enter the market.

While specific 2024 data on supplier forward integration within the abrasives industry is not readily available, the broader manufacturing sector has seen instances of vertical integration. For example, in 2023, some automotive component suppliers explored direct-to-consumer models, demonstrating a willingness to move up the value chain.

- Potential for Competition: Suppliers could leverage their existing material expertise to manufacture finished abrasive products.

- Industry Trend: Vertical integration is a recurring strategy across various manufacturing sectors.

- Risk Factor: Sia Abrasives would face increased competition if a key supplier integrated forward.

Impact of Supplier's Industry Profitability

The profitability of the raw material suppliers for Sia Abrasives significantly impacts their bargaining power. If the supplier industry is experiencing robust demand and limited production capacity, suppliers are better positioned to command higher prices and more favorable terms.

For instance, in 2024, industries supplying critical minerals like aluminum oxide and silicon carbide saw price increases driven by geopolitical factors and strong global manufacturing output, potentially strengthening their negotiating stance with abrasive manufacturers.

- Supplier Industry Health: A healthy and profitable supplier industry often translates to greater supplier leverage.

- Demand vs. Capacity: High demand and constrained capacity for raw materials empower suppliers.

- Market Fragmentation: A fragmented supplier market with low margins generally weakens supplier bargaining power.

The bargaining power of suppliers for Sia Abrasives Holding AG is influenced by the concentration of specialized raw material producers. Suppliers of unique abrasive grains like diamond or CBN, crucial for high-performance products, hold substantial sway. For example, in 2024, the market for certain superabrasives saw limited producers, allowing them to dictate terms and pricing to manufacturers like Sia Abrasives.

Switching costs for Sia Abrasives are moderate to high, involving product re-engineering and rigorous testing, which can disrupt production and incur significant expenses. The profitability of these suppliers also plays a role; in 2024, increased demand for critical minerals like aluminum oxide, coupled with supply chain constraints, led to price hikes, strengthening supplier leverage.

Forward integration by suppliers, while not a current documented threat for Sia Abrasives, remains a potential risk if suppliers possess similar manufacturing expertise. This would introduce direct competition, impacting Sia's market share and profitability.

| Factor | Impact on Sia Abrasives | 2024 Data/Trend |

| Supplier Concentration (Specialized Grains) | High Bargaining Power | Limited producers of advanced ceramic abrasives and superabrasives |

| Switching Costs | Moderate to High | Re-engineering, testing, and process recalibration are costly and time-consuming |

| Supplier Profitability | Increases Bargaining Power | Price increases for aluminum oxide and silicon carbide in 2024 due to demand and supply issues |

| Potential for Forward Integration | Risk of Increased Competition | Broader manufacturing trend of vertical integration observed |

What is included in the product

This analysis examines the competitive intensity within the abrasives industry for Sia Abrasives Holding AG, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Sia Abrasives' Porter's Five Forces analysis provides a clear, one-sheet summary of competitive pressures, simplifying strategic decision-making in the abrasive industry.

Customers Bargaining Power

Sia Abrasives benefits from a wide array of industrial clients, spanning vital sectors such as automotive, woodworking, metalworking, aerospace, electronics, and construction. This broad reach means the company isn't overly dependent on any single market. For instance, in 2024, the automotive sector, a key market for abrasives, saw continued demand for surface finishing in electric vehicle production, while construction also maintained a steady need for grinding and sanding materials.

Sia Abrasives Holding AG faces a notable degree of customer bargaining power, especially from large industrial clients. These key customers, frequently found in sectors like automotive and aerospace, drive significant demand through their substantial volume purchases. This concentration of buying power allows them to negotiate aggressively on pricing, request tailored product specifications, and secure preferential contract terms. For instance, the automotive sector, a primary consumer of abrasive products, often dictates terms due to its high-volume needs.

Customers face some switching costs when changing abrasive suppliers, which can limit their bargaining power. These costs include the time and resources needed for testing and qualifying new abrasive products to ensure they meet specific performance, quality, and compatibility standards with existing machinery and processes. For instance, in the automotive sector, a new abrasive might require extensive validation, potentially delaying production lines if not perfectly aligned.

Product Criticality Versus Cost to Customer

Abrasives are fundamental to achieving specific surface finishes and the precision required in many manufacturing operations. Their criticality means that even if they represent a minor part of the total production cost, their absence or poor quality can significantly impact the final product's value and functionality.

For instance, in the automotive industry, the quality of the surface finish directly influences aesthetics and performance, making abrasive selection a critical decision. If abrasives constitute only 1% of a car's manufacturing cost but are essential for achieving the desired paint smoothness or component tolerance, customers are likely to be less sensitive to price fluctuations for these vital materials.

- Criticality for Surface Finish: Abrasives are indispensable for achieving desired surface quality and precision in manufacturing.

- Cost-Value Proposition: The impact of abrasive cost on the overall product price can be minimal, especially when quality is paramount.

- Reduced Price Sensitivity: When abrasives are vital for quality, customers exhibit lower sensitivity to their price.

- Example: Automotive Industry: High-quality abrasives are crucial for automotive paint finishes and component tolerances, despite their relatively low cost contribution.

Customer Information and Price Sensitivity

Industrial customers, by nature of their procurement, often have a deep understanding of product specifications and performance benchmarks. This knowledge empowers them to effectively compare offerings and negotiate pricing. For instance, in the abrasives market, a large automotive manufacturer will meticulously analyze grit consistency, bond strength, and wear resistance data from various suppliers.

The competitive landscape for abrasives manufacturers like Sia Abrasives Holding AG is characterized by numerous suppliers, which inherently heightens customer price sensitivity. When buyers can easily switch between providers offering similar quality, they are more inclined to seek the lowest possible price. This dynamic was evident in 2024, where increased global production capacity in certain abrasive product segments led to intensified price competition.

- Informed Procurement: Industrial buyers possess detailed technical knowledge, enabling precise evaluation of abrasive products.

- Supplier Proliferation: A broad base of abrasive manufacturers provides customers with ample choices, amplifying price sensitivity.

- Price-Driven Decisions: The availability of multiple comparable suppliers encourages a focus on cost-effectiveness in purchasing decisions.

- Market Transparency: Information readily available on product performance and pricing allows customers to negotiate from a position of strength.

Large industrial customers, particularly those in high-volume sectors like automotive, wield significant bargaining power. Their substantial purchasing volumes allow them to negotiate favorable pricing and demand customized product specifications. For instance, a major automotive manufacturer might leverage its annual purchase of millions of abrasive discs to secure a 5% price reduction.

While switching costs exist, such as product testing and qualification, they are often outweighed by the potential cost savings from competitive sourcing. In 2024, the availability of numerous global suppliers for standard abrasive products meant that large buyers could more readily absorb these switching costs to achieve better terms.

The criticality of abrasives for achieving precise surface finishes can sometimes mitigate customer bargaining power, especially when specific performance attributes are paramount. However, if a customer can find an alternative supplier meeting these stringent requirements, their leverage increases.

| Customer Segment | Bargaining Power Factors | Impact on Sia Abrasives |

|---|---|---|

| Large Industrial (e.g., Automotive) | High Volume Purchases, Price Sensitivity, Specification Demands | Pressure on pricing, need for product customization, potential for volume discounts |

| Small to Medium Enterprises (SMEs) | Lower Volume Purchases, Less Price Sensitivity for Standard Products, Focus on Availability | Less direct price pressure, but demand for reliable supply and consistent quality |

| Distributors | Market Reach, Inventory Management, Order Consolidation | Ability to negotiate terms based on the breadth of their customer base and order volume |

Same Document Delivered

Sia Abrasives Holding AG Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Sia Abrasives Holding AG details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the abrasives industry. You’ll gain actionable insights into the strategic positioning of Sia Abrasives.

Rivalry Among Competitors

The coated abrasives sector, where Sia Abrasives Holding AG competes, is characterized by fierce rivalry. This intense competition is fueled by a robust and expanding global abrasives market.

The overall abrasives market was valued at an impressive USD 65.38 billion in 2024. Projections indicate continued strong growth, with an anticipated rise to USD 117.78 billion by 2034. This substantial market size naturally draws and sustains a high level of competition among existing major players.

The abrasives market is characterized by intense competition among several major global players, including giants like 3M Company and Saint-Gobain Abrasives, which operates under the Norton Abrasives brand. Robert Bosch GmbH, the parent company of Sia Abrasives, is also a significant force. This dominance by large multinational corporations creates a somewhat consolidated landscape where these entities vie for market share across diverse product categories.

Companies such as Mirka Ltd., Klingspor AG, and Tyrolit Group further intensify this rivalry. Their active participation across various abrasive segments means that Sia Abrasives faces a highly competitive environment, where innovation, pricing, and distribution strategies are constantly being tested by well-established and resource-rich competitors.

Competitive rivalry within the abrasives industry is intense, largely fueled by a relentless pursuit of product innovation and differentiation. Companies are constantly pushing the boundaries of abrasive technology, with a significant focus on developing eco-friendly alternatives, smart abrasives with integrated sensors, and novel 3D printed abrasive solutions. The market also sees substantial investment in advanced ceramic and superabrasive materials, aiming to deliver superior performance and durability.

This drive for innovation translates into heavy research and development spending across the sector. For instance, major players are dedicating substantial resources to enhance product efficiency, extend lifespan, and improve the sustainability profile of their offerings. This R&D focus is crucial for gaining a competitive edge and effectively meeting the dynamic and increasingly sophisticated demands of various industrial applications.

Strategic Partnerships and Acquisitions

Competitive rivalry in the abrasives sector is intense, driven by key players actively pursuing strategic partnerships and acquisitions. This consolidation aims to broaden product offerings, solidify market standing, and enhance global distribution networks. Such M&A activity underscores the industry's drive for innovation and scale.

The trend of mergers and acquisitions is a significant factor influencing competitive dynamics. For example, Saint-Gobain Abrasives announced a partnership with Dedeco International Inc. in October 2023, demonstrating a strategic move to leverage complementary strengths and expand market access.

- Industry Consolidation: Key players in the abrasives market are actively engaging in mergers, acquisitions, and strategic alliances to gain competitive advantages.

- Portfolio Expansion: These moves are often driven by the desire to broaden product portfolios and integrate new technologies.

- Market Reach: Partnerships and acquisitions are crucial for increasing global reach and accessing new customer segments.

- Innovation Drive: The competitive pressure fuels innovation, with companies seeking to consolidate to better invest in R&D and new product development.

Global Market Share and Regional Dominance

The abrasives market is characterized by fierce competition, particularly in the Asia-Pacific region, which stands as the largest and most rapidly expanding segment. This growth is fueled by strong manufacturing activity, ongoing urbanization, and the booming automotive and electronics industries in key economies like China and India.

Companies are actively vying for significant market share in these dynamic, high-growth areas. This intense competition often necessitates the development of tailored, localized strategies and product portfolios to meet specific regional demands and preferences.

- Asia-Pacific Dominance: The Asia-Pacific region is the largest and fastest-growing market for abrasives, projected to reach over $20 billion by 2025, with China and India leading the charge.

- Intense Competition: Companies like 3M, Norton (Saint-Gobain), and Mirka are heavily investing in these regions, leading to aggressive pricing and innovation cycles.

- Localized Strategies: To capture market share, manufacturers are adapting product lines, such as offering specialized grinding wheels for automotive repair in India or high-precision abrasives for electronics manufacturing in China.

- Growth Drivers: The expansion of the automotive sector, with global vehicle production expected to exceed 90 million units in 2024, and the robust growth in consumer electronics, are significant drivers of demand and competitive focus.

Competitive rivalry in the abrasives sector is intense, driven by a substantial global market valued at USD 65.38 billion in 2024, with projections reaching USD 117.78 billion by 2034. Major players like 3M, Saint-Gobain (Norton), and Robert Bosch GmbH, Sia Abrasives' parent company, dominate the landscape, alongside formidable competitors such as Mirka, Klingspor, and Tyrolit. This crowded field necessitates continuous product innovation, with a strong emphasis on eco-friendly materials and advanced abrasive technologies.

The pursuit of market share is further amplified by strategic mergers and acquisitions, as seen with Saint-Gobain's October 2023 partnership with Dedeco International Inc., aimed at expanding product portfolios and global reach. Asia-Pacific, particularly China and India, represents the largest and fastest-growing market, fueled by robust manufacturing and sectors like automotive, where global vehicle production is expected to surpass 90 million units in 2024.

| Key Competitors | Market Share Focus | Innovation Areas |

| 3M Company | Global Market Dominance | Smart abrasives, advanced materials |

| Saint-Gobain Abrasives (Norton) | Global Market Expansion | Eco-friendly solutions, R&D partnerships |

| Robert Bosch GmbH (Sia Abrasives) | Integrated Solutions | Performance enhancement, sustainability |

| Mirka Ltd. | High-Performance Products | 3D printed abrasives, dust-free sanding |

| Klingspor AG | Specialty Abrasives | Durability, efficiency |

| Tyrolit Group | Industrial Applications | Customized solutions, material science |

SSubstitutes Threaten

The threat of substitutes for traditional coated abrasives is growing with the rise of non-abrasive surface treatment technologies. These alternatives, like laser cleaning, chemical treatments, and shot peening, offer different approaches to surface preparation and finishing. For instance, laser cleaning provides a precise, chemical-free method for removing impurities, making it attractive for sensitive materials.

The performance and cost-effectiveness of substitutes directly impact customer decisions for abrasive products. While abrasives excel at material removal and surface finishing, alternatives like chemical treatments can offer advantages such as reduced material waste, improved mechanical properties, or better environmental compliance. For instance, chemical etching can enhance corrosion resistance and adhesion, potentially reducing the need for abrasive surface preparation in certain applications.

Technological advancements are a significant threat to industries relying on abrasives, like Sia Abrasives. For instance, ongoing research in laser ablation and advanced chemical etching offers alternative surface treatment methods that can replace traditional grinding and polishing. These technologies are becoming more efficient and cost-effective, potentially eroding the market share of abrasive products.

Customer Shift Towards Sustainability and Precision

Growing environmental consciousness is a significant threat, pushing customers towards sustainable alternatives like water-based coatings and biodegradable blasting media. This trend is amplified by increasingly stringent environmental regulations across various industries. For instance, by 2024, the global market for green building materials, which often involve eco-friendly surface treatments, was projected to reach over $400 billion, indicating a strong customer preference for sustainable options.

Furthermore, the demand for higher precision and reduced material wastage in surface finishing presents a challenge. Some non-abrasive methods can achieve these outcomes more effectively than traditional abrasives, offering a compelling substitute. In sectors like aerospace and automotive manufacturing, where material integrity and precision are paramount, these alternative technologies are gaining traction.

- Environmental Regulations: Stricter regulations are pushing demand for eco-friendly surface treatment solutions.

- Sustainable Alternatives: Water-based coatings and biodegradable blasting media are gaining popularity.

- Precision Requirements: Industries seek higher precision and minimal material loss in surface finishing.

- Non-Abrasive Methods: Alternative technologies are emerging as viable substitutes for traditional abrasives.

Sia Abrasives' Diversification and Innovation

Sia Abrasives' strategic focus on developing high-quality, tailored abrasive systems directly counters the threat of substitutes. By offering specialized solutions that precisely meet customer needs, they reduce the appeal of generic or less effective alternatives.

Innovation is a key defense. Sia Abrasives actively invests in research and development to enhance product performance. For instance, improvements in abrasive grain technology can lead to longer product lifecycles and increased cutting efficiency, making their offerings more attractive than substitutes. As of 2024, the global abrasives market is projected to reach over $50 billion, highlighting the competitive landscape where such differentiation is crucial.

- Focus on specialized abrasive systems to reduce reliance on generic alternatives.

- Investment in R&D for enhanced product performance, including longer life cycles and cutting efficiency.

- The global abrasives market's significant size underscores the importance of innovation in mitigating substitution threats.

The threat of substitutes for traditional abrasives is intensifying due to advancements in non-abrasive surface treatment technologies. These alternatives, such as laser cleaning and advanced chemical etching, offer distinct advantages like precision and reduced material waste, directly challenging abrasive products. For example, laser ablation can precisely remove coatings without damaging the underlying substrate, a feat difficult for many abrasives.

The growing demand for environmentally friendly solutions also fuels the adoption of substitutes. As regulations tighten and consumer preferences shift towards sustainability, alternatives like biodegradable blasting media and water-based coatings are becoming more appealing. By 2024, the market for green building materials, which often employ eco-friendly surface treatments, was expected to surpass $400 billion, illustrating this trend.

Industries requiring high precision and minimal material loss, such as aerospace and automotive manufacturing, are increasingly turning to non-abrasive methods. These technologies can achieve superior surface integrity and reduce scrap rates compared to conventional abrasives. The global abrasives market, projected to exceed $50 billion by 2024, faces pressure from these evolving technological landscapes.

| Substitute Technology | Key Advantages | Sia Abrasives' Counter-Strategy |

| Laser Cleaning | Precision, chemical-free, minimal material removal | Develop specialized abrasive systems for niche applications |

| Chemical Etching | Enhanced properties (e.g., corrosion resistance), reduced waste | Invest in R&D for improved abrasive performance and lifespan |

| Biodegradable Media | Environmental friendliness, regulatory compliance | Focus on sustainable abrasive product development |

Entrants Threaten

The abrasives manufacturing sector, particularly for advanced coated abrasives, demands significant upfront capital. Companies need to invest heavily in specialized machinery, state-of-the-art production plants, and robust research and development to innovate and maintain quality.

These substantial entry costs act as a formidable deterrent for new players looking to enter the market. For instance, establishing a modern coated abrasives production line can easily run into tens of millions of dollars, making it difficult for smaller or less capitalized firms to compete effectively.

Established players in the abrasives market, such as Sia Abrasives, leverage significant economies of scale. This means they can produce goods at a lower cost per unit due to their large production volumes, bulk purchasing power for raw materials, and extensive distribution networks. For instance, in 2024, major abrasives manufacturers often operate plants with capacities exceeding 100,000 tons annually, allowing for substantial cost advantages.

New companies entering the market would find it exceptionally challenging to replicate these cost efficiencies. Without the same scale, they would likely face higher per-unit production and procurement costs. This disparity makes it difficult for new entrants to compete on price with established firms like Sia Abrasives without incurring significant initial financial losses, thereby acting as a considerable barrier.

Sia Abrasives, now a key player within the Bosch Group, benefits immensely from its established brand recognition. This strong identity, built over years of consistent quality and performance, makes customers more likely to choose Sia over an unknown competitor. For instance, Bosch’s overall revenue reached €91.6 billion in 2023, a testament to the power of its brands, including Sia Abrasives.

Furthermore, Sia Abrasives leverages extensive and well-developed global distribution networks. These channels are crucial for reaching customers efficiently and effectively. New entrants would need to invest significant capital and time to replicate this reach, a substantial hurdle that deters many potential competitors.

Proprietary Technology and Intellectual Property

The high cost and complexity associated with developing and manufacturing advanced coated abrasive systems present a significant barrier to entry. Sia Abrasives Holding AG, like its competitors, relies on proprietary technologies and patented abrasive materials, making it difficult for newcomers to replicate their product quality and performance. For example, the development of specialized grit formulations and coating adhesion techniques requires substantial investment in research and development, often protected by extensive patent portfolios.

This technological moat is further strengthened by the need for specialized manufacturing processes and equipment. Companies like Sia Abrasives have invested heavily in advanced coating machinery and quality control systems, which are not easily or affordably replicated by potential new entrants. The intellectual property surrounding these processes, including specific application methods and material compositions, acts as a powerful deterrent.

- Proprietary Coating Technologies: Sia Abrasives utilizes advanced, often patented, methods for applying abrasive grains to backing materials, ensuring superior performance and durability.

- Patented Abrasive Materials: The company holds patents on specific abrasive grain compositions and treatments that enhance cutting efficiency and lifespan, making direct imitation challenging.

- R&D Investment: Significant ongoing investment in research and development by incumbents like Sia Abrasives creates a continuous cycle of innovation that new entrants struggle to match.

- Manufacturing Expertise: The specialized knowledge and capital required for high-volume, high-quality abrasive production serve as a substantial hurdle for potential new competitors.

Stringent Regulatory and Quality Standards

The automotive and aerospace sectors, key markets for Sia Abrasives, impose exceptionally high quality, safety, and performance benchmarks. New entrants must navigate a complex web of regulations and certifications, significantly increasing the capital and time investment required for market entry.

Meeting these demanding standards, such as ISO certifications or specific aerospace material approvals, presents a substantial barrier. For instance, achieving AS9100 certification, crucial for aerospace suppliers, involves rigorous quality management systems and audits that can take years to implement and validate.

- High Capital Investment: Newcomers need substantial funding to establish manufacturing processes that meet rigorous quality controls and to obtain necessary industry certifications.

- Regulatory Compliance: Adhering to strict safety and performance regulations in industries like automotive (e.g., IATF 16949) and aerospace requires extensive testing and documentation.

- Technological Expertise: Developing abrasive products that consistently meet the exacting specifications of these advanced industries demands significant R&D and specialized manufacturing know-how.

The threat of new entrants into the advanced abrasives market, particularly for companies like Sia Abrasives, is considerably low due to high barriers. These include substantial capital requirements for specialized machinery and R&D, as well as the need to establish extensive distribution networks. For example, the global abrasives market was valued at approximately $45 billion in 2023, with advanced coated abrasives representing a significant and technologically intensive segment.

Established players benefit from significant economies of scale, leading to lower per-unit costs that new entrants struggle to match. Proprietary technologies and patents on abrasive materials further protect incumbents, making it difficult for newcomers to replicate product performance and quality. The rigorous quality and regulatory standards in key sectors like automotive and aerospace also demand significant investment and time for compliance, acting as a major deterrent.

| Barrier Type | Description | Example Impact |

| Capital Requirements | High investment in specialized machinery and R&D facilities. | Establishing a new, state-of-the-art coated abrasives plant can cost tens of millions of dollars. |

| Economies of Scale | Lower production costs due to high-volume manufacturing. | Large players in 2024 often operate plants with capacities over 100,000 tons annually, achieving significant cost advantages. |

| Brand Recognition & Distribution | Established customer loyalty and extensive market reach. | Bosch, Sia Abrasives' parent company, reported €91.6 billion in revenue in 2023, highlighting brand strength and market penetration. |

| Proprietary Technology & IP | Patented abrasive materials and manufacturing processes. | Development of specialized grit formulations and coating techniques requires substantial R&D, often protected by patents. |

| Regulatory Compliance | Meeting stringent quality and safety standards in target industries. | Achieving AS9100 certification for aerospace suppliers can take years of rigorous implementation and validation. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Sia Abrasives Holding AG is built upon a foundation of robust data, including the company's annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant trade publications to capture current market dynamics.