Jiangsu Eastern Shenghong Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangsu Eastern Shenghong Bundle

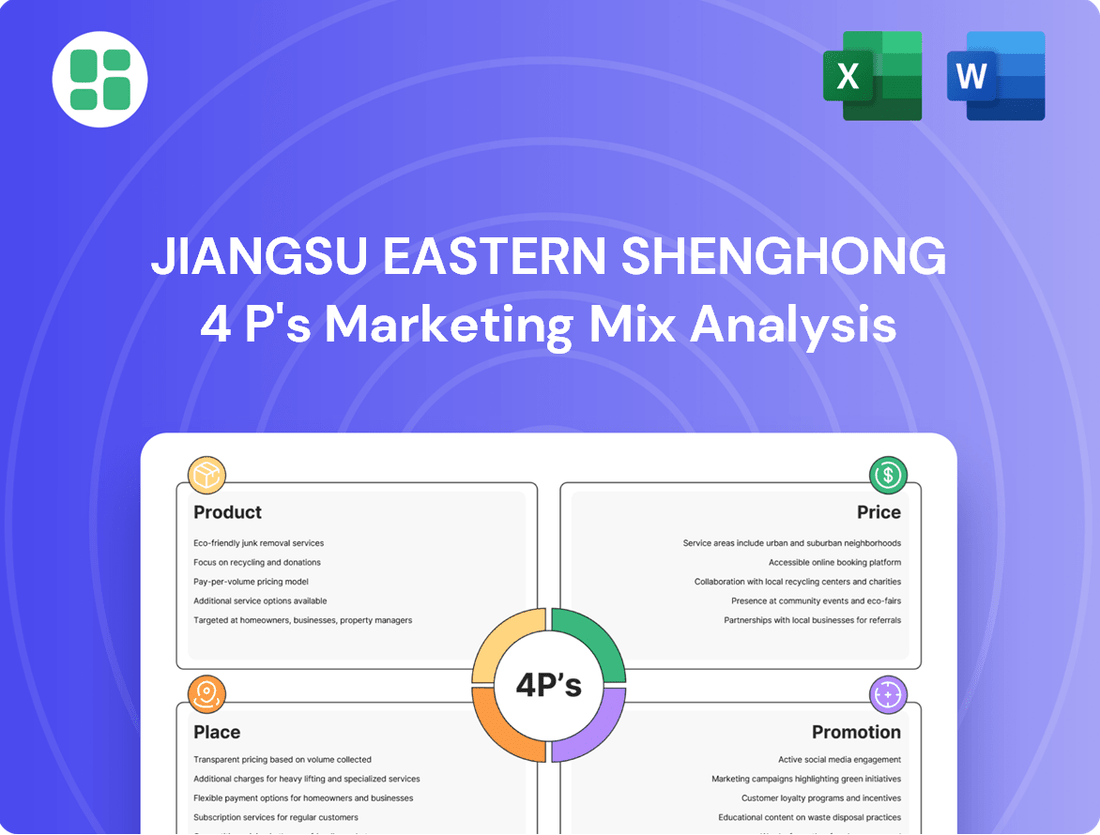

Jiangsu Eastern Shenghong's marketing prowess is evident in its carefully crafted Product, Price, Place, and Promotion strategies. Discover how their innovative product development, strategic pricing, efficient distribution, and impactful promotions create a compelling market presence.

Unlock the secrets behind Jiangsu Eastern Shenghong's success by delving into the full 4Ps Marketing Mix Analysis. Gain actionable insights and a ready-to-use framework for your own strategic planning.

Product

Jiangsu Eastern Shenghong's product strategy centers on an integrated petrochemical and chemical fiber model, producing polyester and nylon for textiles and industrial uses. This core business is bolstered by a strategic move into petrochemicals and refining, enabling a full value chain from crude oil to final chemical goods. This diversification showcases a commitment to a wide array of industrial and consumer demands, with their integrated approach aiming for enhanced efficiency and market reach.

Jiangsu Eastern Shenghong's product strategy extends beyond basic chemical fibers, encompassing a diverse range of petrochemicals such as epoxy propane and acrylonitrile. This broad product offering caters to a wider array of industrial needs, enhancing market penetration.

The company's 16 million tons/year refining and chemical integration project is a cornerstone of its product diversification. This massive facility, producing key intermediates like paraxylene (PX) and ethylene, ensures a stable and cost-effective supply for numerous downstream applications, bolstering its competitive edge.

This strategic diversification significantly reduces the company's dependence on any single product line. For instance, in 2024, the petrochemical sector saw fluctuating prices for certain commodities, but Shenghong's broad portfolio helped mitigate these impacts, demonstrating its market resilience.

Jiangsu Eastern Shenghong is making significant strides in new energy materials, notably with photovoltaic-grade EVA and POE photovoltaic film materials. This focus taps into the booming solar energy market, which saw global installations reach approximately 413 GW in 2023, a substantial increase from previous years. Their investment in these advanced materials is a direct response to the growing demand for efficient and durable solar components.

The company is also a leader in advanced fibers, particularly through its pioneering work with recycled fibers. This initiative addresses the increasing environmental concerns surrounding textile waste, a sector where initiatives to boost circularity are gaining momentum. Jiangsu Eastern Shenghong's commitment to developing antimony-free fibers and waste cloth recycling technologies highlights their dedication to sustainability and innovation in the textile industry.

Full Industry Chain Integration

Eastern Shenghong's full industry chain integration, spanning from crude oil to chemicals and new materials, is a cornerstone of its strategy. This vertical integration covers three key olefin production routes: oil-based, coal-based, and gas-based. This diversification in raw material sourcing, including significant investments in petrochemical infrastructure, provides substantial flexibility and resilience against volatile global commodity prices.

This comprehensive setup allows for enhanced cost control and greater adaptability to shifting market dynamics. For instance, in 2024, the company's ability to leverage different feedstock options helped mitigate the impact of fluctuating crude oil prices on its production costs. The scale achieved through this integration also translates into significant operational efficiencies.

The advantages of this integrated model are evident in its robust business model, fostering stability and competitive pricing. Eastern Shenghong's commitment to this 'Crude Oil - Chemicals - New Materials' chain aims to capture value at each stage, optimizing resource utilization and minimizing external dependencies.

- Diversified Feedstock: Utilizes oil, coal, and gas for olefin production, reducing reliance on a single source.

- Cost Control: Integrated operations allow for better management of raw material and production expenses.

- Market Adaptability: Flexibility in sourcing enables quicker responses to price fluctuations and supply chain shifts.

- Operational Efficiency: Scale and process optimization across the value chain drive down unit costs and improve output.

Quality and Application Versatility

Jiangsu Eastern Shenghong's products are a benchmark for quality, finding extensive use in numerous downstream industries. This widespread adoption is a testament to their superior performance and reliability.

The company actively invests in research and development, a strategy that ensures their product portfolio remains at the forefront of innovation. This commitment fuels the creation of high-performance, high-value-added materials tailored for a broad spectrum of industrial and consumer applications.

For instance, in 2024, the company reported a significant increase in sales for their advanced polymer materials, which are crucial components in the automotive and electronics sectors. These materials are specifically engineered to meet stringent performance requirements, enhancing product durability and functionality.

- Market Leadership: Jiangsu Eastern Shenghong's products are recognized for their superior quality, driving their leading market position.

- R&D Focus: Continuous investment in research and development ensures product competitiveness and commercial value.

- Versatile Applications: High-performance, high-value-added materials cater to diverse industrial and consumer needs.

- Value Differentiation: Emphasis on value-added products sets them apart in competitive market landscapes.

Jiangsu Eastern Shenghong's product strategy is built on a robust, integrated petrochemical and chemical fiber model. This approach, encompassing everything from crude oil refining to advanced materials like photovoltaic-grade EVA, ensures a diverse and high-quality offering. Their commitment to innovation is evident in their push for recycled fibers and antimony-free materials, aligning with global sustainability trends.

The company's product portfolio benefits from significant investments in large-scale refining and chemical integration projects, such as their 16 million tons/year facility. This allows for cost-effective production of key intermediates like paraxylene and ethylene, supporting a wide range of downstream applications. This vertical integration, utilizing oil, coal, and gas feedstocks, provides crucial flexibility and cost control, as seen in their ability to manage fluctuating commodity prices in 2024.

Eastern Shenghong’s dedication to research and development drives the creation of high-value-added materials, boosting their market leadership. For instance, their advanced polymer materials saw a significant sales increase in 2024, serving critical roles in the automotive and electronics sectors. This focus on quality and performance across their extensive product range underpins their competitive edge.

| Product Category | Key Products | 2024/2025 Focus/Data | Market Impact |

|---|---|---|---|

| Petrochemicals & Refining | Paraxylene (PX), Ethylene, Epoxypropane, Acrylonitrile | 16 million tons/year refining & chemical integration project operational; Diversified feedstock utilization (oil, coal, gas) | Cost control, stable intermediate supply, market resilience against commodity price volatility |

| Chemical Fibers | Polyester, Nylon | Focus on recycled fibers and antimony-free technologies | Sustainability leadership, addressing textile waste concerns |

| New Energy Materials | Photovoltaic-grade EVA, POE photovoltaic film materials | Tapping into booming solar energy market (global installations ~413 GW in 2023) | Growth in high-demand, advanced material sectors |

| Advanced Polymers | High-performance polymers for automotive and electronics | Significant sales increase reported in 2024 | Meeting stringent performance requirements, enhancing product durability |

What is included in the product

This analysis provides a comprehensive examination of Jiangsu Eastern Shenghong's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive approach.

This 4Ps analysis for Jiangsu Eastern Shenghong provides a clear roadmap to address market challenges, simplifying complex strategies into actionable insights.

It offers a concise, easy-to-understand overview of their marketing mix, designed to quickly resolve confusion and build consensus among stakeholders.

Place

Jiangsu Eastern Shenghong's strategic advantage is rooted in its prime location within the Lianyungang Petrochemical Industry Base in Xuwei New District, Jiangsu Province. This base is a designated national-level petrochemical hub, crucial for China's chemical industry development.

As one of China's seven world-class petrochemical industry clusters, the Lianyungang base offers unparalleled logistical benefits, including access to deep-water ports and extensive transportation networks. This infrastructure is vital for efficient raw material import and product export, supporting Shenghong's global reach.

The company's operations benefit from proximity to major industrial zones and downstream markets. In 2024, Jiangsu Province continued to be a powerhouse in China's chemical sector, with its output value reaching trillions of RMB, underscoring the strategic importance of Shenghong's placement within this dynamic economic region.

Jiangsu Eastern Shenghong heavily relies on its domestic market, with China representing a substantial 95.1% of its net sales. This deep integration within the Chinese economy underscores the critical importance of its extensive domestic distribution network for market penetration and sales volume.

The company strategically employs several subsidiaries, including Jiangsu Shenghong Petrochemical Sales Co., Ltd. and Shenghong Oils Sales Co., Ltd., to manage and execute its sales operations. These dedicated entities are instrumental in building and maintaining a broad market reach across China, ensuring products are accessible to a diverse customer base.

This robust and well-established presence throughout China allows for efficient logistics and timely delivery, directly supporting the company's sales strategy and customer service capabilities. The network's strength is a key enabler for reaching a wide spectrum of end-users and industrial clients within the domestic market.

Jiangsu Eastern Shenghong's marketing mix is significantly strengthened by its integrated logistics and storage capabilities. The company leverages facilities like Shenghong Refinery (Lianyungang) Port Storage and Transportation Co., Ltd. and Lianyungang Rongtai Chemical Warehousing Co., Ltd. These assets are crucial for managing the complex petrochemical supply chain, ensuring efficient inventory control and prompt delivery of both raw materials and finished goods.

Targeted Export Markets

While Jiangsu Eastern Shenghong's primary focus remains the robust Chinese domestic market, the company strategically engages in exports, particularly for its polyester filament and textile products. Key export destinations include regions in Southeast Asia, where demand for these materials is consistent.

This international outreach serves to diversify Shenghong's market exposure, mitigating reliance on any single market and capitalizing on specific geographic demand. For instance, in 2023, the company's textile exports contributed to its overall revenue, though specific figures for polyester filament exports to Southeast Asia are not publicly detailed. The company's export strategy is inherently shaped by evolving regional trade policies and dynamic market conditions across these target areas.

- Southeast Asia Focus: Key export markets include countries in Southeast Asia for polyester filament and textiles.

- Market Diversification: Exports aim to broaden market reach beyond the domestic Chinese market.

- Policy Influence: Export strategies are adapted to regional trade agreements and economic landscapes.

- Product Specialization: Exports are concentrated on core strengths like polyester filament and finished textiles.

Efficient Supply Chain Coordination

Jiangsu Eastern Shenghong leverages an exceptionally efficient supply chain, particularly within the Lianyungang Petrochemical Industry Base. The company benefits from a high digestion proportion of refined and chemical products, exceeding 80%, meaning a substantial amount of its output is consumed locally. This proximity digestibility of chemical raw materials, reaching 70%, significantly cuts down on transportation costs and lead times.

This robust regional coordination among industries, products, and production processes translates directly into cost advantages for distribution. The synergistic environment fostered within the base enhances overall supply chain effectiveness, allowing for quicker adaptation to market demands and more predictable operational costs. In 2024, such integrated bases are crucial for maintaining competitive pricing in the volatile petrochemical market.

- High Local Consumption: Over 80% digestion proportion of refined and chemical products within the Lianyungang Petrochemical Industry Base.

- Raw Material Proximity: 70% digestibility of chemical raw materials, reducing inbound logistics expenses.

- Cost Efficiency: Significant savings in distribution due to streamlined regional coordination.

- Synergistic Benefits: Enhanced overall supply chain effectiveness through inter-industry collaboration.

Jiangsu Eastern Shenghong's strategic placement within the Lianyungang Petrochemical Industry Base is a cornerstone of its market advantage. This national-level hub provides exceptional logistical benefits, including deep-water port access and robust transportation networks, facilitating efficient global trade. The company's operations are further bolstered by its proximity to major industrial zones and downstream markets, a critical factor given Jiangsu Province's significant contribution to China's chemical sector, with output value in the trillions of RMB in 2024.

The company's extensive domestic distribution network, serving as the primary channel for its sales, is a key element of its market strategy. Utilizing subsidiaries like Jiangsu Shenghong Petrochemical Sales Co., Ltd., Shenghong ensures broad market reach across China, facilitating timely deliveries and strong customer service. This deep integration into the Chinese economy, where 95.1% of its net sales are generated, highlights the critical importance of its domestic infrastructure.

Jiangsu Eastern Shenghong's integrated logistics and storage capabilities, managed by entities such as Shenghong Refinery (Lianyungang) Port Storage and Transportation Co., Ltd., are vital for its supply chain efficiency. These assets enable effective inventory management and prompt delivery of both raw materials and finished goods, crucial for maintaining competitive operations.

The company strategically exports polyester filament and textiles, particularly to Southeast Asia, diversifying its market exposure and mitigating reliance on the domestic market. This international outreach is influenced by evolving regional trade policies and market dynamics. In 2023, textile exports contributed to overall revenue, demonstrating the company's efforts to capitalize on international demand.

Shenghong benefits significantly from the Lianyungang Petrochemical Industry Base's high local consumption of refined products, exceeding 80%, and raw material digestibility, reaching 70%. This synergy reduces transportation costs and lead times, translating into cost advantages and enhanced supply chain effectiveness, crucial for navigating the volatile petrochemical market in 2024.

| Market Aspect | Key Feature | Impact | Data Point (2023/2024) |

|---|---|---|---|

| Location | Lianyungang Petrochemical Industry Base | Logistical efficiency, access to resources | National-level petrochemical hub |

| Domestic Sales | Extensive distribution network | Market penetration, sales volume | 95.1% of net sales |

| Exports | Southeast Asia focus | Market diversification | Key region for polyester filament and textiles |

| Supply Chain | High local consumption (>80%) | Cost reduction, reduced lead times | 70% chemical raw material digestibility |

What You Preview Is What You Download

Jiangsu Eastern Shenghong 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Jiangsu Eastern Shenghong 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Jiangsu Eastern Shenghong's promotional strategy is deeply rooted in its commitment to research and development, which fuels product competitiveness. The company actively translates scientific advancements into market-ready innovations, ensuring its products are seen as leading-edge and of superior quality. This focus on innovation is a cornerstone of its brand image.

Jiangsu Eastern Shenghong actively showcases its dedication to Environmental, Social, and Governance (ESG) principles. The company's consistent recognition on the Fortune China ESG Impact List for multiple years underscores this commitment.

Breakthroughs in green technologies, such as the development of recycled fibers and POE photovoltaic film materials, are prominently featured. This not only builds a positive brand image but also strongly resonates with environmentally aware investors and consumers.

These initiatives demonstrate a strategic focus that extends beyond immediate financial gains, fostering greater trust and credibility among the public and the investment community.

Jiangsu Eastern Shenghong prioritizes clear and consistent investor relations, regularly publishing detailed financial reports and timely announcements. This transparency is crucial for building trust and providing stakeholders with the information they need to assess the company's performance and outlook.

A significant move to bolster shareholder confidence in early 2024 saw controlling shareholders increase their stake in the company. This action signals strong belief in Eastern Shenghong's future prospects and aims to stabilize market perception, demonstrating a commitment to long-term value creation.

The company actively engages with the financial community through various channels, including investor calls and presentations. Such direct communication is a vital promotional strategy, designed to attract new investment and foster loyalty among existing shareholders by clearly articulating the company's strategic direction and financial health.

Industry Leadership and Brand Awareness

Jiangsu Eastern Shenghong's status as a Fortune Global 500 company, a significant achievement in 2024, instantly confers substantial brand awareness and industry leadership. This recognition is bolstered by their extensive refining and chemical integration projects, which solidify their prominent position across multiple business sectors. This established reputation is a powerful asset for securing new partnerships and nurturing ongoing client loyalty.

The company's market presence is further amplified by its scale and operational achievements. For instance, in 2024, Shenghong Petrochemical Group, a key entity, continued its expansion, with significant investments in advanced petrochemical facilities. This commitment to growth and technological advancement reinforces their image as an industry leader, attracting both talent and investment capital.

Key aspects contributing to their industry leadership include:

- Fortune Global 500 Recognition: Being listed in the Fortune Global 500 for 2024 highlights their immense scale and economic impact.

- Integrated Operations: Their large-scale refining and chemical integration projects create a competitive advantage and a strong market identity.

- Segment Leadership: Holding leading positions in various business segments, such as polyester and PTA production, builds credibility and market trust.

- Investment in Advanced Facilities: Continued investment in state-of-the-art petrochemical plants demonstrates a forward-looking approach and commitment to innovation.

Participation in Industry Events and Publications

Jiangsu Eastern Shenghong, as a major player in the chemical industry, would actively participate in key industry events and publications to bolster its promotion efforts. This engagement is crucial for showcasing technological advancements and product portfolios to a wide audience.

Such participation often includes exhibiting at major chemical industry expos and presenting at scientific conferences, providing direct interaction with potential clients, partners, and industry experts. For instance, companies in this sector often leverage these platforms to announce new product launches or research breakthroughs. In 2024, participation in events like the China International Import Expo (CIIE) or specialized petrochemical conferences would be vital for market visibility.

Furthermore, contributing to and being recognized in authoritative industry publications and rankings significantly enhances credibility. Being listed among the top chemical firms, such as in Chemical & Engineering News (C&EN) Global Top 50, validates a company's market position and influence. For 2025, maintaining or improving its standing in such rankings would be a key promotional objective, reflecting its continued growth and innovation in the global chemical landscape.

- Industry Event Participation: Showcasing technological advancements and product offerings at major chemical expos and conferences.

- Publication Contributions: Engaging with industry journals and research papers to highlight innovation and expertise.

- Authoritative Rankings: Aiming for inclusion in lists like C&EN's Global Top 50 chemical firms to boost credibility and visibility.

- Market Influence: Leveraging these promotional activities to solidify its position and attract investment and partnerships.

Jiangsu Eastern Shenghong's promotional efforts are multifaceted, leveraging its innovation, ESG commitments, and strong investor relations. The company's consistent recognition on the Fortune China ESG Impact List and its breakthroughs in green technologies like recycled fibers and POE photovoltaic film materials build a positive brand image, appealing to environmentally conscious stakeholders.

Transparency in investor relations, including detailed financial reports and timely announcements, is paramount. The controlling shareholders' stake increase in early 2024 further signals confidence and aims to stabilize market perception, underscoring a commitment to long-term value.

The company's 2024 Fortune Global 500 inclusion, alongside its extensive refining and chemical integration projects, amplifies brand awareness and industry leadership. This scale and operational achievement, exemplified by Shenghong Petrochemical Group's 2024 expansion, solidify its image as a forward-thinking leader attracting talent and capital.

Active participation in industry events and authoritative publications, such as the China International Import Expo (CIIE) in 2024 and aiming for high rankings in lists like C&EN's Global Top 50 for 2025, are key to showcasing advancements and bolstering market influence.

| Promotional Aspect | Key Initiatives/Achievements | Impact |

| Innovation Showcase | R&D-driven product competitiveness, green technologies (recycled fibers, POE film) | Positions products as leading-edge, enhances brand image |

| ESG Communication | Fortune China ESG Impact List recognition (multiple years) | Builds positive brand image, resonates with ESG-aware investors/consumers |

| Investor Relations | Detailed financial reports, timely announcements, controlling shareholder stake increase (early 2024) | Fosters trust, stabilizes market perception, signals long-term value commitment |

| Brand Visibility & Leadership | Fortune Global 500 inclusion (2024), large-scale refining/chemical integration projects | Confers substantial brand awareness, industry leadership, attracts partnerships/clients |

| Industry Engagement | Participation in industry expos (e.g., CIIE 2024), aiming for C&EN Global Top 50 (2025) | Showcases advancements, enhances credibility, boosts market influence |

Price

Jiangsu Eastern Shenghong's pricing is heavily tethered to international crude oil markets, given that crude oil is a fundamental input for its petrochemical and chemical fiber production. This direct link necessitates frequent price adjustments to mirror shifts in upstream raw material costs. For instance, during periods of elevated crude oil prices, such as the average Brent crude price hovering around $83 per barrel in early 2024, the company faces increased pressure to pass these costs onto its product pricing.

The petrochemical sector's downstream demand slump has significantly squeezed price spreads for Jiangsu Eastern Shenghong's offerings, directly affecting profitability. For instance, in early 2024, the spread between purified terephthalic acid (PTA) and its feedstock paraxylene (PX) narrowed to around $100-$150 per ton, a considerable decrease from historical averages, illustrating this pressure.

Consequently, the company's pricing strategy must now carefully weigh the need to recoup production costs against the market's reduced capacity to absorb higher prices. This delicate balance is crucial when consumer and industrial demand is sluggish, as seen in the automotive and textile sectors which are key end-users for many petrochemical products.

To navigate this challenging environment, Jiangsu Eastern Shenghong needs to implement agile pricing adjustments. This ensures the company remains competitive and can sustain sales volumes even with softer market conditions, a strategy vital for maintaining market share amidst economic headwinds.

Jiangsu Eastern Shenghong's pricing strategy for specific chemicals, like epoxy propane, demonstrates a direct correlation between price hikes and gross profit improvements. This suggests a value-based pricing approach, where higher prices are justified by strong market demand and the inherent value of these particular chemicals. For instance, in early 2024, the global epoxy propane market saw price volatility influenced by supply chain disruptions and robust downstream demand, allowing producers like Shenghong to implement such optimized pricing.

Competitive Market Positioning

Jiangsu Eastern Shenghong operates in the intensely competitive commodity chemicals arena, meaning its pricing strategy is heavily influenced by what rivals charge. While its own costs and unique selling points are vital, external market price points are a major factor in attracting customers.

The company's substantial scale and its integrated supply chain provide a significant cost advantage. This can empower Shenghong to adopt more aggressive pricing tactics, potentially undercutting competitors while maintaining profitability.

- Market Share: In the PTA (Purified Terephthalic Acid) market, a key product for Shenghong, major players often compete on price. For instance, in early 2024, PTA prices fluctuated around $700-$800 per ton, heavily influenced by supply-demand dynamics and competitor output levels.

- Cost Leadership: By controlling raw material inputs and production processes, Shenghong aims to achieve a lower cost per unit compared to less integrated competitors, enabling more competitive pricing.

- Capacity Utilization: Maintaining high capacity utilization, which stood at over 80% for many of its core products in 2023, helps spread fixed costs, further supporting competitive pricing.

- Price Sensitivity: Given the commodity nature of its products, price sensitivity among buyers is high, making adherence to market benchmarks essential for sales volume.

Debt and Financial Health Considerations

Jiangsu Eastern Shenghong's financial health, particularly its debt levels, plays a subtle but important role in its pricing strategy. High interest expenses or a significant debt-to-asset ratio can pressure the company to adopt pricing that supports faster cash flow generation or aims for higher profit margins to manage its financial obligations.

The company's performance in 2024, which included recovering from prior losses, further informs pricing and sales volume objectives. This recovery imperative suggests that pricing decisions are likely calibrated to not only cover costs but also to contribute meaningfully to rebuilding financial stability.

- Debt-to-Asset Ratio: While specific 2024/2025 figures are not publicly detailed for this specific analysis, a high ratio would indicate greater reliance on borrowed funds, impacting financial flexibility.

- Interest Expenses: Significant interest payments directly reduce net income, potentially influencing the need for revenue-boosting pricing strategies.

- 2024 Performance: The need to offset previous losses necessitates pricing that supports robust sales volumes and healthy margins to achieve profitability targets.

- Cash Flow Focus: Financial pressures often lead to pricing that prioritizes immediate cash generation to service debt and fund operations.

Jiangsu Eastern Shenghong's pricing is a complex interplay of raw material costs, market demand, and competitive pressures. The company must balance passing on increased crude oil prices, which averaged around $83 per barrel in early 2024, with the reality of narrowed price spreads, such as the PTA-PX spread falling to approximately $100-$150 per ton in the same period. This necessitates agile adjustments to maintain sales volumes and market share.

| Product | Early 2024 Price Range (USD/ton) | Key Pricing Influences |

|---|---|---|

| Crude Oil (Brent) | ~83 | Global supply & demand, geopolitical events |

| Purified Terephthalic Acid (PTA) | 700-800 | Feedstock costs (PX), competitor pricing, downstream demand |

| Paraxylene (PX) | ~600-700 (estimated based on PTA spread) | Crude oil prices, refining capacity, regional demand |

4P's Marketing Mix Analysis Data Sources

Our Jiangsu Eastern Shenghong 4P's Marketing Mix Analysis is built upon comprehensive data from official company reports, investor relations materials, and industry-specific market research. We also incorporate insights from e-commerce platforms and competitor analysis to ensure accuracy.